Beruflich Dokumente

Kultur Dokumente

Income Tax

Hochgeladen von

Mara MartinezOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Income Tax

Hochgeladen von

Mara MartinezCopyright:

Verfügbare Formate

SUMMARY OF TAX RATES Income Tax on Corporations

Income Tax on Individuals DC RFC NRFC

NRA- NRA- Business Income

RC NRC RA ETB NETB 30% on taxable income

COMPENSATION -or-

30% (GI)

INCOME 20 – 35% 25% (GI) 2% MCIT,

whichever is higher

Fringe Benefits Tax

35%

Improperly

Business Income/ Accumulated

10% X X

Income from Earnings Tax (IAET)

Practice of 20 – 35% 25% (GI)

Profession Branch Profit

Remittance Tax X 15% X

PASSIVE INCOME

Interest (currency Royalties

20% 25% (GI) 20% 30% (GI)

bank deposit, etc)

Interest (currency

Royalties on books, bank deposit, etc) 20% 30% (GI)

literary works, and

10% 25% (GI)

compositions Interest (expanded

foreign currency

15% 7.5% Exempt

Royalties (others) deposit)

20% 25% (GI)

Prizes (above 10k) Capital gains from

20% X

sale of shares of Not over 100,000 = 5%

15%

Prizes (10k and stock not traded Excess amount = 10%

below) 20 – 35% (GI) 20% X

Intercorporate

Winnings dividends GR: 15% if Tax

20% X

DC-DC = exempt Sparring Rule

Exempt

Interest (expanded FC-DC = GI applies

foreign currency e: 30% (GI)

15% Exempt Exempt

deposit system)

Capital gains from

6% CGT based

Interest (long-term sale, exchange or

on GSP or FMV,

deposit) GR: Exempt disposition of lands X X

whichever is

e: Pre-termination before the 5th year and/or buildings

higher

4 years – 5 years = 5% 25% (GI)

3 years – 4 years = 12%

Less than 3 years = 20%

Cash or Property Income Tax on Special Corporations

From DC = 10%

Dividends 20% 25% (GI)

From FC = 20 – 35% (GI)

SPECIAL RESIDENT FOREIGN CORPORATIONS

CAPITAL GAINS International

GR: 2.5% on Gross Philippine Billings

Sales of shares of Traded: Carrier

e: 30% for offline carriers/ no landing rights

stock 6/10 of 1% of Gross Selling Price

Branch Profit

Not Traded: Remittance 15% on total profits applied or earmarked for remittance

15% CGT of Net Selling Price

Regional or

Sale of real Area HQ Exempt

property in the GR: 6% CGT based on GSP or FMV, whichever is higher

Phils e: Sale of principal residence (exempt) Regional

Operating HQ 10%

Other property 6% CGT

Short-term holding period

X X

= 100% of the gain

Long-term holding period

= 50% of the gain

SPECIAL DOMESTIC CORPORATIONS

Non-resident owner or lessor of vessels 4.5% of gross rentals, lease, or

chartered by Phil nationals charter fees from leases or

charters to Filipino citizens

Non-resident owner or lessor of aircraft,

machineries, and other equipment 7.5% of gross rentals or fees

IT RPT

Non-stock

Non-profit EXEMPT for income derived

Organizations from activities pursuant to

(11) the primary purpose for

which they were created

Charitable

Institutions, GR: EXEMPT

Religious e: income from properties or EXEMPT, if ADE used for

Organizations, from activity conducted for charitable, religious, educ

Charitable profit regardless of purpose

Hospitals disposition

Non-stock

Non-profit EXEMPT, if ADE used for

EXEMPT, if ADE used for

Educational charitable, religious, educ

educational purposes

Institutions purpose

Proprietary

GR: 10%

Educational

e: 30% if income from EXEMPT, if ADE used for

Institutions

“unrelated trade, business or charitable, religious, educ

other activity” exceeds 50% purpose

of the total income

Proprietary

GR: 10%

Hospitals

e: 30% if income from EXEMPT, if ADE used for

“unrelated trade, business or charitable, religious, educ

other activity” exceeds 50% purpose

of the total income

Government

GR: EXEMPT

Educational

e: income from properties or EXEMPT, unless beneficial

Institution

activities conducted for use pertains to non-exempt

profit, regardless of entity for a consideration

disposition

Government

Governmental functions:

Agencies

EXEMPT EXEMPT, unless beneficial

use pertains to non-exempt

Proprietary functions: entity for a consideration

Taxable

GOCCs

GR: EXEMPT

e: SSS, GSIS, PHIC, LWDs

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- QuizDokument4 SeitenQuizYong RenNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Land Titles and Deeds Under the Torrens SystemDokument1 SeiteLand Titles and Deeds Under the Torrens SystemMara MartinezNoch keine Bewertungen

- Grandfather RuleDokument1 SeiteGrandfather RuleMara MartinezNoch keine Bewertungen

- Income TaxDokument2 SeitenIncome TaxMara MartinezNoch keine Bewertungen

- Land Titles and Deeds Under the Torrens SystemDokument1 SeiteLand Titles and Deeds Under the Torrens SystemMara MartinezNoch keine Bewertungen

- Crimes Against ChastityDokument1 SeiteCrimes Against ChastityMara MartinezNoch keine Bewertungen

- Rescissible Voidable Unenforceable Void ContractsDokument1 SeiteRescissible Voidable Unenforceable Void ContractsMara MartinezNoch keine Bewertungen

- Labor TablesDokument4 SeitenLabor TablesMara MartinezNoch keine Bewertungen

- ForeclosureDokument1 SeiteForeclosureMara MartinezNoch keine Bewertungen

- ADOPTIONDokument2 SeitenADOPTIONMara MartinezNoch keine Bewertungen

- ADOPTIONDokument2 SeitenADOPTIONMara MartinezNoch keine Bewertungen

- ForeclosureDokument1 SeiteForeclosureMara MartinezNoch keine Bewertungen

- Grandfather RuleDokument1 SeiteGrandfather RuleMara MartinezNoch keine Bewertungen

- Labor TablesDokument4 SeitenLabor TablesMara MartinezNoch keine Bewertungen

- Rescissible Voidable Unenforceable Void ContractsDokument1 SeiteRescissible Voidable Unenforceable Void ContractsMara MartinezNoch keine Bewertungen

- Crimes Against ChastityDokument1 SeiteCrimes Against ChastityMara MartinezNoch keine Bewertungen

- ADOPTIONDokument2 SeitenADOPTIONMara MartinezNoch keine Bewertungen

- ADOPTIONDokument2 SeitenADOPTIONMara Martinez100% (1)

- Ra 7610Dokument7 SeitenRa 7610Mara MartinezNoch keine Bewertungen

- Cred TransDokument1 SeiteCred TransMara MartinezNoch keine Bewertungen

- London BoyDokument2 SeitenLondon BoyMara MartinezNoch keine Bewertungen

- Cred TransDokument1 SeiteCred TransMara MartinezNoch keine Bewertungen

- Cred TransDokument1 SeiteCred TransMara MartinezNoch keine Bewertungen

- Rem StickersDokument1 SeiteRem StickersMara MartinezNoch keine Bewertungen

- London BoyDokument2 SeitenLondon BoyMara MartinezNoch keine Bewertungen

- Ra 7610Dokument7 SeitenRa 7610Mara MartinezNoch keine Bewertungen

- Rem StickersDokument1 SeiteRem StickersMara MartinezNoch keine Bewertungen

- SSS RemindersDokument2 SeitenSSS RemindersMara MartinezNoch keine Bewertungen

- SSS RemindersDokument2 SeitenSSS RemindersMara MartinezNoch keine Bewertungen

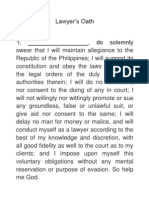

- Lawyer's OathDokument1 SeiteLawyer's OathKukoy PaktoyNoch keine Bewertungen

- IncomeTax Banggawan2019 Ch4Dokument15 SeitenIncomeTax Banggawan2019 Ch4Noreen Ledda50% (8)

- Group 2 Fiscal Policy Assignment 2Dokument16 SeitenGroup 2 Fiscal Policy Assignment 2NGHIÊM NGUYỄN MINH100% (1)

- STD 8th Perfect History and Civics Notes English Medium MH BoardDokument12 SeitenSTD 8th Perfect History and Civics Notes English Medium MH BoardSam Pathan0% (1)

- Major AssumptionsDokument3 SeitenMajor AssumptionsChristian VillaNoch keine Bewertungen

- Financial Analysis Dr. Reddy'sDokument9 SeitenFinancial Analysis Dr. Reddy'sSoumya ChakrabortyNoch keine Bewertungen

- Tax Invoice detailsDokument1 SeiteTax Invoice detailsJaideep SinghNoch keine Bewertungen

- Britannia Annual Report 2015-16Dokument188 SeitenBritannia Annual Report 2015-16Prabha KaranNoch keine Bewertungen

- Earnest Money Receipt Agreement-1Dokument2 SeitenEarnest Money Receipt Agreement-1Asisclo CastanedaNoch keine Bewertungen

- HDFC Fe Mumbai 09 04 2020 PDFDokument11 SeitenHDFC Fe Mumbai 09 04 2020 PDFbrijsingNoch keine Bewertungen

- IncomeTax MaterialDokument91 SeitenIncomeTax MaterialSandeep JaiswalNoch keine Bewertungen

- FESCO GST Electricity bill detailsDokument2 SeitenFESCO GST Electricity bill detailsSidraNoch keine Bewertungen

- All NEW HL P1 Essays Micro Only Tweaked (RWE For Part B) Until NOV21Dokument9 SeitenAll NEW HL P1 Essays Micro Only Tweaked (RWE For Part B) Until NOV21Alex sidiroNoch keine Bewertungen

- Notes FMDokument42 SeitenNotes FMSneha JayalNoch keine Bewertungen

- Basic Concepts of Accounting and Financial Reporting PDFDokument31 SeitenBasic Concepts of Accounting and Financial Reporting PDFALTernativoNoch keine Bewertungen

- Analisis Perpajakan Terhadap Bentuk Usaha Tetap Berbasis Layanan AplikasiDokument23 SeitenAnalisis Perpajakan Terhadap Bentuk Usaha Tetap Berbasis Layanan AplikasiNidha NianNoch keine Bewertungen

- General Principles of Taxation: Tax 111 - Income Taxation Ferdinand C. Importado Cpa, MbaDokument22 SeitenGeneral Principles of Taxation: Tax 111 - Income Taxation Ferdinand C. Importado Cpa, Mbaangelo_maranan100% (1)

- Alberto VegaDokument1 SeiteAlberto Vegaflordeliz12Noch keine Bewertungen

- Data 789 111Dokument74 SeitenData 789 111Ram CherryNoch keine Bewertungen

- CPE520 - Site SelectionDokument3 SeitenCPE520 - Site SelectionJaymacNoch keine Bewertungen

- 11th BPS Arrears Income Tax Relief 89 1 RajManglamDokument8 Seiten11th BPS Arrears Income Tax Relief 89 1 RajManglamShubhamGuptaNoch keine Bewertungen

- Capital Budgeting ExerciseDokument57 SeitenCapital Budgeting Exerciseshani27Noch keine Bewertungen

- ACCT1115 - Group Case Section A17 Part 2 Group 1Dokument7 SeitenACCT1115 - Group Case Section A17 Part 2 Group 1Maria Jana Minela IlustreNoch keine Bewertungen

- Employee's Withholding Certificate 2020Dokument4 SeitenEmployee's Withholding Certificate 2020CNBC.comNoch keine Bewertungen

- Sale of Two Condo UnitsDokument3 SeitenSale of Two Condo UnitsVince Leido0% (1)

- PILMICO v. CIRDokument2 SeitenPILMICO v. CIRPat EspinozaNoch keine Bewertungen

- Best Way to Travel Group Tour GuideDokument5 SeitenBest Way to Travel Group Tour GuidehungcaseNoch keine Bewertungen

- Final Withholding Tax FWT and CapitalDokument40 SeitenFinal Withholding Tax FWT and CapitalEdna PostreNoch keine Bewertungen

- Madhusudhan Offer LetterDokument2 SeitenMadhusudhan Offer LetterJoseph MillerNoch keine Bewertungen

- H.J. Heinz Company Balance Sheet and Vern Corporation Financial StatementsDokument3 SeitenH.J. Heinz Company Balance Sheet and Vern Corporation Financial StatementsTrung Kiên NguyễnNoch keine Bewertungen