Beruflich Dokumente

Kultur Dokumente

Partnership Q4

Hochgeladen von

Lorraine Mae Robrido100%(1)100% fanden dieses Dokument nützlich (1 Abstimmung)

2K Ansichten2 SeitenCopyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

100%(1)100% fanden dieses Dokument nützlich (1 Abstimmung)

2K Ansichten2 SeitenPartnership Q4

Hochgeladen von

Lorraine Mae RobridoCopyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

Partnership Operations – Bonus Quiz 9) A and B formed a partnership.

The partnership agreement stipulates

the following:

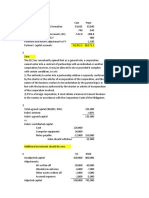

1) A and B formed a partnership. The partnership agreement stipulates Monthly salary of P5,000 for A.

the following: 20% bonus to A, before deductions for salary, interest, and bonus.

Annual salary allowances of P50,000 for A and P30,000 for B. 10% interest on the weighted average capital of B.

Salary allowances are to be withdrawn by the partners throughout Salary, bonus and interest are considered partnership expenses.

the period and are to be debited to their respective drawings The results of operations show the following:

accounts. Revenues 150,000

The partners share profits equally and losses on a 60:40 ratio. Expenses (including salary, interest, and (120,000)

During the period the partnership earned profit of P100,000 before salary bonus)

allowances. Compute for the respective shares of the partners in the Profit 30,000

profit. The weighted average capital balance of B’s capital account is

P100,000. How much is the bonus of A?

2) A and B formed a partnership. The partnership agreement stipulates

the following: 10) A and B formed a partnership on March 1, 2020. The partnership

Annual salary allowances of P80,000 for A and P40,000 for B. agreement stipulates the following:

The partners share profits equally and losses on a 60:40 ratio. Annual salary allowance of P50,000 for A.

During the period there partnership earned profit of P100,000. Compute Interest of 10% on the weighted average capital balance of B.

for the respective shares of the partners in the profit. The partners share profits and losses on a 60:40 ratio.

During the period, the partnership earned profit of P100,000. The

3) A and B formed a partnership on January 1, 2020. Their contributions movements in B’s capital account are as follows:

were credited to their respective capital accounts as follows:

B, Capital

A, 150,000 B, Capital 250,000

80,000 Mar. 1 initial invt.

Capital

Jul. 31 W/D 30,000 40,000 Sep. 30 addt'l. invt.

During the year, the partnership earned profit of P1,000,000. There was

no stipulation in the agreement on how profits are to be shared by the 10,000 Dec. 31 addt'l. invt.

partners. Compute for the respective shares of the partners in the profit. Ending 100,00

0

4) A and B formed a partnership. The partnership agreement stipulates Compute for the interest on B’s weighted average capital.

the following:

Annual salary allowances of P48,000 for A and P30,000 for B. 11) A and B formed a partnership on March 1, 2020. The partnership

Bonus to A of 10% of the profit after partner’s salaries and bonus. agreement stipulates the following:

The partners share profits and losses on a 60:40 ratio. A and B shall maintain average investments of P100,000 and

During the period the partnership earned profit of P100,000 before P150,000, respectively. Interest on the excess or deficiency in a

deductions for salaries and bonus. Compute for the respective shares of capital contribution is to be computed at 10% per annum.

the partners in the profit. After interest allowances, the partners share profits and losses on a

60:40 ratio.

5) A and B formed a partnership. The partnership agreement stipulates During the first six months of operations, the partnership incurred loss

the following: amounting to P60,000. The average capital balances of the partners

Annual salary allowances of P25,000 for A and P4,000 for B. during this period were P120,000 and P110,000, respectively. Compute

for the respective shares of the partners in the loss.

Bonus to A of 10% of the profit after partner’s salaries and bonus.

The partners share profits and losses on a 60:40 ratio.

12) A and B formed a partnership and began operations on March 1,

During the period the partnership incurred loss of P10,000 before

2020. A invested P100,000 cash while B invested equipment with a book

deduction for salaries. Compute for the respective shares of the partners

value of P300,000 and a fair value of P180,000. On August 31, 2020, A

in the loss.

invested additional cash of P20,000. The partnership agreement

stipulates the following:

6) A and B formed a partnership. The partnership agreement stipulates

Monthly salary allowances of P2,000 and P10,000 to A and B,

the following:

respectively, recognized as expenses.

First, A shall receive 10% of profit up to P100,000 and 20% over

20% bonus on profit before salaries and interest but after bonus to

P100,000.

B.

Second, B shall receive 5% of the remaining profit over P150,000.

12% annual interest on the beginning capital of A.

Any remainder shall be shared equally.

Balance equally.

During the year, the partnership earned profit of P280,000. Compute for

The monthly salaries are withdrawn by the partners at each month-end.

the respective shares of the partners in the profit.

The partnership earned profit of P210,000 during the period before

deductions of bonus and interest. Compute the ending balances of the

7) Mr. A, a partner in ABC Co., is deciding on whether to accept a salary

capital accounts of the partners.

of P8,000 or a salary of P5,000 plus a bonus of 10% of profit. The bonus

shall be computed on profit after salaries and bonus. Salaries of the

13) Partner A has a 25% participation in the profits of a partnership.

other partners amount to P20,000. What amount of profit would be

During the year, A’s capital account has a net increase of P10,000.

necessary so that Mr. A would be indifferent between the choices?

Partner A made contributions of P40,000 and capital withdrawals of

P60,000 during the year. How much did the partnership earn during the

8) A and B formed a partnership. The partnership agreement stipulates

year?

the following:

Annual salary allowance of P50,000 for A.

14) The partnership agreement of partners A, B and C stipulates the

Interest of 10% on the weighted average capital balance of B. following:

The partners share profits and losses on a 60:40 ratio. A shall receive a salary of P20,000.

During the period, the partnership earned profit of P100,000. The

Interest of 10% shall be computed on the partners’ capital

movements in B’s capital account are as follows:

contributions of P20,000, P50,000 and P100,000.

B, Capital

Balance is divided among the partners on a 2:3:5 ratio. However,

60,000 Beginning the minimum amounts that B and C shall receive if the partnership

Jul. 31 W/D 30,000 20,000 Apr. 1 addt'l. invt. earns profit are P10,000 and P20,000, respectively, inclusive of

40,000 Sep. 30 addt'l. invt. interest and share in remaining profit.

10,000 Dec. 31 addt'l. invt. How much is the level of profit necessary so that A shall receive a total

Ending 100,00 of P25,000, inclusive of salaries, interest and share in remaining profit,

0 and all of the other partners shall receive their minimum allocable

Compute for the respective shares of the partners in the profit. amounts?

15) The ABC Co., on which A, B and C are partners, reported profit of

P90,000 during the year.

Case #1: If partners A, B and C have a profit sharing agreement of 1/6,

2/6 and 3/6, respectively, how much are their respective shares in the

profit?

Case #2: If partners A, B and C have a profit sharing agreement of 2:3:4,

respectively, how much are their respective shares in the profit?

-JMR

Das könnte Ihnen auch gefallen

- Accounting For Taxes & Employee BenefitsDokument5 SeitenAccounting For Taxes & Employee BenefitsAveryl Lei Sta.Ana100% (1)

- Quiz in AE 09 (Current Liabilities)Dokument2 SeitenQuiz in AE 09 (Current Liabilities)Arlene Dacpano0% (1)

- Multiple Choice Partnership and CorporationDokument14 SeitenMultiple Choice Partnership and CorporationTrina Joy HomerezNoch keine Bewertungen

- LiquidityDokument26 SeitenLiquidityPallavi RanjanNoch keine Bewertungen

- Loans On BottomryDokument4 SeitenLoans On BottomryRheaj AureoNoch keine Bewertungen

- Audit of BanksDokument10 SeitenAudit of BanksIra Grace De Castro100% (2)

- 08 Theoretical Aspects of Public DebtDokument35 Seiten08 Theoretical Aspects of Public DebtAnkit Singh100% (2)

- BRD - Loan & Loan RepaymentDokument8 SeitenBRD - Loan & Loan RepaymentSunisha YadavNoch keine Bewertungen

- AR Practice Problems Solution PDFDokument7 SeitenAR Practice Problems Solution PDFLorraine Mae RobridoNoch keine Bewertungen

- Lecture - Law 21 - 04 - Nature and Effect of ObligationsDokument123 SeitenLecture - Law 21 - 04 - Nature and Effect of ObligationsLorraine Mae RobridoNoch keine Bewertungen

- Orca Share Media1583315619577Dokument13 SeitenOrca Share Media1583315619577Sebastian Vincent Pulga PedrosaNoch keine Bewertungen

- THE EFFECT OF INFLATION ON SPENDING HABITS AND PURCHASING POWER OF CONSUMERS RESIDING IN BATANGAS FinalDokument45 SeitenTHE EFFECT OF INFLATION ON SPENDING HABITS AND PURCHASING POWER OF CONSUMERS RESIDING IN BATANGAS FinalJeyean GempesNoch keine Bewertungen

- Economic SurveyDokument6 SeitenEconomic SurveySeanmigue Tomaroy86% (7)

- Monetary Policy Transmission MechanismDokument29 SeitenMonetary Policy Transmission MechanismVenkatesh SwamyNoch keine Bewertungen

- AFAR 1 Exams 2020Dokument7 SeitenAFAR 1 Exams 2020RJ Kristine DaqueNoch keine Bewertungen

- Partnership Operations: QuizDokument8 SeitenPartnership Operations: QuizLee SuarezNoch keine Bewertungen

- X 3Dokument8 SeitenX 3Max Dela Torre0% (1)

- Partnership AcctgDokument3 SeitenPartnership AcctgcessbrightNoch keine Bewertungen

- Acp 101 MexamDokument5 SeitenAcp 101 MexamLyca SorianoNoch keine Bewertungen

- Activity 2Dokument3 SeitenActivity 2LFGS Finals0% (1)

- Partnership Mock ExamDokument15 SeitenPartnership Mock ExamPerbielyn BasinilloNoch keine Bewertungen

- Problem 44Dokument2 SeitenProblem 44Arian AmuraoNoch keine Bewertungen

- SMA Chapter Four - Variance AnalysisDokument86 SeitenSMA Chapter Four - Variance Analysisngandu100% (1)

- PDF Afar Week1 Compiled Questions CompressDokument78 SeitenPDF Afar Week1 Compiled Questions CompressIo AyaNoch keine Bewertungen

- Project in Advanced Accntg. - LiquidationDokument10 SeitenProject in Advanced Accntg. - LiquidationSnow TurnerNoch keine Bewertungen

- Afar 107 - Business Combination Part 2Dokument4 SeitenAfar 107 - Business Combination Part 2Maria LopezNoch keine Bewertungen

- Dissolution LiquidationDokument9 SeitenDissolution LiquidationCha FeudoNoch keine Bewertungen

- Partnership Dissolution 4Dokument6 SeitenPartnership Dissolution 4Karl Wilson GonzalesNoch keine Bewertungen

- Prelim Exam - Special TopicsDokument9 SeitenPrelim Exam - Special TopicsCaelah Jamie TubleNoch keine Bewertungen

- Job Order CostingDokument51 SeitenJob Order CostingKenneth TallmanNoch keine Bewertungen

- TFA - Chapter 41 - DepletionDokument3 SeitenTFA - Chapter 41 - DepletionAsi Cas JavNoch keine Bewertungen

- CH 005Dokument2 SeitenCH 005Joana TrinidadNoch keine Bewertungen

- Wala LangDokument8 SeitenWala LangMax Dela TorreNoch keine Bewertungen

- AFAR - Partnership OperationDokument21 SeitenAFAR - Partnership OperationReginald ValenciaNoch keine Bewertungen

- There Is Revaluation of Assets Equal To P50,000Dokument2 SeitenThere Is Revaluation of Assets Equal To P50,000Joana TrinidadNoch keine Bewertungen

- Accounting 12Dokument4 SeitenAccounting 12Breathe ArielleNoch keine Bewertungen

- Test Bank Paccounting Information Systems Test Bank Paccounting Information SystemsDokument23 SeitenTest Bank Paccounting Information Systems Test Bank Paccounting Information SystemsFrylle Kanz Harani PocsonNoch keine Bewertungen

- Problem: I - Statement of Affairs and Deficiency AccountDokument1 SeiteProblem: I - Statement of Affairs and Deficiency AccountAnn Marie GabayNoch keine Bewertungen

- Chapter 12-14Dokument18 SeitenChapter 12-14Serena Van Der WoodsenNoch keine Bewertungen

- Retirement of A Partner 1Dokument1 SeiteRetirement of A Partner 1Vonna TerribleNoch keine Bewertungen

- CMPC131Dokument15 SeitenCMPC131Nhel AlvaroNoch keine Bewertungen

- Quiz - M1 M2Dokument12 SeitenQuiz - M1 M2Jenz Crisha PazNoch keine Bewertungen

- Partnership Liquidation - InstallmentDokument2 SeitenPartnership Liquidation - InstallmentRonnelson PascualNoch keine Bewertungen

- 8.0 TVM Financial PlanningDokument2 Seiten8.0 TVM Financial PlanningYashvi MahajanNoch keine Bewertungen

- Partnership Dissolution - PART 1Dokument17 SeitenPartnership Dissolution - PART 1Aby ReedNoch keine Bewertungen

- Activity 1.1 PDFDokument2 SeitenActivity 1.1 PDFDe Nev OelNoch keine Bewertungen

- Partnership DissolutionDokument3 SeitenPartnership DissolutionDan RyanNoch keine Bewertungen

- Cash BasisDokument4 SeitenCash BasisMark DiezNoch keine Bewertungen

- Handouts PartnershipDokument9 SeitenHandouts PartnershipCPANoch keine Bewertungen

- Balbin, Ma. Margarette P. Assignment #1Dokument7 SeitenBalbin, Ma. Margarette P. Assignment #1Margaveth P. BalbinNoch keine Bewertungen

- LiquidationDokument2 SeitenLiquidationMaria LopezNoch keine Bewertungen

- Events After The Reporting Period NCA Held For Disposal Discontinued OperationsDokument2 SeitenEvents After The Reporting Period NCA Held For Disposal Discontinued OperationsJeremiah DavidNoch keine Bewertungen

- St. Scholasticas College: Leon Guinto, ManilaDokument13 SeitenSt. Scholasticas College: Leon Guinto, Manilamaria evangelistaNoch keine Bewertungen

- The Balance Sheet For The Partnership of JJ CC and TTDokument1 SeiteThe Balance Sheet For The Partnership of JJ CC and TTdagohoy kennethNoch keine Bewertungen

- Partnership Accounting Quiz Submissions: Standalone AssessmentDokument5 SeitenPartnership Accounting Quiz Submissions: Standalone AssessmentChesca Alon100% (1)

- CH 009Dokument2 SeitenCH 009Joana TrinidadNoch keine Bewertungen

- Acc 109 p2 Exam TeachersDokument13 SeitenAcc 109 p2 Exam TeachersWilmz SalacsacanNoch keine Bewertungen

- 1st Year ExamDokument9 Seiten1st Year ExamMark Domingo MendozaNoch keine Bewertungen

- Performance AgreementDokument3 SeitenPerformance AgreementAnita WilliamsNoch keine Bewertungen

- Afar 02 P'ship Operation QuizDokument4 SeitenAfar 02 P'ship Operation QuizJohn Laurence LoplopNoch keine Bewertungen

- Introduction To Partnership Accounting Partnership DefinedDokument33 SeitenIntroduction To Partnership Accounting Partnership DefinedMarcus MonocayNoch keine Bewertungen

- 2nd Quizzer 1st Sem SY 2020-2021 - AKDokument6 Seiten2nd Quizzer 1st Sem SY 2020-2021 - AKMitzi WamarNoch keine Bewertungen

- Quiz - PartnershipDokument2 SeitenQuiz - PartnershipLeisleiRagoNoch keine Bewertungen

- CORPORATIONDokument14 SeitenCORPORATIONcpacpacpaNoch keine Bewertungen

- Compound Financial InstrumentDokument10 SeitenCompound Financial Instrumentkrisha milloNoch keine Bewertungen

- 1 Partneship Formation PDFDokument7 Seiten1 Partneship Formation PDFSienna PrcsNoch keine Bewertungen

- B. Winnings Not Exceeding 10,000 D. Interest Income From Bank DepositsDokument3 SeitenB. Winnings Not Exceeding 10,000 D. Interest Income From Bank DepositsVanesa Calimag ClementeNoch keine Bewertungen

- Partnership Q5Dokument2 SeitenPartnership Q5Lorraine Mae RobridoNoch keine Bewertungen

- Quiz OperationsDokument4 SeitenQuiz OperationsAngelo VilladoresNoch keine Bewertungen

- Partnership OperationDokument3 SeitenPartnership OperationShane NayahNoch keine Bewertungen

- CMPC 131 2-Partneship-OperationsDokument4 SeitenCMPC 131 2-Partneship-OperationsGab IgnacioNoch keine Bewertungen

- Robrido, Lorraine Mae DiongzonDokument2 SeitenRobrido, Lorraine Mae DiongzonLorraine Mae RobridoNoch keine Bewertungen

- Partnership Q6 SolutionDokument4 SeitenPartnership Q6 SolutionLorraine Mae RobridoNoch keine Bewertungen

- Partnership Q5Dokument2 SeitenPartnership Q5Lorraine Mae RobridoNoch keine Bewertungen

- Partnership Q6 SolutionDokument4 SeitenPartnership Q6 SolutionLorraine Mae RobridoNoch keine Bewertungen

- Partnership Q3Dokument2 SeitenPartnership Q3Lorraine Mae RobridoNoch keine Bewertungen

- Partnership Q3 SolutionDokument2 SeitenPartnership Q3 SolutionLorraine Mae RobridoNoch keine Bewertungen

- Exercises and Quiz On InvestmentsDokument13 SeitenExercises and Quiz On InvestmentsPrince PierreNoch keine Bewertungen

- Partnership Q1Dokument3 SeitenPartnership Q1Lorraine Mae RobridoNoch keine Bewertungen

- Partnership Q1 SolutionDokument3 SeitenPartnership Q1 SolutionLorraine Mae RobridoNoch keine Bewertungen

- Cash 2018 1 Q PDFDokument4 SeitenCash 2018 1 Q PDFLorraine Mae RobridoNoch keine Bewertungen

- Chap 7 Student Lecture NotesDokument16 SeitenChap 7 Student Lecture NotesLorraine Mae RobridoNoch keine Bewertungen

- CONFRASDokument68 SeitenCONFRASLorraine Mae RobridoNoch keine Bewertungen

- Chapter7 ProblemsonnotesreceivableDokument21 SeitenChapter7 Problemsonnotesreceivableyara suliemanNoch keine Bewertungen

- Connecticut Property Management Agreement PDFDokument4 SeitenConnecticut Property Management Agreement PDFDrake MontgomeryNoch keine Bewertungen

- Gratuity Liability and Benefits of Group Gratuity Trust Fund by CompaniesDokument4 SeitenGratuity Liability and Benefits of Group Gratuity Trust Fund by CompaniesTikaram ChaudharyNoch keine Bewertungen

- Company Appeal (AT) (Ins.) No. 542 of 2023Dokument18 SeitenCompany Appeal (AT) (Ins.) No. 542 of 2023Surya Veer SinghNoch keine Bewertungen

- Actuarial Mathematics II Solutions To Exercises OnDokument4 SeitenActuarial Mathematics II Solutions To Exercises Onshashalom77Noch keine Bewertungen

- Audit of InsuranceDokument26 SeitenAudit of Insuranceashokkeeli100% (1)

- 1.1.2.a Assignment - Partnership Formation and OperationDokument14 Seiten1.1.2.a Assignment - Partnership Formation and OperationGiselle MartinezNoch keine Bewertungen

- Dung - HDTD - Nguyen Thi Kim Loan p8-14Dokument7 SeitenDung - HDTD - Nguyen Thi Kim Loan p8-14nguyenthihoaivietnamNoch keine Bewertungen

- Mack-Cali Realty Corporation Reports Third Quarter 2018 ResultsDokument9 SeitenMack-Cali Realty Corporation Reports Third Quarter 2018 ResultsAnonymous Feglbx5Noch keine Bewertungen

- YMO - Hand Book PDFDokument90 SeitenYMO - Hand Book PDFashu jessyNoch keine Bewertungen

- Simple and Compound InterestDokument31 SeitenSimple and Compound InterestAshley AniganNoch keine Bewertungen

- Introduction To Project Report:: Shiva Credit Co-Operative Society LimitedDokument83 SeitenIntroduction To Project Report:: Shiva Credit Co-Operative Society Limitedpmcmbharat264Noch keine Bewertungen

- Affiliated To University of MumbaiDokument98 SeitenAffiliated To University of MumbaiAnand YadavNoch keine Bewertungen

- ASM Supple TekDokument16 SeitenASM Supple TekRajendra JoshiNoch keine Bewertungen

- Inflation: Chapter FourDokument17 SeitenInflation: Chapter Fourrabia liaqatNoch keine Bewertungen

- Partnership Fundamental Worksheet 1Dokument2 SeitenPartnership Fundamental Worksheet 1kena0% (1)

- The Secret' Investment Advice Given by A World Famous BillionaireDokument7 SeitenThe Secret' Investment Advice Given by A World Famous BillionaireNeli IlenNoch keine Bewertungen

- Mathematics of Investments - Amortization and Sinking FundDokument4 SeitenMathematics of Investments - Amortization and Sinking FundBrando MoloNoch keine Bewertungen

- Income TaxDokument88 SeitenIncome TaxNitesh VyasNoch keine Bewertungen

- Chapter 10 Verification of Balance Sheet Items: 1. ObjectivesDokument23 SeitenChapter 10 Verification of Balance Sheet Items: 1. ObjectivesSyed RizviNoch keine Bewertungen

- Internship Report SejutiDokument46 SeitenInternship Report SejutiChowdhury Afif QuadirNoch keine Bewertungen

- EMI Calculator: Loan Amount 1,250,000 Interest Rate 13.25% No. of Months 132Dokument8 SeitenEMI Calculator: Loan Amount 1,250,000 Interest Rate 13.25% No. of Months 132Sanjeev GulyaniNoch keine Bewertungen