Beruflich Dokumente

Kultur Dokumente

Servlet Controller

Hochgeladen von

Surender SharmaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Servlet Controller

Hochgeladen von

Surender SharmaCopyright:

Verfügbare Formate

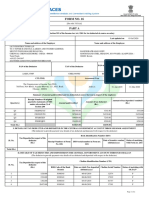

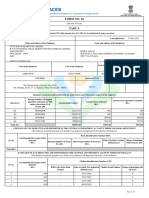

FORM NO.

16

[See rule 31(1)(a)]

PART A

Certificate under Section 203 of the Income-tax Act, 1961 for tax deducted at source on salary

Certificate No. APIGNMK Last updated on 01-Jun-2017

Name and address of the Employer Name and address of the Employee

NAGARRO SOFTWARE PRIVATE LIMITED

PLOT 14, ELECTRONIC CITY, SECTOR 18,

SURENDER SHARMA

GURGAON, HARYANA - 122015

RZ H35 H BLOCK, ASHOK PARK, NO-2, WEST SAGAR PUR, NEW

Haryana

DELHI - 110046 Delhi

accounts@nagarro.com

Employee Reference No.

PAN of the Employee

PAN of the Deductor TAN of the Deductor provided by the Employer

(If available)

AABCN5039J RTKN00902G DFFPS7256H

CIT (TDS) Assessment Year Period with the Employer

From To

The Commissioner of Income Tax (TDS)

2017-18 01-Apr-2016 31-Mar-2017

C.R. Building, Sector 17 . E, Himalaya Marg Chandigarh - 160017

Summary of amount paid/credited and tax deducted at source thereon in respect of the employee

Receipt Numbers of original

Amount of tax deposited / remitted

quarterly statements of TDS Amount of tax deducted

Quarter(s) Amount paid/credited (Rs.)

under sub-section (3) of (Rs.)

Section 200

Q1 QRYLMMVB 107794.00 717.00 717.00

Q2 QSCXZULD 129444.00 915.00 915.00

Q3 QSFKHTLC 129444.00 915.00 915.00

Q4 QSJCRTUD 139671.00 1965.00 1965.00

Total (Rs.) 506353.00 4512.00 4512.00

I. DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH BOOK ADJUSTMENT

(The deductor to provide payment wise details of tax deducted and deposited with respect to the deductee)

Book Identification Number (BIN)

Tax Deposited in respect of the

Sl. No. deductee Date of transfer voucher Status of matching

Receipt Numbers of Form DDO serial number in Form no.

(Rs.) (dd/mm/yyyy) with Form no. 24G

No. 24G 24G

Total (Rs.)

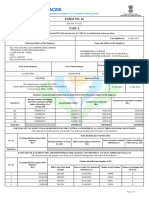

II. DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH CHALLAN

(The deductor to provide payment wise details of tax deducted and deposited with respect to the deductee)

Challan Identification Number (CIN)

Tax Deposited in respect of the

Sl. No. deductee

(Rs.) BSR Code of the Bank Date on which Tax deposited Challan Serial Number Status of matching with

Branch (dd/mm/yyyy) OLTAS*

1 412.00 6390340 06-05-2016 15790 F

2 0.00 - 07-06-2016 - F

3 305.00 6390340 07-07-2016 26115 F

4 305.00 6390340 05-08-2016 21291 F

Signature Not Verified

Signed By:NEERAJ CHHIBBA Page 1 of 2

Signing Date:09.06.2017 19:11

Certificate Number: APIGNMK TAN of Employer: RTKN00902G PAN of Employee: DFFPS7256H Assessment Year: 2017-18

Challan Identification Number (CIN)

Tax Deposited in respect of the

Sl. No. deductee

(Rs.) BSR Code of the Bank Date on which Tax deposited Challan Serial Number Status of matching with

Branch (dd/mm/yyyy) OLTAS*

5 305.00 6390340 07-09-2016 29039 F

6 305.00 6390340 06-10-2016 18032 F

7 305.00 6390340 07-11-2016 34130 F

8 305.00 6390340 06-12-2016 16239 F

9 305.00 6390340 06-01-2017 23238 F

10 305.00 6390340 07-02-2017 31188 F

11 1357.00 6390340 07-03-2017 40714 F

12 303.00 6390340 28-04-2017 16427 F

Total (Rs.) 4512.00

Verification

I, NEERAJ CHHIBBA, son / daughter of SURAJ PAUL CHHIBBA working in the capacity of VP FINANCE (designation) do hereby certify that a sum of Rs. 4512.00

[Rs. Four Thousand Five Hundred and Twelve Only (in words)] has been deducted and a sum of Rs. 4512.00 [Rs. Four Thousand Five Hundred and Twelve Only] has

been deposited to the credit of the Central Government. I further certify that the information given above is true, complete and correct and is based on the books of

account, documents, TDS statements, TDS deposited and other available records.

Place GURGAON

Date 09-Jun-2017 (Signature of person responsible for deduction of Tax)

Designation: VP FINANCE Full Name:NEERAJ CHHIBBA

Notes:

1. Part B (Annexure) of the certificate in Form No.16 shall be issued by the employer.

2. If an assessee is employed under one employer during the year, Part 'A' of the certificate in Form No.16 issued for the quarter ending on 31st March of the financial year shall contain the details

of tax deducted and deposited for all the quarters of the financial year.

3. If an assessee is employed under more than one employer during the year, each of the employers shall issue Part A of the certificate in Form No.16 pertaining to the period for which such

assessee was employed with each of the employers. Part B (Annexure) of the certificate in Form No. 16 may be issued by each of the employers or the last employer at the option of the assessee.

4. To update PAN details in Income Tax Department database, apply for 'PAN change request' through NSDL or UTITSL.

Legend used in Form 16

* Status of matching with OLTAS

Legend Description Definition

Deductors have not deposited taxes or have furnished incorrect particulars of tax payment. Final credit will be reflected only when payment

U Unmatched

details in bank match with details of deposit in TDS / TCS statement

Provisional tax credit is effected only for TDS / TCS Statements filed by Government deductors."P" status will be changed to Final (F) on

P Provisional

verification of payment details submitted by Pay and Accounts Officer (PAO)

In case of non-government deductors, payment details of TDS / TCS deposited in bank by deductor have matched with the payment details

F Final mentioned in the TDS / TCS statement filed by the deductors. In case of government deductors, details of TDS / TCS booked in Government

account have been verified by Pay & Accounts Officer (PAO)

Payment details of TDS / TCS deposited in bank by deductor have matched with details mentioned in the TDS / TCS statement but the

O Overbooked amount is over claimed in the statement. Final (F) credit will be reflected only when deductor reduces claimed amount in the statement or

makes new payment for excess amount claimed in the statement

Signature Not Verified

Signed By:NEERAJ CHHIBBA Page 2 of 2

Signing Date:09.06.2017 19:11

EMPID:4129

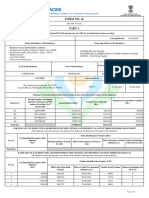

Form No. 16

[See Rule 31(1)(a)]

PART B (Annexure)

Certificate under section 203 of the Income-tax Act, 1961 for Tax deducted at source on Salary

Name and address of the Employer Name and address of the Employee

NAGARRO SOFTWARE PRIVATE LIMITED Surender Sharma

PLOT 14,

ELECTRONIC CITY

SECTOR 18

HARYANA

INDIA

PAN of the Deductor TAN of the Deductor PAN of the Employee Employee Reference No.

provided by the Employer (if

AABCN5039J RTKN00902G available)

DFFPS7256H 4129

CIT(TDS) Assessment Year Period with the Employer

Address : The Commissioner of Income Tax (TDS) FROM TO

C.R. Building, Sector 17 .E, Himalaya Marg 2017-2018 01-Apr-2016 31-Mar-2017

City : Chandigarh Pin code : 160017

Details of Salary Paid and any other income and tax deducted

1.Gross Salary Rs. Rs. Rs.

a)Salary as per provisions contained in sec.17(1) 506,353.00

b)Value of perquisites u/s 17(2) (as per Form No.12BA,

wherever applicable) 0.00

c)Profits in lieu of salary under section 17(3) (as per

Form No.12BA, wherever applicable) 0.00

d)Total 506,353.00

2.Less :Allowance to the extent exempt u/s 10

Allowance Rs.

Conveyance Allowance 19,200.00

House Rent Allowance 78,000.00

97,200.00

3.Balance(1-2) 409,153.00

4.Deductions :

a)Entertainment allowance 0.00

b)Tax on employment 0.00

5.Aggregate of 4(a) and 4(b) 0.00

6.Income chargeable under the head 'Salaries'(3-5) 409,153.00

7.Add: Any other income reported by the employee

Income Rs.

0.00

8.Gross Total Income(6+7) 409,153.00

9.Deductions under Chapter VIA

(A)Sections 80C,80CCC and 80CCD

Gross Amount Deductible Amount

a)Section 80C

Life Insurance Premium 40,452.00 40,452.00

Provident Fund 21,600.00 21,600.00

b)Section 80CCC 0.00 0.00

c)Section 80CCD 0.00 0.00

Note: 1. Aggregate amount deductible under sections 80C, 80CCC and

80CCD(1) shall not exceed one lakh fifty thousand rupees.

Signature Not Verified

Signed By:NEERAJ CHHIBBA

Signing Date:09.06.2017 19:11 Page 1 of 2(Form 16 – Part B)

EMPID:4129

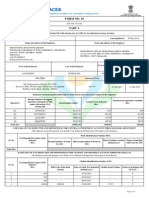

(B)Other sections (e.g. 80E, 80G, 80TTA, etc.)

under Chapter VI-A.

Gross amount Qualifying amount Deductible amount

Section 80D - Medical Insurance - Self / Spouse / Children 3,300.00 3,300.00 3,300.00

10.Aggregate of deductible amount under Chapter VI-A 65,352.00

11.Total Income(8-10) 343,800.00

12.Tax on total income 4,381.00

13.Surcharge (on tax computed at S.No.12) 0.00

14.Education cess @ 3% (on tax computed at S.No.12 + 131.00

on surchage computed at S.No.13)

15.Tax Payable(12+13+14) 4,512.00

16.Less: Relief under Section 89 (attach details) 0.00

17.Tax Payable(15-16) 4,512.00

Verification

I, NEERAJ CHHIBBA, SON OF SURAJ PAUL CHHIBBA working in the capacity of VP FINANCE do hereby certify that the information given

above is true, complete and correct and is based on the books of account, documents, TDS statements, and other available records.

Place Gurgaon

Date 08-Jun-2017 (Signature of person responsible for deduction of tax)

Designation : VP FINANCE Full Name : NEERAJ CHHIBBA

Signature Not Verified

Signed By:NEERAJ CHHIBBA

Signing Date:09.06.2017 19:11 Page 2 of 2(Form 16 – Part B)

EMPID:4129

Form No.12BA

{See Rule 26A(2)(b)}

Statement showing particulars of perquisites,other fringe benefits or amenities and profits in lieu of salary with value thereof

1. Name and address of the employer: NAGARRO SOFTWARE PRIVATE LIMITED

PLOT 14,

ELECTRONIC CITY

SECTOR 18

HARYANA

INDIA

2. TAN RTKN00902G

3. TDS Assessment Range of the employer:

4. Name,designation and PAN of the employee: Surender Sharma

Senior Associate Administration

DFFPS7256H

5. Is the employee a director or a person with N

substantial interest in the company (where the

employer is a company):

6. Income under the head 'Salaries' of the employee 409,153.00

(other than from perquisites):

7. Financial Year: 2016-2017

8. Valuation of Perquisites:

SL. Nature of perquisites(see rule 3) Value of perquisite Amount,if any Amount of

No. as per rules (Rs.) recovered from perquisite

employee (Rs.) chargeable to tax

Col(3)-Col(4) (Rs.)

(1) (2) (3) (4) (5)

1 Accommodation 0.00 0.00 0.00

2 Cars/Other automotive 0.00 0.00 0.00

3 Sweeper, gardener, watchman or personal Attendant 0.00 0.00 0.00

4 Gas, electricity, water 0.00 0.00 0.00

5 Interest free or concessional loans 0.00 0.00 0.00

6 Holiday Expenses 0.00 0.00 0.00

7 Free or Concessional Travel 0.00 0.00 0.00

8 Free Meals 0.00 0.00 0.00

9 Free Education 0.00 0.00 0.00

10 Gifts, vouchers, etc. 0.00 0.00 0.00

11 Credit card expenses 0.00 0.00 0.00

12 Club expenses 0.00 0.00 0.00

13 Use of movable assets by employees 0.00 0.00 0.00

14 Transfer of assets to Employees 0.00 0.00 0.00

15 Value of any other benefit/amenity/service/privilege 0.00 0.00 0.00

16 Stock options (non-qualified options) 0.00 0.00 0.00

17 Other benefits or amenities 0.00 0.00 0.00

18 Total value of perquisites 0.00 0.00 0.00

19 Total value of Profits in lieu of salary as per section 17(3) 0.00 0.00 0.00

9. Details of Tax.

a)Tax deducted from salary of the employee u/s 192(1) 4,512.00

b)Tax paid by employer on behalf of the employee u/s 192(1A) 0.00

c)Total Tax Paid 4,512.00

d)Date of payment into Government treasury Various dates as mentioned on Part A of the Form 16

DECLARATION BY THE EMPLOYER

I, NEERAJ CHHIBBA, SON OF SURAJ PAUL CHHIBBA working as VP FINANCE do hereby declare on behalf of

NAGARRO SOFTWARE PRIVATE LIMITED that the information given above is based on the books of account,documents and

other relevant records or information available with us and the details of value of each such perquisite are in accordance with

section 17 and rules framed there under and that such information is true and correct.

Place Gurgaon

Date 08-Jun-2017 (Signature of person responsible for deduction of tax)

Designation : VP FINANCE Full Name : NEERAJ CHHIBBA

Signature Not Verified

Signed By:NEERAJ CHHIBBA

Signing Date:09.06.2017 19:11 Page 1 of 1(Form 12BA)

FORM NO. 12BB

(See rule 26C)

Statement showing particulars of claims by an employee for deduction of tax under section 192

1. Name and address of the employee : Surender Sharma

2. Permanent Account Number of the employee : DFFPS7256H

3. Financial year : 2016-2017

Details of claims and evidence thereof

Sl. No. Nature of claim Amount(Rs.) Evidence / particulars

(1) (2) (3) (4)

House Rent Allowance:

(i) Rent paid to the landlord : Rs.96000

(ii) Name of the landlord

Suman Devi

(iii) Address of the landlord

1. Rs.96000 House Rent Receipts

71A, New Gopal Nagar,New Delhi

NEW DELHI

Delhi

INDIA

(iv) Permanent Account Number of the landlord

2. Leave travel concessions or assistance Rs.0 Travel Receipts/Tickets

Deduction of interest on borrowing:

(i) Interest payable/paid to the lender

Self Occupied Interest :

Let-OutInterest :

(ii) Name of the lender

Self Occupied :

Let-Out :

(iii) Address of the lender Provisional Certificate from

3. Rs.0.0 Bank/Financial

Self Occupied : Institution/Lender

Let-Out :

(iv) Permanent Account Number of the lender

Self Occupied :

Let-Out :

(a) Financial Institutions

(b) Employer

(c) Others

Signature Not Verified

Signed By:NEERAJ CHHIBBA

Signing Date:09.06.2017 19:11 Page 1 of 2(Form 12BB)

Deduction under Chapter VI-A

(A) Section 80C,80CCC and 80CCD

(i) Section 80C

(a) Provident Fund : Rs.21600

(b) Life Insurance Premium : Rs.40452 Photocopy of the investment

4. Rs. 65352.0

proofs

(ii) Section 80CCC :

(iii) Section 80CCD :

(B) Other sections (e.g. 80E, 80G, 80TTA, etc.) under Chapter VI-A.

(a) Medical Insurance - Self / Spouse / Children : Rs.3300

Verification

I, Surender Sharma son/daughter of Hari Singh. do hereby certify that the information given above is complete and correct.

Place : Gurgaon

Date: 08-Jun-2017

(Signature of the employee)

Designation : Senior Associate Administration Full Name: Surender Sharma

Note: The information/details above, as required for deduction of tax u/s 192 of the Income Tax Act, has been entered by the employee through an authorized

login on the portal.

Signature Not Verified

Signed By:NEERAJ CHHIBBA

Signing Date:09.06.2017 19:11 Page 2 of 2(Form 12BB)

Das könnte Ihnen auch gefallen

- AAFREEN MANSURI - CXVPM5640J - AY201920 - 16 - PartADokument2 SeitenAAFREEN MANSURI - CXVPM5640J - AY201920 - 16 - PartAmanishNoch keine Bewertungen

- BSBPG6820L 2020-21Dokument2 SeitenBSBPG6820L 2020-21Arun PVNoch keine Bewertungen

- Form16 PDFDokument9 SeitenForm16 PDFHarish KumarNoch keine Bewertungen

- Form 16 FY 18-19 PART - ADokument2 SeitenForm 16 FY 18-19 PART - Asai venkataNoch keine Bewertungen

- Form No. 16: Part ADokument6 SeitenForm No. 16: Part Anaveen kumarNoch keine Bewertungen

- Form No. 16: Part ADokument10 SeitenForm No. 16: Part ARAJASHEKAR KYAROLLANoch keine Bewertungen

- FS51853 KPMG PDFDokument9 SeitenFS51853 KPMG PDFAman AgrawalNoch keine Bewertungen

- Atppn7354l 2020 21 PDFDokument2 SeitenAtppn7354l 2020 21 PDFPratik MeswaniyaNoch keine Bewertungen

- Pay Slip March 2017Dokument4 SeitenPay Slip March 2017Anonymous AsVoWD04c0% (1)

- Form 16ADokument4 SeitenForm 16AniranjansankaNoch keine Bewertungen

- Form 16 SV PDFDokument2 SeitenForm 16 SV PDFPravin HireNoch keine Bewertungen

- Form16 Till 14 Dec 2019Dokument11 SeitenForm16 Till 14 Dec 2019Aviral SankhyadharNoch keine Bewertungen

- Form No. 16 Part A (2020)Dokument2 SeitenForm No. 16 Part A (2020)Dharmendra ParmarNoch keine Bewertungen

- PAYSLIPDokument11 SeitenPAYSLIPSaran ManiNoch keine Bewertungen

- Employee: Empno, Desig. Dev Narayan Sah, 52406419756, 2414600, Bela, Awm Pan of The EmployeeDokument2 SeitenEmployee: Empno, Desig. Dev Narayan Sah, 52406419756, 2414600, Bela, Awm Pan of The EmployeeGjjnnmNoch keine Bewertungen

- Form No. 16: Part ADokument6 SeitenForm No. 16: Part Asamir royNoch keine Bewertungen

- Form No. 16: Part BDokument4 SeitenForm No. 16: Part Bmukulgusain2407Noch keine Bewertungen

- Form No. 16: Part ADokument7 SeitenForm No. 16: Part AFuture ArtistNoch keine Bewertungen

- Form16 2021Dokument8 SeitenForm16 2021Mahammad HachanNoch keine Bewertungen

- Kaushik Sarkar Form 16 DynProDokument5 SeitenKaushik Sarkar Form 16 DynProKaushik SarkarNoch keine Bewertungen

- Deve 60398Dokument7 SeitenDeve 60398Devesh Pratap ChandNoch keine Bewertungen

- Form 16 ADokument5 SeitenForm 16 Anisha_khanNoch keine Bewertungen

- Form 16 651746Dokument4 SeitenForm 16 651746Arslan1112Noch keine Bewertungen

- Combined Submitted DocsDokument15 SeitenCombined Submitted DocsViraj ShahNoch keine Bewertungen

- Form 16 - TCSDokument3 SeitenForm 16 - TCSBALANoch keine Bewertungen

- Ahxxxxxxxq q4 2022-23Dokument2 SeitenAhxxxxxxxq q4 2022-23AMAN DEEP SINGHNoch keine Bewertungen

- Form No. 16 Part B (2020)Dokument3 SeitenForm No. 16 Part B (2020)Dharmendra ParmarNoch keine Bewertungen

- YourForm16 2022Dokument8 SeitenYourForm16 2022BHARATH MPNoch keine Bewertungen

- Form 16Dokument2 SeitenForm 16robin0903Noch keine Bewertungen

- PDF To WordDokument1 SeitePDF To WordThe Great Indian TipsNoch keine Bewertungen

- 1 1000 Form16Dokument5 Seiten1 1000 Form16Rakshit SharmaNoch keine Bewertungen

- Form16Dokument5 SeitenForm16er_ved06Noch keine Bewertungen

- Form 16: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDokument4 SeitenForm 16: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalarySyedNoch keine Bewertungen

- 322 PartaDokument2 Seiten322 Partaritik tiwariNoch keine Bewertungen

- BGCC M01495Dokument2 SeitenBGCC M01495RAJKUMAR CHATTERJEE. (RAJA.)Noch keine Bewertungen

- Anil 21-22Dokument2 SeitenAnil 21-22chrisj 99Noch keine Bewertungen

- Computation of Total Income Income From Other Sources (Chapter IV F) 289381Dokument2 SeitenComputation of Total Income Income From Other Sources (Chapter IV F) 289381Ashish AgarwalNoch keine Bewertungen

- Ipca Laboratories LTD - Pithampur: Payslip For The Month of (October - 2021)Dokument4 SeitenIpca Laboratories LTD - Pithampur: Payslip For The Month of (October - 2021)Ashish VermaNoch keine Bewertungen

- b5047 Form16 Fy1819 PDFDokument9 Seitenb5047 Form16 Fy1819 PDFBhumika JoshiNoch keine Bewertungen

- CG FEB 2023 46280987 PayslipDokument1 SeiteCG FEB 2023 46280987 PayslipHR DucallNoch keine Bewertungen

- QUA05242 Form16Dokument5 SeitenQUA05242 Form16saurabhNoch keine Bewertungen

- Employee Details Payment & Leave Details: Arrears Current AmountDokument1 SeiteEmployee Details Payment & Leave Details: Arrears Current AmountLS QNoch keine Bewertungen

- (For Individuals and Hufs Not Having Income From Profits and Gains of Business or Profession) (Please See Rule 12 of The Income-Tax Rules, 1962)Dokument33 Seiten(For Individuals and Hufs Not Having Income From Profits and Gains of Business or Profession) (Please See Rule 12 of The Income-Tax Rules, 1962)harish.nayakNoch keine Bewertungen

- Form16 2022 2023Dokument8 SeitenForm16 2022 2023arun poojariNoch keine Bewertungen

- Salary Jan 2001Dokument2 SeitenSalary Jan 2001Kharde HrishikeshNoch keine Bewertungen

- SRS Business Solutions (India) PVT - LTD: Attendance Details ValueDokument1 SeiteSRS Business Solutions (India) PVT - LTD: Attendance Details ValueraghavaNoch keine Bewertungen

- Form16 2012 AAXPE4654P 2023-24Dokument2 SeitenForm16 2012 AAXPE4654P 2023-24Srinivas EtikalaNoch keine Bewertungen

- May 2020 PDFDokument1 SeiteMay 2020 PDFshaklainNoch keine Bewertungen

- Payslip 11860967 AugDokument1 SeitePayslip 11860967 Augshreya arunNoch keine Bewertungen

- Form 16 FY 19-20Dokument6 SeitenForm 16 FY 19-20Anurag SharmaNoch keine Bewertungen

- DD ProjectDokument2 SeitenDD Projectjatin kuashikNoch keine Bewertungen

- Kansupriya@Deloitte - Com f162022 2023Dokument10 SeitenKansupriya@Deloitte - Com f162022 2023Supriya KandukuriNoch keine Bewertungen

- Peregrine Guarding PVT LTD: Earning DeductionDokument1 SeitePeregrine Guarding PVT LTD: Earning DeductionKruthikaNoch keine Bewertungen

- Form No. 16: Part ADokument9 SeitenForm No. 16: Part ArakehsNoch keine Bewertungen

- 2019 20 PDFDokument7 Seiten2019 20 PDFSanjeet SinghNoch keine Bewertungen

- Ack Cdhpa3843f 2022-23 220950670290722Dokument1 SeiteAck Cdhpa3843f 2022-23 220950670290722rtaxhelp helpNoch keine Bewertungen

- Buqpk7858h 2021-22Dokument2 SeitenBuqpk7858h 2021-22Rahul AryanNoch keine Bewertungen

- Auvpb1446l 2018-19Dokument2 SeitenAuvpb1446l 2018-19Sunil SharmaNoch keine Bewertungen

- Form16 Parta AQLPK9881A 2018-19Dokument2 SeitenForm16 Parta AQLPK9881A 2018-19Rakesh KumarNoch keine Bewertungen

- Form-16 Part-A From TDSCPC Website PDFDokument3 SeitenForm-16 Part-A From TDSCPC Website PDFgaurav singhNoch keine Bewertungen

- Tax Deducted at SourceDokument37 SeitenTax Deducted at SourceasanjeevaNoch keine Bewertungen

- Private YofDokument9 SeitenPrivate YofSasi KumarNoch keine Bewertungen

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Dokument4 SeitenForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Ayush ThakkarNoch keine Bewertungen

- TDS TCSDokument231 SeitenTDS TCSNarinderpal SinghNoch keine Bewertungen

- Form 16 FormatDokument2 SeitenForm 16 FormatParthVanjaraNoch keine Bewertungen

- Tax Deduction at SourceDokument59 SeitenTax Deduction at Sourcepand09Noch keine Bewertungen

- 1form 16 Novopay PDFDokument2 Seiten1form 16 Novopay PDFTirupathi Rao TellaputtaNoch keine Bewertungen

- Tax Deducted at Source UnitDokument13 SeitenTax Deducted at Source Unitsatyanarayan dashNoch keine Bewertungen

- GGGG GGGG GGGGGDokument4 SeitenGGGG GGGG GGGGGKothapalliGuruManiKantaNoch keine Bewertungen

- Tax Deducted at Source (TDS) - Frequently Asked Questions: SL - No. AnswerDokument5 SeitenTax Deducted at Source (TDS) - Frequently Asked Questions: SL - No. AnswerRaveen KumarNoch keine Bewertungen

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Dokument4 SeitenForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Ishani ShahNoch keine Bewertungen

- Akshay - Dev@vedanta - Co.in F16Dokument10 SeitenAkshay - Dev@vedanta - Co.in F16Akshay DevNoch keine Bewertungen

- 27 EtdsDokument29 Seiten27 EtdsSuhag PatelNoch keine Bewertungen

- PDFContent 4 PDFDokument4 SeitenPDFContent 4 PDFphone2hireNoch keine Bewertungen

- Webfurther India Private Limited: Form 16Dokument8 SeitenWebfurther India Private Limited: Form 16RAHUL MITTAPALLYNoch keine Bewertungen

- Aarpa5489j 2019Dokument5 SeitenAarpa5489j 2019drali508482Noch keine Bewertungen

- NSDL Conso File FVU Error Code ListDokument22 SeitenNSDL Conso File FVU Error Code Listlekireddy33% (9)

- Aifpv8610a 2019Dokument4 SeitenAifpv8610a 2019aniketNoch keine Bewertungen

- Internship ProjectDokument57 SeitenInternship ProjectVIKAS AGNIHOTRINoch keine Bewertungen

- TDS Form 16 & 16ADokument14 SeitenTDS Form 16 & 16AVaibhav NagoriNoch keine Bewertungen

- Documents - 5ab25ae789bcd942d600247c - TCL00427 BCWPK5181K16 07 2019 17 22 39 PDFDokument5 SeitenDocuments - 5ab25ae789bcd942d600247c - TCL00427 BCWPK5181K16 07 2019 17 22 39 PDFsadanand kanadeNoch keine Bewertungen

- Direct Taxation: Study NotesDokument610 SeitenDirect Taxation: Study NotesAvneet SinghNoch keine Bewertungen

- AX Educted at Ource - I: KPPM & AssociatesDokument67 SeitenAX Educted at Ource - I: KPPM & AssociatesSaksham JoshiNoch keine Bewertungen

- India: What Is The TDS and Income Tax System in India?Dokument5 SeitenIndia: What Is The TDS and Income Tax System in India?Ketan JajuNoch keine Bewertungen

- Mahindra Finance Education LoanDokument21 SeitenMahindra Finance Education Loanjaspreet singhNoch keine Bewertungen

- Form 16Dokument2 SeitenForm 16Mithun KumarNoch keine Bewertungen

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Dokument4 SeitenForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961rajniNoch keine Bewertungen