Beruflich Dokumente

Kultur Dokumente

Bank Reconciliation Statement Preparation

Hochgeladen von

steveCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Bank Reconciliation Statement Preparation

Hochgeladen von

steveCopyright:

Verfügbare Formate

Running Head: BANK RECONCILIATION 1

Bank Reconciliation

© 2019 Ochieng’ Steve Biko

BANK RECONCILIATION 2

Bank Reconciliation

Introduction

Most companies or businesses have bank accounts through which they receive cash and

cheques deposited by customers/clients for goods and services these businesses offer to these

customers. Accordingly, the bank which a business has an account with must record of all

transactions between customers and any given business. Commercial banks usually send bank

statements to their customers (businesses and individuals). The bank statement is a document that

contains all financial transactions which took place between a bank and business during a given

period (usually one month). Similarly, a company or business must record all transactions affecting

the cash balance. Companies record these transactions in a special book known as the cashbook.

What causes the difference?

In most cases, bank statement and cashbook balances do not agree at any given time due

to some reasons. The main contributors to the difference in the two cash balances include time

lapses (caused by outstanding cheques), bank’s hidden charges and recording errors. Time

lapses make it impossible for both the bank and businesses to record transactions at the same time.

For example, a company may pay suppliers using a cheque today, yet the bank may take several

days to make the payment to the supplier (Weygandt, Kimmel, & Kieso, 2010). So, the supplier

must wait for the cheque to ‘mature.’ Recording errors include errors of both omission and

commission. For instance, if an accounting staff in a bank correctly records a cheque received

from the customer as Ksh. 1,250.00 yet, a corresponding accounting staff in a company records it

as 125.00 or 1520.00, an error of omission or commission occurs respectively which can cause

differences in the cash balances.

BANK RECONCILIATION 3

Bank Reconciliation Procedure

Bank reconciliation is a simple process which involves adjusting the bank statement’s

balance and the cashbook balance to make them read the same balance.

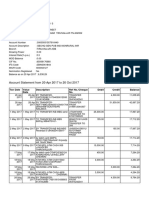

Example

Assume XYZ bank statement reads that the cash balance of company ABC is Ksh. 16,000, yet the

cash balance as per ABC’s books of accounts is Ksh. 12,000 as of January 31, 2018. Given the

following information, prepare a bank reconciliation statement for ABC Company.

Deposits in Transit: Ksh.2,000 (received by the bank on February 1, 2018)

Outstanding Cheques: Ksh. 6,000 (Ksh. 4,000 paid by the bank)

Bank debited a ‘bounced’ cheque of Ksh. 510 from Mr. Reilly who is a customer of ABC company.

Bank’s printing charges Ksh. 40

ABC’s cash balance earned an interest of Ksh. 50.

The bank collected a notes receivable of Ksh 1,020 from a customer of ABC company and the cost

of collecting the amount was Ksh. 20.

One of the bank accounting staff correctly recorded by the bank as Ksh.1,250 yet the one of

company’s accounting staff mistakenly recorded it as Ksh.1,750

BANK RECONCILIATION 4

ABC COMPANY

Bank Reconciliation

January 31, 2018

Cash balance per bank statement Ksh.16,000

Add: Deposits in transit Ksh.2,000

Ksh.18,000

Less: Cheques Outstanding Ksh.6,000

Adjusted cash balance as per bank Ksh.12,000

Cash balance per books Ksh.12,000

Add: Collected note receivable Ksh.1,020

Add: Interest earned on deposit Ksh.50

Less: Bank’s collection fee Ksh.20

Less: + error in recording cheque Ksh.500

Less: ‘Bounced’ cheque Ksh.510

Less: Cheque Printing service charge Ksh.40

Adjusted cash balance per books Ksh. 12,000

BANK RECONCILIATION 5

References

Weygandt, J. J., Kimmel, P. D., & Kieso, D. E. (2010). Financial Accounting, 6e ISV Update. John

Wiley & Sons.

Das könnte Ihnen auch gefallen

- (ToA) Cash & Cash EquivalentsDokument1 Seite(ToA) Cash & Cash Equivalentslooter198Noch keine Bewertungen

- 2020-2021 Financial StatementsDokument51 Seiten2020-2021 Financial StatementsKyra GillespieNoch keine Bewertungen

- Bank Reconciliation StatementDokument13 SeitenBank Reconciliation StatementAli Hassan100% (1)

- Bank Reconciliation StatementDokument18 SeitenBank Reconciliation StatementNaveed Asghar JanNoch keine Bewertungen

- Bank ReconciliationDokument9 SeitenBank Reconciliationlit afNoch keine Bewertungen

- 2022 Financial StatementsDokument19 Seiten2022 Financial StatementsThe King's UniversityNoch keine Bewertungen

- Revew ExercisesDokument40 SeitenRevew Exercisesjose amoresNoch keine Bewertungen

- 1099 G 2018documentdownloadDokument1 Seite1099 G 2018documentdownloadKristine McVeighNoch keine Bewertungen

- Financial StatementsDokument198 SeitenFinancial StatementsRK15 21100% (1)

- Unit 1 IncotaxDokument98 SeitenUnit 1 IncotaxKimberly GallaronNoch keine Bewertungen

- Payroll Register-1-15th - 2019Dokument9 SeitenPayroll Register-1-15th - 2019PW WANoch keine Bewertungen

- Merchandising Business Pt. 2Dokument18 SeitenMerchandising Business Pt. 2Angelo ReyesNoch keine Bewertungen

- Qualified Dividends and Capital Gains WorksheetDokument1 SeiteQualified Dividends and Capital Gains WorksheetBetty Ann LegerNoch keine Bewertungen

- Hong Thien PhuocBui2018Dokument6 SeitenHong Thien PhuocBui2018Thien BaoNoch keine Bewertungen

- Financial Statements First Quarter Ended 31-March-2019Dokument40 SeitenFinancial Statements First Quarter Ended 31-March-2019Milon MahmudNoch keine Bewertungen

- Journal, Ledger and Trial BalanceDokument12 SeitenJournal, Ledger and Trial Balanceari purnomoNoch keine Bewertungen

- Ch04 6e Slutions HoyleDokument44 SeitenCh04 6e Slutions HoyleJackie PerezNoch keine Bewertungen

- Accounting Assignment 04A 207Dokument10 SeitenAccounting Assignment 04A 207Aniyah's RanticsNoch keine Bewertungen

- NVCC Accounting ACC 211 EXAM 1 PracticeDokument12 SeitenNVCC Accounting ACC 211 EXAM 1 Practiceflak27bl2Noch keine Bewertungen

- Ap2904 Cash and Cash EquivalentsDokument8 SeitenAp2904 Cash and Cash EquivalentsMa Yra YmataNoch keine Bewertungen

- Instructions:: Apollo Preliminary Analytical Procedures Audit Mini-CaseDokument14 SeitenInstructions:: Apollo Preliminary Analytical Procedures Audit Mini-CaseShefali GoyalNoch keine Bewertungen

- Worksheet For Bank Reconciliation - 8 PDFDokument2 SeitenWorksheet For Bank Reconciliation - 8 PDFsanele dlaminiNoch keine Bewertungen

- Bank Reconciliation StatementDokument22 SeitenBank Reconciliation StatementasimaNoch keine Bewertungen

- Three-Dated Bank ReconciliationDokument4 SeitenThree-Dated Bank ReconciliationCJ alandyNoch keine Bewertungen

- ACT1122 Conceptual Framework and Accounting Standards - Revised - 2024Dokument14 SeitenACT1122 Conceptual Framework and Accounting Standards - Revised - 2024Migz labianoNoch keine Bewertungen

- Intermediate Acctg 1 - Cash9Dokument3 SeitenIntermediate Acctg 1 - Cash9Joyce Ann GutierrezNoch keine Bewertungen

- Journal Entries - Financial AccountingDokument3 SeitenJournal Entries - Financial AccountingElham JabarkhailNoch keine Bewertungen

- Top of Form Panel 0 4 None 0 0: Legal Name: Social Security NumberDokument2 SeitenTop of Form Panel 0 4 None 0 0: Legal Name: Social Security NumberJason RileyNoch keine Bewertungen

- Financial StatementsDokument1 SeiteFinancial Statementsaashir chNoch keine Bewertungen

- Bank Reconciliation Statement - Process - Format - ExampleDokument5 SeitenBank Reconciliation Statement - Process - Format - ExampleCykee100% (1)

- MOD 03 - Bank ReconDokument3 SeitenMOD 03 - Bank ReconIrish VargasNoch keine Bewertungen

- Apollo Shoes Trial BalanceDokument1 SeiteApollo Shoes Trial Balancebabar zahoorNoch keine Bewertungen

- Borrower Information: Disclosure Statement William D. Ford Federal Direct Loan ProgramDokument3 SeitenBorrower Information: Disclosure Statement William D. Ford Federal Direct Loan ProgramNathan BurrisNoch keine Bewertungen

- Instructions BinghamDokument41 SeitenInstructions Binghamnina45100% (1)

- Answers R41920 Acctg Varsity Basic Acctg Level 2Dokument12 SeitenAnswers R41920 Acctg Varsity Basic Acctg Level 2John AceNoch keine Bewertungen

- BRS, IASB FRMWKDokument4 SeitenBRS, IASB FRMWKNadir MuhammadNoch keine Bewertungen

- Albrecht70844 0538470844 02.01 Chapter01 PDFDokument29 SeitenAlbrecht70844 0538470844 02.01 Chapter01 PDFShamchand B.RNoch keine Bewertungen

- 0 - 1098 Mortgage Interest 2022 - 01122023 - 162111Dokument1 Seite0 - 1098 Mortgage Interest 2022 - 01122023 - 162111Osvaldo CalderonUACJNoch keine Bewertungen

- Bank Reconciliation StatementsDokument3 SeitenBank Reconciliation StatementsPatrick Prem GomesNoch keine Bewertungen

- Toa PreboardDokument9 SeitenToa PreboardLeisleiRagoNoch keine Bewertungen

- ICICI Bank Form-20F Financial Year 2018Dokument520 SeitenICICI Bank Form-20F Financial Year 2018AladdinNoch keine Bewertungen

- What Is A Bank Reconciliation StatementDokument3 SeitenWhat Is A Bank Reconciliation StatementYassi CurtisNoch keine Bewertungen

- Bank Rec MarkingDokument20 SeitenBank Rec MarkingHftc SamNoch keine Bewertungen

- PHI 17A-Dec 2018 PAL Fin Statement 2018Dokument162 SeitenPHI 17A-Dec 2018 PAL Fin Statement 2018makane100% (1)

- At Quiz Set - DDokument3 SeitenAt Quiz Set - DsehunkydoryNoch keine Bewertungen

- Amanda K Scott 3535 W Cambridge AVE Fresno, CA 93722-6561Dokument6 SeitenAmanda K Scott 3535 W Cambridge AVE Fresno, CA 93722-6561Amanda Scott100% (1)

- Windward Fund's 2018 Tax FormsDokument49 SeitenWindward Fund's 2018 Tax FormsJoe SchoffstallNoch keine Bewertungen

- 1481546265426Dokument3 Seiten1481546265426api-370784582Noch keine Bewertungen

- Early in The Year Bill Barnes and Several Friends OrganizedDokument1 SeiteEarly in The Year Bill Barnes and Several Friends OrganizedM Bilal Saleem0% (1)

- Study GuideDokument84 SeitenStudy GuideDonna100% (1)

- Proof of CashDokument7 SeitenProof of CashMARIAN POLANCONoch keine Bewertungen

- Paystub 202011Dokument1 SeitePaystub 202011Bangkit Fajar NugrahaNoch keine Bewertungen

- Midterm Exam No. 3Dokument3 SeitenMidterm Exam No. 3Anie MartinezNoch keine Bewertungen

- Bank ReconcilationDokument9 SeitenBank ReconcilationJohnpaul FloranzaNoch keine Bewertungen

- Illustrative Problem On Adjusted Bank MethodDokument15 SeitenIllustrative Problem On Adjusted Bank MethodRyDNoch keine Bewertungen

- F.A.B.M PortfolioDokument28 SeitenF.A.B.M PortfolioLjoy Vlog SurvivedNoch keine Bewertungen

- Principles of Financial Accounting: Chapter 7 - Fraud, Internal Controls, & CashDokument12 SeitenPrinciples of Financial Accounting: Chapter 7 - Fraud, Internal Controls, & CashAli Zain Parhar100% (2)

- Cash - CRDokument14 SeitenCash - CRpingu patwhoNoch keine Bewertungen

- BRS (Bank Reconciliation Statement)Dokument23 SeitenBRS (Bank Reconciliation Statement)Shruti KapoorNoch keine Bewertungen

- Module 6 Part 2 Internal ControlDokument15 SeitenModule 6 Part 2 Internal ControlKRISTINA CASSANDRA CUEVASNoch keine Bewertungen

- OfferDokument1 SeiteOfferАнастасия МалявкоNoch keine Bewertungen

- Wi Application FormDokument2 SeitenWi Application Formippon_osotoNoch keine Bewertungen

- Hukumonline Top 100 Law Firm Rangking 2021Dokument10 SeitenHukumonline Top 100 Law Firm Rangking 2021Razak ChaidirNoch keine Bewertungen

- SCM Fall 17 - 3 - Purchasing ManagementDokument22 SeitenSCM Fall 17 - 3 - Purchasing ManagementMYawarMNoch keine Bewertungen

- Cal - Dot - Complete StreetsDokument3 SeitenCal - Dot - Complete StreetsprowagNoch keine Bewertungen

- Group 10 IT Project ReportDokument24 SeitenGroup 10 IT Project Reportabhisht89Noch keine Bewertungen

- Members Benefit - OktoberDokument1 SeiteMembers Benefit - OktoberKarina AnantaNoch keine Bewertungen

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Dokument1 SeiteTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Hamza SalihNoch keine Bewertungen

- 0 0 0 0 94791 SGST (0006)Dokument2 Seiten0 0 0 0 94791 SGST (0006)dhavalNoch keine Bewertungen

- Invoice: Gross Invoice Total Minus Outstanding AmountDokument3 SeitenInvoice: Gross Invoice Total Minus Outstanding AmountAbdullah Al Mahmud SuzonNoch keine Bewertungen

- StatementDokument8 SeitenStatementpriyaranjandas97Noch keine Bewertungen

- Rajshree Patil 10Dokument84 SeitenRajshree Patil 1004- SIDDHI PATILNoch keine Bewertungen

- Sep BillDokument11 SeitenSep BillrupeshNoch keine Bewertungen

- July 2018 Bank Voucher Range I Part969Dokument1 SeiteJuly 2018 Bank Voucher Range I Part969Farhan PhotoState & ComposingNoch keine Bewertungen

- 151025-891852 20191231 PDFDokument1 Seite151025-891852 20191231 PDFArina KhairuzanNoch keine Bewertungen

- Account Closure Request Form Yes BankDokument1 SeiteAccount Closure Request Form Yes BankRadheShyam0% (1)

- Mju TVi 0 H RIa VPD 3 CDokument5 SeitenMju TVi 0 H RIa VPD 3 CPallaviNoch keine Bewertungen

- Inland Intermodal Terminals and Freight Logistics Hubs PDFDokument29 SeitenInland Intermodal Terminals and Freight Logistics Hubs PDFMiloš MilenkovićNoch keine Bewertungen

- Current Account - Online Current Account Opening at HDFC Bank PDFDokument2 SeitenCurrent Account - Online Current Account Opening at HDFC Bank PDFVishnu Shankar MishraNoch keine Bewertungen

- BBAV Bank StatementDokument1 SeiteBBAV Bank StatementTommy CliftonNoch keine Bewertungen

- Alcatel-Lucent: Marketing The Cell Phone As A Mobile Wallet (A)Dokument25 SeitenAlcatel-Lucent: Marketing The Cell Phone As A Mobile Wallet (A)Rahul GargNoch keine Bewertungen

- Selection LetterDokument4 SeitenSelection LetterAjit Pal SinghNoch keine Bewertungen

- Students Fee Payment System & Operations: Step by Step GuideDokument20 SeitenStudents Fee Payment System & Operations: Step by Step GuidenitinNoch keine Bewertungen

- DiCeglie052521Invite (30959)Dokument2 SeitenDiCeglie052521Invite (30959)Jacob OglesNoch keine Bewertungen

- 3.2.3 Record - The Ledger (T-Accounts)Dokument3 Seiten3.2.3 Record - The Ledger (T-Accounts)andelka2Noch keine Bewertungen

- Globebill 881537234 07-06-2019Dokument3 SeitenGlobebill 881537234 07-06-2019Benjie PrilaNoch keine Bewertungen

- ZGF HC 9 Idr Jxe DW WPDokument14 SeitenZGF HC 9 Idr Jxe DW WPjayabarathi srinivasanNoch keine Bewertungen

- Test PDF 1Dokument124 SeitenTest PDF 1eltsipe100% (1)

- M Surana and Company: Chartered AccountantDokument15 SeitenM Surana and Company: Chartered AccountantSanjay PurohitNoch keine Bewertungen

- AUB Credit CardDokument18 SeitenAUB Credit CardLovely Jennifer Torremonia IINoch keine Bewertungen

- Getting to Yes: How to Negotiate Agreement Without Giving InVon EverandGetting to Yes: How to Negotiate Agreement Without Giving InBewertung: 4 von 5 Sternen4/5 (652)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Von EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Bewertung: 4.5 von 5 Sternen4.5/5 (14)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindVon EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindBewertung: 5 von 5 Sternen5/5 (231)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Von EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Bewertung: 4.5 von 5 Sternen4.5/5 (15)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineVon EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNoch keine Bewertungen

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesVon EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNoch keine Bewertungen

- The Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingVon EverandThe Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingBewertung: 4.5 von 5 Sternen4.5/5 (760)

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsVon EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNoch keine Bewertungen

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Von EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Bewertung: 4.5 von 5 Sternen4.5/5 (5)

- Start, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookVon EverandStart, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookBewertung: 5 von 5 Sternen5/5 (4)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeVon EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeBewertung: 4 von 5 Sternen4/5 (21)

- Accounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCVon EverandAccounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCBewertung: 5 von 5 Sternen5/5 (1)

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsVon EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsBewertung: 5 von 5 Sternen5/5 (1)

- Ratio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetVon EverandRatio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetBewertung: 4.5 von 5 Sternen4.5/5 (14)

- How to Measure Anything: Finding the Value of "Intangibles" in BusinessVon EverandHow to Measure Anything: Finding the Value of "Intangibles" in BusinessBewertung: 4.5 von 5 Sternen4.5/5 (28)

- The Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceVon EverandThe Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceBewertung: 4 von 5 Sternen4/5 (1)

- Beyond the E-Myth: The Evolution of an Enterprise: From a Company of One to a Company of 1,000!Von EverandBeyond the E-Myth: The Evolution of an Enterprise: From a Company of One to a Company of 1,000!Bewertung: 4.5 von 5 Sternen4.5/5 (8)

- Project Control Methods and Best Practices: Achieving Project SuccessVon EverandProject Control Methods and Best Practices: Achieving Project SuccessNoch keine Bewertungen

- The Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyVon EverandThe Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyNoch keine Bewertungen

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Von EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Bewertung: 4 von 5 Sternen4/5 (33)

- Small Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessVon EverandSmall Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessNoch keine Bewertungen

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsVon EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsBewertung: 4 von 5 Sternen4/5 (7)

- Contract Negotiation Handbook: Getting the Most Out of Commercial DealsVon EverandContract Negotiation Handbook: Getting the Most Out of Commercial DealsBewertung: 4.5 von 5 Sternen4.5/5 (2)

- Financial Accounting For Dummies: 2nd EditionVon EverandFinancial Accounting For Dummies: 2nd EditionBewertung: 5 von 5 Sternen5/5 (10)

- Your Amazing Itty Bitty(R) Personal Bookkeeping BookVon EverandYour Amazing Itty Bitty(R) Personal Bookkeeping BookNoch keine Bewertungen