Beruflich Dokumente

Kultur Dokumente

Dinesh Engineers LTD.: Not Rated

Hochgeladen von

diwanOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Dinesh Engineers LTD.: Not Rated

Hochgeladen von

diwanCopyright:

Verfügbare Formate

IPO Note

Dinesh Engineers Ltd.

Premia Research Issue Opens: September 28, 2018; Issue Closes: October 03, 2018; Price Band: ` 183-185

Company Overview

Recommendation Dinesh Engineers is a contractor and turnkey player providing passive

Not Rated communication infrastructure mainly to the telecom operators and

internet service providers (ISPs). The company’s business segments

Issue Details

include (1) Vendor projects (89.8% of FY18 sales), executes projects

Face Value: `10

which involve obtaining Right of Way (ROW) and laying duct and fiber;

Public Issue: 1.0cr shares

(2) as Infrastructure Providers (IP; 9.1% of FY18 sales), the company

Price Band: `183-185

Issue Size#: ~`185 cr

leases its own optic fiber network (OFC) of ~7,500 km (under IP-1

Bid lot: 80 Equity shares license) which runs across Rajasthan, Gujarat, Maharashtra, Goa,

Issue Type: 100% Book building Karnataka, Andhra Pradesh and Telengana. (3) It is also laying gas

Post Issue Market Cap#: ~`731cr; # - at upper pipeline for MGL (1.1% of FY18 sales). The company’s major clients are

price band

Airtel, BSNL, Reliance Jio, Vodafone, Idea, Tata Communication, etc.

% Shareholding Pre IPO Post IPO

Offer Details

Promoter 100.0 74.7

The offer consists of fresh issue of 1cr shares (`185cr). The proceeds

Public 0.0 25.3

will be utilized to enhance OFC network by 5,400km for `156.4cr. The

Source: RHP

rest of the proceeds will be used to fund general corporate expenses.

Share Reservation % of Net Issue

Our View

QIB 50

Dinesh Engineers stands to benefit from increasing need of fiberization

NII 15

in the telecom sector coupled with its entry into new segments. The

Retail 35

company’s sales and PAT have grown at an impressive CAGR of 64.3%

Company Management and 88.2% respectively (FY13-18), albeit on a lower base. However,

Mr. Dinesh Kollaiah Chairman & tapering off of Bharatnet capex by March 2019, increasing competition

Kargal MD

Whole time and probable delay in rollout of 5G are the key risks particularly for the

Mrs. Shashikala Kargal

director leasing business. At the upper price band, the stock is valued at a P/E

Issue Managers of 11.8xFY18 on post issue basis.

BRLMs Hem Securities Financial Summary

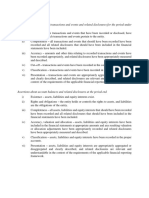

Registrar Link Intime India Pvt. Ltd. Consolidated `cr. FY16 FY17 FY18

Revenue from operations 122 169 302

Analysts: Khadija Mantri EBITDA Margin % 22.7 27.0 35.7

E-mail: research@iifl.com Adj. PAT 12.9 22.0 61.8

September 26, 2018 EPS (`)* 3.3 5.6 15.6

Growth y-o-y (%) 99.7 70.6 180.4

P/E* 56.5 33.1 11.8

P/BV* 25.2 15.8 6.8

RoE (%) 44.6 47.8 57.2

Source: RHP, IIFL Research; *EPS & Ratios at higher end of the price band and on post IPO shares

Dinesh Engineers Ltd.

Premia Research

Key Points

Increasing demand for optic fiber bodes well for the company

The data transmission volumes are increasing rapidly given the rise in

telecom subscribers, internet users and widespread digitalization. This

has led to rise in demand for OFC installations, which are critical in

telecom network expansion. Currently, fiberization is at mere 20%,

while 80% is needed in order to ensure widespread roll-out of 5G in

the coming years. Hence, Dinesh Engineers, in its capacity as an EPC

player (vendor projects) is likely to gain from orders for fiberization,

which involves laying down duct and fiber. Currently, the company’s

order book stands at `420.4cr (~5,600km) executable over 6-9

months.

Capacity expansion of own network to augment growth

Dinesh Engineers currently has own OFC network of more than

7,500km (duct- 4,009km and fiber capitalization -3,491km). The

company’s capability to obtain Right of Way (ROW) faster is

encouraging telecom operators and ISPs to avail of the company’s

established network on a leasing basis. In the leasing business, the

company receives upfront cash (`115.69cr in FY18) at the time of

leasing of network. This leads to higher profitability (EBITDA margin is

as high as ~75%) and returns leading to strong asset turnover. Hence,

the company plans to expand the capacity of its own dedicated OFC

network by ~5,740km in states of Maharashtra, Rajasthan, Karnataka,

Madhya Pradesh and Andhra Pradesh. Moreover, current utilization

level at mere 32% provides significant scope for growth.

Strong track record; diversification to de-risk business

The company’s high network uptime of 99.5%, strong track record and

ease in obtaining ROW helps it enjoy a strong clientele. Further, in

order to de-risk its business, the company has diversified into gas

pipeline segment. It is currently executing a gas pipeline project in the

state of Maharashtra assigned by Mahanagar Gas Ltd. (MGL).

Dinesh Engineers Ltd.

Premia Research

Key Risks

Higher client concentration

Dinesh Engineers derives ~95% of its revenue from top 5 customers.

This increases its business concentration risk.

Delay in 5G rollout, completion of Bharatnet may hamper growth

Delay in rollout of 5G due to poor financial health of telecom

operators, increasing competition and tapering off of Bharatnet capex

by March 2019 may lead to under-utilization of its own OFC network.

Disclaimer

Premia Research

Recommendation Parameters for Fundamental/Technical Reports:

Buy – Absolute return of over +10%

Accumulate – Absolute return between 0% to +10%

Reduce – Absolute return between 0% to -10%

Sell – Absolute return below -10%

Please refer to http://www.indiainfoline.com/research/disclaimer for recommendation parameter, analyst disclaimer and other disclosures.

IIFL Securities Limited (Formerly ‘India Infoline Limited’), CIN No.: U99999MH1996PLC132983, Corporate Office – IIFL Centre, Kamala City,

Senapati Bapat Marg, Lower Parel, Mumbai – 400013 Tel: (91-22) 4249 9000 .Fax: (91-22) 40609049, Regd. Office – IIFL House, Sun Infotech

Park, Road No. 16V, Plot No. B-23, MIDC, Thane Industrial Area, Wagle Estate, Thane – 400604 Tel: (91-22) 25806650. Fax: (91-22) 25806654

E-mail: mail@indiainfoline.com Website: www.indiainfoline.com, Refer www.indiainfoline.com for detail of Associates.

Stock Broker SEBI Regn.: INZ000164132, PMS SEBI Regn. No. INP000002213, IA SEBI Regn. No. INA000000623, SEBI RA Regn.:- INH000000248

For Research related queries, write at research@iifl.com

For Sales and Account related information, write to customer care: cs@iifl.com or call on 91-22 4007 1000

Das könnte Ihnen auch gefallen

- Risk and Control Matrix For Revenue CycleDokument3 SeitenRisk and Control Matrix For Revenue CycleAyrah Erica Jaime100% (8)

- Research Problems, and Information NeedsDokument6 SeitenResearch Problems, and Information NeedsAritra Nandy0% (1)

- Notification of Change of OwnershipDokument3 SeitenNotification of Change of OwnershipMark BurkeNoch keine Bewertungen

- Airtel Marketing MyopiaDokument36 SeitenAirtel Marketing MyopiaBaskar NarayananNoch keine Bewertungen

- GDP Inspection Checklist EMADokument3 SeitenGDP Inspection Checklist EMAPedro MCNoch keine Bewertungen

- Altethia Company IncorporationDokument4 SeitenAltethia Company IncorporationPranav JayaramNoch keine Bewertungen

- Project On Customer Satisfaction OF Air India Submitted in Partial Fulfillment of The Requirements For Course Research Methods in Business in PGDMDokument47 SeitenProject On Customer Satisfaction OF Air India Submitted in Partial Fulfillment of The Requirements For Course Research Methods in Business in PGDMDeepak Nehra100% (1)

- ATT Convergent BillDokument10 SeitenATT Convergent Bill2bjunked4evaNoch keine Bewertungen

- AngelbrokingResearch Tejasnetwork IPONote 130617Dokument12 SeitenAngelbrokingResearch Tejasnetwork IPONote 130617durgasainathNoch keine Bewertungen

- Rolta Mata SecuritiesDokument18 SeitenRolta Mata Securitiesjeetchakraborty61414Noch keine Bewertungen

- MTAR Technologies IPO Note ICICI DirectDokument12 SeitenMTAR Technologies IPO Note ICICI DirectfalconNoch keine Bewertungen

- SBI Securities Sees 22% UPSIDE in Syrma SGS Technology LTD RidingDokument22 SeitenSBI Securities Sees 22% UPSIDE in Syrma SGS Technology LTD RidingManit JainNoch keine Bewertungen

- HFCL - Initiating Coverage - KSL 210521Dokument14 SeitenHFCL - Initiating Coverage - KSL 210521Dhiren DesaiNoch keine Bewertungen

- Balance Score Card On Telecomm SectorDokument15 SeitenBalance Score Card On Telecomm Sectortushartutu67% (6)

- Dynamatic Technologies - IsEC - 31 Mar 2024Dokument63 SeitenDynamatic Technologies - IsEC - 31 Mar 2024rawatalokNoch keine Bewertungen

- Small Midcap Engineering DayDokument7 SeitenSmall Midcap Engineering Daybhavesh32Noch keine Bewertungen

- GTPL Hathway IPO Note 200617Dokument10 SeitenGTPL Hathway IPO Note 200617durgasainathNoch keine Bewertungen

- Apar Industries LTD.: 13 Plan Expenditures and Revival in Capex From Discoms, Key For Earning GrowthDokument24 SeitenApar Industries LTD.: 13 Plan Expenditures and Revival in Capex From Discoms, Key For Earning GrowthVenkatesh GanjiNoch keine Bewertungen

- Ipo Report Polycab India Ltd.Dokument11 SeitenIpo Report Polycab India Ltd.Pratik BobadeNoch keine Bewertungen

- Idea 1Dokument3 SeitenIdea 1mkundan24Noch keine Bewertungen

- Dark Horse Stage 6Dokument7 SeitenDark Horse Stage 6rupesh4286Noch keine Bewertungen

- RetailEquity-How To Analyze IPODokument5 SeitenRetailEquity-How To Analyze IPOmanish shankarNoch keine Bewertungen

- Frontken Initiate Coverage ReportDokument16 SeitenFrontken Initiate Coverage ReportNicholas ChehNoch keine Bewertungen

- Value Research Stock Advisor - Sterlite TechnologiesDokument32 SeitenValue Research Stock Advisor - Sterlite TechnologiesjesprileNoch keine Bewertungen

- Diwali Dhamaka 2020Dokument25 SeitenDiwali Dhamaka 2020Prachi PatwariNoch keine Bewertungen

- Kaynes Technology India LTD - IPO Note - 11!11!2022Dokument8 SeitenKaynes Technology India LTD - IPO Note - 11!11!2022Manipal SinghNoch keine Bewertungen

- Adhigrahan IMTGhaziabad ThreeMusketeersDokument11 SeitenAdhigrahan IMTGhaziabad ThreeMusketeersnagesh_kashyapNoch keine Bewertungen

- Telecom Services: Network Investments Set To Increase With Deployment of New TechnologiesDokument6 SeitenTelecom Services: Network Investments Set To Increase With Deployment of New TechnologiesPREKSHA KARDAMNoch keine Bewertungen

- Reliance Communication Ltd.Dokument2 SeitenReliance Communication Ltd.ratika_bvpNoch keine Bewertungen

- Sansera Engineering LTD - Company Update - 26 June 2022 - Nirmal Bang (Inst.)Dokument4 SeitenSansera Engineering LTD - Company Update - 26 June 2022 - Nirmal Bang (Inst.)darshanmaldeNoch keine Bewertungen

- Vedanta Credit ReportDokument23 SeitenVedanta Credit ReportvishnuNoch keine Bewertungen

- KMT FY18 Investor DayDokument17 SeitenKMT FY18 Investor Dayrchawdhry123Noch keine Bewertungen

- KPIT Technologies - GSDokument49 SeitenKPIT Technologies - GSchetankvora0% (1)

- Group 3 - Vodafone-Idea Merger EditedDokument3 SeitenGroup 3 - Vodafone-Idea Merger EditedKartik GuptaNoch keine Bewertungen

- Idea Cellular LTD: Key DataDokument7 SeitenIdea Cellular LTD: Key Datayash_mulwani5815Noch keine Bewertungen

- Assignment OF Security Anaylsis AND Portfolio Management: Submitted byDokument15 SeitenAssignment OF Security Anaylsis AND Portfolio Management: Submitted byHarry HArmanNoch keine Bewertungen

- Insights TPG May Not Disrupt Attractive Yield and Valuations PDFDokument37 SeitenInsights TPG May Not Disrupt Attractive Yield and Valuations PDFTech DealerNoch keine Bewertungen

- Update - Reliance Jio - The Game Changer - December 2018Dokument5 SeitenUpdate - Reliance Jio - The Game Changer - December 2018NLDFNANoch keine Bewertungen

- Machine Learning EricssonDokument12 SeitenMachine Learning EricssonMohib100% (1)

- Siemens LTD.: PicksDokument4 SeitenSiemens LTD.: PicksomkarwardNoch keine Bewertungen

- It Sector Initiation 310321 PDFDokument119 SeitenIt Sector Initiation 310321 PDFchaingangriteshNoch keine Bewertungen

- Technology: OverweightDokument5 SeitenTechnology: OverweightFakhruddin FazilNoch keine Bewertungen

- Southern Cable Group BHDDokument12 SeitenSouthern Cable Group BHDlkt_pestechNoch keine Bewertungen

- PC - PolicyBazar Sep 2021 20210921201954Dokument18 SeitenPC - PolicyBazar Sep 2021 20210921201954NavinNoch keine Bewertungen

- H G Infra Engineering LTD: Subscribe For Long Term Price Band: INR 263 - 270Dokument8 SeitenH G Infra Engineering LTD: Subscribe For Long Term Price Band: INR 263 - 270SachinShingoteNoch keine Bewertungen

- Kpit Report - Ic - 01dec10Dokument20 SeitenKpit Report - Ic - 01dec10sitanshu kumarNoch keine Bewertungen

- Equity Note - BBS Cables Limited - May 2019Dokument3 SeitenEquity Note - BBS Cables Limited - May 2019jahed uddinNoch keine Bewertungen

- Kaynes TechDokument41 SeitenKaynes Techadityazade03Noch keine Bewertungen

- GTL Infrastructure LTD: Key Financial IndicatorsDokument4 SeitenGTL Infrastructure LTD: Key Financial IndicatorsMehakBatlaNoch keine Bewertungen

- Graphite India LimitedDokument28 SeitenGraphite India LimitedRicha SinghNoch keine Bewertungen

- Presentation On Bharti AirtelDokument36 SeitenPresentation On Bharti AirtelMohit ChaubeyNoch keine Bewertungen

- Happy Forgings Limited - IPO NotexbdjdjdjdjDokument9 SeitenHappy Forgings Limited - IPO NotexbdjdjdjdjAnkit VyasNoch keine Bewertungen

- Natgate 230515 Cu (Kenanga)Dokument4 SeitenNatgate 230515 Cu (Kenanga)Muhammad SyafiqNoch keine Bewertungen

- Ericsson Case Study - QXDDokument10 SeitenEricsson Case Study - QXDTanvir SinghNoch keine Bewertungen

- Thyrocare - Managment MeetDokument6 SeitenThyrocare - Managment Meetrajesh katareNoch keine Bewertungen

- CRNT IR Presentation August 2019 FinalDokument25 SeitenCRNT IR Presentation August 2019 FinalCesar QNoch keine Bewertungen

- Binging Big On BTG : BUY Key Take AwayDokument17 SeitenBinging Big On BTG : BUY Key Take AwaymittleNoch keine Bewertungen

- Credit Research Report: Team 545Dokument22 SeitenCredit Research Report: Team 545D Ban ChoNoch keine Bewertungen

- Tata Motors: CMP: INR308Dokument16 SeitenTata Motors: CMP: INR308VARUN SINGLANoch keine Bewertungen

- BMDE - Project - Group 4Dokument9 SeitenBMDE - Project - Group 4Anurag YadavNoch keine Bewertungen

- TCI ExpressDokument6 SeitenTCI ExpressYash NyatiNoch keine Bewertungen

- SYS - Pakistan's Best Digital Story Initiate With Buy - 27-05-2021Dokument31 SeitenSYS - Pakistan's Best Digital Story Initiate With Buy - 27-05-2021Muhammad Ovais AhsanNoch keine Bewertungen

- Bharti Airtel: CMP: INR349 TP: INR420 (+20%) Stability EmergingDokument14 SeitenBharti Airtel: CMP: INR349 TP: INR420 (+20%) Stability EmergingDivyansh SinghNoch keine Bewertungen

- Telecom PDFDokument36 SeitenTelecom PDFVaibhav KhokharNoch keine Bewertungen

- TruOps CommonLanguage IDCWhitePaperDokument13 SeitenTruOps CommonLanguage IDCWhitePapermahmoud.te.strategyNoch keine Bewertungen

- Forum NXT Battle Card PDFDokument6 SeitenForum NXT Battle Card PDFJOOOOONoch keine Bewertungen

- Agile Procurement: Volume II: Designing and Implementing a Digital TransformationVon EverandAgile Procurement: Volume II: Designing and Implementing a Digital TransformationNoch keine Bewertungen

- Management AssertionsDokument2 SeitenManagement AssertionsTeh Chu LeongNoch keine Bewertungen

- Rhonda Nurenberg ResumeDokument1 SeiteRhonda Nurenberg Resumebeth_ann_hNoch keine Bewertungen

- The Telecommunications Process Classification FrameworkDokument26 SeitenThe Telecommunications Process Classification FrameworkibrahimdesaiNoch keine Bewertungen

- ProntoWash at The Woodlands MallDokument2 SeitenProntoWash at The Woodlands MallPR.comNoch keine Bewertungen

- Exit Interview ProcessDokument12 SeitenExit Interview ProcessmysticdivineNoch keine Bewertungen

- Ms Anuradha Bhatia Dit TP 1 MumbaiDokument28 SeitenMs Anuradha Bhatia Dit TP 1 MumbaiamolkhareNoch keine Bewertungen

- Audit Internal, Operasional & PemerintahDokument27 SeitenAudit Internal, Operasional & PemerintahRizal Fanani AbdilahNoch keine Bewertungen

- Global Transnational Multidomestic International StrategyDokument8 SeitenGlobal Transnational Multidomestic International Strategyefe westNoch keine Bewertungen

- IBO 2004 Theory Answers Part A - CCLDokument5 SeitenIBO 2004 Theory Answers Part A - CCLmartynapetNoch keine Bewertungen

- Training Report at KescoDokument50 SeitenTraining Report at KescoHina Sheikh MansooriNoch keine Bewertungen

- Session 1Dokument63 SeitenSession 1Thanh Tung DaoNoch keine Bewertungen

- Agenda - IAMAIDokument7 SeitenAgenda - IAMAIBhupinder KaurNoch keine Bewertungen

- Template Sponsorship ProposalDokument3 SeitenTemplate Sponsorship ProposalAzalea SabdariffaNoch keine Bewertungen

- GM-RFX RFP Response Form TemplateDokument12 SeitenGM-RFX RFP Response Form TemplateRishikeshNoch keine Bewertungen

- Types of Business ReportsDokument4 SeitenTypes of Business Reportsmohitha_srpNoch keine Bewertungen

- Corporate Governance-As Defined by SECP (Pakistan)Dokument1 SeiteCorporate Governance-As Defined by SECP (Pakistan)tehreemNoch keine Bewertungen

- System Manuals: EBTS and Integrated Site ControllerDokument3 SeitenSystem Manuals: EBTS and Integrated Site ControllerIsac LimaNoch keine Bewertungen

- SAPSCM/APO European Initiative: APO Overview Internal Training Demand Planning OverviewDokument104 SeitenSAPSCM/APO European Initiative: APO Overview Internal Training Demand Planning OverviewVipparti Anil KumarNoch keine Bewertungen

- A Project Report ON Inventory Management atDokument24 SeitenA Project Report ON Inventory Management atStephin JanvelNoch keine Bewertungen

- Revised CCG Checklist 2012Dokument15 SeitenRevised CCG Checklist 2012Apa SughraNoch keine Bewertungen

- ASME IX Summary of Changes (2004)Dokument4 SeitenASME IX Summary of Changes (2004)SurabhiSriramMarutiNoch keine Bewertungen

- Crave - Hiring Deck PDFDokument26 SeitenCrave - Hiring Deck PDFAkim BahadurshaNoch keine Bewertungen

- Ansoff MatrixDokument3 SeitenAnsoff MatrixJatin AhujaNoch keine Bewertungen