Beruflich Dokumente

Kultur Dokumente

Case 8 - Diamond DCF Model

Hochgeladen von

Audrey AngOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Case 8 - Diamond DCF Model

Hochgeladen von

Audrey AngCopyright:

Verfügbare Formate

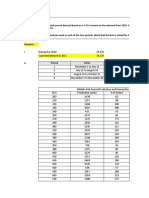

DCF Model

Assumptions

Tax Rate 25% Cash Flow

Discount Rate 16% 100%

Perpetural Growth Rate 3%

80%

EV/EBITDA Mulltiple 7.0x

Transaction Date 12/31/2013 60%

Fiscal Year End 6/30/2014 -$7,296,375 -$14,462,290 $5,203,602 $6,771,739 $8,981,478 $7,896,228 $6,756,978 $5,560,728

40%

Current Price 101,462.00

Shares Outstanding 1,000 20%

Debt 52,766,000

0%

Cash 25,690,000 1/1/2013 1/1/2014 1/1/2015 1/1/2016 1/1/2017 1/1/2018 1/1/2019 1/1/2020

Capex + Working Capital Inve 15,000,000

Discounted Cash Flow Entry 2013 2014 2015 2016 2017 2018 2019

Date 12/31/2013 6/30/2013 6/30/2014 6/30/2015 6/30/2016 6/30/2017 6/30/2018 6/30/2019

Time Periods -1 0 1 2 3 4 5

Year Fraction 1.00 1.00 1.00 1.00 1.00 1.00 1.00

EBIT 6,272,000 51,095 6,272,000 8,363,000 11,309,000 9,862,000 8,343,000

Less: Cash Taxes 1,568,000 12,774 1,568,000 2,090,750 2,827,250 2,465,500 2,085,750

Plus: D&A 3,000,000 3,000,000 3,000,000 3,000,000 3,000,000 3,000,000 3,000,000

Less: Capex & Working Capital Investment 15,000,000 17,500,000 2,500,000 2,500,000 2,500,000 2,500,000 2,500,000

Less: Changes in NWC 375 611 398 511 272 272 272

Unlevered FCF (7,296,375) (14,462,290) 5,203,602 6,771,739 8,981,478 7,896,228 6,756,978

(Entry)/Exit (128,538,000)

Transaction CF 25,690 (7,296,375) (14,462,290) 5,203,602 6,771,739 8,981,478 7,896,228 6,756,978

Transaction CF (128,538,000) (7,296,375) (14,462,290) 5,203,602 6,771,739 8,981,478 7,896,228 6,756,978

Market Value

Market Cap 101,462,000 - -

Plus: Debt 52,766,000 - -

Less: Cash 25,690,000 - -

Enterprise Value 128,538,000 - -

Equity Value/Share 101,462.00 - -

This chart isn't available in your version of Excel.

Cash Flow

Editing this shape or saving this workbook into a

different file format will permanently break the chart.

7,896,228 $6,756,978 $5,560,728 $10,791,228 $9,472,728 $8,087,478 $6,633,228 $9,133,228

1/1/2018 1/1/2019 1/1/2020 1/1/2021 1/1/2022 1/1/2023 1/1/2024 1/1/2025

2020 2021 2022 2023 2024 2025 Exit Terminal Value

6/30/2020 6/30/2021 6/30/2022 6/30/2023 6/30/2024 6/30/2025 6/30/2025 Perpetural Growth 72,841,908

6 7 8 9 10 11 EV/EBITDA 100,163,000

1.00 1.00 1.00 1.00 1.00 1.00 Average 86,502,454

6,748,000 13,722,000 11,964,000 10,117,000 8,178,000 8,178,000

1,687,000 3,430,500 2,991,000 2,529,250 2,044,500 2,044,500

3,000,000 3,000,000 3,000,000 3,000,000 3,000,000 3,000,000

2,500,000 2,500,000 2,500,000 2,500,000 2,500,000 -

272 272 272 272 272 272

5,560,728 10,791,228 9,472,728 8,087,478 6,633,228 9,133,228

86,502,454

5,560,728 10,791,228 9,472,728 8,087,478 6,633,228 9,133,228 86,502,454

5,560,728 10,791,228 9,472,728 8,087,478 6,633,228 9,133,228 86,502,454

Rate of Return

- - - - - - Target Price Upside -100%

- - - - - - Internal Rate of Return (IRR) 1%

- - - - - -

- - - - - - Market Value vs Intrinsic Value

Market Value 101,462.00

- - - - - - Upside (101,462.00)

Intrinsic Value -

Das könnte Ihnen auch gefallen

- Nike Case Final Group 4Dokument15 SeitenNike Case Final Group 4Monika Maheshwari100% (1)

- JetBlue Airways IPO ValuationDokument9 SeitenJetBlue Airways IPO ValuationMuyeedulIslamNoch keine Bewertungen

- Airbus A3XXDokument2 SeitenAirbus A3XXPriyanka Agarwal0% (1)

- Questions:: 1. Is Mercury An Appropriate Target For AGI? Why or Why Not?Dokument5 SeitenQuestions:: 1. Is Mercury An Appropriate Target For AGI? Why or Why Not?Cuong NguyenNoch keine Bewertungen

- Nike INCDokument7 SeitenNike INCUpendra Ks50% (2)

- SWIFT Codes & BIC Codes For All The Banks in TheDokument1 SeiteSWIFT Codes & BIC Codes For All The Banks in TheGhanem AlamroNoch keine Bewertungen

- Nike Case AnalysisDokument11 SeitenNike Case AnalysisastrdppNoch keine Bewertungen

- New Heritage Doll Company Capital Budgeting SolutionDokument10 SeitenNew Heritage Doll Company Capital Budgeting SolutionBiswadeep royNoch keine Bewertungen

- Case AnalysisDokument11 SeitenCase AnalysisSagar Bansal50% (2)

- Flash Memory AnalysisDokument25 SeitenFlash Memory AnalysisTheicon420Noch keine Bewertungen

- Fin 4150 Advanced Business Valuation Assignments Overview: Assignment 1: Class Preparation/Professionalism/ParticipationDokument21 SeitenFin 4150 Advanced Business Valuation Assignments Overview: Assignment 1: Class Preparation/Professionalism/ParticipationEric McLaughlinNoch keine Bewertungen

- Airthread ValuationDokument19 SeitenAirthread Valuation45ss28Noch keine Bewertungen

- Section I. High-Growth Strategy of Marshall, Company Financing and Its Potential Stock Price ChangeDokument11 SeitenSection I. High-Growth Strategy of Marshall, Company Financing and Its Potential Stock Price ChangeclendeavourNoch keine Bewertungen

- Athletic KnitDokument31 SeitenAthletic KnitNish A0% (1)

- Mercury Athletic Footwear Case (Work Sheet)Dokument16 SeitenMercury Athletic Footwear Case (Work Sheet)Bharat KoiralaNoch keine Bewertungen

- Anwal Gas TradersDokument9 SeitenAnwal Gas TraderskarimNoch keine Bewertungen

- AirbusDokument3 SeitenAirbusHP KawaleNoch keine Bewertungen

- f5 Smart NotesDokument98 Seitenf5 Smart Notessakhiahmadyar100% (1)

- AirThread Class 2020Dokument21 SeitenAirThread Class 2020Son NguyenNoch keine Bewertungen

- Answers - Cost of Capital Wallmart Inc.Dokument11 SeitenAnswers - Cost of Capital Wallmart Inc.Arslan HafeezNoch keine Bewertungen

- DCF Model TemplateDokument6 SeitenDCF Model TemplateHamda AkbarNoch keine Bewertungen

- Case 1 Evafin FerrariDokument16 SeitenCase 1 Evafin Ferrarisantiago angarita100% (1)

- TN16 The Boeing 7E7Dokument27 SeitenTN16 The Boeing 7E7Stanleylan100% (5)

- Mercury Case Report Vedantam GuptaDokument9 SeitenMercury Case Report Vedantam GuptaVedantam GuptaNoch keine Bewertungen

- Worldwide Paper Cworldwide Company FinalDokument4 SeitenWorldwide Paper Cworldwide Company FinalNoor Ji100% (2)

- Finals ReviewersDokument213 SeitenFinals ReviewersAngelica RubiosNoch keine Bewertungen

- Bidding For Hertz Leveraged Buyout, Spreadsheet SupplementDokument12 SeitenBidding For Hertz Leveraged Buyout, Spreadsheet SupplementAmit AdmuneNoch keine Bewertungen

- Airbus TemplateDokument2 SeitenAirbus Templateveda20Noch keine Bewertungen

- Case Assignment 8 - Diamond Energy Resources PDFDokument3 SeitenCase Assignment 8 - Diamond Energy Resources PDFAudrey Ang100% (1)

- Mercury AthleticDokument8 SeitenMercury AthleticVaidya Chandrasekhar100% (1)

- New Heritage Doll CompanDokument9 SeitenNew Heritage Doll CompanArima ChatterjeeNoch keine Bewertungen

- ACFINA2 Case Study HanssonDokument11 SeitenACFINA2 Case Study HanssonGemar Singian50% (2)

- New Heritage Doll - SolutionDokument4 SeitenNew Heritage Doll - Solutionrath347775% (4)

- Meaning - Global 2019 Luxury ReportDokument72 SeitenMeaning - Global 2019 Luxury ReportAudrey AngNoch keine Bewertungen

- HPL CaseDokument2 SeitenHPL Caseprsnt100% (1)

- Diamond Energy ResourcesDokument3 SeitenDiamond Energy ResourcesMuhammad FikryNoch keine Bewertungen

- Emerging Trends in Real EstateDokument64 SeitenEmerging Trends in Real Estateritesh rachnalifestyleNoch keine Bewertungen

- DuPont QuestionsDokument1 SeiteDuPont QuestionssandykakaNoch keine Bewertungen

- Flash Memory IncDokument9 SeitenFlash Memory Incxcmalsk100% (1)

- Flash Memory IncDokument3 SeitenFlash Memory IncAhsan IqbalNoch keine Bewertungen

- Investment DetectiveDokument5 SeitenInvestment DetectiveNadya Rizkita100% (1)

- Lex Service PLCDokument3 SeitenLex Service PLCMinu RoyNoch keine Bewertungen

- Lockheed Tristar Case Study 11020241041Dokument19 SeitenLockheed Tristar Case Study 11020241041R Harika Reddy100% (7)

- New Heritage Doll Company Case SolutionDokument31 SeitenNew Heritage Doll Company Case SolutionSoundarya AbiramiNoch keine Bewertungen

- Group B&D Case 19 FonderiaDokument12 SeitenGroup B&D Case 19 FonderiaVinithi ThongkampalaNoch keine Bewertungen

- Airthread Connections Case Work SheetDokument45 SeitenAirthread Connections Case Work SheetBhuvnesh Prakash100% (1)

- Team 14 - Boeing 7E7Dokument10 SeitenTeam 14 - Boeing 7E7Tommy Suryo100% (1)

- Anandam Manufacturing CompanyDokument9 SeitenAnandam Manufacturing CompanyAijaz AslamNoch keine Bewertungen

- New Heritage DoolDokument9 SeitenNew Heritage DoolVidya Sagar KonaNoch keine Bewertungen

- NHDC Solution EditedDokument5 SeitenNHDC Solution EditedShreesh ChandraNoch keine Bewertungen

- Talbros AutomotiveDokument6 SeitenTalbros AutomotiveAhmed NiazNoch keine Bewertungen

- Financial Slide For ReportDokument6 SeitenFinancial Slide For ReportTuan Noridham Tuan LahNoch keine Bewertungen

- Lex Service PLC - Cost of Capital1Dokument4 SeitenLex Service PLC - Cost of Capital1Ravi VatsaNoch keine Bewertungen

- Solutions To Chapters 7 and 8 Problem SetsDokument21 SeitenSolutions To Chapters 7 and 8 Problem SetsMuhammad Hasnain100% (1)

- HBR Hannson Final Case AnalysisDokument5 SeitenHBR Hannson Final Case AnalysisTexasSWO75% (4)

- Final Exam ECO701 2201 1Dokument6 SeitenFinal Exam ECO701 2201 1Rita MaranNoch keine Bewertungen

- Lockheed Tristar Case SolutionDokument3 SeitenLockheed Tristar Case SolutionPrakash Nishtala100% (1)

- Airbus SpreadsheetDokument27 SeitenAirbus SpreadsheetAnnie CondeNoch keine Bewertungen

- Lockheed Case SolutionDokument3 SeitenLockheed Case SolutionKashish SrivastavaNoch keine Bewertungen

- Jetblue Airways Ipo ValuationDokument6 SeitenJetblue Airways Ipo ValuationXing Liang HuangNoch keine Bewertungen

- DCF Model - Power Generation: Strictly ConfidentialDokument5 SeitenDCF Model - Power Generation: Strictly ConfidentialAbhishekNoch keine Bewertungen

- Cash Flow: AssumptionsDokument3 SeitenCash Flow: AssumptionsSudhanshu Kumar SinghNoch keine Bewertungen

- DCF-Model Son 20221105Dokument5 SeitenDCF-Model Son 20221105HoangSon DANGNoch keine Bewertungen

- Valuation Final ExamDokument4 SeitenValuation Final ExamJeane Mae Boo100% (1)

- Synopsis of Many LandsDokument6 SeitenSynopsis of Many Landsraj shekarNoch keine Bewertungen

- GIC Insights 2019 Summary ReportDokument26 SeitenGIC Insights 2019 Summary ReportAudrey AngNoch keine Bewertungen

- Google Temasek e Conomy Sea 2019Dokument65 SeitenGoogle Temasek e Conomy Sea 2019Sofian HadiwijayaNoch keine Bewertungen

- Born This Way BreakdownDokument15 SeitenBorn This Way BreakdownAudrey AngNoch keine Bewertungen

- Human Science EssayDokument2 SeitenHuman Science EssayAudrey AngNoch keine Bewertungen

- COMMISSIONER OF INTERNAL REVENUE vs. PHILIPPINE AIRLINES, INCDokument1 SeiteCOMMISSIONER OF INTERNAL REVENUE vs. PHILIPPINE AIRLINES, INCLean Gela MirandaNoch keine Bewertungen

- Presentation of Financial StatementsDokument5 SeitenPresentation of Financial StatementsVergel MartinezNoch keine Bewertungen

- 22BSPHH01C1021 - Sandip Kumar BhuyanDokument45 Seiten22BSPHH01C1021 - Sandip Kumar BhuyanRoshni BeheraNoch keine Bewertungen

- Folleto Descripcion Del Curso Sena - InglesDokument3 SeitenFolleto Descripcion Del Curso Sena - Inglesyurani andrea revelo jacomeNoch keine Bewertungen

- Space and BCG MatrrixDokument16 SeitenSpace and BCG Matrrixnewa944Noch keine Bewertungen

- Administration of Estates Act, 1961Dokument46 SeitenAdministration of Estates Act, 1961Maame Ekua Yaakwae AsaamNoch keine Bewertungen

- 115 - SilkAir Vs CIRDokument8 Seiten115 - SilkAir Vs CIRCollen Anne PagaduanNoch keine Bewertungen

- STAG S CompendiumDokument78 SeitenSTAG S CompendiumChandrasekarNoch keine Bewertungen

- JUL 23 Shiv Chamber BillDokument1 SeiteJUL 23 Shiv Chamber BillZubair SiddiquiNoch keine Bewertungen

- Lecture - Basic Concepts in Supply Chain ManagementDokument23 SeitenLecture - Basic Concepts in Supply Chain Managementtimesave240Noch keine Bewertungen

- PT 1 Transaction AnalysisDokument3 SeitenPT 1 Transaction AnalysisJanela Venice SantosNoch keine Bewertungen

- HDokument4 SeitenHPrashant Sagar GautamNoch keine Bewertungen

- VJQ.23 04496 2Dokument3 SeitenVJQ.23 04496 2tdm_101Noch keine Bewertungen

- Solutions To Chapter 2Dokument9 SeitenSolutions To Chapter 2Alma Delos SantosNoch keine Bewertungen

- Us Aers A Roadmap To The Issuers Accounting For Convertible DebtDokument260 SeitenUs Aers A Roadmap To The Issuers Accounting For Convertible DebtMANUEL JESUS MOJICA MATEUSNoch keine Bewertungen

- IFRS 15 SolutionsDokument12 SeitenIFRS 15 SolutionsshakilNoch keine Bewertungen

- Specific Financial Reporting Ac413 May19cDokument5 SeitenSpecific Financial Reporting Ac413 May19cAnishahNoch keine Bewertungen

- L2.2 - Market EquilibriumDokument2 SeitenL2.2 - Market Equilibrium12A1-41- Nguyễn Cẩm VyNoch keine Bewertungen

- Activity Based CostingDokument52 SeitenActivity Based CostingAfrina AfsarNoch keine Bewertungen

- VS Booklet 2019 NP PDFDokument134 SeitenVS Booklet 2019 NP PDFJames SimNoch keine Bewertungen

- Services Marketing: Jashandeep Singh, PHDDokument103 SeitenServices Marketing: Jashandeep Singh, PHDmannatNoch keine Bewertungen

- OD223070 GJJ 50374Dokument2 SeitenOD223070 GJJ 50374aathavan1991Noch keine Bewertungen

- Targeted Inflation Rate, NIR, RIRDokument8 SeitenTargeted Inflation Rate, NIR, RIRwakemeup143Noch keine Bewertungen

- 4 PDFDokument2 Seiten4 PDFRÁvi DadheechNoch keine Bewertungen

- Sbi Life Midcap Fund PerformanceDokument1 SeiteSbi Life Midcap Fund PerformanceVishal Vijay SoniNoch keine Bewertungen

- Material and Inventory ReviewerDokument5 SeitenMaterial and Inventory ReviewerLiug Vic Franco B. CajuraoNoch keine Bewertungen

- Various Interests in Chinese Trade and First WarDokument15 SeitenVarious Interests in Chinese Trade and First WarDhruv Aryan KundraNoch keine Bewertungen