Beruflich Dokumente

Kultur Dokumente

Review Materials

Hochgeladen von

Shiela Marie Sta Ana0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

1K Ansichten6 SeitenOriginaltitel

Review-Materials

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

1K Ansichten6 SeitenReview Materials

Hochgeladen von

Shiela Marie Sta AnaCopyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 6

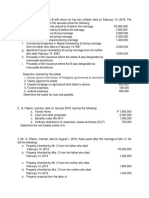

DONOR’S TAX 6.

On January 15, 2014, Daisy gave a piece of land to her

brother-in-law who is getting married on February 14,

1. In February 2017, Bryan received a piece of land with fair 2014. The assessed value and the zonal value of the land

market value at P 100,000 from his wealthy best friend, were P 750,000 and P 1,000,000 respectively. The land had

Rianne, as a birthday gift. Since Bryan had no use of the said an unpaid mortgage of P 200,000, which was not assumed

donated land, he immediately sold it to gorgeous Mike for by the donee and an unpaid realty tax of P 10,000, which

only P 500,000. What is the tax liability of Bryan? was assumed by the donee. How much was the donor’s tax

a. P 150,000 c. P 210,000 due?

b. P 60,000 d. P 360,000 a. P 297,000 c. P 43,200

b. P 237,000 d. P 31,400

2. Based on the facts provided in the immediately preceding

item, if assuming Rianne required Bryan to pay him a token 7. Lolo Jose donated P 50,000 cash to his favorite grandson

amount to P 10,000, how much should Rianne report as who is getting married on June 16, 2016. For donor’s tax

gross gift in his donor’s tax return? purposes the exempt dowry should be:

a. P 1,000,000 c. P 490,000 a. P 50,000 c. P 5,000

b. P 990,000 d. P 0 b. P 10,000 d. none

8. A resident alien donor donated to a Philippine domestic

3. On January 10, 2016, Maria Reyes, single mother, corporation a property located abroad valued at P 500,000.

donated cash in the amount of P 50,000 to her daughter The foreign donor’s tax on the donation was P 100,000. A

Cristina, and on December 20, 2016, she donated another P donation earlier within the same calendar year, was

50,000 to Cristina. Which statement is correct? donated to a legitimate daughter, a property located in the

a. Maria Reyes is subject to donor’s tax in 2016 because Philippines valued at P 300,000. How much was the tax

gross gift is P 100,000. payable?

b. Maria Reyes is exempt from donor’s tax in 2016 a. P 58,500 c. P 56,250

because gross gift is not more than P 100,000. b. P 52,500 d. None of the above

c. Maria Reyes is exempt from donor’s tax in 2016 only to

the extent of P 50,000. ESTATE TAX

d. Maria Reyes is exempt from donor’s tax in 2016 only to

the extent of P 50,000. 9. An inventory of Mr. A’s properties was taken two years

after his death. He had the following properties during the

inventory taking.

4. Mr. Hamas, knowing fully well that he is to die within Cash (20% from income of A’s properties after death)

six (6) months due to brain cancer, sold its residential P4,000,000

property to his only son for P 5,500,000. The fair market Car (bought for P 2M one day before A’s death) P

value of the said property at the time of sale is P 5,000,000. 1,200,000

Which of the following statements is correct? House and Lot (FMV – P 8M on A’s death) P 10,000,000

a. The property should be included as part of the gross Business Interest (worth 6M on A’s death) P 7,000,000

estate since it falls under “transfer in contemplation of

death”, the purpose of which is paying capital gains tax of The following expenses and losses were incurred by the

6% which is cheaper than estate tax. estate.

b. The property should no longer be included in the gross Funeral Expenses P 800,000

estate. Judicial Expenses 400,000

c. The sale should be subject to value added tax and capital Loss of pieces of jewelry (8montsh after A’s death) P

gains tax. 1,000,000

d. The sale should be subject to percentage tax and capital Obligations of A paid using his estate P 2,000,000

gains tax.

The gross estate of A is:

5. On Feb. 14, 2015, Digong donated 2,000 shares of stock a. P 20,400,000 c. P 23,200,000

of Delima Corporation to Obama. Delima Corporation b. P 22,200,000 d. P 23,400,000

shares are listed in the stock exchange. The following are

the trading prices of each share on Feb. 14, 2015: 10. Ajino Moto, non-resident Japanese, died on July 27,

Opening price P 800 2014 leaving the following:

Highest trading price 880 Exclusive properties, Philippines P 1,400,000

Lowest trading price 760 Conjugal Properties, Philippines 420,000

Average Trading Price 820 Conjugal Properties, Abroad 1,820,000

Last Trading Price 840 Deductions Claimed:

Funeral Expenses P 100,000

The gross gift is: Judicial Expenses 100,500

a. P 1,600,000 c. P 1,680,000 Unpaid Expenses 150,500

b. P 1,640,000 d. P 1,760,000 Losses which occurred 7 mos after death due to fire

P 120,000

Donation Mortis causa to Makati City Hall 180,000

Medical Expenses incurred in June 2014 P 550,000 useful life of each vehicle is four (4) years. How

Family Home in Tokyo (included above) 1,500,000 much will be the amount due from Rommel?

Standard deduction 1,000,000 a. P 5,600,000 c. P 5,000,000

b. P 5,150,000 d. P 4,480,000

The estate tax due is: 6. Based on the preceding number, how much input

a. P 44,000 c. P 71,560 tax can be claimed by Rommel?

b. P 69,160 d. P 82,560

a. P 600,000 c. P 12,500

b. P 150,000 d. zero

VALUE ADDED TAX

7. Rey Valera is a well-known author in Financial

1. The Republic of Korea, as an act of goodwill, does Accounting and Auditing Problems. His revised

not impose business taxes to Philippine carriers. book in Financial Accounting contained one-page

Korean Air is operating in the Philippines having two advertisement promoting NU as one of the leading

flights in a week. If you were engaged by Korean Air schools in accountancy in the country. What will be

as its tax consultant and asked you whether it is the tax treatment of the sale of the books for that

liable to percentage tax, which of the following will purposes?

be your advice? a. 12% VAT

a. Korean Air is liable to percentage tax based on b. 0% VAT

gross receipts from passengers, goods, c. Exempt from VAT

cargoes, and mails. d. VAT exempt but subject to % tax

b. Korean Air is liable to percentage tax based on 8. Which of the following is not considered an export

gross receipts from passengers only. sale?

c. Korean Air is liable to percentage tax based on a. Sale of goods, supplies, equipment and fuel to

gross receipts from goods, cargoes, and mails persons engaged in international shipping or

only. international air transport operations.

d. Korean Air is not liable to percentage tax based b. Sale of gold to BSP

on the principle of reciprocity. c. Sale of raw materials or packaging materials

2. A purely cooperative company doing life insurance to an export-oriented enterprise whose

business is subject to what kind of business? export sales is at least seventy (70%) percent

a. Value-added tax of the total annual production.

b. Percentage tax d. Sale of raw materials or packaging materials to

c. Value added tax or percentage tax depending a non-resident buyer for delivery to a local

on the gross receipts for the year. export-oriented enterprise to be used in the

d. Exempt from value-added tax and percentage manufacturing, processing, packing or

tax. repacking in the Philippines of the said buyer’s

3. If a radio or television broadcasting company who goods.

is not mandatorily required to register under the 9. Which of the following is subject to value-added tax

VAT system chose to be a VAT taxpayer, its choice upon receipt by the lessor?

is: a. A loan to the lessor from the lessee

a. Revocable after 2 years b. An option money for the property

b. Revocable after 3 years c. A security deposit to insure the faithful

c. Revocable after 5 years performance of certain obligations of the

d. Irrevocable lessee to the lessor

4. Which of the following is not subject to value-added d. Prepaid rental

tax? 10. A taxpayer decided to cancel its VAT-registration at

a. A resident citizen who performs services in the time when it has unused input tax. What is the

the Philippines, the performance of services is available remedy?

not regular. a. Apply for the issuance of tax credit certificate

b. A non-stock, non-profit private organizations or refund within two (2) years from the date of

engaged in trade or business. cancellation of VAT registration, at the option

c. A government owned or controlled of the taxpayer.

corporation engaged in trade or business. b. Apply for the issuance of tax credit certificate

d. A non-resident person who performs services within two (2) years from the date of

in the Philippines, the performance of services cancellation of VAT registration, however he

is not regular. shall only be entitled for refund if he has no

5. Rommel is an operator of taxi cabs. During a internal revenue tax liabilities.

particular month, he purchased from Mahindra, a c. Apply for the issuance of tax credit certificate

VAT-registered car dealer, 10 sedan type units for a or refund within two (2) years from the quarter

total selling price of 5 million pesos. The estimated

in which the unused input tax was sustained, at a. P 150,000 c. P 26,400

the option of the taxpayer b. P 60,000 d. P 26,000

d. Apply for the issuance of tax credit certificate 17. Pilipinas Shell sold fuel to an international shipping

within two (2) years from the quarter in which carrier whose voyage is from a port in the

the unused input tax was sustained, however, Philippines directly to a foreign port without

he shall be entitled for refund only if he has no docking or stopping at any other port in the

internal revenue tax liabilities. Philippines. What is the treatment of the

transaction for VAT purposes?

a. Exempt c. 12% VAT

b. Zero-rated d. Either “b” or “c”

Sugar Inc., is a trader of sugar. It has the following

18. When is the deadline for manual filing of the

data:

quarterly VAT return?

Sales: Local sales of refined sugar to government P a. Ten days from the end of the quarter

1,000,000; Export sales of refined sugar P1,000,000; b. Twenty days from the end of the quarter

local sales of muscovado, P 1,000,000; c. Twenty-five days from the end of the quarter

Purchases common to all activities: Purchases of d. Thirty days from the end of the quarter

sugar cane, P 3,000,000; Purchases of packaging 19. When a VAT – registered person retires from

materials VAT suppliers, P 500,000; purchases of business, all goods on hand, whether capital goods,

capital goods, useful life is 6 years, P 1,500,000. stock in trade, supplies, or materials as of the date

11. How much is the output tax? of such retirement shall be considered sold. The

a. P 720,000 c. P 480,000 VAT shall be computed based on:

b. P 600,000 d. P 360,000 a. Cost

12. How much is the creditable input tax? b. Fair market value

a. P 222,500 c. P 183,000 c. Cost of fair market value, whichever is higher

b. P 192,000 d. P 152,500 d. Cost of fair market value, whichever is lower

13. How much is the final withholding VAT? 20. Bikings Manpower Agency has the following gross

a. P 70,000 c. P 20,000 receipts from various clientele in a particular month

b. P 50,000 d. zero broken down as follows (net of VAT):

14. ABC Associates, a VAT-registered firm, sold its office Salaries of personnel P 400,000

building together with the lot thereon to DEF Agency Fee 100,000

associates, another VAT-registered firm, for 60

million pesos. Of the total selling price, 40 million How much is the output tax?

pesos pertains to the building. The useful life of the a. P 60,000 c. P 48,000

building is estimated to be 30 years. Assuming the b. 12,000 d. nil

buyer is paid in lump sum, how much output tax 21. Casa Leticia, VAT registered, is engaged in hotel

should be paid by the seller in the month of sale? business. It started operation in November 2105

a. P 7,200,000 c. P 2,480,000 and had the following selected information from its

b. P 4,800,000 d. P 2,400,000 records for the month:

15. Based on the preceding number, how much input Service Revenue P 500,000

tax can be claimed by the buyer in the month of Unearned Revenue 20,000

purchase? Purchases from VAT registered entities:

a. P 7,200,000 c. P 2,480,000 Goods P 150,000

b. P 4,800,000 d. P 2,400,000 Services (20% still unpaid) 200,000

16. Rica Customers Inc., started its business operations Importation of generator with

paying percentage tax. Later on, as its business Useful life of 7 years

improves, it registered under the VAT system. The Dutiable value 1,200,000

following information were taken from its records Customs Duties 100,000

on the last month as a non-VAT taxpayer: Excise Taxes 50,000

Inventory, beginning: Other Charges within the BOC 50,000

Raw Materials P 250,000

Work in Process 540,000 How much VAT did the company remit to the BIR?

Finished Goods 460,000 a. P 25,200 c. P 17,600

Supplies (20,000 pertains to fresh fruits b. P 22,400 d. zero

Given for free during lunchtime) 70,000 22. Matubig Corporation is vat registered and a holder

Property, Plant and Eqt. 90,000 of franchise from the government engaged in the

Intangible Assets 34,800 business of supplying water to several towns in the

region. As recorded in its books, its total gross

How much is the transitional input tax? receipts during the month from sale of water

amounted to P 2,550,000 while the receipts from 1st - Importation of goods for personal use

rental od its equipment amounted to P 280,000. by a person not engaged in trade or

The operating expenses amounted to P 2,000,000, business

11% of which was paid to vat registered persons. 2nd - Isolated services rendered in the

Philippines by nonresident foreign person

The percentage tax due is: a. 1st only c. 1st and 2nd

a. P 0 c. P 56,500 b. 2nd only d. None of the above

b. P 16,500 d. P 51,000 29. In case of sale of real property on installment sales

23. The VAT payable for the month is: by a real property dealer shall be subject to vat on:

a. P 0 c. P 16,500 a. Selling Price

b. P 7,200 d. P 313,200 b. Selling price of fair value whichever is

24. DMCI is a non-VAT registered real estate dealer and lower

lessor. If its monthly rental of residential units c. Selling price or fair value whichever is

exceeds P 12,800 per unit, the same shall be subject higher

to 12% VAT d. Installment payments including interest

a. True, without any further conditions and penalties, actually or constructively

b. True, only If the total annual gross received by the seller.

receipts from rentals exceed P 1,919,500 30. Which of the following types of input VAT is

c. True, only if the total annual gross receipts considered as tax incentives?

from rentals and other operations exceed I. Transitional input VAT

P 1,919,500 II. Presumptive input VAT

d. False, DMCI is a non-VAT registered entity. III. VAT on importation

25. Assuming that the annual gross receipts in the a. I and II only c. II and III only

preceding number amounted to P 1,850,000, the b. I and III only d. I, II, and III

gross receipts from rentals shall be 31. May a transitional input tax credit be claimed on

a. Exempt from VAT subject to percentage inventory of real property (including land),

tax regardless of whether input VAT was actually paid

b. Exempt from VAT and percentage tax on the purchase of such inventory?

c. Subject to 12% vat a. Yes, inventory that forms part of the

d. Subject to 0% VAT valuation of the transitional tax credit

26. Pedro, a non-VAT registered taxpayer is engaged in may include real properties provided that

the following activities: these properties are included in the

Trucking business with gross receipts of P products that the VAT registered persons

800,000. offer for sale to the public.

Lease of apartment house (monthly rental b. Yes, inventory that forms part of the

is P 10,000 per unit) with gross receipts of valuation of the transitional tax credit may

P 700,000 include real properties provided that these

Practice of profession with gross receipts properties are either used in business or

of P 900,000. included in the products that the Vat

registered person offers to the public.

Which of the following statements is correct? c. No, prior payment of input VAT is required

a.He is considered VAT registrable taxpayer before a transitional input VAT is allowed

b.He is mandatorily required to register as tax credit.

under the VAT system d. None of the above

c. He can optionally register under the VAT 32. BOBA residences Inc. is a domestic corporation

system engaged in real estate business. It has the following

d. He is not subject to any percentage tax data for the last quarter of 2015:

27. Any input tax on the purchase or importation of Installment sale of a town house: Realized Gross

goods shall be creditable against the output tax if: Profit (GPR is 30%), P 300,000; Gross Selling Price, P

I. Evidence by a vat invoice or receipt 4,000,000; Zonal Value, P 5,000,000

II. Issued by a vat registered seller Deferred Sale of a parking lot: Gross selling price, P

III. In the course of trade or business 1,000,000; FMV, P 1,500,000;

a. Only I is required Rental Income, P 800,000

b. Only I and II are required Rent Receivable, beg. P 300,000;

c. Only I and III are required Rent Receivable, end P 100,000;

d. I, II and III are required Importation on materials used in the construction,

28. Which of the following transaction is subject to P 2,265,000

VAT?

How much is the VAT due or payable? For the following questions:

a. P 285,000 c. P 261,000

A VAT registered trader has the following

b. P 135,000 d. P 111,000

transactions:

33. Which of the following is not subject to VAT?

a. A resident citizen who performs services Sales of good to private entities, net of VAT P

in the Philippines, the performance of 2,500,000

services is not regular.

b. A non-stock, non-profit private Purchases of goods sold to private entities,

organization engaged in trade or business. gross of 12% VAT 896,000

c. A government owned or controlled

Sales to a government owned corporation

corporation engaged in trade or business.

(GOCC), net of VAT 1,000,000

d. A non-resident person who performs

services in the Philippines, the Purchases of goods sold to GOCC, net of 12%

performance of services is not regular. VAT 700,000

34. Clifford (vat registered) exported goods to

Singapore for sale. He is also subject to business tax 39. How much is the output tax?

of a. P 300,000 c. P 420,000

Excise Tax 3% tax b. P 120,000 d. nil

a. Yes Yes 40. How much is the standard input tax?

b. Yes No a. P 20,000 c. P 50,000

c. No No b. P 70,000 d. nil

d. No Yes 41. How much is the creditable input tax?

35. Which of the following input taxes is creditable? a. P 166,000 c. P 70,000

a. Input taxes from non-VAT suppliers b. P 96,000 d. P 180,000

b. Input taxes from purchase of direct labor 42. How much is the input tax closed to expense

c. Input taxes from importation of goods for (income)?

sale a. P 14,000 c. P (14,000)

d. Input taxes from importation of personal b. P 34,000 d. P (34,000)

and household effect 43. How much is the VAT payable to the BIR?

36. Pedro approached you and asked for your a. P 404,000 c. P 204,000

professional help with regard to the sale of his b. P 390,000 d. nil

ancestral house and lot in the amount of P A Vat- registered trader has the following

5,000,000. Your advice would be: transactions for the month of July 2014:

a. 12% VAT

b. 0% VAT Sale of goods to private entities, net of VAT P

c. 3% tax 2,500,000

d. Exempt from VAT

Purchases of goods sold to private entities, gross

37. A call center in Makati operated by a domestic

of 12% VAT 896,000

corporation provides hotel reservation services to

hotels operating in North America. The services are Sales to a government owned corporation (GOCC),

paid for in US$ and duly accounted for with the net of VAT 1,500,000

rulings of Bangko Sentral ng Pilipinas is subject to:

a. 12% VAT c. 3% Purchases of goods sold to GOCC, net of 12% VAT

b. 0% VAT d. VAT exempt 700,000

38. If the depreciable capital good is sold or transferred Purchases of Machineries, gross of VAT, useful life

a period of five years or prior to the exhaustion of is 6 years 11,200,000

the amortizable input tax thereon, the unamortized

input VAT on capital goods sold can be 44. How much is the VAT payable to the BIR?

a. Claimed as input tax credit on its entirety a. P 280,000 c. P 191,500

during the month or quarter when the b. P 224,000 d. P 300,000

sale or transfer was made. 45. Based on the preceding number, how much is the

b. Expensed outright in the month or quarter input tax closed to expense (income)?

the sale was made. a. P 13,500 c. P (13,500)

c. Amortized over the remaining life of the b. P 21,000 d. P (21,000)

capital good. 46. Using the provisions of the Train law, A lessor rents

d. Claimed as input tax credit in its entirety or his 2 commercial and 10 residential units for

amortized over the remaining life of the monthly rent of P 60,000, and P 15,000 per unit,

capital good at the option of the taxpayer. respectively. During the taxable year, his

accumulated gross receipts amounted to P

3,240,000 (1,440,000 from commercial units and P

1,800,000 from residential units.)

How much is the business tax?

a. P 43,200 c. P 172,800

b. Zero d. 388,800

47. Using the same facts in # 46 under the train law,

assuming the lessor has 5 commercial units and his

accumulated gross receipts during the taxable year

amounted to P 5,400,000 (P 3,600,000 from

commercial units and P 1,800,000 from residential

units), how much is the business tax?

a. P 0 c. P 432,000

b. P 648,000 d. P 216,000

48. Same with number 46 and 47, but assuming the

lessor rents his 5 commercial and 10 residential

units for monthly rent of P 60,000 and P 15,500

per unit, respectively. During the year, his

accumulated gross receipts amounting to P

5,460,000 (P 3,600,000 from commercial units and

P 1,860,000 from residential units), how much is

the business tax?

a. P 655,200 c. P 432,000

b. P 223,200 d. P zero

For the next two questions: Alpha Corporation (vat

registered) has the following data for the month:

Sales – private entities and individuals (10% to

senior citizen) P 2,000,000

Sales – vat exempt goods 1,000,000

Sales – government 1,000,000

The following input taxes were passed-on by vat

suppliers to Alpha Corporation during the month:

Input vat on goods sold to private entities and

individuals P 120,000

Input vat on sale of exempt goods 20,000

Input vat on sale to government 100,000

49. The VAT payable for the month is:

a. P 216,000 c. P 96,000

b. P 108,000 d. P 36,000

50. The amount of input vat not available for tax credit

but may be recognized as cost or expense is:

a. P 20,000 c. P 62,000

b. P 50,000 d. nil

Das könnte Ihnen auch gefallen

- Practice Set 1Dokument4 SeitenPractice Set 1Shiela Mae BautistaNoch keine Bewertungen

- Acco 4133 - Taxation: College of Accountancy and FinanceDokument10 SeitenAcco 4133 - Taxation: College of Accountancy and FinanceNadi Hood100% (1)

- CHAPTER 3 - Transfer and Business TaxDokument6 SeitenCHAPTER 3 - Transfer and Business TaxKatKat Olarte0% (1)

- COMEX1 TAX REVIEW Canvas-1Dokument18 SeitenCOMEX1 TAX REVIEW Canvas-1LhowellaAquinoNoch keine Bewertungen

- Take Home Quiz 1Dokument9 SeitenTake Home Quiz 1Akira Marantal Valdez100% (1)

- VAT AND OPT Monthly EXAMDokument20 SeitenVAT AND OPT Monthly EXAMAlexandra Nicole IsaacNoch keine Bewertungen

- Percentage Taxation2Dokument5 SeitenPercentage Taxation2Ahleeya Ramos100% (3)

- 1Dokument9 Seiten1James Diaz100% (2)

- Audit of SHE 1Dokument2 SeitenAudit of SHE 1Raz MahariNoch keine Bewertungen

- DONOR S Tax Multiple Choice Question 1Dokument13 SeitenDONOR S Tax Multiple Choice Question 1Kj Banal80% (5)

- Tax Solman PDFDokument141 SeitenTax Solman PDFAngelManuelCabacungan100% (1)

- Taxation Quizzer PDFDokument61 SeitenTaxation Quizzer PDFPrince Guese86% (7)

- Multiple Choice - Problems 1Dokument5 SeitenMultiple Choice - Problems 1KatKat Olarte100% (1)

- Quizzer-Donor's TaxDokument4 SeitenQuizzer-Donor's TaxVergel Martinez33% (3)

- TAX.2904 Percentage Tax.Dokument12 SeitenTAX.2904 Percentage Tax.Rodge Gabayoyo100% (2)

- TaxfinalquizwDokument233 SeitenTaxfinalquizwAeron Rai Roque50% (2)

- CPAR - TAX7411 - Estate Tax With Answer PDFDokument6 SeitenCPAR - TAX7411 - Estate Tax With Answer PDFAngelo Villadores92% (12)

- Opt Oct 2017 GCC Self TestDokument5 SeitenOpt Oct 2017 GCC Self TestMary Grace SalcedoNoch keine Bewertungen

- Tax Review Overview Vat and Opt QuizDokument4 SeitenTax Review Overview Vat and Opt QuizYochabel Eureca BorjeNoch keine Bewertungen

- Quiz 8 - BTX 113Dokument3 SeitenQuiz 8 - BTX 113Rae Vincent Revilla100% (1)

- Exercises On Value Added TaxDokument20 SeitenExercises On Value Added TaxIan Jamero100% (2)

- OPT QuizDokument5 SeitenOPT QuizAngeline VergaraNoch keine Bewertungen

- MR A, Filipino, Married To B With Whom He Has Two Children Died On February 14, 2018. TheDokument3 SeitenMR A, Filipino, Married To B With Whom He Has Two Children Died On February 14, 2018. TheSharjaaah100% (2)

- Chapter 15 PDFDokument11 SeitenChapter 15 PDFG & E ApparelNoch keine Bewertungen

- Exercises - Percentage TaxesDokument2 SeitenExercises - Percentage TaxesMaristella GatonNoch keine Bewertungen

- Corporation Part 2Dokument35 SeitenCorporation Part 2annyeongchingu100% (2)

- Donors Tax QuizDokument3 SeitenDonors Tax QuizPrecious Diamond DeeNoch keine Bewertungen

- HANDOUT-business TaxesDokument29 SeitenHANDOUT-business TaxesGianJoshuaDayrit67% (3)

- Tax: TRAIN Illustrative Problems: Long Problem With FormsDokument23 SeitenTax: TRAIN Illustrative Problems: Long Problem With FormsNooroddenNoch keine Bewertungen

- Comprehensive Problem Estate TaxDokument2 SeitenComprehensive Problem Estate Taxmarch0% (1)

- Ans For Remaining Questions PDFDokument23 SeitenAns For Remaining Questions PDFKyla Nicole Cortez40% (5)

- Chap 11 - Percentage Taxes ValenciaDokument23 SeitenChap 11 - Percentage Taxes ValenciaDanzen Bueno Imus0% (1)

- Arturo Died Leaving The Following PropertiesDokument1 SeiteArturo Died Leaving The Following PropertiesCristine Salvacion PamatianNoch keine Bewertungen

- PrefinalDokument7 SeitenPrefinalLeisleiRagoNoch keine Bewertungen

- 7.3.1 Topic Test Questions AnswersDokument34 Seiten7.3.1 Topic Test Questions AnswersliamdrlnNoch keine Bewertungen

- AIR - Donor's TaxDokument5 SeitenAIR - Donor's TaxRaz Jisryl100% (1)

- AC11 Chapter 4 CompilationDokument35 SeitenAC11 Chapter 4 Compilationanon_467190796Noch keine Bewertungen

- 1st Preboard - TaxDokument17 Seiten1st Preboard - TaxKriztleKateMontealtoGelogoNoch keine Bewertungen

- Estate TaxDokument21 SeitenEstate TaxPatrick ArazoNoch keine Bewertungen

- Quiz Tax OPTDokument5 SeitenQuiz Tax OPTAnonymous 7HGskN0% (1)

- VAT QuizzerDokument16 SeitenVAT QuizzerAnonymous 2ajCCT03VM50% (6)

- 2.1bsa-Cy1 - Angela R. Reveral - Business - Taxation - Final - TaskDokument3 Seiten2.1bsa-Cy1 - Angela R. Reveral - Business - Taxation - Final - TaskAngela Ricaplaza Reveral0% (1)

- Problem On OPTDokument12 SeitenProblem On OPTAlice Wu100% (1)

- Chapter 10 - TBTDokument11 SeitenChapter 10 - TBTKatKat Olarte100% (4)

- BLT 101Dokument14 SeitenBLT 101NIMOTHI LASENoch keine Bewertungen

- Chapter 14 Percentage TaxesDokument11 SeitenChapter 14 Percentage TaxesGeraldNoch keine Bewertungen

- TAX Preweek Lecture (B42)Dokument24 SeitenTAX Preweek Lecture (B42)Bernadette Panican100% (1)

- Activity in Excise TaxDokument2 SeitenActivity in Excise TaxLucy Heartfilia67% (3)

- Chapter 4 Sources of Income PDFDokument5 SeitenChapter 4 Sources of Income PDFkimberly tenebroNoch keine Bewertungen

- Sample Exercises ITDokument1 SeiteSample Exercises ITCris Joy BiabasNoch keine Bewertungen

- Chapter 7 - TBTDokument14 SeitenChapter 7 - TBTKatKat Olarte0% (3)

- Quiz 4 VATDokument3 SeitenQuiz 4 VATAsiong Salonga100% (2)

- VATDokument5 SeitenVATCyril John RamosNoch keine Bewertungen

- M Idterm Activity - Donor 'S TaxDokument3 SeitenM Idterm Activity - Donor 'S TaxMary DenizeNoch keine Bewertungen

- TaxationDokument10 SeitenTaxationSteven Mark MananguNoch keine Bewertungen

- Sample Estate Tax ProblemDokument14 SeitenSample Estate Tax ProblemAiza MadumNoch keine Bewertungen

- Donor's Tax Quizzer-2Dokument5 SeitenDonor's Tax Quizzer-2Monina Cabalag0% (1)

- Estate Tax Activities (Questions)Dokument4 SeitenEstate Tax Activities (Questions)Christine Nathalie BalmesNoch keine Bewertungen

- Exercise 7-7. Multiple Choice Problem: Items 1 and 2 Are Based On The Following InformationDokument14 SeitenExercise 7-7. Multiple Choice Problem: Items 1 and 2 Are Based On The Following InformationSheie WiseNoch keine Bewertungen

- Copy 3 ACC 321 Sample Problems For Estate Taxation of Married Individuals and Computation of Tax CreditDokument2 SeitenCopy 3 ACC 321 Sample Problems For Estate Taxation of Married Individuals and Computation of Tax CreditMitsuke MitsukeNoch keine Bewertungen

- 1.0 Accounting Period and MethodDokument22 Seiten1.0 Accounting Period and MethodShiela Marie Sta AnaNoch keine Bewertungen

- TAX-501: Excise Taxes: - T R S ADokument4 SeitenTAX-501: Excise Taxes: - T R S AShiela Marie Sta AnaNoch keine Bewertungen

- RFBT 03 SalesDokument10 SeitenRFBT 03 SalesShiela Marie Sta AnaNoch keine Bewertungen

- RFBT.O 1602.law On Contracts WithanswersDokument42 SeitenRFBT.O 1602.law On Contracts WithanswersDanielle Nicole Marquez0% (1)

- Hbo Chapter1Dokument28 SeitenHbo Chapter1Shiela Marie Sta AnaNoch keine Bewertungen

- 6.0 Final Income TaxationDokument28 Seiten6.0 Final Income TaxationShiela Marie Sta AnaNoch keine Bewertungen

- Hbo Chapter7Dokument19 SeitenHbo Chapter7Shiela Marie Sta AnaNoch keine Bewertungen

- Ap Receivables Quizzer507Dokument20 SeitenAp Receivables Quizzer507Jean Tan100% (1)

- Train Law Vs Nirc Income TaxDokument7 SeitenTrain Law Vs Nirc Income TaxShiela Marie Sta AnaNoch keine Bewertungen

- BagnpesDokument3 SeitenBagnpesShiela Marie Sta AnaNoch keine Bewertungen

- Look For Solution: Prof. Alan Lancelot D. Makasiar, MBADokument3 SeitenLook For Solution: Prof. Alan Lancelot D. Makasiar, MBAShiela Marie Sta AnaNoch keine Bewertungen

- Student Handout Applying Design Thinking PDFDokument3 SeitenStudent Handout Applying Design Thinking PDFShiela Marie Sta Ana0% (1)

- Lesson-2 3Dokument3 SeitenLesson-2 3Shiela Marie Sta AnaNoch keine Bewertungen

- Pfizer ArticleDokument3 SeitenPfizer ArticleShiela Marie Sta AnaNoch keine Bewertungen

- Activity Instructions Identify A Problem Worth Solving PDFDokument4 SeitenActivity Instructions Identify A Problem Worth Solving PDFShiela Marie Sta Ana100% (1)

- Chapter 23Dokument14 SeitenChapter 23muglersaurusNoch keine Bewertungen

- Ap 59 1stpb - 5 06 PDFDokument9 SeitenAp 59 1stpb - 5 06 PDFJasmin NgNoch keine Bewertungen

- Reviewer Negotiable Instruments Law 2014 02 16 PDFDokument34 SeitenReviewer Negotiable Instruments Law 2014 02 16 PDFPV PalmaNoch keine Bewertungen

- BC and Conso Guerrero - 20190723114054 PDFDokument15 SeitenBC and Conso Guerrero - 20190723114054 PDFShiela Marie Sta AnaNoch keine Bewertungen

- San Beda 2005 Negotiable InstrumentDokument24 SeitenSan Beda 2005 Negotiable InstrumentRingo Dungog100% (1)

- Section 195-196: Shiela Marie L. Sta AnaDokument3 SeitenSection 195-196: Shiela Marie L. Sta AnaShiela Marie Sta AnaNoch keine Bewertungen

- BagnpesDokument3 SeitenBagnpesShiela Marie Sta AnaNoch keine Bewertungen

- Law NotesDokument31 SeitenLaw NotesShiela Marie Sta AnaNoch keine Bewertungen

- Auditing Theory PreboardDokument12 SeitenAuditing Theory PreboardShiela Marie Sta AnaNoch keine Bewertungen

- A. Classification OF Individual TaxpayersDokument7 SeitenA. Classification OF Individual TaxpayersShiela Marie Sta AnaNoch keine Bewertungen

- Review of The Accounting Process PDFDokument3 SeitenReview of The Accounting Process PDFShiela Marie Sta AnaNoch keine Bewertungen

- Conceptual Framework: BFACCR3: Financial Accounting and Reporting Part-3Dokument30 SeitenConceptual Framework: BFACCR3: Financial Accounting and Reporting Part-3Shiela Marie Sta AnaNoch keine Bewertungen

- Conceptual Framework: BFACCR3: Financial Accounting and Reporting Part-3Dokument30 SeitenConceptual Framework: BFACCR3: Financial Accounting and Reporting Part-3Shiela Marie Sta AnaNoch keine Bewertungen

- Auditing Theory PRTC PDFDokument35 SeitenAuditing Theory PRTC PDFArah OpalecNoch keine Bewertungen

- Finals - Takehome Quizzes Problems - WithoutDokument5 SeitenFinals - Takehome Quizzes Problems - WithoutMaketh.ManNoch keine Bewertungen

- Si Eft Mandate FormDokument1 SeiteSi Eft Mandate FormdSolarianNoch keine Bewertungen

- A Textbook of Refrigeration and Air Conditioning by R S Khurmi and J K GuptaDokument2 SeitenA Textbook of Refrigeration and Air Conditioning by R S Khurmi and J K GuptaA's Power100% (2)

- JP Morgan Guide - To - Mutual - Fund - InvestingDokument12 SeitenJP Morgan Guide - To - Mutual - Fund - InvestingAnkit KanojiaNoch keine Bewertungen

- Entitlement of Serving GREF PersDokument85 SeitenEntitlement of Serving GREF Persnarayanacs100% (1)

- Sec Contact Center: Offices/ Matters of Concern Email AddressDokument1 SeiteSec Contact Center: Offices/ Matters of Concern Email AddressVinz BiuagNoch keine Bewertungen

- Week 1 OutputDokument4 SeitenWeek 1 OutputFria Mae Aycardo AbellanoNoch keine Bewertungen

- West Bengal Primary Teachers Manual PDFDokument139 SeitenWest Bengal Primary Teachers Manual PDFPrantik Pramanik100% (1)

- Percentages (II) : 3 SolutionsDokument2 SeitenPercentages (II) : 3 Solutions(4C27) Wong Ching Tung, Zoey 20181D043spss.hkNoch keine Bewertungen

- Financial Instrument: What Are Financial Instruments?Dokument9 SeitenFinancial Instrument: What Are Financial Instruments?Ammara NawazNoch keine Bewertungen

- Income Taxation IndividualsDokument19 SeitenIncome Taxation IndividualsJenniNoch keine Bewertungen

- MFD Model Test Questions-Aug2018Dokument16 SeitenMFD Model Test Questions-Aug2018Pravin PawarNoch keine Bewertungen

- Indian Stock MarketDokument23 SeitenIndian Stock MarketPawan GajbhiyeNoch keine Bewertungen

- Motorcycle Rental AgreementDokument2 SeitenMotorcycle Rental Agreementval Geroche78% (9)

- IPO - Methods of PricingDokument9 SeitenIPO - Methods of PricingAmreen Rashida100% (1)

- IA2 02 - Handout - 1 PDFDokument10 SeitenIA2 02 - Handout - 1 PDFMelchie RepospoloNoch keine Bewertungen

- 9 The Bank AccountDokument11 Seiten9 The Bank AccountJc CoronacionNoch keine Bewertungen

- Preventive VigilanceDokument9 SeitenPreventive VigilanceSuranjit BaralNoch keine Bewertungen

- A Quick Overview of Project AccountingDokument27 SeitenA Quick Overview of Project AccountingNigel A.L. Brooks100% (3)

- AK Personal 1Dokument13 SeitenAK Personal 1erniNoch keine Bewertungen

- Legal, Procedural & Tax Aspects of DividendsDokument18 SeitenLegal, Procedural & Tax Aspects of DividendsNavneet Nanda100% (1)

- Century Hongyu AOI BylawsDokument13 SeitenCentury Hongyu AOI BylawsRapplerNoch keine Bewertungen

- The Accounting Information System: Kimmel Weygandt Kieso Accounting, Sixth EditionDokument66 SeitenThe Accounting Information System: Kimmel Weygandt Kieso Accounting, Sixth EditionJoonasNoch keine Bewertungen

- Accountant TestDokument3 SeitenAccountant TestMax SuperNoch keine Bewertungen

- Brochure Dhanaraksha Plus LPPT For Master PolicyholderDokument6 SeitenBrochure Dhanaraksha Plus LPPT For Master Policyholderg26agarwalNoch keine Bewertungen

- EMIS Insights - India Insurance Sector Report 2020 - 2024Dokument79 SeitenEMIS Insights - India Insurance Sector Report 2020 - 2024Kathiravan Rajendran100% (1)

- Topic 8 Capital Reconstruction 1Dokument65 SeitenTopic 8 Capital Reconstruction 1Mei Chien Yap100% (2)

- ICICI Benefit IllustrationDokument4 SeitenICICI Benefit Illustrationudupiganesh3069Noch keine Bewertungen

- MARUBENI Vs CIR TAXDokument2 SeitenMARUBENI Vs CIR TAXLemuel Angelo M. EleccionNoch keine Bewertungen

- Intrinsic Value Formula (Example) - How To Calculate Intrinsic ValueDokument17 SeitenIntrinsic Value Formula (Example) - How To Calculate Intrinsic Valuehareeshac9Noch keine Bewertungen

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProVon EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProBewertung: 4.5 von 5 Sternen4.5/5 (43)

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyVon EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNoch keine Bewertungen

- How to get US Bank Account for Non US ResidentVon EverandHow to get US Bank Account for Non US ResidentBewertung: 5 von 5 Sternen5/5 (1)

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCVon EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCBewertung: 4 von 5 Sternen4/5 (5)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesVon EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNoch keine Bewertungen

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsVon EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNoch keine Bewertungen

- Taxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipVon EverandTaxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipNoch keine Bewertungen

- U.S. Taxes for Worldly Americans: The Traveling Expat's Guide to Living, Working, and Staying Tax Compliant AbroadVon EverandU.S. Taxes for Worldly Americans: The Traveling Expat's Guide to Living, Working, and Staying Tax Compliant AbroadNoch keine Bewertungen

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyVon EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyBewertung: 4 von 5 Sternen4/5 (52)

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessVon EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessBewertung: 5 von 5 Sternen5/5 (5)

- Lower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderVon EverandLower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderNoch keine Bewertungen

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionVon EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionBewertung: 5 von 5 Sternen5/5 (27)

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesVon EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesBewertung: 4 von 5 Sternen4/5 (9)

- Public Finance: Legal Aspects: Collective monographVon EverandPublic Finance: Legal Aspects: Collective monographNoch keine Bewertungen

- Founding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationVon EverandFounding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationNoch keine Bewertungen

- The Hidden Wealth of Nations: The Scourge of Tax HavensVon EverandThe Hidden Wealth of Nations: The Scourge of Tax HavensBewertung: 4 von 5 Sternen4/5 (11)

- Decrypting Crypto Taxes: The Complete Guide to Cryptocurrency and NFT TaxationVon EverandDecrypting Crypto Taxes: The Complete Guide to Cryptocurrency and NFT TaxationNoch keine Bewertungen

- Tax-Free Wealth For Life: How to Permanently Lower Your Taxes And Build More WealthVon EverandTax-Free Wealth For Life: How to Permanently Lower Your Taxes And Build More WealthNoch keine Bewertungen

- The Great Multinational Tax Rort: how we’re all being robbedVon EverandThe Great Multinational Tax Rort: how we’re all being robbedNoch keine Bewertungen

- Deduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesVon EverandDeduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesBewertung: 3 von 5 Sternen3/5 (3)

- Beat Estate Tax Forever: The Unprecedented $5 Million Opportunity in 2012Von EverandBeat Estate Tax Forever: The Unprecedented $5 Million Opportunity in 2012Noch keine Bewertungen

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingVon EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingBewertung: 5 von 5 Sternen5/5 (3)

- Taxes Have Consequences: An Income Tax History of the United StatesVon EverandTaxes Have Consequences: An Income Tax History of the United StatesNoch keine Bewertungen