Beruflich Dokumente

Kultur Dokumente

Castrol ICICI 020519

Hochgeladen von

ADOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Castrol ICICI 020519

Hochgeladen von

ADCopyright:

Verfügbare Formate

Castrol India (CASIND)

CMP: | 152 Target: | 140 ( -8%) Target Period: 12 months REDUCE

May 2, 2019

Volumes disappoint...

Castrol India reported its Q1CY19 numbers, which were below our estimates

on account of lower-than-expected volumes, which declined 2.1% YoY to

50.4 million litre, below our estimate of 53.3 million litre. Hence, revenues

Result Update

increased 5.3% YoY to | 976.2 crore, below our estimate of | 1009.7 crore.

However, the quarter witnessed an increase of 5% YoY in gross margins at

| 101.5/litre, above our estimate of | 99.7/litre, mainly due to a better product

Particulars

mix. On account of higher other expenses, EBITDA per litre came in at

| 56.2/litre (up 5.4% YoY), marginally below our estimate of | 57.6/litre. Particular Amount

Market Capitalization (| Cr) 15,034.6

Subsequently, PAT was at | 185 crore, below our estimate of | 201.9 crore.

Total Debt (| Cr) -

Cash and Investments (| Cr) 784.2

Margins remain healthy on account of better product mix EV (| Crore) 14,250.5

52 week H/L 202/135

Castrol’s raw material cost (base oil) are dependent on the movement of Equity capital (| Crore) 247.3

crude oil prices and rupee against US dollar. During the past few months, Face value (|) 5.0

the company took two price hikes, which led to an increase in net

realisations to | 193.7 crore vs. | 180 per litre YoY. As a result, gross margins Key Highlights

increased and came in at | 101.5/litre. However, the recent upward trajectory

in crude oil prices will escalate raw material costs. On account of the same Weak performance from CV and

and relatively weak product mix, we expect gross margins at | 100.6 per litre industrial segment led to volume

in CY19E and | 96.5 per litre in CY20E. EBITDA is expected at | 54.7 per litre disappointment

(on account of higher than earlier estimated increase in other expenses) and Gross margins per litre continue to

ICICI Securities – Retail Equity Research

| 49.6 per litre in CY19E and CY20E, respectively. remain healthy on better product mix

in favour of passenger cars and two

Rising competition, slowdown in auto - threat to volumes wheelers

Castrol witnessed a decline in volumes of 2.1% YoY to 50.4 million litre. The Volume outlook challenge in medium

slowdown in auto volumes, especially CV sales, had an impact on volumes. term due to weak automotive sales

Industrial volumes also continued to remain weak during the year. Castrol’s

volume portfolio includes commercial volumes, personal mobility, which Recommend REDUCE on stock with

contribute majority of volumes. In the long run, higher drain intervals due to target price of | 140/share

improvement in technology and development of electric vehicle space

poses a risk to Castrol’s volume outlook. We expect volumes at 217 million

litre in CY19E and 224.2 million litre in CY20E.

Valuation & Outlook

Although Castrol was successful in signing OEM contract and strategic Research Analyst

alliances with automotive giants, its strategy to defend potential disruptions

like higher drain interval, BS VI, electric cars will be the key decider, going Mayur Matani

mayur.matani@icicisecurities.com

ahead. The focus on maintaining balance between margins & volumes along

with growth in the personal mobility segment will be key factors directing

the company ahead. However, structural low volume growth in industry

volumes along with increasing competition would continue to remain a

challenge for Castrol, going ahead. Hence, we value Castrol India at 19x

CY20E EPS of | 7.4 to arrive at a target price of | 140 with a REDUCE rating.

Key Financial Summary

s s

(Year-end December) CY16 CY17 CY18 CY19E CY20E CAGR (CY18-20E)

Revenues (| crore) 3,370.4 3,584.3 3,904.6 4,197.1 4,393.1 6.1

EBITDA (| crore) 1,004.9 1,033.0 1,070.8 1,186.3 1,112.4 1.9

Net Profit (| crore) 674.9 691.7 708.3 779.3 733.5 1.8

EPS (|) 6.8 7.0 7.2 7.9 7.4

P/E (x) 22.3 21.7 21.2 19.3 20.5

Price / Book (x) 15.3 14.7 13.1 12.2 12.4

EV/EBITDA (x) 14.1 13.8 13.4 11.8 12.6

RoCE (%) 97.8 96.8 88.3 91.0 86.1

RoE (%) 68.8 67.8 61.6 63.1 60.3

Source: Company, ICICI Direct Research

Result Update | Castrol India ICICI Direct Research

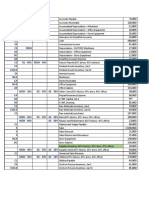

Exhibit 1: Variance Analysis

Q1CY19 Q1CY19 Q1CY18 YoY (%) Q4CY18 QoQ (%) Comments

Total Revenues 976.2 1,009.7 927.1 5.3 1,033.4 -5.5

Raw materials costs 456.7 478.3 429.4 6.4 486.7 -6.2

Employees Cost 50.1 49.7 46.9 6.8 55.9 -10.4

Other Expenses 186.4 174.7 176.5 5.6 173.4 7.5 Other expenses above estimates

Total Expenditure 693.2 702.7 652.8 6.2 716.0 -3.2

EBITDA came in below our estimate on account of lower

EBITDA 283.0 307.0 274.3 3.2 317.4 -10.8

volumes

EBITDA margins (%) 0.3 0.3 29.6 -2930 bps 30.7 -3042 bps

Depreciation 16.2 15.7 14.3 13.3 14.6 11.0

EBIT 266.8 291.3 260.0 2.6 302.8 -11.9

Interest 0.3 0.3 0.7 -57.1 0.3 0.0

Other Income 21.1 22.0 22.8 -7.5 25.6 -17.6

Extra Ordinary Item 0.0 0.0 0.0 NA 0.0 NA

PBT 287.6 313.0 282.1 1.9 328.1 -12.3

Total Tax 102.6 111.1 100.3 2.3 116.2 -11.7

PAT 185.0 201.9 181.8 1.8 211.9 -12.7 Lower volumes contribute to subdued growth in profit YoY

Key Metrics

Exchange rate (|/$) 70.5 70.5 64.5 9.3 72.1 -2.2

Volumes lower than estimates mainly on account of lower

Volumes (mn litre) 50.4 53.3 51.5 -2.1 54.0 -6.7

CV and industrial volumes

Net Realisation (|/litre) 193.7 189.4 180.0 7.6 191.4 1.2

Gross margins per unit increase due to price hikes and

Gross Margins (|/litre) 101.5 99.7 96.6 5.0 98.4 3.1

better product mix

Higher other expenses led to lower EBITDA per unit than

EBITDA (|/litre) 56.2 57.6 53.3 5.4 58.8 -4.5

estimates

Source: Company, ICICI Direct Research

Exhibit 2: Change in estimates

CY19E CY20E

(| Crore) Old New % Change Old New % Change Comments

Revenue 4,200.2 4,197.1 -0.1 4389.3 4,393.1 0.1

EBITDA 1,253.3 1,186.3 -5.6 1,124.2 1,112.4 -1.1 Lower volume gowth impacts EBITDA estimates

EBITDA Margin (%) 29.8 28.3 -5.6 25.6 25.3 -1.1

PAT 823.8 779.3 -5.7 741.1 733.5 -1.0

EPS (|) 8.3 7.9 -5.7 7.5 7.4 -1.0

Source: Company, ICICI Direct Research

Exhibit 3: Assumptions

Current Earlier

Comments

CY17 CY18E CY19E CY20E CY19E CY20E

Exchange rate (|/$) 65.1 68.4 70.6 71.0 70.9 71.0

Lower volume estimates marginally due to weak CV and

Volumes (mn litre) 204.6 213.7 217.0 224.2 221.1 228.5

industrial sales volume

Net Realisation (|/litre) 175.5 182.8 193.5 196.0 190.0 192.1

Revise estimates upwards for CY20E due to better product

Gross Margins (|/litre) 94.0 93.6 100.6 96.5 101.3 95.1

mix

EBITDA (|/litre) 50.7 50.2 54.7 49.6 56.7 49.2

Source: Company, ICICI Direct Research

ICICI Securities | Retail Research 2

Result Update | Castrol India ICICI Direct Research

Story in charts

Exhibit 4: Volume trajectory

60

57.0

56

54.0

51.5 51.2

million litres

52 50.4

48

44

40

Q1CY18 Q2CY18 Q3CY18 Q3CY18 Q1CY19

Source: Company, ICICI Direct Research

Exhibit 5: Steady and stable financial parameters

191.4 193.7

200 180.0 178.5 181.2

160

120 98.4

| per litre

87.9 88.4

96.6 101.5

80

40 83.4 90.8 92.5 92.5 92.5

0

Q1CY18 Q2CY18 Q3CY18 Q4CY18 Q1CY19

Net Realisation Raw Material Costs Gross Margins

Source: Company, ICICI Direct Research

Exhibit 6: EBITDA margins trend

1500 35

29.8

1200 28.8 28.3 30

27.4

25.3

| crore

900 25

%

918.6

1033.0 1070.8 1112.4

1004.9

600 20

300 15

CY16 CY17 CY18E CY19E CY20E

EBITDA EBITDA Margins

Source: Company, ICICI Direct Research

ICICI Securities | Retail Research 3

Result Update | Castrol India ICICI Direct Research

Exhibit 7: Return ratios trend

97.8 96.8

100 91.0

88.3 86.1

90

80

70

%

60 68.8 67.8

61.6 63.1

60.3

50

40

CY16 CY17 CY18E CY19E CY20E

ROE ROCE

Source: Company, ICICI Direct Research

ICICI Securities | Retail Research 4

Result Update | Castrol India ICICI Direct Research

Exhibit 8: Recommendation History vs. Consensus

300 100.0

90.0

250 80.0

200 70.0

60.0

(|)

(%)

150 50.0

40.0

100 30.0

50 20.0

10.0

0 0.0

May-16 Sep-16 Feb-17 Jun-17 Nov-17 Mar-18 Jul-18 Dec-18 Apr-19

Price Idirect target Consensus Target Mean % Consensus with Buy

Source: Bloomberg, Company, ICICI Direct Research

Exhibit 9: Top 10 Shareholders

Rank Investor Name Latest Filing Date % O/S Position Change (m)

1 Castrol, Ltd. 31-Mar-19 51.0 504.5 0.0

2 Life Insurance Corporation of India 31/Mar/19 10.3 102.0 0.0

3 Aberdeen Standard Investments (Asia) Limited 31-Mar-19 1.6 15.8 1.1

4 The Vanguard Group, Inc. 31/Mar/19 1.5 15.2 6.1

5 Aditya Birla Sun Life AMC Limited 31-Mar-19 1.5 14.9 -0.1

6 UTI Asset Management Co. Ltd. 31/Mar/19 1.5 14.4 0.1

7 JPMorgan Asset Management U.K. Limited 31-Mar-19 1.2 11.7 -0.5

8 J.P. Morgan Asset Management (Hong Kong) Ltd. 31/Mar/19 0.7 7.3 0.0

9 Aberdeen Asset Managers Ltd. 31-Mar-19 0.7 6.9 5.6

10 Matthews International Capital Management, L.L.C. 31/Dec/18 0.7 6.7 0.0

Source: Reuters, ICICI Direct Research

Exhibit 10: Recent Activity

BUYS SELLS

Investor name Value (m) Shares (m) Investor name Value (m) Shares (m)

The Vanguard Group, Inc. 14.74 6.13 Reliance Nippon Life Asset Management Limited -30.39 -12.63

Aberdeen Asset Managers Ltd. 13.48 5.60 HSBC Global Asset Management (Hong Kong) Limited -2.58 -1.19

Norges Bank Investment Management (NBIM) 7.91 3.64 Kotak Mahindra Asset Management Company Ltd. -1.95 -0.81

Aberdeen Standard Investments (Asia) Limited 2.54 1.06 Goldman Sachs Asset Management International -1.32 -0.67

IDFC Asset Management Company Private Limited 0.84 0.35 JPMorgan Asset Management U.K. Limited -1.20 -0.50

Source: Reuters, ICICI Direct Research

Exhibit 11: Shareholding Pattern

(in %) Mar-18 Jun-18 Sep-18 Dec-18 Mar-19

Promoter 51.0 51.0 51.0 51.0 51.0

FII 10.7 9.2 8.6 9.0 11.2

DII 17.9 18.6 18.6 18.5 17.3

Others 20.4 21.3 21.8 21.5 20.6

Source: Company, ICICI Direct Research

ICICI Securities | Retail Research 5

Result Update | Castrol India ICICI Direct Research

Financial summary

Exhibit 12: Profit and loss statement | crore Exhibit 13: Cash flow statement | crore

(Year-end December) CY17 CY18E CY19E CY20E (Year-end December) CY17 CY18E CY19E CY20E

Revenue 3584.3 3904.6 4197.1 4393.1 Profit after Tax 691.7 708.3 779.3 733.5

Growth (%) 6.3 8.9 7.5 4.7 Add: Depreciation 45.5 55.6 63.3 66.0

(Inc.)/(Dec.) in stock in trade -5.4 -64.6 -3.0 0.0 Add: Others 0.0 0.0 0.0 0.0

Raw material Costs 1474.7 1757.9 1827.2 2043.3 Cash Profit -60.9 185.2 148.1 47.2

Purchase of Products 196.7 213.3 191.5 186.9 Increase/(Decrease) in CL 48.6 77.0 98.1 47.7

Employee Costs 195.6 203.4 216.0 228.9 (Increase)/Decrease in CA -126.3 -250.6 76.2 -45.4

Other Expenditure 689.7 723.8 779.0 821.5 CF from Operating Activities 671.6 590.3 1016.9 801.8

Op. Expenditure 2,551.3 2,833.8 3,010.8 3,280.6 Purchase of Fixed Assets 56.3 57.3 52.5 90.0

EBITDA 1033.0 1070.8 1186.3 1112.4 (Inc)/Dec in Investments 0.0 0.0 0.0 0.0

Growth (%) 2.8 3.7 10.8 -6.2 Others 0.0 0.0 0.0 0.0

Depreciation 45.5 55.6 63.3 66.0 CF from Investing Activities -56.3 -57.3 -52.5 -90.0

EBIT 987.5 1015.2 1123.0 1046.4 Dividend Paid 810.2 578.7 694.4 752.3

Interest 1.2 1.1 1.2 1.2 Inc/(Dec) in Loan Funds 0.0 0.0 0.0 0.0

Other Income 83.7 84.3 87.1 92.0 Inc/(Dec) in Sh. Cap. & Res. 157.1 0.0 0.0 0.0

PBT 1070.0 1098.4 1208.9 1137.2 Others 0.0 0.0 0.0 0.0

Growth (%) 2.3 2.7 10.1 -5.9 CF from financing activities -653.1 -578.7 -694.4 -752.3

Tax 378.3 390.1 429.7 403.7 Change in cash Eq. -37.8 -45.7 269.9 -40.5

Reported PAT 691.7 708.3 779.3 733.5 Op. Cash and cash Eq. 821.9 784.2 738.5 1,008.5

Growth (%) 2.5 2.4 10.0 -5.9 Cl. Cash and cash Eq. 784.2 738.5 1,008.5 967.9

EPS 7.0 7.2 7.9 7.4 Source: Company, ICICI Direct Research

Source: Company, ICICI Direct Research

Exhibit 14: Balance sheet | crore Exhibit 15: Key ratios | crore

(Year-end December) CY17 CY18E CY19E CY20E (Year-end December) CY17 CY18E CY19E CY20E

Source of Funds Per share data (|)

Equity Capital 494.6 494.6 494.6 494.6 Book Value 10.3 11.6 12.5 12.3

Preference capital 0.0 0.0 0.0 0.0 Cash per share 7.9 7.5 10.2 9.8

Reserves & Surplus 525.6 655.2 740.1 721.3 EPS 7.0 7.2 7.9 7.4

Shareholder's Fund 1,020.2 1,149.8 1,234.7 1,215.9 Cash EPS 7.5 7.7 8.5 8.1

Loan Funds 0.0 0.0 0.0 0.0 DPS 7.0 5.0 6.0 6.5

Deferred Tax Liability -55.2 -55.2 -55.2 -55.2 Profitability & Operating Ratios

Minority Interest 0.0 0.0 0.0 0.0 EBITDA Margin (%) 28.8 27.4 28.3 25.3

Source of Funds 965.0 1094.7 1179.5 1160.7 PAT Margin (%) 19.3 18.1 18.6 16.7

Fixed Asset Turnover (x) 18.3 19.7 22.4 20.8

Application of Funds Inventory Turnover (Days) 32.5 42.5 39.0 39.0

Gross Block 220.9 285.9 300.9 450.9 Debtor (Days) 29.0 36.5 27.0 27.0

Less: Acc. Depreciation 81.8 125.0 175.8 241.8 Current Liabilities (Days) 85.7 74.0 74.0 74.0

Net Block 139.1 160.8 125.0 209.0 Return Ratios (%)

Capital WIP 57.3 37.3 62.3 2.3 RoE 67.8 61.6 63.1 60.3

Total Fixed Assets 196.3 198.1 187.3 211.3 RoCE 96.8 88.3 91.0 86.1

Investments 0.0 0.0 0.0 0.0 RoIC NA NA NA NA

Inventories 319.6 454.6 448.5 469.4 Valuation Ratios (x)

Debtor 285.0 390.5 310.5 325.0 PE 21.7 21.2 19.3 20.5

Cash 784.2 738.5 1,008.5 967.9 Price to Book Value 14.7 13.1 12.2 12.4

Loan & Advance, Other CA 336.8 346.8 356.8 366.8 EV/EBITDA 13.8 13.4 11.8 12.6

Total Current assets 1725.5 1930.4 2124.2 2129.1 EV/Sales 4.0 3.7 3.3 3.2

Current Liabilities 841.9 791.6 850.9 890.6 Leverage & Solvency Ratios

Provisions 114.9 242.2 281.0 289.0 Debt to equity (x) 0.0 0.0 0.0 0.0

Total CL and Provisions 956.8 1033.8 1131.9 1179.6 Interest Coverage (x) 822.9 922.9 935.9 872.0

Net Working Capital 768.7 896.6 992.2 949.4 Debt to EBITDA (x) 0.0 0.0 0.0 0.0

Miscellaneous expense 0.0 0.0 0.0 0.0 Current Ratio 1.8 1.9 1.9 1.8

Application of Funds 965.0 1094.7 1179.5 1160.7 Quick ratio 1.5 1.4 1.5 1.4

Source: Company, ICICI Direct Research Source: Company, ICICI Direct Research

ICICI Securities | Retail Research 6

Result Update | Castrol India ICICI Direct Research

Exhibit 16: ICICI Direct Coverage Universe (Oil & Gas)

CMP TP M Cap EPS (|) P/E (x) EV/EBITDA (x) RoCE (%) RoE (%)

Sector / Company Rating

(|) (|) (| Cr) FY18 FY19E FY20E FY18 FY19E FY20E FY18 FY19E FY20E FY18 FY19E FY20E FY18 FY19E FY20E

BPCL (BHAPET) 334 320 Hold 72,453 40.3 26.8 34.5 8.3 12.4 9.7 7.6 9.5 7.1 15.7 10.3 13.3 23.2 15.7 18.9

Castrol India (CASIND) 152 140 Reduce 15,035 7.2 7.9 7.4 21.2 19.3 20.5 13.4 11.8 12.6 88.3 91.0 86.1 61.6 63.1 60.3

GAIL (India) (GAIL) 333 390 Buy 75,092 15.5 20.5 27.9 21.4 16.3 11.9 12.2 9.8 7.5 11.7 14.7 18.1 9.2 11.5 14.2

Gujarat Gas (GUJGA) 125 145 Buy 8,605 4.2 6.1 6.9 29.5 20.4 18.1 11.9 10.4 9.0 15.3 17.3 19.9 15.8 19.8 19.4

Gujarat State Petro (GSPL) 166 180 Hold 9,351 11.9 14.9 13.5 14.0 11.1 12.3 11.0 7.6 8.2 11.6 16.5 14.0 13.2 14.7 12.0

Gulf Oil Lubricants (GULO) 886 850 Hold 4,392 31.9 36.3 42.5 27.8 24.4 20.8 18.4 14.9 12.9 31.5 36.6 35.0 33.9 31.2 29.9

HPCL (HINPET) 230 225 Hold 35,088 13.6 13.9 8.5 5.7 5.5 9.1 5.3 5.2 7.3 19.3 17.5 10.5 30.5 26.5 15.5

Indraprastha Gas (INDGAS) 303 300 Hold 21,210 8.2 9.6 10.8 37.1 31.6 28.1 21.4 18.5 16.5 27.2 26.5 25.6 19.5 19.1 18.6

Mahanagar Gas (MAHGAS) 912 1010 Buy 9,009 48.4 56.5 59.4 18.9 16.1 15.3 11.4 9.3 8.6 31.9 32.7 30.3 22.8 23.4 21.7

Mangalore Refinery (MRPL)65 75 Buy 11,392 12.8 0.8 7.5 5.1 82.2 8.7 3.5 10.5 4.9 23.2 3.7 13.5 20.4 1.2 11.4

ONGC (ONGC) 142 153 Hold 182,233 16.9 24.9 22.0 8.4 5.7 6.5 5.1 3.4 3.5 7.9 13.8 11.9 9.4 12.4 10.5

Petronet LNG (PETLNG) 210 225 Hold 31,500 13.9 15.1 16.6 15.2 13.9 12.7 9.7 8.9 7.7 25.9 28.7 29.8 21.4 22.2 21.4

Source: Company, ICICI Direct Research

ICICI Securities | Retail Research 7

Result Update | Castrol India ICICI Direct Research

RATING RATIONALE

ICICI Direct endeavors to provide objective opinions and recommendations. ICICI Direct assigns ratings to its

stocks according to their notional target price vs. current market price and then categorizes them as Buy, Hold,

Reduce and Sell. The performance horizon is two years unless specified and the notional target price is defined

as the analysts' valuation for a stock

Buy: >15%

Hold: -5% to 15%;

Reduce: -15% to -5%;

Sell: <-15%

Pankaj Pandey Head – Research pankaj.pandey@icicisecurities.com

ICICI Direct Research Desk,

ICICI Securities Limited,

1st Floor, Akruti Trade Centre,

Road No 7, MIDC,

Andheri (East)

Mumbai – 400 093

research@icicidirect.com

ICICI Securities | Retail Research 8

Result Update | Castrol India ICICI Direct Research

ANALYST CERTIFICATION

I/We, Mayur Matani, MBA, Research Analysts, authors and the names subscribed to this report, hereby certify that all of the views expressed in this research report accurately reflect our views about the subject issuer(s) or securities.

We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in this report. It is also confirmed that above mentioned Analysts of this report have not

received any compensation from the companies mentioned in the report in the preceding twelve months and do not serve as an officer, director or employee of the companies mentioned in the report.

Terms & conditions and other disclosures:

ICICI Securities Limited (ICICI Securities) is a full-service, integrated investment banking and is, inter alia, engaged in the business of stock brokering and distribution of financial products. ICICI Securities Limited is a SEBI registered

Research Analyst with SEBI Registration Number – INH000000990. ICICI Securities Limited SEBI Registration is INZ000183631 for stock broker. ICICI Securities is a subsidiary of ICICI Bank which is India’s largest private sector bank

and has its various subsidiaries engaged in businesses of housing finance, asset management, life insurance, general insurance, venture capital fund management, etc. (“associates”), the details in respect of which are available on

www.icicibank.com

ICICI Securities is one of the leading merchant bankers/ underwriters of securities and participate in virtually all securities trading markets in India. We and our associates might have investment banking and other business relationship

with a significant percentage of companies covered by our Investment Research Department. ICICI Securities generally prohibits its analysts, persons reporting to analysts and their relatives from maintaining a financial interest in the

securities or derivatives of any companies that the analysts cover.

Recommendation in reports based on technical and derivative analysis centre on studying charts of a stock's price movement, outstanding positions, trading volume etc as opposed to focusing on a company's fundamentals and, as

such, may not match with the recommendation in fundamental reports. Investors may visit icicidirect.com to view the Fundamental and Technical Research Reports.

Our proprietary trading and investment businesses may make investment decisions that are inconsistent with the recommendations expressed herein.

ICICI Securities Limited has two independent equity research groups: Institutional Research and Retail Research. This report has been prepared by the Retail Research. The views and opinions expressed in this document may or may

not match or may be contrary with the views, estimates, rating, target price of the Institutional Research.

The information and opinions in this report have been prepared by ICICI Securities and are subject to change without any notice. The report and information contained herein is strictly confidential and meant solely for the selected

recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written consent of ICICI Securities. While we would

endeavour to update the information herein on a reasonable basis, ICICI Securities is under no obligation to update or keep the information current. Also, there may be regulatory, compliance or other reasons that may prevent ICICI

Securities from doing so. Non-rated securities indicate that rating on a particular security has been suspended temporarily and such suspension is in compliance with applicable regulations and/or ICICI Securities policies, in

circumstances where ICICI Securities might be acting in an advisory capacity to this company, or in certain other circumstances.

This report is based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made nor is its accuracy or completeness guaranteed. This report and information herein

is solely for informational purpose and shall not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments. Though disseminated to all the customers

simultaneously, not all customers may receive this report at the same time. ICICI Securities will not treat recipients as customers by virtue of their receiving this report. Nothing in this report constitutes investment, legal, accounting

and tax advice or a representation that any investment or strategy is suitable or appropriate to your specific circumstances. The securities discussed and opinions expressed in this report may not be suitable for all investors, who

must make their own investment decisions, based on their own investment objectives, financial positions and needs of specific recipient. This may not be taken in substitution for the exercise of independent judgment by any recipient.

The recipient should independently evaluate the investment risks. The value and return on investment may vary because of changes in interest rates, foreign exchange rates or any other reason. ICICI Securities accepts no liabilities

whatsoever for any loss or damage of any kind arising out of the use of this report. Past performance is not necessarily a guide to future performance. Investors are advised to see Risk Disclosure Document to understand the risks

associated before investing in the securities markets. Actual results may differ materially from those set forth in projections. Forward-looking statements are not predictions and may be subject to change without notice.

ICICI Securities or its associates might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject company for any other assignment in the past twelve months.

ICICI Securities or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report for services in respect of managing or co-

managing public offerings, corporate finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction.

ICICI Securities encourages independence in research report preparation and strives to minimize conflict in preparation of research report. ICICI Securities or its associates or its analysts did not receive any compensation or other

benefits from the companies mentioned in the report or third party in connection with preparation of the research report. Accordingly, neither ICICI Securities nor Research Analysts and their relatives have any material conflict of

interest at the time of publication of this report.

Compensation of our Research Analysts is not based on any specific merchant banking, investment banking or brokerage service transactions.

ICICI Securities or its subsidiaries collectively or Research Analysts or their relatives do not own 1% or more of the equity securities of the Company mentioned in the report as of the last day of the month preceding the publication of

the research report.

Since associates of ICICI Securities are engaged in various financial service businesses, they might have financial interests or beneficial ownership in various companies including the subject company/companies mentioned in this

report.

ICICI Securities may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report.

Neither the Research Analysts nor ICICI Securities have been engaged in market making activity for the companies mentioned in the report.

We submit that no material disciplinary action has been taken on ICICI Securities by any Regulatory Authority impacting Equity Research Analysis activities.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or

use would be contrary to law, regulation or which would subject ICICI Securities and affiliates to any registration or licensing requirement within such jurisdiction. The securities described herein may or may not be eligible for sale in

all jurisdictions or to certain category of investors. Persons in whose possession this document may come are required to inform themselves of and to observe such restriction.

ICICI Securities | Retail Research 9

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Gunsmoke Guns Search Warrant AffidavitDokument35 SeitenGunsmoke Guns Search Warrant AffidavitMichael_Lee_Roberts100% (1)

- Case Study On Goodweek Tires, IncDokument10 SeitenCase Study On Goodweek Tires, Incmuknerd100% (10)

- HENRI FAYOL'S 14 Principles of ManagementDokument10 SeitenHENRI FAYOL'S 14 Principles of ManagementJULIA ALLANANoch keine Bewertungen

- Indian Footwear Industry ReportDokument33 SeitenIndian Footwear Industry ReportReevolv Advisory Services Private LimitedNoch keine Bewertungen

- ICAEW - FA Questions Answers March 2008 To March 2015.Dokument174 SeitenICAEW - FA Questions Answers March 2008 To March 2015.Rakib Ahmed50% (6)

- Sunshine Stationery Shop Foundation ProjectDokument25 SeitenSunshine Stationery Shop Foundation ProjectKripa Raj Devkishin56% (9)

- Reinald Raven L. Guerrero Taxation Law 1 Surigao Consolidated Mining Co. vs. Collector of Internal Revenue FactsDokument1 SeiteReinald Raven L. Guerrero Taxation Law 1 Surigao Consolidated Mining Co. vs. Collector of Internal Revenue FactsSapere AudeNoch keine Bewertungen

- Paper Industry PDFDokument118 SeitenPaper Industry PDFankur parekh100% (1)

- Stock Update: Relaxo FootwearsDokument3 SeitenStock Update: Relaxo FootwearsADNoch keine Bewertungen

- TTKH Angel PDFDokument14 SeitenTTKH Angel PDFADNoch keine Bewertungen

- Bajaj Finance - SKDokument3 SeitenBajaj Finance - SKADNoch keine Bewertungen

- Viewpoint: Natco PharmaDokument3 SeitenViewpoint: Natco PharmaADNoch keine Bewertungen

- Sharekhan Mutual Fund Finder: Top Equity Fund PicksDokument4 SeitenSharekhan Mutual Fund Finder: Top Equity Fund PicksADNoch keine Bewertungen

- ICB Angel PDFDokument7 SeitenICB Angel PDFADNoch keine Bewertungen

- Gulf Oil Lubricants India LTD: Index DetailsDokument13 SeitenGulf Oil Lubricants India LTD: Index DetailsADNoch keine Bewertungen

- E I L (EIL) : Ngineers Ndia TDDokument8 SeitenE I L (EIL) : Ngineers Ndia TDADNoch keine Bewertungen

- Godrej Agrovet: Agri Behemoth in The MakingDokument38 SeitenGodrej Agrovet: Agri Behemoth in The MakingADNoch keine Bewertungen

- Viewpoint: Godrej Agrovet (GAVL)Dokument3 SeitenViewpoint: Godrej Agrovet (GAVL)ADNoch keine Bewertungen

- Sonata Software (SSOF IN) : Q2FY19 Result UpdateDokument9 SeitenSonata Software (SSOF IN) : Q2FY19 Result UpdateADNoch keine Bewertungen

- Icici Bank LTD: Operating Performance On TrackDokument6 SeitenIcici Bank LTD: Operating Performance On TrackADNoch keine Bewertungen

- Godrej Agrovet: Agri Behemoth in The MakingDokument38 SeitenGodrej Agrovet: Agri Behemoth in The MakingADNoch keine Bewertungen

- Cummins India: CMP: INR 719 Focus On Developing New Growth Areas, Market ShareDokument6 SeitenCummins India: CMP: INR 719 Focus On Developing New Growth Areas, Market ShareADNoch keine Bewertungen

- Cyient LTD.: Q1FY20: Weak Quarter, Lack VisibilityDokument7 SeitenCyient LTD.: Q1FY20: Weak Quarter, Lack VisibilityADNoch keine Bewertungen

- Westlife Development: Topline Tracking ExpectationDokument6 SeitenWestlife Development: Topline Tracking ExpectationADNoch keine Bewertungen

- Voltas PL PDFDokument5 SeitenVoltas PL PDFADNoch keine Bewertungen

- Cummins India (KKC IN) : Analyst Meet UpdateDokument5 SeitenCummins India (KKC IN) : Analyst Meet UpdateADNoch keine Bewertungen

- Voltas Dolat 140519 PDFDokument7 SeitenVoltas Dolat 140519 PDFADNoch keine Bewertungen

- Yes Bank - 29 1 2019 PDFDokument8 SeitenYes Bank - 29 1 2019 PDFADNoch keine Bewertungen

- YesBank (3) - Mac PDFDokument5 SeitenYesBank (3) - Mac PDFADNoch keine Bewertungen

- Westlife Dev JM 180618 PDFDokument9 SeitenWestlife Dev JM 180618 PDFADNoch keine Bewertungen

- Cyient: Poor Quarter Recovery Likely in The Current QuarterDokument9 SeitenCyient: Poor Quarter Recovery Likely in The Current QuarterADNoch keine Bewertungen

- CYIENT Kotak 22102018Dokument6 SeitenCYIENT Kotak 22102018ADNoch keine Bewertungen

- Sonata Software (SONSOF) : Healthy PerformanceDokument5 SeitenSonata Software (SONSOF) : Healthy PerformanceADNoch keine Bewertungen

- Voltas: Building On StrengthsDokument5 SeitenVoltas: Building On StrengthsADNoch keine Bewertungen

- Cyient: Services Guidance Revision Concerns Us Rating: AccumulateDokument7 SeitenCyient: Services Guidance Revision Concerns Us Rating: AccumulateADNoch keine Bewertungen

- 7 Income Tax Act 1Dokument161 Seiten7 Income Tax Act 1Noneya BidnessNoch keine Bewertungen

- CEVI Annual Report FY 2009Dokument36 SeitenCEVI Annual Report FY 2009Community Economic Ventures, Inc.Noch keine Bewertungen

- SC Working Capital: Virtual IntegrationDokument7 SeitenSC Working Capital: Virtual Integrationarsenal GunnerNoch keine Bewertungen

- "The Wallace Group" Strategic Management and Business Policy Essay SampleDokument3 Seiten"The Wallace Group" Strategic Management and Business Policy Essay Samplesameh06Noch keine Bewertungen

- Lisa Eka Cahayati - CH11Dokument5 SeitenLisa Eka Cahayati - CH11Lisa Eka CahayatiNoch keine Bewertungen

- Acc 107 Finals Quiz 3Dokument1 SeiteAcc 107 Finals Quiz 3Jezz CulangNoch keine Bewertungen

- Paramount Polish Processors Private LimitedDokument2 SeitenParamount Polish Processors Private LimitedJeremy HoltNoch keine Bewertungen

- Payslip YemplateDokument2 SeitenPayslip YemplateCristine GonzalesNoch keine Bewertungen

- Privatize ThisDokument220 SeitenPrivatize Thisdonafutow2073Noch keine Bewertungen

- Management Accounting Level 3/series 2 2008 (Code 3023)Dokument17 SeitenManagement Accounting Level 3/series 2 2008 (Code 3023)Hein Linn Kyaw100% (1)

- BusMath01 - Amortization & Commission - Activity - Answer Key PDFDokument2 SeitenBusMath01 - Amortization & Commission - Activity - Answer Key PDFsheisbonjing PHNoch keine Bewertungen

- Leverage Analysis-IDokument2 SeitenLeverage Analysis-Ipoorna_mpcNoch keine Bewertungen

- BINI General Merchandise Answer Key 2Dokument19 SeitenBINI General Merchandise Answer Key 2workwithericajaneNoch keine Bewertungen

- ACTBFAR Exercise Set #1 - Ex 5 - FS ClassificationsDokument1 SeiteACTBFAR Exercise Set #1 - Ex 5 - FS ClassificationsNikko Bowie PascualNoch keine Bewertungen

- Contribution Contributio N Margin Per Unit Margin Ratio: AMIS 4310 Cost-Volume-Profit AnalysisDokument5 SeitenContribution Contributio N Margin Per Unit Margin Ratio: AMIS 4310 Cost-Volume-Profit Analysissev gsdNoch keine Bewertungen

- Lecture 7 - Closing EntriesDokument14 SeitenLecture 7 - Closing EntriesMeer SadaqatNoch keine Bewertungen

- CMA DataDokument35 SeitenCMA Dataashishy99Noch keine Bewertungen

- Salary Slip - Jitendra Kumar Singh - Oct 23Dokument1 SeiteSalary Slip - Jitendra Kumar Singh - Oct 23chagusahoo170Noch keine Bewertungen

- SolutionsDokument11 SeitenSolutionsRaghuveer ChandraNoch keine Bewertungen

- Finals PDFDokument6 SeitenFinals PDFlapNoch keine Bewertungen

- Homework CVP & BEDokument11 SeitenHomework CVP & BEYamato De Jesus NakazawaNoch keine Bewertungen

- Ratio Analysis - Excel ExerciseDokument4 SeitenRatio Analysis - Excel ExerciseS JNoch keine Bewertungen