Beruflich Dokumente

Kultur Dokumente

q1 1

Hochgeladen von

Kristian Jon Rallos PutalanOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

q1 1

Hochgeladen von

Kristian Jon Rallos PutalanCopyright:

Verfügbare Formate

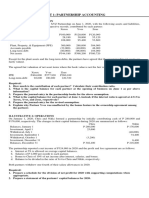

Roberts and Smith drafted a partnership agreement that lists the following assets

contributed at the partnership’s formation:

Contributed by

Roberts Smith

Cash P 20,000 P 30,000

Inventory 15,000

Building 40,000

Furniture & Equipment 15,000

The building is subject to a mortgage of P 10,000, which the partnership has assumed.

The partnership agreement also specifies that profits and losses are to be distributed

evenly. What amounts should be recorded as capital for Roberts and Smith at the

formation of the partnership?

Roberts Smith

a. 35,000 85,000

b. 35,000 75,000

c. 55,000 55,000

d. 60,000 60,000

The partnership agreement provides for equal initial capital. Thus under the bonus

method, the capital credit for Redd should be the same as the contribution for

Grey, resulting to P20,000 bonus from Grey to Redd.

1. On May 1, 2010, the business assets of John and Paul appear below:

John Paul

Cash P 11,000 P 22,354

Accounts Receivable 234,536 567,890

Inventories 120,035 260,102

Land 603,000

Building 428,267

Furniture & Fixture 50,345 34,789

Other Assets 2,000 3,600

Total P 1, 020, 916 P 1, 317, 002

Accounts Payable P 178,940 P 243,650

Notes Payable 200,000 345,000

John, Capital 641, 976

Paul, Capital\ 728,352

Total P 1, 020, 916 P1, 317, 002

John and Paul agreed to form a partnership contributing their respective assets and

equities subject to the following adjustments:

a. Accounts receivable of P20, 000 in John’s books and P35, 000 in Paul’s are

uncollectible.

b. Inventories of P5, 500 n P6, 700 are worthless in John’s and Pail’s respective

books.

c. Other assets of P2, 000 and P3, 600 in John’s and Paul’s respective books are to

be written off.

The capital accounts of John and Paul, respectively, after the adjustments will be:

a. 614, 476 683, 052 c. 640, 876 712, 345

b. 615, 942 717, 894 d. 613,576 683, 350

2. Based on No. 4, how much assets does the partnership have?

a. 2, 317, 918

b. 2, 237, 918

c. 2, 265, 118

d. 2, 365, 218

Das könnte Ihnen auch gefallen

- PARTNERSHIPDokument153 SeitenPARTNERSHIPJoen SinamagNoch keine Bewertungen

- Partnership Formation Answer KeyDokument8 SeitenPartnership Formation Answer KeyNichole Joy XielSera TanNoch keine Bewertungen

- Reviewer For Accounting StudentsDokument12 SeitenReviewer For Accounting StudentsAaliyah ManuelNoch keine Bewertungen

- Partnership Formation 001Dokument20 SeitenPartnership Formation 001Ma Teresa B. Cerezo50% (2)

- Partnership Formation AssignmentDokument3 SeitenPartnership Formation AssignmentAHMUDINNHOR DUMASILNoch keine Bewertungen

- Midterm Exam Accntg For Special TransactionsDokument8 SeitenMidterm Exam Accntg For Special TransactionsJustine FloresNoch keine Bewertungen

- Midterm Exam Accntg For Special TransactionsDokument8 SeitenMidterm Exam Accntg For Special TransactionsJustine Flores100% (1)

- Partnership Formation Sample Questions With AnswersDokument3 SeitenPartnership Formation Sample Questions With AnswersWednesday AddamsNoch keine Bewertungen

- Partnership and Corp Liquid TestbankDokument288 SeitenPartnership and Corp Liquid TestbankWendelyn Tutor80% (5)

- Partnership THEORIES AND PROBLEMSDokument5 SeitenPartnership THEORIES AND PROBLEMSMa Teresa B. CerezoNoch keine Bewertungen

- AFAR Finals With SolutionsDokument16 SeitenAFAR Finals With SolutionsJr TanNoch keine Bewertungen

- Partnership Formation GuideDokument6 SeitenPartnership Formation GuideLee SuarezNoch keine Bewertungen

- Reviewer On Partnership AccountingDokument27 SeitenReviewer On Partnership AccountingannegelieNoch keine Bewertungen

- Partnership Formation 001Dokument3 SeitenPartnership Formation 001John GacumoNoch keine Bewertungen

- Partnership Problems Partnership Problems: Accountancy (La Consolacion College) Accountancy (La Consolacion College)Dokument35 SeitenPartnership Problems Partnership Problems: Accountancy (La Consolacion College) Accountancy (La Consolacion College)MIKASA0% (1)

- AFAR - PartnershipDokument19 SeitenAFAR - PartnershipAlisonNoch keine Bewertungen

- AST MidtermsDokument12 SeitenAST MidtermsRica Regoris100% (1)

- Pamantasan NG CabuyaoDokument2 SeitenPamantasan NG CabuyaoHhhhhNoch keine Bewertungen

- Practice Tests Partnership FormationDokument10 SeitenPractice Tests Partnership FormationClaire RamosNoch keine Bewertungen

- Practical Accounting 2: Angelito R. Punzalan, CPA, MBADokument33 SeitenPractical Accounting 2: Angelito R. Punzalan, CPA, MBADaniella Mae Elip100% (1)

- ACC partnership formation assignmentDokument4 SeitenACC partnership formation assignmentReginald ValenciaNoch keine Bewertungen

- Partnership (Dayag) : Advanced Acctg. IDokument33 SeitenPartnership (Dayag) : Advanced Acctg. IJanysse Calderon100% (1)

- Accounting QuizDokument5 SeitenAccounting QuizLloyd Lameon0% (1)

- Afar - Partnership Formation - BagayaoDokument2 SeitenAfar - Partnership Formation - BagayaoRejay VillamorNoch keine Bewertungen

- Partnership Problems Partnership Problems: Accountancy (La Consolacion College) Accountancy (La Consolacion College)Dokument35 SeitenPartnership Problems Partnership Problems: Accountancy (La Consolacion College) Accountancy (La Consolacion College)Jay Ann DomeNoch keine Bewertungen

- Acctng 304Dokument3 SeitenAcctng 304Lloyd Lameon0% (1)

- Activity 2 FormationDokument4 SeitenActivity 2 FormationCris TineNoch keine Bewertungen

- Partnership QuizzerDokument21 SeitenPartnership QuizzeragbpaulinoNoch keine Bewertungen

- Jedah Noel - ASSIGNMENT 1 - Partnership FormationDokument2 SeitenJedah Noel - ASSIGNMENT 1 - Partnership FormationJeddieh NoelNoch keine Bewertungen

- Activity 1 PartnershipDokument4 SeitenActivity 1 PartnershipJanet AnotdeNoch keine Bewertungen

- Partnership Formation, Operation, Dissolution, and Liquidation by Lump Sum OnlyDokument11 SeitenPartnership Formation, Operation, Dissolution, and Liquidation by Lump Sum OnlyJoyce Ann Cortez100% (2)

- Partnership Formation ExercisesDokument8 SeitenPartnership Formation ExercisesMarjorie NepomucenoNoch keine Bewertungen

- 1.1.1partnership FormationDokument12 Seiten1.1.1partnership FormationCundangan, Denzel Erick S.Noch keine Bewertungen

- 1.1.1partnership FormationDokument12 Seiten1.1.1partnership FormationCundangan, Denzel Erick S.100% (3)

- Partnership FormationDokument69 SeitenPartnership FormationIts SaoirseNoch keine Bewertungen

- Chapter 1 - PartnershipDokument72 SeitenChapter 1 - PartnershipJohn Lloyd Yasto100% (5)

- Partnership Profits and Capital AccountsDokument45 SeitenPartnership Profits and Capital AccountsWe WNoch keine Bewertungen

- Partnership Board ReviewerDokument13 SeitenPartnership Board ReviewerRobert ApolinarNoch keine Bewertungen

- Learning Task No. 1.2Dokument3 SeitenLearning Task No. 1.2Carl Oliver LacanlaleNoch keine Bewertungen

- Unit 1 ActvitiesDokument6 SeitenUnit 1 ActvitiesLeslie Mae Vargas ZafeNoch keine Bewertungen

- Unit 1 - Partnership-AccountingDokument3 SeitenUnit 1 - Partnership-AccountingChristine Alysza AnquilanNoch keine Bewertungen

- Partnership Operation 003Dokument12 SeitenPartnership Operation 003John GacumoNoch keine Bewertungen

- Summer 2020 Exercise9bDokument3 SeitenSummer 2020 Exercise9bMiko ArniñoNoch keine Bewertungen

- ACC 110 - CFE - 21 22 With ANSWERSDokument25 SeitenACC 110 - CFE - 21 22 With ANSWERSGiner Mabale Steven100% (2)

- LONG-PAPER_FORMATION answersDokument8 SeitenLONG-PAPER_FORMATION answerstooru oikawaNoch keine Bewertungen

- Integrated Accounting Review - AFAR T1, AY 2023-2024Dokument40 SeitenIntegrated Accounting Review - AFAR T1, AY 2023-2024Conteza EliasNoch keine Bewertungen

- Chapter 1 - Partnership Formation Partnerhsip Formation - Individual vs. IndividualDokument3 SeitenChapter 1 - Partnership Formation Partnerhsip Formation - Individual vs. IndividualCamille Stephan BenigaNoch keine Bewertungen

- Partnership FormationDokument18 SeitenPartnership FormationHelen Angcon50% (2)

- Activity 1.1 PDFDokument2 SeitenActivity 1.1 PDFDe Nev OelNoch keine Bewertungen

- Partnership Formation Adjustments and Capital AccountsDokument2 SeitenPartnership Formation Adjustments and Capital AccountsLorraine Mae RobridoNoch keine Bewertungen

- Partnership formation and capital accounts problem setDokument5 SeitenPartnership formation and capital accounts problem setRed Yu100% (1)

- 1.1.2.a Assignment - Partnership Formation and OperationDokument14 Seiten1.1.2.a Assignment - Partnership Formation and OperationGiselle MartinezNoch keine Bewertungen

- Practice Sets 1 in AccDokument13 SeitenPractice Sets 1 in Accbetzsnicolai21Noch keine Bewertungen

- Quiz 1 Partnership 09 10Dokument3 SeitenQuiz 1 Partnership 09 10Aldyn Jade GuabnaNoch keine Bewertungen

- PARTNERSHIPDokument2 SeitenPARTNERSHIPtracystewart268Noch keine Bewertungen

- Testbank For ParnetshipDokument4 SeitenTestbank For ParnetshipKristel Joyce LaureñoNoch keine Bewertungen

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeVon EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNoch keine Bewertungen

- Getting Started in Real Estate Investment TrustsVon EverandGetting Started in Real Estate Investment TrustsBewertung: 3 von 5 Sternen3/5 (1)

- Online Customized T-Shirt StoresDokument5 SeitenOnline Customized T-Shirt StoresPalash DasNoch keine Bewertungen

- CF Wacc Project 2211092Dokument34 SeitenCF Wacc Project 2211092Dipty NarnoliNoch keine Bewertungen

- Expertise in trade finance sales and distributionDokument4 SeitenExpertise in trade finance sales and distributionGabriella Njoto WidjajaNoch keine Bewertungen

- Lecture 4Dokument27 SeitenLecture 4aqukinnouoNoch keine Bewertungen

- SPDR Periodic Table WebDokument2 SeitenSPDR Periodic Table WebCarla TateNoch keine Bewertungen

- Customs RA ManualDokument10 SeitenCustoms RA ManualJitendra VernekarNoch keine Bewertungen

- SHELF CORP SECRETS 3 FLIPPING CORPORATIONSDokument24 SeitenSHELF CORP SECRETS 3 FLIPPING CORPORATIONSRamon RogersNoch keine Bewertungen

- GPETRO Scope TenderDokument202 SeitenGPETRO Scope Tendersudipta_kolNoch keine Bewertungen

- IDA - MTCS X-Cert - Gap Analysis Report - MTCS To ISO270012013 - ReleaseDokument50 SeitenIDA - MTCS X-Cert - Gap Analysis Report - MTCS To ISO270012013 - ReleasekinzaNoch keine Bewertungen

- Edvinsson, L. - 1997 - Developing Intellectual Capital at Skandia PDFDokument10 SeitenEdvinsson, L. - 1997 - Developing Intellectual Capital at Skandia PDFreg_kata123Noch keine Bewertungen

- SLEMCoopDokument3 SeitenSLEMCoopPaul Dexter GoNoch keine Bewertungen

- Address Styles in Oracle AppsDokument4 SeitenAddress Styles in Oracle AppskartheekbeeramjulaNoch keine Bewertungen

- Sending DDDDWith Multiple Tabs of Excel As A Single Attachment in ABAPDokument4 SeitenSending DDDDWith Multiple Tabs of Excel As A Single Attachment in ABAPKumar Krishna KumarNoch keine Bewertungen

- The History of ConverseDokument39 SeitenThe History of Conversebungah hardiniNoch keine Bewertungen

- BharatBenz FINALDokument40 SeitenBharatBenz FINALarunendu100% (1)

- LIFO, SEC, GAAP, and Earnings Management in Early 1900s U.SDokument1 SeiteLIFO, SEC, GAAP, and Earnings Management in Early 1900s U.SMohammad ShuaibNoch keine Bewertungen

- HP-Cisco Alliance Strategy ChallengesDokument6 SeitenHP-Cisco Alliance Strategy ChallengesSAHIL100% (1)

- GPB Rosneft Supermajor 25092013Dokument86 SeitenGPB Rosneft Supermajor 25092013Katarina TešićNoch keine Bewertungen

- I Ifma FMP PM ToDokument3 SeitenI Ifma FMP PM TostranfirNoch keine Bewertungen

- The Role of Business ResearchDokument23 SeitenThe Role of Business ResearchWaqas Ali BabarNoch keine Bewertungen

- Case Study: When in RomaniaDokument3 SeitenCase Study: When in RomaniaAle IvanovNoch keine Bewertungen

- Contract: Organisation Details Buyer DetailsDokument4 SeitenContract: Organisation Details Buyer DetailsMukhiya HaiNoch keine Bewertungen

- Acca FeeDokument2 SeitenAcca FeeKamlendran BaradidathanNoch keine Bewertungen

- Corporate BrochureDokument23 SeitenCorporate BrochureChiculita AndreiNoch keine Bewertungen

- Appointment and Authority of AgentsDokument18 SeitenAppointment and Authority of AgentsRaghav Randar0% (1)

- Congson Vs NLRCDokument2 SeitenCongson Vs NLRCDan Christian Dingcong CagnanNoch keine Bewertungen

- Pandit Automotive Tax Recovery ProcessDokument6 SeitenPandit Automotive Tax Recovery ProcessJudicialNoch keine Bewertungen

- American Medical Assn. v. United States, 317 U.S. 519 (1943)Dokument9 SeitenAmerican Medical Assn. v. United States, 317 U.S. 519 (1943)Scribd Government DocsNoch keine Bewertungen

- Human Right Note For BCADokument2 SeitenHuman Right Note For BCANitish Gurung100% (1)

- Subcontracting Process in Production - SAP BlogsDokument12 SeitenSubcontracting Process in Production - SAP Blogsprasanna0788Noch keine Bewertungen