Beruflich Dokumente

Kultur Dokumente

Psa 120-200

Hochgeladen von

Hannah Figueroa0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

65 Ansichten2 SeitenPSA 120 discusses the distinctions between audit services and other related services such as reviews, agreed-upon procedures, and compilations. It describes auditing as providing a high level of assurance through an opinion on whether financial statements are fairly presented, while other services provide lower or no levels of assurance. PSA 120 enhances the reliability and fairness of financial statements through the services provided by auditors. It establishes standards for conducting audits and guidelines for auditor reports to meet the overall objective of independent auditors.

Originalbeschreibung:

Summary on Philippine Standard on Auditing 120 and 200.

Originaltitel

PSA 120-200

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenPSA 120 discusses the distinctions between audit services and other related services such as reviews, agreed-upon procedures, and compilations. It describes auditing as providing a high level of assurance through an opinion on whether financial statements are fairly presented, while other services provide lower or no levels of assurance. PSA 120 enhances the reliability and fairness of financial statements through the services provided by auditors. It establishes standards for conducting audits and guidelines for auditor reports to meet the overall objective of independent auditors.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

65 Ansichten2 SeitenPsa 120-200

Hochgeladen von

Hannah FigueroaPSA 120 discusses the distinctions between audit services and other related services such as reviews, agreed-upon procedures, and compilations. It describes auditing as providing a high level of assurance through an opinion on whether financial statements are fairly presented, while other services provide lower or no levels of assurance. PSA 120 enhances the reliability and fairness of financial statements through the services provided by auditors. It establishes standards for conducting audits and guidelines for auditor reports to meet the overall objective of independent auditors.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

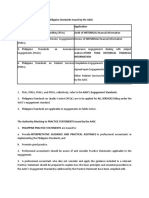

PSA 120

Philippine Standard on Auditing 120 which entitled “Framework of Philippine

Standards on Auditing”, discusses the distinctions between audit and other related services.

Also, the scope covered of the said services.

Auditing emphasizes the given opinion by the auditor using the phrase “present

fairly, in all material aspects”. Expressing a high, but not absolute, level of assurance. It

emphasizes the credibility of a financial statements. On the other hand, the scope of other

related services could be reviews, agreed-upon procedures, and compilations. When the

auditor provided a moderate assurance, it refer to as a review. Meaning, it expresses a negative

assurance on assertions. While, agreed-upon procedures, it is when the auditor, client and any

appropriate parties agreed to report the factual findings of procedure. Lastly, compilations,

providing a much lesser data to become more understandable without giving an assurance at

all.

Financial Statements are presented and prepared annually, wherein it serves as

the major source of information for the intended users. Hence, the objective of PSA 120 is to

identify and describe the appropriate framework concerning the services which is performed by

the auditor. PSA 120 enhances the truthfulness and fairness of a financial statement by the

provided services of an auditor such as auditing and other related services.

Philippine Standard on Auditing established appropriate standards in conducting

an audit and provide set of guidelines on the auditor’s report issued. This standard explicitly

explains the nature and scope of an audit in order to meet the overall objective of the

independent auditor. It also includes the requirements that are applicable in all audits

pertaining to the general responsibilities of the independent auditor. The effectivity date for

the Philippine Standards on Auditing 200 (Redrafted and Revised), entitled “Overall Objective of

the Independent Auditor and the Conduct of an Audit in accordance with Philippine Standards

on Auditing, is for audits of financial statements for periods beginning on or after December 15,

2009.

In this standard, it enables the auditor to express a reasonable assurance with

regards to the preparation of the financial statement, to properly conclude that it is free from

any material misstatement and considering the fact that it is in accordance with an appropriate

financial reporting framework. An unqualified opinion cannot be applied in all cases, if the

auditor doesn’t have a sufficient evidences to prove the latter then he could expressly obtained

a qualified opinion, or a disclaimer, and even withdraw from the engagement.

PSA 200, discusses compliance with ethical requirements concerning the

auditors’ independence which relates to audit engagement. These are the following

requirements: 1. Professional skepticism; when performing an audit the external auditor must

have a questioning mind that recognizes possible events that could make a financial statement

materially misstated; 2. Professional judgement; this ethical requirement will be gained through

experiences that will enable the auditor to make a decisions that are relevant in such

circumstances; 3. Sufficient Appropriate Audit Evidence and Audit Risk; meaning, the auditor

must provide enough evidences that could possibly reduce audit risks to an acceptable low

level; and 3. Conduct of an Audit in Accordance with PSAs; performing an audit in conformity

with all PSAs.

Philippine Standards on Auditing 200, aims the independent auditor to have a

deeper understanding about all the PSAs, to understand its objectives and to apply its

requirements properly, including its application and other explanatory material. And to identify

accurate audit procedures in planning and performing the audit.

Das könnte Ihnen auch gefallen

- CPAR Auditing TheoryDokument62 SeitenCPAR Auditing TheoryKeannu Lewis Vidallo96% (46)

- Comprehensive Manual of Internal Audit Practice and Guide: The Most Practical Guide to Internal Auditing PracticeVon EverandComprehensive Manual of Internal Audit Practice and Guide: The Most Practical Guide to Internal Auditing PracticeBewertung: 5 von 5 Sternen5/5 (1)

- Philippine Standard On Auditing 120Dokument7 SeitenPhilippine Standard On Auditing 120Zach RiversNoch keine Bewertungen

- EFFECT OF SUSTAINABLE PROCUREMENT PRACTICES ON OPERATIONAL PERFORMANCE - CASE STUDY GHANA GRID COMPANY LIMITED (GRIDCo)Dokument69 SeitenEFFECT OF SUSTAINABLE PROCUREMENT PRACTICES ON OPERATIONAL PERFORMANCE - CASE STUDY GHANA GRID COMPANY LIMITED (GRIDCo)Korkor Nartey100% (1)

- Justifying WMSDokument31 SeitenJustifying WMSBunty Da100% (1)

- SAP Manager SD/OTC in USA Resume Sheetal KothariDokument7 SeitenSAP Manager SD/OTC in USA Resume Sheetal KothariSheetalKothari0% (1)

- Acctg 14.1Dokument13 SeitenAcctg 14.1arman dela cruzNoch keine Bewertungen

- Accounting 16aDokument93 SeitenAccounting 16aLelouch BritanianNoch keine Bewertungen

- Chapter 1Dokument17 SeitenChapter 1RahulNoch keine Bewertungen

- Psa 120 PDFDokument9 SeitenPsa 120 PDFMichael Vincent Buan SuicoNoch keine Bewertungen

- Auditing Auditing Report Cabral and de JesusDokument43 SeitenAuditing Auditing Report Cabral and de JesusLalaine De JesusNoch keine Bewertungen

- 1 Overview of The Risk Based Audit ProcessDokument7 Seiten1 Overview of The Risk Based Audit ProcessJohn Carl BlancaflorNoch keine Bewertungen

- Module 001 Overview of The Risk-Based AuditDokument12 SeitenModule 001 Overview of The Risk-Based AuditCherwin bentulan100% (1)

- Aud Spec 101Dokument19 SeitenAud Spec 101Yanyan GuadillaNoch keine Bewertungen

- Lesson 1 - Overview of The Risk-Based Audit ProcessDokument7 SeitenLesson 1 - Overview of The Risk-Based Audit ProcessYANIII12345Noch keine Bewertungen

- Chap 1 Nature of AuditingDokument32 SeitenChap 1 Nature of AuditingAkash Gupta100% (1)

- Module 1Dokument8 SeitenModule 1JayaAntolinAyusteNoch keine Bewertungen

- To Financial Statement Audit: OCTOBER 7, 2021 Auditing TheoryDokument39 SeitenTo Financial Statement Audit: OCTOBER 7, 2021 Auditing TheoryJoyce Anne GarduqueNoch keine Bewertungen

- Unit A: Overview of Audit ProcessDokument18 SeitenUnit A: Overview of Audit Processchloebaby19Noch keine Bewertungen

- AuditmidtermsDokument26 SeitenAuditmidtermsLana sereneNoch keine Bewertungen

- PSA 120, PSA 200, AND Attestation Audit ACCTG 4110: Agreed Upon-ProceduresDokument12 SeitenPSA 120, PSA 200, AND Attestation Audit ACCTG 4110: Agreed Upon-ProceduresMC NEILL SABIDNoch keine Bewertungen

- Auditing Theory Cpa ReviewDokument53 SeitenAuditing Theory Cpa ReviewIvy Michelle Habagat100% (1)

- Sabid - MC Neill - Bsma - 4 - I Am Lost! I Know I UnderstandDokument11 SeitenSabid - MC Neill - Bsma - 4 - I Am Lost! I Know I UnderstandMC NEILL SABIDNoch keine Bewertungen

- Nature of AuditingDokument37 SeitenNature of Auditinganon_672065362Noch keine Bewertungen

- AT 02 Intro To AuditingDokument5 SeitenAT 02 Intro To AuditingPrincess Mary Joy LadagaNoch keine Bewertungen

- Lesson 3 Financial Statements AuditDokument5 SeitenLesson 3 Financial Statements AuditMark TaysonNoch keine Bewertungen

- Auditing TheoryDokument63 SeitenAuditing TheoryJohn Laurence LoplopNoch keine Bewertungen

- Introduction To Financial Statement AuditDokument28 SeitenIntroduction To Financial Statement AuditJnn CycNoch keine Bewertungen

- Orginal AuditingDokument26 SeitenOrginal AuditingShankari MaharajanNoch keine Bewertungen

- Chapter 7 AuditingDokument25 SeitenChapter 7 AuditingMisshtaCNoch keine Bewertungen

- Review and Audit AssuranceDokument6 SeitenReview and Audit AssuranceReg DungcaNoch keine Bewertungen

- ISA 200 SummaryDokument5 SeitenISA 200 SummaryIrma Surya FranyNoch keine Bewertungen

- HFHGFHGHDGSFDHDGGFGDokument31 SeitenHFHGFHGHDGSFDHDGGFGbabylovelylovelyNoch keine Bewertungen

- HFHGFHGHDGSFDHDGGFGDokument31 SeitenHFHGFHGHDGSFDHDGGFGbabylovelylovelyNoch keine Bewertungen

- C9ay1 HsijbDokument15 SeitenC9ay1 HsijbEyob FirstNoch keine Bewertungen

- Reasonable AssuranceDokument12 SeitenReasonable AssuranceHossein DavaniNoch keine Bewertungen

- APPLIED AUDITING Module 1Dokument3 SeitenAPPLIED AUDITING Module 1Paul Fajardo CanoyNoch keine Bewertungen

- Overview of Auditing and AssuranceDokument15 SeitenOverview of Auditing and AssuranceJadeFerrer50% (2)

- 910-Psa 910Dokument26 Seiten910-Psa 910Gwenneth BachusNoch keine Bewertungen

- The Authority Attaching To Philippine Standards Issued by The AASC Standards ApplicationDokument10 SeitenThe Authority Attaching To Philippine Standards Issued by The AASC Standards ApplicationCharmaine PamintuanNoch keine Bewertungen

- Auditing Theory CPARDokument57 SeitenAuditing Theory CPARCarla ZanteNoch keine Bewertungen

- Module For Value EdDokument38 SeitenModule For Value EdJoyce Ann CortezNoch keine Bewertungen

- Audit Theory Chapter 7 Overview of FS Audit ProcessDokument13 SeitenAudit Theory Chapter 7 Overview of FS Audit ProcessAdam SmithNoch keine Bewertungen

- PSA 120 and PSA 200Dokument26 SeitenPSA 120 and PSA 200Anna CastroNoch keine Bewertungen

- Nature and Scope of AuditingDokument23 SeitenNature and Scope of AuditingPrachi GuptaNoch keine Bewertungen

- 10 JournalDokument5 Seiten10 Journalits me keiNoch keine Bewertungen

- Introduction To Auditing (Autosaved) 4Dokument30 SeitenIntroduction To Auditing (Autosaved) 4THATONoch keine Bewertungen

- AuditingTheory Chapter1Dokument19 SeitenAuditingTheory Chapter1Janna Hazel Villarino VillanuevaNoch keine Bewertungen

- Audit Practice and Assurance Services - A1.4 PDFDokument94 SeitenAudit Practice and Assurance Services - A1.4 PDFFRANCOIS NKUNDIMANANoch keine Bewertungen

- Isa 200Dokument17 SeitenIsa 200Mirza Ehsan Ullah MughalNoch keine Bewertungen

- Discuss The Following Concepts in The Conduct of AuditDokument8 SeitenDiscuss The Following Concepts in The Conduct of Auditureka6arnicaNoch keine Bewertungen

- Lesson: Concept of Audit and Other Assurance Engagements Part 1Dokument7 SeitenLesson: Concept of Audit and Other Assurance Engagements Part 1Marielle UyNoch keine Bewertungen

- 50 - Auditing and Accounting StandardsDokument12 Seiten50 - Auditing and Accounting Standardsindu_prasad_1Noch keine Bewertungen

- Psa 200 PDFDokument7 SeitenPsa 200 PDFDanzen Bueno ImusNoch keine Bewertungen

- Engagement Essentials: Preparation, Compilation, and Review of Financial StatementsVon EverandEngagement Essentials: Preparation, Compilation, and Review of Financial StatementsNoch keine Bewertungen

- Annual Update and Practice Issues for Preparation, Compilation, and Review EngagementsVon EverandAnnual Update and Practice Issues for Preparation, Compilation, and Review EngagementsNoch keine Bewertungen

- Audit Risk Alert: General Accounting and Auditing Developments, 2017/18Von EverandAudit Risk Alert: General Accounting and Auditing Developments, 2017/18Noch keine Bewertungen

- Audit Risk Alert: Employee Benefit Plans Industry Developments, 2018Von EverandAudit Risk Alert: Employee Benefit Plans Industry Developments, 2018Noch keine Bewertungen

- Audit Risk Alert: General Accounting and Auditing Developments 2018/19Von EverandAudit Risk Alert: General Accounting and Auditing Developments 2018/19Noch keine Bewertungen

- Audit Risk Alert: Government Auditing Standards and Single Audit Developments: Strengthening Audit Integrity 2018/19Von EverandAudit Risk Alert: Government Auditing Standards and Single Audit Developments: Strengthening Audit Integrity 2018/19Noch keine Bewertungen

- Information Systems Auditing: The IS Audit Reporting ProcessVon EverandInformation Systems Auditing: The IS Audit Reporting ProcessBewertung: 4.5 von 5 Sternen4.5/5 (3)

- Beyond Sarbanes-Oxley Compliance: Effective Enterprise Risk ManagementVon EverandBeyond Sarbanes-Oxley Compliance: Effective Enterprise Risk ManagementNoch keine Bewertungen

- 1812 Growing Revenues Through Commercial Excellence LEK Executive InsightsDokument5 Seiten1812 Growing Revenues Through Commercial Excellence LEK Executive InsightsNguyễn Duy LongNoch keine Bewertungen

- (PPT) QuinnsModel PDFDokument8 Seiten(PPT) QuinnsModel PDFSomchai ChuananonNoch keine Bewertungen

- Contently Gap Analysis WorksheetDokument4 SeitenContently Gap Analysis WorksheetJones D. AsiegbuNoch keine Bewertungen

- Answer - Tutorial - CorporationDokument3 SeitenAnswer - Tutorial - CorporationBanulekaNoch keine Bewertungen

- 3RD Quarter 1601eDokument8 Seiten3RD Quarter 1601eAllen Fey De JesusNoch keine Bewertungen

- Fakultet Za Poslovne Studije I Pravo: Predmet:Upravljanje Ljudskim ResursimaDokument12 SeitenFakultet Za Poslovne Studije I Pravo: Predmet:Upravljanje Ljudskim ResursimaMarija MilojevicNoch keine Bewertungen

- Background InformationDokument5 SeitenBackground InformationJono SoeparjonoNoch keine Bewertungen

- 19llb082 - Banking Law Project - 6th SemDokument25 Seiten19llb082 - Banking Law Project - 6th Semashirbad sahooNoch keine Bewertungen

- Explanation of Bank StatementDokument3 SeitenExplanation of Bank StatementMua-tien DonzoNoch keine Bewertungen

- Inventory Management: Geremy J. Heath and Alister DanksDokument19 SeitenInventory Management: Geremy J. Heath and Alister DanksAnonymous VcLCycHVqNoch keine Bewertungen

- Chapter 13 Entrepreneurship by Zubair A Khan.Dokument29 SeitenChapter 13 Entrepreneurship by Zubair A Khan.Zubair A Khan100% (1)

- Quantitative Finance Financial Economics Bank Risk Management Applied MicroeconomicsDokument7 SeitenQuantitative Finance Financial Economics Bank Risk Management Applied MicroeconomicsRituparna DasNoch keine Bewertungen

- 1027 02 Swot Analysis PowerpointDokument6 Seiten1027 02 Swot Analysis PowerpointTohed JomaNoch keine Bewertungen

- Top 100 Finance - 230516 - 200117Dokument61 SeitenTop 100 Finance - 230516 - 200117alimalan.aik59Noch keine Bewertungen

- LakmeDokument23 SeitenLakmeGarima VyasNoch keine Bewertungen

- Certification Body Requirements: Section 7Dokument20 SeitenCertification Body Requirements: Section 7Nagasimha A RNoch keine Bewertungen

- Tut #21 - International Trade (Answers) - No CSQDokument47 SeitenTut #21 - International Trade (Answers) - No CSQChristie Ann WeeNoch keine Bewertungen

- Formative Assessment 3 - ACAUD 2348Dokument5 SeitenFormative Assessment 3 - ACAUD 2348kasandra lintonganNoch keine Bewertungen

- Gorry Scott-Morton FW 22Dokument22 SeitenGorry Scott-Morton FW 22neerajvijayranjanNoch keine Bewertungen

- Sales TerritoriesDokument17 SeitenSales Territoriesravishekramdev100% (2)

- Tanishq JRM 090729172938 Phpapp01Dokument25 SeitenTanishq JRM 090729172938 Phpapp01Pragya AgrawalNoch keine Bewertungen

- Form 20B: (Refer Section 159 of The Companies Act, 1956)Dokument6 SeitenForm 20B: (Refer Section 159 of The Companies Act, 1956)Surendra DevadigaNoch keine Bewertungen

- Ey CSR Report 2020Dokument60 SeitenEy CSR Report 2020azNoch keine Bewertungen

- ICMO 2024 Form ConstructionDokument2 SeitenICMO 2024 Form Constructionjonathankarta.hdkNoch keine Bewertungen

- Accounting BasicsDokument68 SeitenAccounting BasicsEd Caty100% (1)

- Smart Investors DataDokument6 SeitenSmart Investors DataSamrat SahaNoch keine Bewertungen

- Caap PDFDokument248 SeitenCaap PDFBrijesh PandeyNoch keine Bewertungen