Beruflich Dokumente

Kultur Dokumente

Stamp Duty & Fees PDF

Hochgeladen von

VijaiOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Stamp Duty & Fees PDF

Hochgeladen von

VijaiCopyright:

Verfügbare Formate

www.keralaregistration.gov.

in

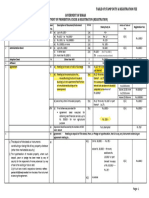

EXISTING RATES OF STAMP DUTY AND REGISTRATION FEES FOR READY REFERENCE

(The Kerala Stamp Act, 1959 is last amended by Kerala Finance Act, 2019 and the Table of Registration fees is last amended by G.O.(P) No.113/2019/TD. dated 24.07.2019)

[This table is for information purpose only. For more accurate definition of provisions, please refer Schedule to Kerala Stamp Act, 1959 and Table of Registration Fees]

Section 2(fb):- “family” means father, mother, grandfather, grandmother, husband, wife, son, adopted son, daughter, adopted daughter, grandchildren, brother and sister (inserted by Kerala Finance Act, 2018)

Sl. No. in

Art. No in the

Nature of Documents Stamp Proper Stamp Duty Registration Fees payable in SRO

Table of Fees

Schedule

Adoption deed 3 Rs.250/- V (4) Rs 1050/-

Agreement or memorandum of an agreement (to giving authority or power to 1% of the value or the estimated cost of construction

2% on the value or the estimated cost

a promoter or developer, by whatsoever name called, for construction, 5 (c) or consideration or fair value of land whichever is I(a)(1)

or fair value

development or sale or transfer of any immovable property) higher, subject to a maximum of Rs 1000

Agreement or memorandum of an agreement (if relating to Monthly Deposit

2% on the value or the estimated

Scheme similar to that of chitties, of whatever name called, between a co- 5 (d) Rs.100/- in respect of each depositor I(a)(1)

cost.

operative Bank/Society and a depositor

Agreement or memorandum of an agreement (If relating to advertisement on

5 (e) Rupees 500 per contract I(a)(1) 2% on the value

mass media)

One rupee for every rupee 1000 or part thereof on the

amount agreed in the contract, subject to a minimum

Agreement or memorandum of an agreement (If relating to public works or

5 (f) of rupees 200 and a maximum of rupees one lakh. [for I(a)(1) 2% on the value

service level agreements)

supplementary deeds duty shall be payable for

amount agreed in supplementary deed ]

Agreement or memorandum of an agreement (if not otherwise provided for) 5 (g) Rs 200/- I(v) Rs 210/-

Rs. 0.1 for every Rs 100 or part there

Agreement, relating to deposit of title deeds (Equitable Mortgage) 6(1) 0.1%, Minimum Rs 200, Maximum Rs 10,000 I(a)(3)

of

Rs. 0.1 for every Rs 100 or part there

Agreement, relating to pawn or Pledge 6(2) 0.1%, Minimum Rs 200, Maximum Rs 10,000 I(a)(3)

of

Release, discharge or cancellation of agreements relating to deposit of title Rs. 0.1 for every Rs 100 or part there

6(3) 0.1%, Maximum Rs 1000 I(a)(4)

deeds, pawn or pledge of

5 rupees for every Rs.100 or part thereof of the amount

Bond 13 I(a)(1) 2% of the amount secured

secured

5 rupees for every Rs.100 or part thereof of the amount

Bottomry bond 14 I(a)(1) 2% of the amount secured

secured

Department of Registration - Government of Kerala

www.keralaregistration.gov.in

Cancellation deed of a previously executed deed (if attested and not otherwise

15 Rs 500 I(u) Rs.210/-

provided for)

Certificate of sale – granted to the purchaser of any property sold by public

2% for registration and No fee if

auction by a Civil or Revenue Court or by the Govt., Collector or other Revenue 16 8 rupees for every Rs.100 or part thereof I(a)(1)

requires only filing in file volume

Officer

Rs.50/- for every Rs.1000/- or part of the total amount Rs.10/- [Appendix II, Rule 44 of Kerala

Filing chitty agreement (Variola) 19 Chit rules

subscribed Chitty Rules 2012]

8 rupees for every Rs.100 or part thereof of the fair 2% of the fair value or consideration

Conveyance - 21 (SALE DEED) - (property situated within panchayath area) 21 (i) I(a)1

value or value of consideration whichever is higher whichever is higher

Conveyance -21- panchayath area - (in respect of whole or a portion of a Two times the stamp duty paid in respect of previous

property involved in the previous conveyance, when executed within a period of 21(ii) conveyance deed or the stamp duty payable under I(a)1 ----- do----

three months from the date of registration of such previous conveyance) 21(i), whichever is higher.

Conveyance – 21-panchayath area—(in respect of whole or a portion of a

One and half times the stamp duty paid in respect of

property involved in the previous conveyance , when executed after three

21(iii) previous conveyance deed or the stamp duty payable I(a)1 ----- do----

months and before six months from the date of registration of such previous

under 21 (i) , whichever is higher.

conveyance.)

Conveyance - 22 (SALE DEED) ( property situated within the areas of 8 rupees for every Rs.100 or part thereof of the fair

22(i) I(a)1 ----- do----

Municipalities/Townships/Cantonments) value or value of consideration whichever is higher

Conveyance -22- municipalities/ townships/ cantonments —(in respect of

Two times the stamp duty paid in respect of previous

whole or a portion of a property involved in the previous conveyance , when

22 ( ii ) conveyance deed or the stamp duty payable under 22 I(a)1 ----- do----

executed within a period of three months from the date of registration of such

(i), whichever is higher.

previous conveyance.)

Conveyance - 22- municipalities/ townships/ cantonments —(in respect of

One and half times the stamp duty paid in respect of

whole or a portion of a property involved in the previous conveyance , when

22 ( iii ) previous conveyance deed or the stamp duty payable I(a)1 ----- do----

executed after three months and before six months from the date of registration

under 22 (i) , whichever is higher.

of such previous conveyance.)

8 rupees for every Rs.100 or part thereof of the fair

Conveyance -22-( property situated within Corporation Area ) 22(iv) I(a)1 ----- do----

value or value of consideration whichever is higher

Department of Registration - Government of Kerala

www.keralaregistration.gov.in

Conveyance -22- Corporations —(in respect of whole or a portion of a property Two times the stamp duty paid in respect of previous

involved in the previous conveyance , when executed within a period of three 22 ( v ) conveyance deed or the stamp duty payable under 22 I(a)1 ----- do----

months from the date of registration of such previous conveyance.) (iv), whichever is higher.

Conveyance - 22- Corporations —(in respect of whole or a portion of a property One and half times the stamp duty paid in respect of

involved in the previous conveyance , when executed after three months and 22 ( vi ) previous conveyance deed or the stamp duty payable I(a)1 ----- do----

before six months from the date of registration of such previous conveyance.) under 22 (iv) , whichever is higher.

EXPLANATION: The amount of two times or one and half times the stamp duty , as the case maybe, payable with respect to a portion or portions of the whole property involved in the previous conveyance shall

be calculated proportionate to the stamp duty paid in the previous conveyance deed.

5 rupees for every Rs.100 or part thereof of the fair

value of land + value of other immovable properties of

2 % of the value / market value of

the transferor company / aggregate of the market

Conveyance – 22 A- Amalgamation of Companies 22A I(a)1 shares and securities / consideration,

value of shares or other marketable securities /the

on which stamp duty is calculated.

amount of consideration paid for such amalgamation

whichever is higher

Copy or Extract -certified to be a true copy or extract by or by order of any public For first 10 pages -Rs.210/-, every

officer and not chargeable under the law for the time being in force relating to 23 Fifty rupees XII (1) additional page above first 10 pages -

court fees Rs. 5/- per page for a document

Exemption - copy of any paper which a public officer is expressly required by law to make or furnish for record in any public office or for any public purpose

Counterpart or Duplicate – of any instrument chargeable with duty and in

respect of which proper stamp duty has been paid – ( Original deed’s stamp does 24 (i) The same duty payable as is in the original I (r) 1 Rs 210/-

not exceed Rs.500/-

Counterpart or Duplicate – of any instrument chargeable with duty and in

respect of which proper stamp duty has been paid- ( Original deed’s stamp 24 (ii) Rs. 500/- I (r) 1 Rs 210/-

exceeds Rs. 500/-

Divorce deed 27 Rs.500/- I (v) Rs.210/-

8 rupees for every Rs.100 or part thereof of the 2% of the fair value or consideration

Exchange ( SD & Fee computed for the property of highest value) 29 I(a)(1)

property of the greater value. whichever is higher

Gift in favour of any of the members of the family and/or legal heirs of the Two rupees for every rupees 1000 or part thereof, 1% of the fair value or market value

31(a) I(a)1 note (viii)

deceased family member subject to a minimum of rupees 1000. whichever is higher

8 rupees for every Rs.100 or part thereof of the fair 2% of the fair value / market value

Gift in favour of a non-family person 31(b) I(a)(1)

value or value of consideration whichever is higher whichever is higher

Same duty as Security bond (No 50) ( 5% of amount

Indemnity Bond 32 I(a)1 2% of the amount secured

secured / Maximum Rs. 500/-)

Department of Registration - Government of Kerala

www.keralaregistration.gov.in

Lease – where rent is fixed and no premium or advance is paid or delivered 33(a) As shown below

5 rupees for every Rs.100 or part thereof of the whole 2% of total sum payable under the

Lease - (less than 1 year) 33a(i) I(d)1(i)

amount payable lease

5 rupees for every Rs.100 or part thereof for Average

Lease (not less than 1 year but not more than 5 years) 33a(ii) I(d)1(ii) 2% of Average Annual Rent

Annual Rent (AAR) reserved

8 rupees for every Rs.100 or part thereof for AAR

Lease (exceeding 5 years but not exceeding 10 years) 33a(iii) I(d)1(ii) 2% of AAR

reserved

8 rupees for every Rs.100 or part thereof for twice the

Lease (exceeding 10 years but not exceeding 20 years) 33a(iv) I(d)1(iii) 2% of twice the amount of AAR

AAR reserved

8 rupees for every Rs.100 or part thereof for three times 2% of three times the amount of

Lease (exceeding 20 years but not exceeding 30 years) 33a(v) I(d)1(iv)

AAR reserved AAR

8 rupees for every Rs.100 or part thereof for four times

Lease (exceeding 30 years but not exceeding 100 years) 33a(vi) I(d)1(v) 2% of four times the amount of AAR

AAR reserved

8 rupees for every Rs.100 or part thereof for 2% of “one- sixth of the whole

consideration equal to one-sixth of the whole amount amount of the rent” which would be

Lease (exceeding 100 years or in perpetuity) 33a(vii) I(d)1(vi)

of rents which would be paid for the first fifty years of paid for the first fifty years of the

the lease lease.

8 rupees for every Rs.100 or part thereof for

consideration equal to three times the amount or value 2% of AAR which would be paid for

Lease (does not purport to be for any definite term) 33a(viii) I(d)1(vii)

of the AAR which would be paid for the first ten years if the first ten years

the lease continued so long

8 rupees for every Rs.100 or part thereof for

LEASE - where the lease is granted for a fine or premium or for money 2% of the amount of premium or

33(b) consideration equal to the amount of such fine or I(d)(2)

advanced and where no rent is reserved advance or fine

premium or advance set forth in lease

8 rupees for every Rs.100 or part thereof for

2% of the amount of such fine or

LEASE - where the lease is granted for a fine or premium or for money consideration equal to the amount of such fine or

33(c) I(d)(3) premium or advance in addition to

advanced in addition to the rent reserved premium or advance in addition to the duty payable

the duty payable under 33(a)

under 33(a)

Explanation I . - When a lessee undertakes to pay any recurring charge, such as Government revenues, the landlord’s share of cessed or the owner’s share of municipal rates or taxes which is by law recoverable

from the lessor, the amount so agreed to be paid by the lessee shall be deemed to be part of the rent.

Explanation II . - Rent paid in advance shall be deemed to be premium or money advanced within the meaning of this serial number unless it is specifically provided in the lease agreement that the rent paid in

advance will be set off towards the last instalment or instalments of rent

Licence to Let - including agreement to let or sublet 35 A Same as Lease ( No 33) I(d) Same as lease

Department of Registration - Government of Kerala

www.keralaregistration.gov.in

Memorandum of association and rules and regulations of a charitable society Rs.1000/- as per Travancore- cochin

under Travancore-Cochin Literary, Scientific and Charitable Societies Registration 36A Rs.500/- literary act 1955 )

Act, 1955 & Societies Registration Act, 1860 Rs. 38/- as per Society reg. act 1860

Mortgage - possession of property is given or agreed to be given and not 8 rupees for every Rs.100 or part thereof for the

37(a) I(a )(1) & I (l) 2% for the amount secured

morgage specified under Sl No 37(d) amount secured by such deed

Mortgage -possession of property is not given or not agreed to be given and not 5 rupees for every Rs.100 or part thereof for the

37(b) I(a )(1) & I (l) 2% for the amount secured

morgage specified under Sl No 37(d) amount secured

0.5% of the amount secured subjected to maximum Rs. 1% for the amount secured,

Mortgage (when executed in favour of commercial banks for securing loans) 37(d) I(a)(1) Note (ix)

20,000/- maximum Rs. 500/-

Exemption 1: Instruments executed by persons taking advances from Government for agricultural purposes or by their sureties as security for the purposes or by their security for the repayment of such

advances

Exemption 2: Instruments executed for securing agricultural and educational loans granted by commercial banks.

15 rupees for every rupees 10,000 for the value or fair

Partition - where the partition is among all or any of the members of the family value, whichever is higher, of the separated share or I(a)1 Note (viii) & I

42 a (ii) 1% of the fair value or market value

and legal heirs of the deceased family member, if any shares of the property, subject to a minimum of rupees (i)

1000.

Partition – in any other case 42 b 6% of Separated Share I(a)(1) & I(i) 2% of Separated Share

Partnership - instrument of partnership deed 43(a) Rs.5000/- I(a)1 2% of value of partnership property

2% of value of partnership property

Dissolution of a partnership deed 43(b) Rs.1000/- 1(p)

Maximum 210/-

Power of Attorney for sole purpose of Registration in relation to a single

44 (a) Rs 50/- I(a)2 Rs. 210/-

transaction

Power of Attorney authorizing one or more person to act in a single transaction

44 (b) Rs 100/- I(a)2 Rs. 210/-

other than 44(a)

Power of Attorney authorizing not more than 5 person to act in general 44 (c) Rs 600/- I(a)2 Rs. 210/-

Power of Attorney authorizing more than 5 but not more than 10 person to act

44 (d) Rs 1000/- I(a)2 Rs. 210/-

in general

Power of attorney when given for consideration and authorize the attorney 2% of value or consideration

44(e) 8 rupees for every Rs.100 or part thereof I(a)1

to sell any immovable property whichever is higher

Power to give authority to sell or develop any immovable property (other than 2% of SD levied subjected to

44 (f) 8 rupees for every Rs.100 or part thereof Note below I a (2)

father, mother, wife, husband, son, daughter, brother, sister) minimum Rs. 210/-

Power of Attorney - in any other case 44 (g) Rs 600/- for each person authorized I a (2) Rs 210/-

Re conveyance if the consideration does not exceed Rs. 1000/- 47(a) The same duty as conveyance (No.21 or 22) I(a)(1) 2% of the amount in document

Rs. 200/- (municipal or corporation area); Rs 150/-

Re conveyance in other case 47(b) I(a)(1) 2% of the amount in document

(panchayath area)

Department of Registration - Government of Kerala

www.keralaregistration.gov.in

Release - When such release operates in favour of any of the members of the Two rupees for every rupees 1000, subject to a I(a)1, note (viii) & I 1% fair value or consideration

48(a)

family and/or legal heirs of the deceased family member minimum of rupees 1000. (e) whichever is higher

Release - Executed by commercial banks in respect of agricultural, educational 1% of the value subject to a

48 (b) 0.1%, Maximum Rs 1000 I(a)1, note (ix)

and other loans maximum of Rs 525.

2% fair value or consideration

Release - in any other case 48 (c) The same duty as conveyance (No.21 or 22) I(a)(1)

whichever is higher

Security Bond ( when the amount secured does not exceed Rs 1000/- 50(a) 5% of the amount secured I(a)(1) 2% of the amount secured

Security Bond (in any other case) 50(b) Rs 500/- I(a)(1) 1% of the value

Settlement - where the settlement is in favour of any of the members of family Two rupees for every rupees 1000, subject to a I (a)1 note viii & I 1% of fair value or market value

51A(a)

and/or legal heirs of the deceased family member minimum of rupees 1000. (j) whichever is higher

Same duty as BOTTOMRY BOND(sl No 14), i,e. (5% of 2% of fair value / market value

Settlement in any other case 51 A (b) I(a)1 & I (j)

fair value or market value) whichever is higher

Same duty as BOTTOMRY BOND(sl No 14), i,e.(5% of

Revocation of settlement 51 B 1 (u) Rs 210/- ( maximum)

fair value or market value) subject to maximum Rs.500/-

2% of consideration or value of

Surrender of Lease - when lease is surrendered before the expiry of lease period 54 (a) Rs 1000 I(a)(1) & I (g) improvements, if not specified fee

payable on the original deed

2% of consideration or value of

Surrender of lease - in any other case 54 (b) Rs. 500/- I(a)(1) & I(g) improvements, if not specified fee

payable on the original deed

2% of fairvalue / consideration

Transfer of lease 56 Same as conveyance rate (Sl No 21/22) I (a)(1)

whichever is higher

Trust -- Declaration of – or concerning any property when made by any writing 57 A Same as conveyance rate (Sl No 21/22) I(a)(1) 2% of the value/trust amount

Trust – Revocation of -- or concerning any property when made by any writing 57 B Same as conveyance rate (Sl No 21/22) I(a)(1) 2% of the value/trust amount

Same duty chargeable to original

Ratification ( Sale, settlement and mortgage) Sec 4 Rs 500/- I (t)

subjected to maximum Rs 525/-

Rectification ( if the deed does not create, transfer, limit, extend, extinguish or Same duty chargeable to original

Nil I(s)

record any right or liability) subjected to maximum Rs 525/-

Will registration / opening a sealed cover Nil V (1), (2) Rs.525/- (for each Testator)

Cancellation of will Nil V (3) Rs 525/- (for each Testator)

Deposit of sealed cover / withdrawal of sealed cover Nil VI (1), (2) Rs 1050/- (for each Testator)

Art. 53 of

Receipt - Sch. I, Indian Rs.1/- (revenue stamp) 1( a)(1) 2% of amount

Stamp Act

Department of Registration - Government of Kerala

www.keralaregistration.gov.in

Duplicate 24 Rs 500/- I (r) (1) Rs 210/-

Same as conveyance (sl No 21/22) as the case may be 2% for fairvalue or consideration

Sale 21 / 22 I (a)(1)

for fair value or consideration whichever is higher whichever is higher

Un valued agreement 5 (e) Rs 200/- I(v) Rs 210/-

Valued agreement 5 (e) Rs. 200/- 1 (a)(1) 2% of the value in the document

(For first 10 pages -Rs.210/-, every

Copying fee for certified copy 23 Rs.50/- XII (1) additional page above first 10 pages -

Rs. 5/-) for a document

Search fee for Single Search / General Search for first 5 years Nil XI(1)&(2 ) a Rs. 105/-

Search fee for Single Search / General Search for 6 to 30 years Nil XI (1)& (2), b Rs. 265/-

Rs. 30/- for each year exceeding 30

Search fee for Single Search / General Search for years exceeding 30 years Nil XI (1)& (2) c

years in addition to Rs.265/-

Application fee for certified copy & Encumbrance Certificate ( single search

Nil XI (3) Rs.15/-

& General search)

Additional sheet ( over and above first two sheets used) Nil I (w) Re 15/- per one sheet

10% of the amount paid subjected to

When the consideration is paid before the Registrar Nil 1(x)

maximum Rs.525/-

Filing translation of document under sec.19 (when the language in the doc. is

Nil II Rs 105/-

not commonly used in the sub distinct and not known to the SR)

Memorandum fee under sec. 64,65, 66, 67 Nil IV (1) Rs 55/-

Cost for sending Dist. Copy under sec 64, 65, 66, 67 + Nil IV(2) Rs 105/- +

Copying fee for document to be send XII (2) Rs. 210/- for each document

Fee under section 30(1) (for documents registered by Dist. Registrar) Nil III Rs 210/-

Attestation of Special Power Same as Sl No 44 VII (1) Rs 105/-

Attestation of General Power Same as Sl No 44 VII (2) Rs 105/-

Private attendance Nil VIII 1(a) Rs 525/-

Jail or Hospital Nil VIII 1 (b) Rs.105/-

Extra Fee for co executants for each instances Nil VIII (3) Rs 105/-

Rs 55/- for every 30 days or part

Safe custody fee Nil IX

maximum Rs 210/-

Will Enquiry / appeal and application under sec.72,73, 35(3) Nil XIII (1 to 5) Rs 55/-

Protest Petition for registering a document / application for withdrawal of a

Nil XIII A Rs 55/-

document presented

Application for Refund of fees / application under sec. 36 / application for

XIV (c, d, e, f) Rs.25/-

returning of a Will already send to DR for safe custody

Department of Registration - Government of Kerala

www.keralaregistration.gov.in

Application for cancellation of a Power of attorney XIV A Rs.105/-

Holiday Registration for each application to accept a document / to attest a

Nil XV (1)& (2) Rs 1050/-

power of attorney / to accept a sealed cover

On every application for holiday registration , an additional fee equal to ½ of the DA admissible under TA rules to officers who attend office shall be ½ DA as remuneration , (maximum one DA as

levied. [XV A (1), (2), (3) of table of fees] remuneration to be appropriated, extra levied should be

Filing translation of power of attorney (when the language in the doc. is not

commonly used in the sub distinct and not known to the SR) / filing special Nil XVI (a), (b), (c) Rs 525/-

power produced along with a document

Rs. 10/- per one sheet (plus GST

Cost of a copying sheet NA XX

@12@)

Survey plan presented along with a document XXI Rs.55/-

TRR Nil XIX Rs. 55/-

Documents securing agricultural loans through co op societies and Housing loan through housing co op societies ( including their release)

I (a )(1) note vii 1% of the value

(principal amount up to Rs 2 lakh)

Documents securing agricultural loans through co op societies and Housing loan through housing co op societies ( including their release)

I(a)(1) 2% of the value

(principal amount above Rs 2 lakh)

Actual TA + (half DA as additional

For proceeding to and returning from PA / Jail/Hospital ( for SR and Peon separately ) for each application. remuneration / PA ) (maximum one

If attends at the same time at two or more residence in same village only one TA, which shall be recovered in equal shares from several VIII 4,5,6, 7 DA as remuneration to be

applicants. ( no TA, if the party arranged vehicle) appropriated, extra levied should

be remitted to treasury)

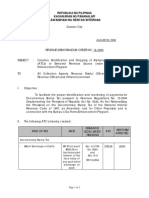

FEES UNDER SPECIAL MARRIAGE ACT [G.O.(P) No. 12/2018/ Law, dtd. 16-11-2018]

GO(P) 12/18/ Law

Special Marriage Notice (paid by the parties) Nil Rs 105/-

dt 16.11.18

Solemnization / Registration of marriage (paid by the parties) Nil ---do-- Rs 1050/-

Fee for search (special marriage) (paid by the applicant) Nil ---do-- RS 105/- for each year

Copying fee (special marriage) (paid by the applicant) 23 Rs 50/- stamp paper ---do-- Rs 105/-

Rs 1050/- as TA to Marriage officer

Solemnization/ registration out side of office (paid by the parties) Nil ---do--

and Rs 1050/- as fee

Recording objection (paid by the objector) Nil ---do-- Rs 105/-(for each objection)

Enquiry in to objection (paid by the objector) Nil ---do-- Rs 525/- (for each enquiry)

Summons to EACH witnesses (paid by the objector) Nil ---do-- Rs 105/- (for each notice )

Department of Registration - Government of Kerala

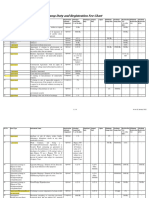

Chit Fees

Kerala Chitty rule 2012 – rule 44 (appendix II) [G.O.(P) No. 209/2013/TD dtd. 18/12/2013 and WP(C) No

2613 of 2014]

I 1 Application to offer Immovable Property as security

(a) Situated within the jurisdiction of the Asst Registrar 100

(b) Situated outside the jurisdiction of the Asst Registrar but within the state 200

Rs. 100 + TA & DA

2 For the Inspection of Immovable Property offered as security

admissible

II 3 Application for Certificate of Sufficiency of Security 100

III 4 For the application for Substitution of Security 500

IV For an application for Previous Sanction 100

V For filing a Declaration of Completion of Subscription [Section 9(1)] 30

VI Issuing a Certificate of Commencement of Chit

(A) Chit Amount - Upto Rs. 5000 10

(b) Chit Amount - Rs. 5001 to Rs.10,000 25

(c) Chit Amount - Rs. 10,001 to Rs.15,000 50

(d) Chit Amount - Rs. 15,001 to Rs.20,000 100

(e) Chit Amount - Rs. Rs. 20001 to Rs.25,000 150

(f) Chit Amount - Rs. 25,001 to Rs.1 Lakh 250

(g) In any other case 750

VII Filing Chit Agreement 10

Filing Alteration of Chit Agreement 10

Filing a Certificate - having furnished of Copy of Registered Chit Agreement

VIII to Subscribers [Section 10(2)] 20

IX Minute Filing 20

X Application for prior approval to Appropriate Sums from the Reserve Fund 1000

XI A fee of Rs. 50 (Rupees Fifty only) shall be levied for the following cases

(a) Removal of defaulting subscriber 50

(b) Substitution of a subscriber 50

(c) Transfer of the rights of foreman 50

(d) Transfer of non-prized subscriber’s right 50

(e) Assent of non-prized subscribers for Withdrawal of a foreman 50

(f) Consent

Chit

of all non-prized or unpaid prized subscribers to the Termination of 50

(g) Protesting against the orders passed by the Registrar 50

XII To conduct any draw in a Chit in the presence of the Registrar or Staff Rs. 200 + TA & DA

XIII 1 Filing of Balance Sheet to be audited by the Chit Auditor

(a)Chit Amount - Upto Rs. 5000 100

(b)Chit Amount - Rs. 5,001 to Rs. 15,000 200

(c)Chit Amount - Rs. 15,001 to Rs. 25,000 300

(d)Chit Amount - Rs. 25,001 to Rs. 50,000 500

(e)Chit Amount - Rs. 50,001 to Rs. One Lakh 1000

(f)In any other case (Including Annual Balance Sheet of companies) 2000

2 For filing the Balance Sheet already audited by an Auditor 500

For Auditing Balance Sheet at the Premises of the Foreman or outside the

3 office of the Rs. 200 + TA & DA

Assistant Registrar

XIV Inspection of records of a chit 10

XV Copy of Chit Records (For every 100 words or fraction thereof) 10

XVI Copy of any order, or award made by the Registrar or his nominee 10

XVII Appeal to the State Government 500

XVIII Winding up of Chit

(a) Chit Amount - Upto Rs. 5,000/- 200

(b) Chit Amount - More than Rs. 5,000/- 400

XIX Opening a New Place of Business 5000

XX For application to award Compensation against petition for winding up of 100

chit

XXI For application for Injunction Order 100

For application for Leave of the Registrar to continue legal proceedings

XXII 100

against foreman

XXIII Application for Attachment of property 1000

XXIV Adjournment of any proceedings 100

XXV Application for Interim Stay of Relief 100

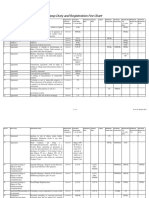

As per order No. GO(P) 63/2016 /TD dated

1 COMPUNDING FEE FOR offences punishable under 76(1) of chits fund act 1982 07/06/2016, Kerala chit fund rule , appendix

III

1 Invitation for subscription without previous sanction (Section 4) Appendix III Rs.5000/-

2 Failure to maintain minimum capital requirement or reserve fund (section 8) Appendix III Rs.5000/-

3 Commencement of chits without obtaining certificate of commencement ( section 9) Appendix III Rs.5000/-

Doing chit business without using / doing other business with using the words chits / chit funds/chitty/kuri (section

4 Appendix III Rs.5000/-

11)

5 Opening place of business without prior approval (section 19) Appendix III Rs.5000/-

6 Failure on the part of foreman to full filling duties under section 22 Appendix III Rs.5000/-

7 Failure on the part of foreman to maintaining records under section 24 Appendix III Rs.500/-

8 Failure on the part of foreman to pay the amount due to defaulting subscribers under section 30 Appendix III Rs.1000/-

Failure on the part of foreman in depositing future subscription / withdrawing the same for other than for payment of

9 Appendix III Rs 500/-

future subscription under section 33(4)

10 Failure on the part of foreman to comply with the directions contained in an order made under section 46(2)/46(3) Appendix III Rs 5000/-

11 Failure on the part of foreman to act as provided in section 61(5) Appendix III Rs.500/-

As per order No. GO(P) 63/2016 /TD dated

2 COMPOUNDING FEE FOR offences punishable under 76(2) of chits fund act 1982 07/06/2016, Kerala chit fund rule , appendix

III

st

1 Failure on the part of foreman filing a certificate under section 10(2) within 15 days after close of the month of 1

Appendix III Rs.1000/-

a draw

1b Failure on the part of foreman filing a copy of minutes under section 18 within 21 days from the date of draw Appendix III Rs.500/-

Failure on the part of foreman to making an entry of removal of subscriber under section 28(3) within 14 days from

1c Appendix III Rs.1000/-

the date of removal

Failure on the part of foreman to making an entry of substitution of subscriber under section 29(2) within 14 days

1d Appendix III Rs.1000/-

from the date of substitution

1e Failure on the part of foreman to filing the entry of transfer of right under section 34,35,37within 15 days Appendix III Rs.1000/-

Failure on the part of foreman to filing a copy of assent under section 26 or consent under section 40(b), 41 within 14

1f Appendix III Rs.1000/-

days from the date of such consent / assent

2 Irregular maintenance of chit records, for each record Appendix III Rs.2000/-

3a Omission on the part of foreman in issuing a copy of registered chit agreement under section 10(1) Appendix III Rs.1000/-

3b Omission on the part of foreman in issuing a copy of resolution under section 38(4) Appendix III Rs.1000/-

Foreman fails to comply with the requirements of the chit agreement regarding the date, time and place at which chit

4 Appendix III Rs.3000/-

is to be drawn / requirements of any direction given under section 38(3)

As per order No. GO(P) 63/2016 /TD dated

3 COMPOUNDING FEE FOR offences punishable under 76(3) of chits fund act 1982 07/06/2016, Kerala chit fund rule , appendix

III

Willfully making any false statement in any document required to be filed under this act Appendix III Rs.5000/-

Note: As per rule 66 of chit fund rule Kerala, Provided that maximum number of offences that can be compounded is limited to three.

Das könnte Ihnen auch gefallen

- Andhra Pradesh and Telangana Stamp ActDokument53 SeitenAndhra Pradesh and Telangana Stamp ActASHUTOSH MISHRANoch keine Bewertungen

- Laws - Guide For Freelancers in IndiaDokument9 SeitenLaws - Guide For Freelancers in Indiaranjithxavier100% (4)

- INDIAN STAMP ACT, 1899 Schedule I-A - SCHEDULE I-ADokument28 SeitenINDIAN STAMP ACT, 1899 Schedule I-A - SCHEDULE I-AyashNoch keine Bewertungen

- Haryana Stamp ActDokument4 SeitenHaryana Stamp ActRupali SamuelNoch keine Bewertungen

- Duty & Fees - Stamp Duty and Registration FeeDokument5 SeitenDuty & Fees - Stamp Duty and Registration FeeBoopathy RangasamyNoch keine Bewertungen

- Karnataka Stamp Act 1957 Schedule PDFDokument53 SeitenKarnataka Stamp Act 1957 Schedule PDFRAJESH KUMARNoch keine Bewertungen

- Bihar Stamp Duty and Registration Charges BiharDokument1 SeiteBihar Stamp Duty and Registration Charges BiharAkshansh NegiNoch keine Bewertungen

- Department of Prohibition, Excise & Registration (Registration)Dokument13 SeitenDepartment of Prohibition, Excise & Registration (Registration)salini jhaNoch keine Bewertungen

- GO ChangeInStampDutyDokument9 SeitenGO ChangeInStampDutySANTHOSH SANTHOSHNoch keine Bewertungen

- Stamp Duty Changes From 10.7.2023Dokument2 SeitenStamp Duty Changes From 10.7.2023Preetha ChelladuraiNoch keine Bewertungen

- Section 2 - Amendment of Schedule-1 of Act No. 2 of 1899Dokument34 SeitenSection 2 - Amendment of Schedule-1 of Act No. 2 of 1899ASHUTOSH MISHRANoch keine Bewertungen

- Document Wise Detail of Stamp Duty PunjabDokument1 SeiteDocument Wise Detail of Stamp Duty PunjabHarjinder SinghNoch keine Bewertungen

- Stamp Duty and Registration Fee Chart: OptionalDokument14 SeitenStamp Duty and Registration Fee Chart: Optionalkalluri raviNoch keine Bewertungen

- Stamp Duty and Registration Fee Chart: OptionalDokument14 SeitenStamp Duty and Registration Fee Chart: OptionalYatish RanjanNoch keine Bewertungen

- 30999rmo 16-2006Dokument5 Seiten30999rmo 16-2006lara.zestoNoch keine Bewertungen

- Stamp Duty On ConveyanceDokument3 SeitenStamp Duty On Conveyancekashvivachhani111Noch keine Bewertungen

- GFR IiiDokument128 SeitenGFR Iiiavinash_vyas77813Noch keine Bewertungen

- Actual Investment Declaration For FY 2017-18: Section Nature of Deduction Maximum Amt Documents RequiredDokument6 SeitenActual Investment Declaration For FY 2017-18: Section Nature of Deduction Maximum Amt Documents Requiredsandeepreddys091537Noch keine Bewertungen

- ANNEXURE 2 - Guidelines On Supporting For Actual Investment (FY 2021-22)Dokument7 SeitenANNEXURE 2 - Guidelines On Supporting For Actual Investment (FY 2021-22)aasasasNoch keine Bewertungen

- IPC Chapter 09A: Chapter IXA - of Offences Relating To ElectionsDokument18 SeitenIPC Chapter 09A: Chapter IXA - of Offences Relating To ElectionsAdnan MoquaddamNoch keine Bewertungen

- 2020-03-26 Stamp Duty and Registration Fee T NaduDokument5 Seiten2020-03-26 Stamp Duty and Registration Fee T Naduvganapathy1000Noch keine Bewertungen

- Edelweiss Broking LTD.: V03/Feb/2020Dokument2 SeitenEdelweiss Broking LTD.: V03/Feb/2020Shyam KukrejaNoch keine Bewertungen

- General Financial and Accounts Rules: Government of RajasthanDokument64 SeitenGeneral Financial and Accounts Rules: Government of RajasthanDrManoj Kumar SharmaNoch keine Bewertungen

- Stamp Duty Rates - Department of Registration & Stamps, MaharashtraDokument3 SeitenStamp Duty Rates - Department of Registration & Stamps, Maharashtrasunil2796Noch keine Bewertungen

- Dalkhola MunicipalityDokument12 SeitenDalkhola MunicipalityHarish Kumar MahavarNoch keine Bewertungen

- StampFees TelanganaDokument22 SeitenStampFees TelanganaAbdul Kalim0% (1)

- Stamp Paper TypesDokument16 SeitenStamp Paper TypesMuhammad Ehsan QadirNoch keine Bewertungen

- List of Registrable ChargesDokument3 SeitenList of Registrable Chargesadv_vinayakNoch keine Bewertungen

- Part-Iii Delegation of Financial Powers: General Financial and Accounts RulesDokument70 SeitenPart-Iii Delegation of Financial Powers: General Financial and Accounts RulesD RamNoch keine Bewertungen

- Karnataka Stamp ActDokument53 SeitenKarnataka Stamp ActAkshay BhatiaNoch keine Bewertungen

- Depositoryparticipants MZDokument146 SeitenDepositoryparticipants MZsekradNoch keine Bewertungen

- Chandigarh - Stamp DutyDokument5 SeitenChandigarh - Stamp DutyVirajNoch keine Bewertungen

- Jagatjit Industries LimitedDokument3 SeitenJagatjit Industries LimitedFARUKH N MႮNՏHiNoch keine Bewertungen

- TransferapplicationDokument17 SeitenTransferapplicationsandeeparora007.com6204Noch keine Bewertungen

- Stamp Duty and Registration Fee Detail PDFDokument7 SeitenStamp Duty and Registration Fee Detail PDFyashpalahujaNoch keine Bewertungen

- Transfer ApplicationDokument17 SeitenTransfer ApplicationMukul KumarNoch keine Bewertungen

- Schedule I and II To The Maharashtra Stamp Act (BOM. ACT LX OF 1958)Dokument32 SeitenSchedule I and II To The Maharashtra Stamp Act (BOM. ACT LX OF 1958)nikita karwaNoch keine Bewertungen

- Chit Fund FeesDokument5 SeitenChit Fund Feesvinod kumarNoch keine Bewertungen

- Project Information Sheet - IPRCLDokument1 SeiteProject Information Sheet - IPRCLMAULIK RAVALNoch keine Bewertungen

- Key Fact DocumentDokument2 SeitenKey Fact DocumentJagiNoch keine Bewertungen

- SOC AssetsDokument2 SeitenSOC AssetsptsmithrafoundationNoch keine Bewertungen

- Legal ChargesDokument2 SeitenLegal ChargesSDTV SriLankaNoch keine Bewertungen

- Stamp Duty and Registration Fee Chart - MPDokument2 SeitenStamp Duty and Registration Fee Chart - MPAkshansh NegiNoch keine Bewertungen

- Stamp Duty and Registration Fee ChartDokument14 SeitenStamp Duty and Registration Fee ChartSujay JadhavNoch keine Bewertungen

- The Maharashtra Act Schedule 1 and 2Dokument40 SeitenThe Maharashtra Act Schedule 1 and 2manish jaiswalNoch keine Bewertungen

- Stamp DutyDokument4 SeitenStamp DutyArushi KumarNoch keine Bewertungen

- Maharashtra: Supuinro, Ji,,g E11gine - SE It Hanical ErnaliulanDokument3 SeitenMaharashtra: Supuinro, Ji,,g E11gine - SE It Hanical ErnaliulanEldhoThomasNoch keine Bewertungen

- TDS Rates and ReturnsDokument4 SeitenTDS Rates and ReturnsMohanlal BishnoiNoch keine Bewertungen

- Vol. I. 1 Ch. 3-DDokument12 SeitenVol. I. 1 Ch. 3-DKanishka SihareNoch keine Bewertungen

- Stamp Duty in RajasthanDokument22 SeitenStamp Duty in RajasthanPooja MisraNoch keine Bewertungen

- Draft Reply To AUDA - 17.02.2023 - Request To Reconsider Decision of Rejecting Our BidDokument5 SeitenDraft Reply To AUDA - 17.02.2023 - Request To Reconsider Decision of Rejecting Our Bidpatelharshh201197Noch keine Bewertungen

- Circular 349-2017 Snap Shot Annexure PDFDokument7 SeitenCircular 349-2017 Snap Shot Annexure PDFaeu3csd bdvtNoch keine Bewertungen

- Special Use Permit - City CouncilDokument1 SeiteSpecial Use Permit - City CouncilMark Anthony AlvarioNoch keine Bewertungen

- SI 2021-023 Broadcasting (Listener's Licenses) (Fees) Notice, 2021Dokument2 SeitenSI 2021-023 Broadcasting (Listener's Licenses) (Fees) Notice, 2021JephiasNoch keine Bewertungen

- TDS Rates On The Income Tax of Bangladesh For 2019-20Dokument19 SeitenTDS Rates On The Income Tax of Bangladesh For 2019-20Muhammad Asaduzzaman MonaNoch keine Bewertungen

- Annex I - RFR Checklist For NCDDP-AFDokument6 SeitenAnnex I - RFR Checklist For NCDDP-AFGEREMY SANTIAGONoch keine Bewertungen

- Fees and Charges To DPDokument2 SeitenFees and Charges To DPMohd FarhanNoch keine Bewertungen

- Stamp Duty and Registration FeeDokument18 SeitenStamp Duty and Registration FeeDeepak KumarNoch keine Bewertungen

- Lease and License - DifferenceDokument10 SeitenLease and License - DifferenceranjithxavierNoch keine Bewertungen

- Kerala High Court Calendar 2019Dokument1 SeiteKerala High Court Calendar 2019ranjithxavierNoch keine Bewertungen

- Gahan Fee Exempted (Kerala)Dokument1 SeiteGahan Fee Exempted (Kerala)ranjithxavierNoch keine Bewertungen

- Kerala Co-Operative Societies - Employees Welfare Fund - Rule AmendedDokument3 SeitenKerala Co-Operative Societies - Employees Welfare Fund - Rule AmendedranjithxavierNoch keine Bewertungen

- Supreme Court of India On Sec 133 (6) of Income Tax Act, 1965Dokument17 SeitenSupreme Court of India On Sec 133 (6) of Income Tax Act, 1965ranjithxavierNoch keine Bewertungen

- Chit Funds Exempted From Service TaxDokument19 SeitenChit Funds Exempted From Service TaxranjithxavierNoch keine Bewertungen

- Kerala Co-Operative Societies Act - Qualifying Test ExemptionDokument3 SeitenKerala Co-Operative Societies Act - Qualifying Test ExemptionranjithxavierNoch keine Bewertungen

- Contact Details of District Sports Councils, Kerala, IndiaDokument2 SeitenContact Details of District Sports Councils, Kerala, Indiaranjithxavier100% (1)

- Monserrat V Ceron ARCELLANA (D2017)Dokument2 SeitenMonserrat V Ceron ARCELLANA (D2017)huhah303100% (1)

- Megahertz CommunicationDokument11 SeitenMegahertz CommunicationRidho Hirzan Saputra100% (1)

- Exercise Economics Evaluation of StermoleDokument28 SeitenExercise Economics Evaluation of StermoleHendro StrifeNoch keine Bewertungen

- Activities of Lic AgentsDokument10 SeitenActivities of Lic Agentssamir249Noch keine Bewertungen

- The Global Financial CrisisDokument26 SeitenThe Global Financial CrisisMazin AhmadNoch keine Bewertungen

- Development Financial InstitutionsDokument8 SeitenDevelopment Financial InstitutionsMonika AgrawalNoch keine Bewertungen

- A Highway To Debt: "He Who Promises Runs in Debt." - The TalmudDokument6 SeitenA Highway To Debt: "He Who Promises Runs in Debt." - The TalmudGautam MehtaNoch keine Bewertungen

- Bay Bitaman Ajil ApplicationDokument29 SeitenBay Bitaman Ajil Applicationproffina786Noch keine Bewertungen

- The Satsuma Zaibatsu by Thomas SchalowDokument28 SeitenThe Satsuma Zaibatsu by Thomas Schalowapi-260432934Noch keine Bewertungen

- Chris Haig 2010 Award Top 100 UsaDokument2 SeitenChris Haig 2010 Award Top 100 Usaapi-267124068Noch keine Bewertungen

- State Attorneys General Lawsuits Against CompaniesDokument13 SeitenState Attorneys General Lawsuits Against CompaniesAnonymous Pb39klJNoch keine Bewertungen

- Rizal Commercial Banking Corporation, Uy Chun BING AND ELI D. LAO, Petitioners, Court of Appeals and Goyu & SONS, INC., RespondentsDokument4 SeitenRizal Commercial Banking Corporation, Uy Chun BING AND ELI D. LAO, Petitioners, Court of Appeals and Goyu & SONS, INC., RespondentsJared LibiranNoch keine Bewertungen

- Techniques For Calculating Efficient FrontierDokument10 SeitenTechniques For Calculating Efficient Frontiersiam122Noch keine Bewertungen

- Punjab & Sind Bank Po 2011 PDFDokument28 SeitenPunjab & Sind Bank Po 2011 PDFnrpindiaNoch keine Bewertungen

- Kokila 3Dokument211 SeitenKokila 3Arpit TibrewalNoch keine Bewertungen

- Carbonell v. CA DigestDokument4 SeitenCarbonell v. CA DigestKirsten Denise B. Habawel-VegaNoch keine Bewertungen

- Pedro Guevara Ramon DioknoDokument27 SeitenPedro Guevara Ramon DioknoRaymond ChengNoch keine Bewertungen

- Finite Mathematics 1Dokument3 SeitenFinite Mathematics 1Joerael HarrisNoch keine Bewertungen

- Guest Posts & Other ResroucesDokument18 SeitenGuest Posts & Other Resroucesinfop15Noch keine Bewertungen

- Commercial BQSDokument47 SeitenCommercial BQSStefhanie Khristine PormanesNoch keine Bewertungen

- Sarfaesi Act 2002Dokument27 SeitenSarfaesi Act 2002Prajakta MantriNoch keine Bewertungen

- Philippine Bank Vs GoDokument21 SeitenPhilippine Bank Vs GolanderNoch keine Bewertungen

- Problem 2Dokument7 SeitenProblem 2Severus S PotterNoch keine Bewertungen

- Education LoanDokument3 SeitenEducation Loanbbanik82Noch keine Bewertungen

- HSBC v. BroquezaDokument3 SeitenHSBC v. BroquezaJay EmNoch keine Bewertungen

- Sale Deed For Immovable Property in Delhi: Form No. 12Dokument6 SeitenSale Deed For Immovable Property in Delhi: Form No. 12Sudeep SharmaNoch keine Bewertungen

- Dena Niwas Housing Loan: (To Be Reset at The End of Every 3 Years)Dokument24 SeitenDena Niwas Housing Loan: (To Be Reset at The End of Every 3 Years)asdNoch keine Bewertungen

- Compensation Analyst or Financial Analyst or Data Analyst or OpeDokument2 SeitenCompensation Analyst or Financial Analyst or Data Analyst or Opeapi-77649810Noch keine Bewertungen

- Agri Lending Learning 35343 - The - Loan - ApplicationDokument7 SeitenAgri Lending Learning 35343 - The - Loan - Applicationapi-3833893Noch keine Bewertungen

- Froilan vs. OrientalDokument4 SeitenFroilan vs. OrientalMarian's PreloveNoch keine Bewertungen