Beruflich Dokumente

Kultur Dokumente

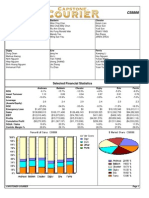

Round: 2 Dec. 31, 2022: Selected Financial Statistics

Hochgeladen von

Ashesh DasOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Round: 2 Dec. 31, 2022: Selected Financial Statistics

Hochgeladen von

Ashesh DasCopyright:

Verfügbare Formate

Round: 2

Dec. 31, C117558

2022

Andrews Baldwin Chester

GARIMA DUBEY Nikhil Chauh Ankit Biswal

Srinivasan K Ashesh Das NITIN KISHORE

AJAY KUMAR PANDEY Chandrashekar Varan Sidhartha Miramir

Sebastian sagayaraj

Digby Erie Ferris

Nivedita G Chainika Dubey

Gajendra J G Das Prakash K C

Chintamani Khanvilk Sneha Kumari

Sriharsha Shivamurt

Selected Financial Statistics

Andrews Baldwin Chester Digby Erie Ferris

ROS 3.2% -0.7% 3.3% 1.8% -4.9% 3.7%

Asset Turnover 1.05 1.09 1.16 1.03 0.86 1.12

ROA 3.3% -0.8% 3.8% 1.9% -4.2% 4.1%

Leverage 2.2 2.0 2.5 1.8 2.4 2.0

ROE 7.5% -1.5% 9.5% 3.4% -9.9% 8.3%

Emergency Loan $0 $658,403 $0 $0 $500,262 $0

Sales $152,551,369 $112,510,924 $180,515,465 $134,019,223 $94,788,125 $106,812,821

EBIT $16,573,726 $4,402,334 $20,064,109 $10,223,530 $474,100 $11,286,176

Profits $4,860,773 ($791,139) $5,888,037 $2,421,603 ($4,649,868) $3,899,313

Cumulative Profit $8,041,388 $8,888,250 $4,289,201 $9,727,896 ($2,677,008) $11,936,539

SG&A / Sales 14.3% 16.1% 13.7% 17.8% 15.6% 16.9%

Contrib. Margin % 33.0% 27.8% 31.7% 31.7% 26.5% 32.3%

CAPSTONE ® COURIER Page 1

Round: 2

Stock & Bonds C117558 Dec. 31, 2022

Stock Market Summary

MarketCap Book Value

Company Close Change Shares EPS Dividend Yield P/E

($M) Per Share

Andrews $31.83 $2.85 2,422,020 $77 $26.75 $2.01 $0.00 0.0% 15.8

Baldwin $27.56 ($13.58) 2,000,000 $55 $26.32 ($0.40) $0.00 0.0% -69.8

Chester $28.26 $6.04 2,399,957 $68 $25.73 $2.45 $0.00 0.0% 11.5

Digby $33.91 ($3.13) 2,501,010 $85 $28.38 $0.97 $0.00 0.0% 35.0

Erie $10.57 ($5.50) 2,373,501 $25 $19.83 ($1.96) $0.00 0.0% -5.4

Ferris $35.62 ($0.31) 2,000,000 $71 $23.59 $1.95 $0.41 1.1% 18.3

Bond Market Summary

Company Series# Face Yield Close$ S&P Company Series# Face Yield Close$ S&P

Andrews Digby

12.5S2024 $13,900,000 12.6% 99.50 CCC 12.5S2024 $13,900,000 12.3% 101.36 BB

14.0S2026 $20,850,000 13.5% 103.58 CCC 14.0S2026 $20,850,000 13.1% 107.03 BB

11.3S2031 $18,000,000 12.2% 92.25 CCC 11.3S2031 $8,274,000 11.5% 97.84 BB

12.4S2032 $12,000,000 12.7% 97.81 CCC Erie

Baldwin 12.5S2024 $13,788,302 12.6% 99.17 CC

12.5S2024 $13,900,000 12.4% 100.51 B 14.0S2026 $20,850,000 13.6% 102.97 CC

14.0S2026 $20,850,000 13.3% 105.44 B 11.3S2031 $1,000,000 12.4% 91.28 CC

11.2S2032 $6,000,000 11.9% 94.40 B 12.8S2032 $20,000,000 12.9% 98.92 CC

Chester Ferris

12.5S2024 $13,900,000 12.7% 98.67 CC 12.5S2024 $4,054,577 12.5% 100.34 B

14.0S2026 $20,850,000 13.7% 102.07 CC 14.0S2026 $20,850,000 13.3% 105.13 B

11.3S2031 $18,994,000 12.6% 89.85 CC

12.8S2032 $25,200,000 13.2% 97.32 CC

Next Year's Prime Rate8.00%

CAPSTONE ® COURIER Page 2

Round: 2

Financial Summary C117558 Dec. 31, 2022

Cash Flow Statement Survey Andrews Baldwin Chester Digby Erie Ferris

CashFlows from operating activities

Net Income(Loss) $4,861 ($791) $5,888 $2,422 ($4,650) $3,899

Adjustment for non-cash items:

Depreciation $10,967 $8,360 $11,087 $8,453 $8,753 $5,867

Extraordinary gains/losses/writeoffs $0 $0 $0 ($311) ($337) ($794)

Changes in current assets and liablilities

Accounts payable $1,627 $826 ($141) $329 ($1,048) $998

Inventory ($8,692) ($10,766) $10,230 ($8,072) ($469) ($6,983)

Accounts Receivable ($1,739) $210 ($3,823) ($466) ($298) ($476)

Net cash from operations $7,023 ($2,161) $23,241 $2,355 $1,953 $2,511

Cash flows from investing activities

Plant improvements(net) ($22,900) ($15,600) ($35,902) ($11,790) ($2,675) ($6,010)

Cash flows from financing activities

Dividends paid $0 $0 $0 $0 $0 ($816)

Sales of common stock $8,000 $0 $0 $4,500 $6,000 $0

Purchase of common stock $0 $0 $0 $0 $0 $0

Cash from long term debt issued $12,000 $6,000 $25,200 $0 $20,000 $0

Early retirement of long term debt $0 $0 $0 ($5,000) ($6,950) ($1,881)

Retirement of current debt $0 $0 ($17,000) ($10,000) ($20,828) ($11,359)

Cash from current debt borrowing $0 $0 $0 $6,000 $2,000 $16,883

Cash from emergency loan $0 $658 $0 $0 $500 $0

Net cash from financing activities $20,000 $6,658 $8,200 ($4,500) $722 $2,828

Net change in cash position $4,123 ($11,103) ($4,461) ($13,935) $0 ($671)

Balance Sheet Survey Andrews Baldwin Chester Digby Erie Ferris

Cash $12,959 $0 $12,448 $20,222 $0 $16,306

Accounts Receivable $12,538 $9,247 $14,837 $11,015 $7,791 $8,779

Inventory $13,813 $18,589 $5,087 $21,537 $25,210 $14,995

Total Current Assets $39,310 $27,837 $32,372 $52,774 $33,001 $40,080

Plant and equipment $164,500 $129,400 $176,702 $129,300 $131,300 $88,000

Accumulated Depreciation ($58,340) ($53,880) ($53,113) ($52,187) ($53,567) ($32,747)

Total Fixed Assets $106,160 $75,520 $123,589 $77,113 $77,733 $55,253

Total Assets $145,470 $103,357 $155,961 $129,888 $110,735 $95,333

Accounts Payable $8,975 $7,382 $8,324 $7,973 $5,520 $6,370

Current Debt $6,950 $2,583 $6,950 $7,909 $2,500 $16,883

Total Current Liabilities $15,925 $9,965 $15,274 $15,882 $8,020 $23,253

Long Term Debt $64,750 $40,750 $78,944 $43,024 $55,638 $24,905

Total Liabilities $80,675 $50,715 $94,218 $58,906 $63,658 $48,158

Common Stock $31,360 $18,360 $32,060 $35,860 $24,360 $18,360

Retained Earnings $33,435 $34,282 $29,683 $35,121 $22,717 $28,815

Total Equity $64,795 $52,642 $61,743 $70,981 $47,076 $47,175

Total Liabilities & Owners Equity $145,470 $103,357 $155,961 $129,888 $110,735 $95,333

Income Statement Survey Andrews Baldwin Chester Digby Erie Ferris

Sales $152,551 $112,511 $180,515 $134,019 $94,788 $106,813

Variable Costs(Labor,Material,Carry) $102,163 $81,285 $123,372 $91,516 $69,713 $72,322

Contribution Margin $50,388 $31,226 $57,143 $42,503 $25,075 $34,491

Depreciation $10,967 $8,360 $11,087 $8,453 $8,753 $5,867

SGA(R&D,Promo,Sales,Admin) $21,848 $18,164 $24,732 $23,836 $14,780 $18,104

Other(Fees,Writeoffs,TQM,Bonuses) $1,000 $300 $1,260 ($11) $1,068 ($766)

EBIT $16,574 $4,402 $20,064 $10,224 $474 $11,286

Interest(Short term,Long term) $8,943 $5,619 $10,821 $6,422 $7,628 $5,165

Taxes $2,671 ($426) $3,235 $1,331 ($2,504) $2,142

Profit Sharing $99 $0 $120 $49 $0 $80

Net Profit $4,861 ($791) $5,888 $2,422 ($4,650) $3,899

CAPSTONE ® COURIER Page 3

Round: 2

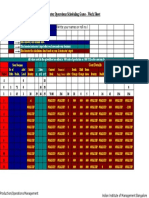

Production Analysis C117558 Dec. 31, 2022

2nd

Shift Auto

Unit & mation Capacity

Primary Units Inven Revision Age Pfmn Size Material Labor Contr. Over- Next Next Plant

Name Segment Sold tory Date Dec.31 MTBF Coord Coord Price

Cost

Cost Marg. time Round Round Utiliz.

Able Trad 1,663 432 6/17/2022 2.0 17500 5.9 13.9 $28.00 $10.28 $7.55 34% 18% 6.0 1,800 116%

Acre Low 2,063 447 5/24/2016 6.6 14000 3.0 17.0 $20.50 $6.38 $6.57 34% 33% 7.0 1,900 132%

Adam High 610 5 1/29/2022 2.3 23000 9.5 11.0 $38.50 $15.02 $9.40 36% 0% 3.0 900 45%

Aft Pfmn 572 0 6/24/2022 1.8 27000 10.9 14.9 $33.50 $15.55 $9.40 25% 0% 3.0 600 95%

Agape Size 619 1 5/28/2022 1.8 19000 5.0 9.4 $34.00 $12.94 $9.59 33% 4% 3.0 600 103%

AGS 0 0 2/13/2022 0.9 15000 4.5 15.0 $26.00 $0.00 $0.00 0% 0% 3.0 450 0%

Baker Trad 1,504 31 4/17/2022 2.0 17500 6.2 13.7 $26.50 $10.52 $8.23 28% 0% 4.0 1,800 85%

Bead Low 1,669 311 5/24/2016 6.6 14000 3.0 17.0 $19.50 $6.38 $7.37 25% 11% 6.0 1,400 110%

Bid High 418 180 10/3/2022 1.5 24000 9.4 10.6 $38.00 $15.46 $9.40 33% 0% 4.0 900 66%

Bold Pfmn 356 222 9/20/2022 1.7 27000 11.0 14.5 $34.50 $15.73 $9.40 23% 0% 3.0 600 89%

Buddy Size 352 167 10/5/2022 1.7 20000 5.1 9.5 $34.00 $13.21 $9.40 31% 0% 4.0 600 86%

Buzz 0 0 12/12/2023 0.0 0 0.0 0.0 $0.00 $0.00 $0.00 0% 0% 1.0 400 0%

Cake Trad 1,938 121 5/21/2022 1.9 19000 6.6 13.4 $27.50 $11.30 $7.05 31% 0% 7.0 1,500 96%

Cedar Low 2,827 152 2/13/2021 6.6 17000 3.0 17.0 $19.00 $7.28 $4.30 37% 87% 10.0 1,737 186%

Cid High 830 14 11/6/2022 1.3 25000 10.0 10.0 $39.00 $16.33 $11.22 31% 70% 3.0 500 169%

Coat Pfmn 662 24 9/3/2022 1.6 27000 11.5 14.4 $33.00 $16.06 $9.74 22% 8% 4.0 600 108%

Cure Size 590 0 10/11/2022 1.5 21000 5.3 8.7 $32.70 $14.05 $9.39 30% 0% 4.0 600 83%

Cut 0 0 4/18/2023 0.0 0 0.0 0.0 $0.00 $0.00 $0.00 0% 0% 5.0 400 0%

Daze Trad 1,672 220 4/17/2022 2.1 17500 6.1 13.8 $28.50 $10.42 $8.30 32% 2% 5.0 1,800 101%

Dell Low 1,862 337 5/24/2016 6.6 14000 3.0 17.0 $21.00 $6.38 $6.49 34% 28% 7.0 1,400 127%

Dixie High 557 238 6/22/2022 1.6 23000 9.2 11.2 $38.50 $14.78 $10.33 31% 26% 3.0 600 125%

Dot Pfmn 461 167 3/26/2022 2.0 26000 9.9 15.3 $33.60 $14.53 $9.65 24% 6% 3.0 600 104%

Dune Size 307 125 4/29/2022 2.6 19000 4.4 10.5 $33.60 $12.11 $9.42 32% 0% 3.0 600 40%

Don 0 0 8/17/2023 0.0 0 0.0 0.0 $0.00 $0.00 $0.00 0% 0% 1.0 250 0%

Eat Trad 1,311 578 4/15/2022 2.9 17500 5.5 14.3 $24.00 $9.90 $6.47 23% 0% 5.5 1,800 68%

Ebb Low 1,586 996 5/24/2016 6.6 14000 3.0 17.0 $19.80 $6.38 $7.17 25% 86% 7.0 1,400 184%

Echo High 349 49 8/6/2022 1.6 23000 9.0 11.0 $36.00 $14.78 $9.42 31% 0% 3.0 750 18%

Edge Pfmn 295 6 5/2/2022 2.6 26000 10.0 15.3 $33.00 $14.59 $9.42 26% 0% 3.0 500 25%

Egg Size 283 0 6/27/2022 1.9 19000 4.5 10.0 $34.00 $12.44 $9.42 35% 0% 3.0 600 37%

Fast Trad 915 297 4/22/2022 2.1 14000 5.5 14.5 $29.00 $8.76 $9.41 33% 44% 4.0 800 142%

Feat Low 1,050 280 7/27/2025 6.6 13000 3.0 17.0 $22.00 $6.08 $8.52 30% 79% 6.0 700 177%

Fist High 603 86 12/22/2022 1.2 25000 10.2 9.8 $39.00 $16.52 $10.14 33% 20% 3.0 500 119%

Foam Pfmn 420 109 11/11/2022 1.5 27000 11.8 14.2 $34.00 $16.30 $8.23 28% 0% 4.0 600 83%

Fume Size 570 21 11/9/2022 1.5 19000 5.4 8.4 $34.00 $13.67 $8.23 36% 0% 4.0 600 83%

Fox 0 0 12/12/2022 0.0 25000 11.0 9.0 $39.00 $0.00 $0.00 0% 0% 5.5 500 0%

CAPSTONE ® COURIER Page 4

Traditional Segment Analysis C117558 Round: 2

Dec. 31, 2022

Traditional Statistics

Total Industry Unit Demand 8,776

Actual Industry Unit Sales |8,776

Segment % of Total Industry |30.3%

Next Year's Segment Growth Rate |9.6%

Traditional Customer Buying Criteria

Expectations Importance

1. Age Ideal Age = 2.0 47%

2. Price $19.00 - 29.00 23%

3. Ideal Position Pfmn 6.4 Size 13.6 21%

4. Reliability MTBF 14000-19000 9%

Top Products in Traditional Segment

Units Cust. Cust. Dec.

Market Sold to Revision Stock Pfmn Size List Age Promo A

ware- Sales A

ccess-

Cust

Name Share Seg Date Out Coord Coord Price MTBF Dec.31 Budget n

ess Budget ibility

Survey

Cake 21% 1,866 5/21/2022 6.6 13.4 $27.50 19000 1.92 $2,000 100% $2,000 67% 57

Daze 19% 1,653 4/17/2022 6.1 13.8 $28.50 17500 2.06 $1,500 93% $2,200 64% 49

Able 19% 1,642 6/17/2022 5.9 13.9 $28.00 17500 2.00 $2,000 100% $2,000 67% 51

Baker 17% 1,484 4/17/2022 6.2 13.7 $26.50 17500 2.05 $1,500 77% $1,500 50% 44

Eat 14% 1,195 4/15/2022 5.5 14.3 $24.00 17500 2.91 $1,500 85% $1,200 47% 28

Fast 10% 915 4/22/2022 5.5 14.5 $29.00 14000 2.08 $900 59% $1,235 48% 24

Dune 0% 9 4/29/2022 4.4 10.5 $33.60 19000 2.64 $2,000 89% $2,000 64% 0

Cedar 0% 3 2/13/2021 3.0 17.0 $19.00 17000 6.60 $2,000 98% $2,000 67% 0

Dot 0% 2 3/26/2022 9.9 15.3 $33.60 26000 1.96 $1,500 80% $1,800 64% 0

Acre 0% 2 5/24/2016 3.0 17.0 $20.50 14000 6.60 $2,000 98% $2,000 67% 0

Dell 0% 2 5/24/2016 3.0 17.0 $21.00 14000 6.60 $2,000 92% $2,800 64% 0

Bead 0% 1 5/24/2016 3.0 17.0 $19.50 14000 6.60 $1,500 71% $1,000 50% 0

CAPSTONE ® COURIER Page 5

Low End Segment Analysis C117558 Round: 2

Dec. 31, 2022

Low End Statistics

Total Industry Unit Demand 11,179

Actual Industry Unit Sales |11,179

Segment % of Total Industry |38.7%

Next Year's Segment Growth Rate |11.7%

Low End Customer Buying Criteria

Expectations Importance

1. Price $14.00 - 24.00 53%

2. Age Ideal Age = 7.0 24%

3. Ideal Position Pfmn 2.7 Size 17.3 16%

4. Reliability MTBF 12000-17000 7%

Top Products in Low End Segment

Units Cust. Cust. Dec.

Market Sold to Revision Stock Pfmn Size List Age Promo A

ware- Sales A

ccess-

Cust

Name Share Seg Date Out Coord Coord Price MTBF Dec.31 Budget n

ess Budget ibility

Survey

Cedar 25% 2,824 2/13/2021 3.0 17.0 $19.00 17000 6.60 $2,000 98% $2,000 55% 44

Acre 18% 2,061 5/24/2016 3.0 17.0 $20.50 14000 6.60 $2,000 98% $2,000 58% 33

Dell 17% 1,860 5/24/2016 3.0 17.0 $21.00 14000 6.60 $2,000 92% $2,800 54% 30

Bead 15% 1,667 5/24/2016 3.0 17.0 $19.50 14000 6.60 $1,500 71% $1,000 33% 26

Ebb 14% 1,585 5/24/2016 3.0 17.0 $19.80 14000 6.60 $1,000 59% $1,050 42% 25

Feat 9% 1,049 7/27/2025 3.0 17.0 $22.00 13000 6.60 $1,100 64% $1,235 36% 17

Eat 1% 115 4/15/2022 5.5 14.3 $24.00 17500 2.91 $1,500 85% $1,200 42% 2

Able 0% 14 6/17/2022 5.9 13.9 $28.00 17500 2.00 $2,000 100% $2,000 58% 0

Daze 0% 1 4/17/2022 6.1 13.8 $28.50 17500 2.06 $1,500 93% $2,200 54% 0

Baker 0% 1 4/17/2022 6.2 13.7 $26.50 17500 2.05 $1,500 77% $1,500 33% 0

CAPSTONE ® COURIER Page 6

High End Segment Analysis C117558 Round: 2

Dec. 31, 2022

High End Statistics

Total Industry Unit Demand 3,439

Actual Industry Unit Sales |3,439

Segment % of Total Industry |11.9%

Next Year's Segment Growth Rate |16.5%

High End Customer Buying Criteria

Expectations Importance

1. Ideal Position Pfmn 10.7 Size 9.3 43%

2. Age Ideal Age = 0.0 29%

3. Reliability MTBF 20000-25000 19%

4. Price $29.00 - 39.00 9%

Top Products in High End Segment

Units Cust. Cust. Dec.

Market Sold to Revision Stock Pfmn Size List Age Promo A

ware- Sales A

ccess-

Cust

Name Share Seg Date Out Coord Coord Price MTBF Dec.31 Budget n

ess Budget ibility

Survey

Cid 24% 830 11/6/2022 10.0 10.0 $39.00 25000 1.27 $2,000 97% $1,500 59% 45

Adam 18% 610 1/29/2022 9.5 11.0 $38.50 23000 2.31 $1,800 88% $1,800 56% 15

Fist 18% 603 12/22/2022 10.2 9.8 $39.00 25000 1.18 $1,100 61% $1,235 44% 36

Dixie 16% 557 6/22/2022 9.2 11.2 $38.50 23000 1.62 $1,500 90% $1,500 51% 16

Bid 12% 418 10/3/2022 9.4 10.6 $38.00 24000 1.45 $1,300 67% $1,500 43% 22

Echo 10% 349 8/6/2022 9.0 11.0 $36.00 23000 1.56 $1,000 53% $1,000 35% 13

Cake 1% 45 5/21/2022 6.6 13.4 $27.50 19000 1.92 $2,000 100% $2,000 59% 0

Aft 0% 8 6/24/2022 YES 10.9 14.9 $33.50 27000 1.76 $1,500 80% $1,500 56% 0

Daze 0% 6 4/17/2022 6.1 13.8 $28.50 17500 2.06 $1,500 93% $2,200 51% 0

Baker 0% 5 4/17/2022 6.2 13.7 $26.50 17500 2.05 $1,500 77% $1,500 43% 0

Coat 0% 4 9/3/2022 11.5 14.4 $33.00 27000 1.60 $1,500 80% $1,500 59% 0

Foam 0% 3 11/11/2022 11.8 14.2 $34.00 27000 1.47 $1,100 59% $1,235 44% 0

CAPSTONE ® COURIER Page 7

Performance Segment Analysis C117558 Round: 2

Dec. 31, 2022

Performance Statistics

Total Industry Unit Demand 2,751

Actual Industry Unit Sales |2,751

Segment % of Total Industry |9.5%

Next Year's Segment Growth Rate |19.7%

Performance Customer Buying Criteria

Expectations Importance

1. Reliability MTBF 22000-27000 43%

2. Ideal Position Pfmn 11.4 Size 14.6 29%

3. Price $24.00 - 34.00 19%

4. Age Ideal Age = 1.0 9%

Top Products in Performance Segment

Units Cust. Cust. Dec.

Market Sold to Revision Stock Pfmn Size List Age Promo A

ware- Sales A

ccess-

Cust

Name Share Seg Date Out Coord Coord Price MTBF Dec.31 Budget n

ess Budget ibility

Survey

Coat 24% 658 9/3/2022 11.5 14.4 $33.00 27000 1.60 $1,500 80% $1,500 47% 46

Aft 21% 564 6/24/2022 YES 10.9 14.9 $33.50 27000 1.76 $1,500 80% $1,500 42% 42

Dot 17% 460 3/26/2022 9.9 15.3 $33.60 26000 1.96 $1,500 80% $1,800 42% 26

Foam 15% 417 11/11/2022 11.8 14.2 $34.00 27000 1.47 $1,100 59% $1,235 35% 35

Bold 13% 355 9/20/2022 11.0 14.5 $34.50 27000 1.67 $1,000 60% $1,000 28% 29

Edge 11% 294 5/2/2022 10.0 15.3 $33.00 26000 2.58 $1,000 50% $1,000 28% 18

Cake 0% 2 5/21/2022 6.6 13.4 $27.50 19000 1.92 $2,000 100% $2,000 47% 0

CAPSTONE ® COURIER Page 8

Size Segment Analysis C117558 Round: 2

Dec. 31, 2022

Size Statistics

Total Industry Unit Demand 2,769

Actual Industry Unit Sales |2,769

Segment % of Total Industry |9.6%

Next Year's Segment Growth Rate |18.6%

Size Customer Buying Criteria

Expectations Importance

1. Ideal Position Pfmn 5.4 Size 8.6 43%

2. Age Ideal Age = 1.5 29%

3. Reliability MTBF 16000-21000 19%

4. Price $24.00 - 34.00 9%

Top Products in Size Segment

Units Cust. Cust. Dec.

Market Sold to Revision Stock Pfmn Size List Age Promo A

ware- Sales A

ccess-

Cust

Name Share Seg Date Out Coord Coord Price MTBF Dec.31 Budget n

ess Budget ibility

Survey

Agape 22% 619 5/28/2022 5.0 9.4 $34.00 19000 1.79 $1,500 80% $1,500 48% 34

Cure 21% 590 10/11/2022 YES 5.3 8.7 $32.70 21000 1.55 $1,500 86% $2,000 60% 65

Fume 21% 570 11/9/2022 5.4 8.4 $34.00 19000 1.48 $1,100 59% $1,235 39% 39

Buddy 13% 352 10/5/2022 5.1 9.5 $34.00 20000 1.69 $1,200 67% $1,300 37% 31

Dune 11% 298 4/29/2022 4.4 10.5 $33.60 19000 2.64 $2,000 89% $2,000 49% 11

Egg 10% 283 6/27/2022 YES 4.5 10.0 $34.00 19000 1.87 $1,000 50% $1,000 31% 14

Cake 1% 24 5/21/2022 6.6 13.4 $27.50 19000 1.92 $2,000 100% $2,000 60% 0

Baker 0% 14 4/17/2022 6.2 13.7 $26.50 17500 2.05 $1,500 77% $1,500 37% 0

Daze 0% 12 4/17/2022 6.1 13.8 $28.50 17500 2.06 $1,500 93% $2,200 49% 0

Able 0% 7 6/17/2022 5.9 13.9 $28.00 17500 2.00 $2,000 100% $2,000 48% 0

CAPSTONE ® COURIER Page 9

Round: 2

Market Share C117558 Dec. 31, 2022

Actual Market Share in Units Potential Market Share in Units

Trad Low High Pfmn Size Total Trad Low High Pfmn Size Total

Industry Unit Sales 8,776 11,179 3,439 2,751 2,769 28,914 Units Demanded 8,776 11,179 3,439 2,751 2,769 28,914

% of Market 30.3% 38.7% 11.9% 9.5% 9.6% 100.0% % of Market 30.3% 38.7% 11.9% 9.5% 9.6% 100.0%

Able 18.7% 0.1% 0.3% 5.8% Able 18.7% 0.2% 5.7%

Acre 18.4% 7.1% Acre 18.4% 7.1%

Adam 17.7% 2.1% Adam 20.1% 2.4%

Aft 0.2% 20.5% 2.0% Aft 0.3% 22.3% 2.2%

Agape 22.3% 2.1% Agape 23.3% 2.2%

Total 18.7% 18.6% 18.0% 20.5% 22.6% 19.1% Total 18.7% 18.6% 20.4% 22.3% 23.5% 19.7%

Baker 16.9% 0.2% 0.5% 5.2% Baker 17.0% 0.2% 0.4% 5.2%

Bead 14.9% 5.8% Bead 14.9% 5.8%

Bid 12.2% 1.5% Bid 11.8% 1.4%

Bold 12.9% 1.2% Bold 12.6% 1.2%

Buddy 12.7% 1.2% Buddy 10.8% 1.0%

Total 16.9% 14.9% 12.3% 12.9% 13.2% 14.9% Total 17.0% 14.9% 12.0% 12.7% 11.3% 14.6%

Cake 21.3% 1.3% 0.9% 6.7% Cake 21.2% 1.3% 0.8% 6.7%

Cedar 25.3% 9.8% Cedar 25.3% 9.8%

Cid 24.1% 2.9% Cid 23.6% 2.8%

Coat 0.1% 23.9% 2.3% Coat 23.4% 2.2%

Cure 21.3% 2.0% Cure 27.7% 2.7%

Total 21.3% 25.3% 25.6% 24.0% 22.2% 23.7% Total 21.3% 25.3% 24.9% 23.5% 28.5% 24.1%

Daze 18.8% 0.2% 0.4% 5.8% Daze 18.8% 0.2% 0.4% 5.8%

Dell 16.6% 6.4% Dell 16.6% 6.4%

Dixie 16.2% 1.9% Dixie 15.6% 1.9%

Dot 16.7% 1.6% Dot 16.3% 1.6%

Dune 10.8% 1.1% Dune 9.2% 0.9%

Total 19.0% 16.7% 16.4% 16.7% 11.2% 16.8% Total 18.9% 16.7% 15.8% 16.3% 9.6% 16.5%

Eat 13.6% 1.0% 4.5% Eat 13.6% 1.0% 4.5%

Ebb 14.2% 5.5% Ebb 14.2% 5.5%

Echo 10.1% 1.2% Echo 9.8% 1.2%

Edge 10.7% 1.0% Edge 10.4% 1.0%

Egg 10.2% 1.0% Egg 9.1% 0.9%

Total 13.6% 15.2% 10.1% 10.7% 10.2% 13.2% Total 13.6% 15.2% 9.8% 10.4% 9.1% 13.0%

Fast 10.4% 3.2% Fast 10.4% 3.2%

Feat 9.4% 3.6% Feat 9.4% 3.6%

Fist 17.5% 2.1% Fist 17.1% 2.0%

Foam 15.2% 1.5% Foam 14.8% 1.4%

Fume 20.6% 2.0% Fume 18.0% 1.7%

Total 10.4% 9.4% 17.6% 15.2% 20.6% 12.3% Total 10.4% 9.4% 17.2% 14.8% 18.0% 12.0%

CAPSTONE ® COURIER Page 10

Round: 2

Perceptual Map C117558 Dec. 31, 2022

Andrews Baldwin Chester

Name Pfmn Size Revised Name Pfmn Size Revised Name Pfmn Size Revised

Able 5.9 13.9 6/17/2022 Baker 6.2 13.7 4/17/2022 Cake 6.6 13.4 5/21/2022

Acre 3.0 17.0 5/24/2016 Bead 3.0 17.0 5/24/2016 Cedar 3.0 17.0 2/13/2021

Adam 9.5 11.0 1/29/2022 Bid 9.4 10.6 10/3/2022 Cid 10.0 10.0 11/6/2022

Aft 10.9 14.9 6/24/2022 Bold 11.0 14.5 9/20/2022 Coat 11.5 14.4 9/3/2022

Agape 5.0 9.4 5/28/2022 Buddy 5.1 9.5 10/5/2022 Cure 5.3 8.7 10/11/2022

AGS 4.5 15.0 2/13/2022

Digby Erie Ferris

Name Pfmn Size Revised Name Pfmn Size Revised Name Pfmn Size Revised

Daze 6.1 13.8 4/17/2022 Eat 5.5 14.3 4/15/2022 Fast 5.5 14.5 4/22/2022

Dell 3.0 17.0 5/24/2016 Ebb 3.0 17.0 5/24/2016 Feat 3.0 17.0 7/27/2025

Dixie 9.2 11.2 6/22/2022 Echo 9.0 11.0 8/6/2022 Fist 10.2 9.8 12/22/2022

Dot 9.9 15.3 3/26/2022 Edge 10.0 15.3 5/2/2022 Foam 11.8 14.2 11/11/2022

Dune 4.4 10.5 4/29/2022 Egg 4.5 10.0 6/27/2022 Fume 5.4 8.4 11/9/2022

Fox 11.0 9.0 12/12/2022

CAPSTONE ® COURIER Page 11

Round: 2

HR/TQM Report C117558 Dec. 31, 2022

HUMAN RESOURCES SUMMARY

Andrews Baldwin Chester Digby Erie Ferris

Needed Complement 938 820 842 870 593 667

Complement 938 820 843 870 593 667

1st Shift Complement 809 798 658 778 442 507

2nd Shift Complement 129 22 185 92 151 160

Overtime Percent 0.0% 0.0% 0.0% 0.0% 0.0% 0.0%

Turnover Rate 8.5% 8.5% 7.0% 7.0% 7.0% 8.9%

New Employees 218 179 59 105 42 137

Separated Employees 0 0 45 0 122 0

Recruiting Spend $3,000 $1,000 $2,000 $2,500 $1,000 $2,500

Training Hours 40 40 80 80 80 30

Productivity Index 100.4% 100.0% 101.4% 101.7% 101.2% 100.0%

Recruiting Cost $871 $357 $177 $367 $83 $480

Separation Cost $0 $0 $225 $0 $610 $0

Training Cost $750 $656 $1,349 $1,392 $949 $400

Total HR Admin Cost $1,621 $1,013 $1,751 $1,759 $1,642 $881

Labor Contract Next Year

Wages $23.15 $23.15 $23.15 $23.15 $23.15 $23.15

Benefits 2,500 2,500 2,500 2,500 2,500 2,500

Profit Sharing 2.0% 2.0% 2.0% 2.0% 2.0% 2.0%

Annual Raise 5.0% 5.0% 5.0% 5.0% 5.0% 5.0%

Starting Negotiation Position

Wages

Benefits

Profit Sharing

Annual Raise

Ceiling Negotiation Position

Wages

Benefits

Profit Sharing

Annual Raise

Adjusted Labor Demands

Wages

Benefits

Profit Sharing

Annual Raise

Strike Days

TQM SUMMARY

Andrews Baldwin Chester Digby Erie Ferris

Process Mgt Budgets Last Year

CPI Systems $0 $0 $0 $0 $0 $0

VendorJIT $0 $0 $0 $0 $0 $0

Quality Initiative Training $0 $0 $0 $0 $0 $0

Channel Support Systems $0 $0 $0 $0 $0 $0

Concurrent Engineering $0 $0 $0 $0 $0 $0

UNEP Green Programs $0 $0 $0 $0 $0 $0

TQM Budgets Last Year

Benchmarking $0 $0 $0 $0 $0 $0

Quality Function Deployment Effort $0 $0 $0 $0 $0 $0

CCE/6 Sigma Training $0 $0 $0 $0 $0 $0

GEMI TQEM Sustainability Initiatives $0 $0 $0 $0 $0 $0

Total Expenditures $0 $0 $0 $0 $0 $0

Cumulative Impacts

Material Cost Reduction 0.00% 0.00% 0.00% 0.00% 0.00% 0.00%

Labor Cost Reduction 0.00% 0.00% 0.00% 0.00% 0.00% 0.00%

Reduction R&D Cycle Time 0.00% 0.00% 0.00% 0.00% 0.00% 0.00%

Reduction Admin Costs 0.00% 0.00% 0.00% 0.00% 0.00% 0.00%

Demand Increase 0.00% 0.00% 0.00% 0.00% 0.00% 0.00%

CAPSTONE ® COURIER Page 12

Round: 2

Ethics Report C117558 Dec. 31, 2022

ETHICS SUMMARY

Other (Fees, Writeoffs, etc.) The actual dollar impact. Example, $120 means Other increased by $120.

Demand Factor The % of normal. 98% means demand fell 2%.

Material Cost Impact The % of normal. 104% means matieral costs rose 4%.

Admin Cost Impact The % of normal. 103% means admin costs rose 3%.

Productivity Impact The % of normal. 104% means productivity increased by 4%.

Awareness Impact The % of normal. 105% means normal awareness was multiplied by 1.05.

Accessibility Impact The % of normal. 98% means normal accessiblity was multiplied by 0.98.

Normal means the value that would have been produced if the problem had not been presented.

No Impact Andrews Baldwin Chester Digby Erie Ferris

Total

Other (Fees, Writeoffs, etc.) $0 $0 $0 $0 $0 $0 $0

Demand Factor 100% 100% 100% 100% 100% 100% 100%

Material Cost Impact 100% 100% 100% 100% 100% 100% 100%

Admin Cost Impact 100% 100% 100% 100% 100% 100% 100%

Productivity Impact 100% 100% 100% 100% 100% 100% 100%

Awareness Impact 100% 100% 100% 100% 100% 100% 100%

Accessibility Impact 100% 100% 100% 100% 100% 100% 100%

CAPSTONE ® COURIER Page 13

Annual Report

Round: 2

Annual Report Baldwin C117558

Dec. 31, 2022

Balance Sheet

DEFINITIONS: Common Size: The common size column

simply represents each item as a percentage of total ASSETS 2022 2021

assets for that year. Cash: Your end-of-year cash Common

position. Accounts Receivable: Reflects the lag between

Size

delivery and payment of your products. Inventories: The Cash $0 0.0% $11,103

current value of your inventory across all products. A zero

Account Receivable $9,247 8.9% $9,457

indicates your company stocked out. Unmet demand

would, of course, fall to your competitors. Plant & Inventory $18,589 18.0% $7,823

Equipment: The current value of your plant. Accum Total Current Assets $27,836 26.9% $28,383

Deprec: The total accumulated depreciation from your

plant. Accts Payable: What the company currently owes

Plant & Equipment $129,400 125.0% $113,800

suppliers for materials and services. Current Debt: The

debt the company is obligated to pay during the next year Accumulated Depreciation ($53,880) -52.1% ($45,520)

of operations. It includes emergency loans used to keep Total Fixed Assets $75,520 73.1% $68,280

your company solvent should you run out of cash during Total Assets $103,357 100.0% $96,663

the year. Long Term Debt: The companys long term debt

is in the form of bonds, and this represents the total value LIABILITIES & OWNERS

of your bonds. Common Stock: The amount of capital

EQUITY

invested by shareholders in the company. Retained

Earnings: The profits that the company chose to keep Accounts Payable $7,382 7.1% $6,556

instead of paying to shareholders as dividends.

Current Debt $2,583 2.5% $0

Long Term Debt $40,750 39.4% $36,674

Total Liabilities $50,715 49.1% $43,230

Common Stock $18,360 17.8% $18,360

Retained Earnings $34,282 33.2% $35,073

Total Equity $52,642 50.9% $53,433

Total Liab. & O. Equity $103,357 100.0% $96,663

Cash Flow Statement

The Cash Flow Statement examines what happened in the Cash Account Cash Flows from Operating Activities 2022 2021

during the year. Cash injections appear as positive numbers and cash Net Income(Loss) ($791) $5,491

withdrawals as negative numbers. The Cash Flow Statement is an excellent Depreciation $8,360 $7,587

tool for diagnosing emergency loans. When negative cash flows exceed Extraordinary gains/losses/writeoffs $0 ($26)

positives, you are forced to seek emergency funding. For example, if sales Accounts Payable $826 ($27)

are bad and you find yourself carrying an abundance of excess inventory,

Inventory ($10,766) $794

the report would show the increase in inventory as a huge negative cash

Accounts Receivable $210 ($1,150)

flow. Too much unexpected inventory could outstrip your inflows, exhaust

your starting cash and force you to beg for money to keep your company Net cash from operation ($2,161) $12,669

afloat. Cash Flows from Investing Activities

Plant Improvements ($15,600) $0

Cash Flows from Financing Activities

Dividends paid $0 $0

Sales of common stock $0 $0

Purchase of common stock $0 $0

Cash from long term debt $6,000 $0

Retirement of long term debt ($1,924) ($5,000)

Change in current debt(net) $2,583 $0

Net cash from financing activities $6,658 ($5,000)

Net change in cash position ($11,103) $7,669

Closing cash position $0 $11,103

Annual Report Page 14

Round: 2

Annual Report Baldwin C117558

Dec. 31, 2022

2022 Income Statement

2022 Common

(Product Name) Baker Bead Bid Bold Buddy Buzz

Total

Size

Sales $39,850 $32,541 $15,880 $12,269 $11,971 $0 $0 $0 $112,511 100.0%

Variable Costs:

Direct Labor $12,372 $12,414 $3,929 $3,331 $3,310 $0 $0 $0 $35,355 31.4%

Direct Material $16,165 $11,358 $6,247 $5,462 $4,468 $0 $0 $0 $43,699 38.8%

Inventory Carry $71 $531 $526 $660 $442 $0 $0 $0 $2,231 2.0%

Total Variable $28,607 $24,303 $10,703 $9,452 $8,219 $0 $0 $0 $81,285 72.2%

Contribution Margin $11,242 $8,238 $5,177 $2,817 $3,752 $0 $0 $0 $31,226 27.8%

Period Costs:

Depreciation $2,640 $2,800 $1,320 $720 $880 $0 $0 $0 $8,360 7.4%

SG&A: R&D $296 $0 $765 $730 $771 $1,000 $0 $0 $3,563 3.2%

Promotions $1,500 $1,500 $1,300 $1,000 $1,200 $0 $0 $0 $6,500 5.8%

Sales $1,500 $1,000 $1,500 $1,000 $1,300 $0 $0 $0 $6,300 5.6%

Admin $638 $521 $254 $196 $192 $0 $0 $0 $1,801 1.6%

Total Period $6,574 $5,821 $5,140 $3,647 $4,342 $1,000 $0 $0 $26,524 23.6%

Net Margin $4,668 $2,417 $38 ($830) ($591) ($1,000) $0 $0 $4,702 4.2%

Definitions: Sales: Unit Sales times list price. Direct Labor: Labor costs incurred to produce the product Other $300 0.3%

that was sold. Inventory Carry Cost: the cost unsold goods in inventory. Depreciation: Calculated on EBIT $4,402 3.9%

straight-line. 15-year depreciation of plant value. R&D Costs: R&D department expenditures for each Short Term Interest $291 0.3%

product. Admin: Administration overhead is estimated at 1.5% of sales. Promotions: The promotion budget Long Term Interest $5,329 4.7%

for each product. Sales: The sales force budget for each product. Other: Chargs not included in other Taxes ($426) -0.4%

categories such as Fees, Write offs, and TQM. The fees include money paid to investment bankers and Profit Sharing $0 0.0%

brokerage firms to issue new stocks or bonds plus consulting fees your instructor might assess. Write-offs Net Profit ($791) -0.7%

include the loss you might experience when you sell capacity or liquidate inventory as the result of

eliminating a production line. If the amount appears as a negative amount, then you actually made money

on the liquidation of capacity or inventory. EBIT: Earnings Before Interest and Taxes. Short Term Interest:

Interest expense based on last years current debt, including short term debt, long term notes that have

become due, and emergency loans, Long Term Interest: Interest paid on outstanding bonds. Taxes:

Income tax based upon a 35% tax rate. Profit Sharing: Profits shared with employees under the labor

contract. Net Profit: EBIT minus interest, taxes, and profit sharing.

Annual Report Page 15

Das könnte Ihnen auch gefallen

- Success MeasuresDokument4 SeitenSuccess MeasuresRachel YoungNoch keine Bewertungen

- Top Round: 5 Financial Results and Company PerformanceDokument13 SeitenTop Round: 5 Financial Results and Company PerformanceAkashNoch keine Bewertungen

- Digby Corp 2021 Annual ReportDokument13 SeitenDigby Corp 2021 Annual ReportwerfsdfsseNoch keine Bewertungen

- COMP-XM® INQUIRER Round 0Dokument21 SeitenCOMP-XM® INQUIRER Round 0Joshua MoyNoch keine Bewertungen

- Report - Solar Power Plant - Financial Modeling PrimerDokument48 SeitenReport - Solar Power Plant - Financial Modeling Primeranimeshsaxena83100% (3)

- Capstone Courier Round 5 ResultsDokument15 SeitenCapstone Courier Round 5 ResultsSanyam GulatiNoch keine Bewertungen

- Solving Pramanik's Bottleneck ChallengeDokument7 SeitenSolving Pramanik's Bottleneck ChallengeSaransh BagdiNoch keine Bewertungen

- Does IT Payoff Strategies of Two Banking GiantsDokument10 SeitenDoes IT Payoff Strategies of Two Banking GiantsScyfer_16031991Noch keine Bewertungen

- BEA Associates - Enhanced Equity Index FundDokument17 SeitenBEA Associates - Enhanced Equity Index FundKunal MehtaNoch keine Bewertungen

- Team Shooting Stars: - FMS DelhiDokument6 SeitenTeam Shooting Stars: - FMS DelhiAkram KhanNoch keine Bewertungen

- Courier 4Dokument14 SeitenCourier 4vivek singhNoch keine Bewertungen

- Comp-Xm® Inquirer0Dokument21 SeitenComp-Xm® Inquirer0Jasleen Kaur (Ms)Noch keine Bewertungen

- Comp-Xm® Inquirer WordDokument37 SeitenComp-Xm® Inquirer WordAnonymous TAV9RvNoch keine Bewertungen

- Capstone Round 3 CourierDokument15 SeitenCapstone Round 3 CourierKitarpNoch keine Bewertungen

- 256 Inquirer1Dokument41 Seiten256 Inquirer1sgoyal89Noch keine Bewertungen

- Courier C58866 Rounds 1-6 (With Scores)Dokument78 SeitenCourier C58866 Rounds 1-6 (With Scores)jackmooreausNoch keine Bewertungen

- COMP-XM® INQUIRER - Round 2Dokument24 SeitenCOMP-XM® INQUIRER - Round 2Gaurav KulkarniNoch keine Bewertungen

- Capxm Final RoundDokument21 SeitenCapxm Final RoundManoj KuchipudiNoch keine Bewertungen

- Research Insights 2 Infosys LimitedDokument6 SeitenResearch Insights 2 Infosys Limited2K20DMBA53 Jatin suriNoch keine Bewertungen

- Base of Capstone StrategyDokument2 SeitenBase of Capstone StrategySagar SabnisNoch keine Bewertungen

- Capsim Simulation: Team Eerie (Group 5)Dokument4 SeitenCapsim Simulation: Team Eerie (Group 5)Dhruv KumbhareNoch keine Bewertungen

- CapstoneDokument3.306 SeitenCapstoneVan Sj TYnNoch keine Bewertungen

- ITBO - Class AssignmentDokument3 SeitenITBO - Class Assignmentaishwarya anandNoch keine Bewertungen

- CAPSIM Capstone Strategy 2016Dokument21 SeitenCAPSIM Capstone Strategy 2016Khanh MaiNoch keine Bewertungen

- Godrej AgrovetDokument37 SeitenGodrej AgrovetBandaru NarendrababuNoch keine Bewertungen

- 268ebirch Paper CompanyDokument14 Seiten268ebirch Paper CompanySumit Singh GorayaNoch keine Bewertungen

- Capstone Industry - 602 Team AndrewsDokument17 SeitenCapstone Industry - 602 Team AndrewsPeshwa BajiraoNoch keine Bewertungen

- MOS GameDokument1 SeiteMOS GameRajesh1 SrinivasanNoch keine Bewertungen

- Final Group Project - Business SimulationDokument6 SeitenFinal Group Project - Business SimulationLakshmi SrinivasanNoch keine Bewertungen

- Round: 7 Dec. 31, 2019: Selected Financial StatisticsDokument15 SeitenRound: 7 Dec. 31, 2019: Selected Financial StatisticsShubham UpadhyayNoch keine Bewertungen

- Tirecity - XLS092 XLS ENGDokument6 SeitenTirecity - XLS092 XLS ENGpp ppNoch keine Bewertungen

- Tire City Case 1Dokument28 SeitenTire City Case 1Srikanth VasantadaNoch keine Bewertungen

- 3i Infotech-Developing A Hybrid StrategyDokument20 Seiten3i Infotech-Developing A Hybrid StrategyVinod JoshiNoch keine Bewertungen

- Comp-XM Basix Guide PDFDokument6 SeitenComp-XM Basix Guide PDFJai PhookanNoch keine Bewertungen

- WACC TemplateDokument13 SeitenWACC TemplateAsad AminNoch keine Bewertungen

- Tire RatiosDokument7 SeitenTire Ratiospp pp100% (1)

- Strategy: Strategy and Tactics Differ Mainly Around Time ScaleDokument18 SeitenStrategy: Strategy and Tactics Differ Mainly Around Time Scalemash68Noch keine Bewertungen

- Master Operations Scheduling Game - Work Sheet: (Write Your Names or Roll No.)Dokument1 SeiteMaster Operations Scheduling Game - Work Sheet: (Write Your Names or Roll No.)Pavel GuptaNoch keine Bewertungen

- Redbus Growth: Next StepDokument11 SeitenRedbus Growth: Next Stepdebjyoti92Noch keine Bewertungen

- Buss. Valuation-Bajaj AutoDokument19 SeitenBuss. Valuation-Bajaj AutoNilesh Kedia0% (1)

- CAPSIM Course Assignment 1Dokument1 SeiteCAPSIM Course Assignment 1Anup DhanukaNoch keine Bewertungen

- Case Analysis Landmark FacilityDokument25 SeitenCase Analysis Landmark Facilitystark100% (1)

- Four Reasons Behind Maruti SuzukiDokument13 SeitenFour Reasons Behind Maruti SuzukiSaurabh PrabhakarNoch keine Bewertungen

- Case Study CNS WorldwideDokument4 SeitenCase Study CNS WorldwideDisha DaveNoch keine Bewertungen

- ACC Cement Research Report and Equity ValuationDokument12 SeitenACC Cement Research Report and Equity ValuationSougata RoyNoch keine Bewertungen

- Air Thread Case QuestionDokument1 SeiteAir Thread Case QuestionSimran MalhotraNoch keine Bewertungen

- Tata Motors ValuationDokument38 SeitenTata Motors ValuationAkshat JainNoch keine Bewertungen

- Group Assignment - Management Control Systems - Birch Paper CompanyDokument6 SeitenGroup Assignment - Management Control Systems - Birch Paper CompanyNatya NindyagitayaNoch keine Bewertungen

- Comp XM Examination GuideDokument15 SeitenComp XM Examination Guidesarathusha100% (1)

- Yankee Fork and Hoe Company1Dokument18 SeitenYankee Fork and Hoe Company1anup_goenkaNoch keine Bewertungen

- SCM CaseletDokument10 SeitenSCM CaseletSreejith P MenonNoch keine Bewertungen

- Gap Analysis For ICICIDokument3 SeitenGap Analysis For ICICISandeep JannuNoch keine Bewertungen

- ABC Analysis in Hospitality: Reducing Costs Through Inventory ClassificationDokument4 SeitenABC Analysis in Hospitality: Reducing Costs Through Inventory ClassificationSarello AssenavNoch keine Bewertungen

- Group Ariel StudentsDokument8 SeitenGroup Ariel Studentsbaashii4Noch keine Bewertungen

- 1 Sampling DistDokument35 Seiten1 Sampling DistYogeshNoch keine Bewertungen

- Valuation of Airthread ConnectionsDokument11 SeitenValuation of Airthread ConnectionsPerumalla Pradeep KumarNoch keine Bewertungen

- Wyndham International HotelsDokument3 SeitenWyndham International HotelsCabron InDaZoneNoch keine Bewertungen

- Bellaire Clinical Labs, Inc. (A)Dokument6 SeitenBellaire Clinical Labs, Inc. (A)VijayKhareNoch keine Bewertungen

- Round: 1 Dec. 31, 2021: Selected Financial StatisticsDokument15 SeitenRound: 1 Dec. 31, 2021: Selected Financial StatisticsParas DhamaNoch keine Bewertungen

- Courier C136952 R1 TEK0 CA2Dokument14 SeitenCourier C136952 R1 TEK0 CA2shivam kumarNoch keine Bewertungen

- HeroMotoCorpAnnualReport18 19Dokument326 SeitenHeroMotoCorpAnnualReport18 19Ashesh DasNoch keine Bewertungen

- 9.understanding RiskDokument18 Seiten9.understanding RiskAshesh DasNoch keine Bewertungen

- 6.bond ValuationDokument23 Seiten6.bond ValuationAshesh DasNoch keine Bewertungen

- Capital Markets and Pricing of RiskDokument23 SeitenCapital Markets and Pricing of RiskAshesh DasNoch keine Bewertungen

- HeroMotoCorpAnnualReport18 19Dokument326 SeitenHeroMotoCorpAnnualReport18 19Ashesh DasNoch keine Bewertungen

- Bal 2014 For Web1Dokument229 SeitenBal 2014 For Web1Ashesh DasNoch keine Bewertungen

- HeroMotoCorpAnnualReport13 14Dokument236 SeitenHeroMotoCorpAnnualReport13 14Ashesh DasNoch keine Bewertungen

- Dynamism: Worldwide Reach Millions of Delighted Customers Industry-Next Innovation Cutting-Edge TechnologyDokument236 SeitenDynamism: Worldwide Reach Millions of Delighted Customers Industry-Next Innovation Cutting-Edge TechnologyAshesh DasNoch keine Bewertungen

- Here 2013-14Dokument180 SeitenHere 2013-14AnneJacinthNoch keine Bewertungen

- Chap005 7e EditedDokument43 SeitenChap005 7e EditedAshesh DasNoch keine Bewertungen

- 20190715054601pdf266 PDFDokument268 Seiten20190715054601pdf266 PDFDeepak SharmaNoch keine Bewertungen

- Bajaj Annual Report 13-14Dokument185 SeitenBajaj Annual Report 13-14swaroop666Noch keine Bewertungen

- Chap013 TNx2Dokument69 SeitenChap013 TNx2Ashesh DasNoch keine Bewertungen

- Profit Planning, Activity-Based Budgeting and E-BudgetingDokument78 SeitenProfit Planning, Activity-Based Budgeting and E-BudgetingAshesh DasNoch keine Bewertungen

- Chap007 7e EditedDokument49 SeitenChap007 7e EditedAshesh DasNoch keine Bewertungen

- Basic Cost Management Concepts and Accounting For Mass Customization OperationsDokument54 SeitenBasic Cost Management Concepts and Accounting For Mass Customization OperationsAshesh DasNoch keine Bewertungen

- Profit Planning, Activity-Based Budgeting and E-BudgetingDokument78 SeitenProfit Planning, Activity-Based Budgeting and E-BudgetingAshesh DasNoch keine Bewertungen

- Interest RatesDokument29 SeitenInterest RatesAshesh DasNoch keine Bewertungen

- Chap013 TNx2Dokument69 SeitenChap013 TNx2Ashesh DasNoch keine Bewertungen

- Chap007 7e EditedDokument49 SeitenChap007 7e EditedAshesh DasNoch keine Bewertungen

- Chap005 7e EditedDokument43 SeitenChap005 7e EditedAshesh DasNoch keine Bewertungen

- Basic Cost Management Concepts and Accounting For Mass Customization OperationsDokument54 SeitenBasic Cost Management Concepts and Accounting For Mass Customization OperationsAshesh DasNoch keine Bewertungen

- Questionnaire For Client AcquisitionDokument4 SeitenQuestionnaire For Client Acquisitionvikramnmba100% (1)

- 3 TQM 2021 (Session3 SPC)Dokument25 Seiten3 TQM 2021 (Session3 SPC)koamaNoch keine Bewertungen

- Sap Press Catalog 2008 SpringDokument32 SeitenSap Press Catalog 2008 Springmehul_sap100% (1)

- Reviewquestion Chapter5 Group5Dokument7 SeitenReviewquestion Chapter5 Group5Linh Bảo BảoNoch keine Bewertungen

- Asst. Manager - Materials Management (Feed & Fuel Procurement)Dokument1 SeiteAsst. Manager - Materials Management (Feed & Fuel Procurement)mohanmba11Noch keine Bewertungen

- Morgan Stanley 2022 ESG ReportDokument115 SeitenMorgan Stanley 2022 ESG ReportVidya BarnwalNoch keine Bewertungen

- Food and Beverage OperationsDokument6 SeitenFood and Beverage OperationsDessa F. GatilogoNoch keine Bewertungen

- Search Suggestions: Popular Searches: Cost Accounting CoursesDokument21 SeitenSearch Suggestions: Popular Searches: Cost Accounting CoursesYassi CurtisNoch keine Bewertungen

- Sample MidTerm Multiple Choice Spring 2018Dokument3 SeitenSample MidTerm Multiple Choice Spring 2018Barbie LCNoch keine Bewertungen

- Consumer Behavior in Relation To Insurance ProductsDokument52 SeitenConsumer Behavior in Relation To Insurance Productsprarthna100% (1)

- Tutorial 3 QuestionsDokument2 SeitenTutorial 3 QuestionsHà VânNoch keine Bewertungen

- BMST5103Dokument38 SeitenBMST5103yusufNoch keine Bewertungen

- Digital Marketing PresentationDokument16 SeitenDigital Marketing PresentationAreeb NarkarNoch keine Bewertungen

- Larsen Toubro Infotech Limited 2015 DRHP PDFDokument472 SeitenLarsen Toubro Infotech Limited 2015 DRHP PDFviswanath_manjula100% (1)

- Student Notice: Project ReportDokument22 SeitenStudent Notice: Project ReportneetuNoch keine Bewertungen

- URC Financial Statement AnalysisDokument17 SeitenURC Financial Statement AnalysisKarlo PradoNoch keine Bewertungen

- Brand India from Local to Global: Patanjali's Growth StrategyDokument30 SeitenBrand India from Local to Global: Patanjali's Growth StrategyJay FalduNoch keine Bewertungen

- Surendra Trading Company: Buyer NameDokument1 SeiteSurendra Trading Company: Buyer Nameashish.asati1Noch keine Bewertungen

- BuddDokument34 SeitenBuddPeishi Ong50% (2)

- Comparison of Mission Statements Mission Accomplished Bicon Shanta BiotechDokument32 SeitenComparison of Mission Statements Mission Accomplished Bicon Shanta BiotechRachael SookramNoch keine Bewertungen

- Practice Test 1 PMDokument34 SeitenPractice Test 1 PMNguyễn Lê Minh NhậtNoch keine Bewertungen

- Salo Digital Marketing Framework 15022017Dokument9 SeitenSalo Digital Marketing Framework 15022017Anish NairNoch keine Bewertungen

- MM-Last Day AssignmentDokument18 SeitenMM-Last Day AssignmentPratik GiriNoch keine Bewertungen

- HR Pepsi CoDokument3 SeitenHR Pepsi CookingNoch keine Bewertungen

- Material Handling and ManagementDokument45 SeitenMaterial Handling and ManagementGamme AbdataaNoch keine Bewertungen

- Abraj IPO Prospectus EnglishDokument270 SeitenAbraj IPO Prospectus EnglishSherlock HolmesNoch keine Bewertungen

- Indian FMCG Industry, September 2012Dokument3 SeitenIndian FMCG Industry, September 2012Vinoth PalaniappanNoch keine Bewertungen

- SRI5307 st20213548Dokument36 SeitenSRI5307 st20213548Sandani NilekaNoch keine Bewertungen

- Group Presentation Guides: Real Company Analysis Improvement InitiativesDokument9 SeitenGroup Presentation Guides: Real Company Analysis Improvement InitiativesVy LêNoch keine Bewertungen