Beruflich Dokumente

Kultur Dokumente

RPT Viewer 1

Hochgeladen von

AbdurRahman CheemaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

RPT Viewer 1

Hochgeladen von

AbdurRahman CheemaCopyright:

Verfügbare Formate

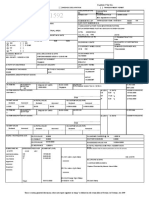

GOODS DECLARATION. GD-I X Custom File No.

[ ] BILL OF ENTRY [ ] BILL OF EXPORT [ ] BAGGAGE DECLARATION [ ] TRANSSHIPMENT PERMIT

2.DECLARATION TYPE 3.VALUATION 4.PREVIOUS REF

1.EXPORTER'S/CONSIGNOR'S NAME AND ADDRESS

2198

EB METHOD PQIB-IB-8472-18-12-2019

Pt Sumber Indah Perkasa 5.PAGE 1 OF 6.CUSTOM OFFICE 7.BANK CODE

Indonesia 1 MCC PMBQ - Import Bulk

8.IGM/EGM NO & DT PQIB-748-2019 Date: 17-12-2019 INDEX 21

10.IMPORTER'S/CONSIGNEE'S/PASSENGER NAME & ADDRESS 9.DRY PORT IGM/EGM NO & INDEX

DT

FAISALABAD OIL REFINERY PVT LTD 11.DECLARANT (OTHER THAN IMPORTER/EXPORTER)

NOWSHERA SHIPPING AGENCY SHOW ROOM NO 4 GROUND FL 25 PAK

JHANG ROAD CHAMBER WEST WHARF ROAD KARACHI

12.TEL 02132852087

14.NTN 15.STR.No / PASSPORT NO & DATE 13.C.H.A.L. No 2198 Job No

16.WAREHOUSE LIC NO 17.TRANSACTION TYPE

0803939 0801040500282

PWL 02/2006 False

18.DOCUMENTS ATTACHED E-Form No Date Value

19.LC/DD NO. & DATE 20.COUNTRY OF DESTINATION

INV [ ] B/G

LC/02/009/396810/23/2019 12:00:00 AM Pakistan

BL/AWB/ [ ] IT EXMP

21.CURRENCY NAME & CODE 30.MARKS/ CONTAINER NOS.

CO [ ]

US $ 840 R.B.D PALM OLEIN IN BULK

PL [ ]

22.VESSEL MODE OF 23.BL.AWL.CON.NO & DATE 24.EXCHANGE RATE

TRANSPORT BLOOMV1901TRHPQ21 11/29/2019 12:00:00 AM 155.490000

M.T. ARGENT BLOOM,

17/12/201923:00 25.PORT OF SHIPMENT 26.PAYMENT TERMS

Tarahan With LC

27.PORT OF DISCHARGE 28.PLACE OF DELIVERY 29.DELIVERY TERMS

CFR

31.NUMBER OF PACKAGES 32.TYPE OF PACKAGE 33.GR OSS WT 34.Volume M3

982000.000 KGS 982.00000 MT

35.GENERAL DESCRIPTION OF GOODS

NET WT

982.00000MT

36.IN THE CASE OF DANGEROUS GOODS INDICATE HAZARD CLASS/DIV:FLASH Containers detail as per attached sheet

POINT

37.ITEM NO 38.QUANTITY 38(b).NO OF UNITS 39.CO CODE 40.SRO NO 41.HS Code

(a)Unit Type SRO741(I)/2013-78-28/08/2013

1 982000.0000 Indonesia 1st Schedule ( Income Tax) Part II Sr 7 of the table-7-30/06/2019 1511.9030

KG 6th Schedule-24-12/06/1998

42.ITEM DESCRIPTION OF GOODS 46.LEVY 47.RATE 48.SUM PAYABLE (PKR)

RBD PALM OLEIN (IN BULK) D-QTY 982000 KGS. 100 CD 7692.5000

F 7554035.0000

ST 0.00 % 0.0000

42(a)

ACD 2.00 % 1781898.0000

43.UNIT VALUE 44.TOTAL VALUE 45.CUSTOM VALUE (PKR) %

IT 5.50 6337182.0000

Declared Assessed Declared Assessed Declared Assessed

SVT 17.00 % 16741585.0000

0.5720 0.5720 561704.0000 561704 89094876.0000 89094876.0000

37.ITEM NO 38.QUANTITY 38(b).NO OF UNITS 39.CO CODE 40.SRO NO 41.HS Code

(a)Unit Type

2

42.ITEM DESCRIPTION OF GOODS 46.LEVY 47.RATE 48.SUM PAYABLE (PKR)

42(a)

43.UNIT VALUE 44.TOTAL VALUE 45.CUSTOM VALUE (PKR)

Declared Assessed Declared Assessed Declared Assessed

49.SRO / Test Report No & Dt 50.FOB VALUE 0.0000 54.LANDING CHARGES @ 1% 1.0000 %

51.FREIGHT 0.0000 55.OTHER CHARGES 0.0000

52.CFR VALUE 561704.0000 89094876.0000

56.ASSESSED VALUE PKR

53.INSURANCE 1.0000 % 57.TOTAL REBATE CLAIM/ PROV. ASSMNT U/S 81

58.MACHINE NO. 59REVENUE RECOVER 60.AMOUNT (PKR) (PKR)

64.I/we declare that the above particulars are true & corrcect.

& DATE CODE LEVY

PQIB-EB-9159- CD 7554035.00

30-12-2019 ST 0.00

61.A.O's name, sig & stamp SIG & DATE

155.490000

ACD 1781898.00

IT 6337182.00 65..C/F/D NO & DATE

Appraiser:

XXXXXX

SVT 16741585.00 C-PQIB-001475-30122019

XXXXXX

Examiner:

Payment Received by Rehmatullah

62.P.A.s name, sig & stamp

XXXXXX

XXXXXX

63.Out of Charge Sig & Stamp

Total: 32463800.0000 66.Bank Stamp

This is a system generated document, it does not require signature or stamp” as defined in sub section (kka) of Section 2 of Customs Act 1969

Das könnte Ihnen auch gefallen

- 36.in The Case of Dangerous Goods Indicate Hazard Class/Div:Flash Point Containers Detail As Per Attached SheetDokument1 Seite36.in The Case of Dangerous Goods Indicate Hazard Class/Div:Flash Point Containers Detail As Per Attached SheetSaba DawoodNoch keine Bewertungen

- Excise & Taxation Department, IslamabadDokument5 SeitenExcise & Taxation Department, IslamabadAbeeha RajpootNoch keine Bewertungen

- .. STDocs Tender TND 095158 181863Dokument28 Seiten.. STDocs Tender TND 095158 181863Abhijor KoliNoch keine Bewertungen

- Draft Sale Deed SobDokument4 SeitenDraft Sale Deed SobHaseeb Mujtehdi100% (1)

- Indemnity Bond For Factory DestuffingDokument4 SeitenIndemnity Bond For Factory DestuffingNitin Jain0% (1)

- 2 Notifications Cic CD - Conversion ChargesDokument9 Seiten2 Notifications Cic CD - Conversion ChargesSushil TyagiNoch keine Bewertungen

- 161-205 Case LawDokument2 Seiten161-205 Case LawAsim Ahmad100% (2)

- Cost Sheet For TRAnspotDokument8 SeitenCost Sheet For TRAnspotkhairejo0% (1)

- Value of SupplyDokument16 SeitenValue of Supplyhariom bajpaiNoch keine Bewertungen

- Rajasthan High Court Order On Bail During LockdownDokument6 SeitenRajasthan High Court Order On Bail During LockdownThe WireNoch keine Bewertungen

- Notes On MVAT Act For StudentsDokument23 SeitenNotes On MVAT Act For StudentsDeepali SolankiNoch keine Bewertungen

- FTO ComplaintDokument4 SeitenFTO ComplaintTahawor AsadNoch keine Bewertungen

- Model Agreement Provided Under The Maharashtra Ownership of Flats Act (Mofa)Dokument10 SeitenModel Agreement Provided Under The Maharashtra Ownership of Flats Act (Mofa)vidya adsule100% (1)

- Voluntary Disclosure Scheme of 1997Dokument11 SeitenVoluntary Disclosure Scheme of 1997Shivam GuptaNoch keine Bewertungen

- S. 489-F PPC Case LawDokument1 SeiteS. 489-F PPC Case Lawsarmad aliNoch keine Bewertungen

- Sale Agreement Mayfair CentreDokument4 SeitenSale Agreement Mayfair CentreUzma SheikhNoch keine Bewertungen

- GST APL-01 VandanDokument14 SeitenGST APL-01 VandanUtkarsh KhandelwalNoch keine Bewertungen

- The Sindh Terms of EmploymentDokument3 SeitenThe Sindh Terms of EmploymentFawaad Hussain100% (1)

- Application For Enrolment As AdvocateDokument4 SeitenApplication For Enrolment As AdvocateshaannivasNoch keine Bewertungen

- Refund of Airline Tickets To Passengers of Public Transport Undertakings - D3M-M2 (Draft - June2016)Dokument3 SeitenRefund of Airline Tickets To Passengers of Public Transport Undertakings - D3M-M2 (Draft - June2016)Disability Rights AllianceNoch keine Bewertungen

- DT Mock Test Paper Solution 1-2Dokument19 SeitenDT Mock Test Paper Solution 1-2Aejaz MohamedNoch keine Bewertungen

- Grounds of Appeal TY-16Dokument2 SeitenGrounds of Appeal TY-16wasim nisarNoch keine Bewertungen

- Reservtn Eng JobsDokument5 SeitenReservtn Eng JobsNehaNoch keine Bewertungen

- Indemnity Bond (Model)Dokument5 SeitenIndemnity Bond (Model)Karthik ChockkalingamNoch keine Bewertungen

- Form No.35 Appeal To The Commissioner of Income Tax (Appeals) - 1, NashikDokument3 SeitenForm No.35 Appeal To The Commissioner of Income Tax (Appeals) - 1, NashikNitin RautNoch keine Bewertungen

- Notes On Sales TaxDokument24 SeitenNotes On Sales Taxsajjad_ym1100% (7)

- Strict Construction RuleDokument4 SeitenStrict Construction RuleReubenPhilipNoch keine Bewertungen

- By KK State of Bombay v. The Hospital Mazdoor SabhaDokument12 SeitenBy KK State of Bombay v. The Hospital Mazdoor SabharagyaNoch keine Bewertungen

- How To Draft Legal Opinion - by Rehan Aziz Shervani - Advocate High Court - Cell-0333-4324961Dokument1 SeiteHow To Draft Legal Opinion - by Rehan Aziz Shervani - Advocate High Court - Cell-0333-4324961rehanshervaniNoch keine Bewertungen

- Draft A Notice For Specific Performance of ContractDokument9 SeitenDraft A Notice For Specific Performance of ContractRobin SinghNoch keine Bewertungen

- Cancellation & Revocation of GST RegistrationDokument5 SeitenCancellation & Revocation of GST RegistrationshenbhaNoch keine Bewertungen

- GST Apl-01Dokument3 SeitenGST Apl-01Manish K JadhavNoch keine Bewertungen

- Important Decisions 2011-2018 Civil PDFDokument178 SeitenImportant Decisions 2011-2018 Civil PDFJoseph SmithNoch keine Bewertungen

- 5 Letter Brands Brand Purchase Agreement June 2011Dokument4 Seiten5 Letter Brands Brand Purchase Agreement June 2011pb2540Noch keine Bewertungen

- TPA Cirular No. 059-03-2016 Dated 28-03-16Dokument89 SeitenTPA Cirular No. 059-03-2016 Dated 28-03-16NitinNoch keine Bewertungen

- C.I.T. v. G.R. KarthikeyanDokument2 SeitenC.I.T. v. G.R. KarthikeyanRonit Kumar0% (1)

- 012 Kerala Stamp (Undervaluation) Rules 1968Dokument15 Seiten012 Kerala Stamp (Undervaluation) Rules 1968shiyas.vkNoch keine Bewertungen

- How Many Questions Can Be Asked in One RTI ApplicationDokument6 SeitenHow Many Questions Can Be Asked in One RTI ApplicationGANESH KUNJAPPA POOJARINoch keine Bewertungen

- V Chettiar V CITDokument42 SeitenV Chettiar V CITManish KumarNoch keine Bewertungen

- 5034 International Trade Law Final 2020Dokument168 Seiten5034 International Trade Law Final 2020VeenaNoch keine Bewertungen

- Arbitration ScriptDokument12 SeitenArbitration Scriptnatasha shahiraNoch keine Bewertungen

- GST APL-01 Lykos India Private LimitedDokument25 SeitenGST APL-01 Lykos India Private LimitedUtkarsh Khandelwal100% (1)

- Din Allotment LetterDokument1 SeiteDin Allotment LetterChujja ChuNoch keine Bewertungen

- Civil Procedure SabitiDokument138 SeitenCivil Procedure SabitisuakelloNoch keine Bewertungen

- Demand Notice - For StudyDokument10 SeitenDemand Notice - For StudyAmbience LegalNoch keine Bewertungen

- Stamp Cert 2017092600220Dokument1 SeiteStamp Cert 2017092600220shubhrajNoch keine Bewertungen

- Excise Policy Go 164Dokument21 SeitenExcise Policy Go 164Sri KanthNoch keine Bewertungen

- IPC Provisions - Illegal Demolition and ConstructionDokument2 SeitenIPC Provisions - Illegal Demolition and ConstructionAnshvaardhaanNoch keine Bewertungen

- Hukum Pharmaceuticals Pvt. LTD - Versus Industrial Promotion BoardDokument13 SeitenHukum Pharmaceuticals Pvt. LTD - Versus Industrial Promotion BoardAnjali PaneruNoch keine Bewertungen

- Before The Commissioner Inland Revenue (Appeal-Iii) KarachiDokument6 SeitenBefore The Commissioner Inland Revenue (Appeal-Iii) Karachiiqbal sheikhNoch keine Bewertungen

- Buchhi Esi WP DocketsDokument22 SeitenBuchhi Esi WP DocketsLakshmi Narayana C100% (1)

- Rules of The High Court of Kerala, 1971Dokument120 SeitenRules of The High Court of Kerala, 1971gensgeorge4328Noch keine Bewertungen

- Sindh Weights & Measures Act 1975 PDFDokument20 SeitenSindh Weights & Measures Act 1975 PDFAnonymous C4vzh7100% (1)

- Rptviewer1 - 2023-08-28T182709.656Dokument1 SeiteRptviewer1 - 2023-08-28T182709.656Zeeshan ZaheerNoch keine Bewertungen

- Acme GD 5Dokument1 SeiteAcme GD 5Ahmed Qayyum0% (1)

- 36.in The Case of Dangerous Goods Indicate Hazard Class/Div:Flash Point Containers Detail As Per Attached SheetDokument1 Seite36.in The Case of Dangerous Goods Indicate Hazard Class/Div:Flash Point Containers Detail As Per Attached SheetahmedNoch keine Bewertungen

- 36.in The Case of Dangerous Goods Indicate Hazard Class/Div:Flash Point Containers Detail As Per Attached SheetDokument1 Seite36.in The Case of Dangerous Goods Indicate Hazard Class/Div:Flash Point Containers Detail As Per Attached Sheetomer akhterNoch keine Bewertungen

- RPT Viewer 1Dokument1 SeiteRPT Viewer 1omer akhterNoch keine Bewertungen

- RPT Viewer 15 J5 HPB6 IDokument1 SeiteRPT Viewer 15 J5 HPB6 Iomer akhterNoch keine Bewertungen

- 36.in The Case of Dangerous Goods Indicate Hazard Class/Div:Flash Point Containers Detail As Per Attached SheetDokument1 Seite36.in The Case of Dangerous Goods Indicate Hazard Class/Div:Flash Point Containers Detail As Per Attached Sheetawaisshah20 gilaniNoch keine Bewertungen

- Accomplisment Letter 120611Dokument3 SeitenAccomplisment Letter 120611Latisha WalkerNoch keine Bewertungen

- Sri Lanka - MAS Holdings Enters New Venture With BAM KnittingDokument2 SeitenSri Lanka - MAS Holdings Enters New Venture With BAM KnittingsandamaliNoch keine Bewertungen

- Insider Trading RegulationsDokument22 SeitenInsider Trading Regulationspreeti211Noch keine Bewertungen

- Tugas AF 4Dokument9 SeitenTugas AF 4Rival RmcNoch keine Bewertungen

- SalesDokument19 SeitenSalesdrbrijmohanNoch keine Bewertungen

- Bangladesh TransportDokument19 SeitenBangladesh TransportMasud SanvirNoch keine Bewertungen

- Case Study Assignment - Neha Nair 26021Dokument3 SeitenCase Study Assignment - Neha Nair 26021NEHA NAIRNoch keine Bewertungen

- Global Economic IntegrationDokument3 SeitenGlobal Economic IntegrationApriyandi TVNoch keine Bewertungen

- Project Management ConceptsDokument8 SeitenProject Management ConceptsAnkita RautNoch keine Bewertungen

- Statute of Limitations On Debt Collection Sorted by StateDokument5 SeitenStatute of Limitations On Debt Collection Sorted by StateWarriorpoetNoch keine Bewertungen

- Managerial Economics: Numerical ProblemsDokument7 SeitenManagerial Economics: Numerical Problemsarchana_anuragiNoch keine Bewertungen

- Chapter 4Dokument2 SeitenChapter 4Dai Huu0% (1)

- ZARA Case Study 2 ZARA THE WORLD S LARGEST FASHION RETAILERDokument6 SeitenZARA Case Study 2 ZARA THE WORLD S LARGEST FASHION RETAILERSinem DüdenNoch keine Bewertungen

- CH.16 Monopolistic Competition (Student)Dokument8 SeitenCH.16 Monopolistic Competition (Student)Briget KoayNoch keine Bewertungen

- All ZtcodeDokument4 SeitenAll Ztcodetamal.me1962100% (1)

- Private Equity AsiaDokument12 SeitenPrivate Equity AsiaGiovanni Graziano100% (1)

- Tien Te ReviewDokument3 SeitenTien Te ReviewViết BảoNoch keine Bewertungen

- Extension of Time Claim ProcedureDokument108 SeitenExtension of Time Claim ProcedureAshish Kumar GuptaNoch keine Bewertungen

- Yusoph Hassan F. Macarambon BSPE 4C DEC 6, 2016 Engineering Economy & Accounting AssignmentDokument4 SeitenYusoph Hassan F. Macarambon BSPE 4C DEC 6, 2016 Engineering Economy & Accounting AssignmentHassan MacarambonNoch keine Bewertungen

- SAP Global Implementation Conceptual-Design-Of-Finance and ControllingDokument172 SeitenSAP Global Implementation Conceptual-Design-Of-Finance and Controllingprakhar31Noch keine Bewertungen

- Reverse Pricing ProcedureDokument4 SeitenReverse Pricing ProcedureAnonymous 13sDEcwShTNoch keine Bewertungen

- Pso Summer Internship ReportDokument19 SeitenPso Summer Internship ReportMaria Masood100% (3)

- Addis Ababa University College of Development StudiesDokument126 SeitenAddis Ababa University College of Development StudieskindhunNoch keine Bewertungen

- The Impact of Food Quality On Customer Satisfaction and Behavioural Intentions: A Study On Madurai RestaurantDokument5 SeitenThe Impact of Food Quality On Customer Satisfaction and Behavioural Intentions: A Study On Madurai RestaurantJohn Francis SegarraNoch keine Bewertungen

- Ch01 Version1Dokument52 SeitenCh01 Version1An Trần Thị HảiNoch keine Bewertungen

- Downtown Revitalization PlanDokument23 SeitenDowntown Revitalization PlanScott FranzNoch keine Bewertungen

- Recap: Globalization: Pro-Globalist vs. Anti-Globalist DebateDokument5 SeitenRecap: Globalization: Pro-Globalist vs. Anti-Globalist DebateRJ MatilaNoch keine Bewertungen

- Ashish Chugh Reveals Top Secrets To Finding Multibagger StocksDokument10 SeitenAshish Chugh Reveals Top Secrets To Finding Multibagger StocksSreenivasulu E NNoch keine Bewertungen

- Lesson 02 - Co3085Dokument46 SeitenLesson 02 - Co3085Juan Carlos Arismendi ZambranoNoch keine Bewertungen

- Progress Test 3Dokument7 SeitenProgress Test 3myriamdzNoch keine Bewertungen