Beruflich Dokumente

Kultur Dokumente

Financial Management - QB & Model - 2016 Regulations

Hochgeladen von

GowthamSathyamoorthySOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Financial Management - QB & Model - 2016 Regulations

Hochgeladen von

GowthamSathyamoorthySCopyright:

Verfügbare Formate

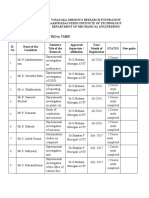

FACULTY OF ARTS AND SCIENCE, AV CAMPUS, CHENNAI

VINAYAKA MISSION’S RESEARCH FOUNDATION

DEPARTMENT OF BUSINESS ADMINISTRATION

BOARD: MANAGEMENT STUDIES

PROGRAM: BBA (BATCH 2017 – 2020)

REGULATION: 2017

SEMESTER: IV

Course Code:

Course Title: FINANCIAL MANAGEMENT

[Students who are admitted MBA for the academic year 2016 – 2017]

QUESTION BANK

UNIT – 1

PART – A (2 MARKS)

1. What is ‘Financial Management’?

2. Enumerate the two objectives of financial management.

3. Mention any four scope of financial management.

4. State any four significance of financial management.

5. List any four important function of Finance.

6. Write any two important relationships between risk and return.

7. What is ‘Working Capital Management’

8. What is time value of money?

9. What are the agency costs?

10. State the major difference between accounts and finance.

11. State Two relationship between finance and economics.

12. What is Present Value concept?

13. Differentiate risk from uncertainty. [any two]

14. State any four approaches for measurement of return.

15. Enumerate any four components required for rate of return.

MBA – 2016 Regulations – II SEM – FM – QB - 2017 Page 1 of 11

PART – B ( 5 MARKS)

1. State any four the importance of financial management.

2. Briefly explain the term ‘Profit Maximization’

3. Roles of a Financial Manager

4. Brief the structure of Financial Management

5. Functions of Financial management.

6. Briefly explain the term ‘Wealth Maximization’

7. Meaning of financial management and its objectives.

8. Mr. X deposits Rs. 100 in a financial institution for a period of 3 years. It pays 10 per

cent interest [compounded] annually. Find out the amount payable by the institution at

the end of the maturity period.

9. If a person deposit Rs. 1000 today in a bank which pays 10 per cent interest

compounded annually, how much will the deposit grow to after 8 years and 12 years?

10. Find the present value of Rs. 1000 receivable in the 6th year end, if the rate of discount

is 10 per cent.

PART – C (10 MARKS)

1. Explain the meaning of financial management. What are its objectives? Explain its

functions.

2. “Profit Maximization is the basic goal of a finance manager”. Do you agree? Discuss.

3. “Investment, financing and dividend decision are all interrelated”. Comment.

4. Explain the relationship between Financial Management and other areas of Management

with relevant examples.

5. Discuss in brief the scope of Financial Management. What are the various methods and

tools of financial management? Explain.

UNIT – II: CAPITAL BUDGETING

PART A (2 MARK)

1. What is “Capital Budgeting”.

2. Define ‘Cut-off Rate’ – Explain with an example.

3. How do you rank projects?

MBA – 2016 Regulations – II SEM – FM – QB - 2017 Page 2 of 11

4. What is Pay-back period?

5. State three types of capital budgeting decisions.

6. State Accept or Reject Criterion under Payback period.

7. Brief the strategic investment decision.

8. A project costs Rs. 10,00,000 and yields an annual cash inflow of Rs. 2,00,000 for 10

years. Calculate its payback period.

9. State Net Present Value method.

10. Describe Internal Rate of Return.

11. What is Average Rate of Return?

12. Define Leverage

13. What is Financial Leverage?

14. What is Operating Leverage?

15. What is Combined Leverage?

PART – B (5 MARKS)

1. Differentiate between NPV and IRR. – Minimum 2 differences.

2. What are the various methods of evaluating a project investment proposal

3. Explain the importance of Capital Budgeting

4. List out the importance of Leverages.

5. State three types of capital budgeting decisions.

6. State Accept or Reject Criterion under Payback period.

7. Determine the payback period for a project which requires a cash outlay of Rs. 10,000

and generates cash inflows of Rs. 2,000, Rs. 4,000 and Rs. 3,000 and Rs. 2,000 in the

first, second, third and fourth year respectively.

8. ABC Ltd is proposing to take up a project which will need an investment of Rs.

40,000. The net income before depreciation and tax is estimated the first five years as

follows: Rs. 10,000, Rs.12,000, Rs. 14,000, Rs.16,000 and Rs. 20,000. Depreciation

is to be charged according to the straight line method. Tax rate is 50%. Calculate the

Accounting Rate of Return.

9. Explain Profitability Index method and it’s accept and rejection rule.

MBA – 2016 Regulations – II SEM – FM – QB - 2017 Page 3 of 11

10. A project requires an initial outlay of Rs. 32,400. Its estimated economic

life is 3 years. The cash streams generated by it are expected to be as

follows :

11.

Years Estimated ACF

(Rs.)

1 16,000

2 14,000

3 12,000

Computed its IRR. If the cost of capital to the firm is 12%, advise the

management whether the project should be accepted or rejected.

PART – C (10 MARKS)

1. Critically examine the various methods of evaluating capital budgeting proposals. Discuss

their advantages and disadvantages.

2. Explain the Present Value Method. How does it evaluate profitability of various capital

projects? Discuss its advantages and limitations.

3. Explain in detail the various types of Leverages?

4. Explain in detail the various methods of evaluating a project investment proposal

5. Calculate i) operating leverage ii) financial leverage and iii) Combined leverage under

situations I and II and financial plans A and B.

Installed Capacity (units) 4,000

Actual Production and sales (Units) 75% of the Capacity

Selling price per unit (Rs.) Rs. 30 per unit

Variable cost per unit (Rs.) Rs. 15 per unit

Fixed Costs (Rs.) Situation I 15,000

Situation II 20,000

Financial Plan

Capital Structure

1 2

Equity Rs. 10,000 Rs 15,000

Debt (0.20 interest) 5,000 2,500

MBA – 2016 Regulations – II SEM – FM – QB - 2017 Page 4 of 11

UNIT – III – CAPITAL STRUCTURE

PART – A (2 MARK)

1. Define capital structure.

2. What is optimum capital structure?

3. What are the various approaches of capital structure?

4. State any two importance of Capital structure planning.

5. Give any two differences between Capital Structure and Financial Structure.

6. What is NI Approach?

7. State the assumptions of the Net Income Approach.

8. State the assumptions of the Net Operating Income Approach.

9. State any three assumptions of MM approach.

10. What is optimum capital structure?

11. What is Arbitrage Process?

12. State any four factors that determining capital structure of a company.

13. Define Net Operating Income Approach.

14. Explain MM approach of Capital Structure.

15. Describe the various theories of capital structure.

PART B (5 MARKS)

1. Explain Net Operating Income Approach (NOI) to Capital Structure with suitable

illustration.

2. Explain the Modigliani and Miller Approach (MM) of Capital Structure with suitable

example.

3. Brief the concept optimum capital structure.

4. List and explain assumptions of MM approach.

5. List and explain assumptions of NI approach.

6. List and explain assumptions of NOI approach.

7. Explain Net Income Approach (NI) to Capital Structure with suitable illustration.

8. Explain Traditional Approach to Capital Structure with suitable illustration.

9. A firm is assumed to have Rs. 8 lakhs of debt of 8 per cent, as expected EBIT of

Rs. 19 lakhs and an overall capitalisation rate of 10 per cent. Calculate the Total

value of the firm

MBA – 2016 Regulations – II SEM – FM – QB - 2017 Page 5 of 11

10. A firm increases in debt from Rs. 8 lakhs to 16 lakhs and uses the cost of debt and

equity are held constant at 8 percent and 10 per cent, respectivey. Find the impact of

change in capital structure on value of the firm.

PART C (10 MARKS)

1. Explain in detail the various Capital structure theories.

2. Briefly explain the various Capital structure patterns?

3. Discuss the factors influencing the capital structure of a company.

4. The expected value of annual net operating income for two firms is Rs.4,000

before taxes, the corporate tax rate is 50 per cent. The after tax capitalisation rate

is 10 per cent for both firms and that firm A has no debt whereas firm B has Rs.

16,000 in 5 per cent bonds. According to the M-M find the total values of the two

firms.

5. Following financial data are avaiable about A.B.C. Ltd.

Expected net operating income Rs. 6,00,000

Debt Rs. 16,00,000 @ 12%

Equity Capitalisation Rate 15%

Equity Share Capital Rs. 24,00,000

What will be the effect of the following actions on the valuation and Ko ?

If the Company raises further debt of Rs. 8,00,000 at 12% and the net

operating income is expected to increase by Rs. 1,20,000 and with increase in

leverage, the equity capitalisation rate increase to 18%.

UNIT – IV - COST OF CAPITAL

PART -A (2 MARK)

1. Define the term ‘Cost of Capital’.

2. What is meant by opportunity cost?

3. “Debt is cheapest source of funds” comment.

4. State two Difference the explicit cost and implicit cost.

5. Describe the term ‘Cost of Preference Shares’

6. Describe the term ‘Cost of Equity Shares’

7. Define the term ‘Cost of Debt ‘

8. Mention any two importance of Weighted average cost of capital

9. “Equity cost is free” Do you agree?

MBA – 2016 Regulations – II SEM – FM – QB - 2017 Page 6 of 11

10. Define weighted average cost of capital?

11. Define the term ‘cost of retained earrings’.

12. What is an indifference point in the EBIT-EPS analysis?

13. A company issues 10% irredeemable debentures of Rs. 1,00,000. The company is in the

55% tax bracket. Calculate cost of debt (before as well as after tax) and if the debentures

are issued at par.

14. A ltd issues Rs. 50,000, 8% debentures at par. The tax rate applicable to the company is

50%. Compute the cost of debt capital.

15. A company’s debentures of the face value of R. 100 bear an 8% coupon rate. Debentures

of this type currently yield 10%. What is the market price of debentures of the company?

PART – B (5 MARKS)

1. Explain the components of cost of capital with an example.

2. Briefly explain Cost of Preference Shares with an example

3. Briefly explain Cost of Debt and provide an example.

4. Explain weighted average cost of capital with an example

5. Briefly explain cost of retained earrings with an example.

6. Briefly explain Cost of Equity Shares with an example

7. Raja & Co issue 9% preference shares of Rs. 100 each at a premium of Rs. 5 per

share. The issue expense per share comes to Rs. 3. Calculate the cost of preference

shares.

8. A company issues 1,000, 7% preference shares of Rs. 100 each at a premium of 10%

redeemable after 5 years at par. Compute the cost of preference capital.

9. A company has 10% redeemable preference shares of Rs. 1,00,000 redeemable at the

end of the 10th year from the year of their issue. The underwriting costs came to 2%.

Calculate the effective cost of preference share capital.

10. A company issues 10,000, 10% preference shares of Rs. 100 each redeemable after 10

years at a premium of 5%. The cost of issue is Rs. 2 per share. Calculate the cost of

preference capital.

Part – C (10 MARKS)

1. Describe the components of cost of capital. Discuss in detail how the cost of various

components of capital is calculated?

2. Explain weighted average cost of capital. How it is computed? Illustrate with an example.

3. A weighted average cost of capital based on existing capital structure.

MBA – 2016 Regulations – II SEM – FM – QB - 2017 Page 7 of 11

a. The new weighted average cost of capital if the company raises an additional

Rs. 20, 00,000 debt by issuing 10% debentures. This would result in

increasing the expected dividend to Rs. 3 and leave the growth rate unchanged

but the price of share will fall to Rs. 15 per share.

b. The cost of capital is in (a) above, growth rate increases to 10%.

4. Excel industries limited has assets of Rs. 1,60,000 which have been financed with Rs.

52,000 of debt and Rs. 90,000 of equity and a general reserve of Rs. 18,000. The firms

total profits after interest and taxes for the ended 31st March 2014, were Rs. 13,000. It

pays 8% interest on borrowed funds and is in the 50% tax bracket. It has 900 equity

shares of Rs. 100 each selling at a market price of Rs. 120 per share. What is the weighted

average cost of capital?

5. Determine the EPS of a textile company which has EBIT of Rs. 1, 60, 000. Its capital

structure consists of the following securities.

10% Debentures … Rs. 5, 00, 000

12% Preference Shares … Rs. 1, 00, 000

Equity Shares of Rs. 100 each… Rs. 4, 00, 000

The company is in the 55% tax bracket. Determine:

i) the firms EPS

ii) the percentage changes in EPS associated with 30% increase and 30%

decrease in EBIT.

iii) The degree of financial leverage.

UNIT –V – WORKING CAPTIAL MANAGEMENT

PART - A (2 MARK)

1. Define working capital. Describe the concepts of working capital.

2. What is operating cycle of working capital?

3. What are the different types of working capital?

4. Define Permanent working capital and Temporary working capital.

5. State any two differences between Temporary and Permanent Working Capital.

6. State any four factors that influencing working capital management of an organisation.

7. Differentiate between Operating Cycle and Business Cycle.

8. What is Cash Management? State the suitable technique for Cash Management.

9. What are the principal motives for holding cash?

MBA – 2016 Regulations – II SEM – FM – QB - 2017 Page 8 of 11

10. What is receivable management? State the importance of receivable management.

11. What is ‘Factoring’?

12. What are the components of receivable management?

13. What is ‘Lock-Box’ System?

14. What is meant by inventory management?

15. State the importance of inventory management.

Part B (5 Marks)

1. List the objectives of Inventory Management.

2. Brief the various techniques of Inventory Management.

3. What are the motives for holding inventory – explain?

4. Explain the factors affecting the working capital requirements of a business.

5. Enumerate the importance of Working Capital Management

6. Brief Speculative motive of holding inventory.

7. What are the basic strategies of efficient cash management?

8. Explain the significance of speedy receivables collection.

9. Calculate Economic Order Quantity from the following:

Consumption during the year 600 units

Ordering cost Rs.12

Carrying cost 20%

Price per unit Rs.20

10. Calculate Economic Order Quantity:

Annual consumption 900 kgs.

Cost of placing and receiving one order Rs.10

Annual carrying and storage cost Rs.20 per unit.

Part - C (10 Marks)

1. Explain the term “Working Capital”. Explain the factors affecting the working capital

requirements of a business.

2. ‘Working Capital management deals with decisions regarding the appropriate mix of

current assets and current liabilities’. Elucidate the statement.

3. What do you mean by Cash Management? Discuss the motives for holding cash and

objectives of Cash Management.

4. Explain Inventory Management. Discuss in brief benefits and costs of holding inventory.

MBA – 2016 Regulations – II SEM – FM – QB - 2017 Page 9 of 11

5. What do you mean by receivables management – explain? What are the motives and cost

of maintaining receivables? Also explain the objectives of Receivable Management.

MBA – 2016 Regulations – II SEM – FM – QB - 2017 Page 10 of 11

FACULTY OF ARTS AND SCIENCE

VINAYAKA MISSION’S RESEARCH FOUNDATION

DEPARTMENT OF BUSINESS ADMINISTRATION

MODEL QUESTION PAPER

Subject Name: FINANCIAL MANAGEMENT Duration: 3 Hrs

Subject Code: Max.Marks:70

Part – A(Answer all the questions) 10 X 2 = 20

1. What is ‘Financial Management’.

2. Enumerate the two objectives of financial management.

3. What is Financial Leverage?

4. What is Pay-back period.

5. Give any two differences between Capital Structure and Financial Structure.

6. State any three assumptions of MM approach.

7. Define the term ‘Cost of Capital’.

8. Define retained earnings

9. Define working capital.

10. Define Permanent working capital and Temporary working capital.

Part – B 4 X 5 = 20

1. A) Briefly explain the term ‘Profit Maximization’ (OR)

B) Roles of a Financial Manager

2. A) Importance of Capital Budgeting (OR)

B) State the assumptions of NI approach.

3. A) State the assumptions of NOI approach. (OR)

B) Briefly explain Cost of Debt and provide an example.

4. A) Briefly explain Cost of Preference Shares with an example (OR)

B) What are the motives for holding inventory – explain?

Part – C(Answer any 3 questions) 3 X 10 = 30

11. “Profit Maximization is the basic goal of a finance manager”. Do you agree? Discuss.

12. Explain in detail the various types of Leverages?

13. Explain in detail the various Capital structure theories.

14. Explain weighted average cost of capital. How it is computed? Illustrate with an

example.

15. Explain the term “Working Capital”. Explain the factors affecting the working capital

requirements of a business.

MBA – 2016 Regulations – II SEM – FM – QB - 2017 Page 11 of 11

Das könnte Ihnen auch gefallen

- Company Valuation Under IFRS - 3rd edition: Interpreting and forecasting accounts using International Financial Reporting StandardsVon EverandCompany Valuation Under IFRS - 3rd edition: Interpreting and forecasting accounts using International Financial Reporting StandardsNoch keine Bewertungen

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsVon EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNoch keine Bewertungen

- FM UT 2 Anna UniversityDokument3 SeitenFM UT 2 Anna UniversityRam VasuNoch keine Bewertungen

- Ba 4202 FM Important QuestionsDokument6 SeitenBa 4202 FM Important QuestionsRishi vardhiniNoch keine Bewertungen

- BBA - III RD F. M. (Question Paper)Dokument4 SeitenBBA - III RD F. M. (Question Paper)DrRashmiranjan PanigrahiNoch keine Bewertungen

- Question Bank Sem IIDokument16 SeitenQuestion Bank Sem IIPrivate 4uNoch keine Bewertungen

- Module I: Introduction To Financial ManagementDokument10 SeitenModule I: Introduction To Financial ManagementPruthvi BalekundriNoch keine Bewertungen

- I. Answer Any Five Sub-Questions, Each Sub-Question Carries Two Marks. 5x2 10Dokument2 SeitenI. Answer Any Five Sub-Questions, Each Sub-Question Carries Two Marks. 5x2 10RavichandraNoch keine Bewertungen

- I. Answer Any Five Sub-Questions, Each Sub-Question Carries Two Marks. 5x2 10Dokument2 SeitenI. Answer Any Five Sub-Questions, Each Sub-Question Carries Two Marks. 5x2 10RavichandraNoch keine Bewertungen

- Financial Management 532635578Dokument30 SeitenFinancial Management 532635578viaan1990Noch keine Bewertungen

- FM Question BankDokument17 SeitenFM Question Bankrising dragonNoch keine Bewertungen

- Financial Management - Sem Ii - Question BankDokument11 SeitenFinancial Management - Sem Ii - Question BankHIDDEN Life OF 【शैलेष】Noch keine Bewertungen

- MMPC 014Dokument6 SeitenMMPC 014Pawan ShokeenNoch keine Bewertungen

- BA7202-Financial Management Question BankDokument10 SeitenBA7202-Financial Management Question BankHR HMA TECHNoch keine Bewertungen

- FM QB New NewDokument22 SeitenFM QB New NewskirubaarunNoch keine Bewertungen

- MBA QuestionsDokument15 SeitenMBA QuestionsKhanal NilambarNoch keine Bewertungen

- MEFA Important QuestionsDokument14 SeitenMEFA Important Questionstulasinad123Noch keine Bewertungen

- Finance NotesDokument6 SeitenFinance NotesFahad BhayoNoch keine Bewertungen

- MEFA Important Questions JWFILESDokument14 SeitenMEFA Important Questions JWFILESEshwar TejaNoch keine Bewertungen

- Que Bank PFMDokument5 SeitenQue Bank PFMAmit KesharwaniNoch keine Bewertungen

- Mefa by Aarya Sri+ Imp Qustns (Uandistar - Org)Dokument202 SeitenMefa by Aarya Sri+ Imp Qustns (Uandistar - Org)Srilekha KadiyalaNoch keine Bewertungen

- Financial-Mgmt I SEM5Dokument7 SeitenFinancial-Mgmt I SEM5Samiksha ParasharNoch keine Bewertungen

- Financial ManagementDokument9 SeitenFinancial ManagementRajyalakshmi MNoch keine Bewertungen

- FM Question BankDokument20 SeitenFM Question BankrajeeevaNoch keine Bewertungen

- Mefa Imp+ Arryasri Guide PDFDokument210 SeitenMefa Imp+ Arryasri Guide PDFvenumadhavNoch keine Bewertungen

- Important Question FMDokument4 SeitenImportant Question FMHardeep KaurNoch keine Bewertungen

- MMPC 14Dokument2 SeitenMMPC 14twinklekumari76263Noch keine Bewertungen

- MEFA Most Important QuestionsDokument15 SeitenMEFA Most Important Questionsapi-26548538100% (5)

- 301 FMDokument3 Seiten301 FMSamrudhi ZodgeNoch keine Bewertungen

- Mba Part 1 Mbad Financial Management 13415 2020Dokument3 SeitenMba Part 1 Mbad Financial Management 13415 2020Panchu HiremathNoch keine Bewertungen

- FM PP 1 PDFDokument3 SeitenFM PP 1 PDFRavichandraNoch keine Bewertungen

- MMPMC 014Dokument3 SeitenMMPMC 014Ashvanee Kr. PathakNoch keine Bewertungen

- Question Bank SifdDokument8 SeitenQuestion Bank SifdVamsi KrishnaNoch keine Bewertungen

- BA5203 Financial ManagementDokument20 SeitenBA5203 Financial Managements.muthuNoch keine Bewertungen

- Financial Management 201Dokument4 SeitenFinancial Management 201Avijit DindaNoch keine Bewertungen

- AFM 2024 QBDokument2 SeitenAFM 2024 QBK Navaneeth RaoNoch keine Bewertungen

- B.B.A. (Sem. VI) Examination January - 2021 Adv. Finan. Manage.-IIDokument2 SeitenB.B.A. (Sem. VI) Examination January - 2021 Adv. Finan. Manage.-IIPILLO PATELNoch keine Bewertungen

- Financial Performance of Icici Bank LTDDokument116 SeitenFinancial Performance of Icici Bank LTDRicardo Nitish KumarNoch keine Bewertungen

- Question BankDokument8 SeitenQuestion BankEvangelineNoch keine Bewertungen

- 1 Financial Management Question PaperDokument2 Seiten1 Financial Management Question PaperHema LathaNoch keine Bewertungen

- Financial Management Question PaperDokument2 SeitenFinancial Management Question PaperHema LathaNoch keine Bewertungen

- SFM - 1Dokument3 SeitenSFM - 1ketulNoch keine Bewertungen

- Gtu Theory QuestionsDokument4 SeitenGtu Theory QuestionsbhfunNoch keine Bewertungen

- Use of Statistical Tables PermittedDokument2 SeitenUse of Statistical Tables PermittedPAVAN KUMARNoch keine Bewertungen

- ACFrOgDyc9k8h IouBPfnYdw4bD1QFiJrmZx LhZbxlTlNWzZLDfyT72KmbfpXfnuBNrHdPuA8TyMY9hUahg5rNBGV5optJk1BQ4K1 YxmHbnmQPyZDjQZLl9wWBb75kM ZDGNHhQxKiU BSAn2Dkl2TQCx8qHSDbsdtDDcPhgDokument2 SeitenACFrOgDyc9k8h IouBPfnYdw4bD1QFiJrmZx LhZbxlTlNWzZLDfyT72KmbfpXfnuBNrHdPuA8TyMY9hUahg5rNBGV5optJk1BQ4K1 YxmHbnmQPyZDjQZLl9wWBb75kM ZDGNHhQxKiU BSAn2Dkl2TQCx8qHSDbsdtDDcPhgGauri SinghNoch keine Bewertungen

- Financial Management - Honours: Eighth Paper (A-34-A) (Accounting and Finance Group) Full Marks: 100Dokument3 SeitenFinancial Management - Honours: Eighth Paper (A-34-A) (Accounting and Finance Group) Full Marks: 100Suraj GuptaNoch keine Bewertungen

- Mbac 2001Dokument6 SeitenMbac 2001sujithNoch keine Bewertungen

- MBG-206 2019-20 - 1Dokument4 SeitenMBG-206 2019-20 - 1senthil.jpin8830Noch keine Bewertungen

- MBM633, QB, Unit-4, 5Dokument4 SeitenMBM633, QB, Unit-4, 5Mayank bhardwajNoch keine Bewertungen

- MBA-I Sem - II Subject: Financial Management (202) : Assignment Submission: 5 Nov 2016Dokument3 SeitenMBA-I Sem - II Subject: Financial Management (202) : Assignment Submission: 5 Nov 2016ISLAMICLECTURESNoch keine Bewertungen

- FM Assignment 6Dokument2 SeitenFM Assignment 6Vundi RohitNoch keine Bewertungen

- MCom AssignmentsDokument4 SeitenMCom AssignmentsrakikiraNoch keine Bewertungen

- Question PaperDokument3 SeitenQuestion PaperAmbrishNoch keine Bewertungen

- Question Paper Code:: Reg. No.Dokument11 SeitenQuestion Paper Code:: Reg. No.Livin TNoch keine Bewertungen

- Financial ManagementDokument3 SeitenFinancial ManagementKala DhashnamoorthyNoch keine Bewertungen

- sFikv8tLO3DuTOB3I8bY 4762Dokument2 SeitensFikv8tLO3DuTOB3I8bY 4762dipusharma4200Noch keine Bewertungen

- Instructions To CandidatesDokument3 SeitenInstructions To CandidatesSchoTestNoch keine Bewertungen

- Lessons in Corporate Finance: A Case Studies Approach to Financial Tools, Financial Policies, and ValuationVon EverandLessons in Corporate Finance: A Case Studies Approach to Financial Tools, Financial Policies, and ValuationNoch keine Bewertungen

- Ug Bba Locf 2021 RegulationDokument27 SeitenUg Bba Locf 2021 RegulationGowthamSathyamoorthySNoch keine Bewertungen

- Vinayaka Missions Research Foundation School of Arts and Science, Avit Campus, ChennaiDokument2 SeitenVinayaka Missions Research Foundation School of Arts and Science, Avit Campus, ChennaiGowthamSathyamoorthySNoch keine Bewertungen

- Commerce Time Table 2021Dokument21 SeitenCommerce Time Table 2021GowthamSathyamoorthySNoch keine Bewertungen

- Course Defining Sample Format - ArtsDokument6 SeitenCourse Defining Sample Format - ArtsGowthamSathyamoorthySNoch keine Bewertungen

- Ug Bba Locf 2021 RegulationDokument27 SeitenUg Bba Locf 2021 RegulationGowthamSathyamoorthySNoch keine Bewertungen

- Omplas Appointment Order (2) (2 Files Merged)Dokument3 SeitenOmplas Appointment Order (2) (2 Files Merged)GowthamSathyamoorthySNoch keine Bewertungen

- Course Defining Sample Format - ArtsDokument6 SeitenCourse Defining Sample Format - ArtsGowthamSathyamoorthySNoch keine Bewertungen

- BUSINESS ENVIRONMENT AND ETHICS INTERNAL MARKS - Splipt Up (1) - 2020Dokument2 SeitenBUSINESS ENVIRONMENT AND ETHICS INTERNAL MARKS - Splipt Up (1) - 2020GowthamSathyamoorthySNoch keine Bewertungen

- Iqac Files ListDokument4 SeitenIqac Files ListGowthamSathyamoorthySNoch keine Bewertungen

- Omplas Appointment Order (2) (2 Files Merged)Dokument3 SeitenOmplas Appointment Order (2) (2 Files Merged)GowthamSathyamoorthySNoch keine Bewertungen

- Gowtham PROFILEDokument1 SeiteGowtham PROFILEGowthamSathyamoorthySNoch keine Bewertungen

- Banking and Financial Services - Vi Sem - BbaDokument24 SeitenBanking and Financial Services - Vi Sem - BbaGowthamSathyamoorthySNoch keine Bewertungen

- Research Methodology MCQ 180629120038 PDFDokument95 SeitenResearch Methodology MCQ 180629120038 PDFbmk2k450% (2)

- Research Methodology MCQ 180629120038 PDFDokument95 SeitenResearch Methodology MCQ 180629120038 PDFbmk2k450% (2)

- Business Environment and Ethics-Vi Sem - BbaDokument24 SeitenBusiness Environment and Ethics-Vi Sem - BbaGowthamSathyamoorthySNoch keine Bewertungen

- BUSINESS ENVIRONMENT AND ETHICS INTERNAL MARKS - Splipt Up (1) - 2020Dokument2 SeitenBUSINESS ENVIRONMENT AND ETHICS INTERNAL MARKS - Splipt Up (1) - 2020GowthamSathyamoorthySNoch keine Bewertungen

- BUSINESS ENVIRONMENT AND ETHICS INTERNAL MARKS - Splipt Up (1) - 2020Dokument2 SeitenBUSINESS ENVIRONMENT AND ETHICS INTERNAL MARKS - Splipt Up (1) - 2020GowthamSathyamoorthySNoch keine Bewertungen

- OpTransactionHistory17 02 2020 PDFDokument2 SeitenOpTransactionHistory17 02 2020 PDFGowthamSathyamoorthySNoch keine Bewertungen

- Bba Ia Vi SemDokument25 SeitenBba Ia Vi SemGowthamSathyamoorthySNoch keine Bewertungen

- CCPayBillCyberReceipt02 04 2020Dokument5 SeitenCCPayBillCyberReceipt02 04 2020GowthamSathyamoorthySNoch keine Bewertungen

- PH.D TITLES WITH GUIDEDokument2 SeitenPH.D TITLES WITH GUIDEGowthamSathyamoorthySNoch keine Bewertungen

- May-2020 Proposed Time TableDokument22 SeitenMay-2020 Proposed Time TableGowthamSathyamoorthyS0% (1)

- BL - Question Bank With KeyDokument32 SeitenBL - Question Bank With KeygowthamNoch keine Bewertungen

- Service Marketing Question Bank - BBA II YRDokument7 SeitenService Marketing Question Bank - BBA II YRGowthamSathyamoorthyS100% (1)

- Business Ethics Question Bank March 2016Dokument6 SeitenBusiness Ethics Question Bank March 2016GowthamSathyamoorthySNoch keine Bewertungen

- 2 Digital Marketing Glossary PDFDokument5 Seiten2 Digital Marketing Glossary PDFdenizsensozNoch keine Bewertungen

- Financial Management - QB & Model - 2016 RegulationsDokument11 SeitenFinancial Management - QB & Model - 2016 RegulationsGowthamSathyamoorthySNoch keine Bewertungen

- Service Marketing Question Bank - BBA II YRDokument7 SeitenService Marketing Question Bank - BBA II YRGowthamSathyamoorthyS100% (1)

- Business Ethics Question Bank March 2016Dokument6 SeitenBusiness Ethics Question Bank March 2016GowthamSathyamoorthySNoch keine Bewertungen

- Task 1Dokument1 SeiteTask 1Robin ScherbatskyNoch keine Bewertungen

- RCSI Presentation - China's Threats: Deflation & Slowing GrowthDokument10 SeitenRCSI Presentation - China's Threats: Deflation & Slowing GrowthRCS_CFANoch keine Bewertungen

- Solution Practice 9 Business Combinations and ImpairmentDokument8 SeitenSolution Practice 9 Business Combinations and ImpairmentGuinevereNoch keine Bewertungen

- Que. 1 Given Below Are The Cash Transaction of M/sDokument5 SeitenQue. 1 Given Below Are The Cash Transaction of M/sdeepika_naikNoch keine Bewertungen

- Assignment 3Dokument5 SeitenAssignment 3Shubham DixitNoch keine Bewertungen

- M9A 2nd Ed V1.2 CH1 (Summarised Ok)Dokument30 SeitenM9A 2nd Ed V1.2 CH1 (Summarised Ok)XuaN XuanNoch keine Bewertungen

- Allied Food Products Capital Budgeting and Cash Flow Estimation Case SolutionDokument23 SeitenAllied Food Products Capital Budgeting and Cash Flow Estimation Case SolutionAsad Sheikh89% (18)

- Introduction To Corporate FinanceDokument26 SeitenIntroduction To Corporate Financekristina niaNoch keine Bewertungen

- Delivery Address Billing Address: Invoice Number Invoice Date Order Reference Order DateDokument1 SeiteDelivery Address Billing Address: Invoice Number Invoice Date Order Reference Order DateTaj Md SunnyNoch keine Bewertungen

- Fi 19Dokument9 SeitenFi 19priyanshu.goel1710Noch keine Bewertungen

- Format For Stock Statement in Case of Manufacturing/ProcessingDokument36 SeitenFormat For Stock Statement in Case of Manufacturing/ProcessingAjoydeepNoch keine Bewertungen

- UBL Internship ReportDokument58 SeitenUBL Internship Reportbbaahmad89100% (1)

- Proof Option & Guidelines Document 2023-24Dokument8 SeitenProof Option & Guidelines Document 2023-24Muthyam PallapuNoch keine Bewertungen

- Investment Management - Lecture MaterialDokument16 SeitenInvestment Management - Lecture MaterialMeyta AriantiNoch keine Bewertungen

- Prepared By:: Sakia Sultana ID: EB143221Dokument83 SeitenPrepared By:: Sakia Sultana ID: EB143221Naomii HoneyNoch keine Bewertungen

- CFS Session 1 Choosing The Firm Financial StructureDokument41 SeitenCFS Session 1 Choosing The Firm Financial Structureaudrey gadayNoch keine Bewertungen

- Semiannual Report: June 30, 2011 BRTNXDokument15 SeitenSemiannual Report: June 30, 2011 BRTNXfstreetNoch keine Bewertungen

- OL Accounting P2Dokument480 SeitenOL Accounting P2Luqman KhanNoch keine Bewertungen

- The Yamuna Syndicate Limited: Ratings Upgraded Summary of Rating ActionDokument8 SeitenThe Yamuna Syndicate Limited: Ratings Upgraded Summary of Rating ActionSandy SanNoch keine Bewertungen

- Transaction SummaryDokument6 SeitenTransaction SummaryYEEUN JONoch keine Bewertungen

- Equity InvestmentsDokument6 SeitenEquity Investmentsela kikayNoch keine Bewertungen

- We The Sheeple vs. The BankstersDokument177 SeitenWe The Sheeple vs. The BankstersLAUREN J TRATAR100% (6)

- 1559051463267lQpqLbRWjUIPzaEz PDFDokument8 Seiten1559051463267lQpqLbRWjUIPzaEz PDFSibu SorenNoch keine Bewertungen

- Practical Accounting 2 First Pre-Board ExaminationDokument15 SeitenPractical Accounting 2 First Pre-Board ExaminationKaren Eloisse89% (9)

- Commercial PaperDokument15 SeitenCommercial PaperKrishna Chandran Pallippuram100% (1)

- IBDokument11 SeitenIBNishant SinghNoch keine Bewertungen

- ch17 180206123815 PDFDokument75 Seitench17 180206123815 PDFYeni Amelia100% (1)

- Sihs-Question Bank For A'levelDokument21 SeitenSihs-Question Bank For A'levelDickson MukunziNoch keine Bewertungen

- Excel ReportDokument10 SeitenExcel ReportPT Sejahtera Inti SentosaNoch keine Bewertungen

- Challan FormDokument1 SeiteChallan FormNoor-Ul AinNoch keine Bewertungen