Beruflich Dokumente

Kultur Dokumente

MGT Acc Q1a

Hochgeladen von

Wen Xin GanOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

MGT Acc Q1a

Hochgeladen von

Wen Xin GanCopyright:

Verfügbare Formate

The challenges of management accounting often involve collecting, recording, and reporting

financial information from multiple departments or divisions. The cost allocation methods

require information about direct materials, production labor and manufacturing overheads.

This information is required by multiple production departments. The management

accountant reviews this information to ensure that production costs are allocated only to

goods and services. Including non-production costs distort the cost of individual products.

Furthermore, the challenge of management accountant is the reliability of the information

such as management accounting techniques often emphasize the timeliness of information to

allow business owners to make decisions. For example, we can determine this year’s sales

and check the result with near-absolute certainty end of the year to get the most accurate

figure. The timeliness of information is more important for us to make a decision that we are

planning. Besides, we should evaluate how important the accuracy of the information is

before relying on management accounting information.

The next challenge of the management accountant is follow the GAAP Compliance. The

management accounting techniques is that many of these techniques do not conform to

generally accepted accounting standards or GAAP. For example, activity-based costing can

provide decision makers with more accurate costing information in another way of allocating

costs to products. However, this method is not compliant with GAAP because it does not

allocate all manufacturing costs to the product. For small business owners, this can become

expensive after using this GAAP compliance. Before implementing management accounting

technology, we should ensure that the benefits of the technology outweigh the costs of

multiple systems. If this is not the case, it may not be worth the time and money.

Moreover, the challenge of management accountant is check the adaptability of the

procedures. Although there are some guidelines for management accounting procedures,

these techniques can still fit the business details. This may be an advantage of management

accounting, but it is also a disadvantage. This is because management accounting is very

flexible, it is difficult to compare results between companies, especially if internally applied

management accounting techniques are inconsistent. For example, we can do a report that

should be tailored to our business. We should ensure that the comparing of the company

performance with other company or industry metrics and do the conclusion.

Das könnte Ihnen auch gefallen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- K 46 Compact Spinning Machine Brochure 2530-V3 75220 Original English 75220Dokument28 SeitenK 46 Compact Spinning Machine Brochure 2530-V3 75220 Original English 75220Pradeep JainNoch keine Bewertungen

- Functions of Communication Oral Communication PDFDokument12 SeitenFunctions of Communication Oral Communication PDFKrystle Francess Barrios0% (1)

- Partnership Accounts:: Assets Revaluation, Dissolution & Conversion To Limited CompanyDokument47 SeitenPartnership Accounts:: Assets Revaluation, Dissolution & Conversion To Limited CompanyWen Xin GanNoch keine Bewertungen

- AuditingDokument99 SeitenAuditingWen Xin GanNoch keine Bewertungen

- TUTORIAL 1 (Clubs and Societies)Dokument5 SeitenTUTORIAL 1 (Clubs and Societies)Wen Xin GanNoch keine Bewertungen

- Tutorial 3 - Topic 3: Accounting For Partnership - Part 2 Question 1 - Argy and BargyDokument6 SeitenTutorial 3 - Topic 3: Accounting For Partnership - Part 2 Question 1 - Argy and BargyWen Xin GanNoch keine Bewertungen

- Mock Exercise 16 July 2021 Dear Students, Submit It Using Dummy Link Provided On WBLEDokument3 SeitenMock Exercise 16 July 2021 Dear Students, Submit It Using Dummy Link Provided On WBLEWen Xin GanNoch keine Bewertungen

- Lecturer Name: A.Jeya Santhini Email: Jeyasanthini@utar - Edu.myDokument33 SeitenLecturer Name: A.Jeya Santhini Email: Jeyasanthini@utar - Edu.myWen Xin GanNoch keine Bewertungen

- AuditingDokument115 SeitenAuditingWen Xin GanNoch keine Bewertungen

- Auditors' Responsibilities and Legal Liabilities (Chapter 5 of Arens)Dokument102 SeitenAuditors' Responsibilities and Legal Liabilities (Chapter 5 of Arens)Wen Xin GanNoch keine Bewertungen

- Auditing & Assurance Services II-UKAF 2124/UBAF 2144 Auditing & Assurance Services II-UKAF 2124/UBAF 2144Dokument108 SeitenAuditing & Assurance Services II-UKAF 2124/UBAF 2144 Auditing & Assurance Services II-UKAF 2124/UBAF 2144Wen Xin GanNoch keine Bewertungen

- Managment Accounting CPDokument2 SeitenManagment Accounting CPWen Xin GanNoch keine Bewertungen

- OrganisationDokument1 SeiteOrganisationWen Xin GanNoch keine Bewertungen

- Benefits of Daydreaming: Presenters: Tan Pei Yi Lee Hui LingDokument6 SeitenBenefits of Daydreaming: Presenters: Tan Pei Yi Lee Hui LingWen Xin GanNoch keine Bewertungen

- Time Script InstructionsDokument4 SeitenTime Script InstructionsWen Xin GanNoch keine Bewertungen

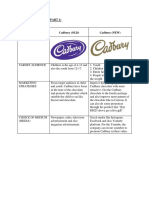

- Cadbury Group 1Dokument1 SeiteCadbury Group 1Wen Xin GanNoch keine Bewertungen

- Apollo Ar19Dokument72 SeitenApollo Ar19Wen Xin GanNoch keine Bewertungen

- Duty RosterDokument1 SeiteDuty RosterWen Xin GanNoch keine Bewertungen

- Reason Choose The BusinessDokument3 SeitenReason Choose The BusinessWen Xin GanNoch keine Bewertungen

- BudgetingDokument3 SeitenBudgetingWen Xin GanNoch keine Bewertungen

- Launching Iphone 12: By: Chong Jing Wen (2005469) & Gan Wen Xin (2006680)Dokument10 SeitenLaunching Iphone 12: By: Chong Jing Wen (2005469) & Gan Wen Xin (2006680)Wen Xin GanNoch keine Bewertungen

- (-) Expenses: Bears Bubble Tea Expected Profit and Expenses For 1 MonthDokument1 Seite(-) Expenses: Bears Bubble Tea Expected Profit and Expenses For 1 MonthWen Xin GanNoch keine Bewertungen

- BudgetingDokument3 SeitenBudgetingWen Xin GanNoch keine Bewertungen

- Cadbury Group 1Dokument1 SeiteCadbury Group 1Wen Xin GanNoch keine Bewertungen

- Example of InfographicsDokument3 SeitenExample of InfographicsWen Xin GanNoch keine Bewertungen

- An Equivalent Circuit of Carbon Electrode SupercapacitorsDokument9 SeitenAn Equivalent Circuit of Carbon Electrode SupercapacitorsUsmanSSNoch keine Bewertungen

- Clinical Nursing SkillsDokument2 SeitenClinical Nursing SkillsJoeNoch keine Bewertungen

- Sindhudurg Kokan All Tourism Spot Information WWW - Marathimann.inDokument54 SeitenSindhudurg Kokan All Tourism Spot Information WWW - Marathimann.inMarathi Mann92% (12)

- Contents:: Project ProgressDokument22 SeitenContents:: Project ProgressJosé VicenteNoch keine Bewertungen

- MathTextbooks9 12Dokument64 SeitenMathTextbooks9 12Andrew0% (1)

- Parallels of Stoicism and KalamDokument95 SeitenParallels of Stoicism and KalamLDaggersonNoch keine Bewertungen

- Deception With GraphsDokument7 SeitenDeception With GraphsTanmay MaityNoch keine Bewertungen

- Arthur Brennan Malloy v. Kenneth N. Peters, 11th Cir. (2015)Dokument6 SeitenArthur Brennan Malloy v. Kenneth N. Peters, 11th Cir. (2015)Scribd Government DocsNoch keine Bewertungen

- Hoaxes Involving Military IncidentsDokument5 SeitenHoaxes Involving Military IncidentsjtcarlNoch keine Bewertungen

- Second ConditionalDokument1 SeiteSecond ConditionalSilvana MiñoNoch keine Bewertungen

- Grunig J, Grunig L. Public Relations in Strategic Management and Strategic Management of Public RelationsDokument20 SeitenGrunig J, Grunig L. Public Relations in Strategic Management and Strategic Management of Public RelationsjuanNoch keine Bewertungen

- RK Modul 2 PDFDokument41 SeitenRK Modul 2 PDFRUSTIANI WIDIASIHNoch keine Bewertungen

- 5909 East Kaviland AvenueDokument1 Seite5909 East Kaviland Avenueapi-309853346Noch keine Bewertungen

- Ingles Nivel 2Dokument119 SeitenIngles Nivel 2Perla Cortes100% (1)

- Ocr Graphics Gcse CourseworkDokument6 SeitenOcr Graphics Gcse Courseworkzys0vemap0m3100% (2)

- Use of ICT in School AdministartionDokument32 SeitenUse of ICT in School AdministartionSyed Ali Haider100% (1)

- Rule 107Dokument8 SeitenRule 107AlexNoch keine Bewertungen

- Adjective Clauses: Relative Pronouns & Relative ClausesDokument4 SeitenAdjective Clauses: Relative Pronouns & Relative ClausesJaypee MelendezNoch keine Bewertungen

- SuratiDokument2 SeitenSuratiTariq Mehmood TariqNoch keine Bewertungen

- Introduction To Biostatistics KMPK 2023Dokument46 SeitenIntroduction To Biostatistics KMPK 2023ciciNoch keine Bewertungen

- Student Handbook MCCDokument32 SeitenStudent Handbook MCCeyusuf74Noch keine Bewertungen

- English Preparation Guide DAF 202306Dokument12 SeitenEnglish Preparation Guide DAF 202306TIexamesNoch keine Bewertungen

- Child Labour: Summary: Is The Imposition of Sanctions On States The Best Way To End ChildDokument3 SeitenChild Labour: Summary: Is The Imposition of Sanctions On States The Best Way To End ChildPrinting PandaNoch keine Bewertungen

- Letter Writing - Task1Dokument5 SeitenLetter Writing - Task1gutha babuNoch keine Bewertungen

- Business Enterprise Simulation Quarter 3 - Module 2 - Lesson 1: Analyzing The MarketDokument13 SeitenBusiness Enterprise Simulation Quarter 3 - Module 2 - Lesson 1: Analyzing The MarketJtm GarciaNoch keine Bewertungen

- Computer Literacy Skills and Self-Efficacy Among Grade-12 - Computer System Servicing (CSS) StudentsDokument25 SeitenComputer Literacy Skills and Self-Efficacy Among Grade-12 - Computer System Servicing (CSS) StudentsNiwre Gumangan AguiwasNoch keine Bewertungen

- Dcat2014 - Simulated Set B - Section 3 - Reading Comprehension - Final v.4.7.2014Dokument6 SeitenDcat2014 - Simulated Set B - Section 3 - Reading Comprehension - Final v.4.7.2014Joice BobosNoch keine Bewertungen

- Evaluation of The Performance of HRCT in The Diagnostic and Management of Covid-19Dokument7 SeitenEvaluation of The Performance of HRCT in The Diagnostic and Management of Covid-19IJAR JOURNALNoch keine Bewertungen