Beruflich Dokumente

Kultur Dokumente

Corporate Brochure PDF

Hochgeladen von

Pietro TorneseOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Corporate Brochure PDF

Hochgeladen von

Pietro TorneseCopyright:

Verfügbare Formate

UNCDF supports microfinance institutions, In 2016: UNCDF is the UN’s capital investment agency

banks, cooperatives, and money transfer

companies to ensure that suitable financial

31 for the world’s 48 least developed countries.

Least Developed

products (savings, credit, insurance, payments, With its capital mandate and instruments,

Countries

and remittances) are available to individuals - with UNCDF Programmes UNCDF offers “last mile” finance models that

notably the 'unbanked' - and micro-enterprises

22 in Africa and Unlocking Public and Private

Finance for the Poor unlock public and private resources, especially

as well as small and medium enterprises, at a

9 in Asia & the Pacific at the domestic level, to reduce poverty and

reasonable cost, and on a sustainable basis, to

overcome economic shocks, ensure smooth 38

Development

support local economic development.

consumption, and provide educational and Partners up from UNCDF’s financing models work through two

entrepreneurial investments to enable the 29 in 2010 channels: financial inclusion that expands the

transition out of poverty. UNCDF also hosts the opportunities for individuals, households, and

Better Than Cash Alliance with the objective to THREEFOLD small businesses to participate in the local

increase in the number

promote the use of digital payment systems for economy, providing them with the tools they

of partners from the

gains in transparency, cost effectiveness, and private sector need to climb out of poverty and manage their

since 2010

outreach. financial lives; and by showing how localized

investments — through fiscal decentralization,

UNCDF also works to ensure that people in all innovative municipal finance, and structured

UNCDF Global Thematic

regions and localities can access investment Initiatives & Diagnostic Tools project finance — can drive public and private

resources, whether public or private, in order to use innovative

finance to contribute to

UNCDF AT A GLANCE funding that underpins local economic

benefit from growth. UNCDF’s work aims at

mobilizing domestic resources to support local

food security, climate change,

acces to energy, women’s UNLOCKING PUBLIC expansion and sustainable development.

economies and service delivery through,

and youth economic

empowerment and social AND PRIVATE FINANCE By strengthening how finance works for poor

FOR THE POOR

protection

inter-alia, fiscal decentralization, climate people at the household, small enterprise, and

finance, women's economic empowerment and local infrastructure levels, UNCDF contributes

financing of infrastructure projects. UNCDF’s to SDG 1 on eradicating poverty and SDG 17 on

focus is on strengthening public financial the means of implementation.

management and local revenue, improving the

quality of public and private investments and UN Capital Development Fund By identifying those market segments where

Two United Nations Plaza

promoting innovations at the local level. New York, NY 10017 innovative financing models can have

info@uncdf.org | www.uncdf.org

Tel: +1-212-906-6565 | Fax: +1-212-906-6479 transformational impact in helping to reach the

www.facebook.com/uncdf

last mile and address exclusion and inequalities

www.twitter.com/uncdf

of access, UNCDF contributes to a number of

Unlocking

Unlocking PublicPublic and Private Finance for the Poor

and Private different SDGs.

Finance for the Poor

Funding Partners UNCDF Programmes

UNIQUE LDCS UNCDF UNDP

Austria Mastercard Worldwide Inclusive Local Development

Belgian Survival Fund Myanmar

FINANCIAL GEOGRAPHIC

Finance Finance

Belgian Tecnical New Zealand MANDATE FOCUS “UNDP will rely upon UNCDF’s

Cooperation (BTC) Norway Benin Bangladesh through grants, soft loans, “to serve first and foremost the financial mandate in specific areas

Belgium Norwegian Agency for Burkina Faso Benin targeted credit enhancements, and LDCs” as established by the UN of shared focus in LDCs.” (UNDP

Bhutan Development Burundi Bhutan

Bill & Melinda Gates Cooperation (Norad) innovative business partnerships. General Assembly. Strategic Plan 2014-2017)

Cameroon Burkina Faso

Foundation Omidyar Network Chad Burundi

China Pact Global Microfinance Democratic Republic Cambodia

Citi Foundation Fund (PGMF) (Myanmar) of Congo Democratic Republic

Danish International Sweden Ethiopia of Congo

Development Agency Swedish International Fiji Ethiopia

(DANIDA) Development Ghana Guinea

Denmark Cooperation Agency Côte d’Ivoire Côte d’Ivoire

Department for (Sida) Jordan Jordan

International Swiss Development Lao PDR Lao PDR

Development (DfID) Corporation (SDC) Lesotho Lesotho

Department of Foreign Thailand Liberia Mali

Affairs and Trade The Mastercard Madagascar Mozambique

(Australia) Foundation Malawi Nepal

European Commission The Netherlands Mozambique Niger 1

International Fund for United Nations Myanmar Papua New Guinea

Agricultural Convention to Combat Nepal Senegal

Development (IFAD) Desertification Innovation

Niger Sierra Leone

Irish Aid (UNCDD) Papua New Guinea Somalia

Italy United Nations Rwanda Tanzania

Lao PDR Development Samoa Timor-Leste

Liechtenstein Programme (UNDP) Senegal Uganda UNCDF

Livelihoods and Food United States Sierra Leone Maturity 2

Security Trust Fund United States Agency for 3 Model

Solomon Islands

(LIFT) International Swaziland

Lux Development Development (USAID)

Scaling Leverage

Tanzania

Luxembourg Togo up

Tonga

Uganda

Vanuatu 1 UNCDF uses core resources as “seed capital” to establish country presence, to develop

Zambia

programmes and to prove concept. This is the innovation stage, for which core resources, healthy risk

appetite, and open platform learning with partners are critical components.

2 UNCDF consolidates the lessons from the innovation stage to create the leverage for unlocking additional

sources of public and private, foreign and domestic resources that will help countries embed the innovations in

institutions, policies, capacities, and systems. During the consolidation stage, lessons can be drawn about the

implications for replication, capacity development, and market potential.

3 UNCDF and its partner institutions also work with national and international investment partners to create the

conditions for scaling up, for which a leverage of at least 1:10 is sought. Scaling up may involve replication across more

institutions, more populations, more geographic localities, and/or more countries.

Visit us at www.uncdf.org, follow @UNCDF and facebook.com/uncdf, and subscribe for updates at http://ow.ly/CA0Qy

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- CH 1 India Economy On The Eve of Independence QueDokument4 SeitenCH 1 India Economy On The Eve of Independence QueDhruv SinghalNoch keine Bewertungen

- SPH4U Assignment - The Wave Nature of LightDokument2 SeitenSPH4U Assignment - The Wave Nature of LightMatthew GreesonNoch keine Bewertungen

- A Novel Adoption of LSTM in Customer Touchpoint Prediction Problems Presentation 1Dokument73 SeitenA Novel Adoption of LSTM in Customer Touchpoint Prediction Problems Presentation 1Os MNoch keine Bewertungen

- A Review Paper On Improvement of Impeller Design A Centrifugal Pump Using FEM and CFDDokument3 SeitenA Review Paper On Improvement of Impeller Design A Centrifugal Pump Using FEM and CFDIJIRSTNoch keine Bewertungen

- Dissertation On Indian Constitutional LawDokument6 SeitenDissertation On Indian Constitutional LawCustomPaperWritingAnnArbor100% (1)

- 4th Sem Electrical AliiedDokument1 Seite4th Sem Electrical AliiedSam ChavanNoch keine Bewertungen

- Gabby Resume1Dokument3 SeitenGabby Resume1Kidradj GeronNoch keine Bewertungen

- Food and Beverage Department Job DescriptionDokument21 SeitenFood and Beverage Department Job DescriptionShergie Rivera71% (7)

- Lab Session 7: Load Flow Analysis Ofa Power System Using Gauss Seidel Method in MatlabDokument7 SeitenLab Session 7: Load Flow Analysis Ofa Power System Using Gauss Seidel Method in MatlabHayat AnsariNoch keine Bewertungen

- STM - Welding BookDokument5 SeitenSTM - Welding BookAlvin MoollenNoch keine Bewertungen

- Feasibility Study of Diethyl Sulfate ProductionDokument3 SeitenFeasibility Study of Diethyl Sulfate ProductionIntratec SolutionsNoch keine Bewertungen

- Chapter 5Dokument3 SeitenChapter 5Showki WaniNoch keine Bewertungen

- 90FF1DC58987 PDFDokument9 Seiten90FF1DC58987 PDFfanta tasfayeNoch keine Bewertungen

- Configuring Master Data Governance For Customer - SAP DocumentationDokument17 SeitenConfiguring Master Data Governance For Customer - SAP DocumentationDenis BarrozoNoch keine Bewertungen

- Working Capital ManagementDokument39 SeitenWorking Capital ManagementRebelliousRascalNoch keine Bewertungen

- Personal Best B1+ Unit 1 Reading TestDokument2 SeitenPersonal Best B1+ Unit 1 Reading TestFy FyNoch keine Bewertungen

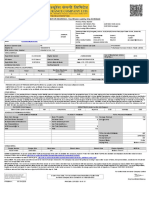

- MOTOR INSURANCE - Two Wheeler Liability Only SCHEDULEDokument1 SeiteMOTOR INSURANCE - Two Wheeler Liability Only SCHEDULESuhail V VNoch keine Bewertungen

- Shubham RBSEDokument13 SeitenShubham RBSEShubham Singh RathoreNoch keine Bewertungen

- The Effectiveness of Risk Management: An Analysis of Project Risk Planning Across Industries and CountriesDokument13 SeitenThe Effectiveness of Risk Management: An Analysis of Project Risk Planning Across Industries and Countriesluisbmwm6Noch keine Bewertungen

- P 1 0000 06 (2000) - EngDokument34 SeitenP 1 0000 06 (2000) - EngTomas CruzNoch keine Bewertungen

- Ytrig Tuchchh TVDokument10 SeitenYtrig Tuchchh TVYogesh ChhaprooNoch keine Bewertungen

- SND Kod Dt2Dokument12 SeitenSND Kod Dt2arturshenikNoch keine Bewertungen

- How To Control A DC Motor With An ArduinoDokument7 SeitenHow To Control A DC Motor With An Arduinothatchaphan norkhamNoch keine Bewertungen

- Delta AFC1212D-SP19Dokument9 SeitenDelta AFC1212D-SP19Brent SmithNoch keine Bewertungen

- Topic 4: Mental AccountingDokument13 SeitenTopic 4: Mental AccountingHimanshi AryaNoch keine Bewertungen

- CNC USB English ManualDokument31 SeitenCNC USB English ManualHarold Hernan MuñozNoch keine Bewertungen

- CoDokument80 SeitenCogdayanand4uNoch keine Bewertungen

- Agricultural Economics 1916Dokument932 SeitenAgricultural Economics 1916OceanNoch keine Bewertungen

- Engine Diesel PerfomanceDokument32 SeitenEngine Diesel PerfomancerizalNoch keine Bewertungen

- Recommended Practices For Developing An Industrial Control Systems Cybersecurity Incident Response CapabilityDokument49 SeitenRecommended Practices For Developing An Industrial Control Systems Cybersecurity Incident Response CapabilityJohn DavisonNoch keine Bewertungen