Beruflich Dokumente

Kultur Dokumente

IMAC (ACC2008) Syllabus SEM 1 18-19

Hochgeladen von

Debbie DebzOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

IMAC (ACC2008) Syllabus SEM 1 18-19

Hochgeladen von

Debbie DebzCopyright:

Verfügbare Formate

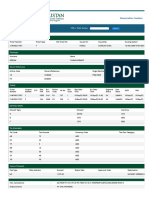

UNIVERSITY OF TECHNOLOGY, JAMAICA

SYLLABUS OUTLINE

COLLEGE : Business and Management

SCHOOL : Business Administration

COURSE OF STUDY : Bachelor of Business Administration

Bachelor of Science in Economics

Bachelor of Science in Child & Adolescent Development

Bachelor of Science in Actuarial Science

LEVEL : Two (2)

MODULE TITLE : Introduction to Management Accounting

MODULE CODE : ACC2008

DURATION (Hours) : 45 hours

CREDIT VALUE : Three (3) credits

PREREQUISITES : None

1.0 MODULE DESCRIPTION

The objective of this module is to provide an understanding of accounting as an aid to

decision making, controlling, planning and monitoring. The module introduces students

to management accounting principles which are used to make and support decisions.

Emphasis will be placed on developing a structured approach to cost and revenue

analysis, problem solving and the preparation of management reports.

2.0 GENERAL OBJECTIVES

Upon the completion of this module, students should:

2.1 understand how information is used to assist managers in making decisions.

2.2 know the different methods of classifying costs to meet the diverse information

needs of stakeholders in an organization.

2.3 understand the importance of budget preparation and its effect on the overall

operation of the organization and in performance evaluation.

2.4 evaluate the information required for making short-term decisions based on

resource constraints, idle capacity and organizational expertise

2.5 analyze actual costs with standard costs and analyze any variances

3.0 MODULE OBJECTIVES/LEARNING OUTCOMES

Unit 1 – Introduction to Cost and Management Accounting (3 hours)

Specific Objectives

Upon the completion of this module, students should be able to:

3.1.1 distinguish data from information.

3.1.2 explain the attributes of good information.

3.1.3 outline the managerial processes of planning, decision making and control.

Introduction to Management Accounting (ACC2008) Syllabus – July 2015 1

3.1.4 describe the purpose and role of cost and management accounting within

organization’s management information system.

3.1.5 compare and contrast financial accounting and managerial accounting

3.1.6 explain the limitations of management information in providing guidance for

managerial decision making

Module content and context

Accounting for management

Management accounting versus financial accounting

Qualitative characteristics of good information

Unit 2 – Cost Classification ( 3 hours)

Specific Objectives

Upon the completion of this module, students should be able to:

3.2.1 define cost.

3.2.2 define the concepts ‘cost object’ and ‘cost unit’.

3.2.3 explain classifications used in the analysis of product/service costs, including by

function, timing and charges against sales, traceability, behaviour, and relevance

to planning, controlling and decision making.

3.2.4 distinguish between production cost and non-production cost when valuing output

and inventories.

3.2.5 select the appropriate classification for a given cost or a group of costs.

3.2.6 provide examples of the different classifications of cost.

3.2.7 illustrate through the use of charts the classification of product/service costs.

3.2.8 compute total cost based on particular classification from a list of cost.

3.2.9 calculate conversion costs and prime costs.

3.2.10 Explain the concepts of controllable and uncontrollable costs.

Module content and context

Management functions

Timing and charges against sales

Traceability

Relevance to planning, controlling and decision making

Behaviour

Introduction to Management Accounting (ACC2008) Syllabus – July 2015 2

Unit 3 – Cost Behaviour and Cost Estimation (6 hours)

Specific Objectives

Upon the completion of this module, students should be able to:

3.3.1 describe linear cost behaviour.

3.3.2 identify the behaviour of cost on a total basis and on a per unit basis.

3.3.3 illustrate graphically the different types of cost behaviour on a per unit basis and

on a total basis.

3.3.4 provide examples of cost which falls within the categories of fixed, variable,

semi-variable and step.

3.3.5 identify non-linear cost behaviour.

3.3.6 graphically represent non-linear cost behaviour.

3.3.7 choose cost behaviour patterns which relate to real world situations.

3.3.8 identify the five methods for estimating cost.

3.3.9 explain the advantages and disadvantages of the five methods of cost estimation.

3.3.10 choose the cost estimation method which is most advantageous for a given

situation.

3.3.11 estimate variable cost, fixed cost and total cost using the high-low method.

3.3.12 compute a cost function using regression analysis.

3.3.13 calculate the coefficient of determination test of reliability.

3.3.14 interpret the coefficient of determination.

3.3.15 evaluate methods for the analysis of costs into fixed and variable components.

Module content and context

Cost Behaviour

- Linear cost behaviour

- Non-linear cost behaviour

Cost Estimation

- High-Low method

- Scattered Graph method

- Regression or least square method

- Account analysis

- Engineering analysis

Unit 4 – Budgeting (9 hours)

Specific Objectives

Upon the completion of this module, students should be able to:

3.4.1 explain why organizations use budgeting.

3.4.2 explain the administrative procedures used in the budgeting process.

3.4.3 describe the stages in the budgeting process.

3.4.4 explain the following types of budgets: zero-based, activity-based, incremental,

master, and flexible.

3.4.5 identify the major components of the master budget.

Introduction to Management Accounting (ACC2008) Syllabus – July 2015 3

3.4.5 prepare the master budget (operating and financial budgets) for manufacturing

and non-manufacturing entities.

3.4.6 explain the relevance of cash budgeting as a planning tool to aid in the

coordination of business activities.

3.4.7 explain the importance of flexible budget

3.4.8 explain the advantages and disadvantages of budgeting

3.4.9 flex a budget to a given level of volume

3.4.10 calculate simple variance between flexed budget, fixed budget and actual

3.4.11 apply the concept of budgeting to our lives.

Module content and context

Nature and purpose of budgeting

Types of budget

- Zero-based budget (Theory only)

- Activity-based budget (Theory only)

- Incremental budget (Theory only)

- Master budget

Unit 5 – Cost Volume Profit Analysis ( 6 hours)

Specific Objectives

Upon the completion of this module, students should be able to:

3.5.1 explain the nature of CVP analysis.

3.5.2 identify assumptions of CVP analysis.

3.5.3 state the uses of CVP analysis in terms of planning and decision-making

situations.

3.5.4 calculate contribution margin ratio and variable cost ratio.

3.5.5 calculate the breakeven point for a single product and for more than one product.

3.5.6 compute safety margin for a single product and for more than one product.

3.5.7 explain an entity’s safety margin.

3.5.8 calculate budgeted sales volume required for a given target net income.

3.5.9 explain how cost-volume-profit aids in decision making.

3.5.10 illustrate with the aid of breakeven charts the break-even point.

3.5.11 present their findings orally, relating to a cost volume profit analysis.

Module content and context

Single product analysis and multi-product analysis

- Uses

- Assumptions

- Breakeven point

- Margin of safety

- Target profit before taxes and after taxes

- Sales mix

- Ratios

- Breakeven charts

Introduction to Management Accounting (ACC2008) Syllabus – July 2015 4

Unit 6 – Marginal Costing and Decision Making (6 hours)

Specific Objectives

Upon the completion of this module, students should be able to:

3.6.1 explain the concept of relevant cost

3.6.2 distinguish between relevant and irrelevant information using appropriate criteria.

3.6.3 explain the use of incremental and opportunity costs in decision-making.

3.6.4 apply relevant costing principles to make or buy sourcing decisions, special order

decisions.

3.6.5 specify the qualitative factors which are relevant to make or buy decisions, special

order decisions.

3.6.6 calculate solutions to problems involving changes in product mix, and/or

discontinued products or departments.

3.6.7 identify limiting factors in a scarce situation

3.6.7 illustrate the impact of limiting factors on the decision making process.

3.6.8 determine the optimal production plan where an organisation is restricted by a

single limiting factor.

Module content and context

Special order

Make or buy

Limiting factor

Discontinuation of product line or department

Unit 7 - Standard Costing and Variance Analysis ( 6 hours)

Specific Objectives

Upon the completion of this module, students should be able to:

3.7.1 define standard cost

3.7.2 explain the purpose and principles of standard costing

3.7.3 outline the uses, features and limitations of standard costing.

3.7.4 explain how standards are developed.

3.7.5 calculate variances for materials, labour and variable overheads variances.

3.7.6 interpret the causes of variances, their inter-relationship with each other and their

relevance to management.

Module content and context

Standard costing purpose and principles

Variance analysis

- Material

- Labor

- Variable overhead

Introduction to Management Accounting (ACC2008) Syllabus – July 2015 5

4.0 LEARNING AND TEACHING APPROACHES

Unit Content Teaching/Learning Strategy

Introduction to Cost and lecture, think-pair-share, discussion, You Tube

1 Management Accounting presentation

2 Cost Classification lecture, peer tutoring, problem solving, game

Cost Behavior and Cost lecture, presentations, problem solving, Case study

3 Estimation presentation, You Tube presentation

4 Budgeting lecture, Quiz, problem solving

5 Cost Volume Profit Analysis lecture, Case study presentations, problem solving

Marginal Costing and Decision lecture, Quiz, peer discussion, peer tutoring, You tube

6 Making presentation

Standard Costing and Variance lecture, Quiz, problem solving

7 Analysis

5.0 BREAKDOWN OF HOURS

Lecture 13 hours

Tutorial 26 hours

Assessment 6 hours

6.0 TEXTBOOKS AND REFERENCES

Required Text:

Drury, C. (2014). Management and cost accounting (9th ed.). London, UK: Cengage

Learning EMEA.

Recommended Text:

Horngren, C.T., Sundem, G.L., Stratton,W.O., Burgstahler, D., & Schatzberg, J. (2012).

Introduction to management accounting (16th ed.). Boston, Massachesetts:

Prentice Hall

Additional Reading:

ACCA paper F2: Management accounting. (2015). London, UK: BPP Learning Media.

ACCA paper F5: Performance management (2015). London, UK: BPP Learning Media.

ACCA Global. (n.d.). Exam Resources. Retrieved from:

http://www.accaglobal.com/an/en/student/exam-support-resources.html

Module information can be found on UTech Online: “Introduction to Management

Accounting”

Moodle password: ACC2008

Introduction to Management Accounting (ACC2008) Syllabus – July 2015 6

8.0 SYLLABUS DEVELOPER(S) & REVIEWER(S)

Errol Brandford

Deonette McInnis-Lambert (1st Revision – 2010)

Carlinton Montgomery (2nd Revision -2012)

James McNish, Mark Jackson and Roger Brown (3rd Revision- July 2014)

James McNish, Deonette McInnis-Lambert, Mark Jackson, Kerwin Hamil (4th Revision-

July 6, 2015)

*Objectives from the cognitive domain and the module context were mirrored from

ACCA F2 – Management Accounting

9.0 APPROVAL

Programme Director (PD): Deonette McInnis-Lambert Signature _____________

College Curriculum Committee: Celia McKoy Signature______________

10.0 ACCEPTANCE BY OFFICE OF CURRICULUM DEVELOPMENT &

EVALUATION (OCDE)

Officer________________________________ Date: ____________________

Introduction to Management Accounting (ACC2008) Syllabus – July 2015 7

Das könnte Ihnen auch gefallen

- Cost and Management Accounting - Course OutlineDokument9 SeitenCost and Management Accounting - Course OutlineJajJay100% (1)

- ACC350 Outline FinalDokument12 SeitenACC350 Outline FinalHamza AsifNoch keine Bewertungen

- Acctg 202 - Module 1 - Strategic Cost ManagementDokument47 SeitenAcctg 202 - Module 1 - Strategic Cost ManagementMaureen Kaye PaloNoch keine Bewertungen

- Sem2 Core SyllabusDokument19 SeitenSem2 Core SyllabusNIMISHA DHAWANNoch keine Bewertungen

- Course Outllin MA English Final - Docx2021Dokument3 SeitenCourse Outllin MA English Final - Docx2021islam hamdyNoch keine Bewertungen

- Fundamentals of Management AccountingDokument484 SeitenFundamentals of Management AccountingMorick Gibson Mwasaga100% (9)

- LT 4. Cost and Management AccountingDokument79 SeitenLT 4. Cost and Management AccountingEalshady HoneyBee Work ForceNoch keine Bewertungen

- Syllabus GM3 MM5004 Operations ManagementDokument23 SeitenSyllabus GM3 MM5004 Operations ManagementFiqriNoch keine Bewertungen

- Ma IIDokument1 SeiteMa IIANoch keine Bewertungen

- Accounting III ACCT 1120: Metropolitan Community College Course Outline FormDokument5 SeitenAccounting III ACCT 1120: Metropolitan Community College Course Outline FormHumberto Romero ZecuaNoch keine Bewertungen

- CIMA-Gateway Section B - Self Study GuideDokument10 SeitenCIMA-Gateway Section B - Self Study GuideimmranlakhaniNoch keine Bewertungen

- Update Syllabus Advanced Cost & Management Accounting Gasal 2019Dokument8 SeitenUpdate Syllabus Advanced Cost & Management Accounting Gasal 2019rief1010Noch keine Bewertungen

- Managerial Economics: (The Course Guide) The NeedDokument72 SeitenManagerial Economics: (The Course Guide) The NeedKintu GeraldNoch keine Bewertungen

- Global-Strategy-And-Leadership Subject OutlineDokument5 SeitenGlobal-Strategy-And-Leadership Subject Outlinedonna14Noch keine Bewertungen

- Toulouse Business School: C O U R S E C O N T E N TDokument28 SeitenToulouse Business School: C O U R S E C O N T E N TlocoNoch keine Bewertungen

- Managerial EconomicsDokument3 SeitenManagerial EconomicsMar BelayNoch keine Bewertungen

- ManacDokument3 SeitenManacMark Anthony ManarangNoch keine Bewertungen

- BKAM2013 - SyllabusDokument4 SeitenBKAM2013 - SyllabusDik Rei ChooNoch keine Bewertungen

- OM Study Guide Lessons 1-12Dokument122 SeitenOM Study Guide Lessons 1-12bingyang75% (4)

- Dokumen - Pub Cost and Management Accounting I 9789387572423 9387572420Dokument748 SeitenDokumen - Pub Cost and Management Accounting I 9789387572423 9387572420Sie Humas Septia Ardianti100% (1)

- Syllabus Akuntansi Manajemen (Management Accounting) ECAU 602103 Even Semester 2018/2019 No. Lecturers E-MailDokument6 SeitenSyllabus Akuntansi Manajemen (Management Accounting) ECAU 602103 Even Semester 2018/2019 No. Lecturers E-Mailwuri nugrahaniNoch keine Bewertungen

- Bule Hora University Collage of Business and Economics Department of Accounting and FinanceDokument4 SeitenBule Hora University Collage of Business and Economics Department of Accounting and Financenahu tube100% (1)

- 2030 - ACC2008 - Management Accounting and Control - Module Profile - Students - 9 May 2021Dokument8 Seiten2030 - ACC2008 - Management Accounting and Control - Module Profile - Students - 9 May 2021JJ FrystNoch keine Bewertungen

- BFIA 2nd SEM COREDokument6 SeitenBFIA 2nd SEM COREChetan SinghNoch keine Bewertungen

- FM NotesDokument25 SeitenFM NotesNidheena K SNoch keine Bewertungen

- Course Code: Course Name: Course Description:: UC-VPAA-COA-SYL-53 September 17, 2012.rev.1Dokument8 SeitenCourse Code: Course Name: Course Description:: UC-VPAA-COA-SYL-53 September 17, 2012.rev.1Annie EinnaNoch keine Bewertungen

- Global Strategy and Leadership: Cpa Program Su Bjec T Ou TlineDokument6 SeitenGlobal Strategy and Leadership: Cpa Program Su Bjec T Ou Tlinesantoshcal3183Noch keine Bewertungen

- Syllabus Akuntansi Manajemen (Management Accounting) ECAU 602103 Even Semester 2016/2017Dokument6 SeitenSyllabus Akuntansi Manajemen (Management Accounting) ECAU 602103 Even Semester 2016/2017Zefanya Artha ValenciaNoch keine Bewertungen

- Book 7: Management Accounting ApplicationsDokument80 SeitenBook 7: Management Accounting Applicationsinfo m-alamriNoch keine Bewertungen

- Course Outline Aacsb Mba 611 Management AccountingDokument6 SeitenCourse Outline Aacsb Mba 611 Management AccountingNishant TripathiNoch keine Bewertungen

- Managerial Accounting STANDARD PDFDokument0 SeitenManagerial Accounting STANDARD PDFMichael YuNoch keine Bewertungen

- GB519 Course PreviewDokument11 SeitenGB519 Course PreviewNatalie ConklinNoch keine Bewertungen

- Chapter 6Dokument18 SeitenChapter 6Jesus ObligaNoch keine Bewertungen

- Managerial Economics BookDokument150 SeitenManagerial Economics BookAbdo Bunkari100% (1)

- Maintenance Management FrameworkDokument6 SeitenMaintenance Management FrameworkKevin Eduardo Acosta BetancourtNoch keine Bewertungen

- International Pricing and Performence Module GuideDokument26 SeitenInternational Pricing and Performence Module GuidebarnaNoch keine Bewertungen

- Module Handbook: Module Title Managerial FinanceDokument12 SeitenModule Handbook: Module Title Managerial FinanceReswinNoch keine Bewertungen

- Principles of Management Accounting-Muhammad Junaid Ashraf & Abdul RaufDokument8 SeitenPrinciples of Management Accounting-Muhammad Junaid Ashraf & Abdul RaufAnonymous qAegy6GNoch keine Bewertungen

- Managerial Economics, Course OutlineDokument3 SeitenManagerial Economics, Course OutlineKaleab EnyewNoch keine Bewertungen

- MA2 Student SyllabusDokument5 SeitenMA2 Student SyllabusNaaNoch keine Bewertungen

- ME COURSE PACK 2019 - Managerial EconomicsDokument13 SeitenME COURSE PACK 2019 - Managerial EconomicsABHINANDAN GHOSH 1927401Noch keine Bewertungen

- Silabus Cost Acc MonikaDokument5 SeitenSilabus Cost Acc MonikaDinda RcNoch keine Bewertungen

- Cost and Management Accounting IIDokument3 SeitenCost and Management Accounting IIfirewNoch keine Bewertungen

- Co. OutlineDokument3 SeitenCo. Outlineyiberta69Noch keine Bewertungen

- BHM 303 Managerial EconomicsDokument131 SeitenBHM 303 Managerial EconomicsGiri PrasadNoch keine Bewertungen

- 203 Paper 5part CDokument94 Seiten203 Paper 5part CIjaz MohammedNoch keine Bewertungen

- N. Cruz-Course Material For Strategic Cost ManagementDokument134 SeitenN. Cruz-Course Material For Strategic Cost ManagementEmmanuel VillafuerteNoch keine Bewertungen

- Lecturenote - 875129059cost and Managerial Accounting IDokument180 SeitenLecturenote - 875129059cost and Managerial Accounting Iwakgaricosc09100% (2)

- Course Outline, Learning Objectives and Student Outcomes: Accounting Pilot & Bridge ProjectDokument13 SeitenCourse Outline, Learning Objectives and Student Outcomes: Accounting Pilot & Bridge Projectluna smithNoch keine Bewertungen

- Course Outline, Learning Objectives and Student Outcomes: Accounting Pilot & Bridge ProjectDokument13 SeitenCourse Outline, Learning Objectives and Student Outcomes: Accounting Pilot & Bridge Projectluna smithNoch keine Bewertungen

- Syllabus in Cost ManagementDokument9 SeitenSyllabus in Cost ManagementChristine LealNoch keine Bewertungen

- CP1 - Syllabus - Final ProofDokument9 SeitenCP1 - Syllabus - Final ProofMoon MoonNoch keine Bewertungen

- Syllabus 2Dokument5 SeitenSyllabus 2KiM Mather MarshallsNoch keine Bewertungen

- PM S24-J25 Syllabus and Study Guide - FinalDokument17 SeitenPM S24-J25 Syllabus and Study Guide - FinalMyo NaingNoch keine Bewertungen

- Introduction To Ops MGT-BSACF - (New)Dokument8 SeitenIntroduction To Ops MGT-BSACF - (New)Hashim MughalNoch keine Bewertungen

- Management Accounting - Costing and Budgeting (Edexcel)Dokument21 SeitenManagement Accounting - Costing and Budgeting (Edexcel)Nguyen Dac Thich100% (1)

- Mastering Opportunities and Risks in IT Projects: Identifying, anticipating and controlling opportunities and risks: A model for effective management in IT development and operationVon EverandMastering Opportunities and Risks in IT Projects: Identifying, anticipating and controlling opportunities and risks: A model for effective management in IT development and operationNoch keine Bewertungen

- Class Participation Grding RubricDokument1 SeiteClass Participation Grding RubricDebbie DebzNoch keine Bewertungen

- Back Injuries Nations 1 Workplace Safety ProblemDokument5 SeitenBack Injuries Nations 1 Workplace Safety ProblemDebbie DebzNoch keine Bewertungen

- How Is The Current Pandemic Impacting The Lives of Jamaicans?Dokument2 SeitenHow Is The Current Pandemic Impacting The Lives of Jamaicans?Debbie DebzNoch keine Bewertungen

- Module Description and OutlineDokument2 SeitenModule Description and OutlineDebbie DebzNoch keine Bewertungen

- Occupational Safety and HealthDokument87 SeitenOccupational Safety and HealthDebbie DebzNoch keine Bewertungen

- Briefly Explain Three Common Indicators of The Existence of Ergonomic ProblemsDokument1 SeiteBriefly Explain Three Common Indicators of The Existence of Ergonomic ProblemsDebbie DebzNoch keine Bewertungen

- Occupational Safety and HealthDokument252 SeitenOccupational Safety and HealthDebbie DebzNoch keine Bewertungen

- Course OutlineDokument2 SeitenCourse OutlineDebbie DebzNoch keine Bewertungen

- Article - The Role of HR in Handling Workplace BullyingDokument3 SeitenArticle - The Role of HR in Handling Workplace BullyingDebbie DebzNoch keine Bewertungen

- Article - The Role of HR in Handling Workplace BullyingDokument14 SeitenArticle - The Role of HR in Handling Workplace BullyingDebbie DebzNoch keine Bewertungen

- Article Review Grading RubricDokument1 SeiteArticle Review Grading RubricDebbie DebzNoch keine Bewertungen

- Article Review Guidelines and QuestionsDokument2 SeitenArticle Review Guidelines and QuestionsDebbie DebzNoch keine Bewertungen

- Article - The Role of HR in Handling Workplace Bullying To SummarizeDokument9 SeitenArticle - The Role of HR in Handling Workplace Bullying To SummarizeDebbie DebzNoch keine Bewertungen

- Add SubmissionDokument1 SeiteAdd SubmissionDebbie DebzNoch keine Bewertungen

- RubricDokument2 SeitenRubricDebbie DebzNoch keine Bewertungen

- GM Tutorial Sheet - SEM 2 2021-22Dokument4 SeitenGM Tutorial Sheet - SEM 2 2021-22Debbie DebzNoch keine Bewertungen

- Appendix B: Screener For Qualitative Focus Groups: NHTSA: Monroney Label Consumer Research ICR Focus Group ScreenerDokument3 SeitenAppendix B: Screener For Qualitative Focus Groups: NHTSA: Monroney Label Consumer Research ICR Focus Group ScreenerDebbie DebzNoch keine Bewertungen

- Safety Awareness - QuizDokument14 SeitenSafety Awareness - QuizDebbie DebzNoch keine Bewertungen

- Article - The Role of HR in Handling Workplace BullyingDokument14 SeitenArticle - The Role of HR in Handling Workplace BullyingDebbie DebzNoch keine Bewertungen

- Global Marketing: Ninth EditionDokument41 SeitenGlobal Marketing: Ninth EditionDebbie DebzNoch keine Bewertungen

- FinMan Unit 6 Lecture-Stock Valuation 2021 S1Dokument24 SeitenFinMan Unit 6 Lecture-Stock Valuation 2021 S1Debbie DebzNoch keine Bewertungen

- Assessment DatesDokument3 SeitenAssessment DatesDebbie DebzNoch keine Bewertungen

- GM Article Review InstructionsDokument2 SeitenGM Article Review InstructionsDebbie DebzNoch keine Bewertungen

- FinMan Unit 8 Lecture-Capital Budgeting 2021 S1Dokument29 SeitenFinMan Unit 8 Lecture-Capital Budgeting 2021 S1Debbie DebzNoch keine Bewertungen

- FM Unit 7 Lecture Notes - Cost of CapitalDokument2 SeitenFM Unit 7 Lecture Notes - Cost of CapitalDebbie DebzNoch keine Bewertungen

- Africa Continental Free Trade AreaDokument4 SeitenAfrica Continental Free Trade AreaDebbie DebzNoch keine Bewertungen

- FM Unit 8 Lecture Notes - Capital BudgetingDokument4 SeitenFM Unit 8 Lecture Notes - Capital BudgetingDebbie DebzNoch keine Bewertungen

- FinMan Unit 5 Lecture-Bond Valuation-2021 S1Dokument42 SeitenFinMan Unit 5 Lecture-Bond Valuation-2021 S1Debbie DebzNoch keine Bewertungen

- FM Unit 6 Lecture Notes - Stock ValuationDokument4 SeitenFM Unit 6 Lecture Notes - Stock ValuationDebbie DebzNoch keine Bewertungen

- FM Unit 7 Lecture Notes - Cost of CapitalDokument2 SeitenFM Unit 7 Lecture Notes - Cost of CapitalDebbie DebzNoch keine Bewertungen

- Dtlstictinf2020d2 enDokument36 SeitenDtlstictinf2020d2 enSarthak KanodiaNoch keine Bewertungen

- 305emm TQM May 2022 Assesment - 1656235593Dokument4 Seiten305emm TQM May 2022 Assesment - 1656235593Sourabh Sunil SinghNoch keine Bewertungen

- Akuntan SI Operasi Kantor CabangDokument31 SeitenAkuntan SI Operasi Kantor CabangIstiqlal RamadhanNoch keine Bewertungen

- CMMI AwarenessDokument14 SeitenCMMI Awarenessmadan1981Noch keine Bewertungen

- 202 Financial ManagementDokument2 Seiten202 Financial ManagementMeet LalchetaNoch keine Bewertungen

- Summary of Changes Sec. XDokument2 SeitenSummary of Changes Sec. XKHALED OSMANNoch keine Bewertungen

- Ticket Display - Pakistan AirlinesDokument2 SeitenTicket Display - Pakistan AirlinesAsimNoch keine Bewertungen

- Market SegmentationDokument2 SeitenMarket SegmentationHa Kieu AnhNoch keine Bewertungen

- Continual Service ImprovementDokument4 SeitenContinual Service ImprovementJosh AlmasiNoch keine Bewertungen

- AFA Animal Production9 Quarter 1 Module 2Dokument21 SeitenAFA Animal Production9 Quarter 1 Module 2Ramil F. AdubalNoch keine Bewertungen

- 5 - "S" System of HousekeepingDokument22 Seiten5 - "S" System of HousekeepingSn CarbonelNoch keine Bewertungen

- Profit & LossDokument12 SeitenProfit & Losskrish589748Noch keine Bewertungen

- EAT 340 UNIT 1 LESSON 3 & 5 - The Appraisal and Feasibility of Projects Study NotesDokument20 SeitenEAT 340 UNIT 1 LESSON 3 & 5 - The Appraisal and Feasibility of Projects Study NotesNhật DuyNoch keine Bewertungen

- Entrepreneurship 2Dokument21 SeitenEntrepreneurship 2Stephanie Nicole Pablo100% (1)

- Batch Manufacturing Record SwadeshiDokument7 SeitenBatch Manufacturing Record SwadeshiAnkurNoch keine Bewertungen

- Joint Product and by Product TestDokument10 SeitenJoint Product and by Product Testthatfuturecpa100% (1)

- Lecture 11 - Standards On Auditing (SA 540 and 550)Dokument7 SeitenLecture 11 - Standards On Auditing (SA 540 and 550)Harshit JainNoch keine Bewertungen

- 01Dokument24 Seiten01deepakkumar20002Noch keine Bewertungen

- Test For AuditDokument9 SeitenTest For AudittimathewosdawitNoch keine Bewertungen

- Week 6 MIL ABM3Dokument2 SeitenWeek 6 MIL ABM3Engene :LiftNoch keine Bewertungen

- Introduction To Basic Marketing - Chapter 1Dokument35 SeitenIntroduction To Basic Marketing - Chapter 1Seema MohammedNoch keine Bewertungen

- American Express - Management TraineeDokument2 SeitenAmerican Express - Management TraineeHarshNoch keine Bewertungen

- Simon Tracy - RPTM 210 Current Trends Paper 2Dokument5 SeitenSimon Tracy - RPTM 210 Current Trends Paper 2api-702986039Noch keine Bewertungen

- Eirseptember 2018Dokument2.927 SeitenEirseptember 2018IvyNoch keine Bewertungen

- Examen Final - Ingles Iv - TerminadoDokument3 SeitenExamen Final - Ingles Iv - TerminadoDavid CarbajalNoch keine Bewertungen

- Visual Merchandising Shoebox Store ProjectDokument2 SeitenVisual Merchandising Shoebox Store Projectarifa.ahmed311Noch keine Bewertungen

- RE Management: Source: Elizabeth Hull, Ken Jackson and Jeremy Dick, Requirements EngineeringDokument49 SeitenRE Management: Source: Elizabeth Hull, Ken Jackson and Jeremy Dick, Requirements EngineeringAB PashaNoch keine Bewertungen

- Chapter 5 - Small BusinessesDokument13 SeitenChapter 5 - Small BusinessesKin FallarcunaNoch keine Bewertungen

- Pre-Paid: Pickup Receipt - Delhivery Challan Awb - 2829212127694 / Delhivery Direct Standard Order ID - O1590654416961Dokument1 SeitePre-Paid: Pickup Receipt - Delhivery Challan Awb - 2829212127694 / Delhivery Direct Standard Order ID - O1590654416961Pinkal PatelNoch keine Bewertungen

- Barber Shop Business Plan ExampleDokument34 SeitenBarber Shop Business Plan ExampleJoseph Quill100% (2)