Beruflich Dokumente

Kultur Dokumente

NAS 2 Inventories

Hochgeladen von

Prashant TamangCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

NAS 2 Inventories

Hochgeladen von

Prashant TamangCopyright:

Verfügbare Formate

NAS 2 Inventories

Revision Note

Relevant For CAP-II students

UNIT OVERVIEW:

objective:

•determination of cost

•its subsequent recognition as an

expenses

•provides guidance on the

techniques and acceptable

methods of determining cost

Scope: applies to all

inventories except

•NAS 32 and NFRS 9

Financial Instruments

Disclosure •NAS 41 Agriculture

•NAS 11 work in progress

arising under construction

contract

Measurement of

inventory

•valuation

Recognition as an principle

expenses •Cost

•Cost Formulas

•Net Relisable

Value

Compiled by CA. Prasant Tamang

For any suggestion and feedback

Reach me at prasant.tamang02@gmail.com

https://www.facebook.com/prasant.tamang.144

NAS 2 Inventories

Revision Note

Relevant For CAP-II students

Relevant Definition

1. Inventories are the assets:

a. Held for sale in the ordinary course of business (finished goods).

b. In the process of production of such sale (Work In Progress).

c. In the form of material or supplies to be consumed in the production process or in

rendering of services (Raw Material).

2. Net Reliasable value (NRV):

Estimated Selling Price in the ordinary course of business – estimated cost of

completion-estimated cost necessary to make sale.

3. Difference between NRV and FV:

S.N NRV Fair Value

1. Meaning as defined in Price that would be

point no 2 received from sale of

assets or paid to transfer a

liability in an ordinary

transaction between

market participants at

measurement date.

2. It is entity specific value

3. It may not equal FV less

cost to sell.

Compiled by CA. Prasant Tamang

For any suggestion and feedback

Reach me at prasant.tamang02@gmail.com

https://www.facebook.com/prasant.tamang.144

NAS 2 Inventories

Revision Note

Relevant For CAP-II students

Measurement of Inventories

Inventories should be measured at lower of

a. Cost or

b. NRV.

1. What is the cost of Inventories?

Cost of inventory:

Purchase cost + cost of conversion +other cost incurred in bring assets to their

present location and conditions.

Purchase cost Cost of conversion Other cost incurred in

bringing assets to their

present location and

conditions.

a. Purchase price a. Direct material

b. Import duties b. Direct labour

and other

taxes

c. Transport, c. Other direct costs

handling and

d. Other costs d. Overhead(fixed and

directly Variable production

attributable overheads)

(any trade

discounts,

rebates and

other similar

items are

deducted in

determining

cost)

Compiled by CA. Prasant Tamang

For any suggestion and feedback

Reach me at prasant.tamang02@gmail.com

https://www.facebook.com/prasant.tamang.144

NAS 2 Inventories

Revision Note

Relevant For CAP-II students

Note:

Allocation of fixed production overheads to the cost of conversion is based on the

normal capacity of the production facilities. When production levels are abnormally

low, unallocated overhead are recognized as an expenses. In period of abnormally high

production, the amount of fixed overhead allocated to each unit of production is

decreased so that inventories are not measured above cost.

Cost excluded from cost of inventories and recognized as an expenses in

profit and loss account:

a. Abnormal amount of wasted material, labor and other production cost.

b. Storage cost, unless those costs are necessary in the production process before a

further production stage;

c. administrative overheads that do not contribute to bringing inventories to their

present location and condition

d. Selling costs.

Example- Cost of inventory

X Ltd. purchases cars from several countries and sells them to Europian countries.

During the current year, this company has incurred following expenses:

1. Trade discounts on purchase

2. Handling costs relating to imports

3. Salaries of accounting department

4. Sales commission paid to sales agents

5. After sales warranty costs

6. Import duties

7. Costs of purchases (based on supplier’s invoices)

8. Freight expense

9. Insurance of purchases

10. Brokerage commission paid to indenting agents

Evaluate which costs are allowed by NAS 2 for inclusion in the cost of inventory in

the books of X Ltd.

Answer:

Salaries of accounting department, sales commission and after sale warranty cost

are excluded in cost of inventory and recognized as expenses.

Items number 1, 2, 6, 7, 8, 9, 10 are allowed by NAS 2 for the calculation of cost of inventory.

The ABC Ltd., while valuing its finished inventory at the year-end wants to include

interest on Bank Overdraft as an element of cost, for the reason that overdraft has

been taken specifically for the purpose of financing current assets like inventory and

for meeting day to day working expenses. (ICAN June 2019)

Answer:

Compiled by CA. Prasant Tamang

For any suggestion and feedback

Reach me at prasant.tamang02@gmail.com

https://www.facebook.com/prasant.tamang.144

NAS 2 Inventories

Revision Note

Relevant For CAP-II students

As per NAS 2 “Inventories”, cost of inventories comprises all costs of purchase, costs

of conversion and other costs incurred in bringing the inventories to their present

location and condition.

NAS 23 borrowing costs identifies circumstance where borrowing costs can be

included in the cost of inventories. Such borrowing cost shall be directly attributable

to the inventories and would have been avoided if the expenditure on inventory had

not been made.

In light of these provisions, in given case, overdraft was taken for financing current

assets and meeting day to day working expenses, not necessarily directly for

inventory only. Therefore, the proposal of ABC Ltd. to include interest on bank

overdraft as an element of cost of inventory is not acceptable because it does not

form part of cost of production.

In a production process, normal waste is 5% of input. 5,000 MT of input were put in

process resulting in wastage of 300 MT. Cost per MT of input is Rs. 1,000. The entire

quantity of waste is on stock at the year end. State with reference to Accounting

Standard, how will you value the inventories in this case? (December 2016) (for

5 marks)

Answer:

As per of NAS- 2,” Inventories”, abnormal amount of wasted materials, labour and

other production costs are excluded from cost of inventories and such costs are

recognized as expenses in the period in which they are incurred.

In this case, normal waste is 250 MT and abnormal waste is 50 MT. The cost of 250

MT will be included in determining the cost of inventories (finished goods) at the

year end. The cost of abnormal waste (50MT x 1,052.63 = Rs 52,632) will be

charged to the profit and loss statement.

Cost per MT (Normal Quantity of 4,750 MT) = 50,00,000 / 4,750 = Rs 1,052.63

Total value of inventory = 4,700 x Rs 1,052.63 = Rs 49,47,361.

2. Allocation of cost to joint products and by-products:

Joint cost allocated between the products on a rational and consistent basis. For

example- on the relative sales value of each product either at the stage in the

production process when the products become separately identif iable, or at the

completion of production.

Most by-products, by their nature, are immaterial- measured at NRV and this value

is deducted from the cost of the main product.

In a manufacturing process of A Ltd., one by product BP emerges besides two main products

MP 1 and MP 2 apart from scrap. Details of cost of production process are here under:

Items Unit Amount Output Closing stock as on

2076-03-32

Raw material 14,500 150,000 MP 1- 5000 units MP 1: 250 units

Compiled by CA. Prasant Tamang

For any suggestion and feedback

Reach me at prasant.tamang02@gmail.com

https://www.facebook.com/prasant.tamang.144

NAS 2 Inventories

Revision Note

Relevant For CAP-II students

Wages 90,000 MP 2 -4000 units MP 2: 100 units

Fixed Overhead 65,000 BP- 2000 units

Variable Overhead 50,000

Average market price of MP 1 and MP 2 is NRs 60 per unit and NRs. 50 per unit respectively,

by- product is sold @ NRs 20 per unit. There is profit of NRs 5000 on sale of by -product

after incurring separate processing charges of NRs. 8000 and packing charge s of NRs. 2000,

NRs 5000 was realised from sale of scrap.

Required:

Calculate value of closing stock of MP 1 and MP 2 as on 2076-03-32.

Answer:

As per NAS 2 ‘Inventories’, most by-products as well as scrap or waste materials, by their

nature, are immateria l. They are often measured at net realizable value and this value is

deducted from the cost of the main product.

1) Calculation of NRV of By-product BP

Selling price of by-product 2,000 units x 40,000

Less: 20 per unit

Separate processing charges of by- product BP (8,000)

Packing charges (2,000)

Net realizable value of by-product BP 30,000

2) Calculation of cost of conversion for allocation

between joint products MP1 and MP2

Raw material 1,50,000

Wages 90,000

Fixed overhead 65,000

Variable overhead 50,000

Less: NRV of by-product BP (See calculation 1) 30,000

Sale value of scrap 5,000 (35,000)

Joint cost to be allocated between MP1 and MP2 3,20,000

3) Determination of “basis for allocation” and allocation of joint cost to MP1

and MP2

MP I MP 2

Output in units (a) 5,000 4,000

Sales price per unit (b) 60 50

Sales value (a x b) 3,00,000 2,00,000

Ratio of allocation 3 2

Joint cost of 3,20,000 allocated in the ratio of 3:2 (c) 1,92,000 1,28,000

Cost per unit [c/a] 38.4 32

4) Determination of value of Closing stock of MP1 and MP2:

Particulars MP 1 MP 2

Closing stock in units 250 units 100 units

Cost per unit 38.4 32

Value of closing stock 9,600 3,200

Compiled by CA. Prasant Tamang

For any suggestion and feedback

Reach me at prasant.tamang02@gmail.com

https://www.facebook.com/prasant.tamang.144

NAS 2 Inventories

Revision Note

Relevant For CAP-II students

3. Measurement Techniques:

Retail Method:

Cost is determined by reducing the sales value of the inventory by the

appropriate percentage gross margin. The percentage used takes into

consideration inventory that has been marked down to below its original

selling price. This method is often used in the retail industry for measuring

inventories of rapidly changing items that have similar margins.

Standard cost method:

Cost is based on normal levels of materials and supplies, labor

efficiency and capacity utilization. They are regularly reviewed and revised

where necessary

From the information given below you are required to estimate the cost of

inventory of Hari Lal as on 31s t December 2018

Beginning inventory: 400 items at NRs 19.5 cost; Retail price NRs. 30

Purchase for the year: 1200 items at NRs. 25 cost; Retail price NRs. 35

Net Sales for the year NRs. 45,000

Answer:

Particulars Cost price Retail Price

Opening inventory (400*19.5)=7,800 (400*30)=12,000

Purchase (1200*25)= 30,000 (1200*35)= 42000

Available for sales 37,800 54,000

Net sales 45,000

Closing inventory (9000/54000*37800)=6,300 9,000

Cost of inventory under retail method= NRs. 6,300

M/s X, Y and Z are in retail business, following information are obtained from

their records for

the year ended 31st March, 2011:

Goods received from suppliers

(subject to trade discount and taxes) ` 15,75,500

Trade discount 3% and sales tax 11%

Packaging and transportation charges ` 87,500

Sales during the year ` 22,45,500

Sales price of closing inventories ` 2,35,000

Find out the historical cost of inventories using adjusted selling price method.

Answer:

Determination of cost of purchases:

Goods received from suppliers 15,75,500

Less : Trade discount 3% (47,265)

Compiled by CA. Prasant Tamang

For any suggestion and feedback

Reach me at prasant.tamang02@gmail.com

https://www.facebook.com/prasant.tamang.144

NAS 2 Inventories

Revision Note

Relevant For CAP-II students

15,28,235

Add : Sales Tax 11% 1,68,106

16,96,341

Add : Packaging and

transportation charges 87,500

17,83,841

Determination of estimated gross profit margin:

Sales during the year 22,45,500

Closing inventory at the selling price 2,35,000

24,80,500

Less : Purchases ( 17,83,841)

Gross profit 6,96,659

Gross profit margin 28.09%

Inventory valuation:

Selling price of closing inventories 2,35,000

Less : Gross profit margin 28.09% ( 66,012)

1,68,988

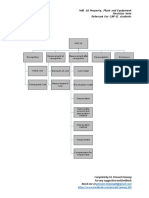

4. Cost Formulas:

Inventory

valuation

Technique

Ordinarily Not Ordinarily

Interchangeable Interchangeable

Specific

Historical Cost Non Historical

identification

Method Cost Method

method

Retail Inventory/

Weighted Standard cost

FIFO Adjusted selling

Average method

price method

Note:

FIFO method: items of inventory that were purchased or produced first are sold

first, and consequently the items remaining in inventory at the end of the period are

those most recently purchased or produced.

Compiled by CA. Prasant Tamang

For any suggestion and feedback

Reach me at prasant.tamang02@gmail.com

https://www.facebook.com/prasant.tamang.144

NAS 2 Inventories

Revision Note

Relevant For CAP-II students

Weighted average: cost of each item is determined from the weighted average of

the cost of similar items at the beginning of a period and the cost of similar items

purchased or produced during the period. The average may be calculated on a

periodic basis, or as each additional shipment is received, depending upon the

circumstances of the entity.

A Ltd. uses a periodic inventory system. The following information relates to 2018-

19.

Date Particulars Unit Cost per unit

April Inventory 200 10

May Purchases 50 11

September Purchases 400 12

February Purchases 350 14

Total 1,000 12,250

Physical inventory as on 31.03.2019 400 units. Calculate ending inventory value and

cost of sales using:

a. FIFO and

b. Weighted average

Answer:

a. Under FIFO

method

Inventory on 31.03.2019 350@14= 4,900

50@12= 600

5,500

Cost of sales Opening inventory +

purchase- closing stock 6,750

12250-5500

b. Under weighted

average method:

Inventory on

31.03.2019

Cost per item 12,250/1000= 12.25

Closing inventory 400*12.25= 4900

Cost of sales 12250-4900= 7350

5. Writing inventories down to net realisable value:

Compiled by CA. Prasant Tamang

For any suggestion and feedback

Reach me at prasant.tamang02@gmail.com

https://www.facebook.com/prasant.tamang.144

NAS 2 Inventories

Revision Note

Relevant For CAP-II students

Materials and other supplies held for use in the production of inventories are not

written down below cost if the finished products in which they will be incorporated are

expected to be sold at or above cost. However, when a decline in the price of materia ls

indicates that the cost of the finished products exceeds net realisable value of FG, the

materials are written down to net realisable value. In such circumstances, the

replacement cost of the materials (latest purchase price) may be the best available

measure of their net realisable value.

A Ltd. purchased raw material @ NRs. 400 per kg. Company does not sell raw

material but uses in production of finished goods. The finished goods in which raw

material is used are expected to be sold at below cost. At the end of the accounting

year, company is having 10,000 kg of raw material in inventory. As the company

never sells the raw material, it does not know the selling price of raw material and

hence cannot calculate the realizable value of the raw material fo r valuation of

inventories at the end of the year. However, replacement cost of raw material is `

300 per kg. How will you value the inventory of raw material?

Answer:

As per NAS 2 “Inventories”, materials and other supplies held for use in the

production of inventories are not written down below cost if the finished products in

which they will be incorporated are expected to be sold at or above cost. However,

when there has been a decline in the price of materials and it is estimated that the

cost of the finished products will exceed net realizable value, the materials are

written down to net realizable value. In such circumstances, the replacement cost

of the materials may be the best available measure of their net realizable value.

In the given case,

Purchase cost of raw material: 10000*400 per kg= NRs. 40,00,000

However, finished goods in which raw material is used are expected to be sold at

below cost.

Hence material are written down to net relisable value. In such circumstances, the

replacement cost of the materials (latest purchase price) may be the best available

measure of their net realisable value.

Therefore, in this case, A Ltd. will value the inventory of raw material at 30,00,000

(10,000 kg. @ 300 per kg.).

Rahul Trading gives the following information relating to items forming part of

inventory as on 32-3-2075. His factory produces Product X using Raw material A.

i) 600 units of Raw material A (Produce @ Rs. 120). Replacement cost of raw

material A as on 32-3-2075 is Rs. 90 per unit.

Compiled by CA. Prasant Tamang

For any suggestion and feedback

Reach me at prasant.tamang02@gmail.com

https://www.facebook.com/prasant.tamang.144

NAS 2 Inventories

Revision Note

Relevant For CAP-II students

ii) 500 units of partly finished goods in the process of producing X and cost incurred

till date Rs. 260 per unit. These units can be finished next year by incurring

additional cost of Rs. 60 per unit.

iii) 1500 units of finished product X and total cost incurred Rs. 320 per unit. Expected

selling price of Product X is Rs. 300 per unit.

Determine how each item of inventory will be valued as on 32-3-2075. Also calculate

the value of total inventory as on 32-3-2075. (ICAN Dec 2018) (For 5 marks)

Answer:

As per NAS 2, Inventories are valued at lower of cost and net realizable

value.(provision 1)

Materials and other supplies held for use in the production of inventories are not

written down below cost if the finished products in which the will be incorporated

are expected to be sold at cost or above cost. However, when there has been a

decline in the price of materials and it is estimated that the cost of the finished

products will exceed net realizable value, the materials are written down to net

realizable value. In such circumstances, the replacement cost of the materials may

be the best available measure of their net realizable value.(provision 2)

In the given case, selling price of product X is Rs. 300 and total cost per unit for

production is Rs.320.

Hence valuation will be:

a. For raw material: (provision 2 applies), so RM written down to replacement

cost i.e. NRs. 90 per unit.

b. WIP goods(partly finished goods): Cost or NRV whichever is lower:

Cost of WIP= 260

NRV of WIP =net selling price of FG- estimated cost of completion- estimate

selling cost

=300-60

=240

Valued at NRs 240 per unit

c. Finished goods: Cost or NRV whichever is lower

Cost of FG= 320

NRV of FG= net selling price of FG-estimated selling cost

=300-0

=300

Valued at NRs. 300 per unit

Hence:

Units Valuation per unit Value

Raw material A 600 90 54,000

Partly Finished 500 240 1,20,000

Goods

Finished goods 1,500 300 450,000

X

Total value of 6,24,000

inventory

Compiled by CA. Prasant Tamang

For any suggestion and feedback

Reach me at prasant.tamang02@gmail.com

https://www.facebook.com/prasant.tamang.144

NAS 2 Inventories

Revision Note

Relevant For CAP-II students

Additional topics:

Reversals of write-downs:

A new assessment is made of net realisable value in each subsequent period.

When

a. previously caused inventories to be written down below cost no longer exist

b. or when there is clear evidence of an increase in net realisable value because of

changed economic circumstances,

the amount of the write-down is reversed (i.e. the reversal is limited to the amount of

the original write-down)

So that the new carrying amount is the lower of the cost and the revised net realisable

value.)

Recognition as an expenses:

1. The amount of inventories recognised as an expense in the period will generally be:

a. carrying amount of the inventories sold in the period in which related revenue is

recognised; and

b. the amount of any write-down of inventories to net realisable value and all losses of

inventories shall be recognised as an expense in the period the write -down or loss

occurs; reduced by

c. the amount of any reversal in the period of any write-down of inventories, arising

from an increase in net realisable value.

2. Some inventories may be allocated to other asset accounts, for example, inventory

used as a component of self-constructed property, plant or equipment. Inventories

allocated to another asset in this way are recognised as an expense during the useful

life of that asset through charging of depreciation on that asset.

An item of inventory costing 20,000 as covered under NAS 2 is consumed in the

construction of self-constructed property to be account ed as Property, plant and

equipment under NAS 16. The cost of such property, plant and equipment other

than inventories is 80,000. Such Inventory needs to be capitalized in the cost of

Property, plant and equipment. The useful life of the property is 5 yea rs. The

depreciation on such property charged to profit and loss account is 20,000 per

annum (i.e. 1,00,000/ 5)

Disclosure Requirement:

The financial statement shall disclose in notes to account:

a. Accounting policies adopted in measuring inventories, including cost formula used

b. Analysis of carrying amount

c. Inventories carried at NRV

d. Amount recognized in profit or loss

e. Inventories pledged as security

Compiled by CA. Prasant Tamang

For any suggestion and feedback

Reach me at prasant.tamang02@gmail.com

https://www.facebook.com/prasant.tamang.144

Das könnte Ihnen auch gefallen

- Israels Samson Option Nuclear ThreatDokument5 SeitenIsraels Samson Option Nuclear ThreatjavalassieNoch keine Bewertungen

- (Roy Porter) Mind-Forg'd Manacles A History of (B-Ok - CC)Dokument212 Seiten(Roy Porter) Mind-Forg'd Manacles A History of (B-Ok - CC)Ahmed ElabyadNoch keine Bewertungen

- Unit 2 Questions on Declaration of Independence and Northwest OrdinanceDokument8 SeitenUnit 2 Questions on Declaration of Independence and Northwest OrdinancejM mNoch keine Bewertungen

- GAD Plan and Budget - DepEdDokument44 SeitenGAD Plan and Budget - DepEdverneiza balbastroNoch keine Bewertungen

- Internal Audit Plan Report 2019 - 20 v1.3Dokument49 SeitenInternal Audit Plan Report 2019 - 20 v1.3Toygar SavkinerNoch keine Bewertungen

- Barangay Clearance Certificate TemplateDokument1 SeiteBarangay Clearance Certificate TemplateLina Rhea74% (19)

- Civil LiabilityDokument74 SeitenCivil LiabilityAllen SoNoch keine Bewertungen

- Angeles City Vs Angeles City Electric CorporationDokument1 SeiteAngeles City Vs Angeles City Electric CorporationJesse MoranteNoch keine Bewertungen

- Fair Value. ACCA. Paper P2. Students notes.: ACCA studiesVon EverandFair Value. ACCA. Paper P2. Students notes.: ACCA studiesNoch keine Bewertungen

- Job Seeking OilerDokument3 SeitenJob Seeking OilerDamar Lintas Buana Co., Ltd.Noch keine Bewertungen

- Case Digest Jaca V People - G.R. No. 166967 - Case DigestDokument2 SeitenCase Digest Jaca V People - G.R. No. 166967 - Case DigestJamesHarvey100% (1)

- Unit Overview:: NAS 2 Inventories Revision Note Relevant For CAP-II StudentsDokument13 SeitenUnit Overview:: NAS 2 Inventories Revision Note Relevant For CAP-II StudentsPrashant TamangNoch keine Bewertungen

- Masr2205 - Cost Definition, Concepts, Classification & AnalysisDokument11 SeitenMasr2205 - Cost Definition, Concepts, Classification & AnalysisDaniela AubreyNoch keine Bewertungen

- CA IPCC As - 2,7,9,10 Accounts As by Rohan SirDokument38 SeitenCA IPCC As - 2,7,9,10 Accounts As by Rohan SirJoya AhasanNoch keine Bewertungen

- I. Objective of IAS 2: Broker-Traders-Those Who Buy or Sell Commodities For Others or On Their OwnDokument5 SeitenI. Objective of IAS 2: Broker-Traders-Those Who Buy or Sell Commodities For Others or On Their OwnLorenz De Lemios NalicaNoch keine Bewertungen

- As - 2: Valuation of InventoriesDokument18 SeitenAs - 2: Valuation of InventoriesrajuNoch keine Bewertungen

- Cfas Pas 1-16Dokument8 SeitenCfas Pas 1-16Sagad KeithNoch keine Bewertungen

- 2nd Group - IASDokument63 Seiten2nd Group - IASmohihsanNoch keine Bewertungen

- Pas 2Dokument4 SeitenPas 2Cristine Jane Granaderos OppusNoch keine Bewertungen

- TugasDokument1 SeiteTugasRaihan Rivellino AdzaniNoch keine Bewertungen

- IAS 2 InventoriesDokument6 SeitenIAS 2 InventoriesRoxan PacsayNoch keine Bewertungen

- Manacc 3-Manacc NotesDokument16 SeitenManacc 3-Manacc NotesUzair IsmailNoch keine Bewertungen

- COST ACCOUNTING FUNDAMENTALSDokument4 SeitenCOST ACCOUNTING FUNDAMENTALSClariz Angelika EscocioNoch keine Bewertungen

- Scope: Allocation of Fixed Production OverheadsDokument8 SeitenScope: Allocation of Fixed Production OverheadsjayveeNoch keine Bewertungen

- Cost Accounting Chapters 1&2Dokument7 SeitenCost Accounting Chapters 1&2ralfgerwin inesaNoch keine Bewertungen

- ACC 203 Module 4 PAS 2 Inventories PAS 41 Biological AssetsDokument15 SeitenACC 203 Module 4 PAS 2 Inventories PAS 41 Biological AssetsKirsty SicamNoch keine Bewertungen

- Ind As 2 Inventories 74892bos60524-Cp6-U1Dokument42 SeitenInd As 2 Inventories 74892bos60524-Cp6-U1kedar bhideNoch keine Bewertungen

- Valuing Inventory: Key Aspects of AS 2Dokument32 SeitenValuing Inventory: Key Aspects of AS 2arvindNoch keine Bewertungen

- Assets Are Not Measured Under The Lower Cost or Net Realizable Value (NRV) Under PAS 2Dokument4 SeitenAssets Are Not Measured Under The Lower Cost or Net Realizable Value (NRV) Under PAS 2Elaiza Jane CruzNoch keine Bewertungen

- Mas 05 Differential CostingDokument5 SeitenMas 05 Differential CostingSadile May KayeNoch keine Bewertungen

- Module 05 - Inventories, Agricultural Assets and ImpairmentDokument21 SeitenModule 05 - Inventories, Agricultural Assets and Impairmentpaula manaloNoch keine Bewertungen

- c1 - Introduction To Cost AccountingDokument2 Seitenc1 - Introduction To Cost AccountingAndrea Camille AquinoNoch keine Bewertungen

- G Ias 2Dokument19 SeitenG Ias 2Daniel MNoch keine Bewertungen

- ACC2706 CheatsheetDokument10 SeitenACC2706 CheatsheetOng Ming XiaNoch keine Bewertungen

- ACC2706 Cheatsheet FinalsDokument11 SeitenACC2706 Cheatsheet FinalsOng Ming XiaNoch keine Bewertungen

- Inventories Accounting StandardDokument25 SeitenInventories Accounting StandardvijaykumartaxNoch keine Bewertungen

- Classification of CostDokument23 SeitenClassification of CostShohidul Islam SaykatNoch keine Bewertungen

- STRACOSMAN - Chapter 2Dokument6 SeitenSTRACOSMAN - Chapter 2Rae WorksNoch keine Bewertungen

- Cost AccountingDokument2 SeitenCost AccountingSherilyn LozanoNoch keine Bewertungen

- MAS-Reviewer 1Dokument13 SeitenMAS-Reviewer 1Raven BermalNoch keine Bewertungen

- Cost Accounting & ControlDokument4 SeitenCost Accounting & ControlQueeny CuraNoch keine Bewertungen

- NAS 16-Property, Plant and EquipmentDokument10 SeitenNAS 16-Property, Plant and EquipmentPrashant TamangNoch keine Bewertungen

- UFAS2Dokument4 SeitenUFAS2Romylen De GuzmanNoch keine Bewertungen

- Charts On AS by Rohan Sir VSMART ACADEMY PDFDokument36 SeitenCharts On AS by Rohan Sir VSMART ACADEMY PDFAejaz Mohamed86% (7)

- Final CoursesDokument159 SeitenFinal CoursesMARTYNNoch keine Bewertungen

- InventoriesDokument3 SeitenInventoriesNikki RañolaNoch keine Bewertungen

- Financial Accounting Management Accounting: Internal Users Managers For PlanningDokument4 SeitenFinancial Accounting Management Accounting: Internal Users Managers For PlanningEpfie SanchesNoch keine Bewertungen

- Cost Concepts, Classification and Analysis: Practice ExerciseDokument9 SeitenCost Concepts, Classification and Analysis: Practice ExerciseKuya ANoch keine Bewertungen

- Pas 2Dokument14 SeitenPas 2Princess Jullyn ClaudioNoch keine Bewertungen

- Scheduler's ImpressiveDokument7 SeitenScheduler's Impressivemaria ronoraNoch keine Bewertungen

- 01 - Finacc - Property, Plant, and EquipmentDokument5 Seiten01 - Finacc - Property, Plant, and EquipmentAbigail PadillaNoch keine Bewertungen

- CA Inter Accounting Revision NotesDokument106 SeitenCA Inter Accounting Revision NoteskalyanikamineniNoch keine Bewertungen

- Chapter 10: Inventories: CustomersDokument4 SeitenChapter 10: Inventories: CustomersireneNoch keine Bewertungen

- FARAP 4404 Property Plant EquipmentDokument11 SeitenFARAP 4404 Property Plant EquipmentJohn Ray RonaNoch keine Bewertungen

- Cost Concepts and Analysis PDFDokument17 SeitenCost Concepts and Analysis PDFHansNoch keine Bewertungen

- Costs in Managerial AccountingDokument9 SeitenCosts in Managerial AccountingVerily DomingoNoch keine Bewertungen

- Assignment 1571213755 SmsDokument15 SeitenAssignment 1571213755 SmsRahul Kumar Sharma 17Noch keine Bewertungen

- Ojas FR Module 1Dokument280 SeitenOjas FR Module 1AnupNoch keine Bewertungen

- COST ACCOUNTING CONCEPTSDokument2 SeitenCOST ACCOUNTING CONCEPTSHoney MuliNoch keine Bewertungen

- KAREN LUZON - Project IntermedDokument1 SeiteKAREN LUZON - Project IntermedKarenn Estrañero LuzonNoch keine Bewertungen

- University of Perpetual Help System Dalta: Calamba Campus, Brgy. Paciano RizalDokument3 SeitenUniversity of Perpetual Help System Dalta: Calamba Campus, Brgy. Paciano RizalJeanette LampitocNoch keine Bewertungen

- Chapter 4 (Acc)Dokument25 SeitenChapter 4 (Acc)shafNoch keine Bewertungen

- Inventories Lkas 2Dokument12 SeitenInventories Lkas 2kavindyatharaki2002Noch keine Bewertungen

- Cost Accounting and Control: Process vs Job Order CostingDokument10 SeitenCost Accounting and Control: Process vs Job Order CostingKristine dela CruzNoch keine Bewertungen

- NAS 2 InventoriesDokument10 SeitenNAS 2 Inventoriessandeep gyawaliNoch keine Bewertungen

- Costing: Although Contract Costing Does Not Differ In: Cost Accounting and Financial AccountingDokument2 SeitenCosting: Although Contract Costing Does Not Differ In: Cost Accounting and Financial AccountingVinu JayaramNoch keine Bewertungen

- Marathon Batch Final With Cover and Index PDFDokument106 SeitenMarathon Batch Final With Cover and Index PDFChandreshNoch keine Bewertungen

- Mammut Trailer Division: Quality Objectives F 2006-2007 IMPROVED COMMUNICATIONDokument4 SeitenMammut Trailer Division: Quality Objectives F 2006-2007 IMPROVED COMMUNICATIONvinothNoch keine Bewertungen

- Pas 2 InventoryDokument3 SeitenPas 2 InventoryHardly Dare GonzalesNoch keine Bewertungen

- Ipsas 12 and Ipsas 27Dokument14 SeitenIpsas 12 and Ipsas 27Kidanu Taye TerfaNoch keine Bewertungen

- NAS 23 Borrowing CostDokument5 SeitenNAS 23 Borrowing CostPrashant TamangNoch keine Bewertungen

- NAS 37 Provision, Contingent Asset and Contingent LiabilitiesDokument5 SeitenNAS 37 Provision, Contingent Asset and Contingent LiabilitiesPrashant TamangNoch keine Bewertungen

- NAS 37 Provision, Contingent Asset and Contingent LiabilitiesDokument5 SeitenNAS 37 Provision, Contingent Asset and Contingent LiabilitiesPrashant TamangNoch keine Bewertungen

- Advanced Financial Reporting Marks WeightageDokument3 SeitenAdvanced Financial Reporting Marks WeightagePrashant TamangNoch keine Bewertungen

- Unit Overview:: NAS 17 Lease Revision Note Relevant For CAP-II StudentsDokument11 SeitenUnit Overview:: NAS 17 Lease Revision Note Relevant For CAP-II StudentsPrashant TamangNoch keine Bewertungen

- NAS 16-Property, Plant and EquipmentDokument10 SeitenNAS 16-Property, Plant and EquipmentPrashant TamangNoch keine Bewertungen

- Communication Studies Journal Article on Climategate Conspiracy TheoryDokument23 SeitenCommunication Studies Journal Article on Climategate Conspiracy Theorycarlos_fecsNoch keine Bewertungen

- Nigerian Journal of Accounting Research paper examines insurance industry's economic impactDokument10 SeitenNigerian Journal of Accounting Research paper examines insurance industry's economic impactBrianNoch keine Bewertungen

- Certificate in Us Gaap: Practical Insight Into US Accounting StandardsDokument7 SeitenCertificate in Us Gaap: Practical Insight Into US Accounting StandardsSagar AroraNoch keine Bewertungen

- Legal Research Draft FinalsDokument2 SeitenLegal Research Draft FinalsLorden FarrelNoch keine Bewertungen

- PSC3Dokument22 SeitenPSC3John WoodNoch keine Bewertungen

- 1 - Growth and Direction of International Trade - PPT - 1Dokument18 Seiten1 - Growth and Direction of International Trade - PPT - 1Rayhan Atunu67% (3)

- Financial Transaction Worksheet, Luca ProblemDokument3 SeitenFinancial Transaction Worksheet, Luca ProblemFeiya LiuNoch keine Bewertungen

- DFSA Business Plan 21-22-Hires SpreadDokument16 SeitenDFSA Business Plan 21-22-Hires SpreadForkLogNoch keine Bewertungen

- Dacanay-vs-Baker-and-Mckenzie-AC-2131Dokument1 SeiteDacanay-vs-Baker-and-Mckenzie-AC-2131DeavinNoch keine Bewertungen

- VCVDokument5 SeitenVCVMustafi MorganNoch keine Bewertungen

- Addendum Number 1 For Module 1 - Camille RamossDokument8 SeitenAddendum Number 1 For Module 1 - Camille RamossCamille Rose B RamosNoch keine Bewertungen

- Guide To Complete Joining FormDokument20 SeitenGuide To Complete Joining FormAnto JoisenNoch keine Bewertungen

- Maharashtra State Board 9th STD History and Political Science Textbook EngDokument106 SeitenMaharashtra State Board 9th STD History and Political Science Textbook EngSomesh Kamad100% (2)

- Dawn Editorials 23 Oct PDFDokument18 SeitenDawn Editorials 23 Oct PDFQasim AliNoch keine Bewertungen

- Mahindra Thar Auction Rules and TimelineDokument6 SeitenMahindra Thar Auction Rules and TimelineSyed RahmanNoch keine Bewertungen

- Mamone IndictmentDokument30 SeitenMamone IndictmentScott SuttonNoch keine Bewertungen

- Commodatum ContractDokument3 SeitenCommodatum ContractLaura Daniela Restrepo MolinaNoch keine Bewertungen

- Community Engagement, Solidarity and CitizenshipDokument3 SeitenCommunity Engagement, Solidarity and CitizenshipEɪ DəNoch keine Bewertungen

- Course Registration FormDokument1 SeiteCourse Registration FormaleepNoch keine Bewertungen

- S.J. Mukhopadhaya, J. (Chairperson) and Balvinder Singh, Member (T)Dokument18 SeitenS.J. Mukhopadhaya, J. (Chairperson) and Balvinder Singh, Member (T)nkhahkjshdkjasNoch keine Bewertungen