Beruflich Dokumente

Kultur Dokumente

01-12 - 20

Hochgeladen von

Brittany EtheridgeOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

01-12 - 20

Hochgeladen von

Brittany EtheridgeCopyright:

Verfügbare Formate

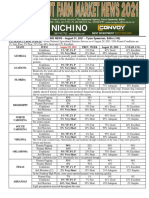

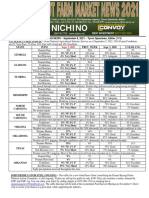

PEANUT MARKETING NEWS – January 28, 2020 – Tyron Spearman, Editor (12)

THE 2020 GEORGIA ECONOMIC OUTLOOK - PEANUTS - By Adam N. Rabinowitz, Assistant Professor and Extension Economist,

Department of Agricultural and Applied Economics, The University of Georgia

The 2019 peanut market has been relatively flat in Georgia as continued impact of stocks from record production in

2017 and the lack of growth in demand in recent years limits price growth for farmers. Forward contracts were around $400

per ton, and with no alternative crop offering relatively higher prices, there was little competition for acreage. Thus,

unsurprisingly, planted peanut acres in Georgia were up just 5,000 acres from 2018 to 670,000 acres.

Meanwhile, total U.S. peanut acreage was 1.425 million acres, down just 500 acres from the prior year, marking the

lowest level of plantings since 2014. Even with acreage flat, yields remained strong in 2019, with U.S. Department of Agriculture

estimates for November yields at 4,080 pounds for the total U.S. and 4,300 pounds for Georgia. These yields would be within

100 pounds of the respective total U.S. and Georgia yields from each of the past two years. The last major deviation from this

point was in 2016 when total U.S. and Georgia yields were about 400 pounds less.

That said, there are some indications that these yields might be slightly overestimated as dry weather in Georgia during

2019 limited some dryland production. Quality of the crop, as determined by the Georgia Federal-State Inspection Service, was

also a concern from the 2019 growing season as aflatoxin was reported at its highest rate since 2016. Even with potentially

lower yields in Georgia than estimated, ending stocks in the U.S. will remain relatively high at more than one million tons.

Without significant decreases in production in recent years, the demand side of the market has needed to respond to alleviate

the excess supply.

Unfortunately, export markets are typically the quickest to respond but have failed to do so. Forecasts are for export

markets to rebound from their recent lows of the 2018-2019 marketing year, yet they are still expected to be 17% lower than

their high during the 2015-2016 marketing year. This is due to two reasons. The first are recent trade disputes that have

resulted in retaliatory tariffs on agricultural products, including peanuts. The second is increased global competition, most

significantly from Argentina, Brazil and India. There is also a potential for further complications in exports as increased testing

occurs on shipments entering the European Union.

Overall, demand is not projected to increase during the 2019-2020 marketing year, staying right around three million

tons. The last significant movement in demand was during the 2015- 2016 marketing year when total disappearance increased

about 700,000 tons from the year before. A year later, disappearance dropped about 200,000 tons and has stayed right around

three million tons. Focusing on the individual components, domestic food use and crush are expected to return to demand

levels from two years ago after a slight decrease in the 2018-2019 marketing year.

With little demand growth and flat prices, government programs have had a significant impact on farm income for

peanut producers. The USDA has continued the Market Facilitation Program (MFP) in response to retaliatory tariffs that took

place during 2019. Peanuts were now included in the direct payments through MFP as part of the total planted acreage eligible

for a county-level payment rate. Two of the three potential payments have been made and the third is expected to be

announced soon.

In addition, the American Peanut Council has received $3.4 million from the Agricultural Trade Promotion Program to

help farmers increase access to new export markets.

With the passage of the Agriculture Improvement Act of 2018, the peanut safety net program in Title I has remained

intact. This includes a Price Loss Coverage (PLC) reference price of $535 per ton. While the payment in October 2018 was $77

per ton, the October 2019 payment increased to $105 per ton as a result of lower prices during the 2018-2019 marketing year.

Prices during the 2019-2020 marketing year are expected to be even lower, and thus estimates for the October 2020 payment

are expected to be around $115 to 120 per ton.

Looking ahead to 2020, one needs to consider the continued excess supply that resulted from record production in

2017 and the stagnant demand during the past four years. This means that a reduction in production is warranted and that

begins with a decrease in planted acres. However, a reduction in planted acres is unlikely to occur, as alternative crops in

Georgia do not present much better opportunities for higher net returns. A price near $400 per ton is expected at this point

and farmers are advised to consider their individual risk tolerance and what makes sense for their business given their own

financial situation. One strategy at current market prices might include contracting for some of the expected production and

waiting for the market to develop throughout the year.

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Candle Stick AnalysisDokument14 SeitenCandle Stick AnalysisDominiqueArringtonNoch keine Bewertungen

- Profile On The Production of Shock Absorber (Spring)Dokument26 SeitenProfile On The Production of Shock Absorber (Spring)ak123456Noch keine Bewertungen

- October 24, 2021Dokument1 SeiteOctober 24, 2021Brittany Etheridge100% (1)

- U.S. PEANUT EXPORTS - TOP 10 - From USDA/Foreign Agricultural Service (American Peanut Council)Dokument1 SeiteU.S. PEANUT EXPORTS - TOP 10 - From USDA/Foreign Agricultural Service (American Peanut Council)Brittany EtheridgeNoch keine Bewertungen

- Said Jeremy Mayes, General Manager For American Peanut Growers IngredientsDokument1 SeiteSaid Jeremy Mayes, General Manager For American Peanut Growers IngredientsBrittany EtheridgeNoch keine Bewertungen

- Cotton Marketing NewsDokument1 SeiteCotton Marketing NewsBrittany EtheridgeNoch keine Bewertungen

- Cotton Marketing NewsDokument2 SeitenCotton Marketing NewsBrittany EtheridgeNoch keine Bewertungen

- 1,000 Acres Pounds/Acre TonsDokument1 Seite1,000 Acres Pounds/Acre TonsBrittany EtheridgeNoch keine Bewertungen

- Cotton Marketing NewsDokument1 SeiteCotton Marketing NewsBrittany EtheridgeNoch keine Bewertungen

- NicholasDokument1 SeiteNicholasBrittany EtheridgeNoch keine Bewertungen

- October 17, 2021Dokument1 SeiteOctober 17, 2021Brittany EtheridgeNoch keine Bewertungen

- October 10, 2021Dokument1 SeiteOctober 10, 2021Brittany EtheridgeNoch keine Bewertungen

- World Agricultural Supply and Demand EstimatesDokument40 SeitenWorld Agricultural Supply and Demand EstimatesBrittany EtheridgeNoch keine Bewertungen

- Dairy Market Report - September 2021Dokument5 SeitenDairy Market Report - September 2021Brittany EtheridgeNoch keine Bewertungen

- October 3, 2021Dokument1 SeiteOctober 3, 2021Brittany EtheridgeNoch keine Bewertungen

- 2021 Export Update - Chinese Future Prices Have Gotten Weaker. This Is Not SurprisingDokument1 Seite2021 Export Update - Chinese Future Prices Have Gotten Weaker. This Is Not SurprisingBrittany EtheridgeNoch keine Bewertungen

- Sept. 26, 2021Dokument1 SeiteSept. 26, 2021Brittany EtheridgeNoch keine Bewertungen

- Sept. 19, 2021Dokument1 SeiteSept. 19, 2021Brittany EtheridgeNoch keine Bewertungen

- Shelled MKT Price Weekly Prices: Same As Last WeekDokument1 SeiteShelled MKT Price Weekly Prices: Same As Last WeekBrittany EtheridgeNoch keine Bewertungen

- Shelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,174,075 Tons, Up 3.0 % UP-$01. CT/LBDokument1 SeiteShelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,174,075 Tons, Up 3.0 % UP-$01. CT/LBBrittany EtheridgeNoch keine Bewertungen

- World Agricultural Supply and Demand EstimatesDokument40 SeitenWorld Agricultural Supply and Demand EstimatesBrittany EtheridgeNoch keine Bewertungen

- YieldDokument1 SeiteYieldBrittany EtheridgeNoch keine Bewertungen

- August 29, 2021Dokument1 SeiteAugust 29, 2021Brittany EtheridgeNoch keine Bewertungen

- FPAC Honeybee Brochure August2021Dokument4 SeitenFPAC Honeybee Brochure August2021Brittany EtheridgeNoch keine Bewertungen

- Shelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,318,000 Tons, Up 8.2 % DOWN - $0.4ct/lbDokument1 SeiteShelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,318,000 Tons, Up 8.2 % DOWN - $0.4ct/lbBrittany EtheridgeNoch keine Bewertungen

- Sept. 12, 2021Dokument1 SeiteSept. 12, 2021Brittany EtheridgeNoch keine Bewertungen

- Export Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) : Down - 11.8 % Down - 16.1%Dokument1 SeiteExport Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) : Down - 11.8 % Down - 16.1%Brittany EtheridgeNoch keine Bewertungen

- August 22, 2021Dokument1 SeiteAugust 22, 2021Brittany EtheridgeNoch keine Bewertungen

- Shelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,318,000 Tons, Up 8.2 % DOWN - $0.6ct/lbDokument1 SeiteShelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,318,000 Tons, Up 8.2 % DOWN - $0.6ct/lbBrittany EtheridgeNoch keine Bewertungen

- Shelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,318,000 Tons, Up 8.2 % DOWN - $0.4ct/lbDokument1 SeiteShelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,318,000 Tons, Up 8.2 % DOWN - $0.4ct/lbBrittany EtheridgeNoch keine Bewertungen

- Sept. 5, 2021Dokument1 SeiteSept. 5, 2021Brittany EtheridgeNoch keine Bewertungen

- Export Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) : Down - 10.8 % Down - 15.0%Dokument1 SeiteExport Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) : Down - 10.8 % Down - 15.0%Brittany EtheridgeNoch keine Bewertungen

- Economic Measures, The Bottom Line and CompetitionDokument9 SeitenEconomic Measures, The Bottom Line and CompetitionSunny GoyalNoch keine Bewertungen

- 12-0090 Corian - Right Colors - Right Prices 2012 - CounterSolutionsDokument2 Seiten12-0090 Corian - Right Colors - Right Prices 2012 - CounterSolutionsbecky4628Noch keine Bewertungen

- 2023 05 17 Hexatronic Group Authorizes Share Repurchase ProgDokument2 Seiten2023 05 17 Hexatronic Group Authorizes Share Repurchase ProgPiotr MatybaNoch keine Bewertungen

- Week05 PPT 2022 Before ClassDokument98 SeitenWeek05 PPT 2022 Before Class罗上宗Noch keine Bewertungen

- High Level DI PDFDokument38 SeitenHigh Level DI PDFabhiNoch keine Bewertungen

- Segway Final PowerpointDokument26 SeitenSegway Final PowerpointJaiminSolankiNoch keine Bewertungen

- Sage MAS90 4.3 Service Update 9Dokument21 SeitenSage MAS90 4.3 Service Update 9Wayne SchulzNoch keine Bewertungen

- 01 Adib Ahmad WDokument11 Seiten01 Adib Ahmad WAdib Ahmad WicaksonoNoch keine Bewertungen

- Kunci Jawaban Siklus Akuntansi (P1)Dokument30 SeitenKunci Jawaban Siklus Akuntansi (P1)Zulkarnain Zoel67% (3)

- Collusive and Non-Collusive OligopolyDokument7 SeitenCollusive and Non-Collusive Oligopolymohanraokp2279Noch keine Bewertungen

- Slobodan Maldini: Handbook For Builders and InvestorsDokument763 SeitenSlobodan Maldini: Handbook For Builders and InvestorsSlobodan MaldiniNoch keine Bewertungen

- Customs Valuation NotesDokument9 SeitenCustoms Valuation NotesSheila ArjonaNoch keine Bewertungen

- Cost Accnt. Lesson 1Dokument23 SeitenCost Accnt. Lesson 1peter banjaoNoch keine Bewertungen

- Problems With ROEDokument2 SeitenProblems With ROEwahab_pakistanNoch keine Bewertungen

- Estimating The Cost of The Proposed Reston VPAC: Construction and Operating Costs, December 8, 2022Dokument10 SeitenEstimating The Cost of The Proposed Reston VPAC: Construction and Operating Costs, December 8, 2022Terry MaynardNoch keine Bewertungen

- Invitation To Tender - Technical Training Services: Introduction To The CAADokument10 SeitenInvitation To Tender - Technical Training Services: Introduction To The CAASean AkirangaNoch keine Bewertungen

- Reconciling The Total and Differential ApproachesDokument2 SeitenReconciling The Total and Differential ApproachesRonabelle NuezNoch keine Bewertungen

- Micro/Macro Mix Up: Diagram DisasterDokument12 SeitenMicro/Macro Mix Up: Diagram DisastertyrramNoch keine Bewertungen

- Cost Allocation, Customer-Profitability Analysis, and Sales-Variance AnalysisDokument59 SeitenCost Allocation, Customer-Profitability Analysis, and Sales-Variance AnalysisHarold Dela Fuente100% (1)

- Cootamundra House PricesDokument4 SeitenCootamundra House PricesDaisy HuntlyNoch keine Bewertungen

- Kapferer and Valette - Beyond Rarity: The Paths of Luxury Desire. How Luxury Brands Grow Yet Remain DesirableDokument15 SeitenKapferer and Valette - Beyond Rarity: The Paths of Luxury Desire. How Luxury Brands Grow Yet Remain DesirableAdriaNoch keine Bewertungen

- Crude Distillation CurvesDokument11 SeitenCrude Distillation CurvesDuncan ReeceNoch keine Bewertungen

- Business Plan On Interior1Dokument6 SeitenBusiness Plan On Interior1Akshatha A BhatNoch keine Bewertungen

- Excise CaseDokument13 SeitenExcise CaseVenkat SujithNoch keine Bewertungen

- IBPS QuantitativeDokument44 SeitenIBPS QuantitativeRam ChandranNoch keine Bewertungen

- Become A Top Seller On EBayDokument18 SeitenBecome A Top Seller On EBayUlises HNoch keine Bewertungen

- TZero 2018 10-KDokument20 SeitenTZero 2018 10-KgaryrweissNoch keine Bewertungen

- Property, Plant and Equipment: Recognition of PPEDokument6 SeitenProperty, Plant and Equipment: Recognition of PPEbigbaekNoch keine Bewertungen