Beruflich Dokumente

Kultur Dokumente

14 - Commissioner v. Glenshaw Glass, 388 US 426 PDF

Hochgeladen von

Florence Rosete0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

16 Ansichten8 SeitenOriginaltitel

14 - Commissioner v. Glenshaw Glass, 388 US 426.pdf

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

16 Ansichten8 Seiten14 - Commissioner v. Glenshaw Glass, 388 US 426 PDF

Hochgeladen von

Florence RoseteCopyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 8

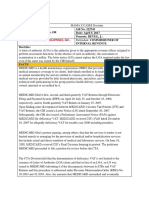

OCTOBER TERM, 1954.

Syllabus. 348 U. S.

COMMISSIONER OF INTERNAL REVENUE v.

GLENSHAW GLASS CO.

CERTIORARI TO THE UNITED STATES COURT OF APPEALS

FOR THE THIRD CIRCUIT.*

No. 199. Argued February 28, 1955.-Decided March 28, 1955.

Money received as exemplary damages for fraud or as the punitive

two-thirds portion of a treble-damage antitrust recovery must be

reported by a taxpayer as "gross income" under § 22 (a) of the

Internal Revenue Code of 1939. Pp. 427-433.

(a) In determining what constitutes "gross income" as defined

in § 22 (a), effect must be given to the catchall language "gains

or profits and income derived from any source whatever." Pp. 429-

430.

(b) Eisner v. Macomber, 252 U. S. 189, distinguished. Pp. 430-

431.

(c) The mere fact that such payments are extracted from the

wrongdoers as punishment for unlawful conduct cannot detract

from their character as taxable income to the recipients. P. 431.

(d) A different result is not required by the fact that § 22 (a)

was re-enacted without change after the Board of Tax Appeals had

held punitive damages nontaxable in Highland Farms Corp., 42

B. T. A. 1314. Pp. 431-432.

(e) The legislative history of the Internal Revenue Code of

1954 does not require a different result. The definition of gross

income was simplified, but no effect upon its present broad scope

was intended. P. 432.

(f) Punitive damages cannot be classified as gifts, nor do they

come under any other exemption in the Code. P. 432.

211 F. 2d 928, reversed.

Solicitor General Sobeloff argued the cause for peti-

tioner. With him on the brief were Assistant Attorney

General Holland, Charles F. Barber, Ellis N. Slack and

Melva M. Graney.

*Together with Commissioner of Internal Revenue v. William

Goldman Theatres, Inc., which was a separate case decided by the

Court of Appeals in the same opinion.

COMMISSIONER v. GLENSHAW GLASS CO. 427

426 Opinion of the Court.

Max Swiren argued the cause for the Glenshaw Glass

Company, respondent. With him on the brief were

Sidney B. Gambill and Joseph D. Block.

Samuel H. Levy argued the cause for William Goldman

Theatres, Inc., respondent. With him on the brief was

Bernard Wolfman.

-MR. CHIEF JUSTICE WARREN delivered the opinion of

the Court.

This ,litigation involves two cases with independent

factual backgrounds yet presenting the identical issue.

The two cases were consolidated for argument before the

Court of Appeals for the Third Circuit and were heard en

banc. The common question is whether money received

as exemplary damages for fraud or as the punitive two-

thirds portion of a treble-damage antitrust recovery must

be reported by a taxpayer as gross income under § 22 (a)

of the Internal Revenue Code of 1939.1 In a single opin-

ion, 211 F. 2d 928, the Court of Appeals affirmed the Tax

Court's separate rulings in favor of the taxpayers. 18

T. C. 860; 19 T. C. 637. Because of the frequent recur-

rence of the question and differing interpretations by

the lower courts of this Court's decisions bearing upon

the problem, we granted the Commissioner of Internal

Revenue's ensuing petition for certiorari. 348 U. S. 813.

The facts of the cases were largely stipulated and are

not in dispute. So far as pertinent they are as follows:

Commissioner v. Glenshaw Glass Co.-The Glenshaw

Glass Company, a Pennsylvania corporatiofi, manufac-

tures glass bottles and containers. It was engaged in

protracted litigation with the Hartford-Empire Com-

pany, which manufactures machinery of a character used

by Glenshaw. Among the claims advanced by Glenshaw

153 Stat. 9, 53 Stat. 574,26 U. S. C. § 22 (a).

OCTOBER TERM, 1954.

Opinion of the Court. 348 U. S.

were demands for exemplary damages for fraud ' and

treble damages for injury to its business by reason of

Hartford's violation of the federal antitrust laws.' In

December, 1947, the parties concluded a settlement of all

pending litigation, by which Hartford paid Glenshaw

approximately $800,000. Through a method of alloca-

tion which was approved by the Tax Court, 18 T. C. 860,

870-872, and which is no longer in issue, it was ultimately

determined that, of the total settlement, $324,529.94 rep-

resented payment of punitive damages for fraud and

antitrust violations. Glenshaw did not report this por-

tion of the settlement as income for the tax year involved.

The Commissioner determined a deficiency claiming as

taxable the entire sum less only deductible legal fees.

As previously noted, the Tax Court and the Court of

Appeals upheld the taxpayer.

Commissioner v. William Goldman Theatres, Inc.-

William Goldman Theatres, Inc., a Delaware corporation

operating motion picture houses in Pennsylvania, sued

Loew's, Inc., alleging a violation of the federal antitrust

laws and seeking treble damages. After a holding that

a violation had occurred, William Goldman Theatres, Inc.

v. Loew's, Inc., 150 F. 2d 738, the case was remanded to

the trial court for a determination of damages. It was

found that Goldman had suffered a loss of profits equal

to $125,000 and was entitled to treble damages in the sum

of $375,000. William Goldman Theatres, Inc. v. Loew's,

Inc., 69 F. Supp. 103, aff'd, 164 F. 2d 1021, cert. denied,

334 U. S. 811. Goldman reported only $125,000 of the

recovery as gross income and claimed that the $250,000

2 For the bases of Glenshaw's claim for damages from fraud, see

Shawkee Manufacturing Co. v. Hartford-Empire Co., 322 U. S. 271;

Hazel-Atlas Glass Co. v. Hartford-Empire Co., 322 U. S. 238.

8 See Hartford-Empire Co. v. United States, 323 U. S. 386, 324

U. S. 570.

COMMISSIONER v. GLENSHAW GLASS CO. 429

426 Opinion of the Court.

balance constituted punitive damages and as such was

not taxable. The Tax Court agreed, 19 T. C. 637, and

the Court of Appeals, hearing this with the Glenshaw case,

affirmed. 211 F. 2d 928.

It is conceded by the respondents that there is no

constitutional barrier to the imposition of a tax on puni-

tive damages. Our question is one of statutory con-

struction: are these payments comprehended by § 22 (a)?

The sweeping scope of the controverted statute is

readily apparent:

"SEC. 22. GROSS INCOME.

"(a) GENERAL DEFINITION.-'Gross income' in-

cludes gains, profits, and income derived from salaries,

wages, or compensation for personal service . . .of

whatever kind and in whatever form paid, or from

professions, vocations, trades, businesses, commerce,

or sales, or dealings in property, whether real or

personal, growing out of the ownership or use of or

interest in such property; also from interest, rent,

dividends, securities, or the transaction of any busi-

ness carried on for gain or profit, or gains or profits

and income derived from any source whatever..

(Emphasis added.) 4

This Court has frequently stated that this language was

used by Congress to exert in this field "the full measure

of its taxing power." Helvering v. Clifford, 309 U. S.331,

334; Helvering v. Midland Mutual Life Ins. Co., 300 U. S.

216, 223; Douglas v. Willcuts, 296 U. S. 1, 9; Irwin v.

Gavit, 268 U. S. 161, 166. Respondents contend that

punitive damages, characterized as "windfalls" flowing

from the culpable conduct of third parties, are not within

the scope of the section. But Congress applied no limi-

tations as to the source of taxable receipts, nor restrictive

4 See note 1, supra.

OCTOBER TERM, 1954.

Opinion of the Court. 348 U. S.

labels as to their nature. And the Court has given a

liberal construction to this broad phraseology in reccgni-

tion of the intention of Congress to tax all gains except

those specifically exempted. Commissioner v. Jacobson,

336 U. S. 28, 49; Helvering v. Stockholms Enskilda Bank,

293 U. S. 84, 87-91. Thus, the fortuitous gain accruing

to a lessor by reason of the forfeiture of a lessee's improve-

ments on the rented property was taxed in Helvering v.

Bruun, 309 U. S. 461. Cf. Robertson v. United States,

343 U. S. 711; Rutkin v. United States, 343 U. Si 130;

United States v. Kirby Lumber Co., 284 U. S. 1. Such

decisions demonstrate that we cannot but ascribe content

to the catchall provision of § 22 (a), "gains or profits and

income derived from any source whatever." The im-

portance of that phrase has been too frequently recognized

since its first appearance in the Revenue Act of 1913'

to say now that it adds nothing to the meaning of "gross

income."

Nor can we accept respondents' contention that a nar-

rower reading of § 22 (a) is required by the Court's char-

acterization of income in Eisner v. Macomber, 252 U. S.

189, 207, as "the gain derived from capital, from labor, or

from both combined." ' The Court was there endeavor-

ing to determine whether the distribution of a corporate

stock dividend constituted a realized gain to the share-

holder, or changed "only the form, not the essence," of

538 Stat. 114, 167.

6

The phrase was derived from Stratton's Independence, Ltd. v.

Howbert, 231 U. S. 399, 415, and Doyle v. Mitchell Bros. Co., 247

U. S. 179, 185i two cases construing the Revenue Act of 1909, 36

Stat. 11, 112. Both taxpayers were "wasting asset" corporations, one

being engaged in mining, the other in lumbering operations. The

definition was applied by the Court to demonstrate a distinction be-

tween a return on capital and "a mere conversion of capital assets."

Doyle v. Mitchell Bros. Co., supra, at 184. The question raised by

the instant case is clearly distinguishable.

COMMISSIONER v. GLENSHAW GLASS CO. 431

426 Opinion of the Court.

his capital investment. Id., at 210. It was held that

the taxpayer had "received nothing out of the company's

assets for his separate use and benefit." Id., at 211. The

distribution, therefore, was held not a taxable event. In

that context-distinguishing gain from capital-the

definition served a useful purpose. But it was not meant

to provide a touchstone to all future gross income

questions. Helvering v. Bruun, supra, at 468-469;

United States v. Kirby Lumber Co., supra, at 3.

Here we have instances of undeniable accessions to

wealth, clearly realized, and over which the taxpayers

have complete dominion. The mere fact that the pay-

ments were extracted from the wrongdoers as punishment

for unlawful conduct cannot detract from their character

as taxable income to the recipients. Respondents

concede, as they must, that the recoveries are taxable to

the extent that they compensate for damages actually

incurred. It would be an anomaly that could not be

justified in the absence of clear congressional intent to

say that a recovery for actual damages is taxable but not

the additional amount extracted as punishment for the

same conduct which caused the injury. And we find no

such evidence of intent to exempt the, payments.

It is urged that re-enactment of § 22 (A.)without change

since the Board of Tax Appeals held 1,-aitive damages

nontaxable in Highland Farms Corp., 42 B. T. A. 1314,

indicates congressional satisfaction with that holding.

Re-enactment--particularly without the slightest affirma-

tive indication that Congress ever had the Highland Farms

decision before it-is an unreliable indicium at best.

Helvering v. Wilshire Oil Co., 308 U. S. 90, 100-101;

Koshland v. Helvering,298 U. S. 441, 447. Moreover, the

Commissioner promptly published his nonacquiescence in

this portion of the Highland Farms holding7 and has,

7 1941-1 Cum. Bull. 16.

OCTOBER TERM, 1954.

Opinion of the Court. 348 U. S.

before and since, consistently maintained the position

that these receipts are taxable.' It therefore cannot be

said with certitude that Congress intended to carve an

exception out of § 22 (a)'s pervasive coverage. Nor does

the 1954 Code's' legislative history, with its reiteration

of the proposition that statutory gross income is "all-

inclusive," '0 give support to respondents' position. The

definition of gross income has been simplified, but no

effect upon its present broad scope was intended.11 Cer-

tainly punitive damages cannot reasonably be classified as

gifts, cf. Commissioner v. Jacobson, 336 U. S. 28, 47-52,

nor do they come under any other exemption provision

in the Code. We would do violence to the plain meaning

of the statute and restrict a clear legislative attempt to

8The long history of departmental rulings holding personal injury

recoveries nontaxable on the theory that they roughly correspond to

a return of capital cannot support exemption of punitive damages

following injury to property. See 2 Cum. Bull. 71; I-1 Cum.

Bull. 92, 93; VII-2 Cum. Bull. 123; 1954-1 Cum. Bull. 179, 180.

Damages for personal injury are by definition compensatory only.

Punitive damages, on the other hand, cannot be considered a restora-

tion of capital for taxation purposes.

1 68A Stat. 3 et seq. Section 61 (a) of the Internal Revenue Code

of 1954, 68A Stat. 17, is the successor to § 22 (a) of the 1939 Cod.,

10

H. R. Rep. No. 1337, 83d Cong., 2d Sess. A18; S. Rep. No. 1622,

83d Cong., 2d Sess. 168.

11In discussing § 61 (a) of the 1954 Code, the House Report states:

"This section corresponds to section 22 (a) of the 1939 Code.

While the language in existing section 22 (a) has been simplified, the

all-inclusive nature of statutory gross income has not been affected

thereby. Section 61 (a) is as broad in scope as section 22 (a).

"Section 61 (a) provides that gross income includes 'all income

from whatever source derived.' This definition is based upon the

16th Amendment and the word 'income' is used in its constitutional

sense." H. R. Rep. No. 1337, supra, note 10, at A18.

A virtually identical statement appears in S. Rep. No. 1622, supra,

note 10, at 168.

COMMISSIONER v. GLENSHAW GLASS CO. 433

426 Opinion of the Court.

bring the taxing power to bear upon all receipts constitu-

tionally taxable were we to say that the payments in

question here are not gross income. See Helvering v.

Midland Mutual Life Ins. Co., supra, at 223.

Reversed.

MR. JUSTICE DOUGLAS dissents.

MR. JUSTICE HARLAN took no part in the consideration

or decision of this case.

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Fire Art Case StudyDokument15 SeitenFire Art Case StudyKimberlyHerring100% (1)

- Final Report - Solving Traveling Salesman Problem by Dynamic Programming Approach in Java Program Aditya Nugroho Ht083276eDokument15 SeitenFinal Report - Solving Traveling Salesman Problem by Dynamic Programming Approach in Java Program Aditya Nugroho Ht083276eAytida Ohorgun100% (5)

- Cat4 Test Practice For Year 11 Level GDokument6 SeitenCat4 Test Practice For Year 11 Level GJoel OkohNoch keine Bewertungen

- 5 - Philippine Refining Co. v. NG SamDokument6 Seiten5 - Philippine Refining Co. v. NG SamFlorence RoseteNoch keine Bewertungen

- 13 - Communication and Information Systems Corp. v. Mark Sensing Austrial PTYDokument3 Seiten13 - Communication and Information Systems Corp. v. Mark Sensing Austrial PTYFlorence Rosete100% (1)

- 2 - Lothar Schuartz v. Court of Appeals - HighlightedDokument6 Seiten2 - Lothar Schuartz v. Court of Appeals - HighlightedFlorence RoseteNoch keine Bewertungen

- Medicard Philippines, Inc. v. CIRDokument3 SeitenMedicard Philippines, Inc. v. CIRFlorence Rosete100% (1)

- Henson JR vs. UCPB General Insurance IncDokument3 SeitenHenson JR vs. UCPB General Insurance IncFlorence Rosete83% (6)

- 8 - Steamship Mutual Underwriting Association (Bermuda) Ltd. v. Sulpicio Lines, Inc., G.R. No. 196072. September 20, 2017Dokument36 Seiten8 - Steamship Mutual Underwriting Association (Bermuda) Ltd. v. Sulpicio Lines, Inc., G.R. No. 196072. September 20, 2017Florence RoseteNoch keine Bewertungen

- Florendo v. Philam Plans, Inc., 666 SCRA 18 (2012)Dokument3 SeitenFlorendo v. Philam Plans, Inc., 666 SCRA 18 (2012)Florence RoseteNoch keine Bewertungen

- 9 - Sony Music v. EspanolDokument13 Seiten9 - Sony Music v. EspanolFlorence RoseteNoch keine Bewertungen

- Tax 1 Midterms Exam ReviewerDokument27 SeitenTax 1 Midterms Exam ReviewerFlorence RoseteNoch keine Bewertungen

- Lothar Schuartz, Et. Al. v. Court of Appeals Case DigestDokument1 SeiteLothar Schuartz, Et. Al. v. Court of Appeals Case DigestFlorence RoseteNoch keine Bewertungen

- 2 Semester, AY2013-2014, AUSL Saturdays, 1:00-3:00 P.M., Rm. 101 Prof. Josephine R. SantiagoDokument8 Seiten2 Semester, AY2013-2014, AUSL Saturdays, 1:00-3:00 P.M., Rm. 101 Prof. Josephine R. SantiagoFlorence RoseteNoch keine Bewertungen

- Biology - Solved ExamDokument27 SeitenBiology - Solved ExamlyliasahiliNoch keine Bewertungen

- Accounting 110: Acc110Dokument19 SeitenAccounting 110: Acc110ahoffm05100% (1)

- Core ApiDokument27 SeitenCore ApiAnderson Soares AraujoNoch keine Bewertungen

- Focus Group DiscussionDokument13 SeitenFocus Group DiscussionSumon ChowdhuryNoch keine Bewertungen

- Childbirth Self-Efficacy Inventory and Childbirth Attitudes Questionner Thai LanguageDokument11 SeitenChildbirth Self-Efficacy Inventory and Childbirth Attitudes Questionner Thai LanguageWenny Indah Purnama Eka SariNoch keine Bewertungen

- Butterfly Valve Info PDFDokument14 SeitenButterfly Valve Info PDFCS100% (1)

- Robot MecanumDokument4 SeitenRobot MecanumalienkanibalNoch keine Bewertungen

- Leg Res Cases 4Dokument97 SeitenLeg Res Cases 4acheron_pNoch keine Bewertungen

- Star QuizDokument3 SeitenStar Quizapi-254428474Noch keine Bewertungen

- Reliability Technoology For Submarine Repeaters PDFDokument8 SeitenReliability Technoology For Submarine Repeaters PDFbolermNoch keine Bewertungen

- Karly Hanson RèsumèDokument1 SeiteKarly Hanson RèsumèhansonkarlyNoch keine Bewertungen

- GearsDokument14 SeitenGearsZulhilmi Chik TakNoch keine Bewertungen

- K9G8G08B0B SamsungDokument43 SeitenK9G8G08B0B SamsungThienNoch keine Bewertungen

- Infusion Site Selection and Infusion Set ChangeDokument8 SeitenInfusion Site Selection and Infusion Set ChangegaridanNoch keine Bewertungen

- Is 13779 1999 PDFDokument46 SeitenIs 13779 1999 PDFchandranmuthuswamyNoch keine Bewertungen

- City/ The Countryside: VocabularyDokument2 SeitenCity/ The Countryside: VocabularyHương Phạm QuỳnhNoch keine Bewertungen

- How To Develop Innovators: Lessons From Nobel Laureates and Great Entrepreneurs. Innovation EducationDokument19 SeitenHow To Develop Innovators: Lessons From Nobel Laureates and Great Entrepreneurs. Innovation Educationmauricio gómezNoch keine Bewertungen

- A Terrifying ExperienceDokument1 SeiteA Terrifying ExperienceHamshavathini YohoratnamNoch keine Bewertungen

- Viva QuestionsDokument3 SeitenViva QuestionssanjayshekarncNoch keine Bewertungen

- Lead Workplace CommunicationDokument55 SeitenLead Workplace CommunicationAbu Huzheyfa Bin100% (1)

- 576 1 1179 1 10 20181220Dokument15 Seiten576 1 1179 1 10 20181220Sana MuzaffarNoch keine Bewertungen

- List of Saturday Opened Branches and Sub BranchesDokument12 SeitenList of Saturday Opened Branches and Sub BranchesSarmad SonyalNoch keine Bewertungen

- Policarpio Vs Manila Times - Unprotected Speech LibelDokument3 SeitenPolicarpio Vs Manila Times - Unprotected Speech LibelStef BernardoNoch keine Bewertungen

- MINIMENTAL, Puntos de Corte ColombianosDokument5 SeitenMINIMENTAL, Puntos de Corte ColombianosCatalina GutiérrezNoch keine Bewertungen

- Sukhtankar Vaishnav Corruption IPF - Full PDFDokument79 SeitenSukhtankar Vaishnav Corruption IPF - Full PDFNikita anandNoch keine Bewertungen

- Article 1156 Gives The Civil Code Definition of Obligation, in Its Passive Aspect. Our Law MerelyDokument11 SeitenArticle 1156 Gives The Civil Code Definition of Obligation, in Its Passive Aspect. Our Law MerelyFeir, Alexa Mae C.Noch keine Bewertungen