Beruflich Dokumente

Kultur Dokumente

Star Engineering Company

Hochgeladen von

Chleo EsperaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Star Engineering Company

Hochgeladen von

Chleo EsperaCopyright:

Verfügbare Formate

Star Engineering Company

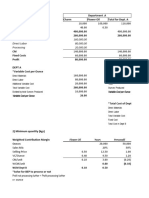

Overhead Distribution Sheet

1.) PRODUCTION DEPARTMENT SERVICE DEPARTMENT

Machining Fabrication Assembly Painting Stores Maintenance Work Office TOTAL BASIS

A. Allocation of Overhead

1. Indirect Labor 33,000.00 22,000.00 11,000.00 7,000.00 44,000.00 32,700.00 - 149,700.00 Exhibit 1

2. Indirect Materials 2,200.00 1,100.00 3,300.00 3,400.00 - 2,800.00 - 12,800.00 Exhibit 1

3. Factory Rent 45,500.00 38,500.00 30,800.00 22,400.00 15,400.00 7,700.00 168,000.00 sq. m

7,700.00

Book

4. Depreciation of Plant &

22,000.00 11,000.00 5,500.00 2,200.00 1,100.00 1,650.00 550.00 44,000.00 Value of

Machinery

Equipment

5. Building Rates & Taxes 650.00 550.00 440.00 320.00 220.00 110.00 110.00 2,400.00 sq. m.

Direct &

6. Welfare Expenses 9,460.00 4,840.00 2,420.00 1,240.00 880.00 654.00 - 19,494.00 Indirect

Labor

Horse

7. Power 40,000.00 20,000.00 2,000.00 4,000.00 - 366.00 68,586.00

2,220.00 Power

8. Work Office & Salaries 130,260.00 130,260.00 Exhibit 1

9. Miscellaneous Store

1,190.00 1,190.00 Exhibit 1

Department Expenses

Total Allocated Overhead 152,810.00 97,990.00 55,460.00 40,560.00 62,790.00 45,980.00 140,840.00 596,430.00

B. Rellocation of Service Department to Production Department

Store Department 33,893.18 16,946.59 8,684.07 4,476.16 - 64,000.00

Maintenance Department 24,200.00 12,100.00 6,050.00 2,420.00 1,210.00 - 45,980.00

Work Office Department 67,200.00 24,640.00 33,600.00 15,400.00 - 140,840.00

125,293.18 53,686.59 48,334.07 22,296.16 - - -

Total Cost of Production 278,103.18 151,676.59 103,794.07 62,856.16 596,430.00

2.) Actual Direct Labor Hours 120000 hours 44000 hours 60000 hours 27500 hours

Overhead Rate per DLH 2.32 3.45 1.73 2.29

3.)

a. I agree with the procedure that was adopted by Star Engineering

Company because the cost drivers reflects on how much each

department used the said overhead. Based on the data given, we

can easily recognize that the Machining Department uses a lot of

the overhead than the others.

b.) Even if using the Direct Labor hours as the basis of the overhead

rate could be efficient, it could still distort the product costing. The

company could consider separating the fixed cost from the variable

cost of the overhead so that they could properly cost their products.

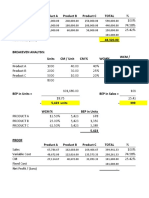

4.) Cost of Job No.

879:

Direct Materials 487.92

Direct Labor 460.10

Factory

Overhead:

Machining (50*2.31 115.50

)

(40*3.45

Fabrication 138.00

)

Assembl (20*1.73

34.60

y )

Painting (20*2.29 45.80

)

TOTAL PRODUCTION COST FOR JOB 1,281.9

NO. 879 2

5.) Cost of Job No. 879 using Cost-Plus-Fixed-

Fee (CPFF)

Total Cost of Job 1,281.9

No. 879 2

Fixed Cost 200.00

TOTAL

RECOVERABLE 1,481.9

COST 2

6.) Star Engineering Company mostly allocates its overhead by

rational basis. In which we could easily monitor the department

who uses more and the one who uses the least overhead. The

company uses the direct labor hours as the basis for its overhead

allocation which means that they focus more on the time spent in

labor when producing each unit. To improve the company, they

must try to separate the fixed cost from the variable costs so that

they could cost their products better and earn a bigger profit.

Das könnte Ihnen auch gefallen

- Star Engineering CompanyDokument5 SeitenStar Engineering CompanyMarilou GabayaNoch keine Bewertungen

- Indian Electricals LimitedDokument8 SeitenIndian Electricals LimitedJoseph MathewNoch keine Bewertungen

- FMDokument17 SeitenFMRaghav Agarwal100% (3)

- Bharat Chemicals Ltd. SolnDokument4 SeitenBharat Chemicals Ltd. SolnJayash KaushalNoch keine Bewertungen

- Indian Electricals Limited (Complete) 1Dokument8 SeitenIndian Electricals Limited (Complete) 1Prashant BarsingNoch keine Bewertungen

- The Garden Spot 1Dokument25 SeitenThe Garden Spot 1Saad Arain0% (1)

- Pioma Plastics Company Cash Flow Statement For The Year Ended July 31 Amount in Rs. Amount in Rs. Cash Flow From Operating ActivitiesDokument4 SeitenPioma Plastics Company Cash Flow Statement For The Year Ended July 31 Amount in Rs. Amount in Rs. Cash Flow From Operating ActivitiesPrajwal PaiNoch keine Bewertungen

- Cash Flow StatementDokument4 SeitenCash Flow StatementRavina Singh100% (1)

- Hamilton - Case BDokument8 SeitenHamilton - Case BJayash KaushalNoch keine Bewertungen

- Assumptions - : Cash Flow From Operations $ 0Dokument4 SeitenAssumptions - : Cash Flow From Operations $ 0Krish HegdeNoch keine Bewertungen

- CH 18Dokument7 SeitenCH 18Amit ChaturvediNoch keine Bewertungen

- Cochin MarineDokument4 SeitenCochin MarineSivasaravanan A TNoch keine Bewertungen

- Harsh Electricals Analyzing Cost in Search of Profit-Case StudyDokument8 SeitenHarsh Electricals Analyzing Cost in Search of Profit-Case StudyAl- Noor0% (1)

- Case Analysis Rosemont Hill Health Center V3 PDFDokument8 SeitenCase Analysis Rosemont Hill Health Center V3 PDFPoorvi SinghalNoch keine Bewertungen

- Group 3 - Master Budget-Earrings UnlimitedDokument8 SeitenGroup 3 - Master Budget-Earrings UnlimitedLorena Mae LasquiteNoch keine Bewertungen

- Marion Boats Assignment 2 LatestDokument2 SeitenMarion Boats Assignment 2 LatestRakesh SkaiNoch keine Bewertungen

- Financial ManagementDokument18 SeitenFinancial ManagementAravind 9901366442 - 990278722433% (3)

- Modern Pharma SolnDokument3 SeitenModern Pharma SolnSakshiNoch keine Bewertungen

- MacDokument4 SeitenMacalwar_shi262068100% (1)

- Financial Accounting and Reporting: The Game of Financial RatiosDokument8 SeitenFinancial Accounting and Reporting: The Game of Financial RatiosANANTHA BHAIRAVI MNoch keine Bewertungen

- Bill French Case SolutionDokument3 SeitenBill French Case SolutionMurat Kalender80% (5)

- A-Cat CorpDokument26 SeitenA-Cat Corpvaibhavjain512Noch keine Bewertungen

- Dispensers of CaliforniaDokument4 SeitenDispensers of CaliforniaShweta GautamNoch keine Bewertungen

- HULDokument28 SeitenHULSneha Jais100% (2)

- Multi Tech Case AnalysisDokument1 SeiteMulti Tech Case AnalysisRit8Noch keine Bewertungen

- Lilac Flour Mills: Managerial Accounting and Control - IIDokument9 SeitenLilac Flour Mills: Managerial Accounting and Control - IISoni Kumari50% (4)

- FM09 CH 10 Im PandeyDokument19 SeitenFM09 CH 10 Im PandeyJack mazeNoch keine Bewertungen

- CASE 6 Tufstuff Inc.Dokument8 SeitenCASE 6 Tufstuff Inc.Karen QuiachonNoch keine Bewertungen

- Case Study: RajnigandhaDokument10 SeitenCase Study: RajnigandhaUdit Varshney0% (1)

- ACCOUNTING STERN CORPORATION (A) AnswerDokument4 SeitenACCOUNTING STERN CORPORATION (A) AnswerPradina RachmadiniNoch keine Bewertungen

- JW SPORT SuppliesDokument5 SeitenJW SPORT SuppliesVishvesh Soni100% (4)

- Earrings UnlimitedDokument3 SeitenEarrings Unlimitedsinbad9772% (18)

- Anandam Case Study - AFSDokument20 SeitenAnandam Case Study - AFSSiddhesh Mahadik67% (3)

- Overheads PracticalDokument37 SeitenOverheads PracticalSushant Maskey100% (1)

- FM09-CH 03Dokument14 SeitenFM09-CH 03vtiwari2Noch keine Bewertungen

- Problem 3-1Dokument2 SeitenProblem 3-1Omar CirunayNoch keine Bewertungen

- Koya Cab Case AnswerDokument2 SeitenKoya Cab Case AnswerBiswajit Prusty100% (2)

- FM09-CH 04Dokument4 SeitenFM09-CH 04Mukul KadyanNoch keine Bewertungen

- Asian Paints Cost and Revenue AnalysisDokument12 SeitenAsian Paints Cost and Revenue AnalysisKriti ShahNoch keine Bewertungen

- Maria Hernandez & AssociatesDokument2 SeitenMaria Hernandez & AssociatesManish Kumar33% (3)

- Campus PizzeriaDokument12 SeitenCampus PizzeriaSHIVAM SRIVASTAVANoch keine Bewertungen

- OjoylanJenny - Charmingly (Case#5)Dokument5 SeitenOjoylanJenny - Charmingly (Case#5)Jenny Ojoylan100% (1)

- Ram Traders - NidhiDokument5 SeitenRam Traders - NidhinidhidNoch keine Bewertungen

- Cost Analysis Sheet DaburDokument11 SeitenCost Analysis Sheet DaburrohitNoch keine Bewertungen

- Hra Group 01-Apturja Power LimitedDokument16 SeitenHra Group 01-Apturja Power Limitedkiran venugopal100% (1)

- Solution:: Present Policy Policy Option 1 Policy Option 2Dokument2 SeitenSolution:: Present Policy Policy Option 1 Policy Option 2Dimple RajpalNoch keine Bewertungen

- Boulevard Sandwiches, Inc. (A) : FAPC Assignment Group 7Dokument7 SeitenBoulevard Sandwiches, Inc. (A) : FAPC Assignment Group 7Akshay100% (1)

- Unit-5 Final AccountsDokument7 SeitenUnit-5 Final AccountsSanthosh Santhu0% (1)

- 11 AmalgmationDokument38 Seiten11 AmalgmationPranaya Agrawal100% (1)

- Manual VishwakarmaDokument9 SeitenManual VishwakarmaAniket GaikarNoch keine Bewertungen

- Attempt Any Four Case Study Case 1: Zip Zap Zoom Car CompanyDokument23 SeitenAttempt Any Four Case Study Case 1: Zip Zap Zoom Car CompanyDiabolic Colt100% (1)

- Bill French Accountant - Case AnalysisDokument8 SeitenBill French Accountant - Case Analysischirag0% (2)

- Case 16 Answers - Hospital Supply IncDokument14 SeitenCase 16 Answers - Hospital Supply IncRaul Carrera, Jr.100% (3)

- Problems On Profitable Product MixDokument9 SeitenProblems On Profitable Product MixUdita DasNoch keine Bewertungen

- Charmingly Personally YoursDokument8 SeitenCharmingly Personally YoursRica PresbiteroNoch keine Bewertungen

- 7 7Dokument11 Seiten7 7Nad AdenanNoch keine Bewertungen

- CVPDokument3 SeitenCVPRajShekarReddyNoch keine Bewertungen

- Class Case 3 - Star Engineering CompanyDokument3 SeitenClass Case 3 - Star Engineering Company9ry5gsghybNoch keine Bewertungen

- FAMA '22 SolutionDokument4 SeitenFAMA '22 SolutionRushil JoshiNoch keine Bewertungen

- Alaire CorporationDokument2 SeitenAlaire CorporationChleo EsperaNoch keine Bewertungen

- Madrigal Company Case StudyDokument4 SeitenMadrigal Company Case StudyChleo EsperaNoch keine Bewertungen

- STAR Engineering CASEDokument5 SeitenSTAR Engineering CASEChleo EsperaNoch keine Bewertungen

- Raiden Paper CompanyDokument11 SeitenRaiden Paper CompanyChleo EsperaNoch keine Bewertungen

- Quick Lunch CaseDokument4 SeitenQuick Lunch CaseChleo EsperaNoch keine Bewertungen

- Browning Cash BudgetDokument1 SeiteBrowning Cash BudgetChleo EsperaNoch keine Bewertungen

- Alaire CorporationDokument2 SeitenAlaire CorporationChleo EsperaNoch keine Bewertungen

- Browning Manufacturing CaseDokument6 SeitenBrowning Manufacturing CaseChleo EsperaNoch keine Bewertungen

- Black BookDokument28 SeitenBlack Bookshubham50% (2)

- Jainithesh - Docx CorrectedDokument54 SeitenJainithesh - Docx CorrectedBala MuruganNoch keine Bewertungen

- Summary - A Short Course On Swing TradingDokument2 SeitenSummary - A Short Course On Swing TradingsumonNoch keine Bewertungen

- Module 5 - Multimedia Storage DevicesDokument10 SeitenModule 5 - Multimedia Storage Devicesjussan roaringNoch keine Bewertungen

- CPM W1.1Dokument19 SeitenCPM W1.1HARIJITH K SNoch keine Bewertungen

- Marshall Baillieu: Ian Marshall Baillieu (Born 6 June 1937) Is A Former AustralianDokument3 SeitenMarshall Baillieu: Ian Marshall Baillieu (Born 6 June 1937) Is A Former AustralianValenVidelaNoch keine Bewertungen

- SyllabusDokument9 SeitenSyllabusrr_rroyal550Noch keine Bewertungen

- Mutual Fund Insight Nov 2022Dokument214 SeitenMutual Fund Insight Nov 2022Sonic LabelsNoch keine Bewertungen

- Solved - in Capital Budgeting, Should The Following Be Ignored, ...Dokument3 SeitenSolved - in Capital Budgeting, Should The Following Be Ignored, ...rifa hanaNoch keine Bewertungen

- Colibri - DEMSU P01 PDFDokument15 SeitenColibri - DEMSU P01 PDFRahul Solanki100% (4)

- Fin 3 - Exam1Dokument12 SeitenFin 3 - Exam1DONNA MAE FUENTESNoch keine Bewertungen

- Mathematical Geophysics: Class One Amin KhalilDokument13 SeitenMathematical Geophysics: Class One Amin KhalilAmin KhalilNoch keine Bewertungen

- Org ChartDokument1 SeiteOrg Chart2021-101781Noch keine Bewertungen

- Mathematics 2 First Quarter - Module 5 "Recognizing Money and Counting The Value of Money"Dokument6 SeitenMathematics 2 First Quarter - Module 5 "Recognizing Money and Counting The Value of Money"Kenneth NuñezNoch keine Bewertungen

- Strength and Microscale Properties of Bamboo FiberDokument14 SeitenStrength and Microscale Properties of Bamboo FiberDm EerzaNoch keine Bewertungen

- Opel GT Wiring DiagramDokument30 SeitenOpel GT Wiring DiagramMassimiliano MarchiNoch keine Bewertungen

- Kuper ManualDokument335 SeitenKuper Manualdonkey slap100% (1)

- BSL-3 Training-1Dokument22 SeitenBSL-3 Training-1Dayanandhi ElangovanNoch keine Bewertungen

- QuestionDokument7 SeitenQuestionNgọc LuânNoch keine Bewertungen

- 0901b8038042b661 PDFDokument8 Seiten0901b8038042b661 PDFWaqasAhmedNoch keine Bewertungen

- Cinnamon Peelers in Sri Lanka: Shifting Labour Process and Reformation of Identity Post-1977Dokument8 SeitenCinnamon Peelers in Sri Lanka: Shifting Labour Process and Reformation of Identity Post-1977Social Scientists' AssociationNoch keine Bewertungen

- List of Light Commercial LED CodesDokument8 SeitenList of Light Commercial LED CodesRenan GonzalezNoch keine Bewertungen

- Unit 10-Maintain Knowledge of Improvements To Influence Health and Safety Practice ARDokument9 SeitenUnit 10-Maintain Knowledge of Improvements To Influence Health and Safety Practice ARAshraf EL WardajiNoch keine Bewertungen

- A Study On Effective Training Programmes in Auto Mobile IndustryDokument7 SeitenA Study On Effective Training Programmes in Auto Mobile IndustrySAURABH SINGHNoch keine Bewertungen

- Reverse Osmosis ProcessDokument10 SeitenReverse Osmosis ProcessHeshamNoch keine Bewertungen

- U2 - Week1 PDFDokument7 SeitenU2 - Week1 PDFJUANITO MARINONoch keine Bewertungen

- Sikkim Manipal MBA 1 SEM MB0038-Management Process and Organization Behavior-MQPDokument15 SeitenSikkim Manipal MBA 1 SEM MB0038-Management Process and Organization Behavior-MQPHemant MeenaNoch keine Bewertungen

- BBCVDokument6 SeitenBBCVSanthosh PgNoch keine Bewertungen

- 8524Dokument8 Seiten8524Ghulam MurtazaNoch keine Bewertungen

- Business Plan GROUP 10Dokument35 SeitenBusiness Plan GROUP 10Sofia GarciaNoch keine Bewertungen