Beruflich Dokumente

Kultur Dokumente

John Bolton Public Financial Disclosure Report, 2018

Hochgeladen von

Erin LaviolaOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

John Bolton Public Financial Disclosure Report, 2018

Hochgeladen von

Erin LaviolaCopyright:

Verfügbare Formate

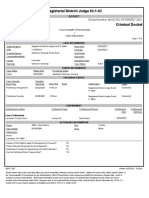

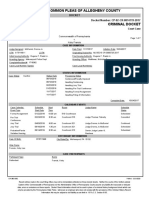

New Entrant Report | U.S. Office of Government Ethics; 5 C.F.R. part 2634 | Form Approved: OMB No.

(3209-0001) (January 2018)

Executive Branch Personnel

Public Financial Disclosure Report (OGE Form 278e)

Filer's Information

Bolton, John

Assistant to the President, National Security Advisor, White House

Date of Appointment: 04/09/2018

Other Federal Government Positions Held During the Preceding 12 Months:

None

Electronic Signature - I certify that the statements I have made in this form are true, complete and correct to the best of my knowledge.

/s/ Bolton, John R [electronically signed on 05/01/2018 by Bolton, John R in Integrity.gov]

Agency Ethics Official's Opinion - On the basis of information contained in this report, I conclude that the filer is in compliance with applicable laws and regulations

(subject to any comments below).

/s/ Passantino, Stefan, Certifying Official [electronically signed on 05/16/2018 by Passantino, Stefan in Integrity.gov]

Other review conducted by

/s/ Gast, Scott F, Ethics Official [electronically signed on 05/10/2018 by Gast, Scott F in Integrity.gov]

U.S. Office of Government Ethics Certification

Bolton, John - Page 1

/s/ Apol, David, Certifying Official [electronically signed on 07/10/2018 by Apol, David in Integrity.gov]

Data Revised 06/18/2018

Data Revised 06/12/2018

Data Revised 06/11/2018

Data Revised 06/08/2018

Data Revised 06/04/2018

Data Revised 05/31/2018

Data Revised 05/30/2018

Data Revised 05/29/2018

Data Revised 05/01/2018

Bolton, John - Page 2

1. Filer's Positions Held Outside United States Government

# ORGANIZATION NAME CITY, STATE ORGANIZATION POSITION HELD FROM TO

TYPE

1 Diamond Offshore Drilling Houston, Texas Corporation Board Director 2/2007 4/2018

2 Fox News New York, New Corporation contributor 5/2007 4/2018

York

3 American Enterprise Institute Washington, Non-Profit Senior Fellow 1/2007 4/2018

District of

Columbia

4 Eden Springs Barcelona, Corporation Board of 10/2013 7/2016

Outside U.S. Directors

5 Garda World Montreal, Corporation board of 3/2017 4/2018

Outside U.S. directors

6 Rhone Group New York, New Corporation Advisor 9/2013 4/2018

York

7 Gatestone Institute New York, New Non-Profit Chairman of 3/2013 4/2018

York Board and

Advisor

8 Hamilton Society Washington, Non-Profit Board of 2/2016 4/2018

District of Directors

Columbia

9 Advanced Plasma Technology Mumbai, Corporation Board of 1/2017 1/2018

Outside U.S. Directors

10 Counter Extremism Project New York, New Non-Profit Advisor 9/2015 4/2018

York

11 Kirkland & Ellis Chicago, Illinois Law Firm of Counsel 1/2008 4/2018

12 American Conservative Union Washington, Non-Profit Board Director 12/2006 4/2018

District of

Columbia

Bolton, John - Page 3

# ORGANIZATION NAME CITY, STATE ORGANIZATION POSITION HELD FROM TO

TYPE

13 John Bolton PAC Washington, Political Chairman 3/2013 4/2018

District of Organization

Columbia

14 John Bolton Super PAC Washington, Political Chairman 3/2013 4/2018

District of Organization

Columbia

15 Foundation for American Security & Washington, Non-Profit Chairman 12/2014 4/2018

Freedom District of

Columbia

16 National Review Institute New York, New Non-Profit Member, Board 7/2013 4/2018

York of Trustees

17 Leadership Insitute Arlington, Non-Profit Member, 6/2017 4/2018

Virginia International

Advisory Board

2. Filer's Employment Assets & Income and Retirement Accounts

Bolton, John - Page 4

# DESCRIPTION EIF VALUE INCOME TYPE INCOME

AMOUNT

1 Diamond Offshore Drilling, stock See Endnote N/A Ordinary $19,310

appreciation rights (value not readily income

ascertainable): 500 vested shares, grant

$140.54, exp. 7/2018; 500 vested shares,

grant $103.02, exp. 10/2018; 500 vested

shares, grant $64.51, exp. 4/2019; 500

vested shares, grant $83.57, exp. 7/2019;

500 vested shares, grant $95.61, exp.

10/2019; 500 vested shares, grant $99.16,

exp. 1/2020; 500 vested shares, grant

$87.65, exp. 4/2020; 500 vested shares,

grant $61.79, exp. 7/2020; 500 vested

shares, grant $68.52, exp. 10/2020; 500

vested shares, grant $66.38, exp. 1/2021;

500 vested shares, grant $78.90, exp.

4/2021; 500 vested shares, grant $70.38,

exp. 7/2021; 500 vested shares, grant

$55.64, exp. 10/2021; 1000 vested shares,

grant $55.72, exp. 1/2022; 1000 vested

shares, grant $66.68, exp. 4/2022; 1000

vested shares, grant $59.19, exp. 7/2022;

1000 vested shares, grant $66.04, exp.

10/2022; 1000 vested shares, grant $67.47,

exp. 1/2023; 1000 vested shares, grant

$69.71, exp. 4/2023; 1000 vested shares,

grant $68.62, exp. 7/2023; 1000 vested

shares, grant $62.31, exp. 10/2023; 1000

vested shares, grant $56.55, exp. 1/2024;

1000 vested shares, grant $48.36, exp.

4/2024; 1000 vested shares, grant $49.57,

exp. 7/2024; 1000 vested shares, grant

$34.54, exp. 10/2024; 1000 vested shares,

grant $37.16, exp. 1/2025; 1000 vested

shares, grant $26.69, exp. 4/2025; 1000

vested shares, grant $25.88, exp. 7/2025;

1000 vested shares, grant $20.93, exp.

1/2026; 1000 vested shares, grant $21.54,

exp. 4/2026; 1000 vested shares, grant

$24.02, exp. 7/2026.

2 Diamond Offshore Drilling N/A Director fees $81,500

3 Fox News N/A Salary $569,423

Bolton, John - Page 5

# DESCRIPTION EIF VALUE INCOME TYPE INCOME

AMOUNT

4 American Enterprise Institute N/A Salary $240,000

5 Garda World (security services, risk N/A Director fees $63,073

assessment)

6 Rhone Group (private equity) N/A Advisory fees $122,600

7 Rhone Group (private equity), advisory fee See Endnote N/A None (or less

receivable (value not readily ascertainable) than $201)

8 Gatestone Institute N/A Board and $155,000

advisory fees

9 Counter Extremism Project United N/A Consulting fees $165,000

10 Equivest SEP IRA No

10.1 Charter Multi-Sector Bond Portfolio Yes $100,001 - None (or less

$250,000 than $201)

10.2 EQ3 Common Stock Index Yes $100,001 - None (or less

$250,000 than $201)

10.3 EQ3 Large Cap Growth Portfolio Yes $1,001 - $15,000 None (or less

than $201)

10.4 EQ3 Multimanager Aggressive Equity Yes $250,001 - None (or less

Portfolio $500,000 than $201)

10.5 SEP Guaranteed Interest Account (cash N/A $100,001 - None (or less

account) $250,000 than $201)

11 Equivest IRA No

11.1 EQ3 Common Stock Index Yes $100,001 - None (or less

$250,000 than $201)

11.2 EQ3 Multimanager Aggressive Equity Yes $100,001 - None (or less

Portfolio $250,000 than $201)

11.3 EQ3 International Equity Yes $50,001 - None (or less

$100,000 than $201)

Bolton, John - Page 6

# DESCRIPTION EIF VALUE INCOME TYPE INCOME

AMOUNT

12 John R. Bolton Solo DB, defined benefit plan N/A $1,000,001 - None (or less

$5,000,000 than $201)

12.1 AXA Growth Strategies Portfolio Yes $1,000,001 - None (or less

$5,000,000 than $201)

13 TIAA-CREF Annuity No

13.1 CREF Equity Index Yes $100,001 - None (or less

$250,000 than $201)

13.2 CREF Global Equity Yes $15,001 - None (or less

$50,000 than $201)

13.3 CREF Growth Yes $50,001 - None (or less

$100,000 than $201)

13.4 CREF Stock Yes $100,001 - None (or less

$250,000 than $201)

13.5 TIAA Real Estate Yes $15,001 - None (or less

$50,000 than $201)

13.6 TIAA Traditional Annuity N/A $15,001 - None (or less

$50,000 than $201)

14 TIAA-CREF 403B No

14.1 CREF Equity Index Yes $15,001 - None (or less

$50,000 than $201)

14.2 CREF Gobal Equities Yes $50,001 - None (or less

$100,000 than $201)

14.3 CREF Growth Yes $50,001 - None (or less

$100,000 than $201)

14.4 CREF Stock Yes $100,001 - None (or less

$250,000 than $201)

14.5 TIAA Traditional Annuity N/A $15,001 - None (or less

$50,000 than $201)

Bolton, John - Page 7

# DESCRIPTION EIF VALUE INCOME TYPE INCOME

AMOUNT

15 Mass Mutual 403b No

15.1 Vanguard Target Retirement 2015 Yes $100,001 - None (or less

$250,000 than $201)

16 U.S. brokerage

16.1 Diamond Drilling stock N/A None (or less Capital Gains $15,001 -

than $1,001) $50,000

16.2 U.S. brokerage cash account N/A $15,001 - None (or less

$50,000 than $201)

17 American Friends of Magen David Adon - N/A Speaking fee $20,000

3/11/18

18 Jerusalem Chai Dinner - 6/5/2017 N/A Speaking fee $5,000

19 Arizona State U. - 3/16/2017 N/A Speaking fee $25,000

20 Bet El Dinner - 12/3/17 N/A Speaking fee $7,500

21 The Hill - articles published 7/17/17, 8/13/17, N/A Writing fees $12,000

8/20/17, 9/11/17, 10/9/17,

10/23/17,11/15/17, 12/28/17, 12/29/17,

1/2/18, 1/24/18, 1/31/18

22 Charles Taylor Dinner - 12/16/17 N/A Speaking fee $10,000

23 Frager Dinner, Young Israel Chovevi - N/A Speaking fee $2,500

4/13/17

24 Israel Day Dinner - 6/4/17 N/A Speaking fee $5,000

25 Colorado Christian University - 7/21/17 N/A Speaking fee $8,000

26 Coptic Soladarity dinner - 6/16/17 N/A Speaking fee $5,000

27 Daily Telegraph - articles published 1/23/17, N/A Writing fees $1,404

2/14/17, 7/10/17, 12/14/17

28 Endowment for Middle East Truth - 9/11/17, N/A Speaking fees $5,000

1/9/18

Bolton, John - Page 8

# DESCRIPTION EIF VALUE INCOME TYPE INCOME

AMOUNT

29 Flagler County Republicans - 11/10/17 N/A Speaking fee $10,000

30 Friends of Israel Defense Forces - 1/7/18 N/A Speaking fee $20,000

31 Globe Events--European Iranian Events - N/A Speaking fee $40,000

7/1/17

32 Guardian of Zion, Rennert Center - 5/29/17 N/A Speaking fee, $100,000

award recipient

33 David Horowitz Freedom Foundation - N/A Speaking fee $10,000

3/8/17

34 Human Rights Voices - 4/28/17, 10/26/17 N/A Speaking fees $7,000

35 Lincoln Club, Coachella, CA - 11/2/17 N/A Speaking fee $20,000

36 National Conference of State Legislatures - N/A Speaking fee $12,500

8/9/17

37 North American Taiwanese Professors N/A Speaking fee $2,000

Association (NATPA) - 8/5/17

38 NEWS UK (Times of London) - articles N/A Writing fees $2,106

published 11/15/16 (paid in 2017), 4/2/17

and 4/2/17

39 Newsmax Media - June issue 2017 N/A Writing fee $2,000

40 NY Post - articles published 4/17/17, N/A Writing fees $1,600

5/22/17, 7/5/17, 9/6/17

41 Pinchuk Foundation, YES Conference - N/A Speaking fees $115,000

9/25/17 and 2/17/18

42 Pope Foundation - 5/12/17 N/A Speaking fee $15,000

43 San Francisco Republicans - 8/17/17 N/A Speaking fee $12,500

44 Skidaway Island Republican Club - 2/19/18 N/A Speaking fee $7,500

45 Smith County Republicans - 1/18/17 and N/A Speaking fees $10,000

3/16/18

Bolton, John - Page 9

# DESCRIPTION EIF VALUE INCOME TYPE INCOME

AMOUNT

46 Texas A&M U. - 3/13/18 N/A Speaking fee $7,000

47 Pittsburgh Tribune - articles published N/A Writing fees $15,000

1/8/17, 2/12/17, 3/12/17, 4/9/17, 5/14/17,

6/11/17,7/9/17, 8/13/17, 9/10/17, 10/8/17,

11/12/17, 12/10/17, 1/14/18, 2/11/18,

3/11/18

48 University of Richmond - 3/31/17 N/A Speaking fee $1,500

49 US Foundation for Liberty - 4/6/17, 9/20/17 N/A Speaking fees $20,000

50 Washington Speakers Bureau N/A

50.1 NMS Management - 2/4/17 N/A Speaking fee $24,000

(after Bureau

commission)

50.2 AmeriQuest Transportation & Logistics - N/A Speaking fee $20,000

2/16/17 (after Bureau

commission)

50.3 Reyes Holdings LLC - 2/23/17 N/A Speaking fee $20,000

(after Bureau

commission)

50.4 Hoover Institution - 2/16/17 N/A Speaking fee $16,000

(after Bureau

commission)

50.5 Women of Washington - 7/19/17 N/A Speaking fee $8,000

(after Bureau

commission)

50.6 First National Bankers Bank - 6/14/17 N/A Speaking fee $20,000

(after Bureau

commission)

50.7 Oklahoma City Town Hall - 10/18/17 N/A Speaking fee $18,200

(after Bureau

commission)

Bolton, John - Page 10

# DESCRIPTION EIF VALUE INCOME TYPE INCOME

AMOUNT

50.8 Deutsche Bank - 5/16/17 N/A Speaking fee $72,000

(after Bureau

commission)

50.9 HSBC - 6/6/17, 8/4/17 N/A Speaking fee $46,500

(after Bureau

commission)

51 Wall Street Journal (Dow Jones) - articles N/A Writing fees $12,700

published 12/27/16, 1/17/17, 2/6/17,

2/13/17, 3/8/17, 4/6/17, 5/23/17, 6/29/17,

8/3/17, 9/8/17, 9/29/17, 10/16/17, 11/21/17,

12/26/17, 1/16/18, 3/1/18

52 Diamond Offshore Drilling, receivable for N/A $1,001 - $15,000 None (or less

director fees earned prior to resignation than $201)

53 "Surrender Is Not an Option" Threshold N/A None (or less

Editions (value not readily ascertainable) than $201)

54 "How Barack Obama is Endangering our N/A None (or less

National Sovereignty" Encounter Books than $201)

(value not readily ascertainable)

55 The Hill - anitcipated writting fees for N/A $1,001 - $15,000 None (or less

articles published 2/12/18, 2/19/18 than $201)

3. Filer's Employment Agreements and Arrangements

Bolton, John - Page 11

# EMPLOYER OR PARTY CITY, STATE STATUS AND TERMS DATE

1 Diamond Offshore Drilling Houston, Texas (1) I will receive payment in the amount of $1,098.90 2/2007

for prorated Directors fees, for services furnished

until my resignation, which was effective on April 8,

2018, in accordance with standard policies for

departing Directors.

(2) Stock appreciation rights (SARs) were granted

quarterly to all Directors as compensation. Standard

terms provide the SAR grants vest upon issuance,

with a 10-year duration and no value upon expiration.

No additional SARs were granted after my separation.

I will exercise unexpired SAR grants by aquiring and

selling stock under the terms of the grants, or will

forfeit the unexpired SAR grants. SARs will be

exercised or forfeited within 90 days of be being

directed to divest in accordance with 5 CFR

2635.403(d).

2 Rhone Group New York, New Pursuant to my contract with the firm, I will receive an 9/2013

York advisory fee payment for services attributable to me

up to the date of my resignation from the firm, which

became effective on April 8, 2018. I will receive the

payment in the second quarter of 2018 pursuant to

standard company policies in the form of an advisory

fee payment related to firm performance while I was

providing services to the firm. No further advisory

fees accrued after my separation.

3 American Enterprise Institute Washington, I will continue to maintain assets in these defined 1/2007

District of contribution plans until they are rolled over into an

Columbia IRA. The plan sponsor and I will not make further

contributions after my separation, which was

effective on April 8, 2018, apart from standard

contributions made after my final salary payment for

services up to April 8, 2018.

4 John R. Bolton Solo DB Bethesda, The account will be rolled over (recharacterized) as an 1/2009

Maryland IRA.

5 The Hill Washington, I will receive payment for articles I authored that were 2/2018

District of published on 2/12/18 and 2/19/18, on terms

Columbia established prior to publication.

Bolton, John - Page 12

4. Filer's Sources of Compensation Exceeding $5,000 in a Year

# SOURCE NAME CITY, STATE BRIEF DESCRIPTION OF DUTIES

1 Diamond Offshore Drilling Houston, Texas Board of Directors

2 Fox News New York, New Commentator

York

3 American Enterprise Institute Washington, Senior Fellow-scholar

District of

Columbia

4 Garda World Montreal, Board of Directors

Outside U.S.

5 Rhone Group New York, New Senior Advisor

York

6 Gatestone Institute New York, New Chairman of Board

York

7 Counter Extremism Project New York, New Advisor, Advisory board

York

8 American Freedom Alliance Encino, Speaking

California

9 AFMDA-Am. Friends of Magen David New York, New Speaking

York

10 Arizona State University Tempe, Arizona Speaking

11 Bet El Yeshiva New York, New Speaking

York

12 Benos Menachem New York, New Speaking

York

13 Cornerstone Church Bowie, Speaking

Maryland

Bolton, John - Page 13

# SOURCE NAME CITY, STATE BRIEF DESCRIPTION OF DUTIES

14 Capital Hill Publications (The HILL) Washington, Writing

District of

Columbia

15 North Carolina Republicans (Charles Taylor) Raleigh, North Speaking

Carolina

16 Chovevei Zion Skokie, Illinois Speaking

17 Colorado Christian University Lakewood, Speaking

Colorado

18 Denton County Republicans Denton, Texas Speaking

19 Eden Springs New York, New Board of Directors

York

20 Flagler County Republicans Palm Coast, Speaking

Florida

21 Friends of Israel Defense Forces New York, New Speaking

York

22 Globe Events Failsworth, Speaking

Outside U.S.

23 Guardian of Zion Jerusalem, Award and Speech

Outside U.S.

24 David Horowitz Freedom Center Sherman Oaks, Speaking

California

25 Human Rights Voices New York, New Speaking

York

26 Lincoln Club of Coachella La Quinta, Speaking

California

27 Old Fashioned Franchise Association Modesto, Speaking

(Wendy's) California

28 Park East Synagogue New York, New Speaking

York

Bolton, John - Page 14

# SOURCE NAME CITY, STATE BRIEF DESCRIPTION OF DUTIES

29 National Conf of State Legislatures Washington, Speaking

District of

Columbia

30 Pinchuk Foundation Kiev, Outside Speaking

U.S.

31 Pope Foundation Washington, Speaking

District of

Columbia

32 Steamboat Institute Steamboat Speaking

Springs,

Colorado

33 San Francisco Republicans San Franciso, Speaking

California

34 Pittsburgh Tribune Pittsburgh, Writing

Pennsylvania

35 Skidaway Island Republican Party Skidaway Island, Speaking

Georgia

36 Texas A&M Univ College Station, Speaking

Texas

37 US Foundation for Liberty Washington, Speaking

District of

Columbia

38 Washington Speakers Bureau Alexandria, Speaking engagements as arranged by Bureau, which is paid a

Virginia commission for each engagement.

39 Wall Street Journal (Dow Jones) New York, New Writing

York

40 NY Post New York, New Writing

York

41 Smith County Republicans Tyler, Texas Speaking

42 AmeriQuest Transportation and Logistics Cherry Hill, New Speaking

Jersey

Bolton, John - Page 15

# SOURCE NAME CITY, STATE BRIEF DESCRIPTION OF DUTIES

43 Reyes Holdings LLC Rosemont, Speaking

Illinois

44 Hoover Institution Stanford, Speaking

California

45 Women of Washington Mercer Island, Speaking

Washington

46 First National Bankers Bank Baton Rouge, Speaking

Louisiana

47 Oklahoma City Town Hall Oklahoma City, Speaking

Oklahoma

48 Deutsche Bank Frankfurt, Speaking

Germany,

Outside U.S.

49 HSBC London, United Speaking

Kingdom,

Outside U.S.

50 United Jewish Federation of NENY Albany, New Speaking

York

51 Men’s Dinner Club of Oklahoma City Oklahoma City, Speaking

Oklahoma

52 Premiere Speakers Bureau Franklin, Speaking

Tennessee

53 NMS Management Melville, New Speaking

York

5. Spouse's Employment Assets & Income and Retirement Accounts

# DESCRIPTION EIF VALUE INCOME TYPE INCOME

AMOUNT

1 Equivest IRA No

Bolton, John - Page 16

# DESCRIPTION EIF VALUE INCOME TYPE INCOME

AMOUNT

1.1 EQ3 Common Stock Index Yes $15,001 - None (or less

$50,000 than $201)

1.2 EQ3 Global Multi-Sector Equity Portfolio Yes $1,001 - $15,000 None (or less

than $201)

1.3 EQ3 Multimanager Aggressive Equity Yes $1,001 - $15,000 None (or less

Portfolio than $201)

1.4 EQ3 International Equity Index Yes $1,001 - $15,000 None (or less

than $201)

2 AXA Pension, cash balance pension plan N/A $50,001 - None (or less

$100,000 than $201)

3 AXA 401K No

3.1 AXA S.A. ADR (AXAHY) N/A $1,001 - $15,000 None (or less

than $201)

3.2 AXA 2010 Target Allocation Portfolio Yes $50,001 - None (or less

$100,000 than $201)

3.3 BlackRock Equity Index Yes $100,001 - None (or less

$250,000 than $201)

3.4 EQ/Gamco Small Value Portfolio Yes $15,001 - None (or less

$50,000 than $201)

3.5 Dodge & Cox International Stock Fund Yes $15,001 - None (or less

$50,000 than $201)

3.6 Fidelity Fixed Income Fund Yes $1,001 - $15,000 None (or less

than $201)

3.7 Metropolitan West Total Return Bond Yes $50,001 - None (or less

$100,000 than $201)

3.8 MFS International Growth Fund Yes $15,001 - None (or less

$50,000 than $201)

4 Self-funded 401K N/A

Bolton, John - Page 17

# DESCRIPTION EIF VALUE INCOME TYPE INCOME

AMOUNT

4.1 Templeton Growth Fund Yes $1,001 - $15,000 None (or less

than $201)

4.2 Neuberger-Berman Genesis Fund Yes $1,001 - $15,000 None (or less

than $201)

4.3 Multi-manager Core Bond Portfolio Yes $15,001 - None (or less

$50,000 than $201)

4.4 Federated High Income Bond Fund Yes $1,001 - $15,000 None (or less

than $201)

4.5 EQ/Capital Guardian Research Portflio Yes $1,001 - $15,000 None (or less

than $201)

4.6 AXA/AB Small Cap Growth Portfolio Yes $50,001 - None (or less

$100,000 than $201)

4.7 AXA MidCap Value Managed Volatility Yes $50,001 - None (or less

Portfolio $100,000 than $201)

4.8 AXA Large Cap Value Managed Volatility Yes $50,001 - None (or less

Portfolio $100,000 than $201)

5 AXA Advisors LLC and AXA Network N/A Fees and

commissions

6 AXA S.A. ADR (AXAHY) See Endnote N/A $1,001 - $15,000 None (or less

than $201)

6. Other Assets and Income

# DESCRIPTION EIF VALUE INCOME TYPE INCOME

AMOUNT

1 Brokerage account #1 No

1.1 AO Smith Corp (AOS) N/A $15,001 - Dividends $201 - $1,000

$50,000

Bolton, John - Page 18

# DESCRIPTION EIF VALUE INCOME TYPE INCOME

AMOUNT

1.2 AMG GW&K Core Bond Fund (MBDFX) Yes $100,001 - $5,001 - $15,000

$250,000

1.3 Bank of America (BAC) N/A $1,001 - $15,000 Dividends $201 - $1,000

1.4 Berkshire Hathaway Inc. (BRK.B) N/A $100,001 - None (or less

$250,000 than $201)

1.5 Amazon.com, Inc. (AMZN) N/A $250,001 - None (or less

$500,000 than $201)

1.6 American Century Ultra Fund Inv Class Yes $15,001 - $1,001 - $2,500

(TWCUX) $50,000

1.7 BlackRock Latin America Fund Inst Shares Yes $15,001 - $201 - $1,000

(MALTX) $50,000

1.8 Brown Advisory Maryland Bond Inv (BIAMX) Yes $100,001 - $1,001 - $2,500

$250,000

1.9 Cooper Companies Inc (COO) N/A $15,001 - Dividends None (or less

$50,000 than $201)

1.10 Cummins Inc (CMI) N/A $15,001 - Dividends $201 - $1,000

$50,000

1.11 Deutsche Strategic High Yield Tax-Free Fund Yes $100,001 - $5,001 - $15,000

Cl S (SHYTX) $250,000

1.12 Eaton Vance Maryland Municipal Inc Fund Cl Yes $100,001 - $5,001 - $15,000

A (ETMDX) $250,000

1.13 Enterprise Products Partners L.P. (EPD) N/A $15,001 - Dividends $1,001 - $2,500

$50,000

1.14 American Funds EuroPacific Gr Fund Cl F-2 Yes $100,001 - $1,001 - $2,500

(AEPFX) $250,000

1.15 Expeditors International of Washington N/A $15,001 - Dividends $201 - $1,000

(EXPD) $50,000

1.16 Exxon Mobil Corp (XOM) N/A $15,001 - Dividends $1,001 - $2,500

$50,000

Bolton, John - Page 19

# DESCRIPTION EIF VALUE INCOME TYPE INCOME

AMOUNT

1.17 Fastenal Company (FAST) N/A $15,001 - Dividends $201 - $1,000

$50,000

1.18 Fidelity Advisor Biotechnology I (FBTIX) Yes $100,001 - None (or less

$250,000 than $201)

1.19 General Electric Co (GE) N/A $15,001 - Dividends $1,001 - $2,500

$50,000

1.20 Gilead Sciences, Inc (GILD) N/A $1,001 - $15,000 None (or less

than $201)

1.21 iShares (Dow Jones) Transportation Average Yes $15,001 - $201 - $1,000

ETF (IYT) $50,000

1.22 Landstar System, Inc (LSTR) N/A $100,001 - Dividends $1,001 - $2,500

$250,000

1.23 Martin Marietta Materials, Inc (MLM) N/A $15,001 - Dividends $201 - $1,000

$50,000

1.24 MAI Managed Volatility Fund Inst Cl (MAPIX) Yes $100,001 - $5,001 - $15,000

$250,000

1.25 Medtronic PLC (MDT) N/A $15,001 - Dividends $201 - $1,000

$50,000

1.26 Merck & Co Inc (MRK) N/A $100,001 - Dividends $5,001 - $15,000

$250,000

1.27 Microsoft Corporation (MSFT) N/A $15,001 - Dividends $201 - $1,000

$50,000

1.28 Monsanto Co (MON) N/A $15,001 - Dividends $201 - $1,000

$50,000

1.29 Morgan Stanley (MS) N/A $50,001 - Dividends $1,001 - $2,500

$100,000

1.30 Oppenheimer Developing Markets Fund Cl Y Yes $100,001 - $1,001 - $2,500

(ODVYX) $250,000

Bolton, John - Page 20

# DESCRIPTION EIF VALUE INCOME TYPE INCOME

AMOUNT

1.31 Oppenheimer Int'l Bond Fund Cl A (OIBAX) Yes $100,001 - $5,001 - $15,000

$250,000

1.32 Oppenheimer Senior Floating Rate Fund Cl Y Yes $100,001 - $2,501 - $5,000

(OOSYX) $250,000

1.33 PowerShares Dynamic Market ETF (PWC) Yes $100,001 - $1,001 - $2,500

$250,000

1.34 Guggenheim S&P 500 Equal Weight ETF Yes $100,001 - $1,001 - $2,500

(RSP) $250,000

1.35 Guggenheim S&P Midcap 400 Pure Growth Yes $100,001 - $201 - $1,000

ETF (RFG) $250,000

1.36 TCW Total Return Bond Fund Cl I (TGLMX) Yes $100,001 - $2,501 - $5,000

$250,000

1.37 Thornburg Int'l Growth Fund Cl I (TINGX) Yes $100,001 - $201 - $1,000

$250,000

1.38 Thornburg Int'l Value Fund Cl I (TGVIX) Yes $100,001 - $1,001 - $2,500

$250,000

1.39 Tocqueville Gold Fund (TGLDX) Yes $1,001 - $15,000 None (or less

than $201)

1.40 Tortoise MLP & Pipeline Fund Inst Cl (TORIX) Yes $50,001 - $1,001 - $2,500

$100,000

1.41 Vanguard Extended Market ETF (VXF) Yes $15,001 - $1,001 - $2,500

$50,000

1.42 Vanguard Small-Cap ETF (VB) Yes $100,001 - $1,001 - $2,500

$250,000

1.43 Vanguard Total Bond Market Index Fund Yes $100,001 - $2,501 - $5,000

Investor Shares (VBMFX) $250,000

1.44 Vanguard Total Stock Market ETF (VTI) Yes $250,001 - $5,001 - $15,000

$500,000

Bolton, John - Page 21

# DESCRIPTION EIF VALUE INCOME TYPE INCOME

AMOUNT

1.45 Vulcan Materials Co (VMC) N/A $50,001 - Dividends $201 - $1,000

$100,000

1.46 Walt Disney Co (DIS) N/A $50,001 - Dividends $1,001 - $2,500

$100,000

1.47 Zimmer Biomet Holdings (ZBH) N/A $15,001 - Dividends $201 - $1,000

$50,000

2 Brokerage account #2 No

2.1 AllianceBern High Income A (AGDAX) Yes $1,001 - $15,000 $201 - $1,000

2.2 AllianceBern Muni Income Natl Fund A (AFB) Yes $1,001 - $15,000 $201 - $1,000

2.3 AllianzGI NFJ Mid-Cap Value Fund Cl A Yes $15,001 - None (or less

(PQNAX) $50,000 than $201)

2.4 AT&T Inc (T) N/A $15,001 - Dividends $2,501 - $5,000

$50,000

2.5 AXA S.A. OTC (AXAHF) N/A $1,001 - $15,000 None (or less

than $201)

2.6 AXA S.A. ADR (AXAHY) N/A $15,001 - Dividends $1,001 - $2,500

$50,000

2.7 CenturyLink Inc (CTL) N/A None (or less Dividends $1,001 - $2,500

than $1,001) Capital Gains

2.8 Comcast Corp (CMCSA) N/A $1,001 - $15,000 None (or less

than $201)

2.9 Dr Pepper Snapple Group (DPS) N/A $1,001 - $15,000 None (or less

than $201)

2.10 Eaton Vance Income Fund of Boston Cl A Yes $1,001 - $15,000 $201 - $1,000

(EVIBX)

2.11 Gilead Sciences, Inc (GIL) N/A $1,001 - $15,000 None (or less

than $201)

Bolton, John - Page 22

# DESCRIPTION EIF VALUE INCOME TYPE INCOME

AMOUNT

2.12 iShares (Dow Jones) US Aerospace & Yes $100,001 - $201 - $1,000

Defense ETF (ITA) $250,000

2.13 Ivy Emerging Markets Equity Fund Cl Y Yes $15,001 - None (or less

(IPOYX) $50,000 than $201)

2.14 JP Morgan Chase & Co (JPM) N/A $15,001 - Dividends $201 - $1,000

$50,000

2.15 MainStay MacKay Convertible Fund Cl I Yes $1,001 - $15,000 $201 - $1,000

(MCNVX)

2.16 Matthews Asia Dividend Fund Inv Cl (MAPIX) Yes $15,001 - $201 - $1,000

$50,000

2.17 MFS Mid Cap Growth Fund Cl A (OCTAX) Yes $1,001 - $15,000 $201 - $1,000

2.18 NCR Corp (NCR) N/A $1,001 - $15,000 None (or less

than $201)

2.19 Nuveen Santa Barbara Int'l Div Growth I Yes $15,001 - $201 - $1,000

(NUIIX) $50,000

2.20 Oppenheimer Senior Floating Rate Fund Cl Y Yes $1,001 - $15,000 $201 - $1,000

(OOSYX)

2.21 Parnassus Endeavor Fund Inv Shares Yes $100,001 - $5,001 - $15,000

(PARWX) $250,000

2.22 Toyota Motor Corp ADR (TM) N/A $1,001 - $15,000 None (or less

than $201)

2.23 Universal Health Services, Inc Cl B (UHS) N/A $15,001 - None (or less

$50,000 than $201)

2.24 Vanguard Total Bond Market Index Fund Inv Yes $15,001 - $1,001 - $2,500

Shares (VBMFX) $50,000

2.25 Vanguard Total Stock Market ETF (VTI) Yes $100,001 - $1,001 - $2,500

$250,000

3 AXA Equitable Cornerstone, variable annuity See Endnote No

Bolton, John - Page 23

# DESCRIPTION EIF VALUE INCOME TYPE INCOME

AMOUNT

3.1 1290 VT GAMCO Small Company Value Yes $50,001 - None (or less

Portfolio $100,000 than $201)

3.2 Fidelity VIP Contrafund Portfolio Yes $250,001 - None (or less

$500,000 than $201)

3.3 Fidelity VIP Mid Cap Portfolio Yes $100,001 - None (or less

$250,000 than $201)

3.4 Franklin Strategic Income VIP Fund Yes $50,001 - None (or less

$100,000 than $201)

3.5 Guaranteed Benefit AXA Moderate Growth See Endnote Yes $500,001 - $15,001 -

Strategy $1,000,000 $50,000

3.6 Lazard Retirement Emerging Markets Yes $15,001 - None (or less

$50,000 than $201)

3.7 MFS International Value Portfolio Yes $100,001 - None (or less

$250,000 than $201)

3.8 PIMCO VIT Total Return Portfolio Yes $15,001 - None (or less

$50,000 than $201)

3.9 Templeton Global Bond VIP Fund Yes $50,001 - None (or less

$100,000 than $201)

4 AXA Equitable IncentiveLife 2000, variable See Endnote No

life insurance

4.1 EQ/Common Stock Index Portfolio Yes $50,001 - None (or less

$100,000 than $201)

4.2 EQ Guaranteed Interest Account (cash N/A $1,001 - $15,000 None (or less

account) than $201)

4.3 EQ/International Equity Index Portfolio Yes $15,001 - None (or less

$50,000 than $201)

4.4 Multimanager Aggressive Equity Portfolio Yes $15,001 - None (or less

$50,000 than $201)

5 AXA Income Manager, variable annuity See Endnote No

Bolton, John - Page 24

# DESCRIPTION EIF VALUE INCOME TYPE INCOME

AMOUNT

5.1 00064 EQ/Common Stock Index Yes $50,001 - None (or less

$100,000 than $201)

5.2 00070 EQ/International Equity Yes $15,001 - None (or less

$50,000 than $201)

5.3 00127 2/15/2022 Fixed Maturity Option See Endnote Yes $50,001 - None (or less

$100,000 than $201)

5.4 00227 AXA Large Cap Growth Managed Yes $15,001 - None (or less

$50,000 than $201)

5.5 00231 AXA Mid Cap Value Managed Volatility Yes $15,001 - None (or less

$50,000 than $201)

5.6 00447 EQ/Core Bond Index Yes $15,001 - None (or less

$50,000 than $201)

6 AXA Equivest, variable annuity No

6.1 AXA Moderate Allocation fund Yes $1,001 - $15,000 None (or less

than $201)

6.2 EQ/Core Bond Index Yes $15,001 - None (or less

$50,000 than $201)

6.3 1290 VT GAMCO Mergers & Acquisitions Yes $15,001 - None (or less

Portfolio $50,000 than $201)

6.4 1290 VT GAMCO Small Company Value Yes $50,001 - None (or less

Portfolio $100,000 than $201)

6.5 EQ/Global Equity Managed Volatility Yes $15,001 - None (or less

$50,000 than $201)

6.6 EQ/JPMorgan Value Opportunities Portfolio Yes $50,001 - None (or less

$100,000 than $201)

6.7 EQ/Large Cap Growth Managed Volatility Yes $100,001 - None (or less

Portfolio $250,000 than $201)

6.8 EQ/Global Bond PLUS Portfolio Yes $15,001 - None (or less

$50,000 than $201)

Bolton, John - Page 25

# DESCRIPTION EIF VALUE INCOME TYPE INCOME

AMOUNT

6.9 EQ/International Equity Index Portfolio Yes $100,001 - None (or less

$250,000 than $201)

7 Brokerage account #3 No

7.1 iShares STOXX Europe 600 Financial Services Yes $15,001 - $1,001 - $2,500

UCTIS ETF $50,000

7.2 iShares Eu Cor Bond 1–5yr UCITS ETF Yes $100,001 - $201 - $1,000

$250,000

7.3 iShares EO Govt Bond 1–3yr UCITS ETF Yes $50,001 - None (or less

$100,000 than $201)

7.4 iShares EURO STOXX Small UCTIS ETF Yes $50,001 - $1,001 - $2,500

$100,000

7.5 iShares STOXX Eurpoe 600 UCTIS ETF (DJXXF) Yes $250,001 - $15,001 -

$500,000 $50,000

7.6 iShares TecDAX UCTIS ETF (EX Yes $15,001 - None (or less

Thesaurierungs Anteile) $50,000 than $201)

8 AXA Equitable Incentive Life Plus, phase 2, No

variable life insurance

8.1 AXA Large Cap Value Managed Volatility Yes $50,001 - None (or less

$100,000 than $201)

8.2 EQ/Large Cap Growth Index Portfolio Yes $50,001 - None (or less

$100,000 than $201)

9 AXA Equitable Incentive Life 2000 variable No

life insurance

9.1 EQ/Common Stock Index Yes $50,001 - None (or less

$100,000 than $201)

9.2 EQ/International Equity Index Portfolio Yes $50,001 - None (or less

$100,000 than $201)

9.3 Multimanager Aggressive Equity Yes $50,001 - None (or less

$100,000 than $201)

Bolton, John - Page 26

# DESCRIPTION EIF VALUE INCOME TYPE INCOME

AMOUNT

9.4 Guaranteed Interest Account (cash account) N/A $1,001 - $15,000 Interest $201 - $1,000

10 Champion 100K, variable life No

10.1 AXA Moderate Allocation Portfolio Yes $15,001 - None (or less

$50,000 than $201)

11 AXA Survivorship 2000, variable life No

11.1 AXA Moderate Plus Allocation Yes $100,001 - None (or less

$250,000 than $201)

12 HSA Health savings account (cash) N/A $1,001 - $15,000 None (or less

than $201)

13 HSBC U.K. cash accounts N/A $500,001 - None (or less

$1,000,000 than $201)

14 U.S. bank #1 cash account N/A $100,001 - None (or less

$250,000 than $201)

15 U.S. bank #2 cash accounts N/A $50,001 - Interest $201 - $1,000

$100,000

16 Commercial real estate, Bethesda, MD N/A $250,001 - None (or less

$500,000 than $201)

17 Undeveloped land, Harpers Ferry, WV N/A $250,001 - None (or less

$500,000 than $201)

18 Randolph Private Equity Funds No

18.1 2008 DIF See Endnote No $1,001 - $15,000 Dividends $5,001 - $15,000

Capital Gains

Interest

Rent or

Royalties

18.1.1 Air Medical Group Holding (Air Evac N/A

Lifeteam)

18.1.2 Critigen (spatial information technology) N/A

Bolton, John - Page 27

# DESCRIPTION EIF VALUE INCOME TYPE INCOME

AMOUNT

18.1.3 Geospatial Holdings (imaging technologies) N/A

18.1.4 Eastern Mountain Sports (sporting/outdoor N/A

equipment retailer)

18.1.5 Distribution International (industrial/marine N/A

meterials)

18.1.6 Dynamic Systems, Inc (mechanical and N/A

process construction services)

18.1.7 Eddie Bauer (apparel retailer) N/A

18.1.8 Clover Technologies (technology products N/A

recycling)

18.1.9 Grandpoint (banking and investments) N/A

18.1.1 GGC Security Holdings (security system N/A

0 services)

18.1.1 GTCR Fund X, L.P. Yes

1

18.1.1 GTCR Fund X AIV, L.P. Yes

2

18.1.1 Herndon Aerospace & Defense (supply N/A

3 chain management)

18.1.1 Infor Enterprise Applications (business N/A

4 application software)

18.1.1 J Jill (apparel retailer) N/A

5

18.1.1 Lantiq Topco / Infineon (semiconductors) N/A

6

18.1.1 Maranon Mezzanine Executive Fund, L.P. Yes

7

Bolton, John - Page 28

# DESCRIPTION EIF VALUE INCOME TYPE INCOME

AMOUNT

18.1.1 Next Models (model management) N/A

8

18.1.1 National Warranty Corporation / Payment N/A

9 Insured Plan, Inc. (automotive finance and

insurance, warranties)

18.1.2 Warranty Topco / Payment Insurance / N/A

0 Interstate (automotive service contracts and

warranties)

18.1.2 Financial American Holdings Corporation N/A

1 (insurance)

18.1.2 Parthenon Capital Partners Fund, L.P. Yes

2

18.1.2 Pugnacious Endeavors, Inc. (Viagogo) (online N/A

3 ticket exchange)

18.1.2 Sierra-Cedar (consulting and shared service N/A

4 provider)

18.1.2 Tejas Industries (industrial machine N/A

5 manufacturer)

18.1.2 Trinseo (chemicals, plastics, latex, synthetic N/A

6 rubber manufacturer)

18.1.2 United Recovery Systems (debt collection) N/A

7

18.1.2 Vestar / InHealth Co-Investors, L.P. No

8

18.1.2 Health Grades (online health provider N/A

8.1 information and marketing)

18.1.2 WFG-Williston Financial Group (financial N/A

9 services)

Bolton, John - Page 29

# DESCRIPTION EIF VALUE INCOME TYPE INCOME

AMOUNT

18.2 2011 DIF See Endnote No $1,001 - $15,000 Dividends $5,001 - $15,000

Capital Gains

Interest

Rent or

Royalties

18.2.1 Aavid Thermalloy (thermal engineering N/A

services and products)

18.2.2 AMZ Ultimate Holding (Arr-Maz) (custom N/A

chemicals)

18.2.3 Apex Tool (hand and power tool N/A

manufacturer)

18.2.4 Apple Leisure (travel and hospitality N/A

services)

18.2.5 Atento (business process outsourcing and N/A

customer experience management services)

18.2.6 Benihana (restaurant chain) N/A

18.2.7 California Pizza Kitchen (restaurant chain) N/A

18.2.8 China Fire and Security Group (fire N/A

protection products)

18.2.9 Chromaflo Technologies LLC (thermoset N/A

plastics)

18.2.1 Collective Brands (Payless) (footwear N/A

0 retailer)

18.2.1 Consolidated Container Company (plastic N/A

1 packaging)

18.2.1 Digital Reasoning (cognitive computing N/A

2 services)

18.2.1 Elgin Equipment Group, LLC (industrial N/A

3 equipment for material handling and

mineral processing)

Bolton, John - Page 30

# DESCRIPTION EIF VALUE INCOME TYPE INCOME

AMOUNT

18.2.1 Elgin Fastener Group, LLC (fastener N/A

4 manufacturer)

18.2.1 EP Minerals (mines, produces and sells N/A

5 earthen products)

18.2.1 Freedom Innovations (prosthetics) N/A

6

18.2.1 GTCR Fund X, L.P. Yes

7

18.2.1 GTCR Fund X AIV, L.P. Yes

8

18.2.1 HVH Transportation (transportation and N/A

9 distribution services)

18.2.2 Integrated Supply Network (supply chain N/A

0 services provider)

18.2.2 International Market Centers (showroom N/A

1 space operator)

18.2.2 Kestra Medical (medical devices) N/A

2

18.2.2 Laborie Medical Technologies (medical N/A

3 devices)

18.2.2 Linq3 Technologies, LLC (lottery services) N/A

4

18.2.2 National Pen Company, LLC N/A

5 (marketing/promotional products)

18.2.2 Phillips & Temro Industries (heating, cooling, N/A

6 electrical component manufacturer)

18.2.2 Albert Tire (wholesale tire distributor) N/A

7

Bolton, John - Page 31

# DESCRIPTION EIF VALUE INCOME TYPE INCOME

AMOUNT

18.2.2 PS Holdings of Delaware (Pacific Sun) N/A

8 (apparel retailer)

18.2.2 Quest Specialty Chemicals, Inc. (specialty N/A

9 chemicals and coatings)

18.2.3 Rogue Wave (enterprise applications) N/A

0

18.2.3 Rough Country Suspension Systems (off- N/A

1 road automotive accessories)

18.2.3 Service King (automotive collision repair ) N/A

2

18.2.3 Shelter Mortgage (mortgage lender) N/A

3

18.2.3 Terra/Tuthill Drive Systems, Inc (drive N/A

4 system manufacturer)

18.2.3 Tollgrade Communications (fault detection N/A

5 hardware and software)

18.2.3 Total Container Group, Inc (industrial N/A

6 containers)

18.2.3 Tri-Ed Distribution (security and home N/A

7 automation products)

18.2.3 True Temper Holdings Corporation, Inc N/A

8 (equipment manufacturer)

18.2.3 Wholesome Pet Care (pet food) N/A

9

18.3 Carlyle US Equity Opportunity Fund See Endnote Yes $1,001 - $15,000 $5,001 - $15,000

18.4 Creador I, LLC See Endnote Yes $1,001 - $15,000 $2,501 - $5,000

18.5 Creador - Sky Vision See Endnote Yes $1,001 - $15,000 None (or less

than $201)

Bolton, John - Page 32

# DESCRIPTION EIF VALUE INCOME TYPE INCOME

AMOUNT

18.6 Creador II See Endnote Yes $15,001 - $5,001 - $15,000

$50,000

18.7 Energy GP III See Endnote Yes $15,001 - None (or less

$50,000 than $201)

18.8 Maranon Mezzanine II See Endnote Yes $15,001 - $5,001 - $15,000

$50,000

18.9 Sankaty Middle Market Opps II See Endnote Yes $15,001 - $201 - $1,000

$50,000

18.10 Saratoga Asia III See Endnote Yes $1,001 - $15,000 $5,001 - $15,000

18.11 Summit Growth VII-A See Endnote Yes $15,001 - $5,001 - $15,000

$50,000

18.12 Whitney VII See Endnote Yes $15,001 - $15,001 -

$50,000 $50,000

19 Rhone Partners IV LP Consolidated See Endnote No $100,001 - Dividends None (or less

Partnership $250,000 Capital Gains than $201)

Interest

Rent or

Royalties

19.1 Orion Engineered Carbons (manufactuer N/A

and supplier of rubber carbon blacks)

19.2 S&B Minerals S.a.r.l. (mining, processing and N/A

trade of industrial minerals)

19.3 CSM Bakery Supplies Limited (bakery N/A

ingredients, finished products and services

for retail and foodservice markets)

19.4 Eden Springs Group (workplace water and N/A

coffee services and supplied)

19.5 ASK Chemicals (foundry consumables: N/A

binders, coatings, feeders, filters, release

agents, inoculants, inoculation wires, master

alloys)

Bolton, John - Page 33

# DESCRIPTION EIF VALUE INCOME TYPE INCOME

AMOUNT

19.6 Elizabeth Arden (cosmetics, skin care and N/A

fragrances)

19.7 Ranpak (paper-based packaging systems) N/A

19.8 Global Knowledge Training (IT and Business N/A

skills training)

19.9 Neovia Logistics (industrial contract N/A

logistics)

20 Rhone Partners V LP See Endnote No $100,001 - None (or less

$250,000 than $201)

20.1 GardaWorld Security (risk assessments, N/A

security personnel, and screening and cash

management services)

20.2 Zodiac Pool Solutions (pool and spa N/A

products)

20.3 VistaJet Group Holding Limited (private jet N/A

services)

21 Rhone Capital III LP Consolidated See Endnote No $1,001 - $15,000 Dividends $15,001 -

Partnership Capital Gains $50,000

Interest

Rent or

Royalties

21.1 Orion Engineered Carbons (manufactuer N/A

and supplier of rubber carbon blacks)

21.2 Coty lnc (cosmetic, skin, fragrance & hair N/A

products)

21.3 UTEX Industries Inc (sealing products) N/A

21.4 Euromar LLC (shipping vessel operation and N/A

management)

21.5 Quiksilver Inc (apparel retailer) N/A

Bolton, John - Page 34

# DESCRIPTION EIF VALUE INCOME TYPE INCOME

AMOUNT

21.6 Greek Yellow Pages (online directory) N/A

21.7 Arizona Chemical (manufacturing and N/A

biorefining pine chemicals)

21.8 Magnesita Refratarios SA (refractory N/A

products)

7. Transactions

(N/A) - Not required for this type of report

8. Liabilities

# CREDITOR NAME TYPE AMOUNT YEAR RATE TERM

INCURRED

1 Rhone Partners IV LP Capital $10,001 - 2018 n/a n/a

commitment $15,000

2 Rhone Partners V LP Capital $250,001 - 2018 n/a n/a

commitment $500,000

3 Randolph Private Equity funds Capital $50,001 - 2018 n/a n/a

commitment $100,000

9. Gifts and Travel Reimbursements

(N/A) - Not required for this type of report

Bolton, John - Page 35

Endnotes

PART # ENDNOTE

2. 1 Income amount reflects exercise of SARs prior to filing date. Remaining SARs are underwater as of

filing date.

2. 7 2018 advisory fee based on firm performance attributable to my services prior to separating from

Rhone has not been calculated as of the filing date. See Part 3.

5. 6 Acquired through employee stock purchase plan.

6. 3 Listed underlying holdings are "separate accounts" in the annuity, which does not report sources of

changes in the values. The annuity has a guaranteed growth feature for the future annuity base if

annuitized.

6. 3.5 Guaranteed growth component; income estimated.

6. 4 Listed underlying holdings are variable "separate accounts" in the policy, which does not report

sources of changes in the values.

6. 5 Variable annuity with a guaranteed base for annuity purposes that goes up 6% per year but cannot be

taken out as a cash value. Underlying holdings are variable "separate accounts" in the annuity, which

does not provide information on source of increases or decreases in value.

6. 5.3 This fund has a guaranteed maturity value, but we don't have the specifics of what it will be worth in

2022

6. 18.1 Reported income reflects estimate based on prior performance; income for 2017 will not be reported

until K-1 is issued later in 2018.

6. 18.2 Reported income reflects estimate based on prior performance; income for 2017 will not be reported

until K-1 is issued later in 2018.

6. 18.3 Reported income reflects estimate based on prior performance; income for 2017 will not be reported

until K-1 is issued later in 2018.

6. 18.4 Reported income reflects estimate based on prior performance; income for 2017 will not be reported

until K-1 is issued later in 2018.

6. 18.5 Reported income reflects estimate based on prior performance; income for 2017 will not be reported

until K-1 is issued later in 2018.

6. 18.6 This fund has 15 holdings. I am a 1.62% owner.

Bolton, John - Page 36

PART # ENDNOTE

6. 18.7 Reported income reflects estimate based on prior performance; income for 2017 will not be reported

until K-1 is issued later in 2018.

6. 18.8 Reported income reflects estimate based on prior performance; income for 2017 will not be reported

until K-1 is issued later in 2018.

6. 18.9 Reported income reflects estimate based on prior performance; income for 2017 will not be reported

until K-1 is issued later in 2018.

6. 18.10 Reported income reflects estimate based on prior performance; income for 2017 will not be reported

until K-1 is issued later in 2018.

6. 18.11 Reported income reflects estimate based on prior performance; income for 2017 will not be reported

until K-1 is issued later in 2018.

6. 18.12 Reported income reflects estimate based on prior performance; income for 2017 will not be reported

until K-1 is issued later in 2018.

6. 19 Value and income of underlying assets not readily ascertainable. Reported income is based on

preliminary information from fund manager on 2017 income.

6. 20 Value and income of underlying assets not readily ascertainable. Reported income is based on

preliminary information from fund manager for 2017.

6. 21 Value and income of underlying assets not readily ascertainable. Reported income is estimated based

on preliminary income information from fund managers for 2017.

Bolton, John - Page 37

Summary of Contents

1. Filer's Positions Held Outside United States Government

Part 1 discloses positions that the filer held at any time during the reporting period (excluding positions with the United States Government). Positions are reportable

even if the filer did not receive compensation.

This section does not include the following: (1) positions with religious, social, fraternal, or political organizations; (2) positions solely of an honorary nature; (3) positions

held as part of the filer's official duties with the United States Government; (4) mere membership in an organization; and (5) passive investment interests as a limited

partner or non-managing member of a limited liability company.

2. Filer's Employment Assets & Income and Retirement Accounts

Part 2 discloses the following:

● Sources of earned and other non-investment income of the filer totaling more than $200 during the reporting period (e.g., salary, fees, partnership share,

honoraria, scholarships, and prizes)

● Assets related to the filer's business, employment, or other income-generating activities that (1) ended the reporting period with a value greater than $1,000 or (2)

produced more than $200 in income during the reporting period (e.g., equity in business or partnership, stock options, retirement plans/accounts and their

underlying holdings as appropriate, deferred compensation, and intellectual property, such as book deals and patents)

This section does not include assets or income from United States Government employment or assets that were acquired separately from the filer's business,

employment, or other income-generating activities (e.g., assets purchased through a brokerage account). Note: The type of income is not required if the amount of

income is $0 - $200 or if the asset qualifies as an excepted investment fund (EIF).

3. Filer's Employment Agreements and Arrangements

Part 3 discloses agreements or arrangements that the filer had during the reporting period with an employer or former employer (except the United States

Government), such as the following:

● Future employment

● Leave of absence

● Continuing payments from an employer, including severance and payments not yet received for previous work (excluding ordinary salary from a current employer)

● Continuing participation in an employee welfare, retirement, or other benefit plan, such as pensions or a deferred compensation plan

● Retention or disposition of employer-awarded equity, sharing in profits or carried interests (e.g., vested and unvested stock options, restricted stock, future share of

a company's profits, etc.)

Bolton, John - Page 38

4. Filer's Sources of Compensation Exceeding $5,000 in a Year

Part 4 discloses sources (except the United States Government) that paid more than $5,000 in a calendar year for the filer's services during any year of the reporting

period.

The filer discloses payments both from employers and from any clients to whom the filer personally provided services. The filer discloses a source even if the source

made its payment to the filer's employer and not to the filer. The filer does not disclose a client's payment to the filer's employer if the filer did not provide the services

for which the client is paying.

5. Spouse's Employment Assets & Income and Retirement Accounts

Part 5 discloses the following:

● Sources of earned income (excluding honoraria) for the filer's spouse totaling more than $1,000 during the reporting period (e.g., salary, consulting fees, and

partnership share)

● Sources of honoraria for the filer's spouse greater than $200 during the reporting period

● Assets related to the filer's spouse's employment, business activities, other income-generating activities that (1) ended the reporting period with a value greater

than $1,000 or (2) produced more than $200 in income during the reporting period (e.g., equity in business or partnership, stock options, retirement plans/accounts

and their underlying holdings as appropriate, deferred compensation, and intellectual property, such as book deals and patents)

This section does not include assets or income from United States Government employment or assets that were acquired separately from the filer's spouse's business,

employment, or other income-generating activities (e.g., assets purchased through a brokerage account). Note: The type of income is not required if the amount of

income is $0 - $200 or if the asset qualifies as an excepted investment fund (EIF). Amounts of income are not required for a spouse's earned income (excluding

honoraria).

6. Other Assets and Income

Part 6 discloses each asset, not already reported, that (1) ended the reporting period with a value greater than $1,000 or (2) produced more than $200 in investment

income during the reporting period. For purposes of the value and income thresholds, the filer aggregates the filer's interests with those of the filer's spouse and

dependent children.

This section does not include the following types of assets: (1) a personal residence (unless it was rented out during the reporting period); (2) income or retirement

benefits associated with United States Government employment (e.g., Thrift Savings Plan); and (3) cash accounts (e.g., checking, savings, money market accounts) at a

single financial institution with a value of $5,000 or less (unless more than $200 of income was produced). Additional exceptions apply. Note: The type of income is not

required if the amount of income is $0 - $200 or if the asset qualifies as an excepted investment fund (EIF).

7. Transactions

Bolton, John - Page 39

Part 7 discloses purchases, sales, or exchanges of real property or securities in excess of $1,000 made on behalf of the filer, the filer's spouse or dependent child during

reporting period.

This section does not include transactions that concern the following: (1) a personal residence, unless rented out; (2) cash accounts (e.g., checking, savings, CDs, money

market accounts) and money market mutual funds; (3) Treasury bills, bonds, and notes; and (4) holdings within a federal Thrift Savings Plan account. Additional

exceptions apply.

8. Liabilities

Part 8 discloses liabilities over $10,000 that the filer, the filer's spouse or dependent child owed at any time during the reporting period.

This section does not include the following types of liabilities: (1) mortgages on a personal residence, unless rented out (limitations apply for PAS filers); (2) loans

secured by a personal motor vehicle, household furniture, or appliances, unless the loan exceeds the item's purchase price; and (3) revolving charge accounts, such as

credit card balances, if the outstanding liability did not exceed $10,000 at the end of the reporting period. Additional exceptions apply.

9. Gifts and Travel Reimbursements

This section discloses:

● Gifts totaling more than $390 that the filer, the filer's spouse, and dependent children received from any one source during the reporting period.

● Travel reimbursements totaling more than $390 that the filer, the filer's spouse, and dependent children received from any one source during the reporting period.

For purposes of this section, the filer need not aggregate any gift or travel reimbursement with a value of $156 or less. Regardless of the value, this section does not

include the following items: (1) anything received from relatives; (2) anything received from the United States Government or from the District of Columbia, state, or

local governments; (3) bequests and other forms of inheritance; (4) gifts and travel reimbursements given to the filer's agency in connection with the filer's official travel;

(5) gifts of hospitality (food, lodging, entertainment) at the donor's residence or personal premises; and (6) anything received by the filer's spouse or dependent children

totally independent of their relationship to the filer. Additional exceptions apply.

Bolton, John - Page 40

Privacy Act Statement

Title I of the Ethics in Government Act of 1978, as amended (the Act), 5 U.S.C. app. § 101 et seq., as amended by the Stop Trading on Congressional Knowledge Act of

2012 (Pub. L. 112-105) (STOCK Act), and 5 C.F.R. Part 2634 of the U. S. Office of Government Ethics regulations require the reporting of this information. The primary use

of the information on this report is for review by Government officials to determine compliance with applicable Federal laws and regulations. This report may also be

disclosed upon request to any requesting person in accordance with sections 105 and 402(b)(1) of the Act or as otherwise authorized by law. You may inspect

applications for public access of your own form upon request. Additional disclosures of the information on this report may be made: (1) to any requesting person,

subject to the limitation contained in section 208(d)(1) of title 18, any determination granting an exemption pursuant to sections 208(b)(1) and 208(b)(3) of title 18; (2) to

a Federal, State, or local law enforcement agency if the disclosing agency becomes aware of violations or potential violations of law or regulation; (3) to another Federal

agency, court or party in a court or Federal administrative proceeding when the Government is a party or in order to comply with a judge-issued subpoena; (4) to a

source when necessary to obtain information relevant to a conflict of interest investigation or determination; (5) to the National Archives and Records Administration or

the General Services Administration in records management inspections; (6) to the Office of Management and Budget during legislative coordination on private relief

legislation; (7) to the Department of Justice or in certain legal proceedings when the disclosing agency, an employee of the disclosing agency, or the United States is a

party to litigation or has an interest in the litigation and the use of such records is deemed relevant and necessary to the litigation; (8) to reviewing officials in a new

office, department or agency when an employee transfers or is detailed from one covered position to another; (9) to a Member of Congress or a congressional office in

response to an inquiry made on behalf of an individual who is the subject of the record; (10) to contractors and other non-Government employees working on a

contract, service or assignment for the Federal Government when necessary to accomplish a function related to an OGE Government-wide system of records; and (11)

on the OGE Website and to any person, department or agency, any written ethics agreement filed with OGE by an individual nominated by the President to a position

requiring Senate confirmation. See also the OGE/GOVT-1 executive branch-wide Privacy Act system of records.

Public Burden Information

This collection of information is estimated to take an average of three hours per response, including time for reviewing the instructions, gathering the data needed, and

completing the form. Send comments regarding the burden estimate or any other aspect of this collection of information, including suggestions for reducing this

burden, to the Program Counsel, U.S. Office of Government Ethics (OGE), Suite 500, 1201 New York Avenue, NW., Washington, DC 20005-3917.

Pursuant to the Paperwork Reduction Act, as amended, an agency may not conduct or sponsor, and no person is required to respond to, a collection of information

unless it displays a currently valid OMB control number (that number, 3209-0001, is displayed here and at the top of the first page of this OGE Form 278e).

Bolton, John - Page 41

Das könnte Ihnen auch gefallen

- Barr, William P. Final278Dokument36 SeitenBarr, William P. Final278Erin LaviolaNoch keine Bewertungen

- Koons Et Al v. Reynolds Et Al.: Activists Sues New Jersey Over New Concealed Carry LawDokument22 SeitenKoons Et Al v. Reynolds Et Al.: Activists Sues New Jersey Over New Concealed Carry LawAmmoLand Shooting Sports NewsNoch keine Bewertungen

- Kellyanne Conway Amended ComplaintDokument2 SeitenKellyanne Conway Amended ComplaintLaw&Crime100% (1)

- TCOLE InvestigationDokument5 SeitenTCOLE InvestigationBob GambertNoch keine Bewertungen

- 03-02-28 "American Legal System Is Corrupt Beyond Recognition " Chief Judge, US Court of Appeals, 5th Circuit, Edith JonesDokument4 Seiten03-02-28 "American Legal System Is Corrupt Beyond Recognition " Chief Judge, US Court of Appeals, 5th Circuit, Edith JonesHuman Rights Alert - NGO (RA)100% (2)

- Vay V Allegheny CountyDokument7 SeitenVay V Allegheny CountyAllegheny JOB Watch100% (1)

- Sec. Austin Letter 3.28.23 (Final)Dokument2 SeitenSec. Austin Letter 3.28.23 (Final)Michael GinsbergNoch keine Bewertungen

- Motion For Joey Langston To Undue His Guilty PleaDokument13 SeitenMotion For Joey Langston To Undue His Guilty PleaRuss LatinoNoch keine Bewertungen

- Final Judgment Denying Election Contest (Lunceford V Craft)Dokument36 SeitenFinal Judgment Denying Election Contest (Lunceford V Craft)Rob LauciusNoch keine Bewertungen

- Flynn Motion To DismissDokument108 SeitenFlynn Motion To DismissLaw&CrimeNoch keine Bewertungen

- Petition To Seize Assets of Asian Massage Businesses and Owners in MissouriDokument22 SeitenPetition To Seize Assets of Asian Massage Businesses and Owners in MissouriElizabeth Nolan BrownNoch keine Bewertungen

- Lafferty InfoWars MT To StayDokument4 SeitenLafferty InfoWars MT To StayAnonymous pPSymSvyNoch keine Bewertungen

- Motion For Injunction, CottonwoodDokument3 SeitenMotion For Injunction, CottonwoodKaren AntonacciNoch keine Bewertungen

- CT State Auditor's Report On Judicial BranchDokument98 SeitenCT State Auditor's Report On Judicial BranchJournalistABC50% (2)

- UnpublishedDokument4 SeitenUnpublishedScribd Government DocsNoch keine Bewertungen

- Raymond Dearie Named As Mar-a-Lago ArbiterDokument10 SeitenRaymond Dearie Named As Mar-a-Lago ArbiterStef DygaNoch keine Bewertungen

- Cherenfant SentencingDokument29 SeitenCherenfant SentencingDavid Oscar MarkusNoch keine Bewertungen

- Inspector General's Report June 2017Dokument10 SeitenInspector General's Report June 2017Dave WilsonNoch keine Bewertungen

- Pennie v. Soros Et Al Amended ComplaintDokument66 SeitenPennie v. Soros Et Al Amended ComplaintBreitbartTexas100% (3)

- Petition For Extraordinary ReliefDokument3 SeitenPetition For Extraordinary ReliefAdam Forgie100% (1)

- Lawsuit To Block Trump From Running For President Filed in ColoradoDokument1 SeiteLawsuit To Block Trump From Running For President Filed in ColoradoRamonita GarciaNoch keine Bewertungen

- Appeals Court Decision HAVERHILL STEM, LLC & Another vs. LLOYD A JENNINGS & Another 2020-P-0537Dokument20 SeitenAppeals Court Decision HAVERHILL STEM, LLC & Another vs. LLOYD A JENNINGS & Another 2020-P-0537Grant EllisNoch keine Bewertungen

- Florida Bar Complaint Against PAM BONDI and MARK HAMILTONDokument22 SeitenFlorida Bar Complaint Against PAM BONDI and MARK HAMILTONNeil Gillespie100% (1)

- Atty Mario Apuzzo Filed Exceptions To NJ LtGov Challenging Admin Judge Masin Decision To Leave Ted Cruz On BallotDokument10 SeitenAtty Mario Apuzzo Filed Exceptions To NJ LtGov Challenging Admin Judge Masin Decision To Leave Ted Cruz On BallotprotectourlibertyNoch keine Bewertungen

- Shelley Joseph ResponseDokument5 SeitenShelley Joseph ResponseAndrew Martinez0% (1)

- Et Al.,: in The United States District Court For The District of ColumbiaDokument8 SeitenEt Al.,: in The United States District Court For The District of ColumbiaRHTNoch keine Bewertungen

- Chrisley Defamation CaseDokument38 SeitenChrisley Defamation CaseNational Content Desk100% (1)

- Ohio V YellenDokument12 SeitenOhio V YellenKaren KaslerNoch keine Bewertungen

- Hpsci Memo Key Points FinalDokument3 SeitenHpsci Memo Key Points FinalBreitbart News100% (3)

- Affidavit of Illegal Discriminatory Practice: F103 Issued 4/94 Revised 9/20/2011Dokument3 SeitenAffidavit of Illegal Discriminatory Practice: F103 Issued 4/94 Revised 9/20/2011Mary BagnaschiNoch keine Bewertungen

- Andrews V McCraw ComplaintDokument22 SeitenAndrews V McCraw ComplaintAmmoLand Shooting Sports NewsNoch keine Bewertungen

- Voeltz v. Obama - Final Opposition To Defendants Motion To Dismiss - Florida Electoral Challenge - 12/13/2012Dokument25 SeitenVoeltz v. Obama - Final Opposition To Defendants Motion To Dismiss - Florida Electoral Challenge - 12/13/2012ObamaRelease YourRecordsNoch keine Bewertungen

- California State Bar vs. Attorney Loren KleierDokument32 SeitenCalifornia State Bar vs. Attorney Loren KleierBakersfieldNowNoch keine Bewertungen

- Levine DeclarationDokument44 SeitenLevine DeclarationLarry Brennan100% (2)

- Response To LOR and Order Curtailment-RedactedDokument18 SeitenResponse To LOR and Order Curtailment-RedactedTim BrownNoch keine Bewertungen

- USA V Arpaio # 239 AMICUS BRIEF - Certain Members of Congress Opposing VacaturDokument15 SeitenUSA V Arpaio # 239 AMICUS BRIEF - Certain Members of Congress Opposing VacaturJack RyanNoch keine Bewertungen

- NORML Amicus BriefDokument36 SeitenNORML Amicus BriefLaw&Crime100% (1)

- Kerchner & Laudenslager V Obama (As Amended) - Petition Objection Filed 17feb2012 Amended 24feb2012Dokument26 SeitenKerchner & Laudenslager V Obama (As Amended) - Petition Objection Filed 17feb2012 Amended 24feb2012protectourliberty100% (1)

- Silverdale BellDokument15 SeitenSilverdale BellWTVCNoch keine Bewertungen

- Sealed Cases in (US) Federal CourtsDokument36 SeitenSealed Cases in (US) Federal CourtsImpello_TyrannisNoch keine Bewertungen

- 11-08-29 PRESS RELEASE: Corruption of The Los Angeles Superior Court, Its Causes and History - Contribution For The Leslie Brodie ReportDokument3 Seiten11-08-29 PRESS RELEASE: Corruption of The Los Angeles Superior Court, Its Causes and History - Contribution For The Leslie Brodie ReportHuman Rights Alert - NGO (RA)100% (1)

- Memorandum of Law Employee Not OfficerDokument5 SeitenMemorandum of Law Employee Not OfficerbiscuitheadNoch keine Bewertungen

- R & C, P.L.L.C.: Attorneys For Plaintiff Robert JohnsonDokument8 SeitenR & C, P.L.L.C.: Attorneys For Plaintiff Robert JohnsonJessicaNoch keine Bewertungen

- GOP Ballot Lawsuit Vs Libertarian Party (SCOTX)Dokument75 SeitenGOP Ballot Lawsuit Vs Libertarian Party (SCOTX)The TexanNoch keine Bewertungen

- Garrett Et Al v. The Ohio State University Motion For Miscellaneous ReliefDokument9 SeitenGarrett Et Al v. The Ohio State University Motion For Miscellaneous ReliefWSYX/WTTENoch keine Bewertungen

- Wisconsin DissentsDokument48 SeitenWisconsin DissentsLaw&CrimeNoch keine Bewertungen

- Salvatore J. Greco v. City of New York, Et Al. - Second Amended ComplaintDokument27 SeitenSalvatore J. Greco v. City of New York, Et Al. - Second Amended ComplaintEric SandersNoch keine Bewertungen

- Notice of Claim Letter - GR Jacobs PDFDokument33 SeitenNotice of Claim Letter - GR Jacobs PDFForBlue100% (1)

- McNair Motion For SJ Ducks Bank's InvolvementDokument11 SeitenMcNair Motion For SJ Ducks Bank's InvolvementMyrtleBeachSC news100% (1)

- Lawsuit: Student Sues Winslow Township School DistrictDokument9 SeitenLawsuit: Student Sues Winslow Township School Districtjalt61Noch keine Bewertungen

- (D.E. 357) Deposition Frederick S. Snow, First American Bank General Counsel & EVP - "Inspections & Appraisals"Dokument25 Seiten(D.E. 357) Deposition Frederick S. Snow, First American Bank General Counsel & EVP - "Inspections & Appraisals"larry-612445Noch keine Bewertungen

- Cheeley Response To Fani Final Brief Georgia RICODokument20 SeitenCheeley Response To Fani Final Brief Georgia RICORobert GouveiaNoch keine Bewertungen

- DOH IG Report On Rebekah JonesDokument268 SeitenDOH IG Report On Rebekah JonesPeter SchorschNoch keine Bewertungen

- Florida Supreme Court On Markeith LoydDokument39 SeitenFlorida Supreme Court On Markeith LoydJason KellyNoch keine Bewertungen

- 4th Circuit TSDB OrderDokument38 Seiten4th Circuit TSDB OrderLaw&CrimeNoch keine Bewertungen

- Purpura-Moran Initial Decision of ALJ MasinDokument9 SeitenPurpura-Moran Initial Decision of ALJ Masinpuzo1Noch keine Bewertungen

- The Handbook for Integrity in the Department of EnergyVon EverandThe Handbook for Integrity in the Department of EnergyNoch keine Bewertungen

- Declaration Of Independence and Constitution Of The United States Of America: With Analysis and InterpretationVon EverandDeclaration Of Independence and Constitution Of The United States Of America: With Analysis and InterpretationNoch keine Bewertungen

- Ashley Biles SentencingDokument5 SeitenAshley Biles SentencingErin LaviolaNoch keine Bewertungen

- Press Release 210417Dokument1 SeitePress Release 210417Erin LaviolaNoch keine Bewertungen

- USA V PhelpsDokument7 SeitenUSA V PhelpsJ RohrlichNoch keine Bewertungen

- Ashley Biles IndictmentDokument4 SeitenAshley Biles IndictmentErin LaviolaNoch keine Bewertungen

- Ian Baunach Probable Cause AffidavitDokument12 SeitenIan Baunach Probable Cause AffidavitErin Laviola100% (1)

- Niviane Phelps Detention OrderDokument1 SeiteNiviane Phelps Detention OrderErin LaviolaNoch keine Bewertungen

- Dominic Glass AffidavitDokument6 SeitenDominic Glass AffidavitErin LaviolaNoch keine Bewertungen

- Landon Perry Grier - Statement of FactsDokument6 SeitenLandon Perry Grier - Statement of FactsLaw&CrimeNoch keine Bewertungen

- Grier Conditions of ReleaseDokument3 SeitenGrier Conditions of ReleaseErin LaviolaNoch keine Bewertungen

- Kelly McKin Arrest AffidavitDokument4 SeitenKelly McKin Arrest AffidavitErin LaviolaNoch keine Bewertungen

- Ernest Mcknight Arrest ReportDokument5 SeitenErnest Mcknight Arrest ReportErin LaviolaNoch keine Bewertungen

- Michael Haak ComplaintDokument1 SeiteMichael Haak ComplaintErin LaviolaNoch keine Bewertungen

- Chance Seneca ComplaintDokument8 SeitenChance Seneca ComplaintErin Laviola100% (1)

- Claire Miller AffidavitDokument4 SeitenClaire Miller AffidavitErin Laviola75% (4)

- Landon Grier BondDokument2 SeitenLandon Grier BondErin LaviolaNoch keine Bewertungen

- Koby Francis 2018 Arrest Court DocketDokument11 SeitenKoby Francis 2018 Arrest Court DocketErin LaviolaNoch keine Bewertungen

- Matthew Leatham ComplaintDokument2 SeitenMatthew Leatham ComplaintErin LaviolaNoch keine Bewertungen

- Claire Miller DocketDokument2 SeitenClaire Miller DocketErin Laviola50% (2)

- OC Communicator - Oct 2 07Dokument6 SeitenOC Communicator - Oct 2 07Erin LaviolaNoch keine Bewertungen

- Lil Wayne AttorneyDokument1 SeiteLil Wayne AttorneyErin LaviolaNoch keine Bewertungen

- Koby Francis 2017 Arrest Court DocketDokument7 SeitenKoby Francis 2017 Arrest Court DocketErin LaviolaNoch keine Bewertungen

- Davis and Williams AffidavitDokument4 SeitenDavis and Williams AffidavitErin LaviolaNoch keine Bewertungen

- OCSO Statement DO ChargesDokument1 SeiteOCSO Statement DO ChargesErin LaviolaNoch keine Bewertungen

- Alec Denney ArrestDokument2 SeitenAlec Denney ArrestErin LaviolaNoch keine Bewertungen

- Lil Wayne Charge DocumentDokument5 SeitenLil Wayne Charge DocumentErin LaviolaNoch keine Bewertungen

- 10-9-2020 Barker Park Media ReleaseDokument1 Seite10-9-2020 Barker Park Media ReleaseErin LaviolaNoch keine Bewertungen

- Hendershott Miles and Butler AffidavitDokument15 SeitenHendershott Miles and Butler AffidavitErin LaviolaNoch keine Bewertungen

- Initial Suicide Report - RedactedDokument2 SeitenInitial Suicide Report - RedactedErin LaviolaNoch keine Bewertungen

- Case Synopsis, ME20-2404, Baker, NevanDokument1 SeiteCase Synopsis, ME20-2404, Baker, NevanErin LaviolaNoch keine Bewertungen

- #8 Firing Email From Headmaster 9-5-2020Dokument3 Seiten#8 Firing Email From Headmaster 9-5-2020Erin LaviolaNoch keine Bewertungen

- Mannitol For Reduce IOPDokument7 SeitenMannitol For Reduce IOPHerryantoThomassawaNoch keine Bewertungen

- SC Circular Re BP 22 Docket FeeDokument2 SeitenSC Circular Re BP 22 Docket FeeBenjamin HaysNoch keine Bewertungen

- PDS Air CompressorDokument1 SeitePDS Air Compressordhavalesh1Noch keine Bewertungen

- Tingalpa Green New Townhouse Development BrochureDokument12 SeitenTingalpa Green New Townhouse Development BrochureMick MillanNoch keine Bewertungen

- Contoh Kuda-Kuda Untuk Pak Henry Truss D&EKK1L KDokument1 SeiteContoh Kuda-Kuda Untuk Pak Henry Truss D&EKK1L KDhany ArsoNoch keine Bewertungen

- Toyota Auris Corolla 2007 2013 Electrical Wiring DiagramDokument22 SeitenToyota Auris Corolla 2007 2013 Electrical Wiring Diagrampriscillasalas040195ori100% (125)

- Impact of Carding Segments On Quality of Card Sliver: Practical HintsDokument1 SeiteImpact of Carding Segments On Quality of Card Sliver: Practical HintsAqeel AhmedNoch keine Bewertungen

- A Survey Report On The Preferred RestaurDokument22 SeitenA Survey Report On The Preferred RestaurEIGHA & ASHLEIGH EnriquezNoch keine Bewertungen

- DX DiagDokument16 SeitenDX DiagMihaela AndronacheNoch keine Bewertungen

- BACS2042 Research Methods: Chapter 1 Introduction andDokument36 SeitenBACS2042 Research Methods: Chapter 1 Introduction andblood unityNoch keine Bewertungen

- A Study of A Skirtless Hovercraft DesignDokument71 SeitenA Study of A Skirtless Hovercraft DesignSunil Kumar P GNoch keine Bewertungen

- Indian Institute of Technology (Indian School of Mines) DhabadDokument23 SeitenIndian Institute of Technology (Indian School of Mines) DhabadAmit KumarNoch keine Bewertungen

- Iso 269-2022-014 Rotary Table NDT Cat IV - Rev1Dokument1 SeiteIso 269-2022-014 Rotary Table NDT Cat IV - Rev1Durgham Adel EscanderNoch keine Bewertungen

- F5 - LTM TrainingDokument9 SeitenF5 - LTM TrainingAliNoch keine Bewertungen

- Module 8 - Simple Interest and Compound InterestDokument11 SeitenModule 8 - Simple Interest and Compound InterestDawn Juliana AranNoch keine Bewertungen

- Uploading, Sharing, and Image Hosting PlatformsDokument12 SeitenUploading, Sharing, and Image Hosting Platformsmarry janeNoch keine Bewertungen

- Objectives in DraftingDokument1 SeiteObjectives in Draftingshannejanoras03Noch keine Bewertungen

- Response LTR 13 330 VielmettiDokument2 SeitenResponse LTR 13 330 VielmettiAnn Arbor Government DocumentsNoch keine Bewertungen

- Account Statement From 1 Oct 2018 To 15 Mar 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDokument8 SeitenAccount Statement From 1 Oct 2018 To 15 Mar 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalancerohantNoch keine Bewertungen

- Arvind Textiles Internship ReportDokument107 SeitenArvind Textiles Internship ReportDipan SahooNoch keine Bewertungen

- Gears, Splines, and Serrations: Unit 24Dokument8 SeitenGears, Splines, and Serrations: Unit 24Satish Dhandole100% (1)

- 0601 FortecstarDokument3 Seiten0601 FortecstarAlexander WieseNoch keine Bewertungen

- White and Yellow Reflective Thermoplastic Striping Material (Solid Form)Dokument2 SeitenWhite and Yellow Reflective Thermoplastic Striping Material (Solid Form)FRANZ RICHARD SARDINAS MALLCONoch keine Bewertungen

- BCCA Semester New Syllabus Direction 2016-17 PDFDokument76 SeitenBCCA Semester New Syllabus Direction 2016-17 PDFChetana Gorakh100% (1)

- MAYA1010 EnglishDokument30 SeitenMAYA1010 EnglishjailsondelimaNoch keine Bewertungen

- Reliability EngineerDokument1 SeiteReliability EngineerBesuidenhout Engineering Solutions and ConsultingNoch keine Bewertungen

- SummaryDokument50 SeitenSummarygirjesh kumarNoch keine Bewertungen

- Assignment Mid Nescafe 111173001Dokument5 SeitenAssignment Mid Nescafe 111173001afnan huqNoch keine Bewertungen

- Class Participation 9 E7-18: Last Name - First Name - IDDokument2 SeitenClass Participation 9 E7-18: Last Name - First Name - IDaj singhNoch keine Bewertungen

- Microstrip Antennas: How Do They Work?Dokument2 SeitenMicrostrip Antennas: How Do They Work?Tebogo SekgwamaNoch keine Bewertungen