Beruflich Dokumente

Kultur Dokumente

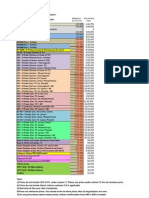

Yorkshire: Revolt Main Cause Subsidiary Cause Patterns

Hochgeladen von

Jack Phillips0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

3 Ansichten1 SeiteThe document summarizes the main and subsidiary causes of tax revolts in Yorkshire, Cornwall, and related to the Amicable Grant and Pilgrimage of Grace in 3 or less sentences. Yorkshire and Cornwall revolted due to being taxed for wars they hadn't paid taxes for before. The Amicable Grant revolt was sparked by excessive tax demands on the laity and clergy beyond recent taxes amid worsening economic conditions. The Pilgrimage of Grace revolt stemmed partly from a request to be relieved from previous taxes and claims that recent subsidies could not be afforded.

Originalbeschreibung:

Originaltitel

Revolt Table

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThe document summarizes the main and subsidiary causes of tax revolts in Yorkshire, Cornwall, and related to the Amicable Grant and Pilgrimage of Grace in 3 or less sentences. Yorkshire and Cornwall revolted due to being taxed for wars they hadn't paid taxes for before. The Amicable Grant revolt was sparked by excessive tax demands on the laity and clergy beyond recent taxes amid worsening economic conditions. The Pilgrimage of Grace revolt stemmed partly from a request to be relieved from previous taxes and claims that recent subsidies could not be afforded.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

3 Ansichten1 SeiteYorkshire: Revolt Main Cause Subsidiary Cause Patterns

Hochgeladen von

Jack PhillipsThe document summarizes the main and subsidiary causes of tax revolts in Yorkshire, Cornwall, and related to the Amicable Grant and Pilgrimage of Grace in 3 or less sentences. Yorkshire and Cornwall revolted due to being taxed for wars they hadn't paid taxes for before. The Amicable Grant revolt was sparked by excessive tax demands on the laity and clergy beyond recent taxes amid worsening economic conditions. The Pilgrimage of Grace revolt stemmed partly from a request to be relieved from previous taxes and claims that recent subsidies could not be afforded.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

tax

Revolt Main Cause Subsidiary Cause Patterns

Yorkshire had never had to pay tax for a

war with France, they expected to pay

Yorkshire tax for war with Scotland. Some

northern counties had been expected

by the King on account of poverty.

Cornwall had never had to pay tax for a

war with Scotland, they expected to pay

tax for war with France. There was a

Cornish

plan for more tax on top of the usual

fifteenth and tenth, but in the end this

never happened.

The Amicable Grant made excessive

demands on the laity and clergy alike.

Laity paid between 7.5% and 16.5% of

Amicable Grant income. Clergy were to pay between

25% and 33%. This tax was placed on

top of recent tax demands and

worsening economic conditions.

Only one article concerned taxation.

Item 14 requested ‘to be discharged on

the fifteenth and taxes now granted by

Pilgrimage of Grace

act of parliament’. Rebels claimed they

could not afford the subsidy of £80,000

from 1534.

Duke of Somerset introduced a tax on

sheep and woollen cloth. Hit poorer

Western peasants and tenants most of all. Tax

was to be assed 2 weeks after

introduction of English prayer book.

Das könnte Ihnen auch gefallen

- A History of Taxation: ScribesDokument11 SeitenA History of Taxation: ScribesAwais AliNoch keine Bewertungen

- Early History of the Colony of Victoria, Volume IIVon EverandEarly History of the Colony of Victoria, Volume IINoch keine Bewertungen

- BIR LOGOand HistoryDokument21 SeitenBIR LOGOand HistorywdadafdawfdNoch keine Bewertungen

- History of Taxation in Rhode Island to the Year 1790Von EverandHistory of Taxation in Rhode Island to the Year 1790Noch keine Bewertungen

- A History of TaxationDokument32 SeitenA History of Taxationno4russoNoch keine Bewertungen

- The Endowed Charities of Kensington: By Whom Bequeathed, and How AdministeredVon EverandThe Endowed Charities of Kensington: By Whom Bequeathed, and How AdministeredNoch keine Bewertungen

- Taxation: Cuerdo, Charles Tristan Ayuban, Ralf Murillo, MontDokument24 SeitenTaxation: Cuerdo, Charles Tristan Ayuban, Ralf Murillo, MontRalf Gabriel AyubanNoch keine Bewertungen

- The Present State of the British Interest in India: With a Plan for Establishing a Regular System of Government in That CountryVon EverandThe Present State of the British Interest in India: With a Plan for Establishing a Regular System of Government in That CountryNoch keine Bewertungen

- Taxes Are Considered A Problem by EveryoneDokument8 SeitenTaxes Are Considered A Problem by EveryoneReychelle Marie BernarteNoch keine Bewertungen

- The Rebellious Colonists and the Causes of the American RevolutionVon EverandThe Rebellious Colonists and the Causes of the American RevolutionNoch keine Bewertungen

- Taxation and Fiscal PolicyDokument3 SeitenTaxation and Fiscal PolicyBanana CrazyNoch keine Bewertungen

- Tan Brown Multicolor Photograph Bathroom Renovation Steps Timeline InfographicDokument1 SeiteTan Brown Multicolor Photograph Bathroom Renovation Steps Timeline InfographicCeline SaludoNoch keine Bewertungen

- James I and FinanceDokument3 SeitenJames I and FinanceschofioNoch keine Bewertungen

- Evolution of Philippine: AtionDokument15 SeitenEvolution of Philippine: AtionRosabel Yanong TiguianNoch keine Bewertungen

- The Evolution Philippine Taxation: Unit VDokument43 SeitenThe Evolution Philippine Taxation: Unit VJay EvardsNoch keine Bewertungen

- Causes of The American RevolutionDokument13 SeitenCauses of The American RevolutionTimothy Amao100% (1)

- The Fiscal CrisisDokument20 SeitenThe Fiscal CrisisusmansaffriNoch keine Bewertungen

- Colonialism and The CountrysideDokument31 SeitenColonialism and The CountrysideJyoti SharmaNoch keine Bewertungen

- Unit 8 The New Land SettlementsDokument14 SeitenUnit 8 The New Land SettlementsVishal Rollno 4004Noch keine Bewertungen

- Chapter 4Dokument18 SeitenChapter 4SSGURU BLOG MUSICAL SOCIAL SCIENCENoch keine Bewertungen

- Causes of The Maltese Uprising in 1798Dokument4 SeitenCauses of The Maltese Uprising in 1798Faucon_MaltaisNoch keine Bewertungen

- Lehs301 PDFDokument31 SeitenLehs301 PDFsahilNoch keine Bewertungen

- © Ncert Not To Be Republished: Colonialism and The CountrysideDokument31 Seiten© Ncert Not To Be Republished: Colonialism and The CountrysideVijay KumarNoch keine Bewertungen

- Pre-Hispanic Period: Evolution of Philippine TaxationDokument8 SeitenPre-Hispanic Period: Evolution of Philippine TaxationAlias SimounNoch keine Bewertungen

- Evolution of Philippine TaxationDokument8 SeitenEvolution of Philippine TaxationMae Niverba67% (3)

- Brief History of Tax LawsDokument9 SeitenBrief History of Tax LawsSaad AhmedNoch keine Bewertungen

- Modern History NCERTDokument176 SeitenModern History NCERTAyush YadavNoch keine Bewertungen

- Taxation Is The Practice of Collecting TaxesDokument4 SeitenTaxation Is The Practice of Collecting TaxesRai GauenNoch keine Bewertungen

- Chapter 1 Income TaxDokument34 SeitenChapter 1 Income TaxGirlie Kaye Onongen PagtamaNoch keine Bewertungen

- History Theme 3 (Class 12)Dokument176 SeitenHistory Theme 3 (Class 12)Abhishek KumarNoch keine Bewertungen

- OT LAWANI - HW French Revolution Cause and Effect (Assignment) - 3054958Dokument2 SeitenOT LAWANI - HW French Revolution Cause and Effect (Assignment) - 3054958Osaretin LawaniNoch keine Bewertungen

- NCERT Book Themes in Indian History Part III Class XIIDokument177 SeitenNCERT Book Themes in Indian History Part III Class XIInikhilam.com100% (2)

- Evolution of Philippine TaxationDokument4 SeitenEvolution of Philippine Taxationyumi timtim50% (2)

- Taxation During The Americans ORIGINALDokument16 SeitenTaxation During The Americans ORIGINALJohn ParadelaNoch keine Bewertungen

- 10Dokument31 Seiten10Rajesh RanjanNoch keine Bewertungen

- Class12 IndianHistory3 Unit10 NCERT TextBook EnglishEdition PDFDokument31 SeitenClass12 IndianHistory3 Unit10 NCERT TextBook EnglishEdition PDFManoj Janardan Jayashree TerekarNoch keine Bewertungen

- 1763-1783 The Road To American Revolution HLDokument120 Seiten1763-1783 The Road To American Revolution HLmurphy0124100% (1)

- Chanpter 10 Company and The Country SideDokument10 SeitenChanpter 10 Company and The Country SideArtworx GzbNoch keine Bewertungen

- Histroy Class 12 Theme 3Dokument178 SeitenHistroy Class 12 Theme 3guru1241987babuNoch keine Bewertungen

- Assignment Shafat SirDokument8 SeitenAssignment Shafat SirNafis Al ZameeNoch keine Bewertungen

- Property Law SummaryDokument62 SeitenProperty Law SummaryFarial Farouk Khan100% (1)

- Histroy Revision GuideDokument64 SeitenHistroy Revision GuideJannet Waitforit IpNoch keine Bewertungen

- Evolution of Philippine TaxationDokument24 SeitenEvolution of Philippine TaxationMary Grace DangtayanNoch keine Bewertungen

- Report On CasesDokument890 SeitenReport On CasesIddi KassiNoch keine Bewertungen

- Unit 15 The New Land Revenue Settlements: StructureDokument10 SeitenUnit 15 The New Land Revenue Settlements: StructureVishal Rollno 4004Noch keine Bewertungen

- Taxation FinalDokument16 SeitenTaxation FinalGhetto Spider100% (1)

- Land Reform EssayDokument5 SeitenLand Reform Essayapi-254098177Noch keine Bewertungen

- Super Memory Secrets WorkbookDokument33 SeitenSuper Memory Secrets Workbookla laNoch keine Bewertungen

- The Road To RevolutionDokument2 SeitenThe Road To RevolutionirregularflowersNoch keine Bewertungen

- Gibson 2015 Review The Poor Had No LawyersDokument4 SeitenGibson 2015 Review The Poor Had No Lawyersanniegao2003Noch keine Bewertungen

- British Guiana Village Administration 1838 To 1903 AshmoreDokument12 SeitenBritish Guiana Village Administration 1838 To 1903 AshmoreKAW100% (1)

- Name: Joshua Gulab Class: Form 4d Subject: History Date: June 9, 2020 Assignment #2Dokument7 SeitenName: Joshua Gulab Class: Form 4d Subject: History Date: June 9, 2020 Assignment #2Joshua GulabNoch keine Bewertungen

- Taxation HandoutsDokument5 SeitenTaxation HandoutsTiyon TiyonNoch keine Bewertungen

- Colonialism and CountrysideDokument13 SeitenColonialism and CountrysideAditiNoch keine Bewertungen

- Activity: Unit 4-A Lesson 3: History of Agrarian Reform in The PhilippinesDokument8 SeitenActivity: Unit 4-A Lesson 3: History of Agrarian Reform in The PhilippinesFrankieNoch keine Bewertungen

- Taxation During Commonwealth PeriodDokument5 SeitenTaxation During Commonwealth PeriodORACION, Mark GerlexNoch keine Bewertungen

- ABA Evidence 1of2 (House of Commons) Documents of British Ru1Dokument413 SeitenABA Evidence 1of2 (House of Commons) Documents of British Ru1Rajiv dixit100% (2)

- Listening List of Orchestral MusicDokument2 SeitenListening List of Orchestral MusicJack PhillipsNoch keine Bewertungen

- Costume Design For Bertozzo ParagraphDokument1 SeiteCostume Design For Bertozzo ParagraphJack PhillipsNoch keine Bewertungen

- Guitar 1 Part Tab - Full ScoreDokument54 SeitenGuitar 1 Part Tab - Full ScoreJack PhillipsNoch keine Bewertungen

- Maniac Designer QuestionDokument1 SeiteManiac Designer QuestionJack PhillipsNoch keine Bewertungen

- Guitar 1 Part TAB - Act 1 Complete - Full ScoreDokument53 SeitenGuitar 1 Part TAB - Act 1 Complete - Full ScoreJack PhillipsNoch keine Bewertungen

- EPQ JournalDokument3 SeitenEPQ JournalJack PhillipsNoch keine Bewertungen

- EPQ Ideas PresentationDokument5 SeitenEPQ Ideas PresentationJack PhillipsNoch keine Bewertungen

- Essay Plan For 30thDokument2 SeitenEssay Plan For 30thJack PhillipsNoch keine Bewertungen

- Jack Phillips - ExamDokument6 SeitenJack Phillips - ExamJack PhillipsNoch keine Bewertungen

- Epsilon Brass Bernard Brown Entry FormDokument3 SeitenEpsilon Brass Bernard Brown Entry FormJack PhillipsNoch keine Bewertungen

- Anarchist - Act 1 Scene 1 - AnalysisDokument13 SeitenAnarchist - Act 1 Scene 1 - AnalysisJack PhillipsNoch keine Bewertungen

- Typical of Baroque and Classical - RevisionDokument1 SeiteTypical of Baroque and Classical - RevisionJack PhillipsNoch keine Bewertungen

- Bartollo - Aria - La VendettaDokument4 SeitenBartollo - Aria - La VendettaJack PhillipsNoch keine Bewertungen

- John Williams Trumpet Concerto Movement II AnaylsisDokument1 SeiteJohn Williams Trumpet Concerto Movement II AnaylsisJack PhillipsNoch keine Bewertungen

- Elizabeths Religious SettlementDokument1 SeiteElizabeths Religious SettlementJack PhillipsNoch keine Bewertungen

- 10 Marker Plan (Features of Baroque Music)Dokument1 Seite10 Marker Plan (Features of Baroque Music)Jack PhillipsNoch keine Bewertungen

- Devise of The Succession NotesDokument1 SeiteDevise of The Succession NotesJack PhillipsNoch keine Bewertungen

- Arlecchino (Harlequin) : Character TypeDokument1 SeiteArlecchino (Harlequin) : Character TypeJack PhillipsNoch keine Bewertungen

- Accidental Death of An AnarchistDokument1 SeiteAccidental Death of An AnarchistJack PhillipsNoch keine Bewertungen

- 114 Transport Iocl Jaipur Aug-2021Dokument2 Seiten114 Transport Iocl Jaipur Aug-2021vikram singh rooppuraNoch keine Bewertungen

- Maceda V MacaraigDokument2 SeitenMaceda V MacaraigbrendamanganaanNoch keine Bewertungen

- 2015 Tax Return Documents (US Auto Motors LLC) Revised PDFDokument20 Seiten2015 Tax Return Documents (US Auto Motors LLC) Revised PDFzlNoch keine Bewertungen

- CIR vs. Procter in Gamble DigestDokument2 SeitenCIR vs. Procter in Gamble DigestDario G. Torres100% (2)

- Instructions For Form IT-203: Nonresident and Part-Year Resident Income Tax ReturnDokument72 SeitenInstructions For Form IT-203: Nonresident and Part-Year Resident Income Tax ReturnDiego12001Noch keine Bewertungen

- Chapter 9 Value Added TaxDokument17 SeitenChapter 9 Value Added TaxJouhara G. San JuanNoch keine Bewertungen

- Chapter 10 Homework SolutionsDokument6 SeitenChapter 10 Homework SolutionsJackNoch keine Bewertungen

- Residence Status and Tax LiabilityDokument14 SeitenResidence Status and Tax LiabilityDrafts StorageNoch keine Bewertungen

- (For Individuals and Hufs Not Having Income From Profits and Gains of Business or Profession) (Please See Rule 12 of The Income-Tax Rules, 1962)Dokument37 Seiten(For Individuals and Hufs Not Having Income From Profits and Gains of Business or Profession) (Please See Rule 12 of The Income-Tax Rules, 1962)Devanshi GoyalNoch keine Bewertungen

- Charles SchwabDokument45 SeitenCharles SchwabThe Washington PostNoch keine Bewertungen

- The University of Lahore College of Law Fee Structure Fall 2021 Bachelor of Law BallbDokument1 SeiteThe University of Lahore College of Law Fee Structure Fall 2021 Bachelor of Law BallbAli SohuNoch keine Bewertungen

- BudheswarDokument1 SeiteBudheswarNiluNoch keine Bewertungen

- GST Chart Book by CA Pranav ChandakDokument54 SeitenGST Chart Book by CA Pranav ChandakAman AhujaNoch keine Bewertungen

- Laporan Neraca 2011Dokument3 SeitenLaporan Neraca 2011afick abidzarNoch keine Bewertungen

- PDF Projected Income Statement and Balance SheetDokument4 SeitenPDF Projected Income Statement and Balance Sheetnavie VNoch keine Bewertungen

- Astrology AscendantDokument21 SeitenAstrology AscendantPrateek JhanjiNoch keine Bewertungen

- International Human Resource Management: Managing People in A Multinational ContextDokument16 SeitenInternational Human Resource Management: Managing People in A Multinational ContextLevor DaCostaNoch keine Bewertungen

- Delaware - Annual Tax ComplianceDokument7 SeitenDelaware - Annual Tax ComplianceJUNA SURESHNoch keine Bewertungen

- EY Tax Administration Is Going DigitalDokument12 SeitenEY Tax Administration Is Going DigitalVahidin QerimiNoch keine Bewertungen

- Case Study-ABAKADA CompanyDokument3 SeitenCase Study-ABAKADA CompanyDawn Juliana Aran100% (1)

- 2015-2018 Tax Bar QuestionsDokument42 Seiten2015-2018 Tax Bar QuestionsDenver Dela Cruz PadrigoNoch keine Bewertungen

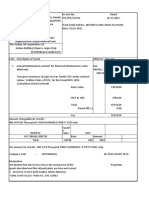

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Dokument1 SeiteTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Gopal SNoch keine Bewertungen

- Revenue Audit Memorandum Order 1-95Dokument6 SeitenRevenue Audit Memorandum Order 1-95azzy_km100% (1)

- QuizDokument5 SeitenQuizRomaica Ella AmbidaNoch keine Bewertungen

- TaxDokument5 SeitenTaxAl Francis Delmar PariñasNoch keine Bewertungen

- Mindray Pricelist - Dec 11-Sales TeamDokument1 SeiteMindray Pricelist - Dec 11-Sales TeamNayan PatelNoch keine Bewertungen

- Impact of GST On Indian Economy: Vishal Singh Chouhan Mba-Fs 3 SemDokument16 SeitenImpact of GST On Indian Economy: Vishal Singh Chouhan Mba-Fs 3 SemstrewNoch keine Bewertungen

- Loan Payoff CalculatorsDokument11 SeitenLoan Payoff CalculatorsBeeipNoch keine Bewertungen

- Carrier: Delhivery: Deliver To FromDokument1 SeiteCarrier: Delhivery: Deliver To FromAjay SinghNoch keine Bewertungen

- Nature of TaxesDokument3 SeitenNature of TaxesCaliboso DaysieNoch keine Bewertungen