Beruflich Dokumente

Kultur Dokumente

ACCOUNT

Hochgeladen von

Angel PadillaCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

ACCOUNT

Hochgeladen von

Angel PadillaCopyright:

Verfügbare Formate

ACCOUNT – the form or record kept for ach item of asset, liability, or proprietorship.

- an accounting device used in summarizing the changes in the A, L, and P caused by the business transactions and events.

LEDGER – a group of accounts.

CHART OF ACCOUNTS – a classified list of account titles is prepared for the use of the bookkeeper.

Real accounts – known as balance sheet accounts

1. assets

2. liabilities

3. capital investment

4. capital withdrawals

Nominal accounts – known as profit and loss accounts

1. income

2. deduction from income

The preparation of chart of accounts covers the following procedures:

1. determination of what specific accounts are required;

2. selection of appropriate and descriptive titles for the accounts.

The accounting cycle, also commonly referred to as accounting process, is a series of procedures in the collection, processing, and communication

of financial information.

As defined in earlier lessons, accounting involves recording, classifying, summarizing, and interpreting financial information.

JOURNAL – the accounting book wherein the business transactions and events are recorded for the first time. It is called book of original entry.

There are various kinds of journal records – cash journal, sales journal, purchases journal, and general journal.

The simplest form of journal is the two-column journal. It is the form which is commonly used for a journal record called the General Journal.

For each transaction, the GJ provides spaces for recording the following information:

1. the date of the transaction;

2. the titles of the accounts involved;

3. the amount or amounts of the transaction;

4. the page of the ledger to which the entry is later transferred; and,

5. an explanation in brief cut concise, and comprehensible statement.

The process of recording the business transaction or event in the GJ is called JOURNALIZING.

PROCEDURES IN JOURNALIZING:

1. The year is written in small figures at the top of the date column.

2. Under the date column, the month of the first transaction is written on the same line as the transaction. The name of the month is NOT

written repeatedly on the same page. Where the month changes, the new month should be written. Every page of the journal should bear

the name of the month in the date column of the transaction first recorded on said page.

3. The day of the transaction is written on the right sub-column of the date column. It is repeated for every transaction occurring on the same

day.

4. The title of the account debited is written on the extreme left of the explanation column and its corresponding amount on the money column

at the left.

5. The title of the account credited is written on the following line and is indented for about one half inch to the right of the debit and its

corresponding amount is place on the money column at the right.

6. The explanation is written on the next line after the last credit entry. This is additional indention to the right by one-half inch.

7. Between entries there must be left a single line spacing.

8. The folio (F) or post reference column is used to indicate the page of the ledger to which the entry is transferred.

The record of the transaction or event is called the JOURNAL ENTRY.

LEDGER – the book of final entry.

POSTING – the process of transferring to the ledger the same information recorded in the journal.

Fund of ABM 1 | ERMALIGAYA | page 1 of 2 pages

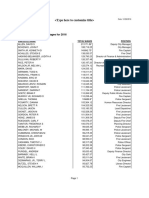

The Chart of Accounts of “Let us Copy and Print”

Balance Sheet Accounts Profit and Loss Accounts

ASSETS INCOME

Cash Printing Supplies

Accounts Receivable

Notes Receivable EXPENSES

Printing Supplies Communications

Printing Equipment Employees’ Salaries

Delivery Equipment Repairs and Maintenance

Rent Expense

LIABILITIES Taxes and Licenses

Accounts Payable Utilities

Notes Payable

CAPITAL

Mika Aereen, Capital

Mika Aereen, Personal

TRANSACTIONS

June 1, 2016 Desiree Cheng open a printing press called the “Let us Copy and Print”, with the capital composed of:

Cash P 1,000,000.00

Printing Supplies 20,000.00

Printing Equipment 400,000.00

June 1, 2016 Paid business tax to the Municipal Treasurer, P 8,000.00

Purchased a delivery van from Toyota Motors for P 60,000 on credit.

Paid the rent of the shop for the month, P 2,500.00.

June 6, 2016 Received P 3,000.00 cash for the receipt printed to various customers.

Sent charge bill, P 2,000.00 for vouchers printed and delivered on credit to the MR3 Corporation.

June 10, 2016 Bought printing supplies on credit from ERM Supply Store, P 1,500.00

June 15, 2016 Sent charge bills for receipts and vochers delivered on credit to:

Tyang Aby’s Cafe P 2,000.00

KKD Hotel 2,500.00

Paid two week’s salary of the employees, P 5,000.00

June 20, 2016 Received cash as collection on credit from

MR3 Corporation P 1,000.00

Tyang Aby’s Cafe 800.00

KKD Hotel 1,400.00

June 25, 2016 Received 2,200.00 cash for the documents printed and delivered to various customers.

Paid 900.00 to ERM Supply Store in partial payment of the debt owing to it.

Desiree Cheng withdrew 500.00 cash for her personal use.

June 27, 2016 Paid 700.00 to repairman for the repair service on the printing equipment.

June 30, 2016 Paid in cash the following:

Assistant’s two employees’ salary P 5,000.00

Water and electric bill 8,500.00

Telephone and Internet 3,500.00

Delivered printed materials to the following:

Cash customers P 1,300.00

MR3 Corporation (on credit) 950.00

KKD Hotel (on credit) 1,200.00

Fund of ABM 1 | ERMALIGAYA | page 2 of 2 pages

Das könnte Ihnen auch gefallen

- Statement of Changes in Equity (SCE)Dokument3 SeitenStatement of Changes in Equity (SCE)Angel Padilla100% (2)

- Curriculum Map - Math 10Dokument1 SeiteCurriculum Map - Math 10Angel PadillaNoch keine Bewertungen

- Bank ReconciliationDokument5 SeitenBank ReconciliationAngel PadillaNoch keine Bewertungen

- PRISAA Minutes of Meeting 1Dokument2 SeitenPRISAA Minutes of Meeting 1Angel Padilla50% (2)

- Bookkeeping NC III TRDokument1 SeiteBookkeeping NC III TRAngel PadillaNoch keine Bewertungen

- Synthetic Division PPDokument16 SeitenSynthetic Division PPAngel PadillaNoch keine Bewertungen

- Kansas SMART Workflow For General Ledger: (Statewide Management, Accounting, and Reporting Tool)Dokument22 SeitenKansas SMART Workflow For General Ledger: (Statewide Management, Accounting, and Reporting Tool)Angel PadillaNoch keine Bewertungen

- A2 ch07 05Dokument33 SeitenA2 ch07 05Angel PadillaNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Ecs h61h2-m12 Motherboard ManualDokument70 SeitenEcs h61h2-m12 Motherboard ManualsarokihNoch keine Bewertungen

- TESTDokument27 SeitenTESTLegal CheekNoch keine Bewertungen

- Hand Out Fire SurpressDokument69 SeitenHand Out Fire SurpressSeptiawanWandaNoch keine Bewertungen

- Hydraulic Mining ExcavatorDokument8 SeitenHydraulic Mining Excavatorasditia_07100% (1)

- QP 12math Term 1Dokument11 SeitenQP 12math Term 1sarthakNoch keine Bewertungen

- Ajmera - Treon - FF - R4 - 13-11-17 FinalDokument45 SeitenAjmera - Treon - FF - R4 - 13-11-17 FinalNikita KadamNoch keine Bewertungen

- Mechanical Engineering - Workshop Practice - Laboratory ManualDokument77 SeitenMechanical Engineering - Workshop Practice - Laboratory Manualrajeevranjan_br100% (4)

- What Is Universe?Dokument19 SeitenWhat Is Universe?Ruben M. VerdidaNoch keine Bewertungen

- Komunikasi Sebagai Piranti Kebijakan Bi: Materi SESMABI Mei 2020Dokument26 SeitenKomunikasi Sebagai Piranti Kebijakan Bi: Materi SESMABI Mei 2020syahriniNoch keine Bewertungen

- Modern School For SaxophoneDokument23 SeitenModern School For SaxophoneAllen Demiter65% (23)

- Native VLAN and Default VLANDokument6 SeitenNative VLAN and Default VLANAaliyah WinkyNoch keine Bewertungen

- Grid Pattern PortraitDokument8 SeitenGrid Pattern PortraitEmma FravigarNoch keine Bewertungen

- Transportasi Distribusi MigasDokument25 SeitenTransportasi Distribusi MigasDian Permatasari100% (1)

- Bcci ScandalDokument6 SeitenBcci ScandalNausaf AhmedNoch keine Bewertungen

- Union Test Prep Nclex Study GuideDokument115 SeitenUnion Test Prep Nclex Study GuideBradburn Nursing100% (2)

- 2016 W-2 Gross Wages CityDokument16 Seiten2016 W-2 Gross Wages CityportsmouthheraldNoch keine Bewertungen

- 10 Killer Tips For Transcribing Jazz Solos - Jazz AdviceDokument21 Seiten10 Killer Tips For Transcribing Jazz Solos - Jazz Advicecdmb100% (2)

- 788 ManualDokument16 Seiten788 Manualn0rdNoch keine Bewertungen

- Internship Report Format For Associate Degree ProgramDokument5 SeitenInternship Report Format For Associate Degree ProgramBisma AmjaidNoch keine Bewertungen

- SyncopeDokument105 SeitenSyncopeJohn DasNoch keine Bewertungen

- SreenuDokument2 SeitenSreenuSubbareddy NvNoch keine Bewertungen

- Facebook: Daisy BuchananDokument5 SeitenFacebook: Daisy BuchananbelenrichardiNoch keine Bewertungen

- I I Formularies Laundry Commercial Liquid Detergents 110-12-020 USDokument6 SeitenI I Formularies Laundry Commercial Liquid Detergents 110-12-020 USfaissalNoch keine Bewertungen

- Dreaded Attack - Voyages Community Map Rules v1Dokument2 SeitenDreaded Attack - Voyages Community Map Rules v1jNoch keine Bewertungen

- Maritime Academy of Asia and The Pacific-Kamaya Point Department of AcademicsDokument7 SeitenMaritime Academy of Asia and The Pacific-Kamaya Point Department of Academicsaki sintaNoch keine Bewertungen

- BJAS - Volume 5 - Issue Issue 1 Part (2) - Pages 275-281Dokument7 SeitenBJAS - Volume 5 - Issue Issue 1 Part (2) - Pages 275-281Vengky UtamiNoch keine Bewertungen

- HSCC SRH 0705 PDFDokument1 SeiteHSCC SRH 0705 PDFBhawna KapoorNoch keine Bewertungen

- ThorpeDokument267 SeitenThorpezaeem73Noch keine Bewertungen

- WHO Guidelines For Drinking Water: Parameters Standard Limits As Per WHO Guidelines (MG/L)Dokument3 SeitenWHO Guidelines For Drinking Water: Parameters Standard Limits As Per WHO Guidelines (MG/L)114912Noch keine Bewertungen

- Recruitment SelectionDokument11 SeitenRecruitment SelectionMOHAMMED KHAYYUMNoch keine Bewertungen