Beruflich Dokumente

Kultur Dokumente

11 Accountancy SP 1 PDF

Hochgeladen von

Sumit MazumderOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

11 Accountancy SP 1 PDF

Hochgeladen von

Sumit MazumderCopyright:

Verfügbare Formate

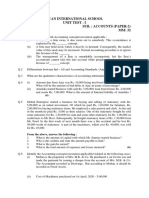

CBSE

Class 11 Accountancy

Sample Paper - 1

For CBSE Examination March 2019

Time allowed: 3 hours

Maximum Marks: 90

General Instructions:

i. This question paper contains Two parts A & B. Both the parts are compulsory for all.

ii. All parts of questions should be attempted at one place.

iii. Part A contains 16 Questions of which. Question 1 to 4 are carry 1 marks each. Question 5

to 9 are carry 3 marks each. Question 10 and 13 are carry 4 marks each. Question 14 to 15

are carry 6 marks each. Question 16 are carry 8 marks each.

iv. Part B 17 to 24 question of which. Question 17 and 18 are carry 1 marks each. Question 19

are carry 3 marks each. Question 20 are carry 4 marks each. Question 21 to 23 are carry

6 marks each. Question 24 are carry 8 marks each. All parts of a question should be

attempted at one place.

Part – A

Financial Account - I

1. Accounting is considered as backbone of the business. How would you define accounting

in the context of a newly starting business?

2. What is meant by Invoice OR Bill in context of ‘Source Documents’?

3. Give the meaning of Revenue with an example.

4. Give two examples of Fictitious Assets.

5. State any three differences between Provision and Reserve.

6. Explain any three internal users of Accounting Information.

7. Rectify the following errors by passing entries:

i. Credit sale of old furniture to Mohan for 1,500 was posted as 5,100.

ii. Goods purchased from David Rs.2,000 passed through sales book.

iii. Sales Book has been totaled Rs.2,000 short.

8. Write any three objectives of Accounting Standards (AS).

9. Explain Consistency assumption and Revenue Recognition principle of accounting.

Material downloaded from myCBSEguide.com. 1 / 17

10. Prepare Cash Book with Bank Column of Vinod from the following transactions:

April 1 Cash in hand ........................................2,200

Cash at Bank ..............................................5,000

April l 5 Received a Cheque from Naresh.................................. 1,000

April l 8 Cheque received from Naresh endorsed to Suresh in full settlement. 1,050

April 10 Paid Life Insurance premium of Mr.Mohan...........................100

April 13 Received and banked a cheque from Pawan in full settlement ............ 750

April 16 Pawan's Cheque returned dishonoured by bank

April 20 Deposited into Bank, Balance of Cash in excess of ......................... 250

11. Complete the following journal entries of Vinod Bros.

Date Particulars L.F. Debit Credit

________ A/c Dr.

To _______________ ........

(i)

(Being goods costing Rs.2,000 was taken by proprietor for ........

personal use the market value of these goods is Rs.2,500)

_________ A/c Dr.

.......

To _______________

(ii)

(Being household furniture sold by Vinod for Rs.14,000 and ........

introduced that money as capital)

____________ A/c Dr.

(iii) To _______________ ....... ........

(Being Rs.800 due from Gaurav are bad debts)

____________ A/c Dr.

To _______________ ........

(iv)

(Being goods costing Rs.1,000 and market price Rs.1,200 ........

were destroyed by fire)

12. Prepare a Bank Reconciliation Statement on 31 May 2018 for the following:

i. Cheques issued before May 31, 2018, amounting to Rs. 25,940 had not been presented

for encashment.

ii. Two cheques of Rs. 3,900 and Rs. 2,350 were deposited into the bank on May 31 but

the bank gave credit for the same in June, 2018.

iii. There was also a debit in the passbook of Rs. 2,500 in respect of a cheque dishonoured

Material downloaded from myCBSEguide.com. 2 / 17

on 31.5.2018. Prepare a bank reconciliation statement as on May 31, 2018.

13. Following transactions are of M/s. Vinod Kumar & Sons for the month of April, 2018.

Prepare their Purchases Book:

April 5 Purchase on credit from M/s. Birla Mills:

100 pieces long cloth @ Rs.80

50 pieces shirting @ Rs.100

April 8 Purchased for cash from M/s. Ambika Mills:

50 pieces muslin @ Rs.120

April 15 Purchased on credit from M/s. Arvind Mills:

20 pieces coating @ Rs.1,000

10 pieces shirting @ Rs.90

April 20 Purchase on credit from M/s. Bharat Typewriters Ltd:

5 typewriters @ Rs.1,400 each

14. On March 15, 2018 Ramesh sold goods for Rs. 8,000 to Deepak on credit. Deepak accepted

a bill of exchange drawn upon him by Ramesh payable after three months. On April, 15

Ramesh endorsed the bill in favour of his creditor Poonam in full settlement of her debt

of Rs. 8,250. On May 15, Poonam discounted the bill with her bank @ 12% p.a. On the due

date Deepak met the bill. Record the necessary journal entries in the books of Ramesh.

15. M/s Vinod & Sons showing following transactions. Prepare accounting equation for the

same:

i. Commenced business with cash………………………… Rs.3,00,000.

ii. Purchased goods for cash…………………………………Rs.80,000.

iii. Purchased machinery on credit………………………….. Rs.1,25,000.

iv. Purchased old car for personal use for ……………….Rs.1,00,000.

16. Vinod Limited purchased a machinery of Rs.3,00,000 on 1st July, 2012 and Rs.3,00,000 on

1st November 2012. Company purchased one more machinery on 1st January 2013 for

Rs.2,00,000. Company sold one machinery for Rs.2,10,000 on 31st March 2014 which was

purchased on 1st July 2012. Company purchased on second hand machinery on the same

day for Rs.1,00,000. Rate of Depreciation is 10% by Straight Line Method and closes its

accounts on 31st December every year.

Material downloaded from myCBSEguide.com. 3 / 17

Prepare Machinery A/c, Machinery Disposal A/c and Provision for Depreciation A/c.

OR

On 1st January, 2005, VK Ltd. Purchased machinery for Rs.2,40,000 and on 30th June

2006, it acquired additional machinery at a cost of Rs.40,000. On 31st March, 2007, one of

the original machine (purchased on 1st January, 2005) which had cost of Rs.10,000 was

found to have become obsolete and was sold as scrap for Rs.1,000. It was replaced on that

date by a new machine costing Rs.16,000. Depreciation is to be provided @ 15% p.a. on

the written down value. Show machinery account by following calendar year.

Part – B

Financial Account - II

17. What is a Contingent Liability? How is it shown in Final Accounts?

18. What is meant by a ‘Statement of Affairs”?

19. From the following information, find out profit:

1. Capital at the end of the year ……………….. Rs.5,00,000

2. Capital in the beginning of the year …………Rs.7,50,000

3. Drawings made during the period ………….. Rs.3,75,000

4. Additional capital introduced ………………..Rs.50,000

20. What are the main disadvantages of computerized accounting?

21. The capital of Mr. Vinod Kumar on 1st April 2002 was Rs.50,000 and 31st March was

Rs.48,000. He has informed you that he withdrew from the business Rs.800 per month for

his private use. He paid Rs.2,000 for his income tax and the instalment of the loan of his

personal house at the rate of Rs.1,500 per month from the business. He had also sold his

shares of X Ltd. Costing Rs.10,000 at a profit of 20% and invested half of this amount in

the business. Calculate profit/loss of the business.

22. Following is the extract from a Trial Balance:

Particulars Amount (Dr.) Amount (Cr.)

Debtors 84,000 --

Bad Debts 2,000 --

Adjustments:

i. Write off Rs.4,000 as further bad debts.

Material downloaded from myCBSEguide.com. 4 / 17

ii. Create a provision for doubtful debts at 5% on Sundry Debtors.

Show the treatment of above items in final accounts.

23. Explain Readymade and Customized software with their advantages & limitations.

24. From the following Trial Balance of M/s.Vinod and Sons as on 31st March. 2002, prepare

Trading and Profit & Loss Account and Balance Sheet.

Particulars Amount Particulars Amount

Capital 50 Bank overdraft 2,850

Bank Balance 600 Creditors 2,500

Debtors 3,800 Capital 12,500

Bad debts 125 Provision for bad debts 200

Stock (opening) 3,460 Sales 15,450

Purchases 5,475 Purchase return 125

Sales return 200 Commission 375

Furniture & fittings 640

Motor vehicles 6,250

Buildings 7,500

Advertisement 450

Interest on bank overdraft 118

Taxes & insurance 1,250

General expenses 782

Salaries 3,300

Adjustments:

i. Stock in hand on 31-3-2002 Rs.5,750.

ii. Depreciate building @ 5%, furniture and fittings @ 10% and motor vehicles @ 20%.

iii. Rs.85 is due for interest on bank overdraft.

iv. Salaries Rs.300 and taxes Rs.120 are outstanding.

v. One third of the commission received is in respect of work to be done next year.

vi. Write off a further sum of Rs.100 as bad debts and provision for bad debts is to be

Material downloaded from myCBSEguide.com. 5 / 17

made equal to 10% on sundry debtors.

OR

From the following Trial Balance of M/s.Vinod and Sons as on 31st December. 2002,

prepare Trading and Profit & Loss Account and Balance Sheet.

Particulars Amount Particulars Amount

Trade expenses 800 Stock (opening) 15,000

Freight & duty 2,000 Plant & Machinery (on 1 Jan) 20,000

Carriage outwards 500 Additions to Plant & Mach. (1 July) 5,000

Sundry debtors 20,600 Drawings 6,000

Furniture & fixtures 5,000 Capital 80,000

Returns inwards 2,000 Reserve for doubtful debts 800

Printing & stationery 400 Rent for premises sublet 1,600

Rent, rates & taxes 4,600 Insurance charges 700

Sundry creditors 10,000 Salaries and wages 21.300

Sales 1,20,000 Cash in hand 6,200

Returns outwards 1,000 Cash at bank 20,500

Postage & telegrams 800

Purchases 82,000

Adjustments:

i. A fire occurred on 5th December 2002 in the godown and stock of the value of

Rs.5,000 was destroyed. It was insured and insurance company admitted full claim.

ii. Insurance prepaid was Rs.100.

iii. Depreciation on furniture & fixtures at 5% p.a. and on plant & machinery 20% p.a.

iv. Reserve for doubtful debts is to be maintained at 5% on sundry debtors.

v. Write off Rs.600 as bad debts.

vi. Stock in hand on 31-12-2002 Rs.14,000.

Material downloaded from myCBSEguide.com. 6 / 17

CBSE Class 11 Accountancy

Sample Paper - 1

For CBSE Examination March 2019

Solutions

1. Accounting is a process of identifying financial transactions, measuring them in

monetary terms, and recording, classifying, summarizing, analyzing, interpreting them

and communicating the results to the users.

2. When a seller sells goods on credit, he prepares an invoice or bill with the details of party

to whom goods are sold with the quantity of goods and total amount.

3. Revenue is sum of cash and credit sales which is earned as a result of sale of goods or

rendering of services.

4. Two examples of fictitious assets are: (i) Preliminary Expenses (ii) Advertisement

Suspense

5. Difference between provision and reserve:

BASIS PROVISION RESERVE

Meaning retain a It means to provide for a future Reserves means to part of

future use. expected liability. profit for

It is appropriation of

Charge/Appropriation It is a Charge against the profit.

profit.

Provides For

It is provided for known liabilities. Increase in capital

employed

6. Internal users of Accounting Information:

i. Proprietors: The proprietors or owners of the business need accounting information

to Estimate the trading results of the business, its financial position towards the end of

the accounting period and future prospects of the business.

ii. Management: Management requires accounting information for planning and

controlling Purposes. By proper use of this information, management can help to

improve efficiency and thereby increase profits of the enterprise.

iii. Employees: Good results of the business provide a great satisfaction to employees as

their bread and butter depends on these results. In those business concerns in which

profit sharing schemes are introduced, employees become very much interested in

Material downloaded from myCBSEguide.com. 7 / 17

knowing how the profit has been ascertained.

7. a. Furniture A/c Dr. 3,600 and Mohan Cr. Rs.3,600.

b. Purchase A/c Dr.2,000; Sales A/c Dr.2,000 and David Cr.4,000.

c. Suspense A/c Dr.2,000 and Sales A/c Cr.2,000.

8. i. Facilitates in better understanding of financial statements.

ii. Adopts significant accounting policies.

iii. Enhancing reliability of financial statements.

9. Consistency Assumption: Accounting practices/method once selected and adopted should

be applied consistently year after year. Consistency helps in eliminating personal bias in

accounting and makes it comparable. The accounting practices may be changed if

necessary or required by the law or accounting standards.

Revenue Recognition Principle: According to this principle revenue is considered to have

been realised when transaction has been entered into and the obligation to receive the

amount has been established.

10. Cash Book

Date Particulars L.F Cash Bank Date Particulars L.F Cash Bank

April To Balance b/d 2,200 5,000 April

1 To Pawan 750 10 By Drawings 100

13 To cash C 1,850 16 By Pawan 750

20 By Bank C 1,850

30 By Balance c/d 250 6,850

To Balance b/d 2,200 7,600 2,200 7,600

May 1 250 6,850

11. Journal Entries

Date Particulars L.F. Debit Credit

Drawing A/c Dr.

To Purchase A/c 2,000

(i) 2,000

(Being goods costing Rs.2,000 was taken by proprietor for

personal use the market value of these goods is Rs.2,500)

Cash A/c Dr.

Material downloaded from myCBSEguide.com. 8 / 17

To Capital A/c 14,000

(ii) 14,000

(Being household furniture sold by Vinod for Rs.14,000 and

introduced that money as capital)

Bad Debts A/c Dr.

(iii) To Gaurav 800 800

(Being Rs.800 due from Gaurav are bad debts)

Loss by Fire A/c Dr.

To Purchase A/c

(iv) 1,000 1,000

(Being goods costing Rs.1,000; market price Rs.1,200 were

destroyed by fire)

12. Bank Reconciliation Statement

(+) (-)

Particulars

Amount Amount

1 Balance as per passbook 45,000

Cheques deposited but not collected by the bank (Rs. 3,900+

2. 6,250

Rs. 2,350)

3. Cheque dishonoured recorded only in passbook 2,2500

4. Cheques issued but not presented for payment 25,940

5. Balance as per cash book 27,810

Total 53,750 53,750

13. Purchase Book

April 13 M/s Birla Mills:

100 pieces long cloth @ Rs 80 8,0000

50 pieces shirting @ Rs.100 5,000 13,000

April 15 M/s Arvind Mills:

20 Pieces coating @ Rs.1000 20,000

10 Pieces shirting @ Rs.90 900 20,900

Material downloaded from myCBSEguide.com. 9 / 17

Purchase A/c Dr. 33,900

14. Journal of Ramesh

2018

Mar. 15 Deepak A/c Dr. 8,000

To Sales A/c

8,000

(Sold goods to Deepak on credit

Mar. 15 Bills Receivable A/c Dr. 8,000

To Deepak A/c

8,000

(Receivable Deepak's acceptance for three months)

April.15 Poonam's A/c Dr. 8,250

To Bills Receivable A/c 8,000

To Discount Received A/c 250

15. Accounting Equation

Particulars Assets = Liabilities

Cash + Stock + Machinery = Creditors + Capital

(i) Commenced Business 3,00,000 + 0 + 0 = 0 + 3,00,000

(ii) Purchased goods (80,000) + 80,000 + 0 = 0 + 0

New Equation 2,20,000 + 80,000 + 0 = 0 + 3,00,000

(iii) Purchased Machine 0 + 0 + 1,25,000 = 1,25,000 + 0

New Equation 2,20,000 + 80,000 + 1,25,000 = 1,25,000 + 3,00,000

(iv) Purchased car (1,00,000) + 0 + 0 = 0 + (1,00,000)

Final Equation 1,20,000 + 80,000 + 1,25,000 = 1,25,000 + 2,00,000

16. Machinery Account

Date Particulars Amount Date Particulars Amount

1/7/12 To Bank A/c 3,00,000

31 Dec By Balance c/d 6,00,000

1/11/12 To Bank A/c 3,00,000

Material downloaded from myCBSEguide.com. 10 / 17

6,00,000 6,00,000

1/1/13 To Balance b/d 6,00,000

31 Dec By Balance c/d 8,00,000

1/1/13 To Bank A/c 2,00,000

8,00,000 8,00,000

1/1/14 To Balance b/d 8,00,000 31/3/14 By Machinery Disposal 3,00,000

31/3/14 To Bank A/c 1,00,000 31 Dec. By Bal. c/d 6,00,000

9,00,000 9,00,000

Provision for Depreciation Account

Date Particulars Amount Date Particulars Amount

By Depreciation (i) 15,000

31 Dec. To Bal. c/d 20,000 31 Dec

(ii) 5,000

20,000 20,000

31 Dec To Bal. c/d 1,00,000 1 jan By Bal. b/d 20,000

31 Dec By Depreciation (i) 30,000

(ii) 30,000

(iii) 20,000

1,00,000 1,00,000

31 March To Machinery disposal 52,500 1 Jan By Bal. b/d 1,00,000

31 Dec To Bal. c/d 1,12,500 31 Dec By Depreciation (i) 7,500

(ii) 30,000

(iii) 20,000

(iv) 7,500

1,65,000 1,65,000

Machinery Disposal Account

Date Particulars Amount Date Particulars Amount

Material downloaded from myCBSEguide.com. 11 / 17

By Bank A/c 2,10,000

31 March To Machinery A/c 3,00,000 31 March By Provision for Dep. 52,500

By P/L A/c 37,500

3,00,000 3,00,000

OR

Machinery Account

Date Particular Amount Date Particulars Amount

2005

By Depreciation A/c 36,000

2005 Jan 1 To Bank A/c 2,40,000 Dec. 31

By Balance c/d 2,04,000

Dec.31

2,40,000 2,40,000

2006 2006

To Balance b/d 2,04,000 By Depreciation A/c 33,600

Jan 1 Dec 31

To Bank A/c 40,000 By Balance c/d 2,10,400

June 30 Dec 31

2,44,000 2,44,000

2007

By Bank (Sale) 1,000

March 31

2007 By Depreciation A/c 270

To Balance b/d 2,10,400 March 31

Jan 1 By P/L A/c 5,954

To Bank A/c 16,000 March 31

March 31 By Depreciation A/c 32,276

Dec 31

By Balance c/d 1,86,900

Dec 31

2,26,400 2,26,400

2008 Jan1 To Balance b/d 1,86,900

17. There are some possible liabilities which are not actual liabilities on the date of Balance

Sheet, but which may become real liabilities after sometime on happening of certain

contingency.

18. Statement of Affairs: A Statement of affairs is a statement of assets and liabilities of a

business as on a particular date. Under this method, profit is ascertained by comparing

the capital at the beginning and at the end of the accounting period, and necessary

Material downloaded from myCBSEguide.com. 12 / 17

adjustments are made for drawings, fresh additional capital, and interest on capital.

19. Profit = 5,00,000 + 3,75,000 - 7,50,000 - 50,000 = 75,000

20. Following are the main limitations of computerised accounting:

i. Very Expensive: The computerised accounting system is a very costly system. It

includes the cost of computers, peripherals and network devices. It also includes the

cost of software that is to be used to automate the system. Computerised accounting

also includes the cost of media that has been used to take regular backups of data. For

example, tape drives and compact disks are generally used for backup purposes.

ii. Problem of Obsolescence: Obsolescence is the major problem of computerised

accounting. The hardware and software industry is continuously growing at a rapid

rate. Due to high speed developments, new hardware devices replace the older one

and newer versions of software are being introduced on routine basis. Therefore, the

organization has to spend a considerable amount of money to purchase new

hardware and software.

iii. Dependence on Computer Accountants: Computerised accountancy requires

computer accountants to record and analyse the transactions. In a computerised

accounting system, a computer illiterate person cannot do anything in the system. The

company is completely dependent on computer accountant for all their accounting

needs.

iv. Problem of Security and Secrecy: The computers are not faithful machines. They just

obey the commands of the person who is sitting in front of it. If a person manages to

get access to the computer, he or she may harm the information stored in the

computer. Several types of other problems like virus or failures may lead to data loss.

Computer networks also cause security problems as the information of one computer

can be accessed from the other. Very strict and careful handling of the information is

needed in computerised accounting system.

21. Profit = closing capital + drawings – additional capital – opening capital

48,000 + (800 12 + 2,000 + 1,500 x 12) - 6,000 - 50,000 = 21,600

Note: Profit on sale of shares = 10,000 20/100 = 2,000

Additional capital = 10,000 + 2,000 = 12,000/2 = 6,000

22. Profit and Loss Account

Particulars Amount Particulars Amount

Material downloaded from myCBSEguide.com. 13 / 17

Bad debts provision 10,000

Balance Sheet

Liabilities Amount Assets Amount

Sundry Debtors 84,000

Less : Bad debts 4,000 76,000

Less : Provision 4,000

23. Readymade Software: These software’s are ready to use, easy to handle or easy to

operate. These software’s save time and cost. The best example for accounting software is

'Tally'

Advantages of Readymade Software’s

i. Suitable for small business firms.

ii. Easily available.

iii. Affordable (Less expensive)

iv. User friendly (No special training required)

Limitations of Readymade Software’s

i. Knowledge of computer is required (as well as knowledge of accounting is also

required).

ii. Costly and installation problems.

iii. Not safe.

Customized Software: Readymade software’s are modified as per the requirement. It

is known as customised Software’s. The cost of customised software is higher than the

readymade software cost and this cost is paid by the user.

Advantages of Customised Software’s

i. Suitable for medium and large business houses.

ii. All transactions are recorded in a systematic manner.

iii. Software is customised according to the requirement.

iv. Reliable.

Limitations of Customised Software’s

i. Special training is required to handle these type of software’s.

ii. Costly.

iii. Outdated software’s may cause problems.

24. Trading Account

Material downloaded from myCBSEguide.com. 14 / 17

Particulars Amount Particulars Amount

To Opening Stock 3,460 By Sales 15,450

To Purchases 5,475 Less: Return 200 15,250

Less: Return 125 5,350 By Closing Stock 5,750

To Gross Profit 12,190

21,000 21,000

Profit and Loss Account

Particulars Amount Particulars Amount

To Bad debts provision 395 By Gross Profit 12,190

By Commission (375 -

To Advertisement 450 250

125)

To Interest on Bank overdraft (118 +

203

85)

To Taxes & Insurance (1,250 + 120) 1,370

To General Expenses 782

To Salaries (3,300 + 300) 3,600

To Dep. on buildings 375

To Dep. on furniture & fittings 64

To Dep. on motor vehicles 1,250

To Net Profit 3,951

12,440 12,440

Balance Sheet

Liabilities Amount Assets Amount

Capital 12,500 Building less depreciation 7,125

Add: Profit 3,951 16,451 Motor vehicles less 5,000

Creditors 2,500 Depreciation 576

Material downloaded from myCBSEguide.com. 15 / 17

Bank overdraft (2,850 + 85) 2,935 Furniture & fitting less dep. 3,330

Advance commission 125 Debtors (3,800 - 100 - 370) 5,750

Salaries due 300 Stock 600

Taxes due 120 Cash at bank 50

22,431 22,431

OR

Trading Account

Particulars Amount Particulars Amount

To Opening Stock 15,000 By Sales 1,20,000

To Purchases 82,000 Less: Return 2,000 1,18,000

Less Return 1,000 By Closing Stock 14,000

Less: Damaged 5,000 76,000

To Freight & duty 2,000

To Gross Profit 39,000

1,32,000 1,32,000

Profit and Loss Account

Particulars Amount Particulars Amount

To Trade Exp. 800 By Gross profit 39,000

To Carriage outward 500 By Rent for Premises 1,600

To Printing & Stationery 400

To Rent, Rates & Taxes 4,600

To Postage & Telegrams 800

To Insurance 700 + 100 600

To Salaries 21,300

Material downloaded from myCBSEguide.com. 16 / 17

To Bad debts 800

To Depreciation on furniture 250

To Depreciation on machinery 4,500

To Net profit 6,050

40,600 40,600

Balance Sheet

Liabilities Amount Assets Amount

Capital 80,000 Plant & machinery less dep. 20,500

Less: Drawings 6,000 Furniture less dep. 4,750

Add: Profit 6,050 80,050 Debtors less provision 19,000

Sundry Creditors 10,000 Stock 14,000

Prepaid insurance 100

Bank 20,500

Cash 6,200

Insurance claims 5,000

90,050 90,050

Book Recommended: ULTIMATE BOOK OF ACCOUNTANCY CLASS 12 CBSE By VISHVAS

PUBLICATIONS (This book is available at Amazon and Flipkart) Contact:

authorcbse@gmail.com.

Material downloaded from myCBSEguide.com. 17 / 17

Das könnte Ihnen auch gefallen

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsVon EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNoch keine Bewertungen

- 11 Accountancy SP 2Dokument17 Seiten11 Accountancy SP 2Vikas Chandra BalodhiNoch keine Bewertungen

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionVon EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNoch keine Bewertungen

- Class Xi SP 1Dokument17 SeitenClass Xi SP 1Priya NasaNoch keine Bewertungen

- Global Financial Development Report 2015/2016: Long-Term FinanceVon EverandGlobal Financial Development Report 2015/2016: Long-Term FinanceNoch keine Bewertungen

- Practice Paper by Dr. Vinod Kumar: For Final Examination March 2021Dokument16 SeitenPractice Paper by Dr. Vinod Kumar: For Final Examination March 2021Pushpinder KumarNoch keine Bewertungen

- SAMPLE PAPER - (Solved) : For Examination March 2018 Accountancy Class - XIDokument14 SeitenSAMPLE PAPER - (Solved) : For Examination March 2018 Accountancy Class - XISaksham AroraNoch keine Bewertungen

- Accountancy Extra PointsDokument14 SeitenAccountancy Extra PointsRishav KuriNoch keine Bewertungen

- Sample Paper For Class 11 Accountancy Set 1 QuestionsDokument6 SeitenSample Paper For Class 11 Accountancy Set 1 Questionsrenu bhattNoch keine Bewertungen

- Part - A (: Time Allowed: 3 Hours Maximum Marks: 90Dokument4 SeitenPart - A (: Time Allowed: 3 Hours Maximum Marks: 90NameNoch keine Bewertungen

- 11 Sample Papers Accountancy 2020 English Medium Set 1 PDFDokument13 Seiten11 Sample Papers Accountancy 2020 English Medium Set 1 PDFpriyaNoch keine Bewertungen

- 2015 11 SP Accountancy Unsolved 01 PDFDokument4 Seiten2015 11 SP Accountancy Unsolved 01 PDFcerlaNoch keine Bewertungen

- 2015 Accountancy Question PaperDokument4 Seiten2015 Accountancy Question PaperJoginder SinghNoch keine Bewertungen

- Part - A (: Time Allowed: 3 Hours Maximum Marks: 90Dokument4 SeitenPart - A (: Time Allowed: 3 Hours Maximum Marks: 90NameNoch keine Bewertungen

- Class 11 Accountancy Worksheet - 2023-24Dokument17 SeitenClass 11 Accountancy Worksheet - 2023-24Yashi BhawsarNoch keine Bewertungen

- 2015 11 SP Accountancy Solved 04 PDFDokument4 Seiten2015 11 SP Accountancy Solved 04 PDFcerlaNoch keine Bewertungen

- Class XI Practice PaperDokument4 SeitenClass XI Practice PaperAyush MathiyanNoch keine Bewertungen

- Test (Single Entry System)Dokument3 SeitenTest (Single Entry System)SarthakNoch keine Bewertungen

- SAMPLE PAPER - (Solved) : For Examination March 2017Dokument13 SeitenSAMPLE PAPER - (Solved) : For Examination March 2017ankush yadavNoch keine Bewertungen

- Part - A (: Time Allowed: 3 Hours Maximum Marks: 90Dokument4 SeitenPart - A (: Time Allowed: 3 Hours Maximum Marks: 90NameNoch keine Bewertungen

- Accounts Specimen QP Class XiDokument7 SeitenAccounts Specimen QP Class XiAnju TomarNoch keine Bewertungen

- Sample Paper Xi Acc 2022 23Dokument7 SeitenSample Paper Xi Acc 2022 23rehankatyal05Noch keine Bewertungen

- © The Institute of Chartered Accountants of India: TH ST THDokument6 Seiten© The Institute of Chartered Accountants of India: TH ST THomkar sawantNoch keine Bewertungen

- Class 11 Accounatncy Sample PaperDokument20 SeitenClass 11 Accounatncy Sample PaperGurjit BrarNoch keine Bewertungen

- Half Yearly Examination, 201 Half Yearly Examination, 201 Half Yearly Examination, 201 Half Yearly Examination, 2018 8 8 8 - 19 19 19 19Dokument5 SeitenHalf Yearly Examination, 201 Half Yearly Examination, 201 Half Yearly Examination, 201 Half Yearly Examination, 2018 8 8 8 - 19 19 19 19Krish BansalNoch keine Bewertungen

- Must DoDokument27 SeitenMust DoKuldeep SharmaNoch keine Bewertungen

- Northern Province Third Term Examination - 2019 NovemberDokument4 SeitenNorthern Province Third Term Examination - 2019 NovemberAshley GazeNoch keine Bewertungen

- CA Foundation MTP 2020 Paper 1 QuesDokument6 SeitenCA Foundation MTP 2020 Paper 1 QuesSaurabh Kumar MauryaNoch keine Bewertungen

- © The Institute of Chartered Accountants of India: TH ST THDokument15 Seiten© The Institute of Chartered Accountants of India: TH ST THGaurav KumarNoch keine Bewertungen

- Ryan International School Unit Test - I Class-Xi Sub.: Accounts (Paper-2) Time: 1 Hrs. MM: 32Dokument2 SeitenRyan International School Unit Test - I Class-Xi Sub.: Accounts (Paper-2) Time: 1 Hrs. MM: 32RGN 11E 20 KHUSHI NAGARNoch keine Bewertungen

- Accounting - Mid Paper 2018 - Regular BatchDokument8 SeitenAccounting - Mid Paper 2018 - Regular BatchShenali NupehewaNoch keine Bewertungen

- BPS Class XI Pre Board Examination Question Papers Jan 2015 All Subjects Scce CommerceDokument53 SeitenBPS Class XI Pre Board Examination Question Papers Jan 2015 All Subjects Scce CommercelembdaNoch keine Bewertungen

- शिक्षा निदेिालय राष्ट्रीय राजधािी क्षेत्र ददल्ली Directorate of Education, GNCT of DelhiDokument4 Seitenशिक्षा निदेिालय राष्ट्रीय राजधािी क्षेत्र ददल्ली Directorate of Education, GNCT of DelhiAshish ChNoch keine Bewertungen

- Xi See Acc 2021 Set 2 QPDokument8 SeitenXi See Acc 2021 Set 2 QPs1672snehil6353Noch keine Bewertungen

- Imt 57Dokument9 SeitenImt 57Pallavi VirmaniNoch keine Bewertungen

- Gongoni Secondary School: End of Term Three Examination 2021Dokument3 SeitenGongoni Secondary School: End of Term Three Examination 2021EVANSNoch keine Bewertungen

- Blossems Convent School CLASS: 11 Commerce Group Subject: Accoutancy Holidays AssignmentDokument3 SeitenBlossems Convent School CLASS: 11 Commerce Group Subject: Accoutancy Holidays AssignmentPawanpreet KaurNoch keine Bewertungen

- 11th BK Final Exam Quesiton Paper March 2021Dokument5 Seiten11th BK Final Exam Quesiton Paper March 2021Harendra Prajapati100% (1)

- Accounts Question Paper Omtex ClassesDokument8 SeitenAccounts Question Paper Omtex ClassesAmin Buhari Abdul KhaderNoch keine Bewertungen

- Class 11 Accounts SP 1Dokument6 SeitenClass 11 Accounts SP 1UdyamGNoch keine Bewertungen

- Part - A (: Time Allowed: 3 Hours Maximum Marks: 90Dokument4 SeitenPart - A (: Time Allowed: 3 Hours Maximum Marks: 90Anonymous VaYaLmoX4Noch keine Bewertungen

- File 9563Dokument29 SeitenFile 9563dhananijeneelNoch keine Bewertungen

- Acc Xi Class Test-I 2022Dokument4 SeitenAcc Xi Class Test-I 2022shaurya kapoorNoch keine Bewertungen

- Class XI Acc SM Arya Annual 2023-24Dokument5 SeitenClass XI Acc SM Arya Annual 2023-24pandeyansh962Noch keine Bewertungen

- Test 5 Principles and Practice of AccountingDokument6 SeitenTest 5 Principles and Practice of Accountingshreya shettyNoch keine Bewertungen

- ProjectDokument4 SeitenProjectSwati DubeyNoch keine Bewertungen

- AccountingDokument3 SeitenAccountingClasherNoch keine Bewertungen

- Presidency University, Bengaluru: School of ManagementDokument4 SeitenPresidency University, Bengaluru: School of ManagementMaroof BaigNoch keine Bewertungen

- Class Xi Acc QPDokument7 SeitenClass Xi Acc QP8201ayushNoch keine Bewertungen

- Assignment 4 Class XI Accounting Eq 20230704163852515Dokument4 SeitenAssignment 4 Class XI Accounting Eq 20230704163852515saumya guptaNoch keine Bewertungen

- CBSE Class 11 Accountancy Worksheet - Question BankDokument17 SeitenCBSE Class 11 Accountancy Worksheet - Question BankUmesh JaiswalNoch keine Bewertungen

- Accounting EquationDokument3 SeitenAccounting EquationSreedhar ReddyNoch keine Bewertungen

- Acc Full Test 3Dokument6 SeitenAcc Full Test 3Periyanan VNoch keine Bewertungen

- Mid Term Accounts - SubjectiveDokument4 SeitenMid Term Accounts - Subjectivekarishma prabagaranNoch keine Bewertungen

- CBSE Class 11 Accountancy Worksheet - Question BankDokument17 SeitenCBSE Class 11 Accountancy Worksheet - Question Bankganesh pathakNoch keine Bewertungen

- Amardeep XI First TermDokument8 SeitenAmardeep XI First TermAnahita GuptaNoch keine Bewertungen

- Session Ending Examination 2019Dokument7 SeitenSession Ending Examination 2019madhudevi06435Noch keine Bewertungen

- EM - Buss - T1 - G11 - I, II PP Ans - 2018Dokument15 SeitenEM - Buss - T1 - G11 - I, II PP Ans - 2018Nipuni PereraNoch keine Bewertungen

- Sample Paper-2016 Subject: Class 11: Part - A (Financial Accounting - I)Dokument4 SeitenSample Paper-2016 Subject: Class 11: Part - A (Financial Accounting - I)Šhûbh Šhôûřyâ KâšhyâpNoch keine Bewertungen

- (ACC-xi 2023) Target Paper by Sir Irfan JanDokument9 Seiten(ACC-xi 2023) Target Paper by Sir Irfan JanmohsinbeforwardNoch keine Bewertungen

- Lesson Plan EnglishDokument15 SeitenLesson Plan EnglishSumit MazumderNoch keine Bewertungen

- Motorised-Two Wheelers Package Policy - Zone B Motor Insurance Certificate Cum Policy ScheduleDokument2 SeitenMotorised-Two Wheelers Package Policy - Zone B Motor Insurance Certificate Cum Policy ScheduleSumit MazumderNoch keine Bewertungen

- New Doc 2020-03-26 13.20.42Dokument13 SeitenNew Doc 2020-03-26 13.20.42Sumit MazumderNoch keine Bewertungen

- My Orginal Research Proposal SumitDokument7 SeitenMy Orginal Research Proposal SumitSumit MazumderNoch keine Bewertungen

- COMPUTER STUDIES G8A vOL 2 ON CLASSIFICATION OF COMPUTERSDokument12 SeitenCOMPUTER STUDIES G8A vOL 2 ON CLASSIFICATION OF COMPUTERSBrown Jr MugogoNoch keine Bewertungen

- Wiley - Digital Signal and Image Processing - 978-0-471-32727-1 PDFDokument2 SeitenWiley - Digital Signal and Image Processing - 978-0-471-32727-1 PDFMayank AwasthiNoch keine Bewertungen

- 56 Cs Aptechtraining 1500 QuestionsDokument162 Seiten56 Cs Aptechtraining 1500 Questionsscs4852Noch keine Bewertungen

- CPD 53792Dokument122 SeitenCPD 53792Zhyl BorromeoNoch keine Bewertungen

- Sx-Ca5xx Om 1999 PDFDokument327 SeitenSx-Ca5xx Om 1999 PDFTNoch keine Bewertungen

- Farm Management Information SystemDokument45 SeitenFarm Management Information SystemTosin Williams60% (10)

- Not AttemptedDokument20 SeitenNot AttemptedRupam SaikiaNoch keine Bewertungen

- Vega Ii PDFDokument6 SeitenVega Ii PDFRudin Fahrudin Rahman100% (1)

- CSE322 SyllabusDokument2 SeitenCSE322 SyllabusAakashRajNoch keine Bewertungen

- Programming in C and C++: Dr. M. Babul IslamDokument15 SeitenProgramming in C and C++: Dr. M. Babul IslamMehedi HasanNoch keine Bewertungen

- QuickTips For A Senior Friendly Computer ClassroomDokument15 SeitenQuickTips For A Senior Friendly Computer ClassroomMeiilha Poetrii UtamiiNoch keine Bewertungen

- Use Case ExampleDokument4 SeitenUse Case ExampleMalik MudassarNoch keine Bewertungen

- ITM Assignment: Chanrdragupt Institute of Management, PatnaDokument10 SeitenITM Assignment: Chanrdragupt Institute of Management, PatnanewsacanNoch keine Bewertungen

- Computer Networks OutlineDokument3 SeitenComputer Networks OutlineNkunzimana HilaireNoch keine Bewertungen

- Foundation of Computer ScienceDokument22 SeitenFoundation of Computer ScienceHarish Morwani100% (3)

- CS101 Imp Short NotesDokument41 SeitenCS101 Imp Short NotesMuhammad ZeeshanNoch keine Bewertungen

- ICT Revision PapersDokument55 SeitenICT Revision PapersjohnNoch keine Bewertungen

- P 05Dokument38 SeitenP 05reza515hei0% (1)

- T.O.K Does Our Knowledge Depend On Our Interactions With Other KnowersDokument4 SeitenT.O.K Does Our Knowledge Depend On Our Interactions With Other KnowersHacherman HackpersonNoch keine Bewertungen

- CO&A 18EC35 Module-1 Notes Dileep Kumar K SDokument32 SeitenCO&A 18EC35 Module-1 Notes Dileep Kumar K SThanushree RMNoch keine Bewertungen

- Matrix Cheat Sheet 5th EditionDokument8 SeitenMatrix Cheat Sheet 5th Editionmasterblah86% (7)

- Cs30101:: Operating SystemsDokument159 SeitenCs30101:: Operating SystemsTanmay PatilNoch keine Bewertungen

- editedA.Y 2022 2023Dokument44 SeiteneditedA.Y 2022 2023JOHNDEL AJOCNoch keine Bewertungen

- Maintenance Chapter 2 PreventiveDokument31 SeitenMaintenance Chapter 2 PreventiveZalmaanjokerNoch keine Bewertungen

- Operator's Manual: EEWA-107/108 Wheel Aligner With Windows 95 and Pro32™ SoftwareDokument110 SeitenOperator's Manual: EEWA-107/108 Wheel Aligner With Windows 95 and Pro32™ SoftwareIulian NgiNoch keine Bewertungen

- CS 208-1-3 Organization of A Microcomputer by Baldev Ram MaliDokument12 SeitenCS 208-1-3 Organization of A Microcomputer by Baldev Ram MaliINFINITY GAmErNoch keine Bewertungen

- Introduction To Computer CH 2Dokument53 SeitenIntroduction To Computer CH 2Mian AbdullahNoch keine Bewertungen

- DepEd TLE Computer Hardware Servicing Curriculum Guide Grade 7-10Dokument9 SeitenDepEd TLE Computer Hardware Servicing Curriculum Guide Grade 7-10ornopiamaritesNoch keine Bewertungen

- Classics of CSDokument1 SeiteClassics of CSAbhisek DasNoch keine Bewertungen

- Node Commander User Manual (8500-0038)Dokument121 SeitenNode Commander User Manual (8500-0038)Tuba Eroglu AzakNoch keine Bewertungen

- Getting to Yes: How to Negotiate Agreement Without Giving InVon EverandGetting to Yes: How to Negotiate Agreement Without Giving InBewertung: 4 von 5 Sternen4/5 (652)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Von EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Bewertung: 4.5 von 5 Sternen4.5/5 (14)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Von EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Bewertung: 4.5 von 5 Sternen4.5/5 (14)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineVon EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNoch keine Bewertungen

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindVon EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindBewertung: 5 von 5 Sternen5/5 (231)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Von EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Bewertung: 4 von 5 Sternen4/5 (33)

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsVon EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsBewertung: 5 von 5 Sternen5/5 (1)

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItVon EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItBewertung: 4.5 von 5 Sternen4.5/5 (14)

- Your Amazing Itty Bitty(R) Personal Bookkeeping BookVon EverandYour Amazing Itty Bitty(R) Personal Bookkeeping BookNoch keine Bewertungen

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Von EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Bewertung: 4.5 von 5 Sternen4.5/5 (5)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsVon EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsBewertung: 4 von 5 Sternen4/5 (7)

- How to Measure Anything: Finding the Value of "Intangibles" in BusinessVon EverandHow to Measure Anything: Finding the Value of "Intangibles" in BusinessBewertung: 4.5 von 5 Sternen4.5/5 (28)

- Accounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCVon EverandAccounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCBewertung: 5 von 5 Sternen5/5 (1)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesVon EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNoch keine Bewertungen

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeVon EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeBewertung: 4 von 5 Sternen4/5 (21)

- Financial Accounting For Dummies: 2nd EditionVon EverandFinancial Accounting For Dummies: 2nd EditionBewertung: 5 von 5 Sternen5/5 (10)

- Ratio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetVon EverandRatio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetBewertung: 4.5 von 5 Sternen4.5/5 (14)

- Start, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookVon EverandStart, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookBewertung: 5 von 5 Sternen5/5 (4)

- Warren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageVon EverandWarren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageBewertung: 4.5 von 5 Sternen4.5/5 (109)

- The Credit Formula: The Guide To Building and Rebuilding Lendable CreditVon EverandThe Credit Formula: The Guide To Building and Rebuilding Lendable CreditBewertung: 5 von 5 Sternen5/5 (1)

- Controllership: The Work of the Managerial AccountantVon EverandControllership: The Work of the Managerial AccountantNoch keine Bewertungen

- Finance Basics (HBR 20-Minute Manager Series)Von EverandFinance Basics (HBR 20-Minute Manager Series)Bewertung: 4.5 von 5 Sternen4.5/5 (32)

- Accounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)Von EverandAccounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)Bewertung: 4.5 von 5 Sternen4.5/5 (5)