Beruflich Dokumente

Kultur Dokumente

Accounting Ratios

Hochgeladen von

Ankit Roy0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

23 Ansichten3 Seitenas

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenas

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

23 Ansichten3 SeitenAccounting Ratios

Hochgeladen von

Ankit Royas

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 3

Industry

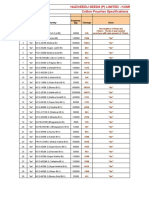

To test Name of Ratio Formula Parties interested

norm

Liquidity and i) Current Ratio Current Assets Short-term creditors, 2:1

Solvency Current Liabilities investors, money

lenders & like parties

ii) Liquid/Quick/ Current assets - Stock - Prepaid -do- 1:1

Acid Test Ratio

Expenses

Current Liabilities - Bank

Overdraft - Prereceived Income

iii) Absolute Liquid Cash + Marketable securities -do- 1:1

Ratio

Quick Liabilities

iv) Proprietary Proprietor’s Fund -do- 60% to

Ratio

Total Assets 75%

[Proprietor’s funds = Equity

Capital + Preference Capital +

Reserves and Surplus +

Accumulated funds - Debit

balances of P & L A/c and

Miscellaneous Expenses]

Capitalisation i) Debt Debt -do- 2:1

Equity Ratio

Equity

[Debt = Long/Short-term loans,

debentures, bills, etc, Equity =

Proprietor’s funds]

ii) Capital Gearing Fixed cost funds -do- 2:1

Ratio

Funds not carrying fixed cost

[Fixed cost funds = Preference

share capital, Debentures,

Loans from banks, financial

institutions, other unsecured

loans].

[Funds not carrying fixed cost

= Equity share capital +

undistributed profit - P & L A/c

(Dr. Bal.) - Misc. expenses].

Profitability and i) Gross Profit Gross Profit x 100 Shareholders, Long- 20% to

Ratio

management Net sales term Creditors, 30%

efficiency Government

ii) Net Profit Ratio Net Profit x 100 -do- 5% to

Net sales 10%

[Net profit may be either

Operating Net profit, Profit

before tax or Profit after tax].

iii) Return on Net profit x 100 -do- —

Capital

Capital employed

Employed

(ROCE) [Capital employed = Fixed

Assets + Current Assets -

Current Liabilities].

iv) Return on Profit after tax -do- —

Proprietors

Proprietor’s funds

fund

v) Return on Profit after tax less pref. -do- —

Capital

Dividend x 100

Equity Share Capital

vi) Earnings per Profit after tax less pref. -do- —

share [EPS]

Dividend

Total No. of Equity Shares

vii) Dividend per Total Dividend paid to ordinary Shareholders, —

share [DPS]

shareholders Investors

Number of ordinary shares

Management i) Stock Turnover Cost of goods sold Management 5 to 6

efficiency Average Stock times

ii) Debtors Debtors + Bills receivable x Management 45 to 60

Turnover Ratio

365 days

Net Credit sales

iii) Debtor’s Credit sales Management 60 to 90

Turnover Rate

Avg. Debtors + Bills receivable days

iv) Creditor’s Creditors + Bills payable x 365 -do-

Turnover Ratio

Credit purchases

v) Creditor’s Credit purchases

Turnover Rate

Average Creditors

vi) Operating Operating Costs x 100

Ratio

Net sales

[Operating Cost = Cost of

goods sold + Operating

expenses (viz. Administrative,

selling & finance expenses)]

Number of times Preference Net profit (after Interest & Tax Preference

preference shareholders’ but before equity dividend) shareholders

dividends covered coverage ratio Preference Dividend

by net profit

Number of times Equity Net profit (after interest, tax & Equity shareholders

equity dividends shareholder’s Pref. Dividend)

covered by net coverage ratio Equity Dividend

profit

Number of times Interest coverage Net profit (before Interest & Debentureholders,

fixed interest ratio Tax) (PBIT) Loan creditors

covered by net Fixed interests & charges

profit

Relationship Total coverage Net profit (before Interest & Shareholders,

between net profit ratio Tax) (PBIT) investors, creditors,

and total fixed Total fixed charges lenders

charges

The idle capacity Fixed expenses to Fixed expenses Management

in the total cost ratio Total cost shareholders

Organisation

Material Material Material consumption Management

consumption to consumption to Sales

sales sales ratio

Wages to sales Wages to sales Wages Management

ratio Sales

The future market Price earning ratio Market price of a share (MPS) Investors, speculators

price of a share Earnings per share (EPS)

Das könnte Ihnen auch gefallen

- Go Thunk Yourself, Again!: Mindset Stacking GuidesVon EverandGo Thunk Yourself, Again!: Mindset Stacking GuidesNoch keine Bewertungen

- Dutch Introduction!!Dokument24 SeitenDutch Introduction!!Aiam Aia PapayaNoch keine Bewertungen

- Bantu LugandaDokument18 SeitenBantu LugandaMichael BloomNoch keine Bewertungen

- The Banking Cartel Wants Me To Turn You Off by Ignoring Your Input Into The Global Currency ResetDokument4 SeitenThe Banking Cartel Wants Me To Turn You Off by Ignoring Your Input Into The Global Currency Resetkaren hudesNoch keine Bewertungen

- Bakery Business PlanDokument34 SeitenBakery Business PlanTummy TruckkNoch keine Bewertungen

- 10 Best Ways To Learn A New LanguageDokument1 Seite10 Best Ways To Learn A New LanguageFalseyNoch keine Bewertungen

- Applicatives in LugandaDokument61 SeitenApplicatives in Lugandakibirango allan100% (1)

- Introduction To Structured FinanceDokument17 SeitenIntroduction To Structured FinanceVaibhav ShahNoch keine Bewertungen

- Regulation Body of KnowledgeDokument238 SeitenRegulation Body of Knowledgeshriarticles3584Noch keine Bewertungen

- How To Develop A Super MemoryDokument12 SeitenHow To Develop A Super MemoryCamden XbowNoch keine Bewertungen

- Executive Summary: Business Plan PurposeDokument2 SeitenExecutive Summary: Business Plan PurposeJohnsNoch keine Bewertungen

- Chartered Financial AnalystDokument9 SeitenChartered Financial AnalystBhavesh SharmaNoch keine Bewertungen

- MT Dutch AdvancedDokument32 SeitenMT Dutch AdvanceddaemonelsonNoch keine Bewertungen

- LinguaBoost BrazPortuguese Sample L1 L5Dokument7 SeitenLinguaBoost BrazPortuguese Sample L1 L5Eugenio HerediaNoch keine Bewertungen

- University of California, Berkeley University of Lancaster: The Word in LugandaDokument19 SeitenUniversity of California, Berkeley University of Lancaster: The Word in LugandaFrancisco José Da SilvaNoch keine Bewertungen

- The BIG List of (100+) Spanish Idioms and ExpressionsDokument8 SeitenThe BIG List of (100+) Spanish Idioms and ExpressionsStefani Camacho FemeniaNoch keine Bewertungen

- MT Japanese IntroductoryDokument13 SeitenMT Japanese IntroductoryNiko MarikewNoch keine Bewertungen

- Intro DutchDokument13 SeitenIntro Dutchd4d42937Noch keine Bewertungen

- Nuevo Pensamiento Similar AuthorsDokument5 SeitenNuevo Pensamiento Similar AuthorsOmlira LaraNoch keine Bewertungen

- CAIA Sample Questions & Exercises: LosebubDokument3 SeitenCAIA Sample Questions & Exercises: LosebubData SoongNoch keine Bewertungen

- Mini-Course Part 01Dokument6 SeitenMini-Course Part 01Berenice Canizal QuijanoNoch keine Bewertungen

- Idioms (SP En)Dokument344 SeitenIdioms (SP En)PepeNoch keine Bewertungen

- Recycling Waste Materials Business PlanDokument55 SeitenRecycling Waste Materials Business PlanMohit YadavNoch keine Bewertungen

- Section 3: SwapsDokument32 SeitenSection 3: Swapsswesam123Noch keine Bewertungen

- 2023 CFA© Program Curriculum Level I Volume 5 Private EquityDokument8 Seiten2023 CFA© Program Curriculum Level I Volume 5 Private EquityRuffin MickaelNoch keine Bewertungen

- FSI Luganda Basic Course InstructorDokument385 SeitenFSI Luganda Basic Course InstructorFantastic JackielineNoch keine Bewertungen

- Learning How To Read Arabic The Quick WayDokument95 SeitenLearning How To Read Arabic The Quick WaysenadbeyNoch keine Bewertungen

- 71 Common Spanish Phrases To Survive Your First Conversation With A Native SpeakerDokument18 Seiten71 Common Spanish Phrases To Survive Your First Conversation With A Native SpeakerBinibining Rica Mae GarcesNoch keine Bewertungen

- E-Commerce Start-Up Business PlanDokument57 SeitenE-Commerce Start-Up Business PlanSheikh Sofiqul IslamNoch keine Bewertungen

- Bonus #3 How To Cut The Time It Takes You To Do Things in Half, EffortlesslyDokument15 SeitenBonus #3 How To Cut The Time It Takes You To Do Things in Half, EffortlesslyRaul RojasNoch keine Bewertungen

- To Test Name of Ratio Formula Parties Interested Industr y NormDokument4 SeitenTo Test Name of Ratio Formula Parties Interested Industr y NormMohit SachdevNoch keine Bewertungen

- To Test Name of RatioDokument12 SeitenTo Test Name of RatioSurendra DevadigaNoch keine Bewertungen

- Company Name: (In Rs CRS) (In Rs CRS)Dokument9 SeitenCompany Name: (In Rs CRS) (In Rs CRS)DineshNoch keine Bewertungen

- Fin QuestionsDokument22 SeitenFin Questionsvikki2point9Noch keine Bewertungen

- Gross Profit Net Profit/ EBIT: Return On Capital EmployesDokument9 SeitenGross Profit Net Profit/ EBIT: Return On Capital Employesshekhar371Noch keine Bewertungen

- CAMEL Rating Toolkit 7.4Dokument34 SeitenCAMEL Rating Toolkit 7.4Setiawan GunadiNoch keine Bewertungen

- RatiosDokument8 SeitenRatiosNashwa KhalidNoch keine Bewertungen

- Accounting For Management: UniversityDokument14 SeitenAccounting For Management: UniversityMehak SharmaNoch keine Bewertungen

- Ch-4 Ratios TheoryDokument3 SeitenCh-4 Ratios TheoryShubham PhophaliaNoch keine Bewertungen

- Afm - 21421134Dokument13 SeitenAfm - 21421134Mehak SharmaNoch keine Bewertungen

- Ratio AnalysisDokument4 SeitenRatio AnalysisLalitha BalajiNoch keine Bewertungen

- Accounting FM NotesDokument2 SeitenAccounting FM NotessapbuwaNoch keine Bewertungen

- AISN Ratio Analysis FINALDokument8 SeitenAISN Ratio Analysis FINALFake NameNoch keine Bewertungen

- Accounting RatiosDokument17 SeitenAccounting RatiosVijayKapoorNoch keine Bewertungen

- Corporate Finance: Short-Term Finance and PlanningDokument26 SeitenCorporate Finance: Short-Term Finance and PlanningSyed Nagma ShabnamNoch keine Bewertungen

- Financial Statements of A CompanyDokument12 SeitenFinancial Statements of A CompanyRiddhi SharmaNoch keine Bewertungen

- Ratios ASDokument6 SeitenRatios ASkhadija mazharNoch keine Bewertungen

- Financial Analysis Cheat Sheet: by ViaDokument2 SeitenFinancial Analysis Cheat Sheet: by Viaheehan6Noch keine Bewertungen

- Capital Gains and Losses: Ebook Summary - Chapter 12Dokument1 SeiteCapital Gains and Losses: Ebook Summary - Chapter 12arianxxxNoch keine Bewertungen

- Ratio Analysis Gamble Part 2Dokument20 SeitenRatio Analysis Gamble Part 2dubduybfNoch keine Bewertungen

- Unit-3 Financial RatiosDokument25 SeitenUnit-3 Financial Ratiosbhargav.bhut112007Noch keine Bewertungen

- Aziacdixon FinanceDokument2 SeitenAziacdixon Financegoitsemodimoj31Noch keine Bewertungen

- CH 10 - Working Capital Management (Chart 10.1) : Operating CycleDokument2 SeitenCH 10 - Working Capital Management (Chart 10.1) : Operating Cyclek kakkarNoch keine Bewertungen

- Working Captain and Current Asset MGTDokument42 SeitenWorking Captain and Current Asset MGTTahsinur Rahman PialNoch keine Bewertungen

- IntroductionDokument11 SeitenIntroductionGokul BansalNoch keine Bewertungen

- AccountingFundamentalsCoursePresentation 201008 132923 PDFDokument69 SeitenAccountingFundamentalsCoursePresentation 201008 132923 PDFkrisdayanti aprilliaNoch keine Bewertungen

- Chapitre 2 Bilan FonctionnelDokument9 SeitenChapitre 2 Bilan Fonctionneleclatdore758Noch keine Bewertungen

- Introduction To Corporate FinanceDokument17 SeitenIntroduction To Corporate Financem.gerryNoch keine Bewertungen

- Account Titles: Accounting (Cagayan State University)Dokument6 SeitenAccount Titles: Accounting (Cagayan State University)Keith Anthony AmorNoch keine Bewertungen

- CH 13Dokument55 SeitenCH 13bbbhaha12Noch keine Bewertungen

- Retirement or Death of Partner NewDokument5 SeitenRetirement or Death of Partner NewAnkit Roy100% (1)

- Important Questions For Accountancy 12th ComDokument17 SeitenImportant Questions For Accountancy 12th ComAnkit RoyNoch keine Bewertungen

- Accounting Ratios NewDokument3 SeitenAccounting Ratios NewAnkit RoyNoch keine Bewertungen

- Calc2 6a Vectors and 3d Geometry PDFDokument7 SeitenCalc2 6a Vectors and 3d Geometry PDFAnkit RoyNoch keine Bewertungen

- 1 - Accounting For Partnership Firms - FundamentalsDokument12 Seiten1 - Accounting For Partnership Firms - FundamentalsAnkit RoyNoch keine Bewertungen

- Soumen Biswas ProfileDokument5 SeitenSoumen Biswas ProfileAnkit RoyNoch keine Bewertungen

- Project For Loan Under BSKP SchemeDokument5 SeitenProject For Loan Under BSKP SchemeAnkit RoyNoch keine Bewertungen

- Linux Command Enigma2Dokument3 SeitenLinux Command Enigma2Hassan Mody TotaNoch keine Bewertungen

- Compare Visual Studio 2013 EditionsDokument3 SeitenCompare Visual Studio 2013 EditionsankurbhatiaNoch keine Bewertungen

- Surefire Hellfighter Power Cord QuestionDokument3 SeitenSurefire Hellfighter Power Cord QuestionPedro VianaNoch keine Bewertungen

- Filipino Chicken Cordon BleuDokument7 SeitenFilipino Chicken Cordon BleuHazel Castro Valentin-VillamorNoch keine Bewertungen

- God Made Your BodyDokument8 SeitenGod Made Your BodyBethany House Publishers56% (9)

- Dry Wall, Ceiling, and Painting WorksDokument29 SeitenDry Wall, Ceiling, and Painting WorksFrance Ivan Ais100% (1)

- Cotton Pouches SpecificationsDokument2 SeitenCotton Pouches SpecificationspunnareddytNoch keine Bewertungen

- Acitve and Passive VoiceDokument3 SeitenAcitve and Passive VoiceRave LegoNoch keine Bewertungen

- Byron and The Bulgarian Revival Period - Vitana KostadinovaDokument7 SeitenByron and The Bulgarian Revival Period - Vitana KostadinovavitanaNoch keine Bewertungen

- Forensic BallisticsDokument23 SeitenForensic BallisticsCristiana Jsu DandanNoch keine Bewertungen

- Fireware EssentialsDokument499 SeitenFireware EssentialsEmmanuel RodríguezNoch keine Bewertungen

- Knowledge, Attitude and Practice of Non-Allied Health Sciences Students of Southwestern University Phinma During The Covid-19 PandemicDokument81 SeitenKnowledge, Attitude and Practice of Non-Allied Health Sciences Students of Southwestern University Phinma During The Covid-19 Pandemicgeorgemayhew1030Noch keine Bewertungen

- Lyndhurst OPRA Request FormDokument4 SeitenLyndhurst OPRA Request FormThe Citizens CampaignNoch keine Bewertungen

- A Comparison of Practitioner and Student WritingDokument28 SeitenA Comparison of Practitioner and Student WritingMichael Sniper WuNoch keine Bewertungen

- NURS FPX 6021 Assessment 1 Concept MapDokument7 SeitenNURS FPX 6021 Assessment 1 Concept MapCarolyn HarkerNoch keine Bewertungen

- Mangaid CoDokument50 SeitenMangaid CoFk Fit RahNoch keine Bewertungen

- DLL Week 7 MathDokument7 SeitenDLL Week 7 MathMitchz TrinosNoch keine Bewertungen

- Danese and Romano (2011) ModerationDokument14 SeitenDanese and Romano (2011) ModerationUmer NaseemNoch keine Bewertungen

- Didhard Muduni Mparo and 8 Others Vs The GRN of Namibia and 6 OthersDokument20 SeitenDidhard Muduni Mparo and 8 Others Vs The GRN of Namibia and 6 OthersAndré Le RouxNoch keine Bewertungen

- Judges Kings ProphetsDokument60 SeitenJudges Kings ProphetsKim John BolardeNoch keine Bewertungen

- Safe Britannia PDFDokument2 SeitenSafe Britannia PDFeden4872Noch keine Bewertungen

- Budget ProposalDokument1 SeiteBudget ProposalXean miNoch keine Bewertungen

- 755th RSBDokument32 Seiten755th RSBNancy CunninghamNoch keine Bewertungen

- Robot 190 & 1110 Op - ManualsDokument112 SeitenRobot 190 & 1110 Op - ManualsSergeyNoch keine Bewertungen

- X-Roc Latex: Product DescriptionDokument2 SeitenX-Roc Latex: Product DescriptionAmr RagabNoch keine Bewertungen

- PDF - Unpacking LRC and LIC Calculations For PC InsurersDokument14 SeitenPDF - Unpacking LRC and LIC Calculations For PC Insurersnod32_1206Noch keine Bewertungen

- Dialogue About Handling ComplaintDokument3 SeitenDialogue About Handling ComplaintKarimah Rameli100% (4)

- Laws and Policies of Fertilizers SectorDokument12 SeitenLaws and Policies of Fertilizers Sectorqry01327Noch keine Bewertungen

- Guidebook On Mutual Funds KredentMoney 201911 PDFDokument80 SeitenGuidebook On Mutual Funds KredentMoney 201911 PDFKirankumarNoch keine Bewertungen