Beruflich Dokumente

Kultur Dokumente

TRUE OR FALSE (p.179,180)

Hochgeladen von

Aberin Galenzoga0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

52 Ansichten2 SeitenOriginaltitel

TRUE OR FALSE (p.179,180).docx

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

52 Ansichten2 SeitenTRUE OR FALSE (p.179,180)

Hochgeladen von

Aberin GalenzogaCopyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

NAME: ABERIN GALENZOGA SCORE:

SECTION: BA2A PROFESSOR: Ms. Ria Mae Layto

True or False (p179-180)

FALSE 1. Foreign corporation, whether engaged in business the Philippine or not, is taxable on

income derived from sources within and without the Philippines.

TRUE 2. Income derived by off shore banking units authorize by the BSP, from foreign currency

transaction with local commercial banks I subject to10% final tax

TRUE 3. Resident foreign corporation applies at a foreign corporation not engaged in trade or

business within the Philippines.

FALSE 4. A domestic, resident foreign and non -resident foreign corporations may deduct from

their business income, itemized deductions under the Tax code.

FALSE 5. A return showing cumulative income and deductions need not be filed if the operations

for the quarter and the p receding quarters yielded no income tax due.

TRUE 6. Non- resident foreign corporation receives the same tax treatment as domestic and

resident foreign corporations with regard to capital gains from sale of shares of stock not traded in

the stock exchange.

TRUE 7. The 10% tax on the taxable income of a proprietary educational institution and non-

profit hospital is absolute.

TRUE 8. Foreign corporation is created and organized under the laws of countries other than the

Philippines.

TRUE 9. Dividends received from a domestic corporation by a non-resident foreign corporation

are subject to a final withholding tax of 15% on certain condition.

TRUE 10. Domestic corporation is taxable on all income derived from sources within and outside

the Philippines

TRUE 11. Subject to the provision of existing special laws or general laws, all corporations,

agencies, or instrumentalities owned or controlled by the Government shall pay such rate of tax

upon their taxable income as are imposed by the Code upon corporations or associations

engaged in a similar business, industry

TRUE 12. Any profit remitted by a branch to its head office shall be subject to a 15% tax which

shall be based on the total profits applied or earmarked for remittance without deduction for the tax

component thereof, except those activities which are registered with the Philippine Economic Zone

Authority.

TRUE 13. Corporations on their income ,are taxed generally from 30 % to 35% depending on

the taxable income year.

TRUE 14. non-resident owner or lessor of vessels chartered by Philippine nationals is taxed at 4

½% of gross rentals, lease or charter fees from leases or charter to Filipino citizens or

corporations, as approved by the Maritime Industry Authority.

FALSE 15. Interest on foreign loans contracted in or after august 1,1986 by a non- resident

foreign corporation are taxed at 10%.

FALSE 16. Non -resident cinematographic film owner, lessor, or distributor is taxed at 15% of

gross income.

FALSE 17. International air carrier and international shipper doing business in the Philippines

shall pay a tax of 10% on its gross Philippine billings.

TRUE 18. Every corporation shall file in a duplicate a quarterly summary declaration of its gross

income and deductions on a cumulative basis for the preceding quarter or quarters upon which the

income tax shall be levied, collected and paid.

TRUE 19. If the gross income from unrelated trade, business or other activity of a proprietary

educational institutions or non-profit hospital exceeds 50%of the total gross income derived from

all sources, the tax prescribed under Section 27(A) shall be imposed on the entire taxable income.

TRUE 20. Non-resident foreign corporation applies to a foreign corporation engaged in trade or

business within the Philippines.

TRUE 21. For domestic and resident corporations adopting the fiscal-year accounting period,

the taxable income shall be computed without regard to the specific date when the specific

sale ,purchases and other transactions occur such that their income and expenses for the fiscal

year shall be deemed to have an earned and spent equally for each month of the period.

TRUE 22. Non-resident owner or lessor of aircraft, machinery and other equipment is taxed at 7

½% of gross rentals, charters and other fees.

FALSE 23. Exempt corporations may not be income tax – exempt on its other activities the tax

rates of which shall be 30% to 35% depending in the taxable year.

TRUE 24. Partnership other than a general professional partnership is also taxable on its

income as general professional partnership.

TRUE 25. Domestic corporation is created or organized under Philippine law.

Das könnte Ihnen auch gefallen

- Uk PayslipDokument3 SeitenUk Paysliphari haranNoch keine Bewertungen

- Tax On Compensation, Dealings in Properties and CorporationDokument6 SeitenTax On Compensation, Dealings in Properties and CorporationOG FAM0% (1)

- Taxation Sia/Tabag TAX.2807-Income Tax On Corporations MAY 2020Dokument12 SeitenTaxation Sia/Tabag TAX.2807-Income Tax On Corporations MAY 2020Ramainne Ronquillo100% (1)

- Accounting for Special Partnership TransactionsDokument15 SeitenAccounting for Special Partnership TransactionsJessaNoch keine Bewertungen

- Chapter 10: Mortgage Markets and DerivativesDokument6 SeitenChapter 10: Mortgage Markets and DerivativesRemar22Noch keine Bewertungen

- Joey, A non-VAT Taxpayer Purchased Merchandise Worth P11,200, VATDokument10 SeitenJoey, A non-VAT Taxpayer Purchased Merchandise Worth P11,200, VATLeah Isabelle Nodalo DandoyNoch keine Bewertungen

- Taxation rules for corporations and foreign entitiesDokument37 SeitenTaxation rules for corporations and foreign entitiesGuinevere100% (1)

- Chapter 1&2 Introduction To Business Taxes & Vat On Sale of Goods or PropertiesDokument6 SeitenChapter 1&2 Introduction To Business Taxes & Vat On Sale of Goods or PropertiesBSA3Tagum Marilet100% (1)

- Chap. 6 8Dokument44 SeitenChap. 6 82vpsrsmg7jNoch keine Bewertungen

- PRELIM Chapter 9 10 11Dokument37 SeitenPRELIM Chapter 9 10 11Bisag AsaNoch keine Bewertungen

- (Solution Answers) Advanced Accounting by Dayag, Version 2017 - Chapter 1 (Partnership) - Answers On Multiple Choice Computation #21 To 25Dokument1 Seite(Solution Answers) Advanced Accounting by Dayag, Version 2017 - Chapter 1 (Partnership) - Answers On Multiple Choice Computation #21 To 25John Carlos DoringoNoch keine Bewertungen

- Midterm Exam - BSAIS 2ADokument6 SeitenMidterm Exam - BSAIS 2AMarilou DomingoNoch keine Bewertungen

- Intacc 3 HWDokument7 SeitenIntacc 3 HWMelissa Kayla ManiulitNoch keine Bewertungen

- CGT Exam With SOlnDokument2 SeitenCGT Exam With SOlnMinaykyuttNoch keine Bewertungen

- ACC 311 Sample Problem General Instructions:: ST ND RD THDokument1 SeiteACC 311 Sample Problem General Instructions:: ST ND RD THexquisiteNoch keine Bewertungen

- Problem 4-29 To 31Dokument1 SeiteProblem 4-29 To 31maryaniNoch keine Bewertungen

- Notes For Civil Code Article 1177 and Article 1178Dokument5 SeitenNotes For Civil Code Article 1177 and Article 1178Chasz CarandangNoch keine Bewertungen

- 5Dokument19 Seiten5Dawn JessaNoch keine Bewertungen

- Chapter 6 - Income Tax For PartnershipDokument40 SeitenChapter 6 - Income Tax For PartnershipNineteen AùgùstNoch keine Bewertungen

- Amended Bsa Handout For Gross Income Part 1Dokument40 SeitenAmended Bsa Handout For Gross Income Part 1Dianne Lontac100% (1)

- Final Withholding Tax FWT and CapitalDokument40 SeitenFinal Withholding Tax FWT and CapitalEdna PostreNoch keine Bewertungen

- Donors TaxDokument5 SeitenDonors TaxHana Grace MamangunNoch keine Bewertungen

- Learning Resource 1 Lesson 2Dokument9 SeitenLearning Resource 1 Lesson 2Novylyn AldaveNoch keine Bewertungen

- 02 Task Performance 1Dokument3 Seiten02 Task Performance 1Dong Rosello100% (1)

- Partnership Notes 2Dokument4 SeitenPartnership Notes 2Joylyn CombongNoch keine Bewertungen

- Tax rates and types for various income sourcesDokument1 SeiteTax rates and types for various income sourcesAirene Talisic PatunganNoch keine Bewertungen

- Chapter 3 Corporate Liquidation and Reorganization-PROFE01Dokument3 SeitenChapter 3 Corporate Liquidation and Reorganization-PROFE01Steffany RoqueNoch keine Bewertungen

- INCTAXA (Basic Income Tax, Final Tax On Passive Income and Capital Gains Tax) - 2Dokument7 SeitenINCTAXA (Basic Income Tax, Final Tax On Passive Income and Capital Gains Tax) - 2Erlle AvllnsaNoch keine Bewertungen

- GuidelinesDokument3 SeitenGuidelines123r12f1Noch keine Bewertungen

- Intermediate Accounting 3 Part 1 Statement of Comprehensive Income ProblemsDokument7 SeitenIntermediate Accounting 3 Part 1 Statement of Comprehensive Income ProblemsAG VenturesNoch keine Bewertungen

- Tax 2 Part 3 Estate TaxDokument25 SeitenTax 2 Part 3 Estate TaxShane TorrieNoch keine Bewertungen

- Assignment 3Dokument6 SeitenAssignment 3Triechia LaudNoch keine Bewertungen

- Quiz in Intacc 1 & 2 (Finals)Dokument1 SeiteQuiz in Intacc 1 & 2 (Finals)Sandra100% (1)

- CF Qualitative CharacteristicsDokument3 SeitenCF Qualitative Characteristicspanda 1Noch keine Bewertungen

- Effect of Working Capital Management and Financial Leverage On Financial Performance of Philippine FirmsDokument9 SeitenEffect of Working Capital Management and Financial Leverage On Financial Performance of Philippine FirmsGeorgina De LiañoNoch keine Bewertungen

- Compilation of ExercisesDokument15 SeitenCompilation of ExercisesHazel MoradaNoch keine Bewertungen

- FAR2 CHAPTER 1 (PG 1-13)Dokument13 SeitenFAR2 CHAPTER 1 (PG 1-13)Layla MainNoch keine Bewertungen

- Unit VIII Accounting For Long Term Construction ContractsDokument8 SeitenUnit VIII Accounting For Long Term Construction ContractsNovylyn AldaveNoch keine Bewertungen

- PFRS of SME and SE - Concept MapDokument1 SeitePFRS of SME and SE - Concept MapRey OñateNoch keine Bewertungen

- Accounting for Leases by Lessor (39Dokument21 SeitenAccounting for Leases by Lessor (39Carl Adrian ValdezNoch keine Bewertungen

- Long-Term Investments Chapter SummaryDokument3 SeitenLong-Term Investments Chapter SummaryJEFFERSON CUTENoch keine Bewertungen

- Week 4 - Lesson 4 Cash and Cash EquivalentsDokument21 SeitenWeek 4 - Lesson 4 Cash and Cash EquivalentsRose RaboNoch keine Bewertungen

- Chapter 12Dokument11 SeitenChapter 12Kim Patrice NavarraNoch keine Bewertungen

- AC 3 - Intermediate Acctg' 1 (Ate Jan Ver)Dokument119 SeitenAC 3 - Intermediate Acctg' 1 (Ate Jan Ver)John Renier Bernardo100% (1)

- Taxation Module 1 Principles WaDokument17 SeitenTaxation Module 1 Principles WaPdf Files100% (1)

- Chapter 10 - Deductions From The Gross Income PDFDokument68 SeitenChapter 10 - Deductions From The Gross Income PDFMary CuisonNoch keine Bewertungen

- Taxation Final Preboard CPAR 92 PDFDokument17 SeitenTaxation Final Preboard CPAR 92 PDFomer 2 gerdNoch keine Bewertungen

- Examination About Investment 4Dokument3 SeitenExamination About Investment 4BLACKPINKLisaRoseJisooJennieNoch keine Bewertungen

- Article 1493: Title Vi Sales Effects of The Contract When The Thing Sold Has Been LostDokument5 SeitenArticle 1493: Title Vi Sales Effects of The Contract When The Thing Sold Has Been LostMaricon AsidoNoch keine Bewertungen

- 4 MCQ - Management of A Public Accounting PracticeDokument2 Seiten4 MCQ - Management of A Public Accounting PracticeRAISA LIDASANNoch keine Bewertungen

- Income Taxation Mcqs&ProblemsDokument14 SeitenIncome Taxation Mcqs&ProblemsJayrald LacabaNoch keine Bewertungen

- Statement of Comprehensive Income - ValixDokument7 SeitenStatement of Comprehensive Income - ValixYstefani ValderamaNoch keine Bewertungen

- VatDokument7 SeitenVatCharla SuanNoch keine Bewertungen

- Chapter 6 To Chapter 8Dokument4 SeitenChapter 6 To Chapter 8Jarren BasilanNoch keine Bewertungen

- Operating Segment StudentsDokument4 SeitenOperating Segment StudentsAG VenturesNoch keine Bewertungen

- PSA 200 Audit Objectives (40Dokument15 SeitenPSA 200 Audit Objectives (40Marko JerichoNoch keine Bewertungen

- Pas 37 Provisions Contingent Liab Contingent AssetsDokument15 SeitenPas 37 Provisions Contingent Liab Contingent Assetswendy alcosebaNoch keine Bewertungen

- Pledge - Mortgage - Chattel MortgageDokument23 SeitenPledge - Mortgage - Chattel MortgageJohn Kayle BorjaNoch keine Bewertungen

- Tax CorporateDokument5 SeitenTax CorporateJorenz ObiedoNoch keine Bewertungen

- Categories of Income and Tax RatesDokument5 SeitenCategories of Income and Tax RatesRonel CacheroNoch keine Bewertungen

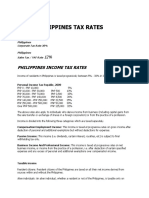

- Philippines Tax RatesDokument7 SeitenPhilippines Tax RatesRonel CacheroNoch keine Bewertungen

- Fin430 - Dec2019Dokument6 SeitenFin430 - Dec2019nurinsabyhahNoch keine Bewertungen

- TikTok Allocation PlanDokument3 SeitenTikTok Allocation PlanTHROnlineNoch keine Bewertungen

- FABM 2 Module 8 Income TaxationDokument8 SeitenFABM 2 Module 8 Income TaxationJOHN PAUL LAGAO0% (1)

- cis305-2Dokument4 Seitencis305-2vqx9phyftvNoch keine Bewertungen

- GST & INDIRECT TAX KEY CONCEPTSDokument2 SeitenGST & INDIRECT TAX KEY CONCEPTSPratik ShahNoch keine Bewertungen

- Direct and Indirect TaxesDokument17 SeitenDirect and Indirect Taxeskchehria100% (6)

- Computation of Total Income Income From Business or Profession (Chapter IV D) 300000Dokument4 SeitenComputation of Total Income Income From Business or Profession (Chapter IV D) 300000ramanNoch keine Bewertungen

- Tax Homework Set 3Dokument4 SeitenTax Homework Set 3afnoewgmfstnwl100% (1)

- U by Emaar Visa Family Value Chart 18sep2018Dokument1 SeiteU by Emaar Visa Family Value Chart 18sep2018chirag.lamsaNoch keine Bewertungen

- ALABANG PLUMBING IntroDokument1 SeiteALABANG PLUMBING IntroIsa NgNoch keine Bewertungen

- Intax Quiz 10Dokument2 SeitenIntax Quiz 10BLACKPINKLisaRoseJisooJennieNoch keine Bewertungen

- Reg No 79 2002 Value Added Tax Regulations PDFDokument32 SeitenReg No 79 2002 Value Added Tax Regulations PDFKalkidan ShashigoNoch keine Bewertungen

- 1202 Second Details Rental Tax Books of AcctDokument1 Seite1202 Second Details Rental Tax Books of AcctMaddahayota CollegeNoch keine Bewertungen

- Ivy Bridge House, Ic Insurance, Address 1 Adam ST, Tax ExemptDokument20 SeitenIvy Bridge House, Ic Insurance, Address 1 Adam ST, Tax ExemptJohn Adam St Gang: Crown ControlNoch keine Bewertungen

- CH 4 In-Class Exercise SOLUTIONSDokument7 SeitenCH 4 In-Class Exercise SOLUTIONSAbdullah alhamaadNoch keine Bewertungen

- Accounting For Special Transactions - Semi FinalsDokument4 SeitenAccounting For Special Transactions - Semi FinalsKarlo PalerNoch keine Bewertungen

- 1701A Annual Income Tax Return: (Add More... )Dokument1 Seite1701A Annual Income Tax Return: (Add More... )Karen Faye TorrecampoNoch keine Bewertungen

- Form PDF 853296050300723-2023-24Dokument9 SeitenForm PDF 853296050300723-2023-24muskanvivekfunhouseNoch keine Bewertungen

- Estate Tax ComputationDokument11 SeitenEstate Tax ComputationNorfaidah Didato GogoNoch keine Bewertungen

- GSTR3B 03alnpk4728k1zv 052021Dokument2 SeitenGSTR3B 03alnpk4728k1zv 052021Harish VermaNoch keine Bewertungen

- Mcgill Personal Finance Essentials Transcript Module 5: The Art of Investing 1, Part 1Dokument11 SeitenMcgill Personal Finance Essentials Transcript Module 5: The Art of Investing 1, Part 1shourav2113Noch keine Bewertungen

- PDF Rendition 1 1Dokument2 SeitenPDF Rendition 1 1chethankapoor9999Noch keine Bewertungen

- English4Accounting CICEX READINGDokument2 SeitenEnglish4Accounting CICEX READINGAdri EmmaNoch keine Bewertungen

- Consumer ArithmaticDokument14 SeitenConsumer ArithmaticKrish Madhav ShethNoch keine Bewertungen

- FAR.2835 Income Taxes PDFDokument7 SeitenFAR.2835 Income Taxes PDFNah HamzaNoch keine Bewertungen

- Advance TaxDokument3 SeitenAdvance TaxRia SarkarNoch keine Bewertungen

- JFC - PH Jollibee Foods Corp. Annual Income Statement - WSJDokument1 SeiteJFC - PH Jollibee Foods Corp. Annual Income Statement - WSJフ卂尺乇ᗪNoch keine Bewertungen

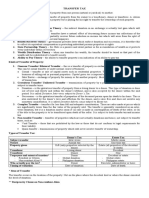

- Tax Reviewer 3 TRANSFER TAXDokument6 SeitenTax Reviewer 3 TRANSFER TAXAlliahDataNoch keine Bewertungen

- Application For Closure of Business/Cancellation of Tin A. VenueDokument9 SeitenApplication For Closure of Business/Cancellation of Tin A. VenueMa. Roa DellomasNoch keine Bewertungen