Beruflich Dokumente

Kultur Dokumente

Solutions Guide: Please Reword The Answers To Essay Type Parts So As To Guarantee That Your Answer Is An Original. Do Not Submit As Your Own

Hochgeladen von

Luciano MoreiraOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Solutions Guide: Please Reword The Answers To Essay Type Parts So As To Guarantee That Your Answer Is An Original. Do Not Submit As Your Own

Hochgeladen von

Luciano MoreiraCopyright:

Verfügbare Formate

Solutions Guide: Please reword the answers to essay type parts so as to guarantee

that your answer is an original. Do not submit as your own.

(a) Strategy I—Aggressive

(1) Amount required: $2,500,000 short-term and $1,000,000 long-term

(2) Cost: (10% × $2,500,000) + (14% × $1,000,000) = $390,000

Strategy 2—Conservative

(1) Amount required: $7,000,000 long-term and $0 short-term

(2) Cost: (14% × $7,000,000) = $980,000

Strategy 3—Trade-off

(1)Calculation of short-term requirements

(1) (2)

Total Funds Permanent Seasonal

Month Requirements Requirements Requirements

January $1,000,000 $3,000,000 $0

February 1,000,000 3,000,000 0

March 2,000,000 3,000,000 0

April 3,000,000 3,000,000 0

May 5,000,000 3,000,000 2,000,000

June 7,000,000 3,000,000 4,000,000

July 6,000,000 3,000,000 3,000,000

August 5,000,000 3,000,000 2,000,000

September 5,000,000 3,000,000 2,000,000

October 4,000,000 3,000,000 1,000,000

November 2,000,000 3,000,000 0

December 1,000,000 3,000,000 0

Monthly Average: Permanent = $3,000,000

Seasonal = $1,166,667 (sum of seasonal requirements ÷ 12)

Seasonal = $1,166,667 (14,000,000 ÷ 12)

(2)Cost: (10% × $1,166,667) + (14% × $3,000,000) = $536,667

(b) Net working capital = Current assets − Current liabilities

Aggressive = $4,000,000 − $2,500,000 = $1,500,000

Conservative = $4,000,000 − $0 = $4,000,000

Trade-off = $4,000,000 − $1,166,667 = $2,833,333

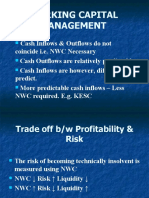

(c) The three strategies differ in terms of profitability and risk. The aggressive strategy is the

most profitableit has the lowest cost, $390,000because it uses the largest amount of the

less-expensive short-term financing. It also pays interest only on needed financing. The

aggressive strategy is also the most risky, relying heavily on short-term financing, which

may have more limited availability. Net working capital is lowest, also increasing risk.

Because the conservative strategy funds the highest amount in any month for the whole year

with more-expensive long-term financing, it is the most expensive ($980,000) and the least

profitable. It is the lowest-risk strategy, however, reserving short-term financing for

emergencies. The high level of working capital also reduces risk.

The trade-off strategy falls between the two extremes in terms of both profitability and risk.

The cost ($536,667) is higher than the aggressive strategy because the permanent funds

requirement of $3,000,000 is financed with more costly long-term funds. In five months

(January, February, March, November, and December), the company pays interest on

unneeded funds. The risk is less than with the aggressive strategy; some short-term

borrowing capacity is preserved for emergencies. Because a portion of short-term

requirements is financed with long-term funds, the firm’s ability to obtain short-term

financing is good.

Mr. Mercado should consider implementing the trade-off strategy. The wide swings in

monthly funds requirements make the cost of the conservative strategy very high in

comparison to the reduced risk. For the same reason, the aggressive strategy is quite risky,

requiring the firm to raise short-term funds ranging from $1,000,000 to $6,000,000. If it

should become difficult to arrange short-term financing, Kanton Company would be in

trouble.

Note: Other recommendations are possible, depending on the student’s risk preference. Of

course, the student should present sound reasons for his or her choice of strategy.

(d) (1) Effective interest, line of credit:

Interest on borrowing: $600,000 × (7% + 2.5%) = $57,000

Interest $57,000

Effective interest = = = 11.88%

Amount available for use $600,000 × 0.80

(2)Effective interest, revolving credit agreement:

Cost of borrowing:

Interest: $600,000 × (7% + 3.0%) $60,000

Commitment Fee: $400,000 × 0.5% 2,000

Total $62,000

Interest and commitment fee

Effective interest =

Amount available for use

$62, 000

= = 12.92%

$600, 000 × 0.80

(e) The line of credit arrangement seems better, since its annual cost of 11.88% is less than the

12.92% cost of the revolving loan arrangement. Kanton will save about 1% in terms of

annual interest cost (11.88% versus 12.92%) by using the line of credit. The only negative is

that if Third National lacks loanable funds, Kanton may not be able to borrow the needed

funds. Under the revolving credit agreement, funds availability would be guaranteed.

Das könnte Ihnen auch gefallen

- Financial Management Assignment - Capitulo 14Dokument4 SeitenFinancial Management Assignment - Capitulo 14Luis Tomas Vazquez BobadillaNoch keine Bewertungen

- Financial Management Gitman Chapter 15Dokument3 SeitenFinancial Management Gitman Chapter 15Samuel Zefanya50% (2)

- Simple and Compound Interest: Concept of Time and Value OfmoneyDokument11 SeitenSimple and Compound Interest: Concept of Time and Value OfmoneyUnzila AtiqNoch keine Bewertungen

- Working Capital Policy Example Problem MDokument23 SeitenWorking Capital Policy Example Problem MPeter PiperNoch keine Bewertungen

- 4) - Are Shares of A Single Foreign Company Issued in The U.S. (ADR or American Depository Receipt)Dokument8 Seiten4) - Are Shares of A Single Foreign Company Issued in The U.S. (ADR or American Depository Receipt)mohanraokp2279Noch keine Bewertungen

- Financial ManagementDokument9 SeitenFinancial ManagementDewanti Almeera100% (1)

- CF Final 2020 Preparation Answers: B. Payback PeriodDokument5 SeitenCF Final 2020 Preparation Answers: B. Payback PeriodXatia SirginavaNoch keine Bewertungen

- BbaDokument5 SeitenBbadevNoch keine Bewertungen

- Simple Discount FINALDokument23 SeitenSimple Discount FINALMa Regina Orejola ReyesNoch keine Bewertungen

- Assignment No. 1Dokument3 SeitenAssignment No. 1ENoch keine Bewertungen

- CH 18 ADokument9 SeitenCH 18 AAlex YaoNoch keine Bewertungen

- Fa 2 1Dokument8 SeitenFa 2 1Quỳnh Anh NguyễnNoch keine Bewertungen

- ACF 103 Revision Qns Solns 20141Dokument11 SeitenACF 103 Revision Qns Solns 20141danikadolorNoch keine Bewertungen

- FIM Exercise AnsDokument6 SeitenFIM Exercise AnsSam MNoch keine Bewertungen

- Discounted Cah Flow Valuation Chapter 6Dokument31 SeitenDiscounted Cah Flow Valuation Chapter 6Rahul KhadkaNoch keine Bewertungen

- Chapter 14 - SolutionsDokument17 SeitenChapter 14 - SolutionsHolly EntwistleNoch keine Bewertungen

- Chapter 08-Borrowing Costs-Tutorial AnswersDokument4 SeitenChapter 08-Borrowing Costs-Tutorial AnswersMayomi JayasooriyaNoch keine Bewertungen

- Reviewer For Midterm XFINMAR A224and A225Dokument5 SeitenReviewer For Midterm XFINMAR A224and A225ralph11240308Noch keine Bewertungen

- Activity Sheet In: Business FinanceDokument8 SeitenActivity Sheet In: Business FinanceCatherine Larce100% (1)

- Quiz Week 1 SolnsDokument8 SeitenQuiz Week 1 SolnsRiri FahraniNoch keine Bewertungen

- Session 5 and 6 - Time Value of MoneyDokument24 SeitenSession 5 and 6 - Time Value of MoneyDebi PrasadNoch keine Bewertungen

- Examples Future Value AnnuityDokument5 SeitenExamples Future Value Annuitykenetic01Noch keine Bewertungen

- Tutorial Set 2 - Key SolutionsDokument4 SeitenTutorial Set 2 - Key SolutionsgregNoch keine Bewertungen

- Bodie10ce SM CH15Dokument13 SeitenBodie10ce SM CH15William GrignonNoch keine Bewertungen

- Mathematics For FinanceDokument12 SeitenMathematics For FinanceAbhishek PrabhakarNoch keine Bewertungen

- Week 4 Questions Solutions Bus 288Dokument10 SeitenWeek 4 Questions Solutions Bus 288Sanya BatraNoch keine Bewertungen

- CH03Dokument5 SeitenCH03Mohsin SadaqatNoch keine Bewertungen

- Answer FIN 401 Exam2 Fall15 V1Dokument7 SeitenAnswer FIN 401 Exam2 Fall15 V1mahmudNoch keine Bewertungen

- Financial MarketsDokument6 SeitenFinancial Marketsheynuhh gNoch keine Bewertungen

- Chapter 13 HW SolutionsDokument23 SeitenChapter 13 HW SolutionsSijo VMNoch keine Bewertungen

- ACF 103 2015 Revision Qns and SolnsDokument13 SeitenACF 103 2015 Revision Qns and SolnsRiri FahraniNoch keine Bewertungen

- Chapter 2 Money Time Relationships and Equivalence 2Dokument21 SeitenChapter 2 Money Time Relationships and Equivalence 2Coreen ElizaldeNoch keine Bewertungen

- 1 Discounts: 1.1 Basic Journal EntriesDokument3 Seiten1 Discounts: 1.1 Basic Journal EntriesAudreySyUyanNoch keine Bewertungen

- Module 1 - Time Value of Money Handout For LMS 2020Dokument8 SeitenModule 1 - Time Value of Money Handout For LMS 2020sandeshNoch keine Bewertungen

- Problem Set 1 - Bonds and Time Value of MoneyDokument4 SeitenProblem Set 1 - Bonds and Time Value of Moneymattgodftey1Noch keine Bewertungen

- Midterm Review Winter 2019Dokument11 SeitenMidterm Review Winter 2019Gurveen Kaur100% (1)

- Sinking Fund MethodDokument3 SeitenSinking Fund MethodJoanna DuqueNoch keine Bewertungen

- Practice Problems On Yield To MaturityDokument2 SeitenPractice Problems On Yield To MaturityCharl PontillaNoch keine Bewertungen

- How To Calculate The Present Value of An AnnuityDokument3 SeitenHow To Calculate The Present Value of An AnnuityM ShahidNoch keine Bewertungen

- Multiple Choice Questions Please Circle The Correct Answer There Is Only One Correct Answer Per QuestionDokument39 SeitenMultiple Choice Questions Please Circle The Correct Answer There Is Only One Correct Answer Per Questionquickreader12Noch keine Bewertungen

- Financial MathematicsDokument44 SeitenFinancial MathematicsJhon Albert RobledoNoch keine Bewertungen

- P1 March 2011 Resit AnswersDokument12 SeitenP1 March 2011 Resit AnswersmavkaziNoch keine Bewertungen

- Course 1: Global Financial Markets and AssetsDokument31 SeitenCourse 1: Global Financial Markets and AssetsDhriti MalhotraNoch keine Bewertungen

- CH 14: Long Term Liabilities: The Timelines of The Bonds Will Be As FollowsDokument9 SeitenCH 14: Long Term Liabilities: The Timelines of The Bonds Will Be As Followschesca marie penarandaNoch keine Bewertungen

- Time Value of Money FormulasDokument8 SeitenTime Value of Money FormulasrovosoloNoch keine Bewertungen

- 02 How To Calculate Present ValuesDokument5 Seiten02 How To Calculate Present ValuesMộng Nghi TôNoch keine Bewertungen

- Engineering Economic TextBook Final ExamDokument12 SeitenEngineering Economic TextBook Final ExamMohd FaizalNoch keine Bewertungen

- Power Notes: Bonds Payable and Investments in BondsDokument38 SeitenPower Notes: Bonds Payable and Investments in BondsiVONoch keine Bewertungen

- Tugas Manajemen Keuangan (Maulana Ikhsan Tarigan) 197007091Dokument5 SeitenTugas Manajemen Keuangan (Maulana Ikhsan Tarigan) 197007091Maulana IkhsanNoch keine Bewertungen

- General Mathematics: Quarter 2 - Module 6: Simple and Compound InterestsDokument22 SeitenGeneral Mathematics: Quarter 2 - Module 6: Simple and Compound InterestsEldon Kim RaguindinNoch keine Bewertungen

- FIN4414 Security Valuation 001Dokument22 SeitenFIN4414 Security Valuation 001apugh1993Noch keine Bewertungen

- Working Capital Management: Cash Inflows & Outflows Do NotDokument30 SeitenWorking Capital Management: Cash Inflows & Outflows Do NotTabish BhatNoch keine Bewertungen

- Intermediate Accounting: Week 3 Assignment Student Name: Nidal Charafeddine Professor: Sheila Woods Devry University July-2016Dokument9 SeitenIntermediate Accounting: Week 3 Assignment Student Name: Nidal Charafeddine Professor: Sheila Woods Devry University July-2016nidal charaf eddineNoch keine Bewertungen

- FA-I CHAPTER FIVE@editedDokument23 SeitenFA-I CHAPTER FIVE@editedHussen AbdulkadirNoch keine Bewertungen

- Module 5: Evaluating A Single ProjectDokument50 SeitenModule 5: Evaluating A Single Project우마이라UmairahNoch keine Bewertungen

- Annuitie S: Liuren WuDokument39 SeitenAnnuitie S: Liuren Wusaikumar selaNoch keine Bewertungen

- An MBA in a Book: Everything You Need to Know to Master Business - In One Book!Von EverandAn MBA in a Book: Everything You Need to Know to Master Business - In One Book!Noch keine Bewertungen

- Job and Process IDokument19 SeitenJob and Process IsajjadNoch keine Bewertungen

- Vector Control of Cage Induction Motors, A Physical InsightDokument10 SeitenVector Control of Cage Induction Motors, A Physical InsightSamuel Alves de SouzaNoch keine Bewertungen

- Fund Multi Rates YsDokument9 SeitenFund Multi Rates YsAejaz AamerNoch keine Bewertungen

- Smart Street Light ProgramDokument5 SeitenSmart Street Light Programapi-553037030Noch keine Bewertungen

- I Used To Be A Desgin StudentDokument256 SeitenI Used To Be A Desgin StudentMLNoch keine Bewertungen

- Ayala de Roxas v. MaglonsoDokument5 SeitenAyala de Roxas v. MaglonsoJohn Rey FerarenNoch keine Bewertungen

- AFSCN Architecture EvolutionDokument7 SeitenAFSCN Architecture Evolutionbaixiu0813Noch keine Bewertungen

- 2-CFOT Handout 23Dokument113 Seiten2-CFOT Handout 23SumitNoch keine Bewertungen

- C FunctionsDokument36 SeitenC FunctionsAditya PandeyNoch keine Bewertungen

- Tamiya Model Magazine - November 2019Dokument70 SeitenTamiya Model Magazine - November 2019temp userNoch keine Bewertungen

- Decline of RomeDokument3 SeitenDecline of RomeTruman Younghan IsaacsNoch keine Bewertungen

- What Makes An Event A Mega Event DefinitDokument18 SeitenWhat Makes An Event A Mega Event DefinitMoosaNoch keine Bewertungen

- Masurare Grosime Vopsea 1 - Fisa-tehnica-Extech-CG204Dokument1 SeiteMasurare Grosime Vopsea 1 - Fisa-tehnica-Extech-CG204RizzoRo1Noch keine Bewertungen

- Module 2 - Govt GrantDokument4 SeitenModule 2 - Govt GrantLui100% (1)

- AgrrrraaDokument31 SeitenAgrrrraaAnonymous apYVFHnCYNoch keine Bewertungen

- The Growing Power of Consumers DeloitteDokument20 SeitenThe Growing Power of Consumers DeloitteNatalia Traldi Bezerra100% (1)

- Ricoh MP C4502 C5502 D143, D144 Parts ListDokument148 SeitenRicoh MP C4502 C5502 D143, D144 Parts Listdarwinabad83% (6)

- Haryana PWD Rates - 2021Dokument462 SeitenHaryana PWD Rates - 2021pranav kumar100% (2)

- High-Precision Rogowski Coils For Improved Relay Protection, Control and MeasurementsDokument2 SeitenHigh-Precision Rogowski Coils For Improved Relay Protection, Control and Measurementskhaled1512Noch keine Bewertungen

- Wireless-N ADSL2+ Gateway: User GuideDokument41 SeitenWireless-N ADSL2+ Gateway: User GuidenaweedqadirNoch keine Bewertungen

- Clay Norris federal criminal complaintDokument11 SeitenClay Norris federal criminal complaintWKYC.comNoch keine Bewertungen

- Full DOST Guidelines FullDokument53 SeitenFull DOST Guidelines FulltinbsullaNoch keine Bewertungen

- Compensation MCQDokument7 SeitenCompensation MCQHarshpreet BhatiaNoch keine Bewertungen

- Reviewer RCCPDokument27 SeitenReviewer RCCPGodwin De GuzmanNoch keine Bewertungen

- Usiness Aluation: DigestDokument28 SeitenUsiness Aluation: Digestgioro_miNoch keine Bewertungen

- Control - Statistical Process Control SPCDokument22 SeitenControl - Statistical Process Control SPCHalimNoch keine Bewertungen

- Thesis On Self Microemulsifying Drug Delivery SystemDokument6 SeitenThesis On Self Microemulsifying Drug Delivery Systembsqfc4d5100% (1)

- Drill CollarsDokument3 SeitenDrill CollarsRambabu ChNoch keine Bewertungen

- Quaid-e-Azam (Rahmatullah) Said Very Clearly That The Rights of The - Will Be Fully Protected in PakistanDokument7 SeitenQuaid-e-Azam (Rahmatullah) Said Very Clearly That The Rights of The - Will Be Fully Protected in PakistanAmna ShahzadNoch keine Bewertungen

- Pamas S4031 WG: Portable Particle Counting System For Water Based Hydraulic FluidsDokument2 SeitenPamas S4031 WG: Portable Particle Counting System For Water Based Hydraulic FluidsSupriyaNathRayNoch keine Bewertungen