Beruflich Dokumente

Kultur Dokumente

More Practices For CH1

Hochgeladen von

lala0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

76 Ansichten2 Seitenddddddddddddddddddddd

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenddddddddddddddddddddd

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

76 Ansichten2 SeitenMore Practices For CH1

Hochgeladen von

laladdddddddddddddddddddd

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

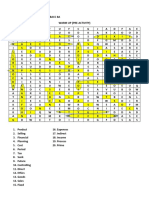

More Practices For CH1-CH3

[EXERCISE 2-1] Classifying Manufacturing Costs

The costs below all relate to Sounds Good, a company based in Alberta that

manufactures high-end audio equipment such as speakers, receivers, CD players,

turntables, and home theatre systems. The company owns all of the manufacturing

facilities (building and equipment) but rents the space used by the non-

manufacturing employees (accounting, marketing, sales, human resources).

Required: For each cost, indicate whether it would most likely be classified as a direct

labour, direct material, manufacturing overhead, marketing and selling, or

administrative cost.

1. Depreciation, taxes, and insurance on the manufacturing facilities.

2. Rent on the office space used by the non-manufacturing staff.

3. Salaries paid to the employees who produce the audio equipment.

4. Cost of the glue used to fasten the company's logo to the grill used on all of

its speakers.

5. The cost of online advertising.

6. Salaries paid to the accounting employees.

7. Salary paid to the production manager who supervises the manufacturing

activities for all products.

8. Cost of the plastic used for turntable dust covers.

9. Bonuses paid to sales staff for meeting their monthly sales goals.

10. Salary paid to the manager of the human resources department.

[EXERCISE 2-2] Classification of Costs as Period or Product Costs

Suppose that you have a summer job at Remotely Speaking, a company that

manufactures sophisticated portable two-way radio transceivers for remote-

controlled military reconnaissance missions. The company, which is privately owned,

has approached a bank for a loan to help finance its tremendous growth. The bank

requires financial statements before approving such a loan. You have been asked to

help pre- pare the financial statements and are given the following list of costs:

1. Depreciation on salespeople's cars.

2. Rent on equipment used in the factory.

3. Lubricants used for machine maintenance.

4. Salaries of personnel who work in the finished goods warehouse.

5. Soap and paper towels used by factory workers at the end of a shift.

6. Factory supervisors' salaries.

7. Heat, water, and power consumed in the factory.

8. Materials used for boxing company products for shipment overseas. (Units

are not normally boxed.)

9. Advertising costs.

10. Workers' Compensation insurance for factory employees.

11. Depreciation on chairs and tables in the factory lunchroom.

12. The wages of the receptionist in the administrative offices.

13. Cost of leasing the corporate jet used by the company's executives.

14. The cost of renting rooms at a British Columbia resort for the annual sales

conference.

15. The cost of packaging the company's product.

Das könnte Ihnen auch gefallen

- Managerial Accounting - Ch.1Dokument2 SeitenManagerial Accounting - Ch.1Ammar HussainNoch keine Bewertungen

- Here are the classifications:1. Period2. Product 3. Product4. Period5. Product6. Product7. Product8. Period9. Period10. Product11. Product12. Period13. Period14. Period15. ProductDokument13 SeitenHere are the classifications:1. Period2. Product 3. Product4. Period5. Product6. Product7. Product8. Period9. Period10. Product11. Product12. Period13. Period14. Period15. ProductDennyseOrlido100% (2)

- Lecture 1, Identifying Costs (Sol)Dokument3 SeitenLecture 1, Identifying Costs (Sol)MO'MEN ROSHDYNoch keine Bewertungen

- Assignment CH 1Dokument27 SeitenAssignment CH 1Svetlana100% (4)

- Cost Classification GuideDokument17 SeitenCost Classification GuideNivin mNoch keine Bewertungen

- Cost Classification Theory and Practice QuestionsDokument9 SeitenCost Classification Theory and Practice QuestionsBilal Rauf100% (1)

- Output CostingDokument39 SeitenOutput CostingTarpan MannanNoch keine Bewertungen

- Solutions To Apply What You Have Learned: ACC 331/brewer CH 2 Classifying CostsDokument7 SeitenSolutions To Apply What You Have Learned: ACC 331/brewer CH 2 Classifying CostsKathryn TeoNoch keine Bewertungen

- Lesson About CostDokument8 SeitenLesson About CostMariana MogîldeaNoch keine Bewertungen

- Chapter2 Homework AnswersDokument13 SeitenChapter2 Homework AnswersHa MinhNoch keine Bewertungen

- Accounting CH 4Dokument7 SeitenAccounting CH 4sabit hussenNoch keine Bewertungen

- Basic Cost Management Concepts: Mcgraw-Hill/IrwinDokument52 SeitenBasic Cost Management Concepts: Mcgraw-Hill/IrwinDaMin ZhouNoch keine Bewertungen

- Basic Cost Management Concepts and Accounting For Mass Customization OperationsDokument55 SeitenBasic Cost Management Concepts and Accounting For Mass Customization OperationsBelajar MembacaNoch keine Bewertungen

- ESTIMATING COSTING TITLEDokument29 SeitenESTIMATING COSTING TITLEKUNAL PATELNoch keine Bewertungen

- Understanding Manufacturing CostsDokument42 SeitenUnderstanding Manufacturing CostsOmar Bani-KhalafNoch keine Bewertungen

- Cost Analysis and Process ImprovementDokument13 SeitenCost Analysis and Process Improvementyash sarohaNoch keine Bewertungen

- Manufacturing CostDokument20 SeitenManufacturing Costchristian ReyesNoch keine Bewertungen

- Costs - Concepts and ClassificationsDokument5 SeitenCosts - Concepts and ClassificationsCarlo B CagampangNoch keine Bewertungen

- Estimation and CostingDokument37 SeitenEstimation and CostingrajeshNoch keine Bewertungen

- ACT 600 Advanced Managerial Accounting: Accumulating and Assigning Costs To ProductsDokument43 SeitenACT 600 Advanced Managerial Accounting: Accumulating and Assigning Costs To ProductsAli H. AyoubNoch keine Bewertungen

- Here are the graphs that illustrate the cost behavior patterns described:1a. Graph B 1b. Graph A1c. Graph C1d. Graph D1e. Graph E 1f. Graph F1g. Graph G1h. Graph HDokument8 SeitenHere are the graphs that illustrate the cost behavior patterns described:1a. Graph B 1b. Graph A1c. Graph C1d. Graph D1e. Graph E 1f. Graph F1g. Graph G1h. Graph HMaya BarcoNoch keine Bewertungen

- Managerial Accounting and Cost Concepts This Chapter Explains That in Managerial Accounting The Term Cost Is Used in Many Different Ways. TheDokument36 SeitenManagerial Accounting and Cost Concepts This Chapter Explains That in Managerial Accounting The Term Cost Is Used in Many Different Ways. TheSohaib ArifNoch keine Bewertungen

- CostDokument27 SeitenCostAbid AliNoch keine Bewertungen

- Additional FINAL ReviewDokument41 SeitenAdditional FINAL ReviewMandeep SinghNoch keine Bewertungen

- Costing Sheets ExplainedDokument9 SeitenCosting Sheets ExplainedAnshul SaxenaNoch keine Bewertungen

- Day 4 Chap 1 Rev. FI5 Ex PR PDFDokument7 SeitenDay 4 Chap 1 Rev. FI5 Ex PR PDFJoannaNoch keine Bewertungen

- ABC analysis improves costing accuracyDokument43 SeitenABC analysis improves costing accuracyKate CygnetNoch keine Bewertungen

- Accounting For Overhead CostsDokument2 SeitenAccounting For Overhead CostsLijobethNoch keine Bewertungen

- Cost Accounting IntroductionDokument92 SeitenCost Accounting IntroductionAnalyn Lafradez100% (3)

- Cost Accounting Concepts: Prof. Dr. Farid MoharamDokument90 SeitenCost Accounting Concepts: Prof. Dr. Farid Moharammohamed el kadyNoch keine Bewertungen

- Cost Terms, Concepts and ClassificationsDokument3 SeitenCost Terms, Concepts and ClassificationsKyleNoch keine Bewertungen

- Ama Case ScenriosDokument5 SeitenAma Case ScenriosAditya JainNoch keine Bewertungen

- Chap 2 Basic Cost Management Concepts and Accounting For Mass Customization OperationsDokument15 SeitenChap 2 Basic Cost Management Concepts and Accounting For Mass Customization OperationsMarklorenz SumpayNoch keine Bewertungen

- MANAGEMENT ACCOUNTING SOLUTIONSDokument9 SeitenMANAGEMENT ACCOUNTING SOLUTIONSMark Anthony DomingoNoch keine Bewertungen

- Cost Accounting - Chap1Dokument29 SeitenCost Accounting - Chap1Alber Howell MagadiaNoch keine Bewertungen

- Homework AssignmentDokument11 SeitenHomework AssignmentHenny DeWillisNoch keine Bewertungen

- Absorption Costing - OverviewDokument24 SeitenAbsorption Costing - OverviewEdwin LawNoch keine Bewertungen

- COST Lesson 2Dokument4 SeitenCOST Lesson 2Christian Clyde Zacal Ching0% (1)

- Acctba3 Business CaseDokument2 SeitenAcctba3 Business CaseGernette Condez TanNoch keine Bewertungen

- Chapter 2 Job Order CostingDokument72 SeitenChapter 2 Job Order CostingLORENZE VIRNUEL UCAB IBA�EZ0% (1)

- Economics of Plant Design (Report)Dokument10 SeitenEconomics of Plant Design (Report)Hamizah Mieza100% (1)

- Session 8 - PGDM 2021-23Dokument36 SeitenSession 8 - PGDM 2021-23Krishnapriya NairNoch keine Bewertungen

- Cost Classification - MBADokument10 SeitenCost Classification - MBAissa.hossam3793Noch keine Bewertungen

- Basic Cost Management Concepts and Accounting For Mass Customization OperationsDokument44 SeitenBasic Cost Management Concepts and Accounting For Mass Customization OperationsRoberto De JesusNoch keine Bewertungen

- Activity Based CostingDokument50 SeitenActivity Based CostingDebrina A. WidyasariNoch keine Bewertungen

- Cost Ascertainment BreakdownDokument36 SeitenCost Ascertainment BreakdownRoma KaurNoch keine Bewertungen

- Design1 Lesson 9 - Cost EvaluationDokument96 SeitenDesign1 Lesson 9 - Cost EvaluationIzzat IkramNoch keine Bewertungen

- EHS301 ENGINEERING ECONOMICS AND MANAGEMENTDokument48 SeitenEHS301 ENGINEERING ECONOMICS AND MANAGEMENTVamshidhar ReddyNoch keine Bewertungen

- Understand Direct, Indirect, Fixed, Variable and Other Types of CostsDokument3 SeitenUnderstand Direct, Indirect, Fixed, Variable and Other Types of CostsMapicoNoch keine Bewertungen

- Chap01 Rev. FI5 Ex PR 2Dokument13 SeitenChap01 Rev. FI5 Ex PR 2Nadya SafarinaNoch keine Bewertungen

- Cost Classification OverviewDokument47 SeitenCost Classification OverviewMazen SalahNoch keine Bewertungen

- Chapter 2 SeatworkDokument7 SeitenChapter 2 Seatworkrhiz cyrelle calanoNoch keine Bewertungen

- Cost AccountingDokument26 SeitenCost Accountingdivya8955Noch keine Bewertungen

- Inventory: COST OF PRODUCTIONDokument104 SeitenInventory: COST OF PRODUCTIONHAFIZ MUHAMMAD UMAR FAROOQ RANANoch keine Bewertungen

- A.3. Cost ClassificationsDokument57 SeitenA.3. Cost ClassificationsTiyas KurniaNoch keine Bewertungen

- Unit 1: Accounting For ManufacturingDokument10 SeitenUnit 1: Accounting For ManufacturingPrincess HoshinoNoch keine Bewertungen

- Operation Caselet - 7 Auburn Machine CoDokument11 SeitenOperation Caselet - 7 Auburn Machine CoArchana DaveNoch keine Bewertungen

- Manufacturing Wastes Stream: Toyota Production System Lean Principles and ValuesVon EverandManufacturing Wastes Stream: Toyota Production System Lean Principles and ValuesBewertung: 4.5 von 5 Sternen4.5/5 (3)

- Read External Data Into SAS: 1. The IMPORT ProcedureDokument5 SeitenRead External Data Into SAS: 1. The IMPORT ProcedurelalaNoch keine Bewertungen

- SAS Certified SpecialilllDokument7 SeitenSAS Certified SpecialillllalaNoch keine Bewertungen

- Sun Mon Tue Wed Thu Fri Sat: New Year's DayDokument6 SeitenSun Mon Tue Wed Thu Fri Sat: New Year's DaysameerNoch keine Bewertungen

- Python The No Bullsht GuideDokument113 SeitenPython The No Bullsht GuidelalaNoch keine Bewertungen

- Project Timeline: Project Start Milestone 3 Milestone 9Dokument1 SeiteProject Timeline: Project Start Milestone 3 Milestone 9suneeth100% (1)

- Sun Mon Tue Wed Thu Fri Sat: New Year's DayDokument6 SeitenSun Mon Tue Wed Thu Fri Sat: New Year's DaysameerNoch keine Bewertungen

- Measure your ring size accurately with this printable ring size guideDokument1 SeiteMeasure your ring size accurately with this printable ring size guide6778HUN50% (2)

- SAS Certified SpecialistmmDokument3 SeitenSAS Certified SpecialistmmlalaNoch keine Bewertungen

- Map Pins InfographicDokument1 SeiteMap Pins InfographiclalaNoch keine Bewertungen

- May 2019 - April 2020Dokument12 SeitenMay 2019 - April 2020Ziegfreedz C. ChannelNoch keine Bewertungen

- Troubleshooting Installation IssuesDokument1 SeiteTroubleshooting Installation IssuesAbcd EfghNoch keine Bewertungen

- Sempre e Senza Sordino: PianoDokument3 SeitenSempre e Senza Sordino: PianolalaNoch keine Bewertungen

- My Class ScheduleDokument1 SeiteMy Class SchedulelalaNoch keine Bewertungen

- Project Timeline: Project Start Milestone 3 Milestone 9Dokument1 SeiteProject Timeline: Project Start Milestone 3 Milestone 9suneeth100% (1)

- 2017 Calendar TemplateDokument12 Seiten2017 Calendar TemplateAndi Bekti WidiyantoNoch keine Bewertungen

- Sun Mon Tue Wed Thu Fri Sat: New YearsDokument12 SeitenSun Mon Tue Wed Thu Fri Sat: New YearsZtiger12Noch keine Bewertungen

- 自测卷1 45单元Dokument1 Seite自测卷1 45单元lalaNoch keine Bewertungen

- Process Steps GuideDokument1 SeiteProcess Steps GuidelalaNoch keine Bewertungen

- Roy的单词自测卷1 5Dokument1 SeiteRoy的单词自测卷1 5lalaNoch keine Bewertungen

- Roy的单词自测卷1 5Dokument1 SeiteRoy的单词自测卷1 5lalaNoch keine Bewertungen

- 久石让乐谱sunday (Piano Stories 2)Dokument6 Seiten久石让乐谱sunday (Piano Stories 2)lalaNoch keine Bewertungen

- Roy's Word Review Barron 1-5 UnitsDokument1 SeiteRoy's Word Review Barron 1-5 UnitslalaNoch keine Bewertungen

- Editing and Proofreading PDFDokument2 SeitenEditing and Proofreading PDFlalaNoch keine Bewertungen

- Roy的单词自测卷1 15Dokument1 SeiteRoy的单词自测卷1 15lalaNoch keine Bewertungen

- Comma Splices BI RevisionDokument18 SeitenComma Splices BI RevisionlalaNoch keine Bewertungen

- Introduction To Logic: PHIL 170Dokument43 SeitenIntroduction To Logic: PHIL 170lalaNoch keine Bewertungen

- Sempre e Senza Sordino: PianoDokument3 SeitenSempre e Senza Sordino: PianolalaNoch keine Bewertungen

- Constructing An Argument AC PDFDokument2 SeitenConstructing An Argument AC PDFlalaNoch keine Bewertungen

- Introduction To Logic: PHIL 170Dokument31 SeitenIntroduction To Logic: PHIL 170lalaNoch keine Bewertungen

- The Effective Theory of Producer and Consumer Surplus: Positive Demand, Negative SupplyDokument7 SeitenThe Effective Theory of Producer and Consumer Surplus: Positive Demand, Negative SupplyCentral Asian StudiesNoch keine Bewertungen

- PAGE - 14 - QuestionsDokument34 SeitenPAGE - 14 - QuestionsAnjelika ViescaNoch keine Bewertungen

- Module 4 Airline Route PlanningDokument54 SeitenModule 4 Airline Route PlanningYohanes Seda100% (1)

- TFA - Chapter 36 - Property, Plant and EquipmentDokument9 SeitenTFA - Chapter 36 - Property, Plant and EquipmentAsi Cas Jav0% (1)

- Relevant Costs For DecisionsDokument9 SeitenRelevant Costs For DecisionskhengmaiNoch keine Bewertungen

- Dake Corporation's manufacturing costs analysisDokument9 SeitenDake Corporation's manufacturing costs analysisWarda Tariq0% (1)

- Frameworks - IIMADokument8 SeitenFrameworks - IIMAParth SOODANNoch keine Bewertungen

- Estimation of ExpensesDokument23 SeitenEstimation of ExpensesBayu MaulidaNoch keine Bewertungen

- Incremental Analysis Decision MakingDokument4 SeitenIncremental Analysis Decision MakingMa Teresa B. CerezoNoch keine Bewertungen

- M.P.Suri Ganesh Asst - Professor in MGT - StudiesDokument31 SeitenM.P.Suri Ganesh Asst - Professor in MGT - Studiessuriganesh007Noch keine Bewertungen

- 11 Pre-Review On EconomicsDokument2 Seiten11 Pre-Review On EconomicsAl-nashreen AbdurahimNoch keine Bewertungen

- Managerial Accounting ConceptsDokument15 SeitenManagerial Accounting ConceptsDesy Joy UrotNoch keine Bewertungen

- ACC 321 Final Exam ReviewDokument6 SeitenACC 321 Final Exam ReviewLauren KlaassenNoch keine Bewertungen

- Responsibility Accounting: Kumaraswamy BodaDokument10 SeitenResponsibility Accounting: Kumaraswamy BodaSumit HukmaniNoch keine Bewertungen

- Cost Accounting Concepts: Prof. Dr. Farid MoharamDokument90 SeitenCost Accounting Concepts: Prof. Dr. Farid Moharammohamed el kadyNoch keine Bewertungen

- Delta System LimitedDokument81 SeitenDelta System LimitedMahbub E AL MunimNoch keine Bewertungen

- C - TS410 - 1809 SAP Certified Application Associate - Business Process Integration With SAP S/4HANA 1809Dokument27 SeitenC - TS410 - 1809 SAP Certified Application Associate - Business Process Integration With SAP S/4HANA 1809Sahar zidanNoch keine Bewertungen

- 1.2 Financial and Management AccountingDokument55 Seiten1.2 Financial and Management Accountingteshome100% (2)

- Assessment of Dairy Marketing in Assosa District, EthiopiaDokument8 SeitenAssessment of Dairy Marketing in Assosa District, EthiopiaPremier PublishersNoch keine Bewertungen

- The COST Model For Calculation of Forest Operations Cost: ArticleDokument9 SeitenThe COST Model For Calculation of Forest Operations Cost: ArticleJ-Claude DougNoch keine Bewertungen

- 2006 LCCI Cost Accounting Level 2 Series 4 Model AnswersDokument15 Seiten2006 LCCI Cost Accounting Level 2 Series 4 Model AnswersHon Loon SeumNoch keine Bewertungen

- SPM WEEK 14 Procurement and Contract ManagementDokument56 SeitenSPM WEEK 14 Procurement and Contract ManagementHunainNoch keine Bewertungen

- III. Government Intervention in The Price SystemDokument7 SeitenIII. Government Intervention in The Price SystemJosephBurleson93Noch keine Bewertungen

- Unit 4 Product Line Decisions: ObjectivesDokument10 SeitenUnit 4 Product Line Decisions: ObjectivesSmrkhaNoch keine Bewertungen

- My Revision Notes AQA A-Level AccountingDokument183 SeitenMy Revision Notes AQA A-Level AccountingKeshinee Sadasing100% (5)

- Cost Accounting and Control Handout 2205 Cost Accounting CycleDokument20 SeitenCost Accounting and Control Handout 2205 Cost Accounting CycleJhenny Mae DeduyoNoch keine Bewertungen

- PpeDokument7 SeitenPpeJer Rama100% (1)

- Intro and Cost BehaviorDokument31 SeitenIntro and Cost BehaviorM HymavathiNoch keine Bewertungen

- ERP Financial Planning SequenceDokument9 SeitenERP Financial Planning SequencegeneNoch keine Bewertungen

- Chương 4Dokument3 SeitenChương 4Trần Khánh VyNoch keine Bewertungen