Beruflich Dokumente

Kultur Dokumente

Chapter 9 - Prospective Analysis

Hochgeladen von

jonaxxCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Chapter 9 - Prospective Analysis

Hochgeladen von

jonaxxCopyright:

Verfügbare Formate

Financial Management

Prospective Analysis

Airish Mae I. Danganan

Rose Ann dela Cruz-Valdez

Prospective Analysis

It is the forecasting of the future financial information. It is the central to security

valuation where both free cash flow and residual income models require estimates of future

financial statements.

Two Techniques in Prospective Analysis

1. Financial Statement Forecasting

2. Valuation

In prospective analysis, we make prospective financial statements which encompasses

financial forecasts and financial projections.

Two Broad Stages of Financial Prospective Analysis

1. Long term Forecasting – analysis of past data and forecasting of financial statements

2. Implementation – use of forecast to value common stock or to accomplish any other

objective for which the forecast was carried out.

Importance of Prospective Analysis

1. Security Valuation – residual income model requires estimates of future financial

statements

2. Management and Assessment – examine viability of company’s strategic plan.

3. Assessment of solvency – ability to meet company’s debt obligation.

4. Predictions of future performance.

In projecting financial statements, it must begin with projecting the income statement

followed by projecting the balance sheet or the statement of financial position.

Projecting Income Statement

Begins by estimating sales, thus sales estimate can be tested for plausibility in fou different

context which are:

1. Past sales trends

2. Market share implied by the sales estimate

3. Its relation to planned marketing efforts

4. Production capacity

Then, followed by projecting cost of goods sold or cost of sales. Cost of goods sold or cost of

sales are all cost that is directly linked to sales. These are always projected as percentage of sales

and their assumption can be affected by a variety of factors both external and internal to the

company.

The last step in projecting income statement is the projecting operating expenses,

depreciation and interest expense. Operating expenses are not directly linked to sales and are

projected on item by item basis. Meanwhile, projecting depreciation and interest expense

requires a look ahead to the projected balance sheet. Past interest expense will be analysed as a

percentage of past debt balances and trend extended into the future.

Financial Management

Prospective Analysis

Airish Mae I. Danganan

Rose Ann dela Cruz-Valdez

Example of Projecting Income Statement

Projecting Balance Sheet

These are the following steps in projecting balance sheet:

1. Project current assets other than cash, using projected sales or cost of goods sold and

appropriate turnover ratios as described below.

2. Project PP&E increases with capital expenditures estimate derived from historical trends

or information obtained in the MD&A section of the annual report.

3. Project current liabilities other than debt, using projected sales or cost of goods sold and

appropriate turnover ratios as described below

4. Obtain current maturities of long-term debt from the long-term debt footnote.

5. Assume other short-term indebtedness is unchanged from prior year balance unless they

have exhibited noticeable trends.

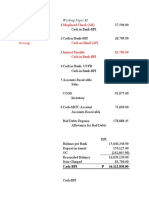

Example of Projecting Balance Sheet

Financial Management

Prospective Analysis

Airish Mae I. Danganan

Rose Ann dela Cruz-Valdez

Results in Projecting Balance Sheet

Sensitivity Analysis

Sensitivity Analysis varies in the projection assumptions to find those with the greatest

effect on projected profits and cash flows. It examines the influential variable closely. It also

prepare expected, optimistic and pessimistic scenarios to develop a range of possible outcomes.

The Residual Income Valuation Model

It defines equity value at time “t” as the sum of current book value and the present value

of all future expected residual income.

Where: BVt is book value at the end of period t, RIt + n is residual income in period t + n,

and k is cost of capital. Residual income at time t is defined as comprehensive net income minus

a charge on beginning book value, that is, RIt = NIt - (k x BVt - 1).

Application of Prospective Analysis in the Residual Income Valuation Model

In its simplest form, we can perform a valuation by projecting the following parameters:

Sales growth

Net profit margin (Net income/Sales)

Net working capital turnover (Sales/Net WC)

Fixed-Asset turnover (Sales/Fixed Asset)

Financial Leverage (Operating Assets/Equity)

Cost of equity capital

Financial Management

Prospective Analysis

Airish Mae I. Danganan

Rose Ann dela Cruz-Valdez

Advantages of Residual Income Model

1. It makes use of data readily available from a firm’s financial statements and can be used

well with firms who do not pay dividends or do not generate positive free cash flow.

2. It looks at the economic profitability of a firm rather than just its accountability

profitability.

Thus, its only drawback in using residual income model is the fact that it relies so heavily on

forward looking estimates of a firm's financial statements, leaving forecasts vulnerable to

psychological biases or historic misrepresentation of a firms financial statements.

Trends in Value Drivers

The Residual Income valuation model defines residual income as:

RIt = NIt – (k X BVt-1)

= (ROEt – k) X BVt-1

Where ROE = NI/BVt-1

- Stock price is only impacted so long as ROE ≠ k

- Shareholder value is created so long as ROE > k

- ROE is a value driver as are its components

- Net Profit Margin

- Asset Turnover

- Financial leverage

Two relevant observations:

- ROEs tend to revert to a long-run equilibrium.

- The reversion is incomplete.

Sources:

DAC 115 Corporate Financial Reporting and Analysis

Financial Statements Analysis by Dina Trisnawati

Fundamentals of Investments (Valuation and Management) 7th Edition By Bradford Jordan,

Thomas W. Miller Jr., Steven D. Dolvin, CPA 2015

Das könnte Ihnen auch gefallen

- Bond Portfolio StrategiesDokument32 SeitenBond Portfolio StrategiesSwati VermaNoch keine Bewertungen

- CO12101E IP08 ProblemDokument6 SeitenCO12101E IP08 ProblemHaydee0% (1)

- THEORIES OF CAPITAL STRUCTUREDokument9 SeitenTHEORIES OF CAPITAL STRUCTURESoumendra RoyNoch keine Bewertungen

- AP - Set up Oracle R12 Accounts Payable (AP) basicsDokument39 SeitenAP - Set up Oracle R12 Accounts Payable (AP) basicssatyam shashi100% (1)

- Chapter 04 Working Capital 1ce Lecture 050930Dokument71 SeitenChapter 04 Working Capital 1ce Lecture 050930rthillai72Noch keine Bewertungen

- What Is A "Derivative" ?Dokument4 SeitenWhat Is A "Derivative" ?RAHULNoch keine Bewertungen

- EBT Market: Bonds-Types and CharacteristicsDokument25 SeitenEBT Market: Bonds-Types and CharacteristicsKristen HicksNoch keine Bewertungen

- Venture Capital FinalDokument26 SeitenVenture Capital Finalaarzoo dadwalNoch keine Bewertungen

- New Trend BankingDokument9 SeitenNew Trend BankingbilalbalushiNoch keine Bewertungen

- Foundational Theories and Techniques for Risk Management, A Guide for Professional Risk Managers in Financial Services - Part II - Financial InstrumentsVon EverandFoundational Theories and Techniques for Risk Management, A Guide for Professional Risk Managers in Financial Services - Part II - Financial InstrumentsNoch keine Bewertungen

- Banker and Customer Relationship PDFDokument25 SeitenBanker and Customer Relationship PDFaaditya01Noch keine Bewertungen

- Credit Risk ManagementDokument3 SeitenCredit Risk Managementamrut_bNoch keine Bewertungen

- Theories of Capital StructureDokument3 SeitenTheories of Capital StructureZahoorKhanNoch keine Bewertungen

- Debenture Trustee & Portfolio ManagersDokument5 SeitenDebenture Trustee & Portfolio ManagersMonika Rani0% (1)

- Unit 2 Capital StructureDokument27 SeitenUnit 2 Capital StructureNeha RastogiNoch keine Bewertungen

- CAMELS Ratings Framework for Banking SupervisionDokument19 SeitenCAMELS Ratings Framework for Banking SupervisionVikas R GaddaleNoch keine Bewertungen

- FEMA REGULATION OF FOREIGN EXCHANGEDokument31 SeitenFEMA REGULATION OF FOREIGN EXCHANGEManpreet Kaur SekhonNoch keine Bewertungen

- Portfolio ManagementDokument40 SeitenPortfolio ManagementSayaliRewaleNoch keine Bewertungen

- Notes - MARKETING - OF - FINANCIAL SERVICES - 2020Dokument69 SeitenNotes - MARKETING - OF - FINANCIAL SERVICES - 2020Rozy SinghNoch keine Bewertungen

- IFS Unit-1 Notes - 20200717114457Dokument9 SeitenIFS Unit-1 Notes - 20200717114457Vignesh C100% (1)

- Untitled 1Dokument3 SeitenUntitled 1cesar_mayonte_montaNoch keine Bewertungen

- Valuation of Bonds and Shares ExplainedDokument40 SeitenValuation of Bonds and Shares ExplainedJyoti Bansal67% (3)

- Asset Backed SecuritiesDokument179 SeitenAsset Backed SecuritiesShivani NidhiNoch keine Bewertungen

- Accounting for Musyarakah Financing: Understanding the Key Concepts and TransactionsDokument16 SeitenAccounting for Musyarakah Financing: Understanding the Key Concepts and TransactionsHadyan AntoroNoch keine Bewertungen

- CH 2 Indian Financial SystemDokument46 SeitenCH 2 Indian Financial Systemmaheshbendigeri5945Noch keine Bewertungen

- Cash Management of MNCDokument23 SeitenCash Management of MNCConnorLokmanNoch keine Bewertungen

- Markowitz TheoryDokument4 SeitenMarkowitz TheoryshahrukhziaNoch keine Bewertungen

- Designing A Global Financing StrategyDokument23 SeitenDesigning A Global Financing StrategyShankar ReddyNoch keine Bewertungen

- It Is A Stock Valuation Method - That Uses Financial and Economic Analysis - To Predict The Movement of Stock PricesDokument24 SeitenIt Is A Stock Valuation Method - That Uses Financial and Economic Analysis - To Predict The Movement of Stock PricesAnonymous KN4pnOHmNoch keine Bewertungen

- Chap 2 - Credit AnalysisDokument27 SeitenChap 2 - Credit Analysischarlie simoNoch keine Bewertungen

- Payout Policy Elements of Payout PolicyDokument6 SeitenPayout Policy Elements of Payout PolicyMarlon A. RodriguezNoch keine Bewertungen

- Financial Statements, Deals With An External Auditor's Responsibilities However, Both Internal andDokument11 SeitenFinancial Statements, Deals With An External Auditor's Responsibilities However, Both Internal andDanisa NdhlovuNoch keine Bewertungen

- Introduction To Financial ManagemntDokument29 SeitenIntroduction To Financial ManagemntibsNoch keine Bewertungen

- Short Term Financial Management in A Multinational CorporationDokument19 SeitenShort Term Financial Management in A Multinational CorporationSiddhant AggarwalNoch keine Bewertungen

- 7 Major Functions of The Reserve Bank of IndiaDokument2 Seiten7 Major Functions of The Reserve Bank of IndiaAkshay GodeNoch keine Bewertungen

- Topic1-Concept of LendingDokument16 SeitenTopic1-Concept of LendingPrEm GaBriel50% (2)

- BFMDokument17 SeitenBFMsaurabhasdfNoch keine Bewertungen

- Under CapitalizationDokument10 SeitenUnder CapitalizationNMRaycNoch keine Bewertungen

- Introduction To DerivativesDokument7 SeitenIntroduction To DerivativesRashwanth TcNoch keine Bewertungen

- Managing and Pricing Deposit ServicesDokument4 SeitenManaging and Pricing Deposit ServicesAli Kamal PashaNoch keine Bewertungen

- Financial Markets and Institutions 1Dokument29 SeitenFinancial Markets and Institutions 1Hamza Iqbal100% (1)

- Finalcil Market - Bba Unit One &twoDokument79 SeitenFinalcil Market - Bba Unit One &twoBhagawat PaudelNoch keine Bewertungen

- Harry Markowitz Portfolio Theory SummaryDokument2 SeitenHarry Markowitz Portfolio Theory SummaryZafar Khan100% (2)

- Lecture 2 Behavioural Finance and AnomaliesDokument15 SeitenLecture 2 Behavioural Finance and AnomaliesQamarulArifin100% (1)

- Primary Role of Company AuditorDokument5 SeitenPrimary Role of Company AuditorAshutosh GoelNoch keine Bewertungen

- Impact of Dividend Announcement On Stock PricesDokument5 SeitenImpact of Dividend Announcement On Stock Pricesolive_3Noch keine Bewertungen

- Cecchetti-5e-Ch02 - Money and The Payment SystemDokument46 SeitenCecchetti-5e-Ch02 - Money and The Payment SystemammendNoch keine Bewertungen

- Central Bank Regulations for Bank and Non-Bank LendingDokument2 SeitenCentral Bank Regulations for Bank and Non-Bank LendingGwenn PosoNoch keine Bewertungen

- Indian Financial System: FunctionsDokument31 SeitenIndian Financial System: Functionsmedha jaiwantNoch keine Bewertungen

- Cash ManagementDokument9 SeitenCash ManagementMeenakshi SundaramNoch keine Bewertungen

- Advanced Capital Budgeting - PDF Shiv1Dokument25 SeitenAdvanced Capital Budgeting - PDF Shiv1Neha Sinha100% (1)

- Components of Financial SystemDokument11 SeitenComponents of Financial SystemromaNoch keine Bewertungen

- Deposit MobiliziationDokument454 SeitenDeposit MobiliziationperkisasNoch keine Bewertungen

- Unit - 1 Introduction To AuditingDokument10 SeitenUnit - 1 Introduction To AuditingDarshan PanditNoch keine Bewertungen

- Systematic and Unsystematic RiskDokument12 SeitenSystematic and Unsystematic Risknilvemangesh89% (9)

- Obligation of BankerDokument1 SeiteObligation of BankerAbinas Agrawal0% (1)

- Aud339 Audit Planning Part 2Dokument26 SeitenAud339 Audit Planning Part 2Nur IzzahNoch keine Bewertungen

- UBS Risk Management and Tax Evasion SolutionsDokument7 SeitenUBS Risk Management and Tax Evasion SolutionsJoshua CabreraNoch keine Bewertungen

- Introduction To Retail BankingDokument6 SeitenIntroduction To Retail BankingS100% (1)

- MFS Module 1Dokument89 SeitenMFS Module 1Navleen KaurNoch keine Bewertungen

- Topic: Markowitz Theory (With Assumptions) IntroductionDokument3 SeitenTopic: Markowitz Theory (With Assumptions) Introductiondeepti sharmaNoch keine Bewertungen

- Corporate Finance Assignment 1 July To Sep BatchDokument9 SeitenCorporate Finance Assignment 1 July To Sep BatchMadhu Patil G TNoch keine Bewertungen

- International Compliance Forum - Brochure - IIOOO91009Dokument15 SeitenInternational Compliance Forum - Brochure - IIOOO91009Nyadroh Clement MchammondsNoch keine Bewertungen

- SyllabusDokument8 SeitenSyllabusAntônio DuarteNoch keine Bewertungen

- Chapter 6 Lecture Slides 9eDokument44 SeitenChapter 6 Lecture Slides 9ecolinmac8892Noch keine Bewertungen

- Shukrullah Assignment No 2Dokument4 SeitenShukrullah Assignment No 2Shukrullah JanNoch keine Bewertungen

- Journal List For AccountingDokument5 SeitenJournal List For AccountingNikhil Chandra ShilNoch keine Bewertungen

- Advanced Accounting UpdatesDokument113 SeitenAdvanced Accounting UpdatesYash KediaNoch keine Bewertungen

- Non-Current Asset PoliciesDokument16 SeitenNon-Current Asset PoliciesPaul ChangNoch keine Bewertungen

- Accounting Information Systems OverviewDokument9 SeitenAccounting Information Systems OverviewKesiah FortunaNoch keine Bewertungen

- Ph.D in Banking Technology RegulationsDokument13 SeitenPh.D in Banking Technology RegulationsShuvajoyyyNoch keine Bewertungen

- Expenditure Cycle Testbank CompressDokument13 SeitenExpenditure Cycle Testbank CompressMark CorpuzNoch keine Bewertungen

- Navin Packaging LTD: Share Capital A/cDokument4 SeitenNavin Packaging LTD: Share Capital A/cMaryNoch keine Bewertungen

- Substantive Tests of Transactions and Balances: Learning ObjectivesDokument61 SeitenSubstantive Tests of Transactions and Balances: Learning ObjectivesMatarintis A Zulqarnain IINoch keine Bewertungen

- Overview of Cost Management and StrategyDokument6 SeitenOverview of Cost Management and StrategyMaribeth BetewanNoch keine Bewertungen

- Working Paper AnalysisDokument10 SeitenWorking Paper AnalysisHannaniah PabicoNoch keine Bewertungen

- KHEA RHUL BrochureDokument12 SeitenKHEA RHUL BrochureBryan SingNoch keine Bewertungen

- Hedge Fund ResumeDokument6 SeitenHedge Fund Resumec2s1s8mr100% (1)

- Sap Fi End User Practice Work: AR AP Asset AccountingDokument19 SeitenSap Fi End User Practice Work: AR AP Asset AccountingHany RefaatNoch keine Bewertungen

- Accounting Education in Nigerian Universities: Challenges and ProspectsDokument9 SeitenAccounting Education in Nigerian Universities: Challenges and Prospectsoluwafemi MatthewNoch keine Bewertungen

- Module 3: Setup of Assets Module Overview: ObjectivesDokument28 SeitenModule 3: Setup of Assets Module Overview: ObjectivesasifNoch keine Bewertungen

- Stratcosman CompilationDokument22 SeitenStratcosman CompilationAl Francis GuillermoNoch keine Bewertungen

- 1.sanish Resume Latest - FinalDokument4 Seiten1.sanish Resume Latest - FinalBos BosNoch keine Bewertungen

- Chapter 3-The Recording Process and Accounting CycleDokument7 SeitenChapter 3-The Recording Process and Accounting CycleParvez TuhenNoch keine Bewertungen

- CFASDokument9 SeitenCFASNikoru ChanNoch keine Bewertungen

- JS 145 NXT With RB Kit and AC CabinDokument1 SeiteJS 145 NXT With RB Kit and AC CabinvikasNoch keine Bewertungen

- CH 06Dokument40 SeitenCH 06lalala010899Noch keine Bewertungen

- DEPA Cost Acctng.Dokument39 SeitenDEPA Cost Acctng.Maria DyNoch keine Bewertungen

- R41819 IRR ABD The Accounting Quiz BeesDokument14 SeitenR41819 IRR ABD The Accounting Quiz BeesGeraldo MejillanoNoch keine Bewertungen

- WSP Cash Conversion Cycle - VFDokument8 SeitenWSP Cash Conversion Cycle - VFMichael OdiemboNoch keine Bewertungen