Beruflich Dokumente

Kultur Dokumente

27 Apple

Hochgeladen von

businessdatabasesOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

27 Apple

Hochgeladen von

businessdatabasesCopyright:

Verfügbare Formate

Apple Computer – 2011

Forest David

A. Case Abstract

Apple is a comprehensive strategic management case that includes the company’s year-end 2010 financial

statements, organizational chart, competitor information and more. The case time setting is the year 2011.

Sufficient internal and external data are provided to enable students to evaluate current strategies and

recommend a three-year strategic plan for the company. Headquartered in Cupertino, California, Apple’s

common stock is publicly traded under the ticker symbol AAPL.

Apple’s newest iPhone has spurred a revolution in cell phones and mobile computing. Even though founder

and CEO Steve Jobs has recently died, Apple continues to innovate its core Mac desktop and laptop

computers -- all of which feature its OS X operating system -- including the iMac all-in-one desktop and

MacBook portable for the consumer and education markets, and the high-end Mac Pro and MacBook Pro

for consumers and professionals involved in design and publishing. Apple has been immensely successful

with its digital music players (iPod) and online music store (iTunes). The company’s iPad tablet

omputer could become another revolutionary technological breakthrough. Apple gets more than half of its

sales from outside the US.

B. Vision Statement (proposed)

To be the most innovative computer, phone, and tablet company in the world.

C. Mission Statement (actual)

Apple Computer is committed to protecting the environment, health, and safety of our employees (9),

customers (1) and the global communities (3) where we operate. We recognize that by integrating sound

environmental, health, and safety management practices into all aspects of our business, we can offer

technologically innovative products (4) and services while conserving and enhancing resources for future

generations (6). Apple strives for continuous improvement in our environmental, health and safety

management systems and in the environmental quality (8) of our products, processes, and services.

1. Customers

2. Products or services

3. Markets

4. Technology

5. Concern for survival, growth, and profitability

6. Philosophy

7. Self-concept

8. Concern for public image

9. Concern for employees

Copyright ©2013 Pearson Education, Inc. publishing as Prentice Hall.

D. External Audit

Opportunities

1. Corporate demand for PCs is increasing.

2. Asia-Pacific sales increased 5.6% in first quarter 2011 and are expected to grow 32 percent in 2011.

3. Shipments to the Middle East, Eastern Europe and Latin America are expected to grow 19 percent in

2011.

4. Consumers prefer phones and tables today to desk top PCs and laptops.

5. Business analytic service industry is still in the development phase.

6. The US malware infection rate is 58.25%.

7. PCs are still the best option for typing, spreadsheets, and activities that require more processing power.

Threats

1. Hewlett-Packard is currently the #1 PC seller with 18.9 percent market share.

2. Competing firms using second and late mover strategies let Apple burden much of the R&D expense.

3. Acer and Lenovo based in Asia are impacting price and increasing their market share in the United

States.

4. Oracle, SAP, and IBM are well entrenched in the business analytics service industry.

5. Rapid technology advancement in the industry.

6. Slowly an increase in viruses created for Apple products.

7. Slowdowns in the global economy.

8. Volatile nature of currency rates.

Competitive Profile Matrix

Apple HP Dell

Critical Success Factors Weight Rating Score Rating Score Rating Score

Advertising 0.05 4 0.20 2 0.10 3 0.15

Market Penetration 0.08 2 0.16 4 0.32 3 0.24

Customer Service 0.05 4 0.20 2 0.10 3 0.15

Store Locations 0.01 4 0.04 2 0.02 1 0.01

R&D 0.12 4 0.48 2 0.24 1 0.12

Employee Dedication 0.05 4 0.20 1 0.05 2 0.10

Financial Profit 0.13 4 0.52 2 0.26 1 0.13

Customer Loyalty 0.08 4 0.32 1 0.08 2 0.16

Market Share 0.10 1 0.10 4 0.40 3 0.30

Product Quality 0.13 4 0.52 2 0.26 1 0.13

Top Management 0.10 4 0.40 2 0.20 3 0.30

Price Competitiveness 0.10 1 0.10 3 0.30 4 0.40

Totals 1.00 3.24 2.33 2.19

Copyright ©2013 Pearson Education, Inc. publishing as Prentice Hall.

EFE Matrix

Opportunities Weight Rating Weighted Score

1. Corporate demand for PCs is increasing. 0.10 1 0.10

2. Asia-Pacific sales increased 5.6% in first quarter 2011 and are 0.05 2 0.10

expected to grow 32 percent in 2011.

3. Shipments to the Middle East, Eastern Europe and Latin America 0.05 2 0.10

are expected to grow 19 percent in 2011.

4. Consumers prefer phones and tables today to desk top PCs and 0.10 4 0.40

laptops.

5. Business analytic service industry is still in the development 0.05 1 0.05

phase.

6. The US malware infection rate is 58.25%. 0.04 4 0.16

7. PCs are still the best option for typing, spreadsheets, and 0.08 2 0.16

activities that require more processing power.

Threats Weight Rating Weighted Score

1. Hewlett-Packard is currently the #1 PC seller with 18.9 percent

0.10 4 0.40

market share.

2. Competing firms using second and late mover strategies let

0.09 4 0.36

Apple burden much of the R&D expense.

3. Acer and Lenovo based in Asia are impacting price and

0.06 3 0.18

increasing their market share in the United States.

4. Oracle, SAP, and IBM are well entrenched in the business

0.06 1 0.06

analytics service industry.

5. Rapid technology advancement in the industry. 0.08 4 0.32

6. Slowly an increase in viruses created for Apple products. 0.06 4 0.24

7. Slowdowns in the global economy. 0.06 3 0.18

8. Volatile nature of currency rates. 0.02 3 0.06

TOTALS 1.00 2.87

E. Internal Audit

Strengths

1. Apple has sold 20 million iPads since the products April 2010 debut.

2. Products include Mac, iPhone, iPad, iPod, Xserve and more.

3. Sells products through retail stores, online stores, and direct sales force.

4. Operate 233 retail stores in the US and 84 internationally.

5. In 2010, Apple’s market capitalization surpassed Microsoft.

6. Employ a first mover approach and considered the best first mover ever.

7. Sales in the Americas and Europe increased 29% and 58% respectively.

8. iPhone sales increased 93% in 2010.

9. Desktop sales increased 43% in 2010.

10. Inventory turnover of 70.

Weaknesses

1. Lack a developed vision or mission statement.

2. Functional business structure.

Copyright ©2013 Pearson Education, Inc. publishing as Prentice Hall.

3. Unwillingness to use debt to finance.

4. Products are the most expensive in their class.

Financial Ratio Analysis

Growth Rate Percent Apple Industry S&P 500

Sales (Qtr vs year ago qtr) 39.00 36.30 14.50

Net Income (YTD vs YTD) NA NA NA

Net Income (Qtr vs year ago qtr) 53.70 54.40 47.50

Sales (5-Year Annual Avg.) 41.16 38.38 8.27

Net Income (5-Year Annual Avg.) 67.11 61.93 8.68

Dividends (5-Year Annual Avg.) NA NA 5.68

Profit Margin Percent

Gross Margin 40.5 39.1 39.9

Pre-Tax Margin 31.6 29.9 18.1

Net Profit Margin 24.0 22.7 13.2

5Yr Gross Margin (5-Year Avg.) 38.8 37.3 39.8

Liquidity Ratios

Debt/Equity Ratio 0.00 0.07 1.01

Current Ratio 1.6 1.6 1.4

Quick Ratio 1.6 1.6 0.9

Profitability Ratios

Return On Equity 41.7 42.2 26.0

Return On Assets 27.1 25.8 8.9

Return On Capital 36.3 35.1 11.8

Return On Equity (5-Year Avg.) 36.2 37.2 23.8

Return On Assets (5-Year Avg.) 23.0 22.0 8.0

Return On Capital (5-Year Avg.) 31.9 31.2 10.8

Efficiency Ratios

Income/Employee 429,172 401,304 126,213

Revenue/Employee 2 Mil 2 Mil 1 Mil

Receivable Turnover 19.9 19.1 15.7

Inventory Turnover 70.5 68.0 12.4

Net Worth Analysis (in millions)

Stockholders Equity $76,615

Net Income x 5 $129,610

(Share Price/EPS) x Net Income $361,615

Number of Shares Outstanding x Share Price $358,594

Method Average $231,609

Copyright ©2013 Pearson Education, Inc. publishing as Prentice Hall.

IFE Matrix

Strengths Weight Rating Weighted Score

1. Apple has sold 20 million iPads since the products April 2010

0.10 4 0.40

debut.

2. Products include Mac, iPhone, iPad, iPod, Xserve and more. 0.10 4 0.40

3. Sells products through retail stores, online stores, and direct

0.04 4 0.16

sales force.

4. Operate 233 retail stores in the US and 84 internationally. 0.04 4 0.16

5. In 2010, Apple’s market capitalization surpassed Microsoft. 0.11 4 0.44

6. Employ a first mover approach and considered the best first

0.11 4 0.44

mover ever.

7. Sales in the Americas and Europe increased 29% and 58%

0.07 4 0.28

respectively.

8. iPhone sales increased 93% in 2010. 0.10 4 0.40

9. Desktop sales increased 43% in 2010. 0.06 4 0.24

10. Inventory turnover of 70. 0.08 4 0.32

Weaknesses Weight Rating Weighted Score

1. Lack a developed vision or mission statement. 0.03 2 0.06

2. Functional business structure. 0.03 2 0.06

3. Unwillingness to use debt to finance. 0.03 2 0.06

4. Products are the most expensive in their class. 0.10 2 0.20

TOTALS 1.00 3.62

F. SWOT

SO Strategies

1. Build two new plants in India for the sole production of Powerbooks and Desktop machines at $400M

each (S9, O1).

2. Produce a new iPhone every 6 months (S8, O4).

WO Strategies

1. Publish a pubic vision and mission statement stressing desk top units as a vital part of the

business (W1, O1).

ST Strategies

1. Increase R&D by $300M (S6, T2).

2. Design automatically updating virus protection for all Apple products (S5, T6).

WT Strategies

1. Switch to a SBU structure (W1, T7).

Copyright ©2013 Pearson Education, Inc. publishing as Prentice Hall.

G. SPACE Matrix

FP

Conservative Aggressive

7

CP IP

-7 -6 -5 -4 -3 -2 -1 1 2 3 4 5 6 7

-1

-2

-3

-4

-5

-6

-7

Defensive Competitive

SP

Internal Analysis: External Analysis:

Financial Position (FP) Stability Position (SP)

Sales 7 Rate of Inflation -2

Gross Margin 7 Technological Changes -7

Debt/Equity 7 Substitute Products -5

ROE 6 Competitive Pressure -6

ROA 7 Barriers to Entry into Market -4

Financial Position (FP) Average 6.8 Stability Position (SP) Average -4.8

Internal Analysis: External Analysis:

Competitive Position (CP) Industry Position (IP)

Market Share -1 Growth Potential 6

Product Quality -1 Financial Stability 6

Customer Loyalty -1 Ease of Entry into Market 3

Technological know-how -1 Resource Utilization 5

Control over Suppliers and Distributors -1 Profit Potential 7

Competitive Position (CP) Average -1.0 Industry Position (IP) Average 5.4

Copyright ©2013 Pearson Education, Inc. publishing as Prentice Hall.

H. Grand Strategy Matrix

Rapid Market Growth

Quadrant II Quadrant I

Apple

Weak Strong

Competitive Competitive

Position Position

Quadrant III Quadrant IV

Slow Market Growth

Copyright ©2013 Pearson Education, Inc. publishing as Prentice Hall.

I. The Internal-External (IE) Matrix

The Total IFE Weighted Scores

Strong Average Weak

4.0 to 3.0 2.99 to 2.0 1.99 to 1.0

4.0 I II III

High

3.0 IV V VI

The

EFE Apple

Total Medium

Weighted

Scores

2.0 VII VIII IX

Low

1.0

Segment 2010 Revenue (millions)

Desktops $6,201

Portables 11,278

iPod 8,274

Music related 4,948

iPhone 25,179

iPad 4,958

Copyright ©2013 Pearson Education, Inc. publishing as Prentice Hall.

Peripherals 1,814

Software 2,573

Total 65,225

J. QSPM

Build two Increase

new plants R&D

Opportunities Weight AS TAS AS TAS

1. Corporate demand for PCs is increasing. 0.10 4 0.40 2 0.20

2. Asia-Pacific sales increased 5.6% in first quarter 2011 and are

0.05 4 0.20 2 0.10

expected to grow 32 percent in 2011.

3. Shipments to the Middle East, Eastern Europe and Latin America 0.05 4 0.20 2 0.10

4. Consumers prefer phones and tables today to desk top PCs and

0.10 2 0.20 4 0.40

laptops.

5. Business analytic service industry is still in the development 0.05 0 0.00 0 0.00

6. The US malware infection rate is 58.25%. 0.04 2 0.08 4 0.16

7. PCs are still the best option for typing, spreadsheets, and

activities that require more processing power. 0.08 4 0.32 3 0.24

Threats Weight AS TAS AS TAS

1. Hewlett-Packard is currently the #1 PC seller with 18.9 percent

0.10 4 0.40 2 0.20

market share.

2. Competing firms using second and late mover strategies let

0.09 2 0.18 4 0.36

Apple burden much of the R&D expense.

3. Acer and Lenovo based in Asia are impacting price and

0.06 3 0.18 2 0.12

increasing their market share in the United States.

4. Oracle, SAP, and IBM are well entrenched in the business

0.06 0 0.00 0 0.00

analytics service industry.

5. Rapid technology advancement in the industry. 0.08 2 0.16 4 0.32

6. Slowly an increase in viruses created for Apple products. 0.06 1 0.06 4 0.24

7. Slowdowns in the global economy. 0.06 0 0.00 0 0.00

8. Volatile nature of currency rates. 0.02 0 0.00 0 0.00

Copyright ©2013 Pearson Education, Inc. publishing as Prentice Hall.

Build two Increase

new plants R&D

Strengths Weight AS TAS AS TAS

1. Apple has sold 20 million iPads since the products April 2010

0.10 4 0.40 3 0.30

debut.

2. Products include Mac, iPhone, iPad, iPod, Xserve and more. 0.10 2 0.20 4 0.40

3. Sells products through retail stores, online stores, and direct

0.04 0 0.00 0 0.00

sales force.

4. Operate 233 retail stores in the US and 84 internationally. 0.04 0 0.00 0 0.00

5. In 2010, Apple’s market capitalization surpassed Microsoft. 0.11 4 0.44 3 0.33

6. Employ a first mover approach and considered the best first

0.11 1 0.11 4 0.44

mover ever.

7. Sales in the Americas and Europe increased 29% and 58%

0.07 4 0.28 3 0.21

respectively.

8. iPhone sales increased 93% in 2010. 0.10 3 0.30 4 0.40

9. Desktop sales increased 43% in 2010. 0.06 4 0.24 2 0.12

10. Inventory turnover of 70. 0.08 0 0.00 0 0.00

Weaknesses Weight AS TAS AS TAS

1. Lack a developed vision or mission statement. 0.03 0 0.00 0 0.00

2. Functional business structure. 0.03 0 0.00 0 0.00

3. Unwillingness to use debt to finance. 0.03 0 0.00 0 0.00

4. Products are the most expensive in their class. 0.10 3 0.30 4 0.40

TOTALS 4.65 5.04

K. Recommendations

1. Build two new plants in India for the sole production of Powerbooks and Desktop machines at $400M

each.

2. Produce a new iPhone every 6 months.

3. Publish a pubic vision and mission statement stressing desk top units as a vital part of the business.

4. Increase R&D by $300M.

5. Design automatically updating virus protection for all Apple products at $100M.

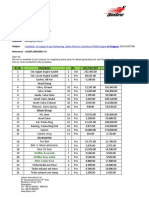

L. EPS/EBIT Analysis (in millions)

Amount Needed: $1,200M

Stock Price: $382

Shares Outstanding: 929

Interest Rate: 5%

Tax Rate: 24%

Copyright ©2013 Pearson Education, Inc. publishing as Prentice Hall.

Common Stock Financing Debt Financing

Recession Normal Boom Recession Normal Boom

EBIT $20,000 $35,000 $50,000 $20,000 $35,000 $50,000

Interest 0 0 0 60 60 60

EBT 20,000 35,000 50,000 19,940 34,940 49,940

Taxes 4,800 8,400 12,000 4,786 8,386 11,986

EAT 15,200 26,600 38,000 15,154 26,554 37,954

# Shares 932 932 932 929 929 929

EPS 16.31 28.54 40.77 16.31 28.58 40.86

20 Percent Stock 80 Percent Stock

Recession Normal Boom Recession Normal Boom

EBIT $20,000 $35,000 $50,000 $20,000 $35,000 $50,000

Interest 48 48 48 12 12 12

EBT 19,952 34,952 49,952 19,988 34,988 49,988

Taxes 4,788 8,388 11,988 4,797 8,397 11,997

EAT 15,164 26,564 37,964 15,191 26,591 37,991

# Shares 930 930 930 932 932 932

EPS 16.31 28.57 40.84 16.31 28.55 40.78

M. Epilogue

Apple continues to post impressive financial results. The only minor issue for Apple in their fiscal Q4 2011

was slightly lower-than-expected iPhone sales, as many customers delayed purchases over rumors of an

iPhone 5. Now that the iPhone 4S has been released, Apple sales are again surging. Apple's dominance in

the tablet market may however come under pressure in 2012 since two of the largest computer

manufacturers in the world, including Dell Inc., have begun working on new tablets that will run on

Windows 8, Microsoft's newest operating system set to be released in the second half of next year.

Apple’s net income for Q4 of 2011 that ended September 24, 2011 rose to $6.6 billion, or $7.05 per share,

up 54 percent from a year earlier. Apple's sales rose 39 percent to $28.3 billion. The company's sales for its

full fiscal year of 2011 were $108.2 billion -- a giant leap ahead of the $65.2 billion Apple raked in last

year.

As of November 1, 2011, Apple again edged out Exxon Mobil in the tight race to be the stock market's

most valuable company in the world. In its Q4 2011, Apple sold more than 17 million iPhones, falling

short of the previous two quarters' sales figures, as some consumers held out in anticipation of the new

iPhone 4S. That's still impressive, however, considering the iPhone 4 had already been on sale for more

than a year during the past quarter.

Apple’s iPad and Mac both set sales records during the company’s fiscal Q4 2011. IPad sales rose to 11.1

million, and Mac sales soared 4.89 million -- the first time Apple has even sold more than 4 million Macs

in a quarter. A recent Gartner survey of personal computer shipments showed that Apple's third-place PC

market share is growing, nibbling away at No. 2 Dell. However, the company’s iPod continued to slump,

with sales falling 27 percent to just 6.6 million units on Q4. That represented the fewest number of iPods

Apple has sold in six years.

Copyright ©2013 Pearson Education, Inc. publishing as Prentice Hall.

Copyright ©2013 Pearson Education, Inc. publishing as Prentice Hall.

Das könnte Ihnen auch gefallen

- English Revision Sheet 2 Quarter Grade 8: NameDokument4 SeitenEnglish Revision Sheet 2 Quarter Grade 8: NamebusinessdatabasesNoch keine Bewertungen

- ProQuestDocuments 2023 02 20Dokument3 SeitenProQuestDocuments 2023 02 20businessdatabasesNoch keine Bewertungen

- LinearcmDokument1 SeiteLinearcmbusinessdatabasesNoch keine Bewertungen

- Local Media5102379369261348384Dokument68 SeitenLocal Media5102379369261348384businessdatabasesNoch keine Bewertungen

- معدل Linear20x20Dokument1 Seiteمعدل Linear20x20businessdatabasesNoch keine Bewertungen

- HostsDokument1 SeiteHostsbusinessdatabasesNoch keine Bewertungen

- In-Plain-Arabic-Practical-Part Hazim HamdyDokument7 SeitenIn-Plain-Arabic-Practical-Part Hazim HamdybusinessdatabasesNoch keine Bewertungen

- الطالب المثالىDokument4 Seitenالطالب المثالىbusinessdatabasesNoch keine Bewertungen

- Oliver Twist Gr6Dokument11 SeitenOliver Twist Gr6businessdatabasesNoch keine Bewertungen

- Books' Schedule: Grade 8 - MR ZiDokument2 SeitenBooks' Schedule: Grade 8 - MR ZibusinessdatabasesNoch keine Bewertungen

- Signature Teacher Subject: DLH International School Middle and High Boys 2019-2020Dokument9 SeitenSignature Teacher Subject: DLH International School Middle and High Boys 2019-2020businessdatabasesNoch keine Bewertungen

- Sony CorporationDokument32 SeitenSony CorporationbusinessdatabasesNoch keine Bewertungen

- Civil War in AmericaDokument1 SeiteCivil War in AmericabusinessdatabasesNoch keine Bewertungen

- Research Paper In-Plain-Arabic - FinalDokument25 SeitenResearch Paper In-Plain-Arabic - FinalbusinessdatabasesNoch keine Bewertungen

- Pepsi CoDokument27 SeitenPepsi CobusinessdatabasesNoch keine Bewertungen

- Poetry PortfolioDokument112 SeitenPoetry PortfoliobusinessdatabasesNoch keine Bewertungen

- Arabic Translation in The Light of Speech Act Theory and Grice Maxims (Pragmatic Equivalence in Translation of Lenin Al-Ramly's in Plain Arabic)Dokument2 SeitenArabic Translation in The Light of Speech Act Theory and Grice Maxims (Pragmatic Equivalence in Translation of Lenin Al-Ramly's in Plain Arabic)businessdatabasesNoch keine Bewertungen

- IntelDokument36 SeitenIntelbusinessdatabasesNoch keine Bewertungen

- What Is The SelfDokument25 SeitenWhat Is The SelfbusinessdatabasesNoch keine Bewertungen

- Diglossia and Code SwitchingDokument6 SeitenDiglossia and Code SwitchingbusinessdatabasesNoch keine Bewertungen

- Microsoft CorporationDokument33 SeitenMicrosoft CorporationbusinessdatabasesNoch keine Bewertungen

- Microsoft CorporationDokument33 SeitenMicrosoft CorporationbusinessdatabasesNoch keine Bewertungen

- Southwest AirlinesDokument15 SeitenSouthwest AirlinesbusinessdatabasesNoch keine Bewertungen

- Difference Between Egyptien and AlgerianDokument2 SeitenDifference Between Egyptien and AlgerianbusinessdatabasesNoch keine Bewertungen

- Whole Foods MarketDokument31 SeitenWhole Foods MarketbusinessdatabasesNoch keine Bewertungen

- HarleyDokument29 SeitenHarleybusinessdatabasesNoch keine Bewertungen

- WendyDokument27 SeitenWendybusinessdatabasesNoch keine Bewertungen

- Burger KingDokument26 SeitenBurger Kingbusinessdatabases100% (1)

- General MotorsDokument38 SeitenGeneral MotorsbusinessdatabasesNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- HFOTA Test Analysis PDFDokument37 SeitenHFOTA Test Analysis PDFridwansurono0% (1)

- 7 ITIL 4 FN GlossaryDokument9 Seiten7 ITIL 4 FN Glossarypavithra chinniNoch keine Bewertungen

- ETFE SINGLE FILM SYSTEM SpecDokument18 SeitenETFE SINGLE FILM SYSTEM SpecM. Murat ErginNoch keine Bewertungen

- Objective: P.Santhiya 25A/2 Pondy Road, Manjakuppam, Cuddalore-607001. +91 9092181426Dokument3 SeitenObjective: P.Santhiya 25A/2 Pondy Road, Manjakuppam, Cuddalore-607001. +91 9092181426Girithar M SundaramNoch keine Bewertungen

- Tax Invoice/Credit Note: Mobile Number Bill Issue Date Account ID Bill Period Bill NumberDokument5 SeitenTax Invoice/Credit Note: Mobile Number Bill Issue Date Account ID Bill Period Bill Numbern4hpx4cyjzNoch keine Bewertungen

- Component IdentificationDokument22 SeitenComponent Identificationjactopple0% (1)

- Computer Science Project FileDokument21 SeitenComputer Science Project FileVidya SajitNoch keine Bewertungen

- Rockwell Automation Teched ProgrammeDokument3 SeitenRockwell Automation Teched ProgrammekphcmNoch keine Bewertungen

- AI Primer: A Business Perspective On AIDokument11 SeitenAI Primer: A Business Perspective On AImy VinayNoch keine Bewertungen

- Network Server Engineer - Arshath - Dubai ResumeDokument4 SeitenNetwork Server Engineer - Arshath - Dubai ResumeArshathNoch keine Bewertungen

- Notes 04 - Block ManipulationDokument2 SeitenNotes 04 - Block ManipulationMan JaNoch keine Bewertungen

- Job Description: Data Architect / Data Modeler Requisition ID: 15001465Dokument11 SeitenJob Description: Data Architect / Data Modeler Requisition ID: 15001465Simon BoyoNoch keine Bewertungen

- The Fire Alarm System Based On Iot: January 2022Dokument6 SeitenThe Fire Alarm System Based On Iot: January 2022ILham FadhillNoch keine Bewertungen

- Value Chain Analysis - Dell IncDokument2 SeitenValue Chain Analysis - Dell IncGANESH JAINNoch keine Bewertungen

- AN Elastic MPLS For Service ProvidersDokument8 SeitenAN Elastic MPLS For Service ProvidersChintanPandyaNoch keine Bewertungen

- Extensibility Guide For JIT-EWM IntegrationDokument18 SeitenExtensibility Guide For JIT-EWM IntegrationAltamir Nunes JuniorNoch keine Bewertungen

- Star Delta Type 2Dokument1 SeiteStar Delta Type 2mostafa tarek mohamed emamNoch keine Bewertungen

- Librerias ArduinoDokument4 SeitenLibrerias ArduinoGustavo Adolfo Peña MarínNoch keine Bewertungen

- GM 5L40E Automatic Diagrams and ListDokument9 SeitenGM 5L40E Automatic Diagrams and ListBrayan Aragon diego100% (1)

- 7.secure Electronic Fund Transfer Over Internet Using DESDokument2 Seiten7.secure Electronic Fund Transfer Over Internet Using DESSHIVANGI SINGHNoch keine Bewertungen

- 8DJH36-23865 SwgGra 20200228130231Dokument3 Seiten8DJH36-23865 SwgGra 20200228130231NedyHortetlNoch keine Bewertungen

- Outlines Profiles and SQL BaselinesDokument44 SeitenOutlines Profiles and SQL BaselinesAshok ThiyagarajanNoch keine Bewertungen

- Removal of Default Vbe 8 - BBB GraphicsDokument4 SeitenRemoval of Default Vbe 8 - BBB Graphicsmario nogueraNoch keine Bewertungen

- ProjectGenerator V1 4Dokument80 SeitenProjectGenerator V1 4Hasan SAYINNoch keine Bewertungen

- A Novel Signal Processing Method Based On Cross-Correlation and Interpolation For ToF MeasurementDokument5 SeitenA Novel Signal Processing Method Based On Cross-Correlation and Interpolation For ToF MeasurementIgnacio ZaradnikNoch keine Bewertungen

- FortiOS-6 2 0-CookbookDokument1.370 SeitenFortiOS-6 2 0-CookbookNeed YouNoch keine Bewertungen

- OTME OXE Datasheet EN PDFDokument9 SeitenOTME OXE Datasheet EN PDFMegresAmirNoch keine Bewertungen

- Oasi540 EngDokument26 SeitenOasi540 EngManuel VisoNoch keine Bewertungen

- Head Group: ACI Godrej Agrovet Private LimitedDokument2 SeitenHead Group: ACI Godrej Agrovet Private LimitedsaifulNoch keine Bewertungen

- Comparative Study Between Engineering Stripe and Feeder Stripe 2165 8064 1000346Dokument10 SeitenComparative Study Between Engineering Stripe and Feeder Stripe 2165 8064 1000346NahidulIslamHadiNoch keine Bewertungen