Beruflich Dokumente

Kultur Dokumente

Peso Dynasty Equity Fund Fact Sheet (PNB)

Hochgeladen von

HihihiOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Peso Dynasty Equity Fund Fact Sheet (PNB)

Hochgeladen von

HihihiCopyright:

Verfügbare Formate

ALLIANZ PNB LIFE INSURANCE, INC. www.allianzpnblife.

ph

Investment Objective

The Fund seeks long-term capital

appreciation by investing in a customized

basket of stocks listed on the Philippine

PESO DYNASTY

Stock Exchange (1) that are considered

highly liquid and actively traded; and (2)

of companies owned and/or controlled by

EQUITY FUND

businessmen of Chinese ethnic origins.

31 OCTOBER 2019

FUND DETAILS:

Inception Date 15-Feb-18 Latest NAVPU 0.927153

Fund Manager PNB - Trust Banking Group Initial NAVPU 1.000000

Fund Currency Peso Highest NAVPU (02.15.2018) 1.000000

Fund Size Php700.63 Million Lowest NAVPU (10.12.2018) 0.769357

Management Fee 2.00% p.a. Pricing / Valuation Daily

RISK CLASSIFICATION when the rate was at 1.3%. Another driver

was the +4.6% hike in August OFW

The Fund is suitable for investors with a

remittances, for a total of Php 19.8 billion

very aggressive profile or for those who

as of 8M19. Infrastructure spending in

take medium to long - term views. As a September surged 69% as the

marked -to-market Fund, its net asset value government ramped up projects for the

and total return may fall or rise as a result second half of the term of the

of stock prices movements. On redemption administration.

of units, a policyholder may receive an

amount less than the original amount With 3Q19 and 9M19 earnings season in

invested. Prior to investment in the Fund, full swing, forward momentum has

the policyholder shall undergo a client gained traction and may continue in the

near term. Critical economic data are

suitability assessment procedure to

scheduled for release early November.

determine whether the Fund is appropriate

for him considering his investment

MARKET OUTLOOK

objective, risk tolerance, preferences and

experience. Positive sentiment is expected to continue

in the coming month given the pending

MARKET COMMENTARY trade deal between the US and China.

Improving sentiment abroad and the good Good GDP and inflation numbers are

3Q19 performance of the Philippines’ top expected to be reported early next month.

three banks led to a strong recovery for the

PSEi this month. The benchmark index

gained 198.05 points or +2.55% albeit on

thin average daily turnover of Php5.3

billion. Net foreign flows turned positive at

RISK PROFILE Php3.7 billion. A drop in both US and

China’s manufacturing index resulted in

both parties going back to the negotiating

table last October 10-11 to try and resolve

differences. The US Fed also made another

25 basis points cut in policy rates for the

month of October.

The consumer price index continued to

decline as September print came at 0.9%

driven by lower prices of food and non-

alcoholic drinks. The transport index

declined 0.9%, while slower increases were

seen in clothing, footwear, housing, water,

electricity, gas, and fuels. The September

inflation print is the lowest since June 2016

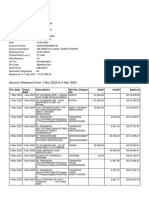

Performance Overview

Performance History Year To Date 1 Year (YoY) 3 Years (YoY) 5 Years (YoY) Since Inception

Absolute 8.00% 15.77% N/A N/A -7.28%

Annualized N/A 15.77% N/A N/A -4.32%

Indexed Performance Over 3 Years (NAV - NAV)

NAVPU Since Inception

1.05

1.00

0.95

0.90

0.85

0.80

0.75

May-18

Nov-18

Dec-18

May-19

Apr-18

Sep-18

Feb-18

Jun-18

Oct-18

Feb-19

Apr-19

Jun-19

Sep-19

Mar-18

Aug-18

Mar-19

Aug-19

Jul-18

Jan-19

Jul-19

PORTFOLIO ANALYSIS

Top 5 Holdings

Securities % Securities (Ticker) Sub-Sector Allocation

SM Investments Corp. (SM) 22.6 SM Investments Corp. (SM) Holdings 22.55%

SM Prime Holdings (SMPH) Property 14.09%

SM Prime Holdings (SMPH) 14.1

BDO Unibank, Inc. (BDO) Banks 12.12%

BDO Unibank, Inc. (BDO) 12.1 JG Summit Holdings, Inc. (JGS) Holdings 9.00%

Metrobank (MBT) Banks 5.98%

JG Summit Holdings, Inc. (JGS) 9.0 Universal Robina Corporation (URC) Food & Beverage 5.96%

Jollibee Foods Corp. (JFC) Food & Beverage 4.41%

Metrobank (MBT) 6.0

Security Bank (SECB) Banks 3.66%

Total 63.7 Cash/Short-Term Deposits

Cash/Short-Term

3.26%

Deposits

GT Capital Holdings, Inc. (GTCAP) Holdings 3.21%

Sub-Sector Allocation

San Miguel Corporation (SMC) Holdings 2.54%

Megaworld Corp. (MEG) Property 2.16%

Robinsons Land Corp. (RLC) Property 2.04%

Robinsons Retail Holdings, Inc. (RRHI) Retail 1.71%

LT Group, Inc. (LTG) Holdings 1.60%

Puregold Price Club, Inc. (PGOLD) Retail 1.50%

Alliance Global Group, Inc. (AGI) Holdings 1.41%

San Miguel Food and Beverage, Inc. (FB) Food & Beverage 0.96%

D&L Industries, Inc. (DNL) Food & Beverage 0.75%

Filinvest Land, Inc. (FLI) Property 0.58%

Total 100.00%

IMPORTANT NOTICE:

This document is for information purposes only. This does not constitute an offer or a solicitation to buy or

sell any investment referred to in this document. The information in this publication is based on carefully

selected sources believed to be reliable but we do not make any representation as to its accuracy or

completeness. Any opinions herein reflected are good as of this date but may be subject to change without

prior notice. Investment or participation in the Fund is subject to risk and possible loss of principal, and is

not insured by the Philippine Deposit Insurance Corporation (PDIC). Losses, if any, shall be for the account

and risk of the Trustor/Participant. Past performance is not indicative of future performance.

Das könnte Ihnen auch gefallen

- Hpam Ultima Ekuitas 1: Month MonthDokument2 SeitenHpam Ultima Ekuitas 1: Month MonthSaid Al MusayyabNoch keine Bewertungen

- Eurobond Fund Factsheet April 2023 (Demo)Dokument1 SeiteEurobond Fund Factsheet April 2023 (Demo)jeremiah.oNoch keine Bewertungen

- ATRAM Alpha Opportunity Fund - Fact Sheet - April 2019Dokument2 SeitenATRAM Alpha Opportunity Fund - Fact Sheet - April 2019Kervin Delos SantosNoch keine Bewertungen

- ATRAM Alpha Opportunity Fund - Fact Sheet - April 2019 PDFDokument2 SeitenATRAM Alpha Opportunity Fund - Fact Sheet - April 2019 PDFMikeNoch keine Bewertungen

- ATRAM Alpha Opportunity Fund - Fact Sheet - Feb 2021Dokument2 SeitenATRAM Alpha Opportunity Fund - Fact Sheet - Feb 2021Gideon Tangan Ines Jr.Noch keine Bewertungen

- Inbound 1447676777343781147Dokument2 SeitenInbound 1447676777343781147ML ChingNoch keine Bewertungen

- ATRAM Alpha Opportunity Fund - Fact Sheet - May 2021Dokument2 SeitenATRAM Alpha Opportunity Fund - Fact Sheet - May 2021Romeo Santos MandingginNoch keine Bewertungen

- Philam Bond Fund, Inc. (PBFI) : Investment Objective CommentaryDokument1 SeitePhilam Bond Fund, Inc. (PBFI) : Investment Objective Commentaryapi-25886697Noch keine Bewertungen

- Empower February 2017Dokument104 SeitenEmpower February 2017Arjun BhatnagarNoch keine Bewertungen

- 006 - Chapter 6Dokument24 Seiten006 - Chapter 6male PampangaNoch keine Bewertungen

- Bifm Pula Money Market Fund Factsheet Q4 2021Dokument1 SeiteBifm Pula Money Market Fund Factsheet Q4 2021Unaswi Pearl ShavaNoch keine Bewertungen

- ATRAM Philippine Equity Opportunity Fund - Fact Sheet - May 2021Dokument2 SeitenATRAM Philippine Equity Opportunity Fund - Fact Sheet - May 2021Jose BorjaNoch keine Bewertungen

- Market Outlook Diwali Picks - Nov 2018Dokument24 SeitenMarket Outlook Diwali Picks - Nov 2018Kishor KrNoch keine Bewertungen

- ATRAM Alpha Opportunity Fund - Fact Sheet - Apr 2020Dokument2 SeitenATRAM Alpha Opportunity Fund - Fact Sheet - Apr 2020anton clementeNoch keine Bewertungen

- CMO BofA 09-11-2023 AdaDokument8 SeitenCMO BofA 09-11-2023 AdaAlejandroNoch keine Bewertungen

- WEEK 44 - November 2 To 5, 2010Dokument2 SeitenWEEK 44 - November 2 To 5, 2010JC CalaycayNoch keine Bewertungen

- PSA - Factsheet - Pioneer Peso Equity Fund - 4Q20Dokument1 SeitePSA - Factsheet - Pioneer Peso Equity Fund - 4Q20Ron CatalanNoch keine Bewertungen

- SPM Sisop Strategy Sep 2022Dokument4 SeitenSPM Sisop Strategy Sep 2022Ally Bin AssadNoch keine Bewertungen

- ATRAM Philippine Balanced Fund - Fact Sheet - Apr 2020Dokument2 SeitenATRAM Philippine Balanced Fund - Fact Sheet - Apr 2020Just VillNoch keine Bewertungen

- Money Market Fund Fact Sheet - Q1 2018Dokument1 SeiteMoney Market Fund Fact Sheet - Q1 2018nathaniel07Noch keine Bewertungen

- ATRAM Phil Equity Smart Index Fund Fact Sheet Jan 2022Dokument2 SeitenATRAM Phil Equity Smart Index Fund Fact Sheet Jan 2022jvNoch keine Bewertungen

- Dollar Income and Growth Dividend-Paying: Fund DetailsDokument2 SeitenDollar Income and Growth Dividend-Paying: Fund DetailsenzlibraryNoch keine Bewertungen

- FMR June 2018Dokument22 SeitenFMR June 2018Salman ArshadNoch keine Bewertungen

- NBFC Sector ReportDokument20 SeitenNBFC Sector ReportAshutosh GuptaNoch keine Bewertungen

- ATRAM Alpha Opportunity Fund - Fact Sheet - Feb 2019Dokument2 SeitenATRAM Alpha Opportunity Fund - Fact Sheet - Feb 2019Kervin Delos SantosNoch keine Bewertungen

- PMS - SISOP Product Sheet - Oct 2020 - 1Dokument4 SeitenPMS - SISOP Product Sheet - Oct 2020 - 1Swades DNoch keine Bewertungen

- ME Cio Weekly Letter PDFDokument7 SeitenME Cio Weekly Letter PDFHiep KhongNoch keine Bewertungen

- NRB News Vol.36 20770404 PDFDokument6 SeitenNRB News Vol.36 20770404 PDFNarenBistaNoch keine Bewertungen

- Preqin Quarterly Update Private Debt Q3 2019Dokument8 SeitenPreqin Quarterly Update Private Debt Q3 2019dNoch keine Bewertungen

- COL Experts Corner 2019-01-18 Fund Managers AttachmentDokument9 SeitenCOL Experts Corner 2019-01-18 Fund Managers AttachmentWa37354Noch keine Bewertungen

- NBFC Es2020Dokument23 SeitenNBFC Es2020Aditya GuptaNoch keine Bewertungen

- ATRAM Phil Equity Smart Index Fund Fact Sheet Nov 2018Dokument2 SeitenATRAM Phil Equity Smart Index Fund Fact Sheet Nov 2018Roan Roan RuanNoch keine Bewertungen

- CMO BofA 09-05-2023 AdaDokument8 SeitenCMO BofA 09-05-2023 AdaAlejandroNoch keine Bewertungen

- Challenges of Shadow Banking: Behavioural Finance and Value InvestingDokument9 SeitenChallenges of Shadow Banking: Behavioural Finance and Value InvestingArnnava SharmaNoch keine Bewertungen

- 2022 Preqin Global Sample Pages: Private EquityDokument9 Seiten2022 Preqin Global Sample Pages: Private EquityIsabelle ZhuNoch keine Bewertungen

- NBP Funds: Capital Market ReviewDokument1 SeiteNBP Funds: Capital Market ReviewSufyan SafiNoch keine Bewertungen

- Vol. No. 7 Issue No. 9: March 2010Dokument32 SeitenVol. No. 7 Issue No. 9: March 2010Dr. Sanjeev KumarNoch keine Bewertungen

- TopmfDokument4 SeitenTopmfapi-3719573Noch keine Bewertungen

- BofA CIO Capital Market OutlookDokument8 SeitenBofA CIO Capital Market OutlookindonesiamillenNoch keine Bewertungen

- FY - IIMK's Financial Newsletter - Issue 1Dokument4 SeitenFY - IIMK's Financial Newsletter - Issue 1ABHISHEK DALAL 23Noch keine Bewertungen

- CMO BofA 02-12-2024 AdaDokument8 SeitenCMO BofA 02-12-2024 AdaAlejandroNoch keine Bewertungen

- Government Money Market I Fund (6) : Fixed Income Stable ValueDokument2 SeitenGovernment Money Market I Fund (6) : Fixed Income Stable ValueiuxhpccxNoch keine Bewertungen

- LebanonEconomicReport 4thquarter2018 English 20191027Dokument12 SeitenLebanonEconomicReport 4thquarter2018 English 20191027Karem MahmoudNoch keine Bewertungen

- Westpack JUN 14 Weekly CommentaryDokument7 SeitenWestpack JUN 14 Weekly CommentaryMiir ViirNoch keine Bewertungen

- Weekly Market Commentary Jan 20 2009Dokument3 SeitenWeekly Market Commentary Jan 20 2009compassfinancialNoch keine Bewertungen

- Snack With Dave: David A. RosenbergDokument9 SeitenSnack With Dave: David A. RosenbergroquessudeNoch keine Bewertungen

- Earnings and GDP Drive PCOMP Higher: Week in ReviewDokument2 SeitenEarnings and GDP Drive PCOMP Higher: Week in ReviewAhwen 'ahwenism'Noch keine Bewertungen

- Pcomp Up On Gov't Stimulus Programs: Week in ReviewDokument2 SeitenPcomp Up On Gov't Stimulus Programs: Week in ReviewJervie GacutanNoch keine Bewertungen

- Tracking The World Economy... - 09/09/2010Dokument2 SeitenTracking The World Economy... - 09/09/2010Rhb InvestNoch keine Bewertungen

- Vietnamese Equities - HSBC ReviewDokument26 SeitenVietnamese Equities - HSBC Reviewapi-3706396Noch keine Bewertungen

- NAFA Islamic Opportunity Fund January 2008Dokument1 SeiteNAFA Islamic Opportunity Fund January 2008Ali RazaNoch keine Bewertungen

- Commercial / Multifamily Real Estate Finance (CREF) Markets - 2018Dokument24 SeitenCommercial / Multifamily Real Estate Finance (CREF) Markets - 2018Sai Sunil ChandraaNoch keine Bewertungen

- Picic Income FundDokument1 SeitePicic Income FundRubina AdilNoch keine Bewertungen

- Philam Managed Income Fund, Inc. (PMIF) : Investment Objective CommentaryDokument1 SeitePhilam Managed Income Fund, Inc. (PMIF) : Investment Objective Commentaryapi-25886697Noch keine Bewertungen

- Economic Brief Sept 2017Dokument20 SeitenEconomic Brief Sept 2017Áron KerékgyártóNoch keine Bewertungen

- ATRAM Dynamic Allocation Fund - Fact Sheet - Apr 2020Dokument2 SeitenATRAM Dynamic Allocation Fund - Fact Sheet - Apr 2020anton clementeNoch keine Bewertungen

- ToI IESP September 2020 FinalDokument13 SeitenToI IESP September 2020 FinalB KNoch keine Bewertungen

- ATRAM Philippine Equity Opportunity Fund - Fact Sheet - Apr 2020Dokument2 SeitenATRAM Philippine Equity Opportunity Fund - Fact Sheet - Apr 2020Neale CacNoch keine Bewertungen

- BDO Peso Balanced Fund (1st Quarter 2010)Dokument1 SeiteBDO Peso Balanced Fund (1st Quarter 2010)Iñigo Martin MendozaNoch keine Bewertungen

- Ch04 Harrison 8e GE SMDokument73 SeitenCh04 Harrison 8e GE SMMuh BilalNoch keine Bewertungen

- Congress ExhibitionCatalogue 15-05-2017Dokument17 SeitenCongress ExhibitionCatalogue 15-05-2017ALNoch keine Bewertungen

- Thesis - Progress Report. For Advisor OnlyDokument3 SeitenThesis - Progress Report. For Advisor OnlyamogneNoch keine Bewertungen

- 121-Ugong Issue 5.2 - FINAL - Doc - With Corrections-2nd RevisionDokument16 Seiten121-Ugong Issue 5.2 - FINAL - Doc - With Corrections-2nd RevisionMarq QoNoch keine Bewertungen

- Tax PaidDokument1 SeiteTax PaidRiya Mazumder Roll 286Noch keine Bewertungen

- New Balance CR$100.00 Minimum Payment Due $0.00 Payment Not RequiredDokument6 SeitenNew Balance CR$100.00 Minimum Payment Due $0.00 Payment Not RequiredKendall Battaglini100% (1)

- Coffee Table Booklet 19012024Dokument244 SeitenCoffee Table Booklet 19012024Antony ANoch keine Bewertungen

- Preparation of Financial Statements-PartnershipsDokument7 SeitenPreparation of Financial Statements-PartnershipsHeavens MupedzisaNoch keine Bewertungen

- Pertemuan 6 - Disposisi Properti, Pabrik Dan PeralatanDokument20 SeitenPertemuan 6 - Disposisi Properti, Pabrik Dan PeralatanTawang Deni WijayaNoch keine Bewertungen

- Application New 2023Dokument8 SeitenApplication New 2023SFS LOANSNoch keine Bewertungen

- This Is A System-Generated Statement. Hence, It Does Not Require Any SignatureDokument6 SeitenThis Is A System-Generated Statement. Hence, It Does Not Require Any SignatureSachinNoch keine Bewertungen

- Ud. Buana Jurnal Penyesuaian: Bulan Desember 2021Dokument10 SeitenUd. Buana Jurnal Penyesuaian: Bulan Desember 2021jefrifirmantoeNoch keine Bewertungen

- Problems Chapter 6-7 International Parity ConditionsDokument12 SeitenProblems Chapter 6-7 International Parity Conditionsarmando.chappell1005Noch keine Bewertungen

- Lalita 23-24Dokument6 SeitenLalita 23-24bankingwithmausamNoch keine Bewertungen

- NF 902 Stock StatementDokument4 SeitenNF 902 Stock Statementyash kumawat70% (10)

- KV sqp1 EconomicsDokument33 SeitenKV sqp1 Economicsyazhinirekha4444Noch keine Bewertungen

- Difference Between Pay Order and Demand DraftDokument3 SeitenDifference Between Pay Order and Demand DraftAman DegraNoch keine Bewertungen

- Final Report Bbs 4yh Resesach Report by Bibek - Docx.odtDokument25 SeitenFinal Report Bbs 4yh Resesach Report by Bibek - Docx.odtBikash ShresthaNoch keine Bewertungen

- Correct?Dokument29 SeitenCorrect?Hong Anh NguyenNoch keine Bewertungen

- Payback Period Year IC FC TVC TC Gross Benefits Net Benefits YearsDokument2 SeitenPayback Period Year IC FC TVC TC Gross Benefits Net Benefits YearsIzhiel Mai PadillaNoch keine Bewertungen

- Prepare The Following Based On This Topic: Inflation and Juan Dela Cruz. Statement of The ProblemDokument4 SeitenPrepare The Following Based On This Topic: Inflation and Juan Dela Cruz. Statement of The ProblemFrencis A. EsquierdoNoch keine Bewertungen

- Finance MCQDokument46 SeitenFinance MCQPallavi GNoch keine Bewertungen

- Sample MCQsDokument6 SeitenSample MCQsRubal GargNoch keine Bewertungen

- Account Statement From 1 Mar 2023 To 4 Mar 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDokument2 SeitenAccount Statement From 1 Mar 2023 To 4 Mar 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit Balancesameer bawejaNoch keine Bewertungen

- WSS 9 Case Studies Blended FinanceDokument36 SeitenWSS 9 Case Studies Blended FinanceAbdullahi Mohamed HusseinNoch keine Bewertungen

- Investment Undertakings PDFDokument64 SeitenInvestment Undertakings PDFDianneNoch keine Bewertungen

- Adani Ports and Special Economic Zone LTD.: Overall Industry Expectation of RatiosDokument10 SeitenAdani Ports and Special Economic Zone LTD.: Overall Industry Expectation of RatiosChirag JainNoch keine Bewertungen

- Lesson #1 FabmDokument32 SeitenLesson #1 FabmCZARINA ROSEANNE M. GIMENEZNoch keine Bewertungen

- Bookkeeper Job DescriptionDokument2 SeitenBookkeeper Job Descriptionvener magpayoNoch keine Bewertungen

- Ugba 101b Test 2 2008Dokument12 SeitenUgba 101b Test 2 2008Minji KimNoch keine Bewertungen