Beruflich Dokumente

Kultur Dokumente

Problems Trial Balance

Hochgeladen von

MUHAMMED RABIHOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Problems Trial Balance

Hochgeladen von

MUHAMMED RABIHCopyright:

Verfügbare Formate

9

Accounting

PROBLEMS FOR TRIAL BALANCE (1-5)

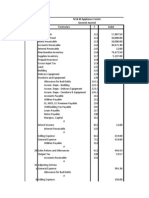

Problem # 9.1: Prepare a Trial Balance for Shining Brothers Pvt. Ltd. at March 31st, 2017?

Description Amount Description Amount Description Amount

Bank Loan Rs. 14,000 Insurance Expense Rs. 7,300 Equipments Rs. 40,000

Marketable Security 6,500 Owner's Investments 95,000 Maintenance Exp. 5,000

Bill Payable 1,000 Rent & Rates Expense 400 Miscellaneous Expenses 4,800

Unearned Revenue 3,500 Acc. Dep. _ Equipments 14,000 Accrued Expenses 1,500

Sundry Debtors 12,000 Accrued Revenue 15,000 Dep. Exp. _ Equipments 2,000

Outstanding Salaries 2,500 Machinery 25,000 Unexpired Insurance 8,500

Prepaid Rent 2,000 Drawings 3,500 Vendor's Payables 500

Shining Brothers Pvt. Ltd.

Trial Balance

As on March 31st, 2017

Amount (Rs.)

S. No Description Ref Dr. Cr.

1 Bank Loan

2 Marketable Security

3 Bill Payable

4 Unearned Revenue

5 Sundry Debtors

6 Outstanding Salaries

7 Prepaid Rent

8 Insurance Expense

9 Owner's Investments

10 Rent & Rates Expense

11 Accumulated Dep. _ Equipments

12 Accrued Revenue

13 Machinery

14 Drawings

15 Equipments

16 Maintenance Exp.

17 Miscellaneous Expenses

18 Accrued Expenses

19 Depreciation Exp. _ Equipments

20 Unexpired Insurance

21 Vendor's Payables

Total Rs. 132,000 Rs. 132,000

www.accountancyKnowledge.com 1 Trial Balance

9

Accounting

Problem # 9.2: There are several Mistakes in the Umer & Brothers (Pvt.) Ltd. Trial Balance. You are requested to

identify Errors and make corrected Trial Balance?

S. No Heads of Accounts Ref Debit Credit

1 Umer Owner Equity 1,551

2 Umer Drawings 560

3 Equipments 2,850

4 Sales 2,850

5 Due from Customers 530

6 Purchases 1,260

7 Purchase Return 364

8 Bank Loan 996

9 Creditors 528

10 Taxes 720

11 Cash in Hand 226

12 Note Payable 680

13 Inventory 264

14 Repair 461

15 Return Inward 98

Total Rs. 7,649 Rs. 6,289

S. No Heads of Accounts Ref Debit Credit

1 Umer Owner Equity

2 Umer Drawings

3 Equipments

4 Sales

5 Due from Customers

6 Purchases

7 Purchase Return

8 Bank Loan

9 Creditors

10 Taxes

11 Cash in Hand

12 Note Payable

13 Inventory

14 Repair

15 Return Inward

Total

www.accountancyKnowledge.com 2 Trial Balance

9

Accounting

Problem # 9.3: Prepare Trial Balance as on 31.03.2012 from the following balances of Ms. Maliha Afzal

Drawings Rs. 74,800 Purchases Rs. 295,700 Stock (1.04.2011) Rs. 30,000 Bills receivable Rs. 52,500

Capital Rs. 250,000 Furniture Rs. 33,000 Discount allowed Rs. 950 Sales Rs. 335,350

Rent Rs. 72,500 Freight Rs. 3,500 Printing charges Rs. 1,500 Sundry creditors 75,000

Insurance Rs. 2,700 Sundry expenses Rs. 21,000 Discount received Rs. 1,000 Bank loan Rs. 120,000

Stock (31.03.2012) Rs. 17,000 Income tax Rs. 9,500 Machinery Rs. 215,400 Bills payable Rs. 31,700

Ms. Maliha Afzal

Trial Balance

As on 31st March, 2012

Amount (Rs.)

S. No Heads of Accounts Ref Dr Cr

10

11

12

13

14

15

16

17

18

19

Total Rs. 813,050 Rs. 813,050

www.accountancyKnowledge.com 3 Trial Balance

9

Accounting

Problem # 9.4: Prepare Trial Balance from the following balances of Mr. Akhtar as on 31.12.2016

Capital Rs. 420,000 Cash in hand Rs. 25,000 Building Rs. 115,000 Cash at bank Rs. 84,700

Machinery Rs. 60,000 Sundry Creditors Rs. 68,000 Furniture Rs. 11,000 Rent Rs. 48,000

Car Rs. 68,000 Opening stock Rs. 86,000 Commission Rs. 1,400 Rates and Taxes Rs. 2,600

Purchases Rs. 94,000 Bad debts Rs. 3,200 Sales Rs. 196,000 Insurance Rs. 2,400

General Expenses Rs. 800 Sundry debtors Rs. 16,200 Reserve for doubtful debts Rs. 7,300 Salaries Rs. 94,000

Closing Stock Rs. 12,000 Unearned Revenue Rs. 16,000 Interest received Rs. 5,000

Mr. Akhtar

Trial Balance

As on 31st December, 2016

Amount (Rs.)

S. No Heads of Accounts Ref Dr Cr

www.accountancyKnowledge.com 4 Trial Balance

9

Accounting

Problem # 9.5: The following balances are extracted from the books of Ms. Maria Waseem, Prepare Trial Balance as on

30.6.2015

Owner’s Equity Rs. 470,200 Machinery Rs. 158,800 Cash in hand Rs. 6,000 Account receivable Rs. 48,000

Building Rs. 320,000 Repairs Rs. 5,400 Stock Rs. 33,000 Insurance premium Rs. 3,300

Account payable Rs. 26,000 Sales Rs. 290,000 Commission Rs. 750 Telephone charges Rs. 6,450

Rent & Taxes Rs. 6,300 Furniture Rs. 11,000 Purchases Rs. 165,000 Discount earned Rs. 1,100

Loan from Sidra Rs. 51,000 Salaries Rs. 70,600 Reserve fund Rs. 5,900 Discount allowed Rs. 650

Note receivable Rs. 8,600 Drawings Rs. 5,000 Bad debts Rs. 1,350 Bills payable Rs. 6,000

Ms. Maria Waseem

Trial Balance

As on 30th June, 2015

Amount (Rs.)

S. No Heads of Accounts Ref Dr Cr

www.accountancyKnowledge.com 5 Trial Balance

Das könnte Ihnen auch gefallen

- LASALA Partnership Formation SWDokument2 SeitenLASALA Partnership Formation SWLizzeille Anne Amor MacalintalNoch keine Bewertungen

- 2.6. Retained EarningsDokument5 Seiten2.6. Retained EarningsKPoPNyx Edits100% (1)

- Chapter 7: Receivables: Principles of AccountingDokument50 SeitenChapter 7: Receivables: Principles of AccountingRohail Javed100% (1)

- Final RequirementDokument18 SeitenFinal RequirementZandra GonzalesNoch keine Bewertungen

- Lesson 3: Worksheet 3: Remedial Lesson 3: Adjusting EntriesDokument2 SeitenLesson 3: Worksheet 3: Remedial Lesson 3: Adjusting EntriesAleana joy PabelicNoch keine Bewertungen

- Assignment Prep Airing Journal Entries and Trail BalancesDokument13 SeitenAssignment Prep Airing Journal Entries and Trail BalancesChristine NorthrupNoch keine Bewertungen

- Partnership Liquidation: Assets Liabilities & EquityDokument2 SeitenPartnership Liquidation: Assets Liabilities & EquityIvy BautistaNoch keine Bewertungen

- PartnershipDokument20 SeitenPartnershipYudna YuNoch keine Bewertungen

- Lumpsum LiquidationDokument28 SeitenLumpsum LiquidationCAMILLE100% (1)

- General Journal - M&MDokument4 SeitenGeneral Journal - M&Mnaztig_017Noch keine Bewertungen

- Gavarra-Marie Joy-Bsais-2b-Problem3-No.3Dokument2 SeitenGavarra-Marie Joy-Bsais-2b-Problem3-No.3Nikki Jean Hona50% (2)

- Quiz 2.1 Financial Statement Analysis - Attempt ReviewDokument7 SeitenQuiz 2.1 Financial Statement Analysis - Attempt ReviewRica Jayne Gerona CuizonNoch keine Bewertungen

- Business Combi Part 2Dokument20 SeitenBusiness Combi Part 2Rica Joy RuzgalNoch keine Bewertungen

- Partnership LiquidationDokument5 SeitenPartnership LiquidationChristian PaulNoch keine Bewertungen

- Quiz No. 1: Intermediate Accounting, Part 4Dokument3 SeitenQuiz No. 1: Intermediate Accounting, Part 4Paula BautistaNoch keine Bewertungen

- Strategic Cost ManagementDokument7 SeitenStrategic Cost ManagementAngeline RamirezNoch keine Bewertungen

- (EXERCISE) Bond ValuationDokument1 Seite(EXERCISE) Bond Valuationclary fray100% (1)

- Classifications of PartnershipDokument3 SeitenClassifications of PartnershipFely MaataNoch keine Bewertungen

- W7 Module 6 COMPARATIVE FINANCIAL STATEMENT ANALYSISDokument8 SeitenW7 Module 6 COMPARATIVE FINANCIAL STATEMENT ANALYSISDanica VetuzNoch keine Bewertungen

- AR Quiz Page 2Dokument25 SeitenAR Quiz Page 2Xia AlliaNoch keine Bewertungen

- Partnership Liquidation Exam AnswersDokument7 SeitenPartnership Liquidation Exam AnswersAlexandriteNoch keine Bewertungen

- Quiz 2 Partnership OperationsDokument4 SeitenQuiz 2 Partnership OperationsChelit LadylieGirl FernandezNoch keine Bewertungen

- Group Activity 5Dokument2 SeitenGroup Activity 5Jeremy James AlbayNoch keine Bewertungen

- Comprehensive ProblemDokument1 SeiteComprehensive ProblemDavid Con RiveroNoch keine Bewertungen

- AC 3 - Intermediate Acctg' 1 (Ate Jan Ver)Dokument119 SeitenAC 3 - Intermediate Acctg' 1 (Ate Jan Ver)John Renier Bernardo100% (1)

- FM - Cost of CapitalDokument26 SeitenFM - Cost of CapitalMaxine SantosNoch keine Bewertungen

- Direct Method or Cost of Goods Sold MethodDokument2 SeitenDirect Method or Cost of Goods Sold MethodNa Dem DolotallasNoch keine Bewertungen

- Q and A PartnershipDokument9 SeitenQ and A PartnershipFaker MejiaNoch keine Bewertungen

- Ast-Chapter 1 p3, p5, p6Dokument8 SeitenAst-Chapter 1 p3, p5, p6Geminah BellenNoch keine Bewertungen

- Nature and Background of The Specialized IndustryDokument3 SeitenNature and Background of The Specialized IndustryEly RiveraNoch keine Bewertungen

- Chapter 1 - Introduction To GovernanceDokument39 SeitenChapter 1 - Introduction To GovernanceMaricar RoqueNoch keine Bewertungen

- Chapter 4 - Accounts ReceivableDokument2 SeitenChapter 4 - Accounts ReceivableJerome_JadeNoch keine Bewertungen

- Ch28 Test Bank 4-5-10Dokument14 SeitenCh28 Test Bank 4-5-10KarenNoch keine Bewertungen

- List of Local Commercial BanksDokument4 SeitenList of Local Commercial Bankskristine_lazarito100% (1)

- Mid Term Assignment 1 On FAR - Journalizing, Posting, and Unadjusted Trial BalanceDokument1 SeiteMid Term Assignment 1 On FAR - Journalizing, Posting, and Unadjusted Trial BalanceAnne AlagNoch keine Bewertungen

- Sol. Man. - Chapter 3 - The Accounting EquationDokument8 SeitenSol. Man. - Chapter 3 - The Accounting EquationMae Ann Tomimbang MaglinteNoch keine Bewertungen

- Notes in Acstr14Dokument3 SeitenNotes in Acstr14Gray JavierNoch keine Bewertungen

- BSA 4C 1 Factors Influenced The Decision of First Year Students of St. Vincent CollegeDokument44 SeitenBSA 4C 1 Factors Influenced The Decision of First Year Students of St. Vincent CollegeVensen FuentesNoch keine Bewertungen

- Exam Questionaire in IntermediateDokument5 SeitenExam Questionaire in IntermediateJester IlaganNoch keine Bewertungen

- (01I) Lower of Cost and NRVDokument3 Seiten(01I) Lower of Cost and NRVGabriel Adrian ObungenNoch keine Bewertungen

- Ca5101 Adjusting Entries La 1Dokument13 SeitenCa5101 Adjusting Entries La 1Michael MagdaogNoch keine Bewertungen

- Activity 1.1 PDFDokument2 SeitenActivity 1.1 PDFDe Nev OelNoch keine Bewertungen

- Assignment02 PDFDokument2 SeitenAssignment02 PDFAilene MendozaNoch keine Bewertungen

- Advanced Accounting BU 455A Spring 2013 Test OneDokument14 SeitenAdvanced Accounting BU 455A Spring 2013 Test OneMichael Tai Maimoni100% (2)

- FAR2 Classwork PDFDokument7 SeitenFAR2 Classwork PDFBarley ManilaNoch keine Bewertungen

- AE 18 Financial Market Prelim ExamDokument3 SeitenAE 18 Financial Market Prelim ExamWenjunNoch keine Bewertungen

- Business Cup Level 1 Quiz BeeDokument28 SeitenBusiness Cup Level 1 Quiz BeeRowellPaneloSalapareNoch keine Bewertungen

- 11 - Bank Reconciliation NotesDokument3 Seiten11 - Bank Reconciliation NotesJann GataNoch keine Bewertungen

- Partnership Problem SetDokument8 SeitenPartnership Problem SetMary Rose ArguellesNoch keine Bewertungen

- Ebit-Eps Analysis: Operating EarningsDokument27 SeitenEbit-Eps Analysis: Operating EarningsKaran MorbiaNoch keine Bewertungen

- Financial Management BSATDokument9 SeitenFinancial Management BSATEma Dupilas GuianalanNoch keine Bewertungen

- 1 Partnership SolutionsDokument34 Seiten1 Partnership SolutionsLuna SanNoch keine Bewertungen

- Chart of Accounts General Ledger General Ledger Page No. Page No. Assets IncomeDokument44 SeitenChart of Accounts General Ledger General Ledger Page No. Page No. Assets IncomeJireh RiveraNoch keine Bewertungen

- Case StudyDokument8 SeitenCase StudyCleofe Mae Piñero AseñasNoch keine Bewertungen

- Assignment 1 AFSDokument14 SeitenAssignment 1 AFSSimra SalmanNoch keine Bewertungen

- Closing and Worksheet UnsolvedDokument6 SeitenClosing and Worksheet UnsolvedNilda Sahibul BaclayanNoch keine Bewertungen

- Quiz 2 3 Sample 3 PaperDokument6 SeitenQuiz 2 3 Sample 3 PaperFami FamzNoch keine Bewertungen

- Assignment # 2 Name: 26. STUDENT26 DateDokument2 SeitenAssignment # 2 Name: 26. STUDENT26 DateHashir HabibNoch keine Bewertungen

- Rectification of Errors Accounting Workbooks Zaheer SwatiDokument6 SeitenRectification of Errors Accounting Workbooks Zaheer SwatiZaheer SwatiNoch keine Bewertungen

- Problems Rectification of Errors Unsolved 1 5Dokument6 SeitenProblems Rectification of Errors Unsolved 1 5Racquel ReyesNoch keine Bewertungen

- Magic of Compounding-1Dokument13 SeitenMagic of Compounding-1AshutoshNoch keine Bewertungen

- Sol2 Receivables 1 9Dokument5 SeitenSol2 Receivables 1 9Shaira CastorNoch keine Bewertungen

- Business Finance Week 5Dokument5 SeitenBusiness Finance Week 5cjNoch keine Bewertungen

- Handbook For Consultants Selection-GoPDokument75 SeitenHandbook For Consultants Selection-GoPzulfikarmoin001Noch keine Bewertungen

- Demystifying The Ichimoku CloudDokument10 SeitenDemystifying The Ichimoku CloudShahzad Dalal100% (1)

- Fiinancial Analysis of Reckitt BenckiserDokument10 SeitenFiinancial Analysis of Reckitt BenckiserKhaled Mahmud ArifNoch keine Bewertungen

- Taxation As A Major Source of Govt. FundingDokument47 SeitenTaxation As A Major Source of Govt. FundingPriyali Rai50% (2)

- Fundamentals of ABM Week1-4 LessonsDokument9 SeitenFundamentals of ABM Week1-4 LessonsYatogamiNoch keine Bewertungen

- Recipe For Indices and Forex InvestingDokument84 SeitenRecipe For Indices and Forex InvestingAbdulafees Abdullahi Adebayo100% (4)

- 39 GSIS Family Bank V BPI Family BankDokument5 Seiten39 GSIS Family Bank V BPI Family BankMarioneMaeThiamNoch keine Bewertungen

- Management Advisory Services: This Accounting Materials Are Brought To You byDokument3 SeitenManagement Advisory Services: This Accounting Materials Are Brought To You byRed MendezNoch keine Bewertungen

- Civil Engineering Thumb RuleDokument28 SeitenCivil Engineering Thumb Rulecivilsadiq100% (16)

- DOE-RE Application Form & RequirementsDokument3 SeitenDOE-RE Application Form & RequirementsUnicargo Int'l ForwardingNoch keine Bewertungen

- Philippine Accounting StandardsDokument4 SeitenPhilippine Accounting StandardsElyssa100% (1)

- Wicktator Trade MaterialDokument11 SeitenWicktator Trade MaterialrontechtipsNoch keine Bewertungen

- Kamran Acca f1 Mcqs.Dokument96 SeitenKamran Acca f1 Mcqs.Renato Wilson67% (3)

- Strat MGMTDokument149 SeitenStrat MGMTfaltumail379Noch keine Bewertungen

- Reverse Engineering Rsi PDF FreeDokument7 SeitenReverse Engineering Rsi PDF FreeJitkaSamakNoch keine Bewertungen

- Summary List of Filers Statement of Assets, Liabilities and NetworthDokument2 SeitenSummary List of Filers Statement of Assets, Liabilities and Networthhans arber lasolaNoch keine Bewertungen

- BKAL1013 (A172) - ppt-T4Dokument27 SeitenBKAL1013 (A172) - ppt-T4Heap Ke XinNoch keine Bewertungen

- Behavioural IssuesDokument64 SeitenBehavioural IssuesEvan JordanNoch keine Bewertungen

- Name: Group: Date:: Chap 1 Practice Questions Lecturer: Christine Colon, ACCADokument3 SeitenName: Group: Date:: Chap 1 Practice Questions Lecturer: Christine Colon, ACCASuy YanghearNoch keine Bewertungen

- Development Project ProposalDokument8 SeitenDevelopment Project Proposalnickdash09100% (1)

- ACC 291 Week 4 ProblemsDokument8 SeitenACC 291 Week 4 ProblemsGrace N Demara BooneNoch keine Bewertungen

- Chapter 5 ReconciliationDokument7 SeitenChapter 5 ReconciliationDevender SinghNoch keine Bewertungen

- Earn Unlimited Income With Priado Wealth AllianceDokument67 SeitenEarn Unlimited Income With Priado Wealth AlliancePeter M100% (1)

- Debt Collector DirectDokument1 SeiteDebt Collector DirectRandy RoxxNoch keine Bewertungen

- HotelDokument2 SeitenHotelSagar KattimaniNoch keine Bewertungen

- Sme in PakistanDokument26 SeitenSme in Pakistansara24391Noch keine Bewertungen

- 2015 2020 CTRM Market OutlookDokument17 Seiten2015 2020 CTRM Market OutlookCTRM CenterNoch keine Bewertungen