Beruflich Dokumente

Kultur Dokumente

Financial Ratios - SMEs in Indonesia

Hochgeladen von

Rabia RasheedOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Financial Ratios - SMEs in Indonesia

Hochgeladen von

Rabia RasheedCopyright:

Verfügbare Formate

Review of Integrative Business and Economics Research, Vol.

8, Supplementary Issue 4 393

The Influence of Financial Ratios Analysis on

the Financial Performance of Micro Small

Medium Enterprises in Indonesia

Gema Muhammad Prawirodipoero*

School of Business and Management, Institut Teknologi

Bandung

Raden Aswin Rahadi

School of Business and Management, Institut Teknologi Bandung

Arif Hidayat

School of Business and Management, Institut Teknologi Bandung

ABSTRACT

Under the current paradigm in small business finance research, Micro, small, and

medium enterprises play a significant role in the economy of a country. With a large

number of MSMEs in Indonesia today, MSMEs help open employment, contribute to

state income in the form of taxes and also contribute a significant contribution to

GDP. MSMEs in Indonesia have a fundamental problem, namely a lack of knowledge

or insight into managing a business, especially in the field of financial management,

so that this makes the development of MSMEs in Indonesia unsustainable. In this

light, this paper will investigate the importance and influence of tools of financial

performance measurement that is financial ratios analysis towards the condition of the

financial performance of MSMEs in Indonesia. This research will further demonstrate

the importance and influence of the financial ratios analysis on the financial

performance of the MSMEs in Indonesia. The paper will also provide advice in using

financial ratios analysis for the owner of MSMEs.

Keywords: Financial ratios analysis, financial performance, MSMEs, Indonesia.

1. INTRODUCTION

Based on Indonesian Law Number 20 of 2008 concerning Micro, Small, and Medium

Enterprises, MSMEs stands for Micro, Small, and Medium Enterprises. The existence

of MSMEs in Indonesia is undeniably very supportive of the country's economy. The

number of MSMEs growth in Indonesia is not very fast, but a large number of

MSMEs in Indonesia in 2018 is registered by more than 55 million units (Suci, 2017).

Recorded on July 6, 2018, the MSMEs sector contributed 60% to national economic

growth (Suci, 2017).

With a large number of MSMEs in Indonesia, the Indonesian Government continues

to target a significant growth of MSMEs in the number of 5% by 2019. So it can be

said that the Indonesian Government is serious in helping the community to develop

industries in the MSMEs sector (Suci, 2017).

With the continued growth in the number of MSMEs in Indonesia, MSMEs business

must improve their capabilities and insights to improve all limitations and compete

optimally (Rahadi, 2016), one of the ways that MSMEs business can do to improve

Copyright 2019 GMP Press and Printing (http://buscompress.com/journal-home.html)

ISSN: 2304-1013 (Online); 2304-1269 (CDROM); 2414-6722 (Print)

Review of Integrative Business and Economics Research, Vol. 8, Supplementary Issue 4 394

competitiveness is by learning about financial management, such as insight of

financial ratio analysis (Wild, 2005).

According to Ward (2007), financial ratio analysis presents the relationship between

the financial statements on a specific period. According to Aksoy & Ugurlu (2006),

financial ratios indicate a company's financial performance so if the ratio of a

company's performance is above the average industry performance of a company then

either (outperformed) and vice versa (underperformed). Of the two statements above

contained the sense that the actual financial ratios illustrate the direct relationship

between the accounts that exist on the financial statements (Ahmad, 2013).

This study, as part of thesis research, will try to define the influence of financial ratios

analysis to the financial performance of MSMEs in Indonesia by analyzing problems

that arise that can be seen from the results of the financial ratio analysis. In this paper,

a model is constructed to measure the usability of the financial ratios analysis on

MSME’s financial performance.

2. LITERATURE REVIEW

Researchers have suggested several theories that show the importance of financial

ratio analysis to financial performances of micro, small, and Medium Enterprises.

Researchers have learned studies in financial ratios analysis and MSMEs in recent

years. Examples of studies include studies from Shahbaz et al. (2014) about

performance measurement of small and medium enterprises; Ndou (2014) about

assessment of access to financial management services by small, medium, and micro

enterprises; Mendoza (2015) about financial performance of micro, small, and

medium enterprises; Mendoza (2014) about accountancy service requirements of

micro, small, and medium enterprises; Chong (2008) about measuring performance of

small-and-medium sized enterprises; Dalrymple (2004) about measuring performance

of small and medium enterprises; Baltar et al. (2014) about innovative entrepreneur

and strategic decisions; Lin et al. (2011) about financial ratio selection for business

crisis prediction; Ohlson (1980) about using financial ratios analysis as a tool to

predict bankruptcy; Lewellen (2002) about using financial ratios analysis as a tool to

predict returns; Saikia (2012) about measuring financial performance of small scale

industries; Naidu & Chand (2013) about Financial problems faced by micro, small

and medium enterprises in the small island states; and Lohrey (2018) about the

importance of financial ratio analysis in financial planning.

Other previous study shows that a company including MSMEs in determining its

plans and evaluating its shortcomings, desperately needs a facility in the form of

financial performance measurement, because financial performance as an indicator

can provide very measurable considerations. Measurement in financial performance

can also help a company in studying conditions in the past in order to avoid the same

mistakes and also in order to maintain what is right (Chmielewska & Matuszyk,

2017).

Financial ratios are one of the tools in financial performances that used as an

analytical tool to assess financial performance and to evaluate the overall financial

Copyright 2019 GMP Press and Printing (http://buscompress.com/journal-home.html)

ISSN: 2304-1013 (Online); 2304-1269 (CDROM); 2414-6722 (Print)

Review of Integrative Business and Economics Research, Vol. 8, Supplementary Issue 4 395

condition of a corporation or other organization. So financial ratios are significant to

pinpoint strengths and weaknesses from which strategies and initiatives can be formed

(Theogene et al., 2017).

Financial ratio analysis has some of the essential components to be discussed, namely

liquidity measurement ratios, debt ratios, profitability indicator ratios, cash flow

indicator ratios, and operating performance ratios (Hayes, 2017).

2.1 Liquidity Measurement Ratios

Liquidity measurement ratios are the ratios that measure the capacity of a company to

meet its temporary obligation commitments. These ratios measure the capacity of a

company to satisfy its temporary liabilities when they fall due. The liquidity ratios are

an aftereffect of partitioning money and other fluid resources by the temporary

borrowings and current liabilities (Costea & Hostiuc, 2009).

Liquidity measurement ratios include some other ratio analyzes in order to take

measurements comprehensively, the analysis of the ratio includes a quick ratio,

current ratio, cash ratio, and cash conversion cycle (Wohlenr, 2017).

2.2 Debt Ratios

Debt ratios measure the ability of a company to meet its financial obligations when

they fall due. Debt ratios indicate the ability of a company to repay the principal

amount of its debts, pay interest on its borrowings, and to meet its other financial

obligations. Debt ratios usually compare the debts of a company to its assets (Falk &

Steiger, 2018).

The typical examples of financial leverage ratios include debt ratio, interest coverage

ratio, capitalization ratio, debt-to-equity ratio, and fixed assets to net worth ratio

(Kenton, 2019).

2.3 Profitability Indicator Ratios

Profitability Indicator Ratio measures a company's capacity to create income

concerning deals, assets, and value. These ratios evaluate the capacity of a company

to create income, benefits, and money streams in respect to concerning some

measurement, frequently the measure of cash contributed. They feature how

adequately the benefit of a company is being overseen (Tulsian, 2014).

Regular instances of profitability ratios incorporate net profit margin, return on

investment (ROI), return on equity (ROE), earning per share (EPS). These

proportions show how well a company is performing at creating benefits (Kenton,

2018).

2.4 Cash Flow Indicator Ratios

Operating performance ratios are tools, which measure the function of certain core

operations for an organization or business. Mainly, these ratios reveal information

about how efficiently that organization is using resources to generate sales and cash.

Copyright 2019 GMP Press and Printing (http://buscompress.com/journal-home.html)

ISSN: 2304-1013 (Online); 2304-1269 (CDROM); 2414-6722 (Print)

Review of Integrative Business and Economics Research, Vol. 8, Supplementary Issue 4 396

A company with stable performance ratios can utilize a minimum resource pool to

generate high levels of sales, as well as a significant cash inflow (Jooste, 2007).

2.5 Operating Performance Ratios

Operating performance ratios are instruments, which measure the capacity of certain

primary operations for a business institution. Mainly, these ratios uncover data about

how effectively that business is utilizing assets to produce deals and money (Heron &

Lie, 2002).

3. SUMMARY OF ANALYSIS

With the significant role of MSMEs in economic growth in Indonesia, the condition

of MSMEs in Indonesia is still not optimal, and there are still many MSMEs in

Indonesia that do not yet have transparent work systems and other weaknesses such as

the absence of standards for products produced and the limited types produced.

The weaknesses above can be overcome by applying measurements to the financial

performance by using financial ratios analysis, one of the methods is to do financial

analysis ratios. By knowing how well financial performance in MSMEs, of course,

the owners of MSMEs can know and evaluate financial problems that have taken

place as a whole so that MSMEs in Indonesia can develop without financial problems

that are already commonplace.

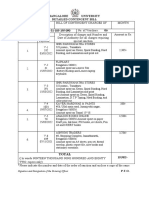

4. DISCUSSIONS AND CONCLUSION

Based on the literature studies above, there are several syntheses that the authors can

discover involving optimizing financial performance in MSMEs industry in Indonesia

using financial ratio analysis. There are five main components involved in the

maximization of financial performance using financial ratios analysis: liquidity

measurement ratios, debt ratios, profitability indicator ratios, cash flow indicator

ratios, and operating performance ratios.

For this preliminary study, the authors have concluded to make a conceptual

framework, which will be applied through future studies.

By referring to Figure 1, a conceptual framework is made to illustrate the factors that

will affect optimizing financial performance in MSMEs industry in Indonesia. In this

study focuses on the five main independent variables namely liquidity measurement

ratios, debt ratios, profitability indicator ratios, cash flow indicator ratios, and

operating performance ratios toward the dependent variable which is maximized

MSMEs financial Performance.

From the conceptual framework used, the hypotheses have been developed for this

study as follow:

H1: Good liquidity measurement ratios had a significant impact on maximized

MSMEs financial performance.

Copyright 2019 GMP Press and Printing (http://buscompress.com/journal-home.html)

ISSN: 2304-1013 (Online); 2304-1269 (CDROM); 2414-6722 (Print)

Review of Integrative Business and Economics Research, Vol. 8, Supplementary Issue 4 397

H2: Good debt ratios had a significant impact on maximized MSMEs financial

performance.

H3: Good profitability indicator ratios had a significant impact on maximized

MSMEs financial performance.

H4: Good cash flow indicator ratios had a significant impact on maximized MSMEs

financial performance.

H5: Good operating performance ratios had a significant impact on maximized

MSMEs financial performance.

Liquidity Measurement

Ratios

H1

Debt Ratios

H2

Profitability Indicator Maximized Financial

H3 Performance of MSMEs

Ratios

H4

Cash Flow Indicator Ratios

H5

Operating Performance

Ratios

Independent Variable Dependent Variable

Figure 1: Conceptual framework (Author’s Interpretation)

5. FUTURE RESEARCH

Copyright 2019 GMP Press and Printing (http://buscompress.com/journal-home.html)

ISSN: 2304-1013 (Online); 2304-1269 (CDROM); 2414-6722 (Print)

Review of Integrative Business and Economics Research, Vol. 8, Supplementary Issue 4 398

This research is an ongoing and repeated process. This study aims to build a

theoretical framework to understand the importance and influence of financial ratio

analysis on the financial performance of MSMEs in Indonesia. This research was also

made as a reference for future researchers with the same scope of research. Many

previous studies have focused on the importance of financial performance to MSMEs

business unit, but this study more intensely focused on tools of financial performance

measurement of MSMEs that is financial ratio analysis.

ACKNOWLEDGMENTS

We want to express our gratitude to School of Business and Management, Institut

Teknologi Bandung for the opportunity to write this work, and to the Society of

Interdisciplinary Business Research for allowing us to present and publish our

findings.

REFERENCES

[1] Ahmad, G. N. (2013). Analysis of Financial Distress in Indonesian Stock

Exchange. Review of Integrative Business & Economics Research, 521-533.

[2] Baltar, F., & Coulon, S. d. (2014). Dynamics of the Entrepreneurial Process: The

Innovative Entrepreneur and the Strategic Decisions.Review of Business and

Finance Studies, 69-81.

[3] Chong, H. G. (2008). Measuring Performance of Small-and-Medium-Sized

Enterprises: The Grounded Theory Approach. Journal of Business and Public

Affairs, 1-10.

[4] Costea, C. D., & Hostiuc, F. (2009). The Liquidity Ratios and Their Significance

in the Financial Equilibrium of the Firms. The Annals of The "Ştefan cel Mare"

University Suceava. Fascicle of The Faculty of Economics and Public

Administration, 252-261.

[5] Dalrymple, J. F. (2004). Performance Measurement for SME Growth - A

Business Profile Benchmarking Approach. Second World Conference on POM

and 15th Annual POM Conference, 1-20.

[6] Falk, M., & Steiger, R. (2018). An Exploration of the Debt Ratio of Ski Lift

Operators. Sustainability 2018, 1-16.

[7] Hayes, A. (2017, September 11). Ratio Analysis: Using Financial Ratios.

Retrieved July 23, 2018, from Investopedia.com:

[8] Heron, R., & Lie, E. (2002). Operating Performance and the Method of Payment

in Takeovers. Journal of Financial and Quantitative Analysis, 137-155.

[9] https://www.investopedia.com/university/ratio-analysis/using-ratios.asp

[10] Jooste, L. (2007). An Evaluation of the Usefulness of Cash Flow Ratios to

Predict Financial Distress. University of Wollongong Research Online, 1-14.

Copyright 2019 GMP Press and Printing (http://buscompress.com/journal-home.html)

ISSN: 2304-1013 (Online); 2304-1269 (CDROM); 2414-6722 (Print)

Review of Integrative Business and Economics Research, Vol. 8, Supplementary Issue 4 399

[11] Kenton, W. (2018, June 29). Profitability Ratios. Retrieved January 11, 2019,

from

Investopedia.com: https://www.investopedia.com/terms/p/profitabilityratios.asp

[12] Kenton, W. (2019, February 8). Debt Ratio. Retrieved February 18, 2019, from

Investopedia.com: https://www.investopedia.com/terms/d/debtratio.asp

[13] Lewellen, J. (2002). Predicting Returns with Financial Ratios. Social Science

Research Network Electronic Paper Collection, 1-35.

[14] Lin, F., Liang, D., & Chen, E. (2011). Financial ratio selection for business crisis

prediction. Expert Systems with Applications, 1-9.

[15] Lohrey, J. (2018, June 26). Importance of Ratio Analysis in Financial Planning.

Retrieved October 1, 2018, from

Chron:https://smallbusiness.chron.com/importance-ratio-analysis-financial-

planning-80600.html

[16] Mendoza, R. R. (2014). Accountancy Service Requirements of Micro, Small, and

Medium Enterprises in the Philippines. International Journal of Business,

Economics, and Law, 123-132.

[17] Mendoza, R. R. (2015). Financial Performance of Micro, Small, and Medium

Enterprises (MSMEs) in the Philippines. International Journal of Business and

Finance Research, 67-80.

[18] Naidu, S., & Chand, A. (2013). Financial Problems Faced by Micro, Small and

Medium Enterprises in the Small Island States: A Case Study of the

Manufacturing sector of the Fiji Islands. Int. J. Business Excellence, Vol. 6, No. 1,

2013, 1-20.

[19] Ndou, M. (2014). An Assessment of Access to Financial Management Services

by Small, Medium, and Micro Enterprises in Thohoyandou Business Centre. 13th

International Academic Conference, Antibes, 336-347.

[20] Oberholzer, M. (2012). The Relative Importance of Financial Ratios in Creating

Shareholders’ Wealth. SAJEMS NS 15 (2012) No 4 , 416-427.

[21] Ohlson, J. A. (1980). Financial Ratios and the Probabilistic Prediction of

Bankruptcy. Journal of Accounting Research Vol. 18 Nd. 1 Spring 1980, 109-

131.

[22] Ptak-Chmielewska, A., & Matuszyk, A. (2018). The Importance of Financial and

non-Financial Ratios in SMEs Bankruptcy Prediction. Bank I Kredyt 49(1), 46-

62.

Copyright 2019 GMP Press and Printing (http://buscompress.com/journal-home.html)

ISSN: 2304-1013 (Online); 2304-1269 (CDROM); 2414-6722 (Print)

Review of Integrative Business and Economics Research, Vol. 8, Supplementary Issue 4 400

[23] Rahadi, R. A. (2016). Opportunities and Challenges for Micro-Small and

Medium Business in Indonesia Facing ASEAN Economic Community. Jurnal

Manajemen dan Kewirausahaan, 18(1), 45-53.

[24] Saikia, H. (2012). Measuring Financial Performance of Small Scale Industries:

Some Evidences from India. Journal of Applied Economics and Business

Research, 46-54.

[25] Shahbaz, M. A., Javed, A., Dar, A., & Sattar, T. (2014). Performance

Measurement of Small and Medium Enterprises (SMEs) in Pakistan. Archives of

Business Research, 42-49.

[26] Suci, Y. R. (2017). Perkembangan UMKM (Usaha Mikro Kecil dan Menengah)

di Indonesia. Jurnal Ilmiah Cano Ekonomos , 51-58.

[27] Theogene, H., Mulegi, T., & Hosee, N. (2017). The Contribution of Financial

Ratios Analysis on Effective Decision Making in Commercial

Banks. International Journal of Management and Applied Science, 33-40.

[28] Tulsian, M. (2014). Profitability Analysis (A comparative study of SAIL &

TATA Steel). IOSR Journal of Economics and Finance (IOSR-JEF), 19-22.

[29] Wild, J. J., Bernstein, L. A., & Subramanyam, K. R. (2005). Financial Statement

Analysis. Jakarta: Salemba Empat.

[30] Wohlner, R. (2017, May 4). Liquidity Measurement Ratios. Retrieved July 22,

2018, from Investopedia.com:

https://www.investopedia.com/university/ratios/liquidity-measurement/

Copyright 2019 GMP Press and Printing (http://buscompress.com/journal-home.html)

ISSN: 2304-1013 (Online); 2304-1269 (CDROM); 2414-6722 (Print)

Das könnte Ihnen auch gefallen

- Industry NoteDokument1 SeiteIndustry NoteRabia RasheedNoch keine Bewertungen

- Organizational Behavior Case:: Bad BrakesDokument1 SeiteOrganizational Behavior Case:: Bad BrakesRabia Rasheed0% (1)

- Cost 2019Dokument13 SeitenCost 2019Rabia RasheedNoch keine Bewertungen

- Operation ManagementDokument15 SeitenOperation ManagementRabia RasheedNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- 3 Decomposition PDFDokument40 Seiten3 Decomposition PDFPyae Phyo KyawNoch keine Bewertungen

- Edu 111 The TrinityDokument4 SeitenEdu 111 The Trinityolatinwoa02Noch keine Bewertungen

- Brand Identity Aaker's ModelDokument2 SeitenBrand Identity Aaker's Modelvibhaanagpal100% (1)

- M. Rahul Ananta - Rudito, BambangDokument5 SeitenM. Rahul Ananta - Rudito, BambangMuhammad Rahul AnantaNoch keine Bewertungen

- Lecture 4 EMADokument36 SeitenLecture 4 EMAYai IbrahimNoch keine Bewertungen

- HA2 Week 9: Lesson 1 Homework: X y X yDokument9 SeitenHA2 Week 9: Lesson 1 Homework: X y X ySebastien TaylorNoch keine Bewertungen

- UA&P-JD Application FormDokument4 SeitenUA&P-JD Application FormuapslgNoch keine Bewertungen

- 968 BMW X5 (G05) Brochure 20x30cm en v18 Low-Min - 0Dokument25 Seiten968 BMW X5 (G05) Brochure 20x30cm en v18 Low-Min - 0tarakeshNoch keine Bewertungen

- A044 2019 20 Readiness Review Template For EAC 3-12-2018 FinalDokument25 SeitenA044 2019 20 Readiness Review Template For EAC 3-12-2018 FinalMohamed AbdelSalamNoch keine Bewertungen

- Kalish GI ProtocolsDokument5 SeitenKalish GI Protocolsgoosenl100% (1)

- Generic List - MOH PHCs-March-2023Dokument11 SeitenGeneric List - MOH PHCs-March-2023drabdulrabbNoch keine Bewertungen

- Lower LimbDokument53 SeitenLower LimbRupesh M DasNoch keine Bewertungen

- Summative Test Module 1.1 1.2Dokument2 SeitenSummative Test Module 1.1 1.2Jocelyn RoxasNoch keine Bewertungen

- Micro Hydro BrochureDokument4 SeitenMicro Hydro BrochureErlangga SatyawanNoch keine Bewertungen

- Gs Reported Speech - ExercisesDokument6 SeitenGs Reported Speech - ExercisesRamona FloreaNoch keine Bewertungen

- Guidelines For Execution of Adapt-Pt: Structural Concrete Software SystemDokument6 SeitenGuidelines For Execution of Adapt-Pt: Structural Concrete Software SystemJoe IztadaNoch keine Bewertungen

- Surveying Lesson 6 To 10 PDFDokument68 SeitenSurveying Lesson 6 To 10 PDFNadane AldoverNoch keine Bewertungen

- Answer: D: ExplanationDokument33 SeitenAnswer: D: Explanationjaime costaNoch keine Bewertungen

- Computer Commerce PDFDokument176 SeitenComputer Commerce PDFMallu TechNoch keine Bewertungen

- Ionic EquilibriumDokument22 SeitenIonic EquilibriumbeherasubhammikunNoch keine Bewertungen

- Fluphenazine Drug Study!Dokument3 SeitenFluphenazine Drug Study!EmJay Balansag100% (3)

- CEP Presentation AOL 2023Dokument143 SeitenCEP Presentation AOL 2023Josh DezNoch keine Bewertungen

- Subject - Monetary Economics: MoneyDokument4 SeitenSubject - Monetary Economics: MoneyRajat LonareNoch keine Bewertungen

- Lecture6-Design Expert Software - TutorialDokument29 SeitenLecture6-Design Expert Software - TutorialAzwan ShakraniNoch keine Bewertungen

- UNITRONICS V200-18-E1Dokument10 SeitenUNITRONICS V200-18-E1eddieipenzaNoch keine Bewertungen

- Unit 2 Computer Hardware and SoftwareDokument24 SeitenUnit 2 Computer Hardware and SoftwareNgHanSeongNoch keine Bewertungen

- Topic: Atoms and Molecules Sub-Topic: Mole: Lesson PlanDokument4 SeitenTopic: Atoms and Molecules Sub-Topic: Mole: Lesson PlanPushpa Kumari67% (3)

- First ContingencyDokument2 SeitenFirst Contingencymanju bhargavNoch keine Bewertungen

- Bond IndexDokument18 SeitenBond IndexBashar ToshtashNoch keine Bewertungen

- Find The Best Location For Your Business or For Your Rice Retailing BusinessDokument2 SeitenFind The Best Location For Your Business or For Your Rice Retailing BusinessAAAAANoch keine Bewertungen