Beruflich Dokumente

Kultur Dokumente

IDirect TCIExpress IC

Hochgeladen von

khprashOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

IDirect TCIExpress IC

Hochgeladen von

khprashCopyright:

Verfügbare Formate

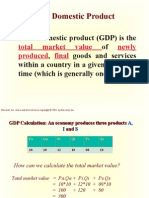

Initiating Coverage

January 25, 2018

Rating Matrix TCI Express (TCIEXP)

Rating : Buy

Target : | 660 | 540

Target Period

Potential Upside

:

:

12-18 months

22%

Speed, agility, delivery!!!

TCI Express (TCIEL) was established as a multi-specialist only express

Financial Parameters (| crore) cargo company with its own distribution set-up across India servicing

| Crore FY17 FY18E FY19E FY20E more than 40000 pick up and delivery points. With over two decades of

Revenues 755.2 857.1 1,012.9 1,183.8 experience, TCIEL commands 3% market share of the | 25000 crore

EBITDA 67.6 83.3 112.0 139.8 express logistics market (unorganised 50%). In the past two decades,

Net Profit 40.7 53.5 66.8 83.6 TCIEL has designed one of the largest pan-India networks of 28 sorting

EPS (|) 10.6 14.0 17.4 21.9 centres and 550 branches offering time-definite solutions to 670 out of

675 districts in India. Post de-merger, TCIEL charted aggressive expansion

Valuation Summary

plans sharpening its focus on owning & modernising sorting centres and

FY17 FY18E FY19E FY20E

strengthening IT infrastructure that would garner revenue, PAT growth of

P/E 50.8 38.7 31.0 24.7

16%, 27% CAGR in FY17-20E to | 1184 crore, | 84 crore, respectively.

Target P/E 62.0 47.3 37.8 30.2

EV / EBITDA 30.9 25.2 18.7 14.9 GST-era calling need for specialised players like TCIEL…

P/BV 12.9 10.3 7.7 5.9 The routing network (hub & spoke), developed, tried & tested over several

RoNW (%) 28.8 29.6 28.4 27.0 years, remains the backbone of the express business that manages

RoCE (%) 35.1 34.9 36.9 36.7 prompt movement of cargo generating higher yield per route. We believe

the GST ideology would lead most business decisions to be focused on

Stock Data

supply chain efficiency rather than state-wise tax benefits. Subsequently,

Particular Amount

the need for specialised players would accelerate demand for organised

Market Capitalization (| Cr) 2,068.2

players like TCIEL. We expect revenues to grow at 16% CAGR in FY17-

Total Debt (FY17) (| Cr) 31.6

Cash and Investments (FY17) (| Cr) 9.5

20E, faster than its historical (FY12-17 CAGR of 9%) to | 1184 crore.

EV (| Cr) 2,090.3 Multi specialist offerings leading to diversified business model

52 week H/L 645 / 284 With services like surface express, domestic air express, international air

Equity capital (| Cr) 7.7 express, reverse express, TCIEL has positioned itself as a multi-specialist

Face value (|) 2.0

logistics player. About 95% of its business is derived from B2B while the

FII Holding (%) 3.2

remaining 5% is derived from B2C. In sectors per se, SMEs contribute

DII Holding (%) 10.2

majority (50%) of overall revenues, automobile spare parts: 13%,

Comparative return matrix (%) pharmaceuticals: 11%, lifestyle retail & engineering: 7% each and

Return % 1M 3M 6M 12M telecom & consumer durables: 6% each. Also, no single client accounts

Blue Dart Exp. 0.3 12.9 (3.3) 3.7 for more than 1% of overall business. We believe this diversification

Gati 2.0 19.6 2.6 13.4 would allow TCIEL to keep its utilisation optimum (85% on each route)

VRL Logistics (3.7) 13.2 27.8 36.2 enabling it to command consistency in EBITDA margins (~8-9%). Lower

TCI Express (4.0) (6.7) 14.5 81.4 rentals (own sorting centres) coupled with GST efficiencies would result

in margin expansion of 300 bps in FY17-20E to 12%.

Price movement Focused asset allocation; robust growth trajectory; assign BUY…

12,000 700 Having outperformed the overall industry in FY17, TCIEL is planning a

11,000 600 capex of | 400 crore (over five years) staying committed to enhancing its

10,000

9,000 500 handling capacity and improving efficiencies. Prudent asset allocation has

8,000 400 led TCIEL to deliver one of the best return ratios (after BlueDart) in the

7,000 industry. On the back of low leverage, robust growth trajectory and high

6,000 300

5,000 return ratios (>25%), we expect TCIEL to continue command premium

200

4,000 valuations. We assign BUY on TCIEL, ascribing a P/E multiple of 30x on an

3,000 100

estimated EPS of | 22 (FY20E) and arrive at a target price of | 660.

2,000 0

Jun-17 Jan-18 Exhibit 1: Financial Performance

(Year-end March) FY16 FY17 FY18E FY19E FY20E

Price (R.H.S) Nifty (L.H.S) Revenues (| crore) 663.2 755.2 857.1 1,012.9 1,183.8

EBITDA (| crore) 54.6 67.6 83.3 112.0 139.8

Adjusted Net Profit (| crore) 28.5 40.7 53.5 66.8 83.6

Research Analysts

EPS (|) 7.4 10.6 14.0 17.4 21.9

Bharat Chhoda P/E (x) 72.2 50.8 38.7 31.0 24.7

bharat.chhoda@icicisecurities.com Price / Book (x) 16.7 12.9 10.3 7.7 5.9

EV/EBITDA (x) 38.2 30.9 25.2 18.7 14.9

Ankit Panchmatia RoCE (%) 34.6 35.1 34.9 36.9 36.7

ankit.panchmatia@icicisecurities.com RoNW (%) 23.9 28.8 29.6 28.4 27.0

Source: Company, ICICIdirect.com Research

ICICI Securities Ltd | Retail Equity Research

Shareholding pattern (Q3FY18) Company background

Shareholding Pattern Holdings (%) TCI Express (TCIEL), headquartered in Gurugram, was established in 1996

Promoters 66.1 as one of the foremost divisions of Transport Corporation of India (TCI).

Institutional investors 13.4 Having achieved financial and growth stability, TCI de-merged this

Others 20.5 division in 2017. Given the exclusivity of the business, TCI issued one

equity share (FV | 2) to existing shareholders for every two equity shares

(FV | 2). Post demerger, TCI Express ceased to remain a division of TCI

Institutional holding trend (%) and was separately listed on the bourses.

The de-merger was done to sharpen TCIEL’s focus on express delivery

12 10.3

services and offer time definite solutions for customer’s requirements. In

9.7 10.2

10 terms of market share, TCIEL commands ~3% of the market share of the

8 7.1 7.3 overall express logistics market, estimated at | 25000 crore. However,

5.1 5.3 from a broader perspective, with total logistics industry (transportation,

6

(%)

3.2

warehousing, value added service and inventory in-transit cost) pegged at

4

13% of overall GDP ($300 billion), TCIEL claims to carry goods worth $7

2 billion (in value) arriving at an indicative market share of 2-3%.

0

Exhibit 3: Express zones…

Q4FY17 Q1FY18 Q2FY18 Q3FY18

FII DII

Exhibit 2: Revenue bifurcation zone-wise…

% of revenue

States

contribution

North Zone

Punjab, Chandigarh, Haryana, Uttarakhand, 29%

Delhi, Uttar Pradesh & Rajasthan

West Zone

Maharashtra, Goa, Gujarat, Madhya 28%

Pradesh, Daman & Diu, Dadar & Nagar

Haveli

South Zone

Andhra Pradesh, Karnataka, Tamil Nadu & 28%

Pondicherry

East Zone & Special Zone

Bihar, Jharkhand, Chhattisgarh, West

Bengal & Odisha, Himachal Pradesh,

Arunachal Pradesh, Assam, Nagaland, 15%

Mizoram, Meghalaya, Sikkim, Tripura,

Manipur, Jammu & Kashmir, Port Blair &

Kerala

Source: Company, ICICIdirect.com Research Source: Company, ICICIdirect.com Research

The wide spectrum of services offered by TCIEL include surface express,

domestic and international air express, e-com express, priority express

and reverse express. These logistical solutions are spread across industry

segments such as automobile spare parts, pharmaceuticals, retail, e-

commerce, telecom and SMEs. The offerings mainly address B2B

customers (95% of revenue). It involves door-to-door pick-up and delivery

of parcels (5-40 kg) in a time bound manner predominantly via surface

transport. TCIEL claims to have one of the largest reaches domestically. It

serves 670 districts (out of 675) through a flotilla of 4000 containerised

trucks. A network of 28 sorting centres, 550 company branches, 400

express routes and 2500 feeder routes, TCIEL serves 40,000 pickup and

delivery points.

ICICI Securities Ltd | Retail Equity Research Page 2

One-stop shop for express logistics requirements…

TCIEL specialises in providing day definite solution services that involve

end-to-end pick-up and delivery of parcels. The company deals in a

variety of parcels with weights ranging from 1 kg (apparels, cellphones,

etc) to 40 kg (consumer durables, automotive ancillaries, etc). Majority of

the revenues are derived from B2B services (95%) while the remaining

5% is contributed by B2C services. Given the peculiarity of the business,

the modal share remains in favour of road transportation (86% of overall

revenues). However, with 8% of revenues from air express, TCIEL also

fulfils requests for same day/next day deliveries in all major metros (24

hours) and mini-metros and A-class cities (48 hours).

Exhibit 4: Road dominates modal share Exhibit 5: B2B remains core to business

Surface

express, 86%

Air express,

8% B2B, 95%

International

air express,

1%

E-commerce

B2C, 5%

express, 5%

Source: Company, ICICIdirect.com Research

Source: Company, ICICIdirect.com Research

TCIEL could be characterised as a less than truck load player (LTL), which

operates in a time sensitive cargo segment. The segment competes with

the likes of BlueDart, Gati KWE and VRL Logistics (LTL) in the listed space.

However, in the unlisted space, it competes with Safexpress and the

Indian operations of DHL and FedEx.

Exhibit 6: Established and valued added service range…

Transportation Storage Services

Company Name Express/ Supply

Road Air Rail Water Warehousing CFS/ICD Cold Chain Bulk Liquid Multi-modal E-commerce

LTL Chain/3PL

Listed Entities

TCI Express Yes Yes - - - - - - Yes - - Yes

Blue Dart Yes Yes - - - - - - Yes - - Yes

VRL Logistics Yes - - - - - - - Yes Yes - -

Gati Limited Yes Yes Yes - - - Yes - Yes Yes - Yes

TCI Yes Yes Yes Yes Yes - Yes - - Yes Yes Yes

Private Players

Delhivery Yes - - - Yes - - - Yes Yes - Yes

Rivigo Yes Yes - - - - Yes - Yes Yes - Yes

Safexpress Yes Yes - - - - Yes - Yes Yes - Yes

DHL Yes Yes - - - - - - Yes - - Yes

Fedex Yes Yes - - - - - - Yes - - -

Source: Company, ICICIdirect.com Research

With a vendor network of 4000+ containerised trucks, 550 branches and

28 sorting centres (mainly leased), TCIEL operates on an asset-light

business model. In contrast, VRL (trucks, warehouses) and BlueDart (flight

carriers) own and manage their assets. However, Gati KWE partially owns

its fleet (~500 trucks) and additionally manages a vendor network

equivalent to that of TCIEL.

ICICI Securities Ltd | Retail Equity Research Page 3

Investment Rationale

Exhibit 7: TCI Developers robust revenue growth… Demarcation to bring focused approach; high growth phase for TCIEL…

TCI Developers

In CY16, Transport Corporation of India (TCI) completed the de-merger of

12.0 its XPS division in the ratio of one share of TCIEL for every two shares

10.0 38% CAGR

held. Post this, the shares of TCIEL were separately listed on the bourses

8.0

in December 2016. Post de-merger, FY17-18 was the first operating year

wherein TCIEL operated as a separate independent entity declaring

| crore

6.0

9.3

10.3 separate business goals and targets. Due to under-investments and

4.0 8.4

different business verticals, TCIEL under the consolidated entity grew at a

2.0

1.5 2.0 2.6 3.1 sluggish pace of mere 9% in FY10-16 compared to the industry, which

0.0

FY11 FY12 FY13 FY14 FY15 FY16 FY17

grew >10% over the same period.

Revenue

Exhibit 8: De-merger to accelerate revenues for TCI Express…

Source: ICICIdirect.com Research

9% CAGR over Acclerating its

2500 FY10-16 growth post de-

TCI Developers was de-merged from parent Transport merger

Corporation of India (TCI) in 2010. The same was 2000 600 663

separately listed on the bourses in April 2011. Post de- 556 659

495 13% YoY

merger, revenues of the company grew at a CAGR of 24% 1500 460

in the next seven years from | 0.5 crore to | 1.9 crore

| crore

386 699 628 407

583 679 615 361

1000 393

248

366 432

500 839

727 812 788 796 826 816

440 474

0

FY10 FY11 FY12 FY13 FY14 FY15 FY16 H1FY17 H1FY18

Transport Division Supply chain TCI Seaways division XPS division

Source: Company, ICICIdirect.com Research

Revenue growth rates for H1FY18 for TCIEL (post de-merger) remained

robust at 13% YoY to | 407 crore compared to | 361 crore in H1FY17. For

the same period, TCIEL outperformed its industry peers BlueDart and VRL

Logistics for which H1FY18 revenue growth rates were at 7% and 4% to

| 1369.5 crore and | 943.8 crore, respectively. However, H1FY18 revenue

of its closest competitor Gati KWE de-grew 3% YoY to | 550 crore.

Exhibit 9: TCIEL delivering industry leading growth rates…

20.0%

16.4% 15.7%

15.0% 12.2%

11.6%

10.2% 10.0%

10.0% 10.3% 7.2%

6.3% 6.6%

% growth rate YoY

5.7% 7.4% 7.3%

3.3% 6.0%

5.0%

2.0% 0.4%

1.6%

0.0% 0.7%

-1.1%

Q1FY17-1.3% Q2FY17 Q3FY17 Q4FY17 Q1FY18 Q2FY18

-4.0%

-5.0% -5.4%

-7.7%

-10.0%

TCIEL Gati KWE Bluedart VRL Logistics

Source: Company, ICICIdirect.com Research

ICICI Securities Ltd | Retail Equity Research Page 4

Trinity of revenue growth, margin expansion & structural changes

The under-investments and sluggish business environment led TCIEL to

grow at 6% CAGR in FY13-16. However, FY16-17 marked the first year for

TCIEL as an independent entity that led to dedicated investment of | 95.3

crore in FY15-17. TCIEL has now earmarked a capex of ~| 400 crore over

five years (FY18-22). The core to these investments would be expanding

its pan-India presence (locations served), improving parcel turnaround

time (handling equipments) and increasing handling capacity (sorting

centres). The focused capex has initiated a new growth phase for the

company with FY17 revenue growth of 14% positioning TCIEL at an

inflection point. Revenues are expected to grow at 16% CAGR to | 1184

crore in FY17-20E.

Exhibit 10: Investments to translate to revenue growth…

1400.0

1200.0 16% CAGR

14%

1000.0 YoY

800.0 6% CAGR

| crore

1183.8

600.0

1012.9

857.1

755.2

400.0

663.2

658.6

600.0

555.7

200.0

0.0

FY13 FY14 FY15 FY16 FY17 FY18 FY19 FY20

Revenue

Source: Company, ICICIdirect.com Research

Over the past few years, Transport Corporation of India (parent) has

increased its investments to accelerate its core business. The average

annual capital expenditure over the past five years was at | 120 crore

(FY12-17) compared to | 72.5 crore in FY06-12. However, recent

investments were mainly allocated to strengthening its multi-modal

carrying capacity. Core investments included that made in ships,

warehouses and truck/cars. Of the total capex of | 152.5 crore and | 168.4

crore in FY15 and FY16, investments in TCIEL were a mere | 3 crore and

| 11 crore (| 49 crore due to de-merger), respectively.

Exhibit 11: TCI capex trend; eludes TCIEL…

200.0

3.9

150.0 12.6

20.7 64.5

14.4

| crore

100.0 27.6

4.3

6.1 77.6

5.7 22.5

50.0 65.2

36.5

24.1 55.6 41.6 95.7 17.9

0.0

FY13 FY14 FY15 FY16 FY17

Hub Centres & small warehouses Wind power Ships & Containers Trucks & Cars Others

Source: Company, ICICIdirect.com Research

ICICI Securities Ltd | Retail Equity Research Page 5

Exhibit 12: Focused capex to lead to profitable growth Ups ante in capital expenditure, TCIEL on accelerated growth path

Capital expenditure FY17 2017-18

Given the focused approach coupled with aggressive capital outlay, we

(| crore) Assets Proposed FY18 Assets

expect TCIEL to continue to post industry leading growth rates. Majority

Sorting Centers 88.5 50.0 138.5

(| 200 crore) of the capital investment outlay of | 400 crore involves

Cars 2.5 1.0 3.5

Plant & Machinery 6.2 2.0 8.2

replacement of all leased sorting/distribution (S&D) centres with the

IT 3.4 2.0 5.4

company owned sorting centres. The S&D operations would

Office Equipment 2.4 3.0 5.4

reduce/eliminate errors, labour and cycle time while increasing accuracy

Furniture & Fixtures 3.3 2.0 5.3

and improving service. These S&D centres would be multi-specialist,

Total 106.3 60.0 166.3

highly mechanised, which would be capable of generating faster

Source: Company, ICICIdirect.com Research turnaround of parcels. TCIEL currently manages 28 S&D centres with a

total warehousing space of 1 million sq ft (msf). Out of these 20 S&D

centres, with coverage of 0.7 msf, 70% are leased. The remaining 0.3 msf

with eight S&D centres are owned.

Exhibit 13: Sorting centres space to double from FY17 to FY22…

2.5

12% CAGR 2 mn sq.ft

2.0 1.6 mn sq.ft

16% CAGR

0.7

1.5

mn.sq.ft

1 mn sq.ft 20% CAGR

0.7

1.0 39% CAGR 0.7

0.7

0.7 1.3

0.5 0.9

0.7

0.5

0.4

0.0

FY 17 FY 18 FY 19 FY 20 FY22

Owned Sorting centreContracted

space

Source: Company, ICICIdirect.com Research

Although the management intends to minimise or shift the S&D

operations to owned facilities, we believe TCIEL would continue to

manage non-core centres on a leased model. Subsequently, we expect

the S&D space to double to 2 msf by FY22. However, the ratio would shift

in favour of owned centres claiming 70% (vs. 30% current) of the overall

space while the remaining 30% (vs. current 70%) would be leased.

Exhibit 14: Reduction in rental expense, efficiencies to drive EBITDA…

160.0

140.0

120.0

100.0

80.0

| crore

60.0

40.0

20.0

54.6 67.6 83.3 112.0 139.8

0.0

FY16 FY17 FY18E FY19E FY20E

EBITDA

Source: Company, ICICIdirect.com Research

Improved efficiencies coupled with a decline in rental expenses would

result in expansion of 300 bps in EBITDA margins to 12% vs. current 9%.

Robust revenue growth coupled with margin expansion are expected to

lead to EBITDA growth of 29% CAGR in FY17-20E to | 140 crore.

ICICI Securities Ltd | Retail Equity Research Page 6

Sorting centres to provide better efficiencies

Sorting activities remain at the heart of the logistics express players. The

turnaround time could be drastically improved by clear segregation and

leveraging the automation at the centres. On the one hand, material

ordered in bulk at possibly a discounted rate can be separated at the

logistics centre, sorted and then shipped to the designated project. On the

other hand, material coming from different suppliers can be consolidated

and then shipped to a certain project.

Exhibit 15: Revised distribution strategy for quick turnaround, better efficiencies…

Elimination to result

faster and efficient

distribution model

Source: Company, ICICIdirect.com Research

In FY17, TCIEL made changes in its distribution strategy. Earlier, the

consignments used to arrive at the consolidation hub unloaded, marked

and numbered and then shifted to respective sorting centres for final

delivery. However, recent changes involved elimination of transportation

to nearby branches and directly ship consignments from its pick-up point

to the nearest sorting centre and direct shipment to consumer. The

strategy has not only led to time saving but also resulted in a reduction of

fixed overheads resulting in margin improvement. The strategy was

implemented in FY17 over eight to 10 metro cities, resulting in margin

expansion of 120 bps in FY16-H1FY18 to 9.4%. The strategy would be

further extended to other cities in FY17-18. However, it would not be

possible across all routes as synergies could be derived only on high

density routes. Moreover, TCIEL has also implemented minimum selling

prices (MSP) across its service centres. The same is executed through

standardised rate cards that would avoid undercutting of prices that were

earlier a practice adopted by business associates to attract volumes.

Exhibit 16: Improved efficiencies to result in uptrend in margin…

14.0

11.8

12.0 11.0

9.4 9.7

10.0 9.0

8.2

8.0

% of sales

Benefits to accrue over

6.0 Optimisation of distribution the estimated time

strategy resulting in margin period

4.0

improvement

2.0

0.0

FY16 FY17 H1FY18 FY18E FY19E FY20E

EBITDA margins

Source: Company, ICICIdirect.com Research

Recent efforts coupled with benefits of route optimisation would accrue

over our estimated period (FY17-20E) resulting in margin expansion of

300 bps to 12% (vs. current 9%).

ICICI Securities Ltd | Retail Equity Research Page 7

GST, e-way bill - Structural impetus to organised segment…

Exhibit 17: GST rate card - Logistics players… Traditionally, due to a multi-point taxation system, logistics activities were

Tax rate Amended Tax rate operationally challenged by complicated transport networks and high

Sector coordination costs. The goods directly supplied to dealers attracted state

earlier under GST

5% - No input tax VAT. To avoid the same, logistics service providers (LSPs) operate a hub-

Road transport 4.5-6%

12% - With input tax and-spoke model in most states wherein transfer from warehouse was

5% treated as stock transfer. The strategy led LSPs to set up a number of

Rail & coastal shipping 4.5-6%

(With input tax) warehouses across states resulting in warehouses operating below

Container rail 6%

12% capacity. With the abolition of multiple taxes, the GST regime has led

(With input tax) most businesses to redesign their supply chain network leading to cost

Express, warehousing & other 18% efficiencies compared to the erstwhile network, which was based on

15%

value added services (With input tax)

state-wise tax benefits. The logistics industry is expected to witness an

Source: Company, ICICIdirect.com Research era of higher turnaround and improved efficiencies as illustrated below:

Exhibit 18: Impact on supply chain mechanism post GST…

FTL model – Covering Last mile or

greater distances Express/LTL

<500-2500 kms <100 kms

Given the benefits of GST and

eradication of state-wise

warehouses, we expect the role of

full truck load (FTL) to decline. A

reduction in diversions taken to

reach outskirts would lead transit Total

time (in km) to decline nearly 5- distance

10%. However, the role of Express/LTL <3000

model kms

express/less than truck load (LTL)

<500 kms

players like TCIEL would increase.

Inbound activities like just-in-time

inventory and outbound activities

like time to market would gain Source: Industry interactions, ICICIdirect.com Research

momentum leading to demand for

time definite logistics services Exhibit 19: Established and valued added service range…

Last mile or

FTL model Express/LTL

<500-1500 kms <100 kms

Total

distance

Express/LTL <2600

model kms

<1000 kms

Source: Industry interactions, ICICIdirect.com Research

A recent, post GST study conducted by Ministry of Road Some of the other benefits are expected to be as follows:

Transport & Highways reveal that trucks have started Idle time for truck fleet is expected to reduce 20% due to

covering 300-325 km/day (vs. earlier 225 km/day).

Efficiencies were on the back of time saving accrued from elimination/rationalisation of check post between states (more than 20

border checkposts, lower congestion and abolition of toll states have already removed check posts)

centres from certain states

Elimination of octroi is expected to reduce congestion and improve

productivity for logistics industry for distribution in large cities

Higher automation coupled with larger warehouses would result in

improved infrastructure and economies of scale

ICICI Securities Ltd | Retail Equity Research Page 8

Exhibit 20: E-way bill mechanism… Earlier, different states prescribed multiple transit passes that made

compliance difficult resulting in bottlenecks at check posts. Electronic way

Distance E-way Bill Validity

(e-way) bill aims to replace separate transit passes with a uniform way bill

Less 100 Km 1 day rule, which will be applicable throughout the country. The hindrances

100-300 Km 3 days

encountered in a conventional check post system would be withdrawn

and replaced by a transparent IT mechanism.

300-500 Km 5 days

Exhibit 21: E-way bill flow: parcel movement…

500-1000 Km 10 days

Transporter

updates e-way

> 1000 Km 15 days Consignor/

bill for any Arrival at delivery

Shipper generates

invoice change of hub

Source: Company, ICICIdirect.com Research vehicle/ mode of

transport

E-way bill has a validity based on date of generation and

distance to be travelled. A vehicle must carry a valid e-

waybill during its entire journey

Transporter Transporter

Transporter

generates generates

generates e-way

Intrastate E-way intrastate e-way

for long haul

bill bill

Arrival of goods Sortation and

at Transporter Long haul Delivery of goods

Hub movement

Source: Industry interactions, ICICIdirect.com Research

Only one e-way bill is required for movement of a full truck load (FTL)

vehicle. Unlike parcel movement, no separate e-way bill is required across

multiple states. However, for parcel movement, a separate e-way bill is

required for intra-state movement and inter-state movement. The GST

Council has approved a nationwide implementation of the e-way bill

pertaining to inter-state movement of goods from February 1, 2018 and

intra-state movement of goods from June 1, 2018.

Exhibit 22: Transparency in parcel movement…

Source: Industry interactions, ICICIdirect.com Research

Commencement of e-way bill would ensure that goods being transported

comply with the GST law, which includes invoicing, disclosure, tax

payment, etc. Moreover, it would also facilitate real time tracking of goods

movement. Unorganised players would remain wary of random checking

by “mobile squads”, which continues under the GST system. The

surveillance under e-way mechanism makes it difficult for unorganised

player to operate. Capitulation of unorganised players coupled with faster

turnaround time would benefit organised player like TCIEL.

ICICI Securities Ltd | Retail Equity Research Page 9

Specialist logistics services like express delivery to gain momentum

Exhibit 23: Global ED business - Oligopolistic nature..! Express delivery (ED) logistics being fast, safe, controllable and traceable

is currently experiencing rapid growth. Increasing demand for time

accuracy and decentralisation of production and need to reduce inventory

costs have necessitated the evolution of ED. The B2B aspect of just-in-

time (JIT) delivery, which involves more frequent delivery of materials at

the right time and right place, could be capably fulfilled by ED. This has

led growth in ED (14% CAGR in FY12-14) to outperform the 12% CAGR

growth in the logistics industry. Over these years, ED players have

evolved from being a basic courier service provider delivering documents

to an integrated door-to-door logistics partner. The consumption-driven

economy led consumer focused industries like auto, apparel, pharma,

Source: ICICIdirect.com Research FMCG, consumer durables to grow at a rate faster than raw material

centric industries like polymers, cotton, coal, mining, etc.

Exhibit 24: Consumer oriented sector remains biggest contributors to express growth…

25

Customer centric Raw material centric

20 15-18

12-15 12-15

15

% growth

10-12

8-10

10

5 2-3

0

FMCG Apparel Pharma Auto Polymers Mining

Source: FSC DRHP, ICICIdirect.com Research

A pan-India express network, which is tried, tested and invested over a

long gestation, remains core to the competitive proposition. Higher initial

investments to build network and scale have led the global ED industry to

become an oligopolistic market. However, inefficiencies and a lack of

infrastructure have given rise to three layers (on the basis of geographical

reach) of ED in developing countries. National service providers, which

have a pan-India reach, offer best pricing. However regional/local service

providers offer deeper penetration and high local connect (SMEs). Given

the synergies and capabilities, national operators continue to control a

significant market share.

Exhibit 25: Relative positioning of express logistics service providers…

e

Source: Ken research, ICICIdirect.com Research

Given the reach and volume sourcing capabilities, regional/local players

seeking growth and higher utilisation levels would collaborate with

national players for parcels delivered across India. Subsequently, the

share of organised national express players is expected to reach 60% by

FY22 vs. the current 50% in FY17.

ICICI Securities Ltd | Retail Equity Research Page 10

Express - “Business class” of logistics industry…

Exhibit 26: Express market by market structure The specialised and priority nature of the business, positions the express

industry as a premium segment in the logistics industry. The industry is

10%

known for providing complete end-to-end solutions for all logistics needs

right from delivery to packaging, sorting, storage, clearance and

payments (COD) as well. The express industry provides an integrated

multimodal approach to the delivery of shipments. Shipments are moved

20%

through air and surface modes depending on the urgency of the delivery.

The average delivery time for a standard package under express logistics

is 24 to 72 hours. Moreover, the segment differentiates itself with

70% implementation of technology (IT) providing crucial real time information

of tracking and tracing. The clientele profile deploying express logistics

includes FMCG, retail, auto components, consumer durables, e-

B2B B2C C2C commerce, etc. These players remain sensitive on time-to-market thereby

Source: Ken research, ICICIdirect.com Research having higher propensity to pay. Consequently, per tonne realisations for

express services remain one of the highest in the industry.

Exhibit 27: Express remains premium category of logistics segment…

Multi-modal Road freight

Transit time Express cost

Route (Rail + Road) cost (|) per

Sr. no (hours) (|) per tonne

freight cost tonne

From To Rail + Road Road (|) per tonne

1 Delhi Chennai 144 94 4136 9053

2 Delhi Hyderabad 120 79 3531 6472 |12000 to

3 Delhi Banglore 144 91 4197 7922 |25000 across

4 Delhi Kolkata 120 84 3344 3560 India

5 Delhi Guwahati 360 121 4110 5310

Source: Company, ICICIdirect.com Research

We believe that a revival in the economy coupled with a shift from

unorganised to organised would lead industries catered to by express

players (organised retail, e-commerce, consumer durables, electronic

products and healthcare) to witness higher than average growth. Given

the benefits of reduced delivery time, growing preference for just-in-time

approach (reducing inventory costs), minimisation of loss of sale

opportunities and rising end-consumer demand for quality logistics

services, express delivery services are increasingly becoming the

preferred mode of logistics for a large number of users.

Exhibit 28: Key drivers of express industry…

E-commerce trade Enables faster collection

catching up in tier-2 for traders offering cash

cities on delivery

Moving goods Designed to suit high

faster in time volume and high value

bound manner customer

Source: Company, ICICIdirect.com Research

ICICI Securities Ltd | Retail Equity Research Page 11

TCIEL –Preferred partner across varied industries…

TCIEL recorded a sales CAGR of ~9% in FY15-17 led by higher client

addition in lifestyle (garment & textile) segment, which grew at 19% CAGR

(favourable base) in FY12-17. The segment now contributes 7% of overall

revenues compared to 5.5% in FY15. However, on a higher base,

pharmaceutical grew at 14% CAGR to | 100.7 crore (13.3% of overall

revenues). Robust growth in the pharmaceutical segment was on the back

of a dedicated team set-up targeting newer clients and value added

services. Over FY15-17, TCIEL has weeded out its clientele in auto

components and others, which had delayed payments following which

growth remained sluggish at 3% CAGR in FY15-17.

Exhibit 29: Sector-wise break-up of TCIEL… Exhibit 30: Business with decent visibility…

Garments and

Textiles , 7%

Energy and Repeat, 25%

Power , 9%

SME's, 45%

Engineering and Contractual, Business

Tele- 60%

Communication,

associates,

11% 15%

Motor vehicle

Pharmaceutical, parts, 14%

13%

Source: Company, ICICIdirect.com Research Source: Company, ICICIdirect.com Research

Approximately 60% of the business is contractual process adopted by

large corporate clients. Apart from cost effectiveness as a parameter, the

key trait for securing a contract remains historical experience and long

term relationships. The business remains sticky as contracts are for a

minimum period of a year, which undergoes tendering each year. In

addition to the new contracts, the renewal/repeat contracts contribute 22-

25% of overall revenues. The remaining (15-20%) is contributed by

business associates (small vehicle owners).

Exhibit 31: Client base of well-renowned corporate players…

Source: Company, ICICIdirect.com Research

ICICI Securities Ltd | Retail Equity Research Page 12

E-commerce - low on management’s pecking order now...

TCIEL provides B2C services to prominent e-commerce companies. In

addition to the execution of B2C deliveries, the company also offered

value added services like cash on delivery (CoD), reverse logistics,

Sunday and holiday deliveries, etc. Key services include bulk movement

(vendor to warehouse, inter-warehouse), warehouse to customer with

cash collection, etc. With the surge in e-tailing in FY11-16, revenues from

the division grew phenomenally by nearly six-fold growth to | 37.8 crore

(5% of overall topline) in FY17. Following this, TCIEL earlier expected this

division to be the future growth engine. However on the lower base the

company expects the division to grow at 40-50% CAGR and estimates it

will contribute <10% of the company’s FY20 topline.

Exhibit 32: E-commerce revenues to remain <10% of overall revenues…

140.0 12%

<10%

120.0 10%

100.0

8%

80.0

| crore

5% 6%

60.0

3% 4%

40.0

20.0 1% 2%

5.6 19.9 37.8 118.4

0.0 0%

FY13 FY16 FY17 FY 20E

E-commerce revenue

Source: Company, ICICIdirect.com Research

The growth attracted many new players that were further supported by

funding from capitalists. In addition to the new player, captive units of e-

tail players like Delhivery (Flipkart), Vulcan Express (Snapdeal), Amazon

Transportation Services (ATS), etc. The B2C delivery space got crowded.

This had a direct impact on pricing resulting in rapid growth at the cost of

margins. The easiest to start routes were initially filled. However, pan-

India players like TCIEL continued their strategic presence across all e-

tailing logistics partners.

Exhibit 33: PE funding ushering competitive intensity in e-commerce logistics…

600

500

400

$ mn

300

200

100

425 81 207 132 436 501

0

2012 2013 2014 2015 2016 2017

PE investments - Transport & Logistics sector

Source: Grant Thornton , ICICIdirect.com Research

ICICI Securities Ltd | Retail Equity Research Page 13

Route optimisation – Sorting centres located strategically…

Exhibit 34: Technical assistance to improve efficiency Express logistics is unique in nature as it differentiates itself from the

traditional transportation business by aiming at movement of time

sensitive cargo while at the same time charging a premium for the same.

Routing network of a hub & spoke model remains the backbone of the

express business that has been developed, tried and tested over several

years. The strong network would enable prompt movement of cargo

driving efficiencies generating higher yield per route.

Exhibit 35: Pan-India presence to keep up competitive positioning…

Source: Company, ICICIdirect.com Research

Source: Company, ICICIdirect.com Research

Over the past two decades, TCIEL has designed one of the largest pan-

India networks of 28 sorting centres and 550 branches. Through a flotilla

of 4000 containerised trucks, TCIEL offers time-definite solutions to 670

out of 675 districts (40000 locations) in India. The company manages 400

express routes and 2500 feeder routes serving close to 3500 pin codes.

TCIEL also leverages information technology (IT) infrastructure to derive

higher efficiencies by adopting technological undertakings like CCTV

surveillance, Central Control Monitoring, GPS enabled vehicles and

enterprise resource planning (ERP) linked branches.

ICICI Securities Ltd | Retail Equity Research Page 14

Fleet management remains core to business model...

Exhibit 36: Expanding its reach…

700 645 660 TCIEL operates a unique asset light business model where majority of the

610

600 550 investments are channelised in expanding its handling capacity (72% of

500

500 the gross block in land & buildings). For trucking, TCIEL refrains from truck

400

ownership by entering into near to long term contracts with truck owners

thereby booking a dedicated space. Approximately 95% of the fleet is

300

managed through vendors while the remaining 5% is hired on a spot

200

basis. The long haul with 1700 trucks remains the backbone of managing

100

the scheduled running plying between sorting centres. These are

0

2012 2013 2014 2015 2016 contractual agreements mostly renewed at the end of every year. As

No of District served these trucks cover majority of the distance, the same are paid on distance

Source: Company, ICICIdirect.com Research covered (per km basis). The remaining 2300 vehicles are parcel gushers,

which connect the initial customer to the sorting centre and/or to the end

customer. Two decades of experience and a widespread network enable

TCIEL to fulfil 20% of volumes directly without shifting them to branches.

Exhibit 37: Fleet utilisation core to business strategy…

Source: Company, ICICIdirect.com Research

Core to TCIEL’s fleet management is a quick payment schedule. The

company maintains a slated payment system with vendors/truck owners

provided payments on fixed dates i.e. third, 13th and 23rd of every month.

The strategy reflects in payable days that are lowest in the industry.

Exhibit 38: TCIEL remains best in industry to collaborate with…

50

45

45 41 41

40 38 37

35 35

35 30

Payable days

30 25

25 20

19 18

20

14 14

15 11 12 13 13 11

10

10

5

0

FY13 FY14 FY15 FY16 FY17

TCIEL Gati-KWE Bluedart Mahindra Logistics

Source: Company, ICICIdirect.com Research

ICICI Securities Ltd | Retail Equity Research Page 15

Financials

Revenues likely to grow at 17% CAGR in FY17-20E

The scheduled investments are expected to result in a 12.3% CAGR

increase in handling capacity to 1 million tonnes compared to the current

765000 tonnes. However, with incremental capacity, we believe utilisation

levels will moderate in a range of 82-83% in initial years (FY18, FY19).

Post stabilisation, we believe TCIEL will reclaim its 85% capacity

utilisation levels. Subsequently, volumes are expected to grow at a CAGR

of 12% to 920920 tonnes. A faster turnaround time coupled with

improved efficiencies would lead to improved realisation for the

company. We expect realisations to grow at 4% CAGR in FY17-20E.

Exhibit 39: Higher capacity maintaining existing utilisation levels… Exhibit 40: Volumes/value on uptrend…

Capacity and utilisation levels Volume/Value mix

1200000 86% 1000000 13500

1000000 85% 85% 85% 12920 13000

800000

800000 84% 84% Utilisation % 12500

| per tonne

600000 12304

in tonnes

in tonnes

600000 83% 11946 12000

400000 11598

400000 82% 82% 11500

1083435

650000

721118

920920

827351

879412

984941

764706

200000 81% 200000 11000

0 80% 0 10500

FY 17 FY 18E FY 19E FY 20E FY 17 FY 18E FY 19E FY 20E

Source: Company, ICICIdirect.com Research Source: Company, ICICIdirect.com Research

SMEs are expected to continue their major contribution in overall

earnings with a contribution of ~43% of FY20 overall revenues. However,

rising consumption across tier-III, tier-IV cities and TCIEL’s focus on

increasing its pan-India reach are expected to result in faster growth

(~20% CAGR) for auto and garments & textiles segments. In categories

per se, TCIEL would continue to maintain its higher contribution (>90%)

from the B2B segment, consciously maintaining its profitable earnings

(<10%) in the highly competitive e-commerce (B2C) segment.

Consequent revenue growth for TCIEL is expected at 16% CAGR (12%

volume, 4% pricing) in FY17- 20E. We expect TCIEL to report net sales of

| 1184 crore in FY20E vs. | 755 crore in FY17.

Exhibit 41: Consolidated revenues to grow at CAGR of 16% over FY17-20E…

Revenue growth

1400 20.0

18.2

1200 16.9

15.0

1000 13.9 13.5

Growth rates (%)

800

| crore

10.0

600

400

5.0

200

755 857 1013 1184

0 0.0

FY 17 FY 18E FY 19E FY 20E

Source: Company, ICICIdirect.com Research

ICICI Securities Ltd | Retail Equity Research Page 16

EBITDA to outperform sales growth with 27% CAGR in FY17-20E

A shortening of the distribution chain coupled with adoption of MSP

pricing strategy makes a strong case for margin expansion. As TCIEL

operates on a contractual trucking agreement, an increase in diesel prices

would have a lower impact on the company’s profitability. Apart from a

delay in revision of freight rates, the entire price fluctuation is a pass-

through. However, TCIEL having bargaining power benefits from higher

volatility as the benefits of price hikes from customer are not completely

passed on to truck suppliers. Apart from operational benefits from

implementation of GST, TCIEL remains committed to focusing only on

profitable growth thereby limiting its investments on e-commerce related

transportation business, which is marred with high competition and

predatory pricing. For its e-commerce division, TCIEL intends to seek

business opportunities only in those geographic areas/routes, which can

command 15-18% threshold EBITDA margins. In addition to the same,

focus on owned sorting centres would result in a decline in rental

expenses from current 2.7% of the topline to 2% of the overall topline.

Exhibit 42: Decline in operational expenses to remain margin accretive…

0.7 0.3

1.4

0.6 MSP led and

Ownership others

Automation model

% of sales

Operating benefits

efficiencies 12

9

FY17 Freight Faster Handling Rent expenses Other initiatives FY20E

expenses

Source: Company, ICICIdirect.com Research

Given its focus on profitability, we expect operational levers to turn in

favour of margin expansion of 300 bps in FY17-20E to 12% by FY20E.

Impressive revenue growth coupled with margin expansion would result

in buoyant EBITDA growth at 27% CAGR in FY17-20E to | 140 crore in

FY20.

Exhibit 43: EBITDA margins expected to improve 300 bps over FY17-20E

160.0 EBITDA and EBITDA margins 14.0

140.0 12.0

11.8

120.0 11.0

9.7 10.0

100.0 9.0

8.0

| crore

80.0

%

6.0

60.0

4.0

40.0

20.0 2.0

67.6 83.3 112.0 139.8

0.0 0.0

FY17 FY18E FY19E FY20E

Source: Company, ICICIdirect.com Research

ICICI Securities Ltd | Retail Equity Research Page 17

PAT growth driven by better operating performance

PAT for FY18 would remain impervious to lower taxation (25% of PBT)

due to a reduction in the basic income tax (25%) announced in the FY17-

18 budget for small companies with an annual turnover of up to | 50

crore. TCIEL being an independent entity reported FY16 earnings of |

25416 and loss of | 140877. As the company would fall in the full basic

corporate tax bracket (30%) from FY19 onwards coupled with higher

depreciation due to capex and minimal interest cost, this would lead PAT

to grow in tandem with EBITDA. Consequent PAT growth is expected at

27% CAGR in FY17-20E to | 83.6 crore in FY20 from | 40.7 crore in FY17.

Exhibit 44: PAT expected to nearly double in FY17-20E

90.0 PAT trend 8.0

80.0 7.1 7.0

6.6

70.0 6.2 6.0

60.0 5.4

5.0

50.0

| crore

4.0

%

40.0

3.0

30.0

20.0 2.0

10.0 1.0

40.7 53.5 66.8 83.6

0.0 0.0

FY 17 FY 18E FY 19E FY 20E

Source: Company, ICICIdirect.com Research

Return ratios to remain one of the best in the industry…

The capital expenditure outlay of | 400 crore over five years is expected

to keep return ratios range-bound over our estimated period (FY18E-20E).

With incremental assets, the asset turnover is expected to moderate from

the current 4x to 3x by FY20E. The return on equity (RoE) and return on

capital employed (RoCE) in FY17-20E are expected to continue to remain

healthy above 25% and 35%, respectively. Albeit range bound, return

ratios are expected to remain one of the best in the industry (after

BlueDart). However, a rapid stabilisation of assets resulting in a steep

improvement in return ratios post completion of expansion would remain

an upside risk to our estimates.

Exhibit 45: Return ratios to remain rage bound…

30.0 29.6 38.0

28.4

36.9

28.0 36.7

27.0

36.0

26.0 25.5

34.9

%

35.1 34.0

24.0

22.0 32.0

FY 17 FY 18E FY 19E FY 20E

RoE RoCE

Source: Company, ICICIdirect.com Research

ICICI Securities Ltd | Retail Equity Research Page 18

Healthy CFO to internally fund capex requirements…

Given the historical investments, capital expenditure over our estimated

period (FY18-20E) would continue to be in the range of | 40 to | 55 crore.

Majority of the capex would entail fixed assets (including land and

building) and modernisation of sorting centres. TCIEL while focusing on

receivables improved its debtor days from 59 days in FY16 to 55 days in

FY17. Moreover, leveraging its goodwill in the market, it has extended its

payable period from 12 days in FY16 to 19 days in FY17. The resultant

working capital cycle improved by eight days from 45 days in FY16 to 37

days in FY17. Ideal working capital management coupled with improved

fundamentals would result in higher cash flow from operations (CFO). We

expect CFO to remain in the range of | 50-70 crore with which the capex

would be internally funded.

Exhibit 46: Capex to be funded internally…

80.0

70.9

70.0

59.9

60.0 55.7

50.0 49.5

50.0 46.8

41.1

35.8

| crore

40.0

30.0

20.0 13.2

9.9 8.1

10.0 3.1

0.0

FY 17 FY 18E FY 19E FY 20E

CFO Capex FCFF

Source: Company, ICICIdirect.com Research

Debt averse; higher profitability to result in steady decline in debt/equity

Amid a steady improvement in profitability coupled with internal funding

of capex, we expect no meaningful change in absolute debt levels in

FY18E-20E. Given the debt averse nature of the management, we expect

net debt to remain at current levels of | 40 crore by FY20E, quoting a

healthy financial leverage of 0.1x.

Exhibit 47: Debt to equity to remain below 0.3x…

50.0 0.30

40.0 0.23

0.20 0.20

30.0 0.17

| crore

(x)

20.0 0.11

0.10

10.0

31.6 46.9 46.9 39.4

0.0 0.00

FY 17 FY 18E FY 19E FY 20E

Debt Debt/Equity

Source: Company, ICICIdirect.com Research

ICICI Securities Ltd | Retail Equity Research Page 19

Risk & Concerns

Risks to capacity utilisation assumptions…

TCIEL currently operates at an average utilisation level of 85%. Utilisation

levels in H1 are usually low at 82%. However, H2 remains strong with

utilisation scaling up to 88%. The current capacity of 765000 tonnes is

expected to reach 1 million tonnes by FY20E. Moreover, these capacities

are static (company owned) for which due to fixed overheads (OHs)

utilisation remains crucial. Under-utilisation would be a double whammy

for our estimates as a decline in topline would be accompanied by margin

compression resulting in a steeper decline in our profitability and EPS

estimated, adversely impacting our target price.

Exhibit 48: Sensitivity of EPS estimates to utilisation…

Change in Utilisation levels

EPS 75% 80% 85% 90% 95%

sensitvity FY19E 13.1 15.5 17.9 20.3 22.7

FY20E 16.3 19.1 21.9 24.6 27.4

Source: ICICIdirect.com Research

Weakening of competitive positioning…

Delhivery, Ecom Express and Rivigo received the maximum funding for

FY17 in the logistics PE space. The funding spree of Rivigo backed by

marquee investors like Warburg Pincus and SAIF Partners has made the

company the fastest start-up to achieve Unicorn status (startup company

valued at over $1 billion). Following the success story, the logistics sector

which was plagued by poor manpower skills, inefficient fleet utilisation

and fragmented infrastructure remains an opportunity for a startup. Age-

old traditions and business methodology are replaced by new age

technologies to achieve global standards. The start-ups are addressing

challenges across logistics segments like cold chain, warehousing,

trucking, 3PL, etc. Some key competitors in start-ups are as follows:

Exhibit 49: Startup watchlist…

Name of the Start-up Services Approximate Funding in CY17 (|

crore)

eKart Captive arm of Flipkart 2600

Rivigo Trucking & 3PL services 600

Blackbuck Fleet aggregator 600

Delhivery B2C e-commerce services 600

Xpressbees B2C e-commerce services 600

Amazon Transporation Services B2C services 337

LEAP India Pallet and container rental 88

4tigo Freight & trucking solution 78

Elasticrun B2C fleet solutions 46

Source: ICICIdirect.com Research

With the sector flush with funds, capex plans of these players would be

phenomenally higher (2-3x higher) than the capex planned by TCIEL. The

direct impact would result in overcapacity leading to subdued realisation.

ICICI Securities Ltd | Retail Equity Research Page 20

Valuations

Preeminent business model to command expensive multiples…

The wide variety of services provided by express players makes it difficult

for a single entity to manage. Following this, players like Gati KWE,

BlueDart and TCI Express have focused on client management, line haul

circuit, value added services and technology. Alternately, these players

have leveraged their goodwill in the market thereby collaborating with a

number of regional players outsourcing majority of its non-core activities

like trucking, last mile delivery. The strategy has given these players

enhanced coverage while at the same time keeping their balance sheet

light. Moreover, higher EBITDA is the consequence of higher realisations

on the back of speed and accuracy. The dual benefit positions the express

business in the top quadrant of our logistics business model matrix,

which represents high growth and high RoCE.

Exhibit 50: Express remains in top quadrant of growth/RoCE matrix…

40.0

High

35.0 Express industry

30.0 Freight Contract Logistics

forwarding/NVOCC

25.0

Container logistics

RoCE

20.0

15.0

10.0 Cold Chain

Road transport

Low

5.0

0.0

0.0Low 2.0 4.0 6.0 8.0 Growth

Revenue 10.0(FY12-17

12.0

CAGR) 14.0 16.0 18.0 High

20.0

Source: FSC DRHP, ICICIdirect.com Research, *Size of bubble represents industry size

At the current market price of | 550, TCIEL is trading at 15x on EV/EBITDA

and 25x FY20E EPS. Near-term financials, in our view, do not entirely

capture the high revenue growth opportunity and huge potential for

improvement in TCIEL’s profitability metrics. Considering the structural

changes, strong competitive positioning, focused growth approach and

future growth prospects, we believe TCIEL is the next best after BlueDart.

We ascribe 30x on FY20 EPS of | 22 (implied EV/EBITDA at 18x) and

arrive at a target price | 660 with a BUY recommendation.

Exhibit 51: Valuation compared to peers

Figures (| crore) FY17 P/E

Company Price Sales EBIDTA OPM PAT PAT % FY18E FY19E FY20E

TCI Express 540 755.2 67.6 9.0 40.7 5.4 38.7 31.0 24.7

Bluedart 4,700 2,689.5 341.7 12.7 137.0 5.1 75.9 62.9 50.0

VRL Logistics 435 1,803.1 218.2 12.1 70.5 3.9 34.0 25.9 20.6

Gati 135 1,691.0 111.8 6.6 29.5 1.7 24.9 30.0 26.0

Average P/E 43.4 37.4 30.3

Valuation metrics

Target P/E multiple 30

2020E PAT 83.6

2020E Market Cap. 2,526.0

No. of shares (crs) 3.8

Target Price (|) 660

CMP (|) 540

Upside/(Downside) % 22

Source: ICICIdirect.com Research

ICICI Securities Ltd | Retail Equity Research Page 21

Appendix

Sector Snapshot

Exhibit 52: Freight transport modal contribution Exhibit 53: Modal share – Tonnes carried

Indian Logistics industry

25000 100

20 15 21

10% CAGR 20000 26

20000 80

15230

15000 60

| billion

12% CAGR

9100 85

10000 40 80 79

74

5170

5000 20

0 0

FY12 FY17P FY22E FY25E Transportation Warehousing Others Overall

Market Size

Unorganised Organised

Source: ICICIdirect.com, Research Source: ICICIdirect.com, Research

Exhibit 54: Freight dynamics across modes… Exhibit 55: Service contribution around logistics

8% 1%

8%

6%

31%

24%

62%

60%

Road Rail Water Air Transportation Warehousing Freight Forwarding Value Added Services

Source: ICICIdirect.com, Research Source: ICICIdirect.com, Research

Exhibit 56: Average profitability across services… Exhibit 57: Express industry bifurcation…

45

35-45 EBITDA margins (%) 14000 12675

40 35-40

35 12000 10834 11211

30 9260 9582

10000

25 20-22 7830 8190

15-25 7050

20

8000

| crore

13-16

15 10-13 6000

8-13

10

3-5 2-4 4000

5

0 2000

CFS Cold Chain & warehousing Container Rail

0

Shipping Trucking (LTL) Supply Chain

2014 2015 2016 2017

Express Distribution Freight Forwarding Trucking (FTL)

Organised Unorganised

Source: ICICIdirect.com, Research Source: ICICIdirect.com, Research

ICICI Securities Ltd | Retail Equity Research Page 22

Each manufacturing company is estimated to spend ~5-10% of sales on

transportation, inventory handling and warehousing, raw material

procuring, order processing, etc.

Exhibit 58: Sector-wise savings in logistics costs on GST implementation…

e

Sector FMCG Consumer durables Pharma Automobiles (MHCV's)

Parameters as a percentage of sales:

Current logistics costs 8-9% 7-8% 5.5-6.5% 5-6%

Direct logistics cost reduction post GST 0.8-1.2% 1.5-1.9% 0.5-0.9% 0.1-0.5%

Additional savings in logistics costs with checkpost dismantling 0.6-0.7% 0.5-0.6% 0.4-0.6% 0.5-0.7%

Total potential savings in logistics costs 1.4-1.8% 2.1-2.5% 1.0-1.4% 0.7-1.1%

Assessment of typical logistics parameters:

Typical no. of warehouses for leading companies* 50 to 60 25 to 30 25 to 35 20 to 25

No of warehouses post likely consolidation 35 to 45 10 to 12 17 to 27 15 to 20

Source: Crisil, Company, ICICIdirect.com Research

The fragmentation of the industry is around road transportation, which is

the largest mode of transport. The shift from pure play warehousing and

transportation to outsourced logistics will result in differentiated business

models in the last-mile reach of various available players. The traditional

version included logistics operations handled by manufacturers thereby

deviating from their core business. However, with changing demand and

needs of the new business, the new logistics model has evolved. New

transportation businesses like project logistics, outsourced warehousing,

3-PL and 4-PL, cold chain have started to derive higher value. As the

logistics service provider (LSP) moves up the pyramid as illustrated

below, they will derive higher value. Across each segment, from 1-PL to

4PL, the degree of specialisation and administration would intensify.

Exhibit 59: Logistics start-up watchlist…

Source: Industry, ICICIdirect.com Research

Any combination within the pyramid is possible. Some of the e-

commerce companies have their own captive units while also undertaking

contracts with other players where they do not have a reach. The

combinations could go up to 7PL (4PL + 3PL). The top of the pyramid

represents an asset light, planning oriented strategy.

ICICI Securities Ltd | Retail Equity Research Page 23

Exhibit 60: TCIEL product offerings…

Source: Company, ICICIdirect.com Research

ICICI Securities Ltd | Retail Equity Research Page 24

Logistics Peer Comparison…

Exhibit 61: Logistics peer valuations…

Mkt Cap Sales PAT RoCE RoE P/E

Company

(INR cr) FY 15 FY 16 FY 17 FY 15 FY 16 FY 17 FY 15 FY 16 FY 17 FY 15 FY 16 FY 17 FY 18E FY 19E FY 20E

Coverage Companies

TCI Express Ltd 2098.2 658.6 663.2 755.2 26.5 28.5 40.7 41.9 34.6 35.1 24.4 23.9 28.8 39.4 31.5 25.2

Blue Dart Express Ltd 11142.6 2272.2 2562.9 2689.5 127.2 196.8 139.8 23.9 34.7 32.2 42.5 51.5 32.6 75.9 62.9 50.0

Gati Ltd 1507.6 1648.1 1667.0 1691.0 41.4 36.8 29.5 11.2 11.4 9.5 6.3 6.6 5.2 24.9 30.0 26.0

Transport Corp of India Ltd 2138.4 1550.5 1734.8 1954.9 50.5 44.6 65.8 15.6 9.2 10.7 12.8 7.8 10.2 25.5 25.5 25.5

Gujarat Pipavav Port Ltd 7254.0 867.0 660.0 683.1 389.2 227.5 282.2 21.7 13.0 14.0 20.9 9.2 11.5 28.0 24.7 20.2

Container Corp Of India Ltd 36267.6 5573.7 6278.2 5971.1 1,047.6 966.8 852.7 12.0 11.7 9.8 13.7 11.2 9.4 36.9 28.4 22.9

Median 18.6 12.4 12.4 17.3 10.2 10.8 32.5 29.2 25.3

Average 21.0 19.1 18.6 20.1 18.4 16.3 38.4 33.8 28.3

VRL Logistics Ltd 3626.5 1706.4 1803.1 1803.1 102.3 70.5 102.1 23.2 19.9 16.9 27.5 23.5 13.4 32.2 25.0 18.9

Mahindra Logistics 3495.6 2063.9 2666.6 2666.6 36.5 45.6 77.6 20.6 13.0 16.9 20.2 12.9 14.0 41.3 31.1 24.2

Navkar Corp Ltd 3033.0 347.3 370.9 370.9 95.1 85.6 112.7 9.9 8.3 6.7 11.6 9.2 6.2 25.9 17.9 16.4

Allcargo Logistics Ltd 4956.9 5640.5 5583.4 5583.4 239.9 231.8 248.0 23.3 22.2 19.9 13.0 13.2 13.1 17.7 15.1 13.9

Future Supply Chain 2735.8 408.0 519.9 561.2 24.6 29.4 45.8 16.4 15.0 15.1 11.3 11.9 15.6 56.8 NA NA

Gateway Distriparks Ltd 2571.4 387.9 393.4 393.4 123.2 74.4 90.2 17.9 18.5 25.7 21.3 12.7 7.3 26.1 20.4 15.7

Adani Ports 90759.5 7108.7 8439.4 8439.4 2,897.2 3,911.5 3,691.3 17.6 20.7 23.1 23.7 24.0 25.5 24.7 21.4 18.5

Median 17.9 18.5 16.9 20.2 12.9 13.4 26.1 20.9 17.5

Average 18.4 16.8 17.8 18.4 15.3 13.6 32.1 21.8 17.9

Mkt Cap Sales PAT RoCE RoE P/E

Global Players

(USD bn) CY14 CY15 CY16 CY14 CY15 CY16 CY14 CY15 CY16 CY14 CY15 CY16 CY17E CY18E CY19E

United Parcel Service Inc 114.7 3553.8 3744.2 4092.1 185.0 310.8 230.5 14.5 24.3 17.6 70.4 210.1 238.7 22.1 18.5 17.0

FedEx Corp 73.5 2794.5 2927.9 3324.1 128.6 64.8 120.1 9.2 4.9 7.6 12.8 6.9 12.6 23.0 20.3 16.4

Deutsche Post AG 50.3 4589.4 4218.0 4263.7 167.8 109.7 196.2 33.7 25.4 38.6 21.6 15.1 23.9 26.1 18.5 15.9

Union Pacific Corp 111.2 1464.0 1399.4 1339.8 316.1 306.1 284.4 12.2 10.7 9.3 24.4 22.8 20.8 23.3 17.7 16.0

Kansas City Southern 11.4 157.3 155.2 156.8 30.7 31.0 32.1 8.2 7.5 7.1 14.1 12.6 12.0 28.7 22.8 20.6

CSX Corp 51.4 772.9 757.6 743.7 117.6 126.2 115.2 8.0 7.7 6.6 17.8 17.3 14.7 27.6 23.8 21.3

Norfolk Southern Corp 43.3 709.4 674.3 664.3 122.1 99.8 112.1 8.4 6.6 6.9 16.8 12.6 13.5 34.1 25.8 22.6

Old Dominion Freight Line Inc 12.2 170.1 190.7 201.0 16.3 19.5 19.9 15.4 15.4 13.4 19.6 19.2 16.7 27.1 21.5 19.0

Median 10.7 9.2 8.5 18.7 16.2 15.7 26.6 20.9 18.0

Average 13.7 12.8 13.4 24.7 39.6 44.1 26.5 21.1 18.6

Source: Company, ICICIdirect.com Research

ICICI Securities Ltd | Retail Equity Research Page 25

Financial Summary (Consolidated)

Exhibit 62: Profit & Loss

(Year-end March) FY 17 FY 18E FY 19E FY 20E

Net Revenue 755.2 857.1 1,012.9 1,183.8

Growth (%) 13.9 13.5 18.2 16.9

Operating expenses 576.3 654.0 769.8 899.7

Employee Cost 58.8 63.3 69.7 76.6

Repairs & Maintainence 4.1 4.3 5.1 6.8

Adminst & other Exp 48.4 52.2 56.4 60.9

EBITDA 67.6 83.3 112.0 139.8

Growth (%) 23.9 23.1 34.5 24.9

Depreciation 4.3 5.4 6.9 9.2

EBIT 63.3 77.9 105.1 130.7

Interest 1.9 2.6 2.3 2.0

Other Income - - - -

PBT 61.4 75.3 102.7 128.7

Growth (%) 41.2 22.5 36.4 25.3

Tax 20.7 21.8 36.0 45.0

Reported PAT 40.7 53.5 66.8 83.6

Exceptional Items - - - -

Adjusted PAT 40.7 53.5 66.8 83.6

Growth (%) 43.1 31.2 24.9 25.3

EPS 10.6 14.0 17.4 21.9

Source: Company, ICICIdirect.com Research

Exhibit 63: Balance Sheet

(Year-end March) FY 17 FY 18E FY 19E FY 20E

Source of Funds

Equity Capital 7.7 7.7 7.7 7.7

Reserves & Surplus 152.4 193.8 260.6 344.2

Shareholder's Fund 160.1 201.4 268.2 351.9

Secured Loan 0.5 0.5 0.5 0.5

Unsecured Loan 31.1 46.4 46.4 38.9

Total Loan Funds 31.6 46.9 46.9 39.4

Deferred Tax Liability - - - -

Minority Interest 2.9 3.0 3.1 3.1

Source of Funds 194.7 251.3 318.2 394.4

Application of Funds

Gross Block 114.7 151.9 195.5 238.9

Less: Acc. Depreciation 18.0 23.4 30.3 39.4

Net Block 96.8 128.6 165.2 199.4

Capital WIP 7.9 11.8 17.7 30.0

Total Fixed Assets 104.6 140.3 182.9 229.4

Intangibles 1.6 1.6 2.4 2.4

Investments - - - -

Debtors 114.9 122.1 141.5 162.2

Cash 9.5 15.8 23.1 28.9

Loan & Advance, Other CA 22.4 28.0 30.8 35.4

Total Current assets 146.8 165.9 195.5 226.5

Creditors 37.8 34.0 38.0 37.0

Other Current Liabilities 8.8 10.1 11.7 13.4

Provisions 11.8 12.4 13.0 13.6

Total CL and Provisions 58.4 56.6 62.6 64.0

Net Working Capital 88.4 109.4 132.8 162.5

Miscellaneous expense - - - -

Application of Funds 194.7 251.3 318.2 394.4

Source: Company, ICICIdirect.com Research

ICICI Securities Ltd | Retail Equity Research Page 26

Exhibit 64: Cash Flow

(Year-end March) FY 17 FY 18E FY 19E FY 20E

Profit after Tax 40.7 53.5 66.8 83.6

Less: Dividend Paid (1.9) (2.6) (2.3) (2.0)

Add: Depreciation 4.3 5.4 6.9 9.2

Add: Others - - - -

Cash Profit 46.9 61.4 76.0 94.8

Increase/(Decrease) in CL 25.6 (1.8) 6.1 1.4

(Increase)/Decrease in CA (22.5) (12.8) (22.2) (25.3)

CF from Operating Activities 50.0 46.8 59.9 70.9

(Add) / Dec in Fixed Assets (38.2) (41.1) (49.5) (55.7)

Goodwill 0.5 - (0.8) -

(Inc)/Dec in Investments - - - -

CF from Investing Activities (37.7) (41.1) (50.3) (55.7)

Inc/(Dec) in Loan Funds (9.2) 15.3 - (7.5)

Inc/(Dec) in Sh. Cap. & Res. (3.6) (12.1) - -

Others (1.3) (2.4) (2.2) (1.8)

CF from financing activities (14.1) 0.7 (2.2) (9.3)

Change in cash Eq. (1.9) 6.4 7.4 5.9

Op. Cash and cash Eq. 11.4 9.5 15.8 23.1

Cl. Cash and cash Eq. 9.5 15.9 23.2 29.0

Source: Company, ICICIdirect.com Research

Exhibit 65: Ratios

(Year-end March) FY 17 FY 18E FY 19E FY 20E

Per share data (|)

Book Value 41.8 52.6 70.1 91.9

EPS* 10.6 14.0 17.4 21.9

Cash EPS 11.8 15.4 19.2 24.2

DPS 0.8 0.8 0.8 0.8

Profitability & Operating Ratios

EBITDA Margin (%) 9.0 9.7 11.1 11.8

PAT Margin (%) 5.4 6.2 6.6 7.1

Fixed Asset Turnover (x) 3.9 3.5 3.2 3.0

Debtor (Days) 53.2 52.0 51.0 50.0

Current Liabilities (Days) 19.3 19.0 18.0 15.0

Return Ratios (%)

RoE* 28.8 29.6 28.4 27.0

RoCE 35.1 34.9 36.9 36.7

RoIC 21.3 21.5 21.2 21.4

Valuation Ratios (x)

PE 50.8 38.7 31.0 24.7

Price to Book Value 12.9 10.3 7.7 5.9

EV/EBITDA 30.9 25.2 18.7 14.9

EV/Sales 2.8 2.4 2.1 1.8

Leverage & Solvency Ratios

Debt to equity (x) 0.2 0.2 0.2 0.1

Interest Coverage (x) 33.9 30.2 44.8 66.4

Debt to EBITDA (x) 0.5 0.6 0.4 0.3

Current Ratio 2.4 2.7 2.8 3.1

Quick ratio 2.4 2.7 2.8 3.1

Source: Company, ICICIdirect.com Research

ICICI Securities Ltd | Retail Equity Research Page 27

RATING RATIONALE

ICICIdirect.com endeavours to provide objective opinions and recommendations. ICICIdirect.com assigns

ratings to its stocks according to their notional target price vs. current market price and then categorises

them as Strong Buy, Buy, Hold and Sell. The performance horizon is two years unless specified and the

notional target price is defined as the analysts' valuation for a stock.

Strong Buy: >15%/20% for large caps/midcaps, respectively, with high conviction;

Buy: >10%/15% for large caps/midcaps, respectively;

Hold: Up to +/-10%;

Sell: -10% or more;

Pankaj Pandey Head – Research pankaj.pandey@icicisecurities.com

ICICIdirect.com Research Desk,

ICICI Securities Limited,

1st Floor, Akruti Trade Centre,

Road No. 7, MIDC,

Andheri (East)

Mumbai – 400 093

research@icicidirect.com

ICICI Securities Ltd | Retail Equity Research Page 28

ANALYST CERTIFICATION

We /I, Bharat Chhoda, MBA and Ankit Panchmatia, MBA Research Analysts, authors and the names subscribed to this report, hereby certify that all of the views expressed in this research report accurately

reflect our views about the subject issuer(s) or securities. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in this

report.

Terms & conditions and other disclosures:

ICICI Securities Limited (ICICI Securities) is a full-service, integrated investment banking and is, inter alia, engaged in the business of stock brokering and distribution of financial products. ICICI Securities

Limited is a Sebi registered Research Analyst with Sebi Registration Number – INH000000990. ICICI Securities is a wholly-owned subsidiary of ICICI Bank which is India’s largest private sector bank and has

its various subsidiaries engaged in businesses of housing finance, asset management, life insurance, general insurance, venture capital fund management, etc. (“associates”), the details in respect of which

are available on www.icicibank.com.

ICICI Securities is one of the leading merchant bankers/ underwriters of securities and participate in virtually all securities trading markets in India. We and our associates might have investment banking

and other business relationship with a significant percentage of companies covered by our Investment Research Department. ICICI Securities generally prohibits its analysts, persons reporting to analysts

and their relatives from maintaining a financial interest in the securities or derivatives of any companies that the analysts cover.

The information and opinions in this report have been prepared by ICICI Securities and are subject to change without any notice. The report and information contained herein is strictly confidential and

meant solely for the selected recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without

prior written consent of ICICI Securities. While we would endeavour to update the information herein on a reasonable basis, ICICI Securities is under no obligation to update or keep the information current.

Also, there may be regulatory, compliance or other reasons that may prevent ICICI Securities from doing so. Non-rated securities indicate that rating on a particular security has been suspended

temporarily and such suspension is in compliance with applicable regulations and/or ICICI Securities policies, in circumstances where ICICI Securities might be acting in an advisory capacity to this

company, or in certain other circumstances.

This report is based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made nor is its accuracy or completeness guaranteed. This

report and information herein is solely for informational purpose and shall not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial

instruments. Though disseminated to all the customers simultaneously, not all customers may receive this report at the same time. ICICI Securities will not treat recipients as customers by virtue of their

receiving this report. Nothing in this report constitutes investment, legal, accounting and tax advice or a representation that any investment or strategy is suitable or appropriate to your specific

circumstances. The securities discussed and opinions expressed in this report may not be suitable for all investors, who must make their own investment decisions, based on their own investment

objectives, financial positions and needs of specific recipient. This may not be taken in substitution for the exercise of independent judgment by any recipient. The recipient should independently evaluate

the investment risks. The value and return on investment may vary because of changes in interest rates, foreign exchange rates or any other reason. ICICI Securities accepts no liabilities whatsoever for any

loss or damage of any kind arising out of the use of this report. Past performance is not necessarily a guide to future performance. Investors are advised to see Risk Disclosure Document to understand the

risks associated before investing in the securities markets. Actual results may differ materially from those set forth in projections. Forward-looking statements are not predictions and may be subject to

change without notice.

ICICI Securities or its associates might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject company for any other assignment

in the past twelve months.

ICICI Securities or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report for services in

respect of managing or co-managing public offerings, corporate finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction.

ICICI Securities or its associates might have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the companies mentioned

in the report in the past twelve months.

ICICI Securities encourages independence in research report preparation and strives to minimize conflict in preparation of research report. ICICI Securities or its associates or its analysts did not receive any

compensation or other benefits from the companies mentioned in the report or third party in connection with preparation of the research report. Accordingly, neither ICICI Securities nor Research Analysts

and their relatives have any material conflict of interest at the time of publication of this report.

It is confirmed that Bharat Chhoda, MBA and Ankit Panchmatia, MBA Research Analysts of this report have not received any compensation from the companies mentioned in the report in the preceding

twelve months.

Compensation of our Research Analysts is not based on any specific merchant banking, investment banking or brokerage service transactions.

ICICI Securities or its subsidiaries collectively or Research Analysts or their relatives do not own 1% or more of the equity securities of the Company mentioned in the report as of the last day of the month

preceding the publication of the research report.

Since associates of ICICI Securities are engaged in various financial service businesses, they might have financial interests or beneficial ownership in various companies including the subject

company/companies mentioned in this report.

It is confirmed that Bharat Chhoda, MBA and Ankit Panchmatia, MBA Research Analysts do not serve as an officer, director or employee of the companies mentioned in the report.

ICICI Securities may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report.

Neither the Research Analysts nor ICICI Securities have been engaged in market making activity for the companies mentioned in the report.

We submit that no material disciplinary action has been taken on ICICI Securities by any Regulatory Authority impacting Equity Research Analysis activities.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution,

publication, availability or use would be contrary to law, regulation or which would subject ICICI Securities and affiliates to any registration or licensing requirement within such jurisdiction. The securities

described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession this document may come are required to inform themselves of and

to observe such restriction.

ICICI Securities Ltd | Retail Equity Research Page 29

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Isolation-Based Anomaly Detection: Data Mining I.2.6 (Artificial Intelligence) : LearningDokument44 SeitenIsolation-Based Anomaly Detection: Data Mining I.2.6 (Artificial Intelligence) : LearningkhprashNoch keine Bewertungen