Beruflich Dokumente

Kultur Dokumente

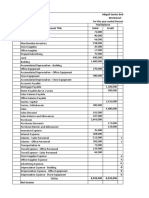

Unadjusted Trial Balance Adjusting Entries

Hochgeladen von

Cj BarrettoOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Unadjusted Trial Balance Adjusting Entries

Hochgeladen von

Cj BarrettoCopyright:

Verfügbare Formate

UNADJUSTED TRIAL BALANCE ADJUSTING ENTRIES

Cash 423,000

Accounts Receivable 643,000

Prepaid Rent 144,000 a. 72,000

Cooking Supplies 388,000 b. 353,000

Land 630,000

Building 1,250,000

Acc. Depreciation-Bldg 413,000 c.30,000

Cooking Equipment 870,000

Acc. Depreciation-CE 212,000 c. 48,000

Notes Payable 1,400,000

Accounts Payable 110,000

Anas, Capital 1,400,000

Anas, Drawing 240,000

Gourmet Cooking Revenues 2,202,000

Salaries Expense 619,000 d. 25,000

Travel Expense 127,000

Advertising Expense 215,000

Insurance Expense 40,000

Utilities Expense 102,000

Miscellaneous Expense 46,000

TOTALS 5,737,000 5737000

a. Rent Expense a. 72,000

b. Cooking Supplies Expense b. 353,000

c. Depreciation Expense c. 78,000

d. Accrued Salaries d. 25,000

e. Interest Expense e. 252,000

e. Accrued Interest e. 252000

TOTALS 780,000 780,000

Net Income

TOTALS

ADJUSTED TRIAL BALANCE INCOME STATEMENT BALANCE SHEET CLOSING ENTRIES POST CLOSING TB

423,000 423,000 423,000

643,000 643,000 643,000

72,000 72,000 72,000

35,000 35,000 35,000

630,000 630,000 630,000

1,250,000 1,250,000 1,250,000

443,000 443,000

870,000 870,000 870,000

260,000 260,000

1,400,000 1,400,000

110,000 110,000

1,400,000 1,400,000

240,000 240,000

2,202,000 2,202,000 2,202,000

644,000 644,000 644,000

127,000 127,000 127,000

215,000 215,000 215,000

40,000 40,000 40,000

102,000 102,000 102,000

46,000 46,000 46,000

72,000 72,000 72,000

353,000 353,000 353,000

78,000 78,000 78,000

25,000 25,000

252,000 252,000 252,000

252,000 252,000

6,092,000 6092000 1929000 2,202,000 4,163,000 3890000

273,000 273,000 273,000

2202000 2,202,000 4,163,000 4163000 2,202,000 2202000 3,923,000

POST CLOSING TB

443,000

260,000

1,400,000

110,000

1,433,000

25,000

252,000

3923000

Das könnte Ihnen auch gefallen

- Seatwork 5Dokument2 SeitenSeatwork 5Jasmine ManingoNoch keine Bewertungen

- Clenneth CompanyDokument21 SeitenClenneth CompanyRich ann belle AuditorNoch keine Bewertungen

- Worksheet Problem #5Dokument104 SeitenWorksheet Problem #5Gutierrez Ronalyn Y.Noch keine Bewertungen

- WorksheetDokument3 SeitenWorksheetMario CuadroNoch keine Bewertungen

- Castillo Bsais 1aDokument14 SeitenCastillo Bsais 1aMiles CastilloNoch keine Bewertungen

- Dr. Nick Marasigan Trial Balance AdjustmentsDokument2 SeitenDr. Nick Marasigan Trial Balance Adjustmentskianna doctoraNoch keine Bewertungen

- Quiz FS MerchandisingDokument3 SeitenQuiz FS Merchandisingchey dabestNoch keine Bewertungen

- Sample Woksheet For Service ConcernDokument1 SeiteSample Woksheet For Service ConcernEzekiel LapitanNoch keine Bewertungen

- AccountingDokument10 SeitenAccountingBhy Juarte SaludaresNoch keine Bewertungen

- BFARChapter 8Dokument19 SeitenBFARChapter 8Herah SexyNoch keine Bewertungen

- Teresita Buenaflor CompanyDokument18 SeitenTeresita Buenaflor CompanyLera Acuzar100% (1)

- AccountingDokument2 SeitenAccountingKatherine EbalNoch keine Bewertungen

- Comprehensive ActivityDokument2 SeitenComprehensive ActivitySofia Lynn Rico RebancosNoch keine Bewertungen

- Assignment No. 6Dokument14 SeitenAssignment No. 6Angela MacailaoNoch keine Bewertungen

- Leah May Santiago Information System Worksheet December 31, 2021 Trial Balance Adjustments Account Titles Debit Credit Debit CreditDokument5 SeitenLeah May Santiago Information System Worksheet December 31, 2021 Trial Balance Adjustments Account Titles Debit Credit Debit CreditJoy Santos80% (10)

- Erlinda Company Unadjusted Trial Balance WorksheetDokument12 SeitenErlinda Company Unadjusted Trial Balance WorksheetJekoeNoch keine Bewertungen

- H.W ch4q7 Acc418Dokument4 SeitenH.W ch4q7 Acc418SARA ALKHODAIRNoch keine Bewertungen

- NERACA LAJUR MILKITA COOKIES 4 (AutoRecovered)Dokument7 SeitenNERACA LAJUR MILKITA COOKIES 4 (AutoRecovered)ekaNoch keine Bewertungen

- 10 Column Heavy BombersDokument3 Seiten10 Column Heavy BombersVince Ferdinand Pajanustan100% (1)

- Unadjusted Trial Balance to Adjusted Trial Balance and Financial StatementsDokument2 SeitenUnadjusted Trial Balance to Adjusted Trial Balance and Financial StatementsOmelkhair YahyaNoch keine Bewertungen

- Activity (Worksheet Preparation)Dokument3 SeitenActivity (Worksheet Preparation)Lehnard Delos Reyes GellorNoch keine Bewertungen

- Name: Edmalyn R. Canton - BSA 1 - BE 302 Morning Subject/course: 892 - Acc 111 Activity 34Dokument6 SeitenName: Edmalyn R. Canton - BSA 1 - BE 302 Morning Subject/course: 892 - Acc 111 Activity 34Adam CuencaNoch keine Bewertungen

- Abigail Santos Boutique, Worksheet and Financial Statement For MerchandisingDokument9 SeitenAbigail Santos Boutique, Worksheet and Financial Statement For MerchandisingFeiya LiuNoch keine Bewertungen

- Problems 7 10Dokument19 SeitenProblems 7 10Margiery GannabanNoch keine Bewertungen

- T-Accounts of TeresitaDokument3 SeitenT-Accounts of TeresitaRhea Sismo-anNoch keine Bewertungen

- Abigail Santos Boutique, Financial Statement For MerchandisingDokument9 SeitenAbigail Santos Boutique, Financial Statement For MerchandisingFeiya Liu100% (1)

- DeceVid Company Final Worksheet PDFDokument1 SeiteDeceVid Company Final Worksheet PDFAngel Nhova Pepito OmalayNoch keine Bewertungen

- Prelim Exam VillanuevaDokument4 SeitenPrelim Exam VillanuevaMischa Bianca BesmonteNoch keine Bewertungen

- FAR2 WorksheetDokument37 SeitenFAR2 Worksheetrj aNoch keine Bewertungen

- Prepare Worksheet Hyun Bin ClinicDokument3 SeitenPrepare Worksheet Hyun Bin ClinicChris Aruh BorsalinaNoch keine Bewertungen

- Cash-Flow Relocare2Dokument4 SeitenCash-Flow Relocare2Adrian AdiNoch keine Bewertungen

- Quiz8 Ruby SaludaresDokument12 SeitenQuiz8 Ruby SaludaresBhy Juarte SaludaresNoch keine Bewertungen

- YARADokument5 SeitenYARAMischa Bianca BesmonteNoch keine Bewertungen

- Uas - Tarissa Yusriani - SPT PPH Badan 1771Dokument14 SeitenUas - Tarissa Yusriani - SPT PPH Badan 1771tarissa YusrianiNoch keine Bewertungen

- Travel Agency RubisomethingDokument12 SeitenTravel Agency RubisomethingItsRenz YTNoch keine Bewertungen

- Acctg Midterms-CosicoDokument6 SeitenAcctg Midterms-CosicoKyla Marie BayanNoch keine Bewertungen

- Advanced Accounting 3Dokument1 SeiteAdvanced Accounting 3Tax TrainingNoch keine Bewertungen

- Lesley Dela Cruz Clearners Financial StatementsDokument7 SeitenLesley Dela Cruz Clearners Financial StatementsJasmine ActaNoch keine Bewertungen

- Pearl River Valley Flood Control District 2022 BudgetDokument1 SeitePearl River Valley Flood Control District 2022 BudgetAnthony WarrenNoch keine Bewertungen

- PERSIJADokument10 SeitenPERSIJAricoananta10Noch keine Bewertungen

- Projected Cash Flow and Profit for Farm Business 2021-2025Dokument9 SeitenProjected Cash Flow and Profit for Farm Business 2021-2025Allia AntalanNoch keine Bewertungen

- Book 1Dokument6 SeitenBook 1xbautista124Noch keine Bewertungen

- Worksheet MerchandisingDokument3 SeitenWorksheet MerchandisingLyca MaeNoch keine Bewertungen

- Adjusted Trial BalanceDokument2 SeitenAdjusted Trial BalanceJerrica Rama100% (1)

- Worksheet MerchandisingDokument6 SeitenWorksheet MerchandisingLyca Mae CubangbangNoch keine Bewertungen

- Landing On YouDokument5 SeitenLanding On YouCharsel LumileNoch keine Bewertungen

- Chapter 6 Problem 7 8Dokument12 SeitenChapter 6 Problem 7 8mackyberriesNoch keine Bewertungen

- The Accounting Cycle PHASE 1 - RECORDING AND CLASSIFYING PROCESS (During The Accounting Period)Dokument19 SeitenThe Accounting Cycle PHASE 1 - RECORDING AND CLASSIFYING PROCESS (During The Accounting Period)Allondra DapengNoch keine Bewertungen

- Lembar Jawab Laporan KeuanganDokument10 SeitenLembar Jawab Laporan Keuanganricoananta10Noch keine Bewertungen

- Arguelles Medical ClinicDokument3 SeitenArguelles Medical ClinicPJ PoliranNoch keine Bewertungen

- Feb 27 - AssignmentDokument1 SeiteFeb 27 - AssignmentGeofrey RiveraNoch keine Bewertungen

- Jansen Balance SheetDokument3 SeitenJansen Balance SheetRowella Mae VillenaNoch keine Bewertungen

- LECTURE Jan. 3 2023Dokument17 SeitenLECTURE Jan. 3 2023lheamaecayabyab4Noch keine Bewertungen

- Book 111111Dokument3 SeitenBook 111111Janet AnotdeNoch keine Bewertungen

- Grand MLB Basic Commodities Corporation 2023'Dokument8 SeitenGrand MLB Basic Commodities Corporation 2023'Bambie Porras Jaca100% (1)

- REBYUDokument16 SeitenREBYUChi EstrellaNoch keine Bewertungen

- Giotech Corporation Trial BalanceDokument3 SeitenGiotech Corporation Trial BalanceMarites AmorsoloNoch keine Bewertungen

- Toko Kenanga Neraca Percobaan / Work Sheet Per 31 Desember 2016 No Keterangan Neraca Saldo Penyesuaian Debet Kredit Debet KreditDokument4 SeitenToko Kenanga Neraca Percobaan / Work Sheet Per 31 Desember 2016 No Keterangan Neraca Saldo Penyesuaian Debet Kredit Debet KreditWasiah R MaharyNoch keine Bewertungen

- Answer Key - Chapter 6 - ACCOUNTINGDokument92 SeitenAnswer Key - Chapter 6 - ACCOUNTINGIL MareNoch keine Bewertungen

- Punctuation MarkDokument1 SeitePunctuation MarkCj BarrettoNoch keine Bewertungen

- Accounting Information System 12 Edition Solution Manual CH15Dokument39 SeitenAccounting Information System 12 Edition Solution Manual CH15Bayoe Ajip100% (1)

- Toa 123Dokument13 SeitenToa 123fredeksdiiNoch keine Bewertungen

- Unadjusted Trial Balance Adjusting Entries Adjusted Trial BalanceDokument3 SeitenUnadjusted Trial Balance Adjusting Entries Adjusted Trial BalanceCj BarrettoNoch keine Bewertungen

- Hangeul Worksheet Writing PracticeDokument5 SeitenHangeul Worksheet Writing PracticeCj BarrettoNoch keine Bewertungen

- Accounting For Single Entry and Incomplete Records PDFDokument18 SeitenAccounting For Single Entry and Incomplete Records PDFCj BarrettoNoch keine Bewertungen

- WorkDokument2 SeitenWorkCj BarrettoNoch keine Bewertungen

- MODULE 5 - Investment Property: 3.1.1 Definition & NatureDokument12 SeitenMODULE 5 - Investment Property: 3.1.1 Definition & NatureCj BarrettoNoch keine Bewertungen

- Engaging in Small Talks-1Dokument31 SeitenEngaging in Small Talks-1Khan TanNoch keine Bewertungen

- Accounting for cash and cash equivalentsDokument2 SeitenAccounting for cash and cash equivalentsCj BarrettoNoch keine Bewertungen

- Adjusted Trial Balance SpreadsheetDokument3 SeitenAdjusted Trial Balance SpreadsheetCj BarrettoNoch keine Bewertungen

- DhoaidhnalcnfDokument2 SeitenDhoaidhnalcnfCj BarrettoNoch keine Bewertungen

- Practice Sheet 2Dokument1 SeitePractice Sheet 2Cj BarrettoNoch keine Bewertungen

- PARTNERSHIP Happy TummyDokument7 SeitenPARTNERSHIP Happy TummyCj BarrettoNoch keine Bewertungen

- Accounting Cycle Hacks Under 40 CharactersDokument1 SeiteAccounting Cycle Hacks Under 40 CharactersJassenNoch keine Bewertungen

- Note Receivable HandoutDokument2 SeitenNote Receivable HandoutCj BarrettoNoch keine Bewertungen

- Merchandising AccountingDokument4 SeitenMerchandising AccountingJuby BelandresNoch keine Bewertungen

- VisionDokument1 SeiteVisionCj BarrettoNoch keine Bewertungen

- NC-3REVISED ExampleDokument2 SeitenNC-3REVISED ExampleStephanie CruzNoch keine Bewertungen

- Meaning of Business: Art. 1767, New Civil Code of The Philippines Sec.2 B.P. 68 or Corporation Code of The PhilippinesDokument25 SeitenMeaning of Business: Art. 1767, New Civil Code of The Philippines Sec.2 B.P. 68 or Corporation Code of The PhilippinesAnali BarbonNoch keine Bewertungen

- Final Output Intacc PDFDokument7 SeitenFinal Output Intacc PDFCj BarrettoNoch keine Bewertungen

- AFAR ProblemDokument27 SeitenAFAR ProblemCj BarrettoNoch keine Bewertungen

- OpjoihjDokument1 SeiteOpjoihjCj BarrettoNoch keine Bewertungen

- #01 Accounting ProcessDokument3 Seiten#01 Accounting ProcessZaaavnn VannnnnNoch keine Bewertungen

- Final Output Intacc PDFDokument7 SeitenFinal Output Intacc PDFCj BarrettoNoch keine Bewertungen

- 3Dokument1 Seite3Cj BarrettoNoch keine Bewertungen

- WorkDokument2 SeitenWorkCj BarrettoNoch keine Bewertungen

- HJHXHDZJXDokument3 SeitenHJHXHDZJXCj BarrettoNoch keine Bewertungen

- Note Receivable HandoutDokument2 SeitenNote Receivable HandoutCj BarrettoNoch keine Bewertungen

- Pure TheoryDokument3 SeitenPure TheoryAshima MishraNoch keine Bewertungen

- The Constitution of The Student Council of Pope John Paul II Catholic High SchoolDokument4 SeitenThe Constitution of The Student Council of Pope John Paul II Catholic High Schoolapi-118865622Noch keine Bewertungen

- Trivandrum District IT Quiz Questions and Answers 2016 - IT Quiz PDFDokument12 SeitenTrivandrum District IT Quiz Questions and Answers 2016 - IT Quiz PDFABINNoch keine Bewertungen

- Esmf 04052017 PDFDokument265 SeitenEsmf 04052017 PDFRaju ReddyNoch keine Bewertungen

- Understanding the Causes and Misconceptions of PrejudiceDokument22 SeitenUnderstanding the Causes and Misconceptions of PrejudiceმარიამიNoch keine Bewertungen

- 6th South African Armoured Division (Part 3)Dokument9 Seiten6th South African Armoured Division (Part 3)Clifford HolmNoch keine Bewertungen

- CardingDokument9 SeitenCardingSheena JindalNoch keine Bewertungen

- List LaguDokument13 SeitenList LaguLuthfi AlbanjariNoch keine Bewertungen

- EXL ServiceDokument2 SeitenEXL ServiceMohit MishraNoch keine Bewertungen

- CV Experienced Marketing ProfessionalDokument2 SeitenCV Experienced Marketing ProfessionalPankaj JaiswalNoch keine Bewertungen

- Test Bank For Goulds Pathophysiology For The Health Professions 5 Edition Karin C VanmeterDokument36 SeitenTest Bank For Goulds Pathophysiology For The Health Professions 5 Edition Karin C Vanmetermulctalinereuwlqu100% (41)

- Russell's View On World Government in His Essay The Future of MankindDokument3 SeitenRussell's View On World Government in His Essay The Future of MankindRafaqat Ali100% (1)

- School Form 10 SF10 Learners Permanent Academic Record For Elementary SchoolDokument10 SeitenSchool Form 10 SF10 Learners Permanent Academic Record For Elementary SchoolRene ManansalaNoch keine Bewertungen

- Electricity TariffsDokument5 SeitenElectricity TariffsaliNoch keine Bewertungen

- Flexible Learning Part 1Dokument10 SeitenFlexible Learning Part 1John Lex Sabines IgloriaNoch keine Bewertungen

- IJBMT Oct-2011Dokument444 SeitenIJBMT Oct-2011Dr. Engr. Md Mamunur RashidNoch keine Bewertungen

- Blueprint For The Development of Local Economies of SamarDokument72 SeitenBlueprint For The Development of Local Economies of SamarJay LacsamanaNoch keine Bewertungen

- Rights of Accused in Libuit v. PeopleDokument3 SeitenRights of Accused in Libuit v. PeopleCheska BorjaNoch keine Bewertungen

- Sohan vs. Mohan PlaintDokument6 SeitenSohan vs. Mohan PlaintKarandeep Saund100% (5)

- Al Fara'aDokument56 SeitenAl Fara'azoinasNoch keine Bewertungen

- KSDL RameshDokument10 SeitenKSDL RameshRamesh KumarNoch keine Bewertungen

- ICPC Members 24 July 2023Dokument6 SeitenICPC Members 24 July 2023Crystal TsangNoch keine Bewertungen

- Tugas Kelompok 3 Bahasa InggrisDokument5 SeitenTugas Kelompok 3 Bahasa InggrisAditya FrediansyahNoch keine Bewertungen

- Flowserve Corp Case StudyDokument3 SeitenFlowserve Corp Case Studytexwan_Noch keine Bewertungen

- Engineering Economy 2ed Edition: January 2018Dokument12 SeitenEngineering Economy 2ed Edition: January 2018anup chauhanNoch keine Bewertungen

- 0500 w16 Ms 13Dokument9 Seiten0500 w16 Ms 13Mohammed MaGdyNoch keine Bewertungen

- FinTech BoguraDokument22 SeitenFinTech BoguraMeraj TalukderNoch keine Bewertungen

- Aqua Golden Mississippi Tbk Company Report and Share Price AnalysisDokument3 SeitenAqua Golden Mississippi Tbk Company Report and Share Price AnalysisJandri Zhen TomasoaNoch keine Bewertungen

- Principles of Administrative TheoryDokument261 SeitenPrinciples of Administrative TheoryZabihullahRasidNoch keine Bewertungen

- MG6863 - ENGINEERING ECONOMICS - Question BankDokument19 SeitenMG6863 - ENGINEERING ECONOMICS - Question BankSRMBALAANoch keine Bewertungen