Beruflich Dokumente

Kultur Dokumente

Case Study - Ram

Hochgeladen von

swathyCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Case Study - Ram

Hochgeladen von

swathyCopyright:

Verfügbare Formate

Mr. Ram, 29 years old, is working as a Engineer, TCS Bangalore.

The following are his details:

DATA SHEET OF THE CLIENT: (Method used: personal Interview and Questionnaire

CLIENT’S PERSONAL DETAILS

NAME: Ram

GENDER: Male

Date of Birth: 04-09-1990

Residential Address: No 4, Aishwarya Gardens, Sanjay Nagar, Bengaluru, Karnataka.

Occupation: TCS Bangalore

Phone Number: 8138024345

Marital status: single

Desired/ Expected age of retirement: 60 years

Details of Family/ Other retired Parties:

Wife – Home maker

Mother- Rtd. Professor, PSG Institute of Medical Sciences, Coimbatore

Qn. 1. Expectation from Investment in portfolio: Annual Return expectation on a long-term

basis:

Ans: - Good small Cap Mutual Fund investment is the area of interest for the client. These funds

have generated a CGAR of slightly over 15% returns on a long term basis.

Qn. 2. Are you happy with the past/present performance of your investment portfolio:

Ans: -Not very happy as the present level of returns are not sufficient.

Qn:3. Do you anticipate any major expenses ?

Ans: Nature of expense: Nil

Qn: 4. Are you aware of mutual funds equity schemes

Ans: Heard it is risky but capable of earning better returns in the long run

Qn:5. Would you be pleased to take some risk for a better return

Ans: I think I am open to it.

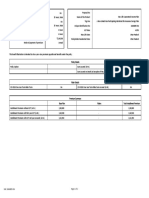

ANNUAL INCOME AND OTHER DETAILS

Annual Income from Active work Rs 12 Lakhs

Source of this income Salary

Expected annual growth rate 8%

Income from other sources Rs 300000

Expected annual growth rate 3%

Total Gross income Rs 1380000

Total tax liability

Tax deductions 120000

Housing Interest 120000

Life Insurance Premium 96000

PPF 80000

Fixed deposits 40000

MONTHLY EXPENSE DETAILS

Annual Income from Active work Rs 12 Lakhs

Source of this income Salary

Expected annual growth rate 8%

Income from other sources Rs 300000

Expected annual growth rate 3%

Total Gross income Rs 1380000

Tax deductions 120000

Housing Interest 120000

Life Insurance Premium 96000

PPF 80000

Fixed deposits 40000

INVESTMENT DETAILS/ per year

Investment Portfolio Break Up Fixed deposit PPF

Investment details 400000 80000

Expected annual growth 6.75% 8.10%

Date of Maturity 1 year (2nd Dec 20) 5 years (2nd

dec 2024)

Is it a must keep No Yes

OTHER ASSETS

Non Investment Portflio Residence

& Real

Estate

Investment Details 85 lakhs

Rent 25000/

month

Is it must keep Yes

LOANS AND LIABILITIES & EMIs

Liability Break up Property Loan Others

Total Amount Taken 30 lakhs 2 lakhs

Present Balance 27 Lakhs 1 lakh

EMI 25000 10000

(Instalments)-

No interest

Lender SBI Friends

INSURANCE

Insurance Break Up Life

Insurer Self

Start Date 1st Jan 2017

Maturity Date 2nd February 2042

Premium/Frequency 96000(yearly)

Maturity Value 3892000

Sum Assured 15 lakhs

QUESTIONS

1. Is Mr. Ram going on the right path in terms of his investments? If no, where can he

improve?

2. The data gathered about Ram explains that he has not started to invest in stock market or

mutual funds. Can risky funds be recommended to him if he is ok in bearing more risk.

3. What is his HLV at an expected, given (1) Expected rate of interest 8% (2) self maintenance

expenditure is Rs. 1,50,000 per year (2) Tax liability per year Rs. 3,50,000/-. Is his life

adequately covered ?

4. What can be a suitable wealth management plan for the next 10 years starting from

January, 2020 for Ram which includes insurance and retirement, given his present

profile? Given:-

a. He expects a return of 6.7% from Bank FD where he wants to invest after

retirement

b. Inflation rate is expected to be 3.7%

c. You can make your own justifiable assumptions on any other parameters, if any

missing

Other Information:

1. Return on his current insurance plan is likely to be around 6.25% p.a.

2. Term plan premium table for Mr. Ram for 35 year tenure

Sum Assure Premium

per year

Rs. 25 lakhs 4484

Rs. 50 lakhs 6277

Rs. 75 lakhs 8608

Every additional 25 lakhs will cost him additional Rs. 4100/- on premium every year.

Das könnte Ihnen auch gefallen

- Life Insurance Mcqs QuestionnaireDokument6 SeitenLife Insurance Mcqs QuestionnaireTrev ANoch keine Bewertungen

- RPR Whatsapp PDFDokument1 SeiteRPR Whatsapp PDFHarpinder ਮਾਨNoch keine Bewertungen

- Summer Internship Project Report Swati MishraDokument97 SeitenSummer Internship Project Report Swati MishraAvneesh Thakur67% (6)

- 1 Investment Options To Retirement MoneyDokument3 Seiten1 Investment Options To Retirement MoneyAMIT SHARMANoch keine Bewertungen

- Tutorial PFPDokument20 SeitenTutorial PFPGAW KAH YAN KITTYNoch keine Bewertungen

- Idfc Long Term Infrastructure BondsDokument2 SeitenIdfc Long Term Infrastructure Bondsnaav_adnaavNoch keine Bewertungen

- Wealth Management Group 8: Name Roll NoDokument16 SeitenWealth Management Group 8: Name Roll NoAdii AdityaNoch keine Bewertungen

- BOOST UP PDFS - Quantitative Aptitude - SI & CI Problems (Hard Level Part-1)Dokument23 SeitenBOOST UP PDFS - Quantitative Aptitude - SI & CI Problems (Hard Level Part-1)ishky manoharNoch keine Bewertungen

- C Endowment 25 YrsDokument5 SeitenC Endowment 25 YrsSaurabh GargNoch keine Bewertungen

- ICICI Guaranteed BenifitsDokument3 SeitenICICI Guaranteed BenifitsNaveen SettyNoch keine Bewertungen

- PD Interest RateDokument2 SeitenPD Interest RatecraftylandofficialNoch keine Bewertungen

- Financial Planning Pre-Retirement StageDokument14 SeitenFinancial Planning Pre-Retirement StageHIGGSBOSON304Noch keine Bewertungen

- DEL L&T Infrastructure BondDokument3 SeitenDEL L&T Infrastructure Bondpoly899Noch keine Bewertungen

- Micro Loan Application Form PDFDokument8 SeitenMicro Loan Application Form PDFKoushik ChakrabortyNoch keine Bewertungen

- Priti CaseDokument3 SeitenPriti Casecarry minatteeNoch keine Bewertungen

- Case CDokument3 SeitenCase Cnaveen0037Noch keine Bewertungen

- Case: Roger: (Reference Date: 1st April, 2019)Dokument6 SeitenCase: Roger: (Reference Date: 1st April, 2019)Krish BhutaNoch keine Bewertungen

- Qa Si Ci AdwbDokument5 SeitenQa Si Ci AdwbMohit Sharma0% (1)

- Taxation Cia 3Dokument27 SeitenTaxation Cia 3Soumya KesharwaniNoch keine Bewertungen

- Press Release: L&T Infrastructure Finance Company LimitedDokument4 SeitenPress Release: L&T Infrastructure Finance Company Limitedjignesh_vaderaNoch keine Bewertungen

- Investment PlanDokument1 SeiteInvestment PlanNitin AgarwalNoch keine Bewertungen

- 0000 Template - PCCDokument2 Seiten0000 Template - PCCRose Cano-AmbuloNoch keine Bewertungen

- Compond InterestDokument5 SeitenCompond InterestArvind SrivastavaNoch keine Bewertungen

- Sample Financial PlanDokument6 SeitenSample Financial Plannirmalsingh14503Noch keine Bewertungen

- Customer's Declaration: Assessment of Suitability and Appropriateness For Sale of Third Party ProductsDokument17 SeitenCustomer's Declaration: Assessment of Suitability and Appropriateness For Sale of Third Party ProductsKavya NageshNoch keine Bewertungen

- c549992e-cba1-4e32-9e08-7f8ff2a6d613Dokument7 Seitenc549992e-cba1-4e32-9e08-7f8ff2a6d613vonamal985Noch keine Bewertungen

- Features of ICICI Pru Guaranteed Income For Tomorrow: What Are Benefits of This Policy?Dokument3 SeitenFeatures of ICICI Pru Guaranteed Income For Tomorrow: What Are Benefits of This Policy?Meenu SinghNoch keine Bewertungen

- Null - 2021-12-15T162511.916Dokument1 SeiteNull - 2021-12-15T162511.916Mayur NagdiveNoch keine Bewertungen

- IDFC BondDokument3 SeitenIDFC BondKeisham BabitaNoch keine Bewertungen

- Gurpreet Case Study - Only AnswersDokument12 SeitenGurpreet Case Study - Only Answerspooja katariya0% (1)

- Financial Plan: Jaipuria Institute of Management LucknowDokument7 SeitenFinancial Plan: Jaipuria Institute of Management Lucknowmak_max11Noch keine Bewertungen

- Investment Declaration Form - FY 2022-23Dokument7 SeitenInvestment Declaration Form - FY 2022-23varaprasadNoch keine Bewertungen

- Housing Loan ExerciseDokument11 SeitenHousing Loan ExerciseMuskan RaghuwanshiNoch keine Bewertungen

- Post Office Surjit PDFDokument7 SeitenPost Office Surjit PDFPawan SharmaNoch keine Bewertungen

- EducationLoan Conv PDS ENGDokument4 SeitenEducationLoan Conv PDS ENGWan NurdyanaNoch keine Bewertungen

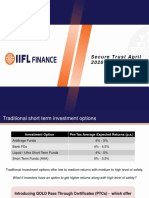

- Secure Trust April 2020 - PTC Series ADokument17 SeitenSecure Trust April 2020 - PTC Series ARohan RautelaNoch keine Bewertungen

- One-Pager-POS Saral Nivesh-1Dokument2 SeitenOne-Pager-POS Saral Nivesh-1abilashvincentNoch keine Bewertungen

- Bba Alternative Assignment-1Dokument2 SeitenBba Alternative Assignment-1princrNoch keine Bewertungen

- Features of ICICI Pru Guaranteed Income For Tomorrow: What Are Benefits of This Policy?Dokument3 SeitenFeatures of ICICI Pru Guaranteed Income For Tomorrow: What Are Benefits of This Policy?ShreyaNoch keine Bewertungen

- DownloadDokument3 SeitenDownloadKiran JohnNoch keine Bewertungen

- Financial Plan SampleDokument3 SeitenFinancial Plan SampleShruti SrivastavaNoch keine Bewertungen

- 19c157c7-bb83-4fab-8d2d-5c792c1af156Dokument7 Seiten19c157c7-bb83-4fab-8d2d-5c792c1af156vonamal985Noch keine Bewertungen

- Employees Provisional Savings (EPS) Form For Calculation of TDS To Be Deducted For The Financial Year 2021-2022Dokument3 SeitenEmployees Provisional Savings (EPS) Form For Calculation of TDS To Be Deducted For The Financial Year 2021-2022neeta rautelaNoch keine Bewertungen

- Features of ICICI Pru Guaranteed Income For Tomorrow (Long-Term)Dokument3 SeitenFeatures of ICICI Pru Guaranteed Income For Tomorrow (Long-Term)shashank pathakNoch keine Bewertungen

- Features of ICICI Pru Guaranteed Income For Tomorrow (Long-Term)Dokument3 SeitenFeatures of ICICI Pru Guaranteed Income For Tomorrow (Long-Term)ShreyaNoch keine Bewertungen

- 029 Practice Test 08 Taxation Test Solution Subjective Udesh RegularDokument8 Seiten029 Practice Test 08 Taxation Test Solution Subjective Udesh Regulardeathp006Noch keine Bewertungen

- ReportDokument7 SeitenReporttanjim_47Noch keine Bewertungen

- Sample Wealth GRIP ReportDokument5 SeitenSample Wealth GRIP Reportenigma1234Noch keine Bewertungen

- NRI News Letter From SBI Thiruvananthapuram CircleDokument5 SeitenNRI News Letter From SBI Thiruvananthapuram CircleDev RajNoch keine Bewertungen

- Sample Case StudYDokument11 SeitenSample Case StudYArun SahooNoch keine Bewertungen

- CFP TAXDokument15 SeitenCFP TAXAmeyaNoch keine Bewertungen

- Ashwin 2019Dokument3 SeitenAshwin 2019Aditya BohraNoch keine Bewertungen

- UIN: 104N085V04 Page 1 of 2Dokument2 SeitenUIN: 104N085V04 Page 1 of 2Yashwant ojhaNoch keine Bewertungen

- b464b3f8-a02f-4f47-8e63-821b81be0bb2Dokument7 Seitenb464b3f8-a02f-4f47-8e63-821b81be0bb2vonamal985Noch keine Bewertungen

- Time Value of MoneyDokument8 SeitenTime Value of MoneySocio Fact'sNoch keine Bewertungen

- Draft Proposal 904374689Dokument19 SeitenDraft Proposal 904374689SIDDHESH WADEKARNoch keine Bewertungen

- CI QuestioDokument46 SeitenCI QuestioRajendra KumarNoch keine Bewertungen

- IllustrationDokument2 SeitenIllustrationSakshi RaghuvanshiNoch keine Bewertungen

- Dena Niwas Housing Loan: (To Be Reset at The End of Every 3 Years)Dokument24 SeitenDena Niwas Housing Loan: (To Be Reset at The End of Every 3 Years)asdNoch keine Bewertungen

- A Haven on Earth: Singapore Economy Without Duties and TaxesVon EverandA Haven on Earth: Singapore Economy Without Duties and TaxesNoch keine Bewertungen

- Freedom Unleashed: How to Make Malaysia a Tax Free CountryVon EverandFreedom Unleashed: How to Make Malaysia a Tax Free CountryBewertung: 5 von 5 Sternen5/5 (1)

- A Haven on Earth: Singapore Economy Without Duties and TaxesVon EverandA Haven on Earth: Singapore Economy Without Duties and TaxesNoch keine Bewertungen

- JagoInvestor Book ReviewDokument33 SeitenJagoInvestor Book ReviewDwarkesh PanchalNoch keine Bewertungen

- Wey FinMan 4e TB AppK Other-Significant-LiabilitiesDokument11 SeitenWey FinMan 4e TB AppK Other-Significant-LiabilitiesJim AxelNoch keine Bewertungen

- Insular Life V Ebrado DigestDokument2 SeitenInsular Life V Ebrado Digestanj26a100% (1)

- Accoutnt Statement PDFDokument3 SeitenAccoutnt Statement PDFAlam MD SazidNoch keine Bewertungen

- Model Test 1: 5. The Losses of A Few Are Shared Amongst Many ThroughDokument1 SeiteModel Test 1: 5. The Losses of A Few Are Shared Amongst Many ThroughAnil KumarNoch keine Bewertungen

- Examples Solutions (PP 61-80)Dokument20 SeitenExamples Solutions (PP 61-80)Carmela BuncioNoch keine Bewertungen

- Tata Aia Life Insurance PLANSDokument5 SeitenTata Aia Life Insurance PLANSdeepmerwadeNoch keine Bewertungen

- Dear RespondentDokument5 SeitenDear RespondentPankaj SinghNoch keine Bewertungen

- Advanced Business Analytics - Essentials For Developing A Competitive Advantage-Springer Singapore (2016) PDFDokument163 SeitenAdvanced Business Analytics - Essentials For Developing A Competitive Advantage-Springer Singapore (2016) PDFNEELANSH YADAVNoch keine Bewertungen

- Ic 38 Short NotesDokument30 SeitenIc 38 Short NotesSAPNA SONINoch keine Bewertungen

- TakafulDokument29 SeitenTakafulMuhd FaridNoch keine Bewertungen

- SRS Vitality Protect LeafletDokument4 SeitenSRS Vitality Protect LeafletPraveen KumarNoch keine Bewertungen

- Huum - Info Shriram Life Insurance Company Wiki PRDokument2 SeitenHuum - Info Shriram Life Insurance Company Wiki PRRitik JainNoch keine Bewertungen

- Illustration NNNNDokument4 SeitenIllustration NNNNHaris Ali0% (1)

- Newsletter 17th - 23rd February 2024Dokument38 SeitenNewsletter 17th - 23rd February 2024ashsjkakNoch keine Bewertungen

- Risk AssignmentDokument4 SeitenRisk AssignmentMd. Asifujjaman JoyNoch keine Bewertungen

- Britannic Assurance - Moor Green Memories by Reg MonkDokument3 SeitenBritannic Assurance - Moor Green Memories by Reg MonkmikesoupNoch keine Bewertungen

- Life Insurance BasicsDokument42 SeitenLife Insurance BasicsYogesh GuptaNoch keine Bewertungen

- III BBA Star Health Insurance ProjectDokument151 SeitenIII BBA Star Health Insurance ProjectSuresh Kumar100% (1)

- Insurance Case DigestsDokument20 SeitenInsurance Case DigestsPalangkikay WebNoch keine Bewertungen

- Definition, Nature, Scope and History of Insurance: Difinition What Is Insurance?Dokument65 SeitenDefinition, Nature, Scope and History of Insurance: Difinition What Is Insurance?Geoffrey MwangiNoch keine Bewertungen

- A Study On Customer Satisfaction of Insurance CompaniesDokument6 SeitenA Study On Customer Satisfaction of Insurance CompaniesInternational Journal of Innovative Science and Research TechnologyNoch keine Bewertungen

- JAPAN Insurance MarketDokument12 SeitenJAPAN Insurance MarketGabriela DendeaNoch keine Bewertungen

- ICICI PrudentialDokument74 SeitenICICI PrudentialChanchal PassiNoch keine Bewertungen

- Variable IC Mock Exam Version 2 10022023Dokument16 SeitenVariable IC Mock Exam Version 2 10022023Jayr Purisima100% (1)

- EN Canadian Ethics Course For Life Insurance Agents 1Dokument37 SeitenEN Canadian Ethics Course For Life Insurance Agents 1foyakip453Noch keine Bewertungen

- Chapter-25 - Insurance - Pension Fund OperationsDokument35 SeitenChapter-25 - Insurance - Pension Fund Operationsmohammad olickNoch keine Bewertungen