Beruflich Dokumente

Kultur Dokumente

Global Insights Report: "Black Friday'S S&P Index Trade"

Hochgeladen von

Jeffrey LinOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Global Insights Report: "Black Friday'S S&P Index Trade"

Hochgeladen von

Jeffrey LinCopyright:

Verfügbare Formate

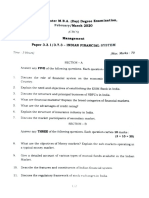

Global Insights Report

from www.mrtopstep.com

November 29th, 2010

Today's Points of Interests:

Volume: 7.5k SPZs and 2.78mil ESZs traded

S&P futures vs. fair value: -5.50. NASDAQ futures vs. fair value: -13.00.

15 SPZ/H spds traded

“BLACK FRIDAY’s S&P INDEX TRADE”

Friday started with combined GLOBEX volumes of 2k SPZs and 275k ESZ traded and a sharply

lower 8:30 opening range of 1186.50 to 1186.80. Just after the opening print the SPZ sold off a little

over 1 handle down to 1184.40 then slowly made it way back to a new daily high of 1193.00. The

SPZ opened 4 handles above the GLOBEX lows of 1182.50 and with all the selling done pre~open

and most people unable to hold the futures over the weekend the SPZ and ESZ did what the does

best lately, it went for the buy stops. Its 10:38 CT , we have still 30 locals in the pit, 7.6k S&P

options trade - 5.2k calls and 2.5k puts, total SPZ volume is 2k with 510k minis traded. It’s 11:22

and after a few small sell offs the SPZ is back trading at the 1190 level. For the half hour the SPZ

traded 1188 to 1190 and got hit by a big sell program going into the 12:00 cash close that sold the

SPZ from 1188.50 down 1185.50 in less then 1 minute. The SPZ traded 1188.30 on the 12:00 cash

close and at 12:05 the SPZ was traded 1185.50. At 12:09 the SPZ hit out more sell stops down to a

new low at 1183.80 and another new low going into the futures close 1183.00 on the last tick of the

day. In the end the Dow and S&P lost 1% and 0.9 % accordingly while the NASDAQ gained 0.7 %

for the week. European debt concerns and North Korea helped end the week on a sour note.

Monday? That was an ugly close last Friday, the VIX settled back above 21. In Asia of 8 of 11

markets closed higher. In Europe 10 out 10 markets are trading lower. Last night the ESZ traded

all the way back up to 1193.75 and gave up its gains overnight and made new low at 1179.50. Its

6:30 am and the SPZ is 1182.50 last , down .20 The big question here is what the markets will do

going into month end. The way we see this is it’s like a game of cat and mouse. The BULLs only

have so many days left in the year to mark things up and the BEARs know time is running short

for the BULLs. Our call? Today is CYBER / Mutual Fund Monday and based on Fridays close

we think it’s possible to see some early weakness then some type of bounce. Our levels for the day

1173.00 to 1175.00 and above we have 1193 to 1195.00 and then 1199 to 1203.

Distributed by mrtopstep.com. © 2010

Contributor’s Corner: Fari Hamzei / Hamzei, Founder HamzeiAnalytics.com

Market Timing Comments as of November 28, 2010

Twice per month, we hold a Market Timing Webinar which is open to all. There we discuss what

we see as critical technical and quantitative analyses of our equity markets including, but not

limited to, potential exopgenous pending news, upcoming economic calendar, big-cap high-beta

earnings calendar, indices price levels and quantified sentiment data. Here is a short excerpt on

one of the charts discussed in our Sunday November 28th webinar.

Here is our SP1_MoMo Chart. It depicts S&P-500 Cash Index both in daily and weekly

barintervals plus a modified S&P-500 only Proprietary Advance Decline (Breadth) Indicator (SP1)

and its fast shorter-term brethren (MoMo).

Distributed by mrtopstep.com. © 2010

On the intermediate timeframe (WEEKLY graph on the left), you can see that we are still on an

UP bias, while on DAILY graph (center) we are on a shorter-term SELL signal. What is critical

in both of these charts is the New 52-week Highs and Lows. New 52wk Lows are picking up a bit.

Also note the 200bar moving average (the thick white line). This is a key line-in-the-sand price for

large institutional players.

SP1 is obviously at a critical juncture (it is at -1 sigma) and MoMo suggests we may see a further

drop in the S&P-500 Breadth before we resume the upward move. On or about negative ten (-10)

on MoMo often coincides with short-term reversals to the upside. In like fashion plus ten (+10) is

where often market eases off and reverses to the downside.

Bottom Line: With a backdrop of Irish Debt Crisis and North Korean adventurism, we should

expect additional upward moves in equity index volatility which could flush out the weak longs and

set us up for an enhanced move up into the much-anticipated year-end tax selling.

THE WEEK AHEAD:

MONDAY: Texas manufacturing outlook survey, Chicago Fed Midwest manufacturing index, St.

Louis Fed Pres Bullard speaks, Cyber Monday

TUESDAY: ISM-NY report on business, S&P/Case-Shiller home price index, consumer confidence,

Minnesota Fed Pres Kocherlakota speaks, Bernanke speaks, Obama meets with Congressional

leaders

WEDNESDAY: Auto sales, MBA mortgage applications, Challenger job-cut report, ADP

employment report, productivity and costs, ISM mfg index, construction spending, oil inventories,

Beige Book, Fed vice chair Yellen speaks

THURSDAY: ECB announcement, jobless claims, pending home sales, Philadelphia Fed Pres

Plosser speaks, Fed Gov. Duke speaks, chain-store sales; Earnings from Toll Brothers, Del Monte

and Kroger

FRIDAY: Employment situation, factory orders, ISM non-mfg index

The information and data in this report were obtained from sources considered reliable. Their

accuracy or completeness is not guaranteed and the giving of the same is not to be deemed

as an offer or solicitation on our part with respect to the sale or purchase of any securities or

commodities. Mr. TopStep, its officers and directors may in the normal course of business have

positions, which may or may not agree with the opinions expressed in this report. Any decision to

purchase or sell as a result of the opinions expressed in this report will be the full responsibility

of the person authorizing such transaction. There is a substantial risk of loss in trading futures

and options.

Distributed by mrtopstep.com. © 2010

There is a substantial risk of loss in trading futures and options. Past performance is not

indicative of future results.

Distributed by mrtopstep.com. © 2010

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Foreign Direct Investment PDFDokument13 SeitenForeign Direct Investment PDFHemanth KumarNoch keine Bewertungen

- Limit Cambodia Monetary Policy On Dollarization Between 2000 - 2005Dokument15 SeitenLimit Cambodia Monetary Policy On Dollarization Between 2000 - 2005Channara KolNoch keine Bewertungen

- Gann AnglesDokument18 SeitenGann AnglesJonathan Tan100% (3)

- Psychology of Risk-Behavioral Finance PerspectiveDokument28 SeitenPsychology of Risk-Behavioral Finance Perspectivestreettalk700Noch keine Bewertungen

- Life Insurance Is A Contract Between The Policy Owner and The InsurerDokument52 SeitenLife Insurance Is A Contract Between The Policy Owner and The InsurerKartik VariyaNoch keine Bewertungen

- CBCS 3.3.1 Indian Financial System 2020Dokument2 SeitenCBCS 3.3.1 Indian Financial System 2020Bharath MNoch keine Bewertungen

- Salesoft, IncDokument5 SeitenSalesoft, IncArpit Kasture0% (1)

- Banking Banana Skins 2012 ResultsDokument43 SeitenBanking Banana Skins 2012 Resultsankur4042007Noch keine Bewertungen

- 16 Best Cold Calling Scripts PDFDokument17 Seiten16 Best Cold Calling Scripts PDFLiberty Online Học tiếng anh trực tuyến 1 kèm 1100% (3)

- Project Work BajajDokument49 SeitenProject Work BajajSurendra Kumar MullangiNoch keine Bewertungen

- Volume Spread AnalysisDokument31 SeitenVolume Spread AnalysisNGUYENQUANGDAT2000Noch keine Bewertungen

- Chap 022Dokument44 SeitenChap 022jmsmartinsNoch keine Bewertungen

- Portfolio Analysis-Case On Alex SharpeDokument30 SeitenPortfolio Analysis-Case On Alex SharpeKomalDewanandChaudharyNoch keine Bewertungen

- POSTIONAL - StockMockDokument46 SeitenPOSTIONAL - StockMockSathishkumar TvsNoch keine Bewertungen

- Introduction To Currency Trading: Foreign Exchange Central Banks CurrenciesDokument25 SeitenIntroduction To Currency Trading: Foreign Exchange Central Banks Currenciesarunchary007Noch keine Bewertungen

- Q2 2019 Release ENG FinalDokument14 SeitenQ2 2019 Release ENG FinalValter SilveiraNoch keine Bewertungen

- 2nd MeetingDokument28 Seiten2nd MeetingYusufMulhanNoch keine Bewertungen

- XL DynamicsDokument3 SeitenXL DynamicsManojSharmaNoch keine Bewertungen

- Financial InnovationsDokument8 SeitenFinancial Innovationsganesh_patareNoch keine Bewertungen

- Country, Industry and Factor Risk Loading in Portfolio ManagementDokument11 SeitenCountry, Industry and Factor Risk Loading in Portfolio ManagementFazry SidiqNoch keine Bewertungen

- Asset Management - Tools and Strategies-Bloomsbury (2011)Dokument256 SeitenAsset Management - Tools and Strategies-Bloomsbury (2011)Kitrakleog 03052002Noch keine Bewertungen

- BCG Matrix & GE Matrix: Prepared by Kanishk Dhingra Karishma SobtiDokument16 SeitenBCG Matrix & GE Matrix: Prepared by Kanishk Dhingra Karishma SobtikaruNoch keine Bewertungen

- Franck and Lamontagne-Defriez - MAC in Syndicated Lending Part 2Dokument7 SeitenFranck and Lamontagne-Defriez - MAC in Syndicated Lending Part 2Richard DablahNoch keine Bewertungen

- Merger & AcquisitionDokument13 SeitenMerger & Acquisitionshakib rahmanNoch keine Bewertungen

- Project Report On MultiCurrency Forex Card of Thomas CookDokument64 SeitenProject Report On MultiCurrency Forex Card of Thomas Cookarjun lal100% (1)

- For Definition of Arbitrage PDFDokument10 SeitenFor Definition of Arbitrage PDFJoseph ArmachieNoch keine Bewertungen

- Abonacci Trading v11-11Dokument12 SeitenAbonacci Trading v11-11ghcardenas100% (1)

- PRUlink Fund Report 2017Dokument440 SeitenPRUlink Fund Report 2017Barath KumarNoch keine Bewertungen

- TTCK ReviewDokument34 SeitenTTCK ReviewLê Diễm QuỳnhNoch keine Bewertungen