Beruflich Dokumente

Kultur Dokumente

5 614332 3235090956423

Hochgeladen von

Kalpesh ShahOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

5 614332 3235090956423

Hochgeladen von

Kalpesh ShahCopyright:

Verfügbare Formate

Investor’s Eye

December 28, 2018

Index

Sharekhan Special - IDFC Bank - Capital First

Viewpoint - Lumax Auto Technologies

Visit us at www.sharekhan.com

For Private Circulation only

Sharekhan Special

IDFC Bank - Capital First

Merger complete; Retain Neutral view

Key points

Merger of IDFC Bank and Capital First Valuation: Considering the share swap, we

complete; To create a new entity: The merger believe the merged entity is valued at ~1x its

of IDFC Bank (IDFCBK) and Capital First (CAPF) FY2018 (proforma) book value, which we opine

has been completed, with December 31, 2018, is reasonable. Though the merger creates a

being the record date. Consequently, holdings in stronger entity and is strategically positive for

CAPF stock shall get converted into appropriate the long term, we see limited upside in the near

number of shares in IDFCBK. The new combined term. Hence, we have a Neutral view on the new

entity will be called IDFC First Bank and equity combined entity.

shares of IDFCBK will be issued to the existing

shareholders of CAPF, which shall rank pari Merger mutually beneficial for the long term:

passu with the existing shares of IDFCBK. With We believe while for the near term, there may

the delisting of CAPF, we drop our coverage on it. be challenges, the merger will be positive in the

long term for the combined entities.

The share swap ratio will be of 139 shares of

IDFCBK to 10 shares held in CAPF. The deal IDFCBK will be better off by gaining on the

values CAPF at 2.1x its FY2018A book value, expertise of CAPF management and will

while it values IDFCBK at 0.88x its FY2018A look to develop further lending products for

book value. The combined entity will be at ~1x the retail segment. The bank will be able to

its book value (arrived on a pro forma basis achieve a higher retail book acquisition. Recent

from FY2018 reported balance sheet figures). challenges before the NBFC segment in terms

of ALM management and their cost of funding

The merger will be creating a combined loan for CAPF will be addressed to a large extent by

asset book of Rs. 1.03 lakh crore for the merged the merger with a bank. CAPF currently has a

entity – IDFC First Bank – with net worth of funding profile, primarily funded by term loans

Rs. 44,056 crore. The board of IDFCBK has and cash credit (43.3% of total borrowings) and

approved the appointment of V Vaidyanathan, NCDs (41.8% of total borrowings), the rest being

Founder and Chairman, CAPF, as Managing funded via commercial papers (CPs). With the

Director and Chief Executive Officer of the merger, CAPF will have access to cheaper bank

merged entity. funds, which will not only help it see reduced

cost of funds, but also be complimentary for

Outlook: We believe despite near-term

IDFC First Bank (IDFCF) to grow its retail base

uncertainties on the business amalgamation,

by cross-selling benefits. IDFCBK, despite

there can be significant strategic long-term

its efforts, has been able to reach at 13.3% of

positives for the entity. CAPF has been successful

CASA ratio since its relatively short period

in developing and growing its business and loan

of existence. The bank’s funded book is also

book at a healthy pace, along with keeping good

largely wholesale heavy, with infrastructure

control on the asset quality. Thus, management

(29% of the total funded book) and corporate

has demonstrated its capability and quality;

(39% of the total funded book) and retail only

and now helming a bank potentially can be a

15% of the book.

strong win-win for both the entities in the long

term.

Sharekhan Limited, its analyst or dependant(s) of the analyst might be holding or having a position in the companies mentioned in the article.

December 28, 2018 2

Viewpoint

On growth highway

Key points

Lumax Auto Technologies

LAT to capitalise on consumer shift towards

View: Positive | CMP: Rs185 premium products, upcoming regulatory

changes to open new avenues: Lumax Auto

Technologies (LAT) is well positioned to

Company details outpace the automotive industry’s growth. The

Market cap: Rs1,261 cr automotive industry is fast moving towards LED

lighting, which will substantially benefit LAT (as

52-week high/low: Rs224/127 it supplies circuit boards to Lumax Industries).

NSE volume: (No of shares) 0.72 lakh Share of LED currently stands at 25-30% and is

expected to reach about 50% levels in the next

BSE code: 532796 two years. Further, given increased congestion

and driver fatigue, the passenger vehicle (PV)

NSE code: LUMAXTECH

industry is increasingly moving towards AMT

Sharekhan code: LUMAXTECH transmission from manual transmission, which

will benefit LAT. AMT penetration currently

Free float: (No of shares) 3.02 cr

is in early double digits and is witnessing

exponential growth, with AMT having almost

thrice the realisation compared to manual

Shareholding pattern

transmission. Further, upcoming BS6 regulations

Institutions (would come in force from April 2020) provide

2% Corporate Bodies a huge opportunity for LAT. The company will

9% supply oxygen sensors for the two-wheeler

(2W) segment as fuel injection would become

Foreign mandatory post BS6 norms. Further, LAT will

Promoters

17% supply telematics for CV players once the

52%

regulation comes into effect. In addition, order

wins in the air filter segment and new product

introduction in the aftermarket space would

Public and Others boost revenue. We expect LAT to post 15%

20% topline growth in FY2020.

Operating leverage; Better product mix to

drive margin expansion; Expect 140 BPS

Price chart improvement during FY2018-FY2020; Return

220

ratios to improve substantially: Revenue of LAT

is expected to clock strong double-digit growth

200

over the next two years, attributable to a host of

180 new opportunities opening up. The standalone

business also is on a strong footing and is

160

likely to add meaningfully to topline growth.

140 Strong revenue growth would bring in operating

120

leverage. Secondly, the likely improvement

in product mix augurs well for LAT’s margins.

100

Accelerated growth in the lucrative aftermarket

Aug-18

Dec-17

Apr-18

Dec-18

segment and improving traction from the new

business (air filters, gear shifters, oxygen sensors

and seat frames), which attract a double-digit

Price performance

margin, are expected to boost OPM’s over the

next two years. We have factored in a 140 BPS

(%) 1m 3m 6m 12m margin expansion over FY2018-FY2020 and

expect OPM to reach 10.5% by FY2020. Given

Absolute -2.8 5.9 43.0 11.0

the margin expansion, improved operational

Relative to Sensex -3.6 7.2 39.8 3.8 efficiency and reduction in debt, we expect

LAT’s ROE to improve significantly from 11.8% in

FY2018 to about 16% levels in FY2020.

December 28, 2018 3

Sharekhan Viewpoint

Valuations: Initiate coverage with a Positive component players fasten the access to latest

view: LAT is one of the leading auto component technologies so as to fully capitalise on existing

manufacturers focused on domestic markets. as well emerging opportunities. Strong topline

The company is likely to benefit in a big way from growth (20% CAGR over FY2018-FY2020) and

the upcoming regulatory changes and shifting operating performance would be reflected in

consumer preferences. The company has a the bottom line as well with PAT likely to report

well-diversified product portfolio and enjoys a robust 34% CAGR, making it one of the fastest

established relations with most of the leading growing auto component companies. We initiate

auto OEMs spread across the 2W, 3W, PV and CV viewpoint coverage on the stock and expect 18-

segments. Technical tie-ups with leading global 20% upside over the next 8 to 10 months.

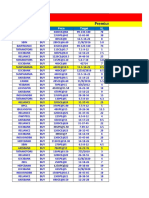

Valuation (Consolidated) Rs cr

Particulars FY16 FY17 FY18 FY19E FY20E

Revenues (Rs cr) 905.2 965.4 1111.5 1382.6 1590.0

Growth (%) 8.1 6.7 15.1 24.4 15.0

EBIDTA (Rs cr) 68.4 73.1 101.6 137.3 166.9

OPM (%) 7.6 7.6 9.1 9.9 10.5

Net Profit (Rs cr) 31.8 40.9 53.3 79.8 95.3

Growth (%) 8.7 28.6 30.4 49.8 19.4

EPS 4.7 6.0 7.8 11.7 14.0

P/E (x) 39.6 30.8 23.6 15.8 13.2

P/BV (x) 4.5 3.4 2.8 2.4 2.1

EV/EBIDTA (x) 18.8 17.0 11.9 8.7 7.0

ROE (%) 11.3 11.0 11.8 15.4 15.9

ROCE (%) 16.5 13.6 17.7 21.6 22.9

Company background: is present in the 2W and 3W segments (50% of

1HFY2019 sales), passenger cars (29% of 1HYF2019

Lumax Auto Technologies (LAT) is part of Lumax sales) and aftermarkets (13% of 1HFY2019 sales).

– D K Jain Group. The company is a leading auto

component manufacturer with a well-diversified The company has 14 manufacturing plants at five

product portfolio. Some of the products include different locations across the country catering

intake stems, integrated plastic modules, 2W chassis to the exports and aftermarkets segments. The

and lighting, gear shifters, seat structures and company is amongst the few integrated players in

mechanisms, LED lighting, aerospace and defence India, possessing the combination of robust R&D

engineering services, aftermarket, electrical and capabilities, technological competence and ability

electronics components, telematics products and to design and manufacture products. LAT is the only

services, and oxygen sensors. LAT supplies to most company in the country having the competencies to

of the leading automobile OEMs in the country and manufacture and supply gearlever for electric cars.

Segment revenue mix – 1HFY2019 (% of sales) Product wise revenue mix - 1HFY2019 (% of sales)

Aftermarkets

Lighting

Others 13%

24%

8%

Moulded parts

Aftermarkets 16% other misc

13% 8%

SMT Chasis & frames

Passenger 2/3 W 10%

16%

Car 50%

Intake systems Gear Shifters & parking

29%

3% brakes

10%

Sharekhan Limited, its analyst or dependant(s) of the analyst might be holding or having a position in the companies mentioned in the article.

December 28, 2018 4

Sharekhan Stock Ideas

Automobiles Infrastructure / Real estate

Apollo Tyres Gayatri Projects

Ashok Leyland ITNL

Bajaj Auto IRB Infrastructure Developers

Gabriel India Jaiprakash Associates

Hero MotoCorp Larsen & Toubro

M&M NBCC (India)

Maruti Suzuki Sadbhav Engineering

Rico Auto Industries

TVS Motor Oil & gas

Oil India

Banks & Finance Petronet LNG

Axis Bank Reliance Industries

Bajaj Finance Selan Exploration Technology

Bajaj Finserv

Bank of Baroda Pharmaceuticals

Bank of India Aurobindo Pharma

Capital First Cipla

Federal Bank Cadila Healthcare

Housing Development Finance Corporation Divi’s Labs

HDFC Bank Glenmark Pharmaceuticals

ICICI Bank Lupin

LIC Housing Finance Sun Pharmaceutical Industries

PTC India Financial Services Torrent Pharmaceuticals

Punjab National Bank

SBI Building materials

Union Bank of India Grasim Industries

Yes Bank The Ramco Cements

Shree Cement

Consumer goods UltraTech Cement

Britannia

Emami Discretionary consumption

GSK Consumers Arvind Ltd

Godrej Consumer Products Century Plyboards (India)

Hindustan Unilever Inox Leisure

ITC Info Edge (India)

Jyothy Laboratories Kewal Kiran Clothing

Marico Orbit Exports

Zydus Wellness Relaxo Footwear

Thomas Cook India

IT / IT services Wonderla Holidays

Firstsource Solutions Zee Entertainment

HCL Technologies

Infosys Diversified / Miscellaneous

Persistent Systems Aditya Birla Nuvo

Tata Consultancy Services Bajaj Holdings & Investment

Wipro Bharti Airtel

Bharat Electronics

Capital goods / Power Gateway Distriparks

CESC Max Financial Services

CG Power & Industrial Solutions PI Industries

Finolex Cable Ratnamani Metals and Tubes

Greaves Cotton Supreme Industries

Kalpataru Power Transmission UPL

KEC International

PTC India

Thermax

Triveni Turbine

V-Guard Industries

Va Tech Wabag

Know more about our products and services

For Private Circulation only

Disclaimer: This document has been prepared by Sharekhan Ltd. (SHAREKHAN) and is intended for use only by the person or entity

to which it is addressed to. This Document may contain confidential and/or privileged material and is not for any type of circulation

and any review, retransmission, or any other use is strictly prohibited. This Document is subject to changes without prior notice.

This document does not constitute an offer to sell or solicitation for the purchase or sale of any financial instrument or as an official

confirmation of any transaction. Though disseminated to all customers who are due to receive the same, not all customers may

receive this report at the same time. SHAREKHAN will not treat recipients as customers by virtue of their receiving this report.

The information contained herein is obtained from publicly available data or other sources believed to be reliable and SHAREKHAN

has not independently verified the accuracy and completeness of the said data and hence it should not be relied upon as such. While

we would endeavour to update the information herein on reasonable basis, SHAREKHAN, its subsidiaries and associated companies,

their directors and employees (“SHAREKHAN and affiliates”) are under no obligation to update or keep the information current. Also,

there may be regulatory, compliance, or other reasons that may prevent SHAREKHAN and affiliates from doing so. This document is

prepared for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Recipients

of this report should also be aware that past performance is not necessarily a guide to future performance and value of investments

can go down as well. The user assumes the entire risk of any use made of this information. Each recipient of this document should

make such investigations as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies

referred to in this document (including the merits and risks involved), and should consult its own advisors to determine the merits and

risks of such an investment. The investment discussed or views expressed may not be suitable for all investors. We do not undertake to

advise you as to any change of our views. Affiliates of Sharekhan may have issued other reports that are inconsistent with and reach

different conclusions from the information presented in this report.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any

locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation

or which would subject SHAREKHAN and affiliates to any registration or licencing requirement within such jurisdiction. The securities

described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession

this document may come are required to inform themselves of and to observe such restriction.

The analyst certifies that the analyst has not dealt or traded directly or indirectly in securities of the company and that all of the views

expressed in this document accurately reflect his or her personal views about the subject company or companies and its or their

securities and do not necessarily reflect those of SHAREKHAN. The analyst further certifies that neither he nor his relatives has any

direct or indirect financial interest nor have actual or beneficial ownership of 1% or more in the securities of the company nor have

any material conflict of interest nor has served as officer, director or employee or engaged in market making activity of the company.

Further, the analyst has also not been a part of the team which has managed or co-managed the public offerings of the company and

no part of the analyst’s compensation was, is or will be, directly or indirectly related to specific recommendations or views expressed

in this document.

Either SHAREKHAN or its affiliates or its directors or employees / representatives / clients or their relatives may have position(s), make

market, act as principal or engage in transactions of purchase or sell of securities, from time to time or may be materially interested

in any of the securities or related securities referred to in this report and they may have used the information set forth herein before

publication. SHAREKHAN may from time to time solicit from, or perform investment banking, or other services for, any company

mentioned herein. Without limiting any of the foregoing, in no event shall SHAREKHAN, any of its affiliates or any third party involved

in, or related to, computing or compiling the information have any liability for any damages of any kind.

Compliance Officer: Mr. Joby John Meledan; Tel: 022-61150000; email id: compliance@sharekhan.com;

For any queries or grievances kindly email igc@sharekhan.com or contact: myaccount@sharekhan.com

Registered Office: Sharekhan Limited, 10th Floor, Beta Building, Lodha iThink Techno Campus, Off. JVLR, Opp. Kanjurmarg Railway

Station, Kanjurmarg (East), Mumbai – 400042, Maharashtra. Tel: 022 - 61150000. Sharekhan Ltd.: SEBI Regn. Nos.: BSE / NSE / MSEI

(CASH / F&O / CD) / MCX - Commodity: INZ000171337; DP: NSDL/CDSL-IN-DP-365-2018; PMS: INP000005786; Mutual Fund: ARN

20669; Research Analyst: INH000006183;

Disclaimer: Client should read the Risk Disclosure Document issued by SEBI & relevant exchanges and the T&C on www.sharekhan.

com; Investment in securities market are subject to market risks, read all the related documents carefully before investing.

Das könnte Ihnen auch gefallen

- Summary of W.DDokument6 SeitenSummary of W.Dapi-3749193Noch keine Bewertungen

- 5 6154726356081967287 PDFDokument9 Seiten5 6154726356081967287 PDFKalpesh ShahNoch keine Bewertungen

- Candlesticks - The Basics (2000) PDFDokument27 SeitenCandlesticks - The Basics (2000) PDFJayakumar Mundayodummal100% (2)

- 5 6093898 709953675529Dokument2 Seiten5 6093898 709953675529Kalpesh ShahNoch keine Bewertungen

- 5 609116 0913115611237Dokument7 Seiten5 609116 0913115611237Kalpesh ShahNoch keine Bewertungen

- 5 60600099 01864779880Dokument4 Seiten5 60600099 01864779880Kalpesh ShahNoch keine Bewertungen

- Futures Magazine - The Art of Day-TradingDokument35 SeitenFutures Magazine - The Art of Day-Tradingapi-370474480% (5)

- 5 61029 36313281904816Dokument15 Seiten5 61029 36313281904816Kalpesh ShahNoch keine Bewertungen

- Trading Vs Making MoneyDokument26 SeitenTrading Vs Making MoneyHarsh Dixit100% (1)

- Van Tharp Worrying While TradingDokument5 SeitenVan Tharp Worrying While TradingLokator100% (1)

- 5 6120581817050333308 PDFDokument9 Seiten5 6120581817050333308 PDFKalpesh ShahNoch keine Bewertungen

- 5 60735 3125Dokument86 Seiten5 60735 3125Kalpesh ShahNoch keine Bewertungen

- Stock Books 012-Economics - How The Stock Market WorksDokument30 SeitenStock Books 012-Economics - How The Stock Market WorksdiglemarNoch keine Bewertungen

- 7 Steps To Success Trading Options OnlineDokument146 Seiten7 Steps To Success Trading Options OnlineRaju.Konduru100% (1)

- YearCompass Booklet en Us A4 FillableDokument20 SeitenYearCompass Booklet en Us A4 FillablePaul LeeNoch keine Bewertungen

- 5 6100630289506107520Dokument1 Seite5 6100630289506107520Kalpesh ShahNoch keine Bewertungen

- 5 6062405870845689872 PDFDokument7 Seiten5 6062405870845689872 PDFKalpesh ShahNoch keine Bewertungen

- 5 6183748012741754986Dokument5 Seiten5 6183748012741754986Kalpesh ShahNoch keine Bewertungen

- 5 6120581817050333308 PDFDokument9 Seiten5 6120581817050333308 PDFKalpesh ShahNoch keine Bewertungen

- 5 6088872756403765337Dokument3 Seiten5 6088872756403765337Kalpesh ShahNoch keine Bewertungen

- 5 6062405870845689865 PDFDokument11 Seiten5 6062405870845689865 PDFKalpesh ShahNoch keine Bewertungen

- 5 6132197805210468370Dokument2 Seiten5 6132197805210468370Kalpesh ShahNoch keine Bewertungen

- 5 6118376536027431105Dokument17 Seiten5 6118376536027431105Kalpesh ShahNoch keine Bewertungen

- 5 6156738380756418780Dokument11 Seiten5 6156738380756418780Kalpesh ShahNoch keine Bewertungen

- 5 6086860637240033391Dokument41 Seiten5 6086860637240033391Kalpesh ShahNoch keine Bewertungen

- 5 6086860637240033391Dokument41 Seiten5 6086860637240033391Kalpesh ShahNoch keine Bewertungen

- 5 6086860637240033389Dokument6 Seiten5 6086860637240033389Kalpesh ShahNoch keine Bewertungen

- 5 6107037530308214954Dokument13 Seiten5 6107037530308214954Kalpesh ShahNoch keine Bewertungen

- 5 6109166326553510010Dokument2 Seiten5 6109166326553510010Kalpesh ShahNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Roberts, Donaldson. Ante-Nicene Christian Library: Translations of The Writings of The Fathers Down To A. D. 325. 1867. Volume 15.Dokument564 SeitenRoberts, Donaldson. Ante-Nicene Christian Library: Translations of The Writings of The Fathers Down To A. D. 325. 1867. Volume 15.Patrologia Latina, Graeca et OrientalisNoch keine Bewertungen

- 15.597 B CAT en AccessoriesDokument60 Seiten15.597 B CAT en AccessoriesMohamed Choukri Azzoula100% (1)

- Pa Print Isang Beses LangDokument11 SeitenPa Print Isang Beses LangGilbert JohnNoch keine Bewertungen

- What Is A Designer Norman PotterDokument27 SeitenWhat Is A Designer Norman PotterJoana Sebastião0% (1)

- Apple Festival Program 2017Dokument3 SeitenApple Festival Program 2017Elizabeth JanneyNoch keine Bewertungen

- Introduction To Philosophy of The Human Person: Presented By: Mr. Melvin J. Reyes, LPTDokument27 SeitenIntroduction To Philosophy of The Human Person: Presented By: Mr. Melvin J. Reyes, LPTMelvin J. Reyes100% (2)

- Michael M. Lombardo, Robert W. Eichinger - Preventing Derailmet - What To Do Before It's Too Late (Technical Report Series - No. 138g) - Center For Creative Leadership (1989)Dokument55 SeitenMichael M. Lombardo, Robert W. Eichinger - Preventing Derailmet - What To Do Before It's Too Late (Technical Report Series - No. 138g) - Center For Creative Leadership (1989)Sosa VelazquezNoch keine Bewertungen

- 2024 01 31 StatementDokument4 Seiten2024 01 31 StatementAlex NeziNoch keine Bewertungen

- InnovationDokument19 SeitenInnovationPamela PlamenovaNoch keine Bewertungen

- Q3 Lesson 5 MolalityDokument16 SeitenQ3 Lesson 5 MolalityAly SaNoch keine Bewertungen

- Echeverria Motion For Proof of AuthorityDokument13 SeitenEcheverria Motion For Proof of AuthorityIsabel SantamariaNoch keine Bewertungen

- Student Worksheet Task 1 - Long Reading: Fanny Blankers-KoenDokument2 SeitenStudent Worksheet Task 1 - Long Reading: Fanny Blankers-KoenDANIELA SIMONELLINoch keine Bewertungen

- SULTANS OF SWING - Dire Straits (Impresión)Dokument1 SeiteSULTANS OF SWING - Dire Straits (Impresión)fabio.mattos.tkd100% (1)

- CAP214 Web Devlopment PDFDokument9 SeitenCAP214 Web Devlopment PDFAlisha AgarwalNoch keine Bewertungen

- Xavier High SchoolDokument1 SeiteXavier High SchoolHelen BennettNoch keine Bewertungen

- Political and Institutional Challenges of ReforminDokument28 SeitenPolitical and Institutional Challenges of ReforminferreiraccarolinaNoch keine Bewertungen

- QTP Common FunctionsDokument55 SeitenQTP Common FunctionsAnkur TiwariNoch keine Bewertungen

- GemDokument135 SeitenGemZelia GregoriouNoch keine Bewertungen

- Understanding SIP RE-INVITEDokument6 SeitenUnderstanding SIP RE-INVITESK_shivamNoch keine Bewertungen

- Deadlands - Dime Novel 02 - Independence Day PDFDokument35 SeitenDeadlands - Dime Novel 02 - Independence Day PDFDavid CastelliNoch keine Bewertungen

- Language Analysis - GRAMMAR/FUNCTIONS Context Anticipated ProblemsDokument2 SeitenLanguage Analysis - GRAMMAR/FUNCTIONS Context Anticipated Problemsshru_edgyNoch keine Bewertungen

- Pronouns Workshop SENADokument7 SeitenPronouns Workshop SENAPaula Rodríguez PérezNoch keine Bewertungen

- Hydraulics Experiment No 1 Specific Gravity of LiquidsDokument3 SeitenHydraulics Experiment No 1 Specific Gravity of LiquidsIpan DibaynNoch keine Bewertungen

- Berrinba East State School OSHC Final ITO For Schools Final 2016Dokument24 SeitenBerrinba East State School OSHC Final ITO For Schools Final 2016hieuntx93Noch keine Bewertungen

- Custom Belt Buckles: Custom Brass Belt Buckles - Hand Made in The USA - Lifetime Guarantee of QualityDokument1 SeiteCustom Belt Buckles: Custom Brass Belt Buckles - Hand Made in The USA - Lifetime Guarantee of QualityAndrew HunterNoch keine Bewertungen

- LM213 First Exam Notes PDFDokument7 SeitenLM213 First Exam Notes PDFNikki KatesNoch keine Bewertungen

- KBC Autumn Regatta 2023 Saturday Race ScheduleDokument2 SeitenKBC Autumn Regatta 2023 Saturday Race SchedulezainNoch keine Bewertungen

- Order of Magnitude-2017Dokument6 SeitenOrder of Magnitude-2017anon_865386332Noch keine Bewertungen

- 23 East 4Th Street NEW YORK, NY 10003 Orchard Enterprises Ny, IncDokument2 Seiten23 East 4Th Street NEW YORK, NY 10003 Orchard Enterprises Ny, IncPamelaNoch keine Bewertungen

- Polymeric Nanoparticles - Recent Development in Synthesis and Application-2016Dokument19 SeitenPolymeric Nanoparticles - Recent Development in Synthesis and Application-2016alex robayoNoch keine Bewertungen