Beruflich Dokumente

Kultur Dokumente

Investment Proofs Covering Form - FY 2019-202011 PDF

Hochgeladen von

BargavaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Investment Proofs Covering Form - FY 2019-202011 PDF

Hochgeladen von

BargavaCopyright:

Verfügbare Formate

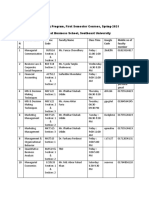

JKT/JKTC

Investment Proofs Form - FY. 2019-2020

EMPLOYEE CODE : 4346 NAME : Karthik L Contact No. : ______________

7353333853

PAN ( Mandatory ) : BESPK6384J DOJ: 20-05-1988

ADDRESS : #43,2nd floor Ramya Nilaya,9th cross,2nd block Akashayanagara,Ramamurthynagar,Banglore:560016

I. A. Deduction to be Claimed U/S 80 as per specified limit: Relation of

policy holder

with employee Amount (Rs.)

1 Mediclaim Policy Premium for Self/Spouse/ Children [u/s 80D]-upto Rs. 25,000/-

2 Mediclaim Policy Premium for Non Senior citizen parents( Age below 60 years) [u/s 80D]-upto Rs. 25,000/- Father 25000

3 Mediclaim Policy Premium/medical expenses for Senior citizen parents(age above 60 years) [u/s 80D]-upto Rs. 50,000/- Father 50000

4 Medical treatment of handicapped dependent [u/s 80DD]- upto Rs. 75,000/-

5 Payment of interest amount on loan taken for higher education [U/s 80 E]

6 Ragiv Gandhi Equity Saving Scheme [80CCG]upto Rs. 50,000/-

7 National Pension Scheme [80CCD-1B] upto Rs.50000/-

B Deduction U/S 80C/ 80CCC limit up to 1.5 lac.

1 Life Insurance Pension Scheme Premium

2 Sukanya Samriddhi Deposit

3 Life Insurance Premium Self 4500

4 Deposit in Public Provident Fund Self 80000

5 Purchase of National Saving Certificates

6 Payment of Unit Linked Insurance plan ( ULIP )

7 Payment of Equity linked Mutual Fund (Only Eligible Tax Saver Fund ) (ELSS)

8 Payment of tuition fees for any of two children

Child 1: (Amount in Rs) Child 2: (Amount in Rs)

9 Repayment of Principal Amount of Housing Loan During the F.Y. 2019-2020

10 Fixed Deposit with Bank/ Post Office for lockin period 5 years or more and Tax saver only.

11 Others (Please provide details)

Total Amount from 1 to 11 (Restricted to Rs. 1,50,000/- encluding Employee PF amt, would be added from payroll)

155000

II. Deduction to be Claimed U/s 24 for Housing Loan

Do you have possession of the Property (Yes / No), if Yes date of Possession

Name of owner & Address of the Property

Interest amount paid on Housing Loan for the F.Y. 2019-20120 - limit upto Rs. 200,000/-

Note: 1- The employee who is claiming benefit of home loan first time in current employment or possession got in current FY, ownership and possession proofs

to be submitted with interest & principal certificate from bank.

2- If employee not having possession of house , interest benefit can not be claimed.

III. RENT FOR THE PURPOSE OF HRA EXEMPTION U/S 10(13A)

Name & Address of Address of accommodation PAN of landlord Rent Amount p.m Period

Landlord

Owner : Ramya, From 20-May-15

#43,Ramya Nilaya,9th Owner : Ramya, #43,2nd floor Ramya

cross,2nd block Nilaya,9th cross,2nd block ANLPV9625Q 17000 To TILL DATE

Akashayanagara,Rama Akashayanagara,Ramamurthynagar,Ban

murthynagar,Banglore: glore:560016

Note :1-To get the HRA exemption every employee needs to submit one rent payment receipt of each of four Quarter for financial year 2019-20.

2-if annual rent above 1lakh , PAN copy of landlord mandatory requirement to be enclosed with rent receipts.

3-HRA exemption and home loan benefits can not be claimed for the same city hence please do not submit the same for tax benefits.

IV. (Any other income other than salary income.

(ii) Income from other sources

(a) Saving Interest

(b) Other incomes

Total

V. Any investment's payment due after 5th of Feb'2020, kindly fill up details below and submit proofs for this before 8th of March 2020. Relation of

Particulars Amounts policy holder Due Dates

1

2

3

4

I hereby declare that all the information given by me is true and correct & that the investments declared above, will not be used anywhere else to get income tax.

benefit. Banglore

Place :

Dated : Signature

Das könnte Ihnen auch gefallen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- PIA - Pakistan International AirlinesDokument52 SeitenPIA - Pakistan International AirlinesKhubaib MalikNoch keine Bewertungen

- Primark EthicsDokument4 SeitenPrimark Ethicsapi-505775092Noch keine Bewertungen

- BUSI8141-Strategic Leadership Course Outline PDFDokument4 SeitenBUSI8141-Strategic Leadership Course Outline PDFlak gallageNoch keine Bewertungen

- Faculty - Business Management - 2023 - Session 1 - Degree - HRM581Dokument4 SeitenFaculty - Business Management - 2023 - Session 1 - Degree - HRM581FARAIZAM AZUAN HAFIZ JAFFARNoch keine Bewertungen

- Labor Relations - Policy and DefinitionsDokument4 SeitenLabor Relations - Policy and Definitionschisel_159100% (1)

- Introduction To Information System: by Dr. Onkar NathDokument21 SeitenIntroduction To Information System: by Dr. Onkar NathHardik A SondagarNoch keine Bewertungen

- Introduction To Telecom Reform and Liberalization: Policy and Regulatory ToolsDokument20 SeitenIntroduction To Telecom Reform and Liberalization: Policy and Regulatory ToolsAlex CurtoisNoch keine Bewertungen

- Domain Property Guide 2013Dokument56 SeitenDomain Property Guide 2013El RuloNoch keine Bewertungen

- EOU Test HP3 Unit 10Dokument6 SeitenEOU Test HP3 Unit 10Ngân HạnhNoch keine Bewertungen

- Brief Summary Shyam Enterprises Pvt. LTDDokument46 SeitenBrief Summary Shyam Enterprises Pvt. LTDchinmay HegdeNoch keine Bewertungen

- 2 - Appropriate Building Technology (ABT)Dokument64 Seiten2 - Appropriate Building Technology (ABT)Yohannes Tesfaye100% (1)

- AMBUJADokument2 SeitenAMBUJAAbhay Kumar SinghNoch keine Bewertungen

- Chapter 12Dokument2 SeitenChapter 12Mikasa MikasaNoch keine Bewertungen

- F8 AA QB September 2020-June 2021 As at 11 May 2020 FINALDokument424 SeitenF8 AA QB September 2020-June 2021 As at 11 May 2020 FINALBacho Tsverikmazashvili100% (1)

- Week 8 Entrep (April 26-30)Dokument7 SeitenWeek 8 Entrep (April 26-30)LouisseNoch keine Bewertungen

- Business Strategy SimulationDokument16 SeitenBusiness Strategy SimulationMohit OstwalNoch keine Bewertungen

- Connecticut Foreclosure EventDokument2 SeitenConnecticut Foreclosure EventHelen BennettNoch keine Bewertungen

- Butler Lumber Company PDFDokument13 SeitenButler Lumber Company PDFFreshela AtasNoch keine Bewertungen

- Supply Chain Circularity Practices of Snowtex Outerwear LTDDokument13 SeitenSupply Chain Circularity Practices of Snowtex Outerwear LTDfaisal huqNoch keine Bewertungen

- Corporate Liquidation Answer SheetDokument4 SeitenCorporate Liquidation Answer SheetsatyaNoch keine Bewertungen

- Swot Analysis of BSNLDokument2 SeitenSwot Analysis of BSNLNiharika SinghNoch keine Bewertungen

- OJT Report SampleDokument49 SeitenOJT Report SampleKimberly Ann Lumanog AmarNoch keine Bewertungen

- Social Science Class 10 QuestionDokument20 SeitenSocial Science Class 10 Questionradhe thakurNoch keine Bewertungen

- WorksheetsDokument23 SeitenWorksheetsoxygeniaxxNoch keine Bewertungen

- A Research Porposal Dak BahadurDokument6 SeitenA Research Porposal Dak BahadurNabin AnupamNoch keine Bewertungen

- Fast Facts: Financial LiteracyDokument3 SeitenFast Facts: Financial LiteracyThe Partnership for a Secure Financial Future100% (1)

- Tong Hop T.anh Chuyen NganhDokument23 SeitenTong Hop T.anh Chuyen NganhVi PhươngNoch keine Bewertungen

- Tax Invoice Original For Buyer Procandour Automotive Systems Private LimitedDokument1 SeiteTax Invoice Original For Buyer Procandour Automotive Systems Private LimitedAdam WellsNoch keine Bewertungen

- Basic Economics of Food MarketDokument29 SeitenBasic Economics of Food MarketiloverentNoch keine Bewertungen

- SL N o Course Name Course Code Faculty Name Class Time Google Code Mobile No of Faculty MemberDokument2 SeitenSL N o Course Name Course Code Faculty Name Class Time Google Code Mobile No of Faculty Memberএ.বি.এস. আশিকNoch keine Bewertungen