Beruflich Dokumente

Kultur Dokumente

Jakarta Greater Jakarta Industrial Market Update - Q3 2019 - V2 PDF

Hochgeladen von

Eka Esti SusantiOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Jakarta Greater Jakarta Industrial Market Update - Q3 2019 - V2 PDF

Hochgeladen von

Eka Esti SusantiCopyright:

Verfügbare Formate

I N D U ST R I A L

JAKARTA PROPERTY MARKET

Q3 2019

INDUSTRIAL

ECONOMIC OVERVIEW

Leads Property Research | Jakarta Property Market Q3 2019

Economic Overview INDUSTRIAL

Economic Indicators as of Q3 2019

Indonesia’s Economic Indicators

Q1 Q2 Q3

Indicator 2012 2013 2014 2015 2016 2017 2018

2019 2019 2019

Economic Growth (%

6.23 5.78 5.02 4.79 5.02 5.19 5.18 5.07 5.05 5.02

YoY)

Inflation Rate

4.3 8.4 8.4% 3.4 3.0 3.8 3.1 2.4 3.32 3.13

(% YoY)

Exchange Rate

9,714 12,189 12,440 13,795 13,436 13,548 14,481 14,244 14,141 14,174

(USD/IDR)

BI 7-Days Repo Rate

- - - - 4.75 4.25 6.00 6.00 5.75 5.00

(%)

Source : Bank Indonesia, BPS , Leads Property Research.

INDUSTRIAL

INDUSTRIAL MARKET UPDATE

AS OF Q3 2019

Leads Property Research | Jakarta Property Market Q3 2019

Industrial Land INDUSTRIAL

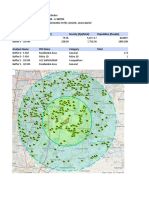

Major Industrial Estate in Jakarta and Tangerang

Tj. Priok

Seaport

Soekarno-

Hatta Airport

1

Tangerang 2 JAKARTA

4

5

Serang

Tangerang

Distance from Distance Distance from Distance

No. Industrial Estate Soekarno – from Tj. Priok No. Industrial Estate Soekarno – from Tj. Priok

Hatta Airport Seaport Hatta Airport Seaport

1 Jakarta Industrial Estate Pulogadung (JIEP) 30.9 km 13.3 km 5 Modern Cikande Industrial Estate 35.5 km 61.1 km

2 Kawasan Industri Pasar Kemis 11.6 km 36.5 km

3 Millenium Industrial Estate 22.1 km 46.2 km

4 Krakatau Industrial Estate Cilegon 68 km 93.2 km

Source : Leads Property Research

Industrial Land INDUSTRIAL

Major Industrial Estate in Bekasi

1

Tj. Priok

Soekarno- Seaport

Hatta Airport

BEKASI REGENCY

JAKARTA

2 KARAWANG

REGENCY

BEKASI CITY 4

3

5 6

7

8

9 10

Distance

Distance from Distance Distance

from

No. Industrial Estate Soekarno – from Tj. Priok No. Industrial Estate from Tj. Priok

Soekarno –

Hatta Airport Seaport Seaport

Hatta Airport

Kawasan Berikat Nusantara – Marunda

1 36.6 km 10.5 km 6 Kawasan Industri Karyadeka Pancamurni 58.6 km 38.8 km

Center

2 Kawasan Industri Gobel (KIG) 50.7 km 29.7 km 7 Lippo Cikarang (Delta Silicon) 56.9 km 38.0 km

3 MM 2100 52.3 km 32.6 km 8 Bekasi International Industrial Estate (BIIE) 58 km 39.2 km

Kawasan Industrial Terpadu Indonesia China

4 Jababeka Industrial Estate Cikarang (JIEC) 59.9 km 35.4 km 9 63.6 km 45.3 km

(KITIC)

5 East Jakarta Industrial Park (EJIP) 56.5 km 35.9 km 10 Greenland International Industrial City (GIIC) 64.6 km 45.8 km

Source: Leads Property Services Indonesia, July 2019

Industrial Land INDUSTRIAL

Major Industrial Estate in Karawang

Tj. Priok

Soekarno- Seaport

Hatta Airport

BEKASI

JAKARTA REGENCY

KARAWANG

REGENCY

BEKASI CITY

3

1 4

5

2 7

Distance Distance

Distance from Distance from

from Tj. from Tj.

No. Industrial Estate Soekarno No. Industrial Estate Soekarno Hatta

Priok Priok

Hatta Airport Airport

Seaport Seaport

1 Artha Industrial Hill 70.6 km 51.0 km 5 Suryacipta City of Industry 80.7 km 59.8 km

2 Karawang New Industry City 71.2 km 52.0 km 6 Bukit Indah Industrial Park 90.7 km 69.9 km

Karawang International Industrial City

3 73.3 km 52.3 km 7 Kawasan Industri Kujang Cikampek 91 km 69.6 km

(KIIC)

4 Kawasan Industri Mitrakarawang (KIM) 77.6 km 56.9 km

Source : Leads Property Research

Industrial Land INDUSTRIAL

Supply & Demand As of Q3 2019

Cummulative Supply Cummulative Demand Sales Rate

15,000 100.00%

90.00%

12,000 80.00%

70.00%

9,000 60.00%

50.00%

6,000 40.00%

30.00%

3,000 20.00%

10.00%

- 0.00%

Q1 2015

Q2 2015

Q3 2015

Q4 2015

Q1 2016

Q2 2016

Q3 2016

Q4 2016

Q1 2017

Q2 2017

Q3 2017

Q4 2017

Q1 2018

Q2 2018

Q3 2018

Q4 2018

Q1 2019

Q2 2019

Q3 2019

*Cumulative supply include existing (ready-to-build land) and future supply which are already offered to the market.

• There was additional industrial land supply of 96 hectare in Greater Jakarta area, which is part of phased land selling. Such figure has

brought cumulative supply to register 12,472 hectare of land. Out of such figure, Bekasi, Karawang and Purwakarta area holding 74%

proportion of industrial land distribution in Greater Jakarta area.

• Total cumulative demand in Q3 2019 is registered at 11,401 Ha, an insignificant growth of 0.90% QoQ, which is equivalent 101 hectare

of demand. In terms of annual figure, annual demand grew by 1.4% or 154 hectare of land. Some business sectors driving industrial land

demand include textile, consumer goods, steel, building material, automotive, electrical, and petrochemical, taking place mostly in Bekasi,

Karawang - Purwakarta and Cilegon.

Source : Leads Property Research

Industrial Land INDUSTRIAL

Supply Based on Location as of Q3 2019

Tangerang,

6%

Serang,

8%

Bekasi, 43%

Karawang & Purwakarta, 29%

Bogor, 1%

Jakarta, 7% Cilegon, 6%

The industrial land supply distributions in Jakarta & Greater Jakarta are still predominantly at Bekasi with 43% of the total supply and

following on the second domination by Karawang & Purwakarta regions with 29% of the total supply. While the remaining is contributed by

Serang (8%), Jakarta (7%), Cilegon (6%), Tangerang (6%), and Bogor only 1%.

*Cumulative supply include existing (ready-to-build land) and future supply that already offered to the market.

Source : Leads Property Research

Industrial Land INDUSTRIAL

Market Statistics By Location as of Q3 2019

Average Land Price

Location Land Absorption Rate

IDR/sqm USD/sqm

Bekasi 93.31% 2,875,000 202.84

Bogor 84.86% 2,500,000 176.38

Cilegon 91.74% 2,000,000 141.10

Jakarta 99.73% 5,750,000 405.67

Karawang & Purwakarta 84.78% 2,240,834 158.09

Serang 81.52% 2,000,000 141.10

Tangerang 96.20% 2,466,667 174.03

Average 91.31% 2,746,000 193.74

Exchange Rate USD 1 = Rp 14,174

• As depicted in the picture, industrial land price tend to stabilize. Landlords would prefer maintaining land price as most of them still have

land bank yet to be developed. During Q3 2019, price of industrial land achieved IDR 2,746,000 psm, or an insignificant correction of

0.18%.

• Such correction occurred as industrial complex in Jakarta and Cilegon offered their new phase of industrial land selling at competitive price

that is lower than average market price.

Source : Leads Property Research

Industrial Land INDUSTRIAL

Price Based on Location as of Q3 2019

Bekasi Bogor Cilegon Jakarta Karawang & Purwakarta Serang Tangerang

7,000,000

6,000,000

5,000,000

4,000,000

IDR psm

3,000,000

2,000,000

1,000,000

-

2015 2016 2017 2018 Q1 2019 Q2 2019 Q3 2019

Source : Leads Property Research

Summary INDUSTRIAL

Industrial Market of Jakarta & Greater Jakarta as of Q3 2019

Q2 2018 Y-o-Y Q3 2019 Q-o-Q Q2 2019

Total Stock Cumulative (ha)* 11,496 12,472 12,376

Land Absorption 85.47% 91.31% 91.30%

IDR 2,718,000 IDR 2,746,000 IDR 2,708,000

Average Land Price

USD 182.06 USD 193.74 USD 191.85

Exchange Rate USD 1 = Rp14,174 (Q3 2019)

*Cumulative supply include existing (ready-to-build land) and future supply that already offered to the market.

Source : Leads Property Research

Outlook INDUSTRIAL

Industrial Market of Jakarta as of Q3 2019

Market Outlook

As Indonesian’s economy is predicted to experience low figure of economic growth of 4.9% by

Insignificant 2020*, industrial sector might undergo further pressure. Land absorption in 2020 is expected to

Demand be lesser than 2019 as industrialists might not expand. The impact of global economic slow-

Decrease down might bring industrialists to reduce production, hence, export activities are potential to be

more limited as well.

The result of the election implies that the on-going infrastructure program will continue on, which

will bring positive climate to industrial sectors. Infrastructures development e.g. Jakarta-

Stock Increase Cikampek Elevated Tollway, Cibitung- Cilincing Tollway (part of JORR 2), and Patimban Port are

expected to lure industrialist to have their existence along- and-nearby such infrastructures,

hence, it would bring more demand of industrial land in some regions.

Such correction occurred as an industrial complex in Jakarta and Cilegon as they offered their

Price Stable new phase of industrial land selling at competitive price that is lower than average market price.

However, the average asking price of industrial land is predicted to be stable.

Source : Leads Property Research

INDUSTRIAL

THANK YOU

Leads Property Research | Jakarta Property Market Q3 2019

Das könnte Ihnen auch gefallen

- Jakarta Greater Jakarta Industrial Market Update - Q3 2019 - V2 PDFDokument14 SeitenJakarta Greater Jakarta Industrial Market Update - Q3 2019 - V2 PDFEka Esti SusantiNoch keine Bewertungen

- 2022 Kiic Presentaion EnglishDokument25 Seiten2022 Kiic Presentaion EnglishDina YuniarNoch keine Bewertungen

- Innovative Financing To Support Massive Toll Road DevelopmentDokument10 SeitenInnovative Financing To Support Massive Toll Road DevelopmentFREE FOR FREEDOMNoch keine Bewertungen

- Pt. Sun Kusuma Wijaya: General Contractor Dan DeveloperDokument14 SeitenPt. Sun Kusuma Wijaya: General Contractor Dan Developerediheryanto1933Noch keine Bewertungen

- International Seminar KOREADokument31 SeitenInternational Seminar KOREAyurie dillahNoch keine Bewertungen

- Indian Institute of Technology Kharagpur Kharagpur, West Bengal 721302Dokument28 SeitenIndian Institute of Technology Kharagpur Kharagpur, West Bengal 721302Bipradip BiswasNoch keine Bewertungen

- Civil Shelter Sinohydro-AaDokument1 SeiteCivil Shelter Sinohydro-AaSyach FirmNoch keine Bewertungen

- Grand Rebana Industrial CityDokument31 SeitenGrand Rebana Industrial Citym.hanan0705Noch keine Bewertungen

- Smartpolitan Brochure enDokument15 SeitenSmartpolitan Brochure enRockyBloomNoch keine Bewertungen

- PT Summarecon Agung TBK: September 2018Dokument28 SeitenPT Summarecon Agung TBK: September 2018MUHAMMAD THARIQ AZIZNoch keine Bewertungen

- Gudang Kuning - Floor PlanDokument1 SeiteGudang Kuning - Floor PlanSyach FirmNoch keine Bewertungen

- Fintech Park BrochureDokument6 SeitenFintech Park BrochureAkshay sharmaNoch keine Bewertungen

- Net Manufacting Unit Rs. 11.25 Million Mar-2022Dokument19 SeitenNet Manufacting Unit Rs. 11.25 Million Mar-2022Waqas BukhariNoch keine Bewertungen

- Report Vineet 7semDokument86 SeitenReport Vineet 7semvineet aalwaniNoch keine Bewertungen

- TBA TBA: Pt. Fiper IndonesiaDokument1 SeiteTBA TBA: Pt. Fiper IndonesiaSyach FirmNoch keine Bewertungen

- CV Rizal Bachtiar PDFDokument3 SeitenCV Rizal Bachtiar PDFRizal BachtiarNoch keine Bewertungen

- Ru Nit 1819 NadDokument69 SeitenRu Nit 1819 NadPrashamNoch keine Bewertungen

- Ayush DAADokument2 SeitenAyush DAARanbhir KapoorNoch keine Bewertungen

- PT Summarecon Agung TBK: January 2019Dokument28 SeitenPT Summarecon Agung TBK: January 2019candra_sugiantoNoch keine Bewertungen

- Gathergates - Panel MakerDokument16 SeitenGathergates - Panel Makerwali sakit tak berdarahNoch keine Bewertungen

- Laporan CSS Valve CheckDokument4 SeitenLaporan CSS Valve CheckpurwowicaksonorizkyNoch keine Bewertungen

- Electrical Fittings Manufacturing Unit Rs. 5.61 Million Dec-2017Dokument18 SeitenElectrical Fittings Manufacturing Unit Rs. 5.61 Million Dec-2017OSAMANoch keine Bewertungen

- Fs Idxtechno 2023 08Dokument3 SeitenFs Idxtechno 2023 08Rian Haris SNoch keine Bewertungen

- Testing & Examination of Lifting Machinery, Lifting Tackles and Pressure VesselsDokument2 SeitenTesting & Examination of Lifting Machinery, Lifting Tackles and Pressure VesselsRamaraju RNoch keine Bewertungen

- PT Summarecon Agung TBK: A Company PresentationDokument27 SeitenPT Summarecon Agung TBK: A Company PresentationFerdi HuangNoch keine Bewertungen

- "Construction of Building": A Practical Training Report ONDokument58 Seiten"Construction of Building": A Practical Training Report ONLokesh K100% (1)

- Company Profile DkCE (English)Dokument39 SeitenCompany Profile DkCE (English)fikoh dewiNoch keine Bewertungen

- KATALOG HI GARD RICWIL 2019 Dikompresi - Reduce MinDokument32 SeitenKATALOG HI GARD RICWIL 2019 Dikompresi - Reduce MinDeden MardiansyahNoch keine Bewertungen

- Achmad Zainullah: ProjectsDokument13 SeitenAchmad Zainullah: ProjectsArie RitongaNoch keine Bewertungen

- Clay Bricks Manufactruing Kiln Zigzag Technology Rs. 33.74 Million Jun-2021Dokument21 SeitenClay Bricks Manufactruing Kiln Zigzag Technology Rs. 33.74 Million Jun-2021ABDUL BASITNoch keine Bewertungen

- MTC Spiral Duct New KitchenDokument4 SeitenMTC Spiral Duct New KitchenSyach FirmNoch keine Bewertungen

- P (Anssonic Frant Pages A PROJECT REPORTDokument4 SeitenP (Anssonic Frant Pages A PROJECT REPORTsatyam computersNoch keine Bewertungen

- Front SectionDokument8 SeitenFront SectionPreet ChahalNoch keine Bewertungen

- P1C2 PDFDokument1 SeiteP1C2 PDFfaizaltanjungNoch keine Bewertungen

- Potongan: Pondok Indah Mall 3 & Office TowerDokument1 SeitePotongan: Pondok Indah Mall 3 & Office TowerfaizaltanjungNoch keine Bewertungen

- BPJTDokument26 SeitenBPJTMartin Darma SetiawanNoch keine Bewertungen

- ITR Report FormatDokument9 SeitenITR Report FormatKill YouNoch keine Bewertungen

- To Study The Trading Process On Stock Market: DeclarationDokument7 SeitenTo Study The Trading Process On Stock Market: DeclarationSneha SinghNoch keine Bewertungen

- 2013HW70753-EndSemReport-Sagar AgrawalDokument56 Seiten2013HW70753-EndSemReport-Sagar AgrawalSouravDasNoch keine Bewertungen

- Shop Dwg-Top PlateDokument1 SeiteShop Dwg-Top PlateSyach FirmNoch keine Bewertungen

- Kkkssnene 555Dokument2 SeitenKkkssnene 555Abhishek SharmaNoch keine Bewertungen

- Kertajati Industrial Estate MajalengkaDokument8 SeitenKertajati Industrial Estate MajalengkabimobimoprabowoNoch keine Bewertungen

- Topic 2 Sistem ScadaDokument13 SeitenTopic 2 Sistem ScadaFebian TomyNoch keine Bewertungen

- A ON Industrial Training On "Python Programming" Taken atDokument32 SeitenA ON Industrial Training On "Python Programming" Taken atGumit RathoreNoch keine Bewertungen

- Et Nit 1920 015Dokument15 SeitenEt Nit 1920 015DEEPA BAGNoch keine Bewertungen

- Software House Rs. 6.80 Million Jun-2018Dokument17 SeitenSoftware House Rs. 6.80 Million Jun-2018Nauman QureshiNoch keine Bewertungen

- Gudang Minyak Rev.02-IsoDokument1 SeiteGudang Minyak Rev.02-IsoSyach FirmNoch keine Bewertungen

- Digital FarmingDokument3 SeitenDigital FarmingTeobelliniNoch keine Bewertungen

- Bicycle Parts Manufacturing Unit CarrierDokument17 SeitenBicycle Parts Manufacturing Unit CarrierAftabunarNoch keine Bewertungen

- Invoice: EH/IMP21-41113Dokument3 SeitenInvoice: EH/IMP21-41113Angela Merici waruwuNoch keine Bewertungen

- Aerocity - Kertajati AirportDokument18 SeitenAerocity - Kertajati AirportPsetyadi HECJKTNoch keine Bewertungen

- BS It BWP 2ND 1e 1Dokument1 SeiteBS It BWP 2ND 1e 1Ali ShahNoch keine Bewertungen

- Smart Floor Cleaning Robot Using Android: Project Report ONDokument9 SeitenSmart Floor Cleaning Robot Using Android: Project Report ONShakib ShaikhNoch keine Bewertungen

- Water and Fireproof Cloth Manufacturing Unit Rs. 54.01 Million Feb-2021Dokument21 SeitenWater and Fireproof Cloth Manufacturing Unit Rs. 54.01 Million Feb-2021MUHAMMAD ARSLAN YASIN SUKHERANoch keine Bewertungen

- KOICA - Info Memo WR - Merangin & Bodri - Rev 5Dokument5 SeitenKOICA - Info Memo WR - Merangin & Bodri - Rev 5Sayembara Desain Rumah SubsidiNoch keine Bewertungen

- Akbar Imam Witjaksono: Education SkillsDokument10 SeitenAkbar Imam Witjaksono: Education SkillsAkbar Imam WitjaksonoNoch keine Bewertungen

- E Presale Brochure Caslano ParkDokument9 SeitenE Presale Brochure Caslano ParkkholilNoch keine Bewertungen

- Tech Doc 18-250Dokument31 SeitenTech Doc 18-250BhanusriNoch keine Bewertungen

- Tugas TEKBANG IV (Abdul Halim N)Dokument36 SeitenTugas TEKBANG IV (Abdul Halim N)AdulNoch keine Bewertungen

- Developing Airport Systems in Asian Cities: Spatial Characteristics, Economic Effects, and Policy ImplicationsVon EverandDeveloping Airport Systems in Asian Cities: Spatial Characteristics, Economic Effects, and Policy ImplicationsNoch keine Bewertungen

- Database Sipil 09 UpdateDokument20 SeitenDatabase Sipil 09 UpdateWidi NugrahaNoch keine Bewertungen

- Nilai Tugas Dasar k3Dokument6 SeitenNilai Tugas Dasar k3LastiarSPSianturiNoch keine Bewertungen

- DB Intermark BSDDokument14 SeitenDB Intermark BSDIwan Piana100% (1)

- Mitra 10 CibuburDokument62 SeitenMitra 10 CibubursuarditayasaNoch keine Bewertungen

- Electronic City Indonesia Annual Report 2014 Company Profile ECII Indonesia InvestmentsDokument195 SeitenElectronic City Indonesia Annual Report 2014 Company Profile ECII Indonesia InvestmentsAry PandeNoch keine Bewertungen

- Draft Usulan Lokasi CBT d3 Radiologi-1 (1) - 1Dokument6 SeitenDraft Usulan Lokasi CBT d3 Radiologi-1 (1) - 1Isra AndhikaNoch keine Bewertungen

- Resi Pengiriman Sheika HijabDokument17 SeitenResi Pengiriman Sheika HijabMOBA VICTORYNoch keine Bewertungen

- Sales ReportDokument36 SeitenSales ReportsaidfachmiNoch keine Bewertungen

- Perumahan Emerald Cilebut Dan CibinongDokument41 SeitenPerumahan Emerald Cilebut Dan Cibinongaria kharsa negaraNoch keine Bewertungen

- Referensi Proyek: Taman Anggrek Projects ResidenceDokument8 SeitenReferensi Proyek: Taman Anggrek Projects Residencebrot tamaNoch keine Bewertungen

- Label Raport SMK Gema KasaDokument27 SeitenLabel Raport SMK Gema Kasamts. miftahulhudaNoch keine Bewertungen

- List Influencer Somebymi AyieDokument11 SeitenList Influencer Somebymi AyieNurfatma SaryNoch keine Bewertungen

- Penjualan Sales 1650975283732Dokument27 SeitenPenjualan Sales 1650975283732Muhammad SeptiantoNoch keine Bewertungen

- Format Import MasterDokument1.226 SeitenFormat Import Masterdeni wardimanNoch keine Bewertungen

- Daftar Peserta Gel 2 (12.30-14.30)Dokument6 SeitenDaftar Peserta Gel 2 (12.30-14.30)Ashar PrayogaNoch keine Bewertungen

- BKPM&IIPC Presentation KOIF Juni 2015Dokument48 SeitenBKPM&IIPC Presentation KOIF Juni 2015mza.arifin100% (1)

- Perkiraan Waktu Kedatangan Banjir Berdasarkan Analisis Empirik Rekaman Data Sistem Peringatan Dini Banjir Kota BekasiDokument8 SeitenPerkiraan Waktu Kedatangan Banjir Berdasarkan Analisis Empirik Rekaman Data Sistem Peringatan Dini Banjir Kota BekasiSanti SariNoch keine Bewertungen

- List Provider BNI LifeDokument241 SeitenList Provider BNI LifeAbeNoch keine Bewertungen

- Merchant PayTren QRDokument17 SeitenMerchant PayTren QRDenriizkii ArifNoch keine Bewertungen

- Profil LRT Kirim Ke CorsecDokument29 SeitenProfil LRT Kirim Ke CorsecPutra R V Siahaan100% (1)

- JFest Chart (OneStopInfo Indonesian JFest)Dokument17 SeitenJFest Chart (OneStopInfo Indonesian JFest)Ari CakraNoch keine Bewertungen

- Sertifikat Covid-19 Sesi 2 Kabupaten BekasiDokument38 SeitenSertifikat Covid-19 Sesi 2 Kabupaten BekasiKiky Aristiana NugrahaNoch keine Bewertungen

- Final Exam LAW - Kezia - ENV17 PDFDokument7 SeitenFinal Exam LAW - Kezia - ENV17 PDFKezia KusumaningtyasNoch keine Bewertungen

- BSDE Annual Report 2018Dokument38 SeitenBSDE Annual Report 2018Furqon MuhammadNoch keine Bewertungen

- Daftar Industrial EstatesDokument2 SeitenDaftar Industrial EstatesKepo DehNoch keine Bewertungen

- Curriculum Vitae: Personal DetailsDokument7 SeitenCurriculum Vitae: Personal Detailszikrillah1Noch keine Bewertungen

- Ookla Rev2Dokument406 SeitenOokla Rev2AdheNoch keine Bewertungen

- EDIT Lampiran 2 Data Individu PUSKESMASDokument159 SeitenEDIT Lampiran 2 Data Individu PUSKESMASRuang Bersalin PKC Johar BaruNoch keine Bewertungen

- WPDT ExportDokument123 SeitenWPDT ExportryanmarestahadiNoch keine Bewertungen

- JMA Planned Urban SprawlDokument10 SeitenJMA Planned Urban SprawlBayu WirawanNoch keine Bewertungen