Beruflich Dokumente

Kultur Dokumente

Bartle Beyl, Inc - Kfc. 2306

Hochgeladen von

clarika0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

444 Ansichten2 Seiten2306

Originaltitel

BARTLE BEYL, INC - KFC. 2306

Copyright

© © All Rights Reserved

Verfügbare Formate

XLS, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument melden2306

Copyright:

© All Rights Reserved

Verfügbare Formate

Als XLS, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

444 Ansichten2 SeitenBartle Beyl, Inc - Kfc. 2306

Hochgeladen von

clarika2306

Copyright:

© All Rights Reserved

Verfügbare Formate

Als XLS, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

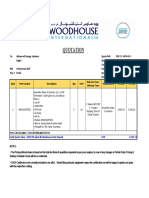

Republic of the Philippines

For BIR BCS/ Department of Finance

Use Only Item: Bureau of Internal Revenue

BIR Form No.

Certificate of Final Tax

2306

January 2018 (ENCS)

Withheld at Source 2306 01/18ENCS

Fill in all applicable spaces. Mark all appropriate boxes with an "X".

1 For the Period From 01 01 2020 (MM/DD/YYYY) To 01 31 2020 (MM/DD/YYYY)

Part I – Income Recipient/Payee Information

2 Taxpayer Identification Number (TIN) 008 - 174 - 664 - 0037

3 Payee’s Name (Last Name, First Name, Middle Name for Individual OR Registered Name for Non-Individual)

BARTLE BEYL, INC.

4 Registered Address 4A ZIP Code

JUBILANT BLDG., COMMONWEALTH AVENUE, QUEZON CITY

5 Foreign Address, if applicable 5A ICR No. (For Alien Payee Only)

Part II – Withholding Agent/Payor Information

6 Taxpayer Identification Number (TIN) 000 - 803 - 752 - 0000

7 Payor’s Name (Last Name, First Name, Middle Name for Individual OR Registered Name for Non-Individual)

PHILIPPINE FISHERIES DEVELOPMENT AUTHORITY

8 Registered Address 8A ZIP Code

PCA ANNEX BLDG., ELLIPTICAL RD., DILIMAN, QUEZON CITY 1104

Part III – Details of Income Payment and Tax Withheld (Attach additional sheet if necessary)

Nature of Income Payment ATC Amount of Payment Tax Withheld

VAT Withholding on Purchase of Goods WV010 1,446.43 72.32

Total 1,446.43 72.32

We declare under the penalties of perjury that this certificate has been made in good faith, verified by us, and to the best of our knowledge and belief, is true and

correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof. Further, we give our consent

to the processing of our information as contemplated under the *Data Privacy Act of 2012 (R.A. No. 10173) for legitimate and lawful purposes.

Date Signed (MM/DD/YYYY)

ROMMEL R. RONDA

OIC, Accounting Division (TIN: 222-053-406)

Signature over Printed Name of Payor/Payor’s Authorized Representative/Tax Agent

(Indicate Title/Designation and TIN)

Tax Agent Accreditation No./ Date of Issue Date of Expiry

Attorney’s Roll No. (if applicable) (MM/DD/YYYY) (MM/DD/YYYY)

CONFORME:

Date Signed (MM/DD/YYYY)

Signature over Printed Name of Payee/Payee’s Authorized Representative/Tax Agent

(Indicate Title/Designation and TIN)

Tax Agent Accreditation No./ Date of Issue Date of Expiry

Attorney’s Roll No. (if applicable) (MM/DD/YYYY) (MM/DD/YYYY)

To be accomplished for Value-Added Tax/Percentage Tax Withholding (substituted filing)

I declare, under the penalties of perjury, that the information herein stated are reported under BIR Form No. 1600 which have been filed with the Bureau of Internal

Revenue.

Signature over Printed Name of Payor/Payor’s Authorized Representative/Tax Agent

(Indicate Title/Designation and TIN)

Tax Agent Accreditation No./ Date of Issue Date of Expiry

Attorney’s Roll No. (if applicable) (MM/DD/YYYY) (MM/DD/YYYY)

I declare under the penalties of perjury that I am qualified under substituted filing of Percentage Tax/Value-Added Tax Returns (BIR Form 2551Q/2550M/Q), since I

have only one payor from whom I earn our income; that, in accordance with RR 14-2003, I have availed of the Optional Registration under the 3% Final Percentage Tax

Withholding/12% Final VAT Withholding in lieu of the 3% Percentage Tax/12% VAT in order to be entitled to the privileges accorded by the Substituted Percentage Tax

Return/Substituted VAT Return System prescribed in the aforesaid Regulations; that, this Declaration is sufficient authority of the withholding agent to withhold 3% Final

Percentage Tax/12% Final VAT from myr sale of goods and/or services.

Signature over Printed Name of Payee/Payee’s Authorized Representative/Tax Agent

(Indicate Title/Designation and TIN)

Tax Agent Accreditation No./ Date of Issue Date of Expiry

Attorney’s Roll No. (if applicable) (MM/DD/YYYY) (MM/DD/YYYY)

*NOTE: The BIR Data Privacy is in the BIR website (www.bir.gov.ph)

Das könnte Ihnen auch gefallen

- How to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionVon EverandHow to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionNoch keine Bewertungen

- Accounting For BegginersDokument24 SeitenAccounting For BegginersLisandra SantosNoch keine Bewertungen

- Relation of A Debtor and A CreditorDokument9 SeitenRelation of A Debtor and A Creditorrkgupta.comNoch keine Bewertungen

- Chapter-4 Banker and The CustomerDokument8 SeitenChapter-4 Banker and The CustomerSamuel DebebeNoch keine Bewertungen

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDokument2 SeitenKawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldGjianne PeñaredondoNoch keine Bewertungen

- Withdrawal Great American Life FormsDokument13 SeitenWithdrawal Great American Life FormsMax PowerNoch keine Bewertungen

- Tools SBF Form1366Dokument3 SeitenTools SBF Form1366aphexishNoch keine Bewertungen

- Acc Business Combination NotesDokument118 SeitenAcc Business Combination NotesTheresaNoch keine Bewertungen

- The General Relationship Between Bank and Its CustomerDokument9 SeitenThe General Relationship Between Bank and Its CustomerAnkit AgarwalNoch keine Bewertungen

- (D) Capital of The Surviving SpouseDokument3 Seiten(D) Capital of The Surviving SpouseAnthony Angel TejaresNoch keine Bewertungen

- Intermediate Accounting I - Notes (9.13.2022)Dokument18 SeitenIntermediate Accounting I - Notes (9.13.2022)Mainit, Shiela Mae, S.Noch keine Bewertungen

- Income Tax On Individuals and Tax RatesDokument25 SeitenIncome Tax On Individuals and Tax RatesmmhNoch keine Bewertungen

- Strategic Tax Management - Week 2Dokument44 SeitenStrategic Tax Management - Week 2Arman DalisayNoch keine Bewertungen

- Percentage Tax: o o o o o oDokument11 SeitenPercentage Tax: o o o o o oMark Joseph BajaNoch keine Bewertungen

- Investor Agreement PDFDokument2 SeitenInvestor Agreement PDFRam Kumar BasakNoch keine Bewertungen

- Individual Taxpayer Identification Number (ITIN) Example: A Checking AccountDokument1 SeiteIndividual Taxpayer Identification Number (ITIN) Example: A Checking AccountLJBernardoNoch keine Bewertungen

- A. Chart of Accounts: Salaries PayableDokument12 SeitenA. Chart of Accounts: Salaries PayableJerome SerranoNoch keine Bewertungen

- MorrisBreann Fall 2020 MGMT 343 Exam #1Dokument4 SeitenMorrisBreann Fall 2020 MGMT 343 Exam #1Breann MorrisNoch keine Bewertungen

- Summary of Ias 20 Govt GrantsDokument2 SeitenSummary of Ias 20 Govt Grantsenzo100% (1)

- Account Deletion Form.Dokument2 SeitenAccount Deletion Form.Gelian PasagueNoch keine Bewertungen

- Final PPT NSTP Drug Addiction g1Dokument83 SeitenFinal PPT NSTP Drug Addiction g1JovilleNoch keine Bewertungen

- Articles of IncorporationDokument6 SeitenArticles of IncorporationLaviniaNoch keine Bewertungen

- Hailey College of Banking and FinanceDokument18 SeitenHailey College of Banking and Financesea waterNoch keine Bewertungen

- Executors AccountsDokument5 SeitenExecutors AccountskennedyNoch keine Bewertungen

- Group 3 - ReportDokument104 SeitenGroup 3 - ReportRenelle HabacNoch keine Bewertungen

- Financial StatementsDokument1 SeiteFinancial Statementsaashir chNoch keine Bewertungen

- Final Output: Case 1: Quarantina Catering Services (QCS)Dokument3 SeitenFinal Output: Case 1: Quarantina Catering Services (QCS)Jillian Mae Sobrino Belegorio100% (1)

- Department of The Treasury Internal Revenue Service Notice 1382Dokument30 SeitenDepartment of The Treasury Internal Revenue Service Notice 1382peterjohannes100% (1)

- Chapter 02 - Statement of Financial Position and Income StatementDokument20 SeitenChapter 02 - Statement of Financial Position and Income StatementThorngsokhom0% (1)

- Bank ReconciliationDokument9 SeitenBank Reconciliationlit afNoch keine Bewertungen

- Cash and BankDokument19 SeitenCash and BankJatinNoch keine Bewertungen

- RFBT3205 Negotiable Instrument and Bouncing Check 220320 155925Dokument5 SeitenRFBT3205 Negotiable Instrument and Bouncing Check 220320 155925MOTC INTERNAL AUDIT SECTIONNoch keine Bewertungen

- 18.made in India Cisco Reroutes InnovationDokument12 Seiten18.made in India Cisco Reroutes InnovationMudasir Awan0% (1)

- Chapter 9Dokument10 SeitenChapter 9Caleb John SenadosNoch keine Bewertungen

- Bar Examination Questionnaire For Commercial LawDokument32 SeitenBar Examination Questionnaire For Commercial LawRodel Rivera100% (1)

- Corporate Income TaxDokument24 SeitenCorporate Income TaxRIRI RUMAIZHANoch keine Bewertungen

- Journal, Ledger and Trial BalanceDokument12 SeitenJournal, Ledger and Trial Balanceari purnomoNoch keine Bewertungen

- Derivatives and HedgingDokument3 SeitenDerivatives and HedgingPrankyJellyNoch keine Bewertungen

- Hewlett-Packard (HP) and Autonomy AcquisitionDokument21 SeitenHewlett-Packard (HP) and Autonomy AcquisitionPhạm Thu HuyềnNoch keine Bewertungen

- Long Form Audit ReportDokument10 SeitenLong Form Audit Reportchitrank10100% (3)

- CorporationsDokument46 SeitenCorporationsDandred AdrianoNoch keine Bewertungen

- Power of Attorney: XXXXXX (Name of The Company)Dokument3 SeitenPower of Attorney: XXXXXX (Name of The Company)Anonymous AVTazyRlNoch keine Bewertungen

- Introduction To Transfer Taxation-1Dokument13 SeitenIntroduction To Transfer Taxation-1WillowNoch keine Bewertungen

- Treasury Single Account (TSA) As A Strategy For Blocking Revenue LeakagesDokument20 SeitenTreasury Single Account (TSA) As A Strategy For Blocking Revenue LeakagesLearning SystemNoch keine Bewertungen

- Assignment 02 Leases-SolutionDokument7 SeitenAssignment 02 Leases-SolutionJaziel SestosoNoch keine Bewertungen

- Tax Remedies ActDokument8 SeitenTax Remedies ActrobNoch keine Bewertungen

- IFRS 9 and Expected Loss Provisioning - Executive Summary: What's Different About Impairment Recognition Under IFRS 9?Dokument2 SeitenIFRS 9 and Expected Loss Provisioning - Executive Summary: What's Different About Impairment Recognition Under IFRS 9?Adrean Ysmael MapanaoNoch keine Bewertungen

- Common Prospectus EnglishDokument364 SeitenCommon Prospectus EnglishRoy KoushaniNoch keine Bewertungen

- Incidents in The Life of A Promissory Note: StepsDokument4 SeitenIncidents in The Life of A Promissory Note: StepsCharisse MaticNoch keine Bewertungen

- Bank Reconciliation Statement PreparationDokument5 SeitenBank Reconciliation Statement PreparationsteveNoch keine Bewertungen

- Sample Articles of PartnershipDokument57 SeitenSample Articles of PartnershipClint Jan SalvañaNoch keine Bewertungen

- Truth in Lending ActDokument2 SeitenTruth in Lending ActGabieNoch keine Bewertungen

- Estate Tax SyllabusDokument7 SeitenEstate Tax SyllabuscuteangelchenNoch keine Bewertungen

- Companies (Beneficial Owner) Regulations, 2022Dokument12 SeitenCompanies (Beneficial Owner) Regulations, 2022Andrew WanderaNoch keine Bewertungen

- Making Use of The Illinois Rules - Part 1: Reducing Illinois Estate Taxes Through Lifetime GiftsDokument36 SeitenMaking Use of The Illinois Rules - Part 1: Reducing Illinois Estate Taxes Through Lifetime Giftsrobertkolasa100% (1)

- BPCL Delear Selection Guidelines BrochureDokument23 SeitenBPCL Delear Selection Guidelines BrochureKiran Tejavath67% (3)

- Assessment and Returns of IncomeDokument13 SeitenAssessment and Returns of IncomeMaster KihimbwaNoch keine Bewertungen

- Triple L Food Corp 2306 - JollibeeDokument1 SeiteTriple L Food Corp 2306 - JollibeeclarikaNoch keine Bewertungen

- Certificate of Final Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)Dokument2 SeitenCertificate of Final Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)ROGER DRIO, JRNoch keine Bewertungen

- BIR2306 LUELCO Santa CeciliaDokument18 SeitenBIR2306 LUELCO Santa CeciliaMaria RinaNoch keine Bewertungen

- Triple L Food Corp 2306 - JollibeeDokument1 SeiteTriple L Food Corp 2306 - JollibeeclarikaNoch keine Bewertungen

- Triple L Food Corp 2306 - JollibeeDokument1 SeiteTriple L Food Corp 2306 - JollibeeclarikaNoch keine Bewertungen

- Triple L Food Corp 2306 - JollibeeDokument1 SeiteTriple L Food Corp 2306 - JollibeeclarikaNoch keine Bewertungen

- Triple L Food Corp 2306 - JollibeeDokument1 SeiteTriple L Food Corp 2306 - JollibeeclarikaNoch keine Bewertungen

- Triple L Food Corp 2306 - JollibeeDokument1 SeiteTriple L Food Corp 2306 - JollibeeclarikaNoch keine Bewertungen

- CSC Resolution 01 0940Dokument17 SeitenCSC Resolution 01 0940Nhil Cabillon Quieta100% (1)

- Flow Chart in Handling Sexual Harassment CasesDokument1 SeiteFlow Chart in Handling Sexual Harassment CasesvisayasstateuNoch keine Bewertungen

- Digital Persona SDKDokument2 SeitenDigital Persona SDKclarika100% (1)

- Mary Martha Balancing Lifes PrioritiesDokument34 SeitenMary Martha Balancing Lifes PrioritiesclarikaNoch keine Bewertungen

- Mary Martha Balancing Lifes PrioritiesDokument34 SeitenMary Martha Balancing Lifes PrioritiesclarikaNoch keine Bewertungen

- Unitary TheoryDokument5 SeitenUnitary TheorySuhag100% (1)

- AMLA SingaporeDokument105 SeitenAMLA SingaporeturkeypmNoch keine Bewertungen

- 4 - DeclarationDokument1 Seite4 - DeclarationSonu YadavNoch keine Bewertungen

- Contemporary Banking-A Micro Finance PerspectiveDokument4 SeitenContemporary Banking-A Micro Finance PerspectiveHardhik S ShethNoch keine Bewertungen

- Business Plan AluminiumDokument11 SeitenBusiness Plan AluminiumSaravanakumar SaravanaNoch keine Bewertungen

- Armstrong BCE3 Install 507120-01Dokument18 SeitenArmstrong BCE3 Install 507120-01manchuricoNoch keine Bewertungen

- AmeriMex Blower MotorDokument3 SeitenAmeriMex Blower MotorIon NitaNoch keine Bewertungen

- Cso Application FormDokument3 SeitenCso Application Formmark jefferson borromeo100% (1)

- Risk Management and InsuranceDokument64 SeitenRisk Management and InsuranceMehak AhluwaliaNoch keine Bewertungen

- Ib Assignment FinalDokument7 SeitenIb Assignment FinalGaurav MandalNoch keine Bewertungen

- Audit Fraud MemoDokument16 SeitenAudit Fraud MemoManish AggarwalNoch keine Bewertungen

- ACTION Plan OF OFFICE SUPPLIES SY 2021-2022Dokument2 SeitenACTION Plan OF OFFICE SUPPLIES SY 2021-2022Leslie VillegasNoch keine Bewertungen

- Joint ArrangementDokument3 SeitenJoint Arrangementkim cheNoch keine Bewertungen

- Sample For Manpower Supply Agreement - PDF - Receivership - EmploymentDokument29 SeitenSample For Manpower Supply Agreement - PDF - Receivership - EmploymentVETSAN ENTERPRISESNoch keine Bewertungen

- 01 de Leon v. CA (Caballa)Dokument2 Seiten01 de Leon v. CA (Caballa)Ton RiveraNoch keine Bewertungen

- SGVFS032855 : Ayala Land, Inc. and Subsidiaries Consolidated Statements of Financial PositionDokument8 SeitenSGVFS032855 : Ayala Land, Inc. and Subsidiaries Consolidated Statements of Financial Positionbea's backupNoch keine Bewertungen

- Faculty of Law Economics and Finance (FDEF) - 11 - 2018Dokument68 SeitenFaculty of Law Economics and Finance (FDEF) - 11 - 2018Minhaz SuzonNoch keine Bewertungen

- E1 2 Patent Searches - Activity TemplateDokument21 SeitenE1 2 Patent Searches - Activity Templateapi-248496741Noch keine Bewertungen

- Goverenment of Hong Kong V MunozDokument2 SeitenGoverenment of Hong Kong V Munozana ortizNoch keine Bewertungen

- BR Case SummaryDokument43 SeitenBR Case SummaryGhanshyam ChauhanNoch keine Bewertungen

- Legodesk - BFSIsDokument24 SeitenLegodesk - BFSIsashishpadhyNoch keine Bewertungen

- Admin Law Midterm ReviewerDokument8 SeitenAdmin Law Midterm ReviewerRaine VerdanNoch keine Bewertungen

- South Africa Income Tax - Exemptions PBODokument8 SeitenSouth Africa Income Tax - Exemptions PBOmusvibaNoch keine Bewertungen

- Econ 151 SyllabusDokument2 SeitenEcon 151 SyllabusImmah SantosNoch keine Bewertungen

- Request For Repair of Ict EquipmentDokument1 SeiteRequest For Repair of Ict EquipmentAdrian AtillagaNoch keine Bewertungen

- (LLOYD) Law of Conservation of Linear MomentumDokument9 Seiten(LLOYD) Law of Conservation of Linear MomentumHideous PikaNoch keine Bewertungen

- De Jesus vs. Aquino GR No.164662Dokument11 SeitenDe Jesus vs. Aquino GR No.164662Anabelle C. AvenidoNoch keine Bewertungen

- CMPG 213 - Assignment 3Dokument8 SeitenCMPG 213 - Assignment 3Henco SchutteNoch keine Bewertungen

- Evidence Case DigestDokument4 SeitenEvidence Case DigestBrenda de la GenteNoch keine Bewertungen

- Does That Sound Fair?Dokument5 SeitenDoes That Sound Fair?Nick van ExelNoch keine Bewertungen