Beruflich Dokumente

Kultur Dokumente

Chapter 6-8

Hochgeladen von

Carmela Jimenez0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

13 Ansichten7 Seitencontrollership

Originaltitel

CHAPTER 6-8

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldencontrollership

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

13 Ansichten7 SeitenChapter 6-8

Hochgeladen von

Carmela Jimenezcontrollership

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 7

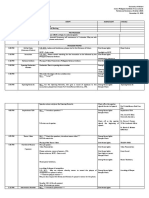

CHAPTER 6: This is a very common objective if there are perceived

problems in this area is:

INTERNAL AUDIT FUNCTION

That the company is following operating policies and

External Auditors

procedures.

- Review disputes between the external auditors

and management. Prevalence of computer systems and the degree to which

- Review the use of external auditors for other they are now integrated into a company’s most crucial

services. operations.

That computer systems are accurately processing

Internal Audits

data.

- final approval over the person selected to fill

this position Ethical standards

- Review the replacement of the internal audit

director. That the company is following an approved set of

- Review the internal audit staff’s objectives, work ethical guidelines

plans, training, and reports.

Annual internal audit plan for reviewing the previous

- Review the cooperation received by the internal

objectives.

auditors

- Review disaster recovery plans. That it creates an annual audit plan that addresses

all of these objectives.

Financial Systems

- Investigate fraud and other forms of financial The final objective relates to the output from the work of the

misconduct internal audit department

- Review corporate policies for compliance with That it provides written reports of its findings to

laws and ethics those levels of management needing the

- Verify that financial reports address all information in order to correct faulty systems

information requirements of lenders

- Review all reports to shareholders, including Internal Audit Activities

special reports, for consistency

The eight internal audit objectives followed by a variety of

- of information

related audit activities.

The audit committee is empowered to investigate fraud and

1. Objective: That control systems will adequately safeguard

other forms of financial misconduct,

company assets

Rather than review the results of such an investigation by

Cash

someone else.

Fixed assets

Inventory

Supplies

Internal Audit Objectives

2. Objective: That company financial statements follow GAAP

-framework for constructing audit programs and are accurate

-determining the most appropriate skill set for the staff, plus Cost of goods sold

-the number of people needed to staff the department Expenses

Revenue

Useful objectives when the audit staff is so small that there is

no room to pursue a wider-ranging set of objectives are: 3. Objective: That the company is following operating policies

and procedures

That control systems will adequately safeguard

company assets Labor, inventory, bank recon, FS, machine run,

product quality level, scraps, shipments, accuracy

That company financial statements follow generally and timeliness.

accepted accounting principles (GAAP) and are

accurate.

4. Objective: That computer systems are accurately

processing data

Data is accurate, correctly calculating, new systems

for proper processing

5. Objective: That the company is following an approved set

of ethical guidelines

reported ethics cases

number of ethics training hours per year

teach ethics to employees that matches and

supports the principles described in the company’s

official ethics policy.

6. Objective: That the department creates an annual audit

plan that addresses all of these objectives

consulted regarding the contents

reviews for all of the previous audit objectives

key control problems pointed out by the external

auditors

7. Objective: That the department provides written reports of

its findings to those levels of management needing the

information in order to correct faulty systems

Verify that feedback

Verify the degree to which recommendations have

been implemented

CHAPTER 7: Factors to Consider when Recruiting

Recruiting, Training, and Supervision Integrity

- accounting employees must care about their

Recruiting Sources

reputation for honesty and objectivity

3 key factors involved in selecting a recruiting source

Process knowledge.

1. Recruiting cost. - search firms conduct their own screening of

2. Recruiting quality. candidates, which results in a higher quality of

3. Recruiting time. applicant

The recruiting sources are:

Communication skills.

Audit and consulting firms - actively participate in meetings with other

- This approach is very inexpensive employees, clearly summarize and present

- this is an excellent way to bring in top-notch information, and create understandable written

personnel quickly and at low cost. reports

Campus recruiting. Drive.

- lower-level positions - complete work in a timely manner and take the

- It is also expensive initiative in undertaking new projects.

Employees. Technical capability.

- best sources of recruits is current employees - Accounting degree. Possessing such a degree

- incentive turns the entire employee group into from an accredited university should form the

an enthusiastic horde of recruiters basis of a minimal technical qualification.

Former employees. Teamwork skills.

- This approach is not only quick and inexpensive, - able to function with the rest of the group

but best of all, it results in highly qualified

candidates who require minimal interviewing Turnover likelihood.

before being hired back. - high probability of staying with the company

Internet Postings.

- Quality of recruit tends to be low Factors to Consider When Promoting

Newspaper advertisements. Sideways

- the low quality is that only those people who - Through the hierarchy of the accounting

are actively looking for work are reviewing the department

advertisements; this ignores the most qualified - is intended to expand a person’s skill base.

people, who are currently working elsewhere - to add to the experience of the staff in other

areas

Professional publications - Generally, it reduces turnover, because the

- advantage of this approach is that only a controller is giving all employees a chance to

selected group acquire new skills

(reverse can also happen if a staff person does

Search firms. not want to shift to a new skill area, may even

- most expensive recruiting approach quit)

- search firms conduct their own screening of

candidates, which results in a higher quality of Vertical Variety

applicant - Less common type

- Someone is shifted upward in the corporate

hierarchy

Importance of Reduced Turnover How to Motivate Employees

This section describes the impact of turnover and how to 3 types of motivation systems

prevent it from happening.

1.) long-range career plan

By keeping the staff turnover rate as low as possible, a - based on the career plan.

controller can avoid many problems. - Discuss career options

These problems are:

2.) annual performance goals (midrange motivational

Increased costs. system)

Increased inefficiency. - pay raises or bonuses at the end of the year

Increased time by the controller. - (For example, accounts receivable turnover of

- In short, recruiting reduces the time available 8.0 can be awarded with a 2 percent raise)

for completing other aspects of the job.

Loss of specialized knowledge. 3.) team-based contests or targets in the very short

Risk of an inappropriate hire. term

- one that grabs and holds the attention of

the accounting staff every day. This system is

much more difficult to arrange

How is it possible to drive turnover down to such low levels

- (For example, a clean-desk week, the rewards

that a controller no longer has to deal with its effects?

for reaching such goals should involve the

The answer is: to meet the needs of employees group, such as a free team lunch)

The ways to reduce turnover are:

Clarify jobs and related procedures.

Improve communications.

Increase pay.

Look for a history of job longevity.

Meet special employee needs.

Recognize employee efforts.

Review employees frequently.

Importance of Developing Career Plans for Employees

This section describes how to lock in employees for long

period of time by assisting them in developing career plans.

Career planning reduces turnover while promoting

employees to the maximum level and allowing the controller

to plan for employee advancement in an orderly manner.

The most common certifications for an accounting person to

earn are:

Certified Public Accountant (CPA).

Certified Management Accountant (CMA).

Certified Internal Auditor.

Certified Production and Inventory Manager.

- No renewal

Credit-rating agencies

Financial advisory services

CHAPTER 8

Brokerage firms

Controller’s Role in Investor Relations Bond-rating agencies

Bank loan officers

Objectives of the Investor Relations Function Bondholders

Financial press

Principal purpose of the IR function, regardless of who

Portfolio managers

performs it, is the enhancement of shareholder value

Government agencies dealing with financial matters

Some chief executive officers (CEOs) might still regard the IR (federal, state, and local)

function as a simple financial reporting activity, with no intent Employees

to affect the stock price

3 Broad Groups: (at which the IR activity is primarily and

But many CFOs will bluntly state that the objective is to continuously directed)

maximize the market price so as to minimize the cost of

(1) security analysts

equity capital

(2) stockbrokers,

(3) large institutional investors.

Communication Vehicles for Investor Relations

Methods used to communicate investor-related messages:

Information Needs of the Financial Analyst

Annual report to shareholders

Quarterly reports to shareholders (and the financial Financial Analyst a.k.a the security analyst

community)

Annual meeting with shareholders - the analyst desires information so that he can

Reports to the Securities and Exchange Commission reasonably predict earnings

(SEC): - most important source of information for the

- Annual Report Form 10-K security analyst: is management presentations

- Quarterly Report Form 10-Q

Presentation content to analysts for a well established,

- Current Report Form 8-K

reputable company:

Regular or special meetings with security analysts,

institutional investors, brokers, and large individual 1. To give a sense of an experienced, in-depth, and

investors—often arranged in cooperation with one well-qualified management.

of the several associations or societies for analysts - The CEO should be present and give the

Institutional advertising in newspapers or principal talk—about prospects, style of

periodicals (financial or general interest) management, management development

Dividend stuffers programs, market position,

Corporate announcements of special interest to

investors or potential investors: 2. To provide an insight into the long-term prospects of

- New products or services the entity, the following subjects might be covered

- Management changes by a knowledgeable executive (CEO, executive

- Acquisitions and/or divestments vicepresident, senior vice president of finance, or

- Reorganization attempts, such as restructuring, controller):

unfriendly takeovers - The system or method of strategic planning

- short-term or annual plan process

- Important research and development programs

Investor Relations Message Recipients

underway

IR function must service an unusually complex and diverse

audience. For example: 3. To provide a broad financial picture, including the

financial strength of the company, perhaps a slide

Investors and potential stock investors (small) presentation (graphs and charts) could be given that

Large institutional stock investors and potential would identify

investors - Status of orders on hand

Security analysts - Trend of sales, by product line

- comparative ratios with industry or selected (ex. We expect continued revenue growth of 60 to

competitors 80 percent for the next three years)

4. The chief marketing executive probably should make Mosaic Approach

a presentation that would describe and illustrate - to release a broad range of nonmaterial

major new products, or major revenue procedures, information to analysts. They can then use this

and the sales prospects for the next year or two information to create their own models of a

company’s operations and likely operating

5. Other executives, as appropriate, might discuss any results

timely topics, such as:

- Employee relations

Forward-Looking Statements

- Cost reduction programs

- Process improvements, including use of computers Private Securities Litigation Reform Act (PSLRA) was that new

law

PSLRA is Section 102, “Safe Harbor for Forward- Looking

Statements.”

Information Needs of Other Groups

- provides companies with a safe harbor from

These other players have varying interests liability for forward-looking statements to the

extent that such statements are identified as

typical individual shareholder

forward-looking statements, and are

- most concerned with the general progress of

accompanied by “meaningful cautionary

the company

statements

a bank loan officer A forward-looking statement is defined in the PSLRA as

- prospects of repaying the loan on time follows:

- His relationship is more confidential than the

A statement containing a projection of revenues,

general public

income (even loss), earnings per share, dividends

“ “ of the plans or objectives of management for

Bond-rating agencies

future operations

- may be exposed to past and prospective debt

“ “ of future economic performance

service coverage and related matters

Any report issued by an outside reviewer retained by

an issuer

A statement containing a projection or estimate of

Providing Guidance

such other items

The most common type of guidance issued is:

Organization Structure for Investor Relations

For either a range or specific point, and usually

IR program must permit the exercise of 2 skills by company

includes all key factors that would be of interest to

executives the ability to:

an investor

(ex. We now expect 2008 sales to range between 1. Communicate effectively

$120 and $135 million, resulting in net profits of 2. Ferret out and comprehend the financial significance

between $14 and $17 million….) of operating trends and relationships

There must be a coordinated approach; the company must

An alternative is to provide guidance using

speak with one voice

percentages

(ex. Our projected revenue growth is 7 to 10 What organizational structure is desirable?

percent. Based on our estimated increase of 5

percent in cost of goods) One answer is, “The one that is effective.”

Role of the Controller and Other Principals

If a company is not willing to provide this level of

guidance, then a lesser alternative is to discuss What should be the role of the controller?

anywhere from a one- to five-year projection

For the typical medium-sized to large company,

- where the CEO is somewhat active in IR, (d) Direction company is headed

- where the CFO tends to spend some time with

(e) Any forthcoming major events that can be

IR activities

announced

A likely split of functions might be listed as:

2. Meet, on a one-to-one basis or with a few individuals

CONTROLLER only, any major

3. As appropriate in IR meetings, refer financial

1. information resource or source for any financial questions to the vice president of finance or

data controller

2. As required, an interpreter of the financial data 4. Meet with other major players, as deemed proper:

3. Communicator of financial information to commercial bankers, investment bankers, rating

individuals and groups entitled to receive it agencies.

4. Prepares, or reviews for accuracy and 5. Ascertain that the messages in any important public

completeness, any financial commentary in such statements, are as she thinks they should be

financial documents 6. Address important company matters and the annual

5. A reviewer for content and accuracy of all news meeting of shareholders.

releases, special announcements, and publications of

the investor relations activity

*When the controller is de facto

- the CFO, he or she would exercise the duties listed

previously, plus those of the CFO enumerated next.

CHIEF FINANCIAL OFFICER

1. Should be the principal communicator of financial

policy

2. Should be the principal spokesperson or negotiator,

subject to approval of the CEO and/or Board of

Directors, as may be applicable, in connection with

the actual and imminent raising of capital

3. Should review all major published financial

documents

4. If the IR department is a part of the financial

organization, should direct its activities, establish

appropriate disclosure policies

*If the IR activities are under the cognizance of the CEO or

the public relations officer, the CFO should make appropriate

recommendations on suggested improvements.

CHIEF EXECUTIVE OFFICER

1. Preside over major meetings with security analysts,

large investors.

Present the background and related information on

such important matters as:

(a) Company mission, purpose, goals and objectives,

and so forth

(b) Competitive position of the company

(c) Major operating accomplishments in recent

periods

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Wonka ScriptDokument9 SeitenWonka ScriptCarlos Henrique Pinheiro33% (3)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- B SDokument36 SeitenB SkeithguruNoch keine Bewertungen

- The Futures Game: Who Wins, Who Loses, and WhyDokument17 SeitenThe Futures Game: Who Wins, Who Loses, and WhySergio Pereira0% (1)

- Chapter 16 "How Well Am I Doing?" - Financial Statement AnalysisDokument134 SeitenChapter 16 "How Well Am I Doing?" - Financial Statement AnalysisTyra Joyce RevadaviaNoch keine Bewertungen

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Fabric Test ReportDokument4 SeitenFabric Test ReportHasan MustafaNoch keine Bewertungen

- Lucent TechDokument3 SeitenLucent TechCarmela JimenezNoch keine Bewertungen

- Student Handbook 2 OfficialDokument3 SeitenStudent Handbook 2 OfficialCarmela JimenezNoch keine Bewertungen

- Program-Flow-Testi 2019Dokument5 SeitenProgram-Flow-Testi 2019Carmela JimenezNoch keine Bewertungen

- Pink Yellow Floral Funeral Elderly Woman Trifold BrochureDokument1 SeitePink Yellow Floral Funeral Elderly Woman Trifold BrochureCarmela JimenezNoch keine Bewertungen

- LawDokument1 SeiteLawCarmela JimenezNoch keine Bewertungen

- Front PageDokument1 SeiteFront PageCarmela JimenezNoch keine Bewertungen

- DocxDokument27 SeitenDocxNak HusderNoch keine Bewertungen

- Bberg Online Assessment FINDokument30 SeitenBberg Online Assessment FINCarmela JimenezNoch keine Bewertungen

- Investing in Real and Financial AssetsDokument2 SeitenInvesting in Real and Financial AssetsCarmela JimenezNoch keine Bewertungen

- TopicDokument3 SeitenTopicCarmela JimenezNoch keine Bewertungen

- RESUMEDokument2 SeitenRESUMECarmela JimenezNoch keine Bewertungen

- GPC LyricsDokument7 SeitenGPC LyricsCarmela JimenezNoch keine Bewertungen

- Generoso PharmaceuticalDokument4 SeitenGeneroso Pharmaceuticallucas67% (3)

- Investing in Real and Financial AssetsDokument2 SeitenInvesting in Real and Financial AssetsCarmela JimenezNoch keine Bewertungen

- Bloomberg navigation and functions quizDokument3 SeitenBloomberg navigation and functions quizCarmela JimenezNoch keine Bewertungen

- Estate TaxDokument47 SeitenEstate TaxCarmela Jimenez50% (2)

- AEDokument2 SeitenAECarmela JimenezNoch keine Bewertungen

- Estate TX 101 AnswerDokument2 SeitenEstate TX 101 AnswerCarmela JimenezNoch keine Bewertungen

- FS AnalysisDokument134 SeitenFS AnalysisCarmela JimenezNoch keine Bewertungen

- Program FlowDokument5 SeitenProgram FlowCarmela JimenezNoch keine Bewertungen

- Estate Tax Calculation and Vanishing Deduction DetailsDokument1 SeiteEstate Tax Calculation and Vanishing Deduction DetailsCarmela JimenezNoch keine Bewertungen

- AEDokument1 SeiteAECarmela JimenezNoch keine Bewertungen

- Program Flow TestiDokument4 SeitenProgram Flow TestiCarmela JimenezNoch keine Bewertungen

- Carry Me Anywhere Corporation: Payment Payment PaymentDokument4 SeitenCarry Me Anywhere Corporation: Payment Payment PaymentCarmela JimenezNoch keine Bewertungen

- Au Log 3Dokument4 SeitenAu Log 3Carmela JimenezNoch keine Bewertungen

- Chapter 04 - Key Concepts of Firm Production, Costs, and RevenueDokument20 SeitenChapter 04 - Key Concepts of Firm Production, Costs, and Revenueermiyas tesfayeNoch keine Bewertungen

- Carry Me Anywhere CorporationDokument4 SeitenCarry Me Anywhere CorporationCarmela JimenezNoch keine Bewertungen

- Kisarta 5E - The Lost Codex of KisartaDokument52 SeitenKisarta 5E - The Lost Codex of KisartaКaloyan Panov100% (1)

- The Big Mac TheoryDokument4 SeitenThe Big Mac TheoryGemini_0804Noch keine Bewertungen

- Penyebaran Fahaman Bertentangan Akidah Islam Di Media Sosial Dari Perspektif Undang-Undang Dan Syariah Di MalaysiaDokument12 SeitenPenyebaran Fahaman Bertentangan Akidah Islam Di Media Sosial Dari Perspektif Undang-Undang Dan Syariah Di Malaysia2023225596Noch keine Bewertungen

- Ola Ride Receipt March 25Dokument3 SeitenOla Ride Receipt March 25Nachiappan PlNoch keine Bewertungen

- Data Mahasiswa Teknik Mesin 2020Dokument88 SeitenData Mahasiswa Teknik Mesin 2020Husnatul AlifahNoch keine Bewertungen

- Ei 22Dokument1 SeiteEi 22larthNoch keine Bewertungen

- Management of HBLDokument14 SeitenManagement of HBLAnnaya AliNoch keine Bewertungen

- Architecture FirmDokument23 SeitenArchitecture Firmdolar buhaNoch keine Bewertungen

- Filipino Values and Patriotism StrategiesDokument3 SeitenFilipino Values and Patriotism StrategiesMa.Rodelyn OcampoNoch keine Bewertungen

- Annamalai University: B.A. SociologyDokument84 SeitenAnnamalai University: B.A. SociologyJoseph John100% (1)

- Murder in Baldurs Gate Events SupplementDokument8 SeitenMurder in Baldurs Gate Events SupplementDavid L Kriegel100% (3)

- Sana Engineering CollegeDokument2 SeitenSana Engineering CollegeandhracollegesNoch keine Bewertungen

- Revision FinalDokument6 SeitenRevision Finalnermeen mosaNoch keine Bewertungen

- E-Mobility - Ladestation - Charging Station in Thalham - Raspberry Pi OCPPDokument8 SeitenE-Mobility - Ladestation - Charging Station in Thalham - Raspberry Pi OCPPjpcmeNoch keine Bewertungen

- Science Club-6Dokument2 SeitenScience Club-6Nguyễn Huyền Trang100% (1)

- 2011 Grade Exam ResultDokument19 Seiten2011 Grade Exam ResultsgbulohcomNoch keine Bewertungen

- Usui MemorialDokument6 SeitenUsui MemorialstephenspwNoch keine Bewertungen

- Working While Studying in Higher Education: The Impact of The Economic Crisis On Academic and Labour Market Success (Preprint Version)Dokument22 SeitenWorking While Studying in Higher Education: The Impact of The Economic Crisis On Academic and Labour Market Success (Preprint Version)Vexie Monique GabolNoch keine Bewertungen

- Techm Work at Home Contact Center SolutionDokument11 SeitenTechm Work at Home Contact Center SolutionRashi ChoudharyNoch keine Bewertungen

- MUN Resolution For The North Korean Missile CrisisDokument2 SeitenMUN Resolution For The North Korean Missile CrisissujalachamNoch keine Bewertungen

- 1Dokument1 Seite1MariaMagubatNoch keine Bewertungen

- Forest Economics: Question 1. What Are The Limitations of Applications of Economic Principles in Forestry?Dokument2 SeitenForest Economics: Question 1. What Are The Limitations of Applications of Economic Principles in Forestry?Nikhil AgrawalNoch keine Bewertungen

- Unit Test: VocabularyDokument2 SeitenUnit Test: VocabularyTrang PhạmNoch keine Bewertungen

- High-Performance Work Practices: Labor UnionDokument2 SeitenHigh-Performance Work Practices: Labor UnionGabriella LomanorekNoch keine Bewertungen

- IMRANADokument4 SeitenIMRANAAji MohammedNoch keine Bewertungen