Beruflich Dokumente

Kultur Dokumente

M Com Amara Raja Ratio Analysis

Hochgeladen von

Gopi NathCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

M Com Amara Raja Ratio Analysis

Hochgeladen von

Gopi NathCopyright:

Verfügbare Formate

Ratio Analysis

INTRODUCTION TO FINANCIAL MANAGEMENT

MEANING OF FINANCIAL MANAGEMENT

Financial management is that managerial activity which is concern with planning

and controlling of the firm’s financial resources. It was a branch of economics till1890

and as a separate discipline, it is of recent origin. Still it has no unique body of knowledge

of its own, and draws heavily on the economics for its theoretical concepts today.

Today practicing managers are interested in this subject, because among the most

crucial decisions of the firm are those which relate to finance and understanding of the

theory of financial management, provides them with conceptual and analytical insights to

take those decisions skillfully.

DEFINITION

“Financial management is an area of financial decision making harmonizing

individual motivation and enterprise goals”

-WESTON AND BRIGHAM

“Financial management is the application of the planning and control function to

the finance function”

-HOWARD AND UPON

“Financial management is the application activity of a business that is responsible

for obtaining and effectively utilizing the funds necessary for efficient operations”

-JOSEPH AND MASSIE

“Financial management is concerned is with the effective use of an important

economic resource, namely capital fund”

-EZRA SOLORNN & PRINGLE JOHN .J

V.C.R. DEGREE & P.G. College, Chittoor. Page 1

Ratio Analysis

RATIO ANALYSIS

Ratio analysis is the process of identifying the financial strengths and weaknesses

of the firm by properly establishing relationship between the items of the balance sheet

and profit & loss account. Management should be particularly interested in knowing

financial strengths and weakness of the firm to make their best use and to be able to spot

out financial weakness of the firm to take their suitable corrective actions.

Ratio analysis is the starting point for making plans, before using any

sophisticated forecasting ad planning procedures.

NATURE OF RATIO ANALYSIS

Ratio analysis is a powerful tool of financial analysis. A ratio is defined as “The

indicated quotient of two mathematical expressions” and as “The relationship between

two or more things”.

A ratio is used as a benchmark for evaluating the financial position and

performance of a firm. The relationship between two accounting figures, expressed

mathematically, is known as a financial ratio.

Ratio analysis helps to summaries large quantities of financial data and to make

qualitative judgment about the firm’s financial performance. The persons interested in the

analysis of financial statements can be grouped under three heads owners or investors

who are desire primarily a basis for estimating earning capacity. Creditors who are

concerned primarily with liquidity and ability to pay interest and redeem loan within a

specified period. Management is interested in evolving analytical tools the will measure

costs, efficiency, liquidity and profitability with a view to make intelligent decisions.

OBJECTIVES OF RATIO ANALYSIS

Analysis of financial statements may be made for a particular purpose in view

To find out the financial stability and soundness of the business enterprise.

To assess and evaluate the earning capacity of the business

To estimate and evaluate the fixed assets, stock etc., of the concern

V.C.R. DEGREE & P.G. College, Chittoor. Page 2

Ratio Analysis

To estimate and determine the possibilities of future growth of business

To assess and evaluate the firm’s capacity and ability to repay short and long term

loans.

USERS OF FINANCIAL ANALYSIS

Financial analysis is the process of identifying the financial strengths and

weaknesses of the firm by properly establishing relationship between the items of the

balance sheet and profit & loss account. The information contained it these statements are

used by management, investors, creditors, suppliers and others to know the operating

performance and financial position of firm.

MANAGEMENT

Management of the firm would be interested in every aspect of the

financial analysis. It is their overall responsibility to see that the resources of the

firm are used most effectively, and that the firm’s financial condition is sound.

INVESTORS

Investors who have invested their money in the firm’s shares, are most

concerned about the firm’s earnings. They restore more confidence in those

firms’s that shows steady growth in earnings. As such, they concentrate on the

analysis of the firm’s present and future profitability. They also interested in the

firm’s financial structure to the extent it influence the firm’s ability and risk.

TRADE CREDITORS

Trade creditors are interested in firm’s ability to meet their claims over a

very short period of time. Their analysis will therefore confine to the evaluation of

the firm’s liquidity position.

SUPPPLIERS OF LONG – TERM DEBT:

Suppliers of long – term debt are concerned with firm’s long-term

solvency and survival. They analysis the firm’s profitability overtime. Its ability to

generate cash to be able to pay interest and repay principal and the relationship

between various sources of funds.

V.C.R. DEGREE & P.G. College, Chittoor. Page 3

Ratio Analysis

DEFINITION

“The indicated quotient of two mathematical expression” and as “the relationship

between two numbers”.

Accountant’s handbook by Wixon, kell and Bedford, a ratio “is an expression of

the quantitative relationship between two numbers”.

People use ratios to determine those financial characteristics of the firm in

which they are interested.

With the help of ratio one can determine

The ability of the firm to meet its current obligations

To extent to which the firm used its long term solvency by borrowings funds

The efficiency with which the firm is utilizing its assets in generating sales

revenue

The overall operating efficiency and performance of the firm.

V.C.R. DEGREE & P.G. College, Chittoor. Page 4

Ratio Analysis

INDUSTRY PROFILE

A battery is an electrochemical device in which the free energy of a Chemical

reaction is converted into electrical energy. The chemical Energy contained in the active

materials is converted into electrical by Mean of electrochemical oxidation-reduction

reactions.

HOW A BATTERY WORKS

When you place the key in your car's ignition and turn the ignition switch to "ON"

a signal is sent to the car's battery. Upon receiving this signal the car battery takes energy

that it has been strong in chemical form and releases it as electricity. This electric power

is used to crank the engine. The battery also to power the car's lights and others

accessories.

It is the only device, which can store electrical energy in the form of chemical

energy, and hence it is called as a storage battery.

SEALED MAINTENANCE FREE (SMF) BATTERIES

Sealed Maintenance Free (SMF) batteries technologies are leading the battery

industry in the recent year in automobile and industrial sector around the globe.

SMF batteries come under the rechargeable battery category so it can be used a

number of times in the life if a battery. SMF batteries are more economical than nickel

cadmium batteries. These batteries are more compact than the west type batteries. It can

be used at any position, these batteries are very popular for portable power requirement

and space constraint applications.

VALUE REGULATED LEAD ACID (VRLA) BATTERIES

VRLA batteries are leak proof, spill-proof and explosion-restraint and having life

duration of 15-20 years. These batteries withstand the environment conditions due to high

technology, in built in the batteries, Each cell is housed in a power coated steel tray

making them convenient to transport and installation, so transit damages are minimized in

case of these batteries. Sealed Maintenance Free (SMF) batteries and value Regulated

V.C.R. DEGREE & P.G. College, Chittoor. Page 5

Ratio Analysis

Lead Acid {VRLA) batteries technology are leading the battery industry in the recent

years in automobile and industrial battery sector around the globe VRLA batteries have

become the preferred choice in various application such as uninterrupted power supply,

emergency lights, and security systems and weighting scales.

CLASSIFICATION OF BATTERIES

Batteries are broadly classified into two segments like,

Automotive Batteries

Industrial Batteries.

AUTOMOTIVE BATTERIES

Apart from mopeds all other automobiles including scooter need storage battery.

So automotive batteries are playing pre-dominant role in automobile sector by influencing

customers in the automobile market. Automobile batteries can be further distinguished as

the original equipment (OE) markets as low as 5-6%. OE segment has the advantage of

securing continuous orders and inquiries. This enables manufacturers to streamline

production facilities, plan production schedules and attain certain level of operational

efficiency.

The replacement market, on the other hand, is much larger. The replacement

market is characterized by the presence of large unorganized sector, which constitutes

around 55-60% of the total replacement market. This is possible due to low capital entry

barrier. These players have the advantage of inapplicability of excise duties.

INDUSTRIAL BATTERIES

The industrial battery segment comprises of two main categories. One comprises

of the "Stationary segment" and the second relating to "Motive; Power and Electric

Vehicles". The Motive Power Electric Vehicles segment comprising of Telecom, Railways

and Power Industries have registered a growth in excess of 20% and this trend is likely to

continue in the next 5 years".

The Industrial segment is highly technological intensive and access to high quality

worked-class technology is an important factor and is vital for brand reference.

V.C.R. DEGREE & P.G. College, Chittoor. Page 6

Ratio Analysis

The total demand for the industrial battery segment is met by indigenous

production with a small saves of about 10% by imports. The demand for industrial

batteries has grown slowly and steadily. Due to strong customers like telecom, railways

and electricity boards, the industrial batteries are on prosperous scale.

RECYCLING BATTERIES

Battery acid is recycled by neutralizing it into water of converting it to sodium

sulphate for laundry detergent, glass and textile manufacturing. Cleaning the battery

cases, meeting the plastic and reforming it into uniform pellets recycle plastic. Lead,

which makes up 50% of every battery, is method, poured into slabs and purified.

MAJOR MANUFACTURERS IN BATTERY INDUSTRY IN INDIA:

The following are the major manufacturers in battery industry in India.

Exide Industries.

Amara Raja Batteries Ltd.

Standard Batteries.

Amco Batteries.

Tudor India.

Hyderabad Batteries Ltd.

Sealed Maintenance Free (SMF) batteries and Value Regulated Lead Acid

(VRLA) technologies are leading the battery industry in the recent years, and they

preferred choice in various applications such as uninterrupted power supply, emergency

lights, and Security systems and Weighting scales.

CHARACTERISTICS OF VRLA BATTERIES

DMF batteries are comes under the rechargeable battery category so It can use a

number of times in the life of a battery. SMF batteries are more economical than nickel

cadmium batteries. These batteries are more compact than the wet type batteries. It can be

used at any position: then batteries are very popular for portable power requirements and

space constraint applications.

V.C.R. DEGREE & P.G. College, Chittoor. Page 7

Ratio Analysis

VRLA batteries are leak proof, spill-proof and explosion resistant and having life

duration of 15-20 years. These batteries withstand the environmental conditions due to

high technology in built in the batteries. Each cell is housed in a power coated steel tray

making them convenient to transportation and installation, so transit damages are

minimized in the case of these batteries.

PROSPECTS OF SMF/VRLA BATTERIES IN INDIA

The following factors are influencing the demand for VRLA technology batteries.

Entry to multinational in Telecom industry.

DOT's policy decision to upgrade the overall technology base.

Constraints in the use of conventional battery in radio paging and cellular

segments.

Due to project expansion in Telecom & Railways, the demands for VRLA

batteries are greater than other industrial batteries.

TELECOM

The Government's policy to increase the capacity from 10 million to 21 million

lines by 2000 increased the demand for storage batteries considerably the value added

services like radio paging and cellular will increase the demand for storage batteries in

future considerably.

RAILWAYS

In Railways, the demand estimate is based on the annual coach production this

comes to 2500 numbers by Railways itself and 1000 numbers more by various other

segments, replacement demand and annual requirement for railways electrification.

POWER SECTOR

In this sector, the estimated 90 private power projects which are expected to

produce 40,000MV with an approximate capital outlay of Rs. l,40,000crores would keep

the industry's future brighter in the coming years. The demand of VRLA batteries is

V.C.R. DEGREE & P.G. College, Chittoor. Page 8

Ratio Analysis

increasing due to its performance over conventional batteries. So it is more acceptable to

consumers. The demand is OEM segments will grow time with the growing automation in

industries.

COMPANY PROFILE

Amara Raja Batteries Private Limited (ARBL) incorporated under the companies

act, 1956 in 13th February 1985, and converted into Public Limited Company on 6 th

September 1990.

V.C.R. DEGREE & P.G. College, Chittoor. Page 9

Ratio Analysis

The technocrat entrepreneur Sri Rama Chandra Naidu Galla is the chairman and

managing director of the company. ARBL is the first company in India which

manufactures Value Regulated Lead Acid (VRLA) Batteries. The main objective of the

company is manufacturing of good quality of “Sealed Maintenance Free (SMF)” acid

batteries. the company is setting up to Rs. 1,920 lakhs plant is in 18 acres in Karakambadi

village Renigunta mandal. The project site is notified under “B” category.

The company has the clear cut policy of direct selling without any intermediate.

So they have set up six branches and are operated by corporate operations office located

in Chennai. The company has virtual monopoly in higher A.H.(Amp Hour) rating market

its product VRLA. It is also having the facility for industrial and automotive batteries.

Amara Raja is a 5 ‘S’ company and its aim is to improve the work place

environment by using 5 ’S’ technique which is:

1. SEIRI - Sort Out.

2. SEITON - Systematic Arrangement

3. SEISO - Spic and Span

4. SEIKETSU - Standardization

5. SHITSUKI - Self discipline

They propose to accomplish this by

Training the people and creating awareness on 5 ‘S’

Motivating and changing the behaviour patterns of the people

V.C.R. DEGREE & P.G. College, Chittoor. Page 10

Ratio Analysis

Establishing standards for the implementation of element of 5 ‘S’.

They believe that effective implementation of 5 ’S’ technique s will result in

Consistent and better quality product

Higher productivity

Higher employee morale

COLLABORATORS

Amara Raja has a strategic tie-up with Johnson Controls Incorporation of USA.

Amara Raja and Johnson Controls Inc. both are having a 26% each share in ARBL and

the remaining is on public share. Amara Raja is a company with commitment to achieve

excellence in all its activities. The company is currently poised on a healthy growth rate

of 2.5% per annum and the present turnover of around 270 crores. Major customers rae

BSNL, VSNL, SIEMENS, and BHEL etc.

Amara Raja is the largest manufacturer of Maintenance Free – Value Regulated

lead acid batteries (MF-VRLA) batteries in the Indian Ocean rim and Johnson Controls is

the largest manufacturer of Lead Acid batteries in North America and a leading global

supplier to major automobile manufacturers and industrial customers. The synergy of

Amara Raja and Johnson Controls compliments the strengths of both product design and

market presence. This joint venture meets the requirements for a global source for

International quality batteries and support services for both Auto and Industrial

applications in this region. By employing latest generation technology and with a clear

understanding of current power back-up requirements, Amara Raja has become the

benchmark in the manufacture of Industrial batteries. In a brief span of 5 years since

commencing commercial operations, ARBL has emerged as a largest manufacturer of

standby VRLA batteries in the Indian Ocean rim comprising the area ranging from Africa

and the Middle East to South East Asia.

AWARDS FOR AMARA RAJA BATTERIES LTD

“The Spirit of Excellence” – awarded by Academy of Fine Arts, Tirupati.

V.C.R. DEGREE & P.G. College, Chittoor. Page 11

Ratio Analysis

“Best Entrepreneur of the Year, 1998” – awarded by Hyderabad Management

Association, Hyderabad.

“Industrial Economist Business Excellence Award” - in 1991 awarded by the

Industrial Economists, Chennai.

“Excellence Award” - by the Institution of Economic Studies, New Delhi.

“Udyog Rattan Award” – by the Institution of Economic Studies, New Delhi.

“Excellence in Environmental Management” for the year 2001-02 from the

Andhra Pradesh State Pollution Control Board.

MILESTONES OF ARBL

Year Milestone

1997 100 crore turnover

1997 ISO-9001 accreditation

1998 QS-9000 accreditation

MANPOWER DETAILS OF ARBL

Executives - 250 members

Staff - 420 members

Trainees - 70 members

Direct & Indirect Manpower - 620 members

Total Manpower is - 1360 members

AMARA RAJA’S STRENGTHS

Proven technology from GNB and being a pioneer

Strong and well organized customer base

Full organized infra structure in place

Manufacturing facilities perceived as a benchmark in India.

Complete range of VRLA batteries

Proven field performance in all user segments

V.C.R. DEGREE & P.G. College, Chittoor. Page 12

Ratio Analysis

Approved vendor status in major user segment

CULTURE AND ENVIRONMENT

Amara Raja is putting a number of HRD initiatives to foster a spirit of

togetherness and a culture of meritocracy. Involving employees at all levels in

building organizational support plans and in evolving our vision for the

Organization.

ARBL encourages initiative and growth of young talent allows the organization

to develop innovative solutions and ideas.

Benchmark pollution control measures, energy conservation measures, waste

reduction schemes, massive greenbelt development programs.

Amara Raja has now targeted to secure the ISO-14001 certification in the next

year.

QUALITY POLICY

ARBL’s main policy is to achieve customer satisfaction through the collective

commitment of employees in design, manufacture and marketing of reliable power

systems, batteries, allied products and services.

To accomplish the above, ARBL focus on

Establishing superior specifications for our products and processes

Employing state-of-the-art technologies and robust design principles.

Striving for continuous improvements in process and product quality

Implementing methods and techniques to monitor quality levels.

Providing prompt after-sales services.

Amara Raja will train, motivate and involve employees at every level to achieve

their aim.

ARBL’S FUTURE PLANS

o Maximize export of its batteries.

V.C.R. DEGREE & P.G. College, Chittoor. Page 13

Ratio Analysis

o Emerge itself as a global player

o Constant upgradiation of products

o Stream of new models

o Constant stress of improving productivity.

AMARA RAJA GROUP COMPRISES OF FOLLOWING COMPANIES

Amara Raja Batteries Limited (ARBL), Karakambadi, Tirupati.

Amara Raja Power Systems Limited(ARPSL), Karakambadi, Tirupati

Mangal precision products Petamitta, Chittoor Dist.

Amara Raja Electronics Limited.(AREPL), Dighavamagham, Chittoor Dist

Amara Raja infra Limited Karakambadi chittoor Dist

Amara Raja Industrial service Limited Karakambadi chittor Dist

Galla foods Limited Rangampet chittor.

AMARA RAJA BATTERIES LIMITED

Amara Raja Batteries Limited was established in the year 1985 and then

converted into limited in the year 1990. Amara Raja has a strategic tie-up with Johnson

Controls Inc. of the USA.

Amara Raja has demonstrated its commitment to offer optimum system solutions

of the highest quality and has become the largest supplier of standby power systems to

core Indian utilities such as the Indian Railways, Department of Telecommunications,

Electricity Boards and major power generation companies. Extensive plans have been

charted out for the future, wherein the company undertakes to become the most preferred

supplier for power back-up systems.

Amara Raja has offered time tested world-class technology and processes

developed on International standards – be it high integrity VRLA systems like Power

Stack and Power Plus or the recently launched high performance UPS battery –

KOMBAT & Amaron Hi-life automotive batteries that are the products of the

collaborative batteries efforts of engineers at Johnson Controls Inc. and Amara Raja.

V.C.R. DEGREE & P.G. College, Chittoor. Page 14

Ratio Analysis

ARBL comprises of two major divisions viz., Industrial Battery Division and

Automotive battery division. Total strength of ARBL comes around 1350.

ARBL

Industrial Battery Division (IBD) Automotive

BatteryDivision(ABD)

1. Railway Coaches 1. Two wheelers

2. Telecom 2. Four wheelers

3. UPS 3. Heavy vehicles

INDUSTRIAL BATTERY DIVISION (IBD)

Amara Raja has become the benchmark in the manufacture of Industrial batteries.

India is one of the largest and fastest growing markets for industrial batteries in the world

and Amara Raja is leading in the front, with an 80% market share for standby VRLA

batteries. It is also having the facility for producing plastic components required for

Industrial batteries.

ARBL is the first company in India to manufacture VRLA batteries (S.M.F.). The

company has set-up Rs.1920 Lakhs plant in 18 acres in Karakambadi village, Renigunta

Mandal. The project site is notified under ‘B’ category.

CAPACITY

The actual installed capacity of IBD is 4 Lakh cells per annum and utilization

capacity is reached to 3,25,000 cells per annum.

V.C.R. DEGREE & P.G. College, Chittoor. Page 15

Ratio Analysis

PRODUCTS

Types of VRLA batteries manufactured in IBD are

1. Power Stack

2. Kombat (UPS Battery)

3. Brute

4. Genpro

CUSTOMERS

Amara Raja being the first entrant in this industry had the privilege of pioneering

VRLA technology in India. Amara Raja has established itself as a reliable supplier of

high-quality products to major segments like Telecom, Railways and Power.

COMPETITORS

The major competitors for Amara Raja Batteries products are Exide Industries

Ltd., Hyderabad Batteries Ltd., and GNB.

AUTOMOTIVE BATTERY DIVISION (ABD)

ARBL has inaugurated its new automotive plant at Karakambadi in Tirupati on

September 24th, 2001. This plant is part of the most completely integrated battery

manufacturing facility in India with all critical components, including plastics sourced in-

house from existing facilities on-site. In this project, Amara Raja’s strategic alliance

partners Johnson Controls, USA have closely worked with their Indian counterparts to put

together the latest advances in manufacturing technology and plant engineering. It is also

having the facility for producing plastic components required for automotive batteries.

CAPACITY

With an existing production capacity of 5 Lakh units of automotive batteries, the new

Greenfield plant will now be able to produce 1 million batteries per annum. This is the first

phase in the enhancement of Amara Raja’s production capacity in which the company has

invested Rs.45 crores. In the next phase, at an additional cost of Rs.25 crores, production

V.C.R. DEGREE & P.G. College, Chittoor. Page 16

Ratio Analysis

capacity will increase to 2 million units estimated to complete around 3 years. After that

ARBL will become the single largest facility for battery manufacture in Asia.

PRODUCTS

The products of ABD are

1. Amaron Hi-Way

2. Amaron Harvest

3. Amaron Shield

The plastic products of ABD are Jars and Jar Covers.

CUSTOMERS

ARBL has prestigious OEM (original equipment manufacture) clients like FORD,

General Motors, Daewoo Motors, Mercedes Benz, Daimler Chrysler, Maruti Udyog Ltd.,

Premier Auto Ltd., and recently acquired a preferential supplier alliance with Ashok

Leyland, Hindustan Motors, Telco, Mahindra & Mahindra and Swaraj Mazda.

COMPETITORS

Exide, Prestolite and AMCO.

AMARA RAJA POWER SYSTEMS LIMITED

Amara Raja Power Systems Pvt. Ltd. was incorporated in 1984 and was co-

promoted by A.P. ELECTRONIC DEVELOPMENT CORPORATION (APEDC). By

virtues of APEDC’s equity participation, ARPSL has become a deemed public limited

company as per section 43 (A) of The Companies Act. ARPSL is engaged in the

manufacture of Uninterrupted Power Systems (UPS) Battery Chargers (BC) and inverters.

The company had a technical collaboration with H.D.R. Power Systems Inc. USA. The

company has entered into a new collaboration with M/s. Rectifier Technologies, Australia

for manufacturing the advanced Switch Mode Power Supply units [SMPS] for battery

charging purpose. The present credit rating of the company is “A”.

Total strength of ARPS (P) L comes around 265.

PRODUCTS

V.C.R. DEGREE & P.G. College, Chittoor. Page 17

Ratio Analysis

The products of ARPSL are

1. Conventional chargers

2. Switch Mode Rectifiers[SMR]

3. Integrated Power Supply Systems (Ips).

CUSTOMERS

BSNL, VSNL, SIEMENS, SPCNL, RELIANCE & LG

MANGAL PRECISION PRODUCTS PVT. LTD.

It was started in the year 1996-97 at pentamitta village, Chittoor Dist. It produces

battery components like copper connectors, copper inserts, hardware required by ARBL

&ARPSL.

The unit is having required machinery and equipment like power press break,

mechanical press, could forging machine, thread forming machine, lathe, drilling,

trapping machine etc., to produce the above components These components are Electro-

plated and dispatched to ARBL & ARPSL.

AMARA RAJA ELECTRONICS PVT. LTD.(AREPL)

It was recently established in 2000. it produces electronic card and power

distribution boards for UPS and inverters.

PRODUCT PROFILE

Type of VRLA batteries manufactured in the industial battery division

1. Power Stack

2. Kombat(UPS battery)

3. Brute

4. Genpro

INTRODUCTION TO FINANCE

V.C.R. DEGREE & P.G. College, Chittoor. Page 18

Ratio Analysis

INTRODUTCTION

Finance is the one of the basic foundation of all kinds of economic activities it is

the master key which provides access to all the sources for being employed in the

business hence it is rightly said that finance is life blood of enterprise, besides being the

scarcest elements, it is also the most indispensable requirement. Without finance neither

any business can be started nor successfully run. Provision of sufficient funds at the

required time is the key to success of concern. As matter of fact finance may be said to be

the circularity system of economic body, making possible the needed co-operation among

many units of the activity.

FINANCIAL MANAGEMENT

Financial management is a service activity which is associated with providing

quantitative information, primarily financial in nature and that may be needs for making

economic decision regarding reasoned choice among different alternative courses of

action. Financial management is that specialized function of general management which

is related to the procurement of finance and its effective utilization for the achievement of

common goal of the organization. It includes each and every activity of business.

Financial management has been defined differently by different scholars.

DEFINITION

“Financial management is an area of financial decision making harmonizing

individual motivation and enterprise goals”

-WESTON AND BRIGHAM

“Financial management is the application of the planning and control function to

the finance function”

-HOWARD AND UPON

“Financial management is the application activity of a business that is responsible

for obtaining and effectively utilizing the funds necessary for efficient operations”

V.C.R. DEGREE & P.G. College, Chittoor. Page 19

Ratio Analysis

-JOSEPH AND MASSIE

“Financial management is concerned is with the effective use of an important

economic resource, namely capital fund”

-EZRA SOLORNN & PRINGLE JOHN .J

IMPORTANCE OF FINANCE MANAGEMENT IN PRESENT INDUSTRIAL

SETUP

The following are the points to highlight the importance of finance.

Finance for business promotion

Fiancé management for optimum use of firm

Use for co-operation in business activity

Useful in decision making

Determinant of business success

Measurement of performance

Basis of planning, co-ordination and control

Useful to share holders and investors.

FINANCIAL ANALYSIS

MEANING

Analysis means to put the meaning of a statement into simple terms for the benefit

of a person. Analysis comprises resolving the statement by breaking them into simple

statement by a process to rearranging regrouping and collation of information.

DEFINITION

According to Myers “financial analysis is largely a study of relation ship among

various financial factors in a business as disclosed by a single set of statements and a

study of the trend of those factors as shown in a service of statements “.

OBJECTIVES OF FINANCIAL ANALYSIS

V.C.R. DEGREE & P.G. College, Chittoor. Page 20

Ratio Analysis

The following are the main objectives of financial analysis:

To estimate the earning capacity of the firm.

To gauge the financial position and financial performance of the firm.

To determine long term liquidity of the funds as well as solvency.

To determine the debt capacity of the firm.

To decide about the future prospects of the firm.

TOOLS FOR FINANCIAL ANALYSIS

Following are the various tools available for financial analyst:

1. Comparative statements.

2. Statements of changes in working capital.

3. Trend analysis.

4. Average analysis.

5. Common size statement.

RATIO ANALYSIS

The Ratio analysis is the most powerful tool of the financial analysis. As stated in

the beginning, many diverse groups of people are interested in analyzing the financial

information to indicate the operating and financial efficiency, and growth of the firm.

These people use ratios to determine those financial characteristics of the firm in which

they are interested

MANAGERIAL USES OF RATIO ANALYSIS

1. HELP IN DECISION MAKING

Financial statements are prepared primarily for decision making but the

information provided in financial statements is not end in itself and no meaning full

V.C.R. DEGREE & P.G. College, Chittoor. Page 21

Ratio Analysis

conclusion drawn from these statements alone. Ratio analysis help in making decisions

from the information provided in these financial statement.

2. HELP IN FINANCIAL FORECASTING AND PLANNING

Ratio analysis is of much help in financial forecasting and planning. Planning is

looking ahead and the ratios calculated for a number of years work as a guide for the

future. Meaning full conclusion can be drawn for future from these ratios. Thus ratio

analysis helps in forecasting and planning.

3. HELPS IN COMMUNICATING

The financial strength and weakness of a firm are communicating in a more easy

and understandable manner by the use of ratios. The information contained in the

financial statements is conveyed in a meaning full manner to the one for whom is meant.

Thus ratios help in communicating and enhance the value of financial statements.

4. HELPS IN COORDINATING

Ratios even help in coordination which is of at most importance in effective

business management. Better communication of the efficacy weakness of and enterprice

result in better coordination in the enterprise.

5. OTHER USES

There are so many other uses of the ratio analysis. It is an essential part of the

budgetary control and standard costing. Ratios are of an immense important in the

analysis and interpretation of financial statements as they bring out the strength or

weakness of a firm.

V.C.R. DEGREE & P.G. College, Chittoor. Page 22

Ratio Analysis

NEED FOR THE STUDY

The company did not follow any scientific inventory management system before 2004

and hence there arise a need to devise a system which could considerably reduce the cost

and thus constituting toward profitability. Every firm must maintain adequate inventory

for its smooth running of the business and to sustain the competition.

To facilitate smooth production and sales operations.

To face the risk of variation in demand and supply.

To face the price changes in inventory quantity and discounts.

The importance of inventory control management cannot be over-emphasized in this

complex industrial world.

V.C.R. DEGREE & P.G. College, Chittoor. Page 23

Ratio Analysis

SCOPE OF THE STUDY

In Amara Raja Batteries Limited, 85% of raw materials are imported and other B and C

class elements are specially made for them. Lead items and bench quantity for an

imported material is high which around 60 days from the date of order is. Hence adapting

required strategies and techniques to maintain balanced inventory is inevitable to

contribute to bottom line.

80% of raw materials are imported.

High lead time for imported material.

High batch quantity for imported material.

V.C.R. DEGREE & P.G. College, Chittoor. Page 24

Ratio Analysis

LIMITATIONS

The ratio analysis is one of the power full tools to analyze financial statements.

Through ratios are simple to calculate and easy to understand, they suffer from some

serious limitations.

1. LIMITATION OF SINGLE RATIO

A single ratio usually does not convey much of a sense. To make a better

interpretation, a number of ratios have to be collected which is likely to confuse

the analyst than help him in making any meaning full conclusion.

2. LACK OF ADEQUATE STANDARDS

V.C.R. DEGREE & P.G. College, Chittoor. Page 25

Ratio Analysis

There are no well accepted statements of rules of thumb for all ratios

which can be accepted as norms. It renders interpretation of the ratio difficult.

3. PERSONAL BIOS

Ratios are only means of financial analysis and not an end in itself. Ratios

have to be interpreted and different people may interpret the same ratio in

different ways.

4. ABSOLUTE FIGURE DISTORTIVE

Ratios devoid of absolute figure may prove distortive as ratio analysis is

primarily a quantitative analysis and not qualitative analysis.

5. PRICE LEVEL CHANGES

While making ratio analysis, no consideration is made to the change I

price levels and this makes the interpretation of ratios invalid.

RATIO ANALYSIS

Financial analysis is the process of identifying the financial strengths and

weaknesses of the firm by properly establishing relationship between the items of the

balance sheet and profit & loss account. Management should be particularly interested in

knowing financial strengths and weakness of the firm to make their best use and to be

able to spot out financial weakness of the firm to take their suitable corrective actions.

Financial analysis is the starting point for making plans, before using any

sophisticated forecasting ad planning procedures.

NATURE OF RATIO ANALYSIS

V.C.R. DEGREE & P.G. College, Chittoor. Page 26

Ratio Analysis

Ratio analysis is a powerful tool of financial analysis. A ratio is defined as “The

indicated quotient of two mathematical expressions” and as “The relationship between

two or more things”. A ratio is used as a benchmark for evaluating the financial position

and performance of a firm. The relationship between two accounting figures, expressed

mathematically, is known as a financial ratio. Ratio analysis helps to summaries large

quantities of financial data and to make qualitative judgment about the firm’s financial

performance.

The persons interested in the analysis of financial statements can be grouped

under three heads owners or investors who are desire primarily a basis for estimating

earning capacity. Creditors who are concerned primarily with liquidity and ability to pay

interest and redeem loan within a specified period. Management is interested in evolving

analytical tools the will measure costs, efficiency, liquidity and profitability with a view

to make intelligent decisions.

STANDARDS OF COMPARISON

The Ratio analysis involves comparison for a useful interpretation of the financial

statements. A single ratio is itself does not indicate favorable or unfavorable condition. It

should be compared with some standard. Standards of comparison are

1. Historical

2. Horizontal

3. Budgeted

4. Absolute

HISTORICAL

Ratios calculated from the past financial statements of the same firm.

HORIZONTAL

Ratios of some selected firms, especially the most progressive and successful

competitor, at the same point of time.

BUDGETED

V.C.R. DEGREE & P.G. College, Chittoor. Page 27

Ratio Analysis

The budgeted standard is arrived at after preparing the budget for a period ratios

developed from actual performance are compared to the planed ratios in the budget to

examine the degree of accomplishment to the anticipated targets of the firms

ABSOLUTE

Absolute standards are those, which become generally recognized as being

desirable regardless of the type of the company, the time ,stage of business cycle or the

objectives of the analyst

OBJECTIVES OF RATIO ANALYSIS

Analysis of financial statements may be made for a particular purpose in view

To find out the financial stability and soundness of the business enterprise.

To assess and evaluate the earning capacity of the business

To estimate and evaluate the fixed assets, stock etc., of the concern

To estimate and determine the possibilities of future growth of business

To assess and evaluate the firm’s capacity and ability to repay short and long term

loans.

USERS OF FINANCIAL ANALYSIS

Financial analysis is the process of identifying the financial strengths and

weaknesses of the firm by properly establishing relationship between the items of the

balance sheet and profit & loss account. The information contained it these statements are

used by management, investors, creditors, suppliers and others to know the operating

performance and financial position of firm.

MANAGEMENT

Management of the firm would be interested in every aspect of the

financial analysis. It is their overall responsibility to see that the resources of the

firm are used most effectively, and that the firm’s financial condition is sound.

INVESTORS

V.C.R. DEGREE & P.G. College, Chittoor. Page 28

Ratio Analysis

Investors who have invested their money in the firm’s shares, are most

concerned about the firm’s earnings. They restore more confidence in those Firms

that shows steady growth in earnings. As such, they concentrate on the analysis of

the firm’s present and future profitability. They also interested in the firm’s

financial structure to the extent it influence the firm’s ability and risk.

TRADE CREDITORS

Trade Creditors are interested in firm’s ability to meet their claims over

a very short period of time. Their analysis will therefore confine to the evaluation

of the firm’s liquidity position.

SUPPLIERS OF LONG – TERM DEBT

Suppliers of Long – Term Debt are concerned with firm’s long-term

solvency and survival. They analysis the firm’s profitability overtime. Its ability to

generate cash to be able to pay interest and repay principal and the relationship

between various sources of funds.

RATIO ANALYSIS

The Ratio analysis is the most powerful tool of the financial analysis. As stated in

the beginning, many diverse groups of people are interested in analyzing the financial

information to indicate the operating and financial efficiency, and growth of the firm.

These people use ratios to determine those financial characteristics of the firm in which

they are interested.

With the help of ratios one can determine

The ability of the firm to meet its current obligations.

The extent to which the firm has used its long-term solvency by borrowing

funds.

The efficiency with which the firm is utilizing its assets in generating sales

revenue

The overall operating efficiency and performance of the firm.

V.C.R. DEGREE & P.G. College, Chittoor. Page 29

Ratio Analysis

TYPES OF RATIOS

Several ratios, calculated from accounting data, can be grouped into various

classes according to financial activity or function to be evaluated.

As started earlier. The parties interested in financial analysis are short term and

long term creditors, owners and management. Short-term creditor’s main interest is the

liquidity position or the short-term solvency of the firm. Owners concentrate on the firm’s

profitability and financial condition. Management is interested in evaluating every aspect

of the firm’s performance. In view of the requirement various users of ratios, the ratios

classified into the following four important categories.

V.C.R. DEGREE & P.G. College, Chittoor. Page 30

Ratio Analysis

A. LIQUIDITY RATIOS

1. CURRENT RATIO

The current ratio is an acceptable measure of the firm’s short term solvency.

Current assets include cash within a year, such as marketable securities, debtors and

inventories. Prepaid expenses are also included in the current assets as they represent the

payments that will not be made by the firm in the future. All the obligations maturing

with in year are included in current liabilities. Current liabilities include creditors, bills

payable, accrued expenses, short-term bank loan, income-tax liability and long-term debt

maturing in the current year.

The current ratio is a measure of the firm’s short-term solvency. It indicates the

availability of current assets in rupees for every one rupee of current liability. A current

ratio of 2:1 is considered satisfactory. The higher current ratio, the greater the margin of

V.C.R. DEGREE & P.G. College, Chittoor. Page 31

Ratio Analysis

safety; the large the amount of current assets in relation to current liabilities, the more the

firm’s ability to meet its obligations. It is a crude-and-quick measure of the firm’s

liquidity.

2. QUICK RATIO

Quick ratio establishes a relationship between quick or liquid assets and current

liabilities. An asset is liquid if it can be converted into cash immediately or reasonably

soon without a loss of value. Cash is the most liquid asset, other assets that are considered

to be relatively liquid asset and included in quick assets are debtors, bills receivables and

marketable securities. Inventories are considered to be less liquid. Inventories normally

require some time for realizing into cash. The quick ratio is found out by dividing quick

assets by current liabilities. Generally a quick ratio of 1:1 is considered adequate

3. CASH RATIO

Cash is the most liquid asset; a financial analyst may examine Cash Ratio and its

equivalent current liabilities. Cash and Bank balances and short-term marketable

securities are the most liquid assets of a firm. Trade investment or marketable securities is

equivalent of cash; therefore, they may be included in the computation of cash ratio.

If the company carries a small amount of cash, there is nothing to be worried

about the lack of cash it the company has reserves borrowing power. Cash ratio is perhaps

the most stringent measure of liquidity. Cash Ratio is calculated as cash and marketable

securities by current liabilities.

B. LEVERAGE RATIOS

1. DEBT RATIO

Several debt ratios may used to analyze the long-term solvency of a firm. The firm

may be interested in knowing the proportion of the interest-bearing debt in the capital

structure. It may, therefore, compute debt ratio by dividing total debt by capital employed

on net assets. Total debt will include short and long-term borrowings from financial

institutions, debentures/bonds, deferred payment arrangements for buying equipments,

V.C.R. DEGREE & P.G. College, Chittoor. Page 32

Ratio Analysis

bank borrowings, public deposits and any other interest-bearing loan. Capital employed

will include total debt and net worth.

A high ratio means that claims of creditors are greater than those of owner. A high

level of debt introduces inflexibility in the firm’s operations due to the increasing

interference and pressure from creditors.

2. DEBT EQUITY RATIO

Debt equity ratio indicates the relationship describing the lenders contribution for

each rupee of the owner’s contribution is called debt-equity ratio. Debt equity ratio is

directly computed by dividing total debt by net worth. Lower debt–equity ratio, higher the

degree of protection. A debt-equity ratio of 2:1 is considered ideal.

3. INTEREST COVERAGE RATIO

The interest coverage ratio or the times-interest-earned is used to test the firm’s

debt-servicing capacity. The interest coverage ratio is computed by dividing earnings

before interest and taxes (EBIT) by interest charges. In this the lender will be interested in

finding out whether the business would earn sufficient profits to pay the interest charges.

4. PROPRIETARY RATIO

The total shareholder’s fund is compared with the total tangible assets of the

company. This ratio indicates the general financial strength of concern. It is a test of the

soundness of financial structure of the concern. The ratio is of great significance to

creditors since it enables them to find out the proportion of shareholders funds in the total

investment of business.

C. ACTIVITY RATIOS

1. WORKING CAPITAL TURNOVER RATIO

This ratio measures the relationship between working capital and sales. The ratio

shows the number of times the working capital results in sales. Working capital as usual is

V.C.R. DEGREE & P.G. College, Chittoor. Page 33

Ratio Analysis

the excess of current assets over current liabilities. The following formula is used to

measure the ratio

2. CURRENT ASSETS TURNOVER RATIO

This ratio is calculated by dividing sales into current assets. This ratio expressed

the number of times current assets are being turnover in stated period. This ratio shows

how well the current assets are being used in business. The higher ratio is showing that

better utilization of the current assets another a low ratio indicated that current assets are

not being effectively utilized.

3. FIXED ASSETS TURNOVER RATIO

The firm may wish to know its efficiency of utilizing fixed assets and current assets

separately. The use of depreciated value of fixed assets in computing the fixed assets turnover

may render comparison of firm's performance over period or with other firms. The ratio is

supposed to measure the efficiency with which fixed assets employed a high ratio indicates a

high degree of efficiency in asset utilization and a low ratio reflects inefficient use of assets.

4. TOTAL ASSETS TURNOVER RATIO

This ratio expresses relationship between the amounts invested in the assets and

resulting in terms of sales. This is calculated by dividing the net sales by total sales. The higher

ratio means better utilization and vice-versa. This ratio shows the firm's ability in generating

sales from all financial resources committed to total assets.

5. DEBTORS TURNOVER RATIO

Debtors turn over ratio indicates the relationship between sales and average

debtors. It is calculated by dividing sales by average debtors. Higher turn over ratio

indicated better performance and lower turn over ratio indicated inefficiency. It includes

debtors as well as the bills receivables.

6. INVENTORY TURNOVER RATIO

Inventory turn over ratio indicated the efficiency of firm in producing and selling its

products. It is calculated by dividing the cost of goods sold by average inventory. It measures

V.C.R. DEGREE & P.G. College, Chittoor. Page 34

Ratio Analysis

how fast the inventory is moving through the firm and generating sales. The Inventory turn over

ratio reflects the efficiency of inventory management.

D. PROFITABILITY RATIOS

1. GROSS PROFIT RATIO

Gross profit ratio establishes the relationship between Gross profit and sales. It

indicates the efficiency of production or trading operation. A high gross profit ratio is a

good management as it implies that cost of production is relatively low.

2. NET PROFIT RATIO

Net profit ratio establishes the relationship between net profit and sales. It is

determined by dividing the net profit (after taxes) by net sales. It indicates the efficiency

of the management in manufacturing, selling, administrative and other activities of the

firm.

3. RETURN ON INVESTMENT

This ratio indicates the relationship between net profit after interest, tax and

shareholder’s funds. It is calculated by dividing net profit after interest and tax by

shareholder’s funds. Return on investment is very important for the investor. The higher

ratio will be better for the concern. This ratio is very important to the decision-making.

4. EARNING PER SHARE

Earning per share indicates whether the firm’s earning power on per has increased

or not. Earning per share simply show the profitability of the firm on a per share basis. It

does not reflect how much is paid as dividend and how much is retained in the business.

But, a profitability index, it is valuable and widely used ratio. It also helps in estimating

the company’s capacity to pay dividend to its equity shareholders. It is calculated by

dividing the profit after taxes by the total number of equity shares.

5. DIVIDEND PER SHARE

The net profit after taxes belongs to shareholders. But the income which they

really receive is the amount of earning s distributed as cash dividends. Therefore, a large

V.C.R. DEGREE & P.G. College, Chittoor. Page 35

Ratio Analysis

number of present and potential investors may be interested in DPS, rather than EPS. DPS

is the earning distributed to ordinary shareholders dividends by the number of shares.

6. DIVIDEND PAYOUT RATIO

It measures the relationship between the returns available to equity shareholders

and the dividend paid to them. It reveals what proportion of earnings per share has been

used for paying dividend and what has been retained for sloughing back. Low ratio

indicated conservative dividend policy. If an investor seeks regular cash returns he prefers

to invest in a company in which it is a higher level.

V.C.R. DEGREE & P.G. College, Chittoor. Page 36

Ratio Analysis

RESEARCH METHODOLOGY

The main aim of the study is to know the financial performance of the Amara Raja

Batteries Limited, Tirupati, Chittoor Dist.

RESEARCH

Any effort which is directed to study of the strategy needed to identify the

problem and selecting of best solutions for better results is known as research

RESEARCH DESIGN

The descriptive form of research method is adopted for the study. The nature and

characteristics of the financial statements of Amara Raja Batteries Limited have been

described in this study.

FINANCIAL TOOL APPLIED FOR THE STUDY

The financial statements may be made simpler for any reader to understand the

operating results and financial health of business. The technique of financial analysis

applied is “RATIO ANALYSIS”

METHODOLOGY OF THE STUDY

The analysis and interpretation of financial statements of Amara Raja Batteries

Limited, Could be done with the help of Balance sheets and Profit & Loss accounts of

Amara Raja Batteries Limited

METHODS OF DATA COLLECTION

The required data has been collected from secondary and primary sources of

information.

PRIMARY DATA

Primary data were collected from the financial controller and accounts manager by

the personal discussion with them.

V.C.R. DEGREE & P.G. College, Chittoor. Page 37

Ratio Analysis

SECONDARY DATA

Secondary data is collected from the

Company’s Annual reports

V.C.R. DEGREE & P.G. College, Chittoor. Page 38

Ratio Analysis

DATA ANALYSIS AND INTERPRETATION

A.LIQUIDIY RATIO

1. CURRENT RATIO:

Current assets

Current assets = ------------------------------

Current liabilities

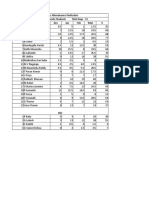

Year Current Assets Current Liabilities Current Ratio

2015-16 3,500,193,294 1,312,272,610 2.67

2016-17 5,975,961,025 2,020,744,952 2.95

2017-18 5,259,900,816 1,843,091,712 2.85

2018-19 6,310,628,185 3,190,856,472 1.90

2019-20 7,418,670,474 3,491,041,303 2.12

INTERPRETATION

V.C.R. DEGREE & P.G. College, Chittoor. Page 39

Ratio Analysis

Current ratio is useful to measure the firm’s short-term solvency. The standard

norm of the current ratio is 2:1. During the period 2016-14 the Current Ratio of the

company is 2.67, 2.95, 2.85, 1.97 and 2.12.In the year 2019-20 the Current ratio is

Increased from1.97 to 2.12 . It shows the better performance of the company in the year

2019-20 than 2018-2019.

2. QUICK RATIO

Quick assets

Quick ratio= ------------------------

Current assets

Year Quick assets Current Liabilities Quick Ratio

2015-16 2,578,479,879 1,312,272,610 1.96

2016-17 4,032,625,321 2,020,744,952 1.99

2017-18 3,651,632,143 1,843,091,712 1.98

2018-19 4,134,904,610 3,190,856,472 1.29

2019-20 4,571,704,172 3,491,041,303 1.30

V.C.R. DEGREE & P.G. College, Chittoor. Page 40

Ratio Analysis

INTERPRETATION

The Quick ratio is more penetrating test of liquidity than the current ratio. The standard

norm of the quick ratio is 1:1. During the period 2016-14, the Quick Ratio of the company is

1.96, 1.99, 1.98, 1.29 and 1.3.In the year 2019-20, the Quick Ratio is 1ncreased to 1.3 so the

Standard norm is satisfactory.

3. CASH RATIO

Cash+ marketable securities

Cash ratio= --------------------------------------------

Current liabilities

Year Cash Marketable Current Cash

Securities Liabilities Ratio

2015-16 2,56,000,280 1,312,272,610 0.19

2016-17 5,1,143,739 2,020,744,952 0.25

2017-18 7,02,851,806 1,843,091,712 0.38

2018-19 6,24,672,429 3,190,856,472 0.19

2019-20 4,02,084,121 3,491,041,303 0.11

V.C.R. DEGREE & P.G. College, Chittoor. Page 41

Ratio Analysis

INTERPRETATION

In all the above years the Cash Ratio is very low. The standard norm for Cash ratio

is 1:2. The company is failed in keeping sufficient cash, bank balances and marketable

securities.

B. LEVERAGE RATIOS

1. DEBT RATIO

Total Debt

Debt Ratio = -------------------------------------

Total Debt + Net Worth

Total Debt = Secured + Unsecured Loans, Net Worth = Share holders Funds

Year Total Debt Capital Employed Debt Ratio

2015-16 1,407,083,880 3,843,741,557 0.36

2016-17 3,162,620,560 6,493,635,030 0.48

2017-18 2,858,709,934 6,914,574,278 0.41

2018-19 9,11,894,460 6,348,321,650 0.14

2019-20 9,50,460,292 7,409,732,119 0.12

V.C.R. DEGREE & P.G. College, Chittoor. Page 42

Ratio Analysis

INTERPRETATION

The Debt ratio gives results relating to Capital structure of a firm. The Debt ratio

is 0.36 in the year 2015-16, and it is increased to 0.48 in the year 2016-17, and it is

decreased to 0.41 in the year 2017-18, and again it is decreased to 0.14 in the year 2018-

13 and again it is decreased to 0.12 in the year 2019-20.From the above fluctuating trend

we can say that, the company much not dependence on debt because debt is decreased.

2. DEBT-EQUITY RATIO

Total Debt

Debt-Equity Ratio = ------------------------

Net Worth

Total Debt = Secured + Unsecured Loans, Net Worth = Share holders Funds

Year Total Debt Net Worth Debt-Equity Ratio

2015-16 1,407,083,880 2,436,657,677 0.58

2016-17 3,162,620,560 3,331,014,470 0.95

2017-18 2,858,709,934 4,055,864,344 0.70

2018-19 911,894,460 5,436,427,190 0.17

2019-20 950,460,292 6,459,271,827 0.14

V.C.R. DEGREE & P.G. College, Chittoor. Page 43

Ratio Analysis

INTERPRETATION

The Debt-Equity ratio gives results relating to Capital structure of a firm. The

Debt-Equity ratio is 0.58 in the year 2015-16, and it is increased to 0.95 in the year 2016-

17, and it is decreased to 0.70 in the year 2017-18, it is decreased to 0.17 in the year

2018-19 and it again decreased to 0.14 in the year 2019-20. The company depends on the

debt fund is decreased.

3. INTEREST COVERAGE RATIO

EBIT

Interest Coverage Ratio = -----------------------

Interest

EBIT = Earnings Before Interest and Tax.

Year EBIT Interest ICR

2015-16 6,81,060,155 30,924,293 22.02

2016-17 1,330,072,551 1,29,308,874 10.28

2017-18 1,044,220,357 1,82,365,723 5.72

2018-19 2,478,633,177 67,715,572 36.60

2019-20 2,195,608,155 14,520,441 151.20

V.C.R. DEGREE & P.G. College, Chittoor. Page 44

Ratio Analysis

INTERPRETATION

Interest Coverage ratio is 22.02 in the year 2015-16, again it is decreased to 10.28

in the year 2016-17, and again it is decreased 5.72 in the year 2017-18. It is increased to

36.60 in the year 2018-19,again it is increased to 151.2 in the year 2019-20.In this

position, outside investors are interested to invest the money in this company.

4. PROPRIETARY RATIO

Shareholder’s Funds

Proprietary Ratio = --------------------------------

Total Assets

Shareholder’s Funds = Share Capital + Reserves and Surplus

Year Shareholders’ Funds Total Assets Proprietary Ratio

2,436,657,677 5,292,107,128 0.46

2015-16

V.C.R. DEGREE & P.G. College, Chittoor. Page 45

Ratio Analysis

3,331,014,470 8,683,886,037 0.38

2016-17

4,055,864,344 8,940,174,313 0.45

2017-18

5,436,427,190 9,755531,000 0.55

2018-19

6,459,271,827 11,105,707,129 0.58

2019-20

INTERPRETATION

During the period 2016-2020, the Proprietary ratios are 0.46, 0.38, 0.45, 0.55,

and0.58. In the year 2019-20 the Proprietary ratio is high.

C. ACTIVITY RATIOS

1. WORKING CAPITAL TURNOVER RATIO

Net Sales

Working Capital Turnover Ratio = ---------------------------

Working Capital

Working Capital = Current Assets-Current Liabilities

Year Net sales Working Capital WCTR

2015-16 5,958,016,404 2,187,920,684 2.72

V.C.R. DEGREE & P.G. College, Chittoor. Page 46

Ratio Analysis

2016-17 10,833,256,904 3,955,216,073 2.73

2017-18 13,131,788,116 3,416,809,104 3.85

2018-19 14,652,096,705 3,119,771,713 4.69

2019-20 17,611,206,751 3,927,629,171 4.48

INTERPRETATION

Working capital turnover ratio is useful to measure the operating efficiency of the

firm. Working capital turnover ratio is 2.72 in the year 2015-16. It increased from the year

2016-17 (2.73) to 2017-18(4.69) but it decreased to 4.48 in the year2019-20.

3. CURRENT ASSETS TURNOVER RATIO

Net Sales

Current Assets Turnover Ratio = --------------------------

Current Assets

V.C.R. DEGREE & P.G. College, Chittoor. Page 47

Ratio Analysis

Year Net sales Current assets CATR

2015-16 5,958,016,404 3,500,193,294 1.73

2016-17 10,833,256,904 5,975,961,025 1.81

2017-18 13,131,788,116 5,259,900,816 2.49

2018-19 14,652,096,705 6,310,628,185 2.32

2019-20 17,611,206,751 7,418,670,474 2.37

INTERPRETATION

During the period 2016-1, Current Asset Turnover ratios are 1.73, 1.81, 2.49, 2.32

and 2.37. From the year 2015-12, it is increasing, and it is decreased to 2.32 in the

year2018-14, in the year 2019-20 and again it is increased to 2.37.

V.C.R. DEGREE & P.G. College, Chittoor. Page 48

Ratio Analysis

3. FIXED ASSETS TURNOVER RATIO

Net Sales

Fixed Assets Turnover Ratio = ------------------------------------

Net Fixed Assets

Year Net sales Net fixed assets FATR

2015-16 5,958,016,404 1,568,304,581 3.80

2016-17 10,833,256,904 1,888,508,475 5.73

2017-18 13,131,788,116 2,813,242,340 4.66

2018-19 14,652,096,705 3,057,255,262 4.79

2019-20 17,611,206,751 3,150,869,618 5.58

INTERPRETATION

V.C.R. DEGREE & P.G. College, Chittoor. Page 49

Ratio Analysis

Fixed Assets Turnover ratio is high in the year 2016-17, i.e. 5.73. It is decreased to

4.66 in the year 2017-18. It is increased to 4.79 in the year 2018-19. Again it increased to 5.58 in

the year 2019-20. It shows the effective utilization of fixed asset

4. TOTAL ASSETS TURNOVER RATION

Net Sales

Total Assets Turnover Ratio = -------------------------

Total Assets

Year Net sales Total assets TATR

2015-16 5,958,016,404 5,292,107,128 1.12

2016-17 10,833,256,904 8,683,886,037 1.25

2017-18 13,131,788,116 8,940,174,313 1.46

2018-19 14,652,096,705 9,755,531,000 1.50

2019-20 17,611,206,751 11,105,707,129 1.58

INTERPRETATION

V.C.R. DEGREE & P.G. College, Chittoor. Page 50

Ratio Analysis

During the period 2015-14, Total Assets Turnover ratio is increasing from the

value 1.12 to 1.58. It shows the effective capacity of the total assets.

5. DEBTORS TURNOVER RATIO

Net Sales

Debtors Turnover Ratio = ------------------------------------

Average Debtors

Year Net sales Average Debtors DTR

2015-16 5,958,016,404 1,459,544,977 4.08

2016-17 10,833,256,904 2,264,682,019 4.78

2017-18 13,131,788,116 2,078,493,040 6.31

2018-19 14,652,096,705 2,422,954,714 6.04

2019-20 17,611,206,751 3,056,623,935 5.76

INTERPRETATION

V.C.R. DEGREE & P.G. College, Chittoor. Page 51

Ratio Analysis

During the period 2015-14, Debtors Turnover ratios are 4.08, 4.78, 6.31, 6.04 and

5.76. Debtors Turnover ratio is high in the year 2017-18, after it is decreased to 5.76 in

the year2019-20 so company decreased credit sales and increased cash sales.

6. INVENTORY TURNOVER RATIO

Cost of Goods Sold

Inventory Turnover Ratio = ------------------------------------

Average Inventory

Opening Stock + Closing Stock

Average Inventory = -----------------------------------------

2

Year Cost Of Goods Sold Average Inventory ITR

2015-16 5,958,016,404 7,46,837,818 7.97

2016-17 10,833,256,904 1,432,524,560 7.56

2017-18 13,131,788,116 1,775,802,189 7.39

2018-19 14,652,096,705 1,891,996,124 7.74

2019-20 17,611,206,751 2,511,344,939 7.01

V.C.R. DEGREE & P.G. College, Chittoor. Page 52

Ratio Analysis

INTERPRETATION

Inventory Turnover ratio is 7.97 in the year 2015-16. In the years 2016-12, the

ratios are decreased i.e. 7.56, 7.39. And it is increased to 7.74 in the year 2018-19, after it

is decreased to 7.01 in the year 2019-20 so that in this ratio fluctuations are high.

D.PROFITABILITY RATIOS

1. GROSS PROFIT RATIO

Gross Profit

Gross Profit Ratio = ------------------------------ x 100

Sales

Year Gross profit Sales GPR

2015-16 7,11,984,448 5,958,016,404 11.95

2016-17 1,459,381,425 10,833,256,904 13.47

2017-18 12,265,866,080 13,131,788,116 9.34

2018-19 2,546,348,749 14,652,096,705 17.37

2019-20 2,210,128,596 17,611,206,751 12.54

INTERPRETATION

This ratio indicates the relationship of gross profits on sales. During the period

2015-14, the gross profits are 11.95, 13.47, 9.34, 17.3 and 12.54. In the year 2019-20 the

gross profit ratio is decreased to12.54.

2. NET PROFIT RATIO

Profit After Tax

Net Profit Ratio = ------------------------------------ x 100

Sales

Year Net Profit Sales Net Profit Ratio

470,434,575 5,958,016,404 7.89

2015-16

V.C.R. DEGREE & P.G. College, Chittoor. Page 53

Ratio Analysis

943,631,511 10,833,256,904 8.71

2016-17

804,786,707 13,131,788,116 6.12

2017-18

1,670,333,868 14,652,096,705 11.39

2018-19

2019-20 1,480,963,975 17,611,206,751 8.40

INTERPRETATION

During the period 2017-14, the Net profits are 7.89, 8.71, 6.12, and 11.39. In the

year 2019-20 ARBL have large amount of profits, but it is decreased to 8.4 in the year

2019-20 .

5. RETURN ON INVESTMENT

Net Profit After Interest & Tax

Return on Investment = --------------------------------------------- x 100

Shareholder’s Funds

V.C.R. DEGREE & P.G. College, Chittoor. Page 54

Ratio Analysis

Net Profit After Return on

Year Shareholders Funds

Interest & Tax Investment

470,434,575 2,436,657,677 19.30

2015-16

943,631,511 3,331,014,470 28.32

2016-17

804,786,707 4,055,864,344 19.84

2017-18

1,670,333,865 5,436,427,190 30.72

2018-19

1,480,963,975 6,459,271,827 22.92

2019-20

INTERPRETATION

During the period 2017-14, Return on Investments are 19.30, 28.32, 19.84, 30.72

and 22.92. Return on Investment is high in the year 2019-20, i.e. 30.72. But it is

decreased to 22.92 in the year 2019-20.

4. EARNING PER SHARE

Profit After Tax

Earning Per Share = --------------------------------------

V.C.R. DEGREE & P.G. College, Chittoor. Page 55

Ratio Analysis

Number of Equity Shares

Year Profit After Tax Number of Shares Earning Per Share

470,434,575 11,387,500 41.31

2015-16

943,631,511 56,937,500 16.57

2016-17

804,786,707 85,406,250 9.42

2017-18

1,670,333,865 85,406,250 19.56

2018-19

1,480,963,975 85,406,250 17.34

2019-20

INTERPRETATION

Earning per Share reveals how much income available to the equity share holders.

Earnings Per Share is Rs.41.31 in the year 2015-16, and further it decrease to Rs.16.57 in the

year 2016-17, again it is decrease to Rs.9.42 in the year 2017-18, and it is increased to

Rs.19.56 in the year 2018-19, again it is decreased to 17.34 in the year 2019-20.It gives a

view of the comparative earnings of a firm.

5. DIVIDEND PER SHARE

V.C.R. DEGREE & P.G. College, Chittoor. Page 56

Ratio Analysis

Dividend

Dividend Per Share = ----------------------------------

Number of Shares

Dividend Per

Year Dividend Number of Shares

Share

39,856,250 11,387,500 3.5

2015-16

39,856,250 56,937,500 0.7

2016-17

68,325,000 85,406,250 0.8

2017-18

247,678,125 85,406,250 2.9

2018-19

222,056,250 85,406,250 2.6

2019-20

INTERPRETATION

During the period 2015-14, Dividend per Share is 3.5, 0.7, 0.8, 2.9 and 2.6 there is

fluctuating year by year. In the year 2018-19 dividend per share is high. After it is

decreased to 2.6 in the year 2019-20.

6. DIVIDEND PAYOUT RATIO

Dividend Per Share

V.C.R. DEGREE & P.G. College, Chittoor. Page 57

Ratio Analysis

Dividend Payout Ratio = ----------------------------------

Earning Per Share

Dividend

Year Dividend Per Share Earning Per Share

Payout Ratio

3.5 41.31 0.08

2015-16

0.7 16.57 0.04

2016-17

0.8 9.42 0.08

2017-18

2.9 19.56 0.14

2018-19

2.6 17.34 0.14

2019-20

INTERPRETATION

During the period 2019-14, the Dividend Payout Ratios are 0.08, 0.04, 0.08, 0.14

and 0.14. In the year 2018-19 and 2019-20 the Dividend Payout Ratio is same.

V.C.R. DEGREE & P.G. College, Chittoor. Page 58

Ratio Analysis

FINDINGS

Company has reached the standard ratio in the present year i.e. 2:1. So the company is

having in a position to repayment of its short term liabilities.

The company is maintaining quick assets over the quick ratio. So the quick assets

would meet the quick liabilities.

By observing the cash ratio the company is failed in keeping the sufficient cash, bank

balances .so the company cash performance is in down position.

The company depended more on the debt fund in previous. Now it is decreased in the

present year.

Interest coverage ratio is high in the present year. So, investors are interested to invest

the money in this company.

Working capital turnover ratio is decreased in the present year. The company should

has effective utilization of working capital.

V.C.R. DEGREE & P.G. College, Chittoor. Page 59

Ratio Analysis

Fixed assets turnover ratio is gradually increasing from 2015-2020. So, the company

generating more sales.

Debtors turnover ratio is decreased in the present year. So the company reduced its

credit sales and increased its cash sales.

The Gross profit & Net profits are decreased in the present year i.e 2017-18. So the

company should have good control over the operating expenses.

SUGGESTIONS

After the analysis of financial statements, the company status is good because the net

working capital of the company is doubled from the last year’s position

The company is paying high interest rate; it leads to face the problems in future.

The company is utilizing the fixed assets, which majorly help to the growth of the

organization. The company should maintain it perfectly.

ARBL has to increase its Gross profits and Net profits it helps for the diversification

of the company.

V.C.R. DEGREE & P.G. College, Chittoor. Page 60

Ratio Analysis

CONCLUSION

From the above analysis of the company, I conclude that the company’s financial

position is good because the company’s leverage, activity and profitability positions are

good and the company have to increase its liquidity position for better performance in

future .

V.C.R. DEGREE & P.G. College, Chittoor. Page 61

Ratio Analysis

PROFIT AND LOSS ACCOUNT FOR THE YEAR ENDED MARCH

31, 2016.

Year Ended Year Ended

Particulars

31-03-2016 31-03-2015

INCOME

Sales – Gross 7,451,032,988 4,458,295,779

Less: Excise duty Collected 1,493,016,594 539,737,583

Net Saless 5,958,016,404 3,918,558,196

Other Income 97,738,804 73,518,437

Increase /( Decrease )in Stock 181,845,189 41,637,449

TOTAL 6,237,600,397 4,033,714,082

EXPENDITURE

Purchase of Finished Goods 1,190,212 4,353,496

Raw Material Consumed 3,937,812,454 2,232,086,848

Payments & Benefits to Employees 265,997,094 207,269,383

Manufacturing, Selling, Admin & Other Expenses 1,093,657,443 761,850,408

Duties & Taxes 26,007,989 294,245,095

Interest 30,924,293 13,435,515

Depreciation 170,026,464 147,009,114

TOTAL 5,525,615,949 3,660,249,859

Profit Before Taxation 711,984,448 373,464,223

Add: Provision for Deferred Income

Tax credited back (Net) - 10,915,000

Less: Provision for Taxation – Current 217,500,000 135,000,000

- Deferred 16,080,646

- Earlier years 4,475,039 3,846,464

- Wealth Tax 94,188 147,729

- Fringe Benefit Tax 3,400,000 6,919,300

Profit After Taxation 470,434,575 238,465,730

Profit brought forward from previous year 749,031,694 566,874,029

Profit Available for Appropriation 1,219,466,269 805,339,759

Less: Appropriation

Transfer to General Reserve 47,043,458 23,846,573

Proposed Dividend 39,856,250 28,468,750

Dividend Tax 6,773,570 3,992,742

Balance Carried to Balance Sheet 1,125,792,991 749,031,694

Basic Earnings Per Equity Share 41.31 20.94

V.C.R. DEGREE & P.G. College, Chittoor. Page 62

Ratio Analysis

BALANCE SHEET AS AT MARCH 31, 2016

Particulars As at 31-03-2016 As at 31-03-2015

SOURCES OF FUNDS

Shareholders' Funds

Share capital 113,875,000 113,875,000

Reserves and surplus 2,322,782,677 1,898,977,921

2,436,657,677 2,012,852,921

Loan Funds

Secured 1,074,874,049 189,001,189

Unsecured 332,209,831 216,407,580

1,407,083,880 405,408,769

Deferred tax liability 136,092,961 120,012,315

Total 3,979,834,518 2,538,274,005

APPLICATION OF

FUNDS

Fixed Assets

Gross block 2,577,786,073 1,907,116,068

Less: Depreciation 1,009,481,492 863,568,510

Net block 1,568,304,581 1,043,547,558

Capital work-in-progress 61,667,597 48,149,118

1,629,972,178 1,091,696,676

Investments 161,941,656 320,140,656

Current Assets, Loans and

Advances

Inventories 921,713,415 571,962,221

Sundry debtors 1,459,544,977 856,520,556

Cash and bank balances 256,000,280 205,212,363

Loans, advances and 859,824,054 634,750,549

deposits

Other Current Assets 3,110,568 12,035,439

3,500,193,294 2,280,481,128

Less: Current liabilities and

provisions

Liabilities 735,304,583 673,895,907

Provisions 576,968,027 480,148,548

1,312,272,610 1,154,044,455

Net current assets 2,187,920,684 1,126,436,673

Total 3,979,834,518 2,538,274,005

V.C.R. DEGREE & P.G. College, Chittoor. Page 63

Ratio Analysis

PROFIT AND LOSS ACCOUNT FOR THE YEAR ENDED MARCH

31, 2017.

Year Ended Year Ended

Particulars

31-03-2017 31-03-2016

INCOME

Sales – Gross 13,499,867,499 7,451,032,988

Less: Excise duty Collected 2,666,610,595 1,493,016,594

Net Sales 10,833,256,904 5,958,016,404

Other Income 256,100,643 97,738,804

Increase /( Decrease )in Stock 582,065,982 181,845,189

TOTAL 11,671,423,529 6,237,600,397

EXPENDITURE

Purchase of Finished Goods 6,378,625 1,190,212

Raw Material Consumed 7,794,794,675 3,937,812,454

Payments & Benefits to Employees 408,078,078 265,997,094

Manufacturing, Selling, Admin & Other Expenses 1,579,591,221 1,093,657,443

Duties & Taxes 49,438,561 26,007,989

Interest 129,308,874 30,924,293

Depreciation 244,452,070 170,026,464

TOTAL 10,212,042,104 5,525,615,949

Profit Before Taxation 1,459,381,425 711,984,448