Beruflich Dokumente

Kultur Dokumente

Corporate Fact Sheet 080828

Hochgeladen von

rameshmallem0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

9 Ansichten2 SeitenDCBL has a cement capacity of 9 MnTPA, at 100% PPC The Company is the third largest player in Southern region. 72 MW Thermal Power Plant in TN catering to captive consumption, surplus is sold to third parties. DCBL is headquartered in New Delhi with cement plants in South India and Integrated Sugar plants in the state of uttar Pradesh.

Originalbeschreibung:

Copyright

© Attribution Non-Commercial (BY-NC)

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenDCBL has a cement capacity of 9 MnTPA, at 100% PPC The Company is the third largest player in Southern region. 72 MW Thermal Power Plant in TN catering to captive consumption, surplus is sold to third parties. DCBL is headquartered in New Delhi with cement plants in South India and Integrated Sugar plants in the state of uttar Pradesh.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

9 Ansichten2 SeitenCorporate Fact Sheet 080828

Hochgeladen von

rameshmallemDCBL has a cement capacity of 9 MnTPA, at 100% PPC The Company is the third largest player in Southern region. 72 MW Thermal Power Plant in TN catering to captive consumption, surplus is sold to third parties. DCBL is headquartered in New Delhi with cement plants in South India and Integrated Sugar plants in the state of uttar Pradesh.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

For more information on the company, please visit our website

www.dalmiacement.com or call us on 011-23465204/201/200 or

write to us at investorquery@dalmiacement.com

BSE Code: 500097 NSE Code: DALMIACEM Business Highlights

Market Capitalization: Rs. 2,038 crore

(as of March 31, 2010) • With a Cement capacity of 9 MnTPA, at 100% PPC the

Company is the third largest player in Southern region.

Shares Outstanding: 8.09 crore • New cement plant of 2.5 MnT at Ariyalur, TN

Face Value per Equity Share: Rs. 2 commissioned in FY10.

• The Company has excellent limestone reserves.

9M’10 Gross Sales Rs. 1,771 crore • Low lead distance of 340 kms.

9M’10 EBITDA Rs. 413 crore • Also produces Special Cement catering to niche

9M’10 Earnings per Share Rs. 16.68 segment.

• 72 MW Thermal Power Plant in TN catering to captive

consumption, surplus is sold to third parties.

• The Company can crush upto 3 lacs metric tonnes of

cane per annum, across three plants in U.P.

• Capable of processing Raw Sugar.

• Combined Cogeneration power facility of 79 MW

across 3 sugar plants of which two third is exportable.

• PPA Regulations amended favorably for U.P. sugar

mills – Tariff rates have been raised by over 25%

• Facility for ethanol at Jawaharpur (U.P.) sugar plant,

with distillation capacity of 80 KLPD (kilo liters per

Company Profile day).

Founded in 1935 by Sh. Jaidayal Dalmia; the cement

division of the Company was established in 1939 and Key Financial Summary:

enjoys a heritage of 70 years. It diversified into sugar

segment in 1994, though it continues with its some 4 year

other businesses including refractory for cement (In Rs. Crore) FY05 FY06 FY07 FY08 FY09 CAGR

industry. DCBL is headquartered in New Delhi with Net Sales 450 570 986 1,481 1,753 40%

Total Income 464 585 1,007 1,508 1,779 40%

Cement plants in South India and Integrated Sugar

EBITDA Opr. 73 99 270 496 526 64%

plants in the state of Uttar Pradesh. Interest 23 23 54 113 143

PBDT 50 76 216 383 383 66%

While the Company continues to build on its identified Taxes 5 24 67 87 101

values and culture, its corporate social responsibility PAT 31 85 229 347 159 51%

initiatives focus on four core areas of basic education,

healthcare, livelihood and civic infrastructure Margins

improvement. EBITDA Margin (%) 16% 17% 27% 33% 30%

PAT Margin (%) 7% 13% 20% 21% 9%

Our footprint Sales Volume

('000T)

Cement 1,403 1,577 2,713 3,265 3,383 25%

Sugar 75 99 93 141 162 21%

Sugar – 3 Units, UP (In Rs. Crore) 31-Mar-08 31-Mar-09 31-Dec-09

Sugar (22,500 TCD)

Cogeneration (79 MW) Net Worth 1,147 1,268 1,403

Distillery (80 KLPD) Borrowed Funds 1,583 2,338 2,573

Deferred Tax 163 229 261

Gross Block* 2,384 3,316 3,539

Net Block* 1,826 2,667 2,795

Investments 431 447 471

Cement : 14 MnT

OCL # 5.3 MT, Orissa Cash & Cash Equivalents 270 275 479

Head Office Kadapa 2.5 MT, AP Other Net Current Assets 367 446 492

Plant Locations DPM 4.0 MT, TN *Includes CWIP

Ariyalur 2.5 MT, TN

# OCL is an associate Company

Investment Highlights Indian Cement Industry

• Group Restructuring: Demand for cement in India was strong with CAGR of

9.3% during the period FY05 to FY09. It is expected to

grow in double digits from here on, as is evident from FY10

over 10% growth.

Demand momentum is driven by:

• Rural/mass housing to benefit from rising

incomes: According to working group of XI Five Year

Plan, the housing shortage was estimated at 47.4mn in

2007 and is expected to be 74mn by 2012.

• Urban Real Estate recovery to boost cement

demand: Recovery in real estate is sector is likely to

sustain 10-12% growth over the long term

• Significant Thrust on Infrastructure creation:

Infrastructure spend to rise from 6% to 9% of GDP by

FY12 and to 10.25%of GDP by FY17

Shareholders of DCBL will receive additional shares

in DBEL in the ratio of 1:1, latter will be listed on stock

exchanges in next 6-8 months subject to regulatory

approvals.

• OCL investment provides regional

diversification: Enhanced stake of 45.4% in OCL, a

listed Co. with capacity of 5.3 MnT and presence in

eastern region which has been exhibiting demand

growth in high teens.

• Poised to outperform industry growth: DCBL

and OCL have outperformed industry growth by 1.5-

2x in the last 5 years in key markets of Southern and

Eastern India. The companies are likely to continue to

outperform on account of recently expanded

capacities.

Cement Capacity Pipeline

• Accelerating Growth Opening Estimated Additions Closing

Capacity FY10 FY10 FY11 FY12 FY 12

Net Sales (Rs. Cr)

(Mn T)

600

North 78 12 7 11 106

24%

500 33%

28% East 30 10 11 4 54

400 West 32 1 3 4 27

300 South 78 23 21 5 124

200

All India 218 46 42 24 330

100

DCBL estimates addition of 112 MnTPA in All India capacity

0

Q1 Q2 Q3

by FY-12.

FY07 FY08 FY09 FY10

YTD (Apr‐Dec) Net sales (Rs. Cr) Indian Sugar Industry

1,500 29 % 1,629

• India is the second largest producer but largest

19 % consumer of sugar in the world.

1,000

• At present more than 5 million hectare of land is

allocated for sugarcane cultivation with a productivity of

69 tones on each hectare.

500 • Indian sugar industry has moved from surplus inventory

to substantial deficit in SY09.

9 Mths FY08 9 Mths FY09 9 Mths FY10

• Sugar production reached an all time low of 14.7 MnT

450

YTD (Apr‐Dec) EBITDA (Rs. Cr) during SY09 due to sharp fall in the sugarcane acreage.

Estimates for SY10 production is 17 MnT.

400 413 • However, sugar consumption continued to grow at a

18%

steady pace from 20 MnT in 2007 to 23 MnT in 2009

350 9%

and possibly 25.5 MnT by 2012. It depicted a CAGR of

300 6% during SY05-09.

• The commodity saw a phenomenal average growth of

250 67% in spot prices for FY10 (Rs 31,583/T) as compared

200

to previous year (Rs.18958/T); touching an all time high

of Rs 44,000/T in Jan’10.

9 Mths FY08 9 Mths FY09 9 Mths FY10

Das könnte Ihnen auch gefallen

- Research :: Company :: Oudh Sugar MillsDokument8 SeitenResearch :: Company :: Oudh Sugar Millsshashi_svtNoch keine Bewertungen

- Specificic Requested Info For NED - ReviewedDokument4 SeitenSpecificic Requested Info For NED - ReviewedRaphael MashapaNoch keine Bewertungen

- Facilitating Power Trade in the Greater Mekong Subregion: Establishing and Implementing a Regional Grid CodeVon EverandFacilitating Power Trade in the Greater Mekong Subregion: Establishing and Implementing a Regional Grid CodeNoch keine Bewertungen

- Shubham Wadage ReportDokument18 SeitenShubham Wadage ReportPragati ChaudharyNoch keine Bewertungen

- 5000 TCD Sugar Plant 35 MW Co-Generation Power Plant Along With 80 KLPD DistilleryDokument24 Seiten5000 TCD Sugar Plant 35 MW Co-Generation Power Plant Along With 80 KLPD DistilleryServinorca, C.A.Noch keine Bewertungen

- Presentacion CPAC 4Q22Dokument38 SeitenPresentacion CPAC 4Q22stefa2901Noch keine Bewertungen

- Dhampur Sugar Mill: Investment Rationale Brief & AbstractDokument18 SeitenDhampur Sugar Mill: Investment Rationale Brief & AbstractPragati ChaudharyNoch keine Bewertungen

- Daily StatisticsDokument5 SeitenDaily Statisticssj02Noch keine Bewertungen

- Group No 5 - Ultratech - Jaypee 20th Sep-1Dokument23 SeitenGroup No 5 - Ultratech - Jaypee 20th Sep-1Snehal100% (1)

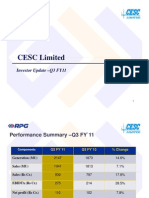

- CESC Limited CESC Limited: Investor Update - Q3 FY11Dokument14 SeitenCESC Limited CESC Limited: Investor Update - Q3 FY11Namuduri RamakanthNoch keine Bewertungen

- TRIVENI - Investor Presentation - 06-Feb-23 - TickertapeDokument41 SeitenTRIVENI - Investor Presentation - 06-Feb-23 - TickertapeSudhanshu SahooNoch keine Bewertungen

- 13 - Chapter 4Dokument43 Seiten13 - Chapter 4malathiNoch keine Bewertungen

- MSP Steel & PowerDokument7 SeitenMSP Steel & PowerraghuNoch keine Bewertungen

- Presentacion CPAC 2Q23Dokument32 SeitenPresentacion CPAC 2Q23SANDRO LUIS GUEVARA CONDENoch keine Bewertungen

- Tata Chemicals LTD: 12-Feb-2008 Pioneer Intermediaries PVT LTD - Agarwalla, AshwaniDokument32 SeitenTata Chemicals LTD: 12-Feb-2008 Pioneer Intermediaries PVT LTD - Agarwalla, Ashwaniapi-3828752Noch keine Bewertungen

- Template-V04Dokument21 SeitenTemplate-V04Sachin NaikNoch keine Bewertungen

- VEDL Press Release Q2 FY23 VFDokument7 SeitenVEDL Press Release Q2 FY23 VFbsrchandruNoch keine Bewertungen

- Quotation: Weaver Bird Shelters Private LimitedDokument1 SeiteQuotation: Weaver Bird Shelters Private Limitedsathish kumarNoch keine Bewertungen

- The Central Arecanut & Cocoa Marketing and Processing Cooperative LTD., (Campco) 'Varanashi Towers', Mission Street, Mangalore - 575 001Dokument7 SeitenThe Central Arecanut & Cocoa Marketing and Processing Cooperative LTD., (Campco) 'Varanashi Towers', Mission Street, Mangalore - 575 001ANUSHA TomyNoch keine Bewertungen

- Presentation 1QFY17Dokument42 SeitenPresentation 1QFY17kimNoch keine Bewertungen

- Initiating Coverage - Orient Cement 171220 PDFDokument16 SeitenInitiating Coverage - Orient Cement 171220 PDFJayshree JadhavNoch keine Bewertungen

- Sector Momentum Cement-202104120837409214783Dokument4 SeitenSector Momentum Cement-202104120837409214783flying400Noch keine Bewertungen

- OPI Gas Brochure 23sep2020Dokument8 SeitenOPI Gas Brochure 23sep2020ALI ABBASNoch keine Bewertungen

- Kenya Sugar Update Report - Nairobi - Kenya - 03-31-2008Dokument10 SeitenKenya Sugar Update Report - Nairobi - Kenya - 03-31-2008Virnic FarmNoch keine Bewertungen

- Nimir Industrial Chemicals Limited: Corporate Briefing SessionDokument14 SeitenNimir Industrial Chemicals Limited: Corporate Briefing SessionIlyas FaizNoch keine Bewertungen

- Sagar Cement LTD - 23 January 2021Dokument11 SeitenSagar Cement LTD - 23 January 2021nakilNoch keine Bewertungen

- Shareholder Pattern: CEO's & Chairman's MessageDokument2 SeitenShareholder Pattern: CEO's & Chairman's MessageSohini DeyNoch keine Bewertungen

- Case: Hero Cements LTD (HCL) : BackgroundDokument4 SeitenCase: Hero Cements LTD (HCL) : BackgroundCH NAIR0% (1)

- Products Agro Services: Rationale For RecommendationDokument1 SeiteProducts Agro Services: Rationale For Recommendationrahul kumarNoch keine Bewertungen

- WCM FinalDokument2 SeitenWCM FinalRujuta SawantNoch keine Bewertungen

- Swot Analysis of Ultratech CementDokument31 SeitenSwot Analysis of Ultratech Cementtarunnayak11100% (7)

- EMP - 2009 Annual Reports PDFDokument116 SeitenEMP - 2009 Annual Reports PDFpuput utomoNoch keine Bewertungen

- 2010-11-Complete-10 & 11Dokument48 Seiten2010-11-Complete-10 & 11Muhammad SaleemNoch keine Bewertungen

- Impact of COVID-19 On The Indian Economy: Status: ConfidentialDokument23 SeitenImpact of COVID-19 On The Indian Economy: Status: ConfidentialKun NalNoch keine Bewertungen

- Research Report On Sterlite Technologies by MoneybeeDokument2 SeitenResearch Report On Sterlite Technologies by MoneybeemoneybeeNoch keine Bewertungen

- Investment Ideas - 887 - 6th April, 2023Dokument4 SeitenInvestment Ideas - 887 - 6th April, 2023Krishnendu ChakrabortyNoch keine Bewertungen

- PAMPA 2024 01 IR Presentation WebDokument32 SeitenPAMPA 2024 01 IR Presentation WebMartin NizNoch keine Bewertungen

- Buy Tata ChemicalsDokument9 SeitenBuy Tata ChemicalsSovid GuptaNoch keine Bewertungen

- Group - 26: Presented byDokument23 SeitenGroup - 26: Presented byHetvi KhyaliNoch keine Bewertungen

- Binani Cement-Monarch Fundamental PickDokument9 SeitenBinani Cement-Monarch Fundamental Pickshailesh kumarNoch keine Bewertungen

- BRM AssignmentDokument16 SeitenBRM AssignmentHimanshu GuptaNoch keine Bewertungen

- BRM AssignmentDokument17 SeitenBRM AssignmentHimanshu GuptaNoch keine Bewertungen

- Barauni Refinary PresentationDokument20 SeitenBarauni Refinary PresentationraviakashmurtyNoch keine Bewertungen

- 6 Sugar - FinalDokument28 Seiten6 Sugar - FinalMinerva RodríguezNoch keine Bewertungen

- Textilies Sector Presentaion FICCIDokument15 SeitenTextilies Sector Presentaion FICCIrjjain07Noch keine Bewertungen

- Amtek Auto Ltd-Firstcall-22 Mar10Dokument21 SeitenAmtek Auto Ltd-Firstcall-22 Mar10Swati DixitNoch keine Bewertungen

- Historical Profile of Cement IndustryDokument28 SeitenHistorical Profile of Cement IndustrySundas MoinNoch keine Bewertungen

- Pakistan Cement IndustryDokument28 SeitenPakistan Cement Industrybhika100% (3)

- Initiating Coverage - Ultratech Cement LTD - 110920Dokument18 SeitenInitiating Coverage - Ultratech Cement LTD - 110920Rohan AgrawalNoch keine Bewertungen

- Annual Accounts 2018Dokument100 SeitenAnnual Accounts 2018Syed Arham MurtazaNoch keine Bewertungen

- KRC Uttam 27aug09Dokument1 SeiteKRC Uttam 27aug09sabri1234Noch keine Bewertungen

- Buy Unitech - Target 51Dokument7 SeitenBuy Unitech - Target 51Sovid GuptaNoch keine Bewertungen

- 08.00 Raju Goyal CTO UltraTech CementDokument11 Seiten08.00 Raju Goyal CTO UltraTech CementParamananda SinghNoch keine Bewertungen

- Binani Cement Limited: SynopsisDokument16 SeitenBinani Cement Limited: SynopsisGaurav JoshiNoch keine Bewertungen

- Sagar Cements Initial (Geojit)Dokument10 SeitenSagar Cements Initial (Geojit)beza manojNoch keine Bewertungen

- Fund Mercator 02072012093953Dokument6 SeitenFund Mercator 02072012093953mdshoppNoch keine Bewertungen

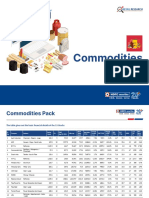

- HSL - Commodities Pack Report - 2021-202108182348310059173Dokument16 SeitenHSL - Commodities Pack Report - 2021-202108182348310059173SHAIK AHMEDNoch keine Bewertungen

- Research :: Company :: Visaka Industries LTDDokument7 SeitenResearch :: Company :: Visaka Industries LTDshashi_svtNoch keine Bewertungen

- CitibankDokument50 SeitenCitibankUtsav Mahendra100% (1)

- Foreign Exchange Guidelines by Bangladesh Bank PDFDokument380 SeitenForeign Exchange Guidelines by Bangladesh Bank PDFMohammad Khaled Saifullah Cdcs100% (1)

- Amended GISDokument1 SeiteAmended GISGCL88 BUILDERS AND COMMERCIAL TRADING CORP.Noch keine Bewertungen

- Star Health and Allied Insurance Co LTD DRHPDokument423 SeitenStar Health and Allied Insurance Co LTD DRHPajitNoch keine Bewertungen

- Institute of Business Management: 2 Assignment - Fall 2021Dokument2 SeitenInstitute of Business Management: 2 Assignment - Fall 2021Amna PervaizNoch keine Bewertungen

- Structure of Financial System in MalaysiaDokument42 SeitenStructure of Financial System in MalaysiaJames CharlieNoch keine Bewertungen

- Tata Motors Abridged LOF - Vfinal PDFDokument88 SeitenTata Motors Abridged LOF - Vfinal PDFdhanoj6522100% (1)

- Ratios Analysis Notes AND ONE SOLVED QUIZDokument6 SeitenRatios Analysis Notes AND ONE SOLVED QUIZDaisy Wangui100% (1)

- The Tata Corus MergerDokument13 SeitenThe Tata Corus MergerRanjit KarnaNoch keine Bewertungen

- FAR160 JUNE 2019 Q2 COMPANY-answer Madam CheckedDokument3 SeitenFAR160 JUNE 2019 Q2 COMPANY-answer Madam CheckedNur Anis AqilahNoch keine Bewertungen

- A Study On Investment Behaviour of Millennials Towards Investment in Share MarketDokument11 SeitenA Study On Investment Behaviour of Millennials Towards Investment in Share MarketAnonymous CwJeBCAXpNoch keine Bewertungen

- INfyDokument14 SeitenINfyswaroop shettyNoch keine Bewertungen

- Maf603 Test 1 May 2021 - SolutionDokument3 SeitenMaf603 Test 1 May 2021 - SolutionSITI FATIMAH AZ-ZAHRA ABD WAHIDNoch keine Bewertungen

- Final Future Union - The Rubicon Report - Conflict Capital (Full Report)Dokument100 SeitenFinal Future Union - The Rubicon Report - Conflict Capital (Full Report)New York Post100% (2)

- Pre Imbalance BibleDokument67 SeitenPre Imbalance BibleVarun 99100% (1)

- SOP - Loan Against Securities - Version 4Dokument5 SeitenSOP - Loan Against Securities - Version 4RuchitaNoch keine Bewertungen

- Chapter-I: AcquirerDokument17 SeitenChapter-I: AcquirerankitstupidNoch keine Bewertungen

- HSBC Premier TcsDokument3 SeitenHSBC Premier TcsDreamworxx DevelopmentsNoch keine Bewertungen

- Copra Farming CalculatorDokument13 SeitenCopra Farming Calculatorerik francis laurenteNoch keine Bewertungen

- Budi Business PlanDokument6 SeitenBudi Business Plan4K's GraphicsNoch keine Bewertungen

- How To Trade The ABCD PatternDokument8 SeitenHow To Trade The ABCD PatternUtkarshNoch keine Bewertungen

- Assignment 5 (Price Discrimination)Dokument2 SeitenAssignment 5 (Price Discrimination)Baideshik JobNoch keine Bewertungen

- Bad Debt To Manufacturing Practise Q 3Dokument10 SeitenBad Debt To Manufacturing Practise Q 3Zin MgNoch keine Bewertungen

- Dealogic IntroductionDokument7 SeitenDealogic IntroductionAndrás ÁcsNoch keine Bewertungen

- How To Get All The Money You Need To Buy PropertyDokument83 SeitenHow To Get All The Money You Need To Buy PropertyKora Sadler100% (2)

- Robert Montoya Case LearningsDokument4 SeitenRobert Montoya Case Learningsish juneNoch keine Bewertungen

- Retail Clothing Business PlanDokument8 SeitenRetail Clothing Business Plantanna_dwitawana100% (1)

- Banking Strategies For The FutureDokument11 SeitenBanking Strategies For The FutureMarco MolanoNoch keine Bewertungen

- Five Things About China's New Five-Year Plan: Special CoverageDokument3 SeitenFive Things About China's New Five-Year Plan: Special CoverageThomasNoch keine Bewertungen

- Professional Portfolio: FinanceDokument6 SeitenProfessional Portfolio: FinanceKunal KumarNoch keine Bewertungen

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassVon EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNoch keine Bewertungen

- 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurVon Everand12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurBewertung: 4.5 von 5 Sternen4.5/5 (3)

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeVon EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeBewertung: 4.5 von 5 Sternen4.5/5 (90)

- Secrets of the Millionaire Mind: Mastering the Inner Game of WealthVon EverandSecrets of the Millionaire Mind: Mastering the Inner Game of WealthBewertung: 4.5 von 5 Sternen4.5/5 (1027)

- Summary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedVon EverandSummary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedBewertung: 4.5 von 5 Sternen4.5/5 (38)

- To Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryVon EverandTo Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryBewertung: 4 von 5 Sternen4/5 (26)

- When the Heavens Went on Sale: The Misfits and Geniuses Racing to Put Space Within ReachVon EverandWhen the Heavens Went on Sale: The Misfits and Geniuses Racing to Put Space Within ReachBewertung: 3.5 von 5 Sternen3.5/5 (6)

- Having It All: Achieving Your Life's Goals and DreamsVon EverandHaving It All: Achieving Your Life's Goals and DreamsBewertung: 4.5 von 5 Sternen4.5/5 (65)

- Summary of Zero to One: Notes on Startups, or How to Build the FutureVon EverandSummary of Zero to One: Notes on Startups, or How to Build the FutureBewertung: 4.5 von 5 Sternen4.5/5 (100)

- SYSTEMology: Create time, reduce errors and scale your profits with proven business systemsVon EverandSYSTEMology: Create time, reduce errors and scale your profits with proven business systemsBewertung: 5 von 5 Sternen5/5 (48)

- Built to Serve: Find Your Purpose and Become the Leader You Were Born to BeVon EverandBuilt to Serve: Find Your Purpose and Become the Leader You Were Born to BeBewertung: 5 von 5 Sternen5/5 (25)

- Take Your Shot: How to Grow Your Business, Attract More Clients, and Make More MoneyVon EverandTake Your Shot: How to Grow Your Business, Attract More Clients, and Make More MoneyBewertung: 5 von 5 Sternen5/5 (22)

- Entrepreneurial You: Monetize Your Expertise, Create Multiple Income Streams, and ThriveVon EverandEntrepreneurial You: Monetize Your Expertise, Create Multiple Income Streams, and ThriveBewertung: 4.5 von 5 Sternen4.5/5 (89)

- Summary of The Four Agreements: A Practical Guide to Personal Freedom (A Toltec Wisdom Book) by Don Miguel RuizVon EverandSummary of The Four Agreements: A Practical Guide to Personal Freedom (A Toltec Wisdom Book) by Don Miguel RuizBewertung: 4.5 von 5 Sternen4.5/5 (112)

- Every Tool's a Hammer: Life Is What You Make ItVon EverandEvery Tool's a Hammer: Life Is What You Make ItBewertung: 4.5 von 5 Sternen4.5/5 (249)

- Transformed: Moving to the Product Operating ModelVon EverandTransformed: Moving to the Product Operating ModelBewertung: 4 von 5 Sternen4/5 (1)

- ChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveVon EverandChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveNoch keine Bewertungen

- Summary of The E-Myth Revisited: Why Most Small Businesses Don't Work and What to Do About It by Michael E. GerberVon EverandSummary of The E-Myth Revisited: Why Most Small Businesses Don't Work and What to Do About It by Michael E. GerberBewertung: 5 von 5 Sternen5/5 (39)

- 24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldVon Everand24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldBewertung: 5 von 5 Sternen5/5 (20)

- The Master Key System: 28 Parts, Questions and AnswersVon EverandThe Master Key System: 28 Parts, Questions and AnswersBewertung: 5 von 5 Sternen5/5 (62)

- The Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelVon EverandThe Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelBewertung: 5 von 5 Sternen5/5 (51)

- The Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimeVon EverandThe Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimeBewertung: 4.5 von 5 Sternen4.5/5 (58)

- Your Next Five Moves: Master the Art of Business StrategyVon EverandYour Next Five Moves: Master the Art of Business StrategyBewertung: 5 von 5 Sternen5/5 (802)

- Be Fearless: 5 Principles for a Life of Breakthroughs and PurposeVon EverandBe Fearless: 5 Principles for a Life of Breakthroughs and PurposeBewertung: 4 von 5 Sternen4/5 (49)

- Think Like Amazon: 50 1/2 Ideas to Become a Digital LeaderVon EverandThink Like Amazon: 50 1/2 Ideas to Become a Digital LeaderBewertung: 4.5 von 5 Sternen4.5/5 (60)

- Rich Dad's Before You Quit Your Job: 10 Real-Life Lessons Every Entrepreneur Should Know About Building a Multimillion-Dollar BusinessVon EverandRich Dad's Before You Quit Your Job: 10 Real-Life Lessons Every Entrepreneur Should Know About Building a Multimillion-Dollar BusinessBewertung: 4.5 von 5 Sternen4.5/5 (407)

- The Kingdom Driven Entrepreneur's Guide: Doing Business God's WayVon EverandThe Kingdom Driven Entrepreneur's Guide: Doing Business God's WayBewertung: 5 von 5 Sternen5/5 (42)