Beruflich Dokumente

Kultur Dokumente

Cordillera Career Development College College of Accountancy Buyagan, Poblacion, La Trinidad, Benguet

Hochgeladen von

Gi Ne VaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Cordillera Career Development College College of Accountancy Buyagan, Poblacion, La Trinidad, Benguet

Hochgeladen von

Gi Ne VaCopyright:

Verfügbare Formate

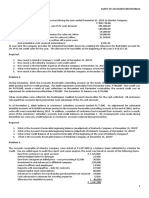

CORDILLERA CAREER DEVELOPMENT COLLEGE

College of Accountancy

Buyagan, Poblacion, La Trinidad, Benguet

Accounting 9A-Auditing

EXERCISE 1

The accountant of SANCHEZ COMPANY is in the process of preparing the company’s financial

statements for the year ended December 31; 2018.He is trying to determine the correct balance of cash

and cash equivalents to be reported as a correct asset of the statement of the financial position. The

following items are being considered:

Balance in the company’s accounts at the Metropolitan Bank:

Current account (based on bank statement) P18, 000

Saving account P132, 600

Undeposited customer checks of P22, 200 (including a customer dated January 2, 2019 for P3,

000).

Currency and coins on hand of P3,480

Saving account at the Northern Philippines Bank with a balance of P2, 400, 000. This account is

being accumulate cash for future plant expansion (in 2019)

Petty cash of P4,000 (currency of P1, 200 and unreplenished vouchers for P2, 800)

P120, 000 in a current account at the Northern Philippines Bank. This represent a 20%

compensating balance for P600, 000 loan with the bank. Sanchez Company is legally restricted to

withdraw the funds until the loan is due in 2021.

Treasury bills :

Two-month maturity bills P90, 000

Seven-month bills P120, 000

Time deposit P100, 000

1. What is the correct balance of cash and cash equivalents to be reported in the current asset section of

the statement of financial position?

a. P547, 480 b. P427, 480 c. P430, 280 d. P327, 480

EXERCISE 2

You are the auditor of the BULAGA Inc. you obtained the statement and checks directly from the bank.

In reconciling the bank balance at December 31, 2018, you observed the following facts:

Balance per general ledger, 12/31/2018

P28, 064

Balance per bank statement, 12/31/2018

11, 046

Outstanding checks, 12/31/2013(including certified checks of P15, 000)

45, 500

Receipts of 12/31/2013, deposited 1/2/19

22, 482

Proceeds of bank loan, 12/31/2018, discounted for 90-days at 10% per year omitted from records

48, 750

Deposit of 12/23/2018, omitted from the bank statement

12, 871

Check 143 of BULAG charge by the bank in error to BULAGA Inc.

7, 200

Deposit of BULAG Inc. credited in error to BULAGA Inc. on 12/06/2018

8, 755

Debited memo for the cost of a checkbook

150

Check of BULAGA in payments of accounts payable and had been recorded by the bookkeeper

as the correct amount is;

12,300

The Ledger account for Cash in bank included petty cash fund amounting to

4, 200

Proceeds from cash sales for July 18 were stolen. The company expects to recover this amount

from the insurance company. The cash receipt was recorded in the books, but no entry was made for

the loss.

15, 700

The company’s account was charged on December 26 for a customer uncollectible check amounting to

31, 350

1. Prepare a bank reconciliation statement to arrive at the adjusted balances at December 31, 2018.

2. Adjusting journal entries as of December 31, 2018

/dbay-an

Das könnte Ihnen auch gefallen

- Mavis Pinera Problem #1Dokument3 SeitenMavis Pinera Problem #1Live LoveNoch keine Bewertungen

- Bank Reconciliation ActivitiesDokument3 SeitenBank Reconciliation ActivitiesRheu ReyesNoch keine Bewertungen

- AudDokument46 SeitenAudJane ConstantinoNoch keine Bewertungen

- Audit of Cash and Cash Equivalent Problem 1 (Adapted)Dokument6 SeitenAudit of Cash and Cash Equivalent Problem 1 (Adapted)Robelyn Asuna LegaraNoch keine Bewertungen

- Auditing ProblemsDokument26 SeitenAuditing ProblemsKingChryshAnneNoch keine Bewertungen

- Substantive Tests of CashDokument2 SeitenSubstantive Tests of CashAmy EbanayNoch keine Bewertungen

- DocxDokument5 SeitenDocxLorraine Mae Robrido100% (2)

- Audit of Cash Bank ReconDokument8 SeitenAudit of Cash Bank ReconPaul Mc AryNoch keine Bewertungen

- Ia ReviewerDokument24 SeitenIa ReviewerDan Edriel RonabioNoch keine Bewertungen

- CCE ReceivablesDokument5 SeitenCCE ReceivablesJane TuazonNoch keine Bewertungen

- Cash & Cash Equivalents QuizDokument1 SeiteCash & Cash Equivalents QuizJaypee BignoNoch keine Bewertungen

- ReSA B42 FAR Final PB Exam - Questions, Answers - SolutionsDokument24 SeitenReSA B42 FAR Final PB Exam - Questions, Answers - SolutionsLuna V100% (2)

- INSTRUCTIONS: Shade The Letter of Your Choice On The Answer Sheet Provided. If Your Answer Is Not inDokument8 SeitenINSTRUCTIONS: Shade The Letter of Your Choice On The Answer Sheet Provided. If Your Answer Is Not inPrankyJelly0% (1)

- Cash and Cash E-WPS OfficeDokument7 SeitenCash and Cash E-WPS OfficeKristine GalleneroNoch keine Bewertungen

- Peer Mentoring PostTestDokument7 SeitenPeer Mentoring PostTestronnelNoch keine Bewertungen

- Quiz AP Receivables 2ndsetDokument7 SeitenQuiz AP Receivables 2ndsetMaritessNoch keine Bewertungen

- Q2 FAR0 - 1st Sem 2019 20Dokument2 SeitenQ2 FAR0 - 1st Sem 2019 20Ceejay Cruz TusiNoch keine Bewertungen

- University of Nueva Caceres College of Business and Accountancy J. Hernandez Avenue, Naga City Prelim Exam Intermediate Accounting One JdmanaogDokument10 SeitenUniversity of Nueva Caceres College of Business and Accountancy J. Hernandez Avenue, Naga City Prelim Exam Intermediate Accounting One JdmanaogJustin ManaogNoch keine Bewertungen

- Cpa Review Auditing ProblemsDokument16 SeitenCpa Review Auditing ProblemsMellinia MantesNoch keine Bewertungen

- Audit Ar With SolutionsDokument14 SeitenAudit Ar With Solutionsbobo kaNoch keine Bewertungen

- 6Dokument2 Seiten6Lazy LeathNoch keine Bewertungen

- 3-Cash and Cash Equiv ExercisesDokument8 Seiten3-Cash and Cash Equiv ExercisesAngelica CastilloNoch keine Bewertungen

- Mocule1 Quiz 202Dokument4 SeitenMocule1 Quiz 202yowatdafrickNoch keine Bewertungen

- CashDokument7 SeitenCashhellohello100% (1)

- Ugrd-Actg412 Applied AuditingDokument4 SeitenUgrd-Actg412 Applied AuditingPatrick Juri SanchezNoch keine Bewertungen

- Audit of ArDokument8 SeitenAudit of ArRizzel SubaNoch keine Bewertungen

- QuizzersDokument4 SeitenQuizzersJulie ann EgiptoNoch keine Bewertungen

- PeerDokument8 SeitenPeerronnelNoch keine Bewertungen

- QUIZ 1. Audit of Cash ManuscriptDokument4 SeitenQUIZ 1. Audit of Cash ManuscriptJulie Mae Caling MalitNoch keine Bewertungen

- Audprob (Lecture 2a - Front)Dokument2 SeitenAudprob (Lecture 2a - Front)Leona CrisostomoNoch keine Bewertungen

- (Problems) - Audit of CashDokument33 Seiten(Problems) - Audit of CashPraise Buenaflor14% (7)

- Activity 1 - Cash and Cash EquivalentsDokument4 SeitenActivity 1 - Cash and Cash EquivalentsSean Lester S. NombradoNoch keine Bewertungen

- Audit of Accounts ReceivablesDokument5 SeitenAudit of Accounts ReceivablesIzza Mae Rivera KarimNoch keine Bewertungen

- Ap Cash Cash Equivalents QuizDokument8 SeitenAp Cash Cash Equivalents QuizJenny BernardinoNoch keine Bewertungen

- Cash and Cash Equivalents QuizDokument2 SeitenCash and Cash Equivalents QuizMarkJoven Bergantin100% (1)

- 112 Seatwork1 ForStudentsDokument5 Seiten112 Seatwork1 ForStudentsJoventino NebresNoch keine Bewertungen

- PAULA GOZUN - Activity 2 Accounting For Cash-receivables-InventoriesDokument9 SeitenPAULA GOZUN - Activity 2 Accounting For Cash-receivables-InventoriesPaupauNoch keine Bewertungen

- 02audit of CashDokument12 Seiten02audit of CashJeanette FormenteraNoch keine Bewertungen

- Reviewees IntaccDokument6 SeitenReviewees IntaccMarvic Cabangunay0% (2)

- Securities: Date Acquired Maturity Date AmountDokument5 SeitenSecurities: Date Acquired Maturity Date AmountThe Chuffed Shop PHNoch keine Bewertungen

- Accounting For Cash-receivables-InventoriesDokument12 SeitenAccounting For Cash-receivables-InventoriesPaupau100% (1)

- Peer Mentoring PretestxxDokument7 SeitenPeer Mentoring PretestxxronnelNoch keine Bewertungen

- PDF Audit of Cash Roque 2018 1 Compress PDFDokument87 SeitenPDF Audit of Cash Roque 2018 1 Compress PDFFernando III PerezNoch keine Bewertungen

- Quiz Module 1 FINALDokument4 SeitenQuiz Module 1 FINALeia aieNoch keine Bewertungen

- Answer in Act. 2 For Cash-receivables-InventoriesDokument10 SeitenAnswer in Act. 2 For Cash-receivables-InventoriesPaupauNoch keine Bewertungen

- Midterm Exam KeyDokument5 SeitenMidterm Exam KeyRiña Lizte AlteradoNoch keine Bewertungen

- Drill 1 (15 Marks) : General Direction: Place On A Separate Sheet of Paper and Show Supporting Solutions in Good FormDokument3 SeitenDrill 1 (15 Marks) : General Direction: Place On A Separate Sheet of Paper and Show Supporting Solutions in Good FormKaye GonxalesNoch keine Bewertungen

- WP - CCE and ReceivablesDokument8 SeitenWP - CCE and ReceivablesHavanah Erika Dela CruzNoch keine Bewertungen

- Audit of Accounting ReceivablesDokument9 SeitenAudit of Accounting ReceivablesHelix HederaNoch keine Bewertungen

- 10.21.2017 Audit of ReceivablesDokument10 Seiten10.21.2017 Audit of ReceivablesPatOcampoNoch keine Bewertungen

- Practice SetDokument4 SeitenPractice SetXena Natividad100% (1)

- Auditing ProblemDokument11 SeitenAuditing ProblemNicole Gole CruzNoch keine Bewertungen

- HANDOUT - CASH AND CASH EQUIVALENTS - Inclusions and ExclusionsDokument4 SeitenHANDOUT - CASH AND CASH EQUIVALENTS - Inclusions and ExclusionsKAYLA SHANE GONZALESNoch keine Bewertungen

- Intermediate Accounting 1 - Cash and Cash EquivalentsDokument14 SeitenIntermediate Accounting 1 - Cash and Cash EquivalentsKristine Jewel MirandaNoch keine Bewertungen

- Intermediate Accounting1 PDFDokument7 SeitenIntermediate Accounting1 PDFTangent Pcs100% (1)

- FAR Practice ProblemsDokument34 SeitenFAR Practice ProblemsJhon Eljun Yuto EnopiaNoch keine Bewertungen

- ACCTG102 MidtermQ1.5 Cash Make Up ExamDokument6 SeitenACCTG102 MidtermQ1.5 Cash Make Up ExamBarrylou Manayan100% (1)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionVon EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNoch keine Bewertungen

- Mastering Bookkeeping: Unveiling the Key to Financial SuccessVon EverandMastering Bookkeeping: Unveiling the Key to Financial SuccessNoch keine Bewertungen

- Public Financial Management Systems—Sri Lanka: Key Elements from a Financial Management PerspectiveVon EverandPublic Financial Management Systems—Sri Lanka: Key Elements from a Financial Management PerspectiveNoch keine Bewertungen

- P102 Lesson 4Dokument24 SeitenP102 Lesson 4Tracy Blair Napa-egNoch keine Bewertungen

- Tugas-MPSI-P1-P14 - Kelompok 2 - 19.4A.04Dokument29 SeitenTugas-MPSI-P1-P14 - Kelompok 2 - 19.4A.04gilang putraNoch keine Bewertungen

- EAU 2022 - Prostate CancerDokument229 SeitenEAU 2022 - Prostate Cancerpablo penguinNoch keine Bewertungen

- Jsa - Cable TerminationDokument4 SeitenJsa - Cable TerminationSantos Rex73% (15)

- ADMS 2510 Week 13 SolutionsDokument20 SeitenADMS 2510 Week 13 Solutionsadms examzNoch keine Bewertungen

- Food Safety and StandardsDokument8 SeitenFood Safety and StandardsArifSheriffNoch keine Bewertungen

- Virtual Asset Insurance Risk Analysis - OneDegreeDokument3 SeitenVirtual Asset Insurance Risk Analysis - OneDegreeShaarang BeganiNoch keine Bewertungen

- 3 CBLSF 50 HDokument6 Seiten3 CBLSF 50 HNaz LunNoch keine Bewertungen

- Brigada EskwelaDokument4 SeitenBrigada EskwelaJas Dela Serna SerniculaNoch keine Bewertungen

- Cronbach's AlphaDokument4 SeitenCronbach's AlphaHeide Orevillo Apa-apNoch keine Bewertungen

- Moot Problem FinalDokument2 SeitenMoot Problem FinalHimanshi SaraiyaNoch keine Bewertungen

- Vol II - PIM (Feasibility Report) For Resort at ChorwadDokument42 SeitenVol II - PIM (Feasibility Report) For Resort at Chorwadmyvin jovi denzilNoch keine Bewertungen

- Taxicab Operators V BOTDokument2 SeitenTaxicab Operators V BOTHazel P.Noch keine Bewertungen

- GB Programme Chart: A B C D J IDokument2 SeitenGB Programme Chart: A B C D J IRyan MeltonNoch keine Bewertungen

- 1-Page TimeBoxing Planner v2.0Dokument2 Seiten1-Page TimeBoxing Planner v2.0ash.webstarNoch keine Bewertungen

- Bitmicro Case Complainants PositionDokument19 SeitenBitmicro Case Complainants PositionNoy SorianoNoch keine Bewertungen

- Presentation - 02 Reliability in Computer SystemsDokument24 SeitenPresentation - 02 Reliability in Computer Systemsvictorwu.ukNoch keine Bewertungen

- Tata Steel Ratio AnalysisDokument41 SeitenTata Steel Ratio AnalysisGourav VallakattiNoch keine Bewertungen

- Green Tyre TechnologyDokument4 SeitenGreen Tyre TechnologyAnuj SharmaNoch keine Bewertungen

- PDF Applied Failure Analysis 1 NSW - CompressDokument2 SeitenPDF Applied Failure Analysis 1 NSW - CompressAgungNoch keine Bewertungen

- BrochureDokument8 SeitenBrochurevacmanilaNoch keine Bewertungen

- ColgateDokument32 SeitenColgategargatworkNoch keine Bewertungen

- Clark Hess1Dokument668 SeitenClark Hess1Jeyner Chavez VasquezNoch keine Bewertungen

- Orphanage Project ProposalDokument3 SeitenOrphanage Project ProposaldtimtimanNoch keine Bewertungen

- Ojsadmin, 12 ZhangG 19Dokument14 SeitenOjsadmin, 12 ZhangG 19Kristel MitraNoch keine Bewertungen

- Mas MockboardDokument7 SeitenMas MockboardMaurene DinglasanNoch keine Bewertungen

- ME232 Thermodynamics 2 Quiz 1 - P1&P3 Complete SolutionDokument2 SeitenME232 Thermodynamics 2 Quiz 1 - P1&P3 Complete Solutioncarlverano0428Noch keine Bewertungen

- Urban Issues: Rio Case StudyDokument4 SeitenUrban Issues: Rio Case Studyxbox pro hiNoch keine Bewertungen

- TUF-2000M User Manual PDFDokument56 SeitenTUF-2000M User Manual PDFreinaldoNoch keine Bewertungen

- Allama Iqbal Open University, Islamabad Warning: (Department of Secondary Teacher Education)Dokument2 SeitenAllama Iqbal Open University, Islamabad Warning: (Department of Secondary Teacher Education)Tehmina HanifNoch keine Bewertungen