Beruflich Dokumente

Kultur Dokumente

Wellington West: TAG Oil Update

Hochgeladen von

mpgervetOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Wellington West: TAG Oil Update

Hochgeladen von

mpgervetCopyright:

Verfügbare Formate

International Energy

TAG Oil Ltd. (TAO-V, $6.62)

Recommendation: Speculative Buy

Kevin Shaw, P.Eng. (403) 781-2715; kshaw@wwcm.com

Ronald Cheung, CFA (403) 781-2718; rcheung@wwcm.com

December 15, 2010

All values in C$ unless otherwise noted.

Current Price $6.62 Acquired Stake in Offshore Permit in Main

Target Price (12-Month)

Implied Capital Gain

$9.50

44%

Taranaki Fairway Adds Exploration Upside

Changes

Old New 20% W.I. of Kaheru prospect in offshore Taranaki is strategic to TAG

Production (boe/d) F ‘11E 758 Unch. Gross prospective resource is ~350 bcf gas w/ 10 mmbbl condensate; 8 km

CFPS FD FY 2011E $0.09 Unch. from shore & close proximity to existing infrastructure for easy tie-ins.

Production (boe/d) F ‘12E 2,008 Unch.

CFPS FD FY 2012E $0.37 Unch. Test result of the 1st htzl well in New Zealand coming in January ’11

Recommendation Spec. Unch. Testing & clean-up flow continues as oil, gas & frac fluids are recovered

Buy from the hztl; we look for an initial rate of 500+ boe/d & a high oil cut.

Target Price $9.50 Unch.

Company Profile Driving forward in ’11 at Taranaki and high impact East Coast basins

TAG Oil Ltd. (TAO) is an emerging Financed for ‘11 to drill multiple wells on Cheal & Broadside permits (new

international exploration and production drilling to resume in February); E. Coast exploration wells also planned.

company operating in New Zealand’s East

Coast and Taranaki basins. The company has Offshore potential adds $2.10 unrisked or $0.21 risked to our EMV/sh

three permits in the East Coast basin (~14 Spec Buy with a $9.50 target; conservative risked EMV/sh of ~$12 w/

billion bbls OOIP) and two permits in the steady drilling & catalysts from Taranaki and high impact E. Coast in 2011.

Taranaki basin (~100 million boe OOIP).

TAG is currently producing ~570 boe/d from

the Cheal initial discovery / pool in the

Taranaki basin with 2P reserves of 0.7

million boe, although we expect significant

resource upside in these two areas.

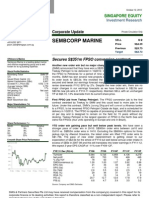

Price Chart Financial Summary

Shares FY 2011 O/S (mm, FD TSM) 52.1 52-Week Trading Range $1.53-$6.90

Price (C$) Volume ('000s) Market Capitalization (C$mm) $345 Average Weekly Volume 881,723

8.00

.

1,400,000

Net Debt (C$mm) (81) Market Float (mm) $255

Enterprise Value (C$mm) $264 Risked EMV/Share $12.15

7.00 1,200,000 Forecasts FY 2009* FY 2010* FY 2011E* FY 2012E*

Production (boe/d) 135 201 758 2,008

6.00

1,000,000 % gas 0% 0% 36% 41%

Modeled WTI Oil Price (US$/bbl) $61.56 $70.38 $80.74 $83.75

5.00

800,000 Modeled US$/CAD$ Exchange Rate $0.88 $0.99 $0.95 $0.95

4.00 Realized Oil Price (C$/boe) $44.14 $82.64 $60.38 $56.35

600,000 Revenues (C$mm) $4.9 $6.5 $15.9 $41.9

3.00 Cashflow (C$mm) $2.0 $0.3 $4.8 $19.5

400,000 DACF (C$mm) $2.0 $0.3 $4.8 $19.5

2.00

Capex (C$mm) $2.5 $2.3 $19.5 $56.4

1.00 200,000 EPS (FD TSM) ($1.05) ($0.08) $0.03 $0.24

CFPS (FD TSM) $0.11 $0.01 $0.09 $0.37

0.00 0 Valuation 2011E 2012E

Dec‐09

Feb‐10

Apr‐10

Jun‐10

Aug‐10

Oct‐10

Dec‐10

EV/DACF 58.4x 16.1x

EV/BOE/d (per unit production) $367,371 $156,985

Source: Thomson One P/E 206.2x 27.3x

Target EV/DACF 89.8x 23.8x

* Fiscal year ends on March 31 of each year

Source: Company Reports, Wellington West Capital Markets Inc.

Please see disclaimers on the last two pages of this report.

TAG Oil Ltd.

Investment Summary and Outlook

TAG Oil (TAG) is a “pure play” New Zealand-based exploration and

production company positioned to exploit over 2 million prospective acres &

14+ billion barrels of original oil in place (OOIP), offering both high impact

exploration and lower risk development upside. TAG offers a mix of risk and

reward opportunities across a combination of large oil-in-place conventional

reservoirs and emerging unconventional resource plays. The Taranaki basin in

North New Zealand is a mature proven-producing basin yet remains highly

underexplored as compared to other mature basins around the world like those

found in North America. The lower risk Taranaki basin offers significant growth

potential across two acreage blocks (or permits) that hold an estimated 100

million bbl OOIP and are 100% owned by TAG. The company’s fiscal 2012

(ends March 31, 2012) focus is to delineate reserves and boost corporate oil

production. The East Coast basin offers “game changing” upside for TAG

throughout the prove-up and commerciality of multiple oil shale zones that have

similar technical characteristics to both the North Dakota Bakken & emerging

Paris Basin Liassic resource plays. Both the Taranaki and East Coast basins are

prime candidates for application of North American based multi-stage frac

technology. TAG has also recently acquired an initial liquids-rich gas discovery

and has entered the offshore space both within the proven-producing Taranaki

basin. Being fully financed for 2011, TAG is expected to drive forward its

development and exploration programs with steady drilling planned at both the

Taranaki and East Coast basins in the coming year.

Taranaki Offshore Basin – Macro Picture

Untapped Exploration Potential with Multiple Prospects

While most current producing fields are located onshore, the offshore basin

accounts for more than two-thirds of the potentially recoverable petroleum

reserves in New Zealand. The Taranaki Basin houses all of New Zealand ~20

producing oil and gas fields that range in size from approximately 10 mmboe up

to 3.4 tcf of original gas reserves. The giant offshore Maui gas-condensate field

that has been a mainstay since the early 1980’s and currently accounting for more

than 75% of the hydrocarbon production in country. The Maui field is now in

decline mode and is expected to only be partially replaced by the offshore

Pohokura and Kupe fields, which are likely to come into production over the next

few years.

Kevin Shaw, P.Eng, (403)781-2715; kshaw@wwcm.com December 15, 2010- 2

Ronald Cheung, CFA (403) 781-2718; rcheung@wwcm.com

TAG Oil Ltd.

Exhibit 1: New Zealand’s Offshore Portion of Taranaki Basin

Source: 2010 New Zealand Petroleum Basin Report

Taranaki Offshore Basin – Acquisition Potential

Acquires 20% Interest in Prospective Exploration Permit Along Fairway

The Kaheru Prospect is the primary structure and target with mean

prospective resources estimated to be ~350 bcf of gas and 10 mmbbl of

associated condensate immediately adjacent to Origin Energy’s Rimu-Kauri

fields. The prospect lies beside two of the most recently discovered producing

oil and gas fields, Rimu (32 bcf and 2.5 mmbls recoverable) and Kauri (1.3

mmbls recoverable), and is a sub-thrust anticline south of an extensive onshore

hydrocarbon trend and immediately to the south of the proven Tarata Thrust

trend and to the east of the Kupe Field (288 bcf and 27mmboe in recoverables).

The acreage is also covered by both 2D and 3D seismic, is in shallow water

Kevin Shaw, P.Eng, (403)781-2715; kshaw@wwcm.com December 15, 2010- 3

Ronald Cheung, CFA (403) 781-2718; rcheung@wwcm.com

TAG Oil Ltd.

(drilling depth of 20-30 meters) and is operated by Roc Oil, a well-proven off-

shore operator with extensive experience, (i.e. active in New Zealand, UK,

Africa, etc.) which in our view adds to the attractiveness of the prospect for

TAG.

TAG and company partners are likely to spud the first off-shore tests

between 2011 and May of 2013 at a cost of ~ $6mm net to TAG. The

company will also participate in the processing of 3D seismic data at a net cost of

~$225k over the first two years.

Exhibit 2: Kaheru Prospect - In Close Proximity to Existing Offshore Fields

Maui Rimu/

Kauri

Kaheru

Kupe

Prospect

Source: Company Report, Wellington West Capital Markets Inc.

Valuation and Summary Recommendation

We maintain a $9.50 target price and a Speculative Buy rating. Given TAG

is an early-stage exploration and development company and is just starting to

become active with initial drilling & frac operations after a recent equity

financing, we focus our valuation on the company’s exploration upside shown by

our net risked EMV/sh of ~$12.15. Our EMV/sh is driven by a risked

recoverable resource potential of up to ~57 mmboe vs. unrisked of ~526 mmboe

recoverable. The Kaheru offshore potential is an early stage exploration play yet

provides another great call option on the company. We conservatively estimate

that the acquisition adds a risked $0.21 to our EMV/sh with a 10% COS (i.e. the

unrisked potential for the Kaheru prospect is ~$2.10/sh). In 2011, TAG has a

Kevin Shaw, P.Eng, (403)781-2715; kshaw@wwcm.com December 15, 2010- 4

Ronald Cheung, CFA (403) 781-2718; rcheung@wwcm.com

TAG Oil Ltd.

number of development and exploration activities which include horizontal and

vertical drilling on the Cheal and Broadside permits and launching the

company’s East Coast program with an estimated 5 exploration wells focused

initially on shallow conventional oil targets.

Exhibit 3: WCM Risked EMV/sh Valuation Breakdown – Including Exploration & Development Upside

for Both Taranaki (now Onshore & Offshore) and East Coast Basins

WWCM Unrisked Working WWCM Risked

COS Net Risked

Prospect/Field Resource Interest Resource

(%) EMV/sh

(Gross, mmboe) (%) (Net, mmboe)

East Coast Basin

Conventional 87.0 100% 10% 8.7 $1.99

Waipawa Oil Shale 175.0 100% 10% 17.5 $2.67

Whangai Oil Shale 175.0 100% 10% 17.5 $2.67

Taranaki Basin

Cheal - Mt. Messenger 7.0 100% 65% 4.6 $1.29

Cheal - Urenui 5.0 100% 35% 1.8 $0.46

Broadside - Mt. Messenger 7.0 100% 65% 4.6 $1.24

Broadside - Urenui 2.0 100% 35% 0.7 $0.08

Kaheru 68.3 20% 10% 1.4 $0.21

Cash (Net debt) $1.55

Total 526.3 56.6 $12.15

Source: Company Reports, Wellington West Capital Markets Inc.

Exhibit 4: Summary Valuation Table

Valuation Matrix Forecast Target Multiple Value Weighting Weighted Value

Core 2P NPV10 $ 2.11 1.0 $ 2.11 10% $ 0.21

Asset EMV/share $ 12.15 1.0 $ 12.15 75% $9.11

2011E DACF (Fiscal Yr. 2012) $ 0.37 5.0 $ 1.87 15% $ 0.28

12-month derived target price $ 9.60

Source: Wellington West Capital Markets Inc.

Kevin Shaw, P.Eng, (403)781-2715; kshaw@wwcm.com December 15, 2010- 5

Ronald Cheung, CFA (403) 781-2718; rcheung@wwcm.com

TAG Oil Ltd.

Disclaimers

The particulars contained herein were obtained from sources that we believe to be

reliable, but are not guaranteed by us and may be incomplete or inaccurate. The

opinions expressed are based upon our analysis and interpretation of these

particulars and are not to be construed as a solicitation of offer to buy or sell the

securities mentioned herein. Wellington West Capital Markets Inc. (“WWCM”)

may act as financial advisor, fiscal agent or underwriter for certain of the

companies mentioned herein, and may receive remuneration for its services.

WWCM and/or its principals, officers, directors, representatives, and associates

may have a position in the securities mentioned herein and may make purchases

and/or sales of these securities from time to time in the open market or otherwise.

This report may not be reproduced in whole or in part, or further distributed or

published or referred to in any manner whatsoever nor may the information,

opinions or conclusions contained herein be referred to without in each case the

prior written consent of WWCM.

U.S. Institutions may conduct business through our affiliate Wellington West

Capital Markets (USA) Inc. Wellington West Capital Markets (USA) Inc. accepts

the contents of this research report, however, the company that prepared this report

may not be subject to U.S. rules regarding the preparation of research reports and

the independence of research analysts.

This report will be forwarded to our affiliate Wellington West Capital Inc.

(“WWCI”). Subject to WWCI management review and approval, this report may

be distributed to clients of WWCI. WWCI and WWCM are members of the

Canadian Investor Protection Fund (“CIPF”).

Wellington West Capital Markets Stock Rating System

The rating system is based on the stock’s expected absolute total return over the

next 12 months. Generally, Strong Buy rating is expected to produce a total

return of 25% or more, Buy a total return of 10% to 25%, Market Perform a total

return of 0% to 10% and Underperform a negative total return. Speculative Buy

rating is expected to produce a total return of 25% or more, but is based on

factors and forecasts that have high degrees of uncertainty. The distribution of

the recommendations for the last three-month period and their relationship with

investment banking business are available on request by emailing to

compliance@wwcm.com.

Analyst Compensation

Research analysts receive compensation based on a number of factors as

determined by WWCM’s management. Compensation is affected by all of the

firm’s business activities, including revenue generated from capital markets and

investment banking. No part of the compensation of the analyst who authored

this report is based on the specific recommendation or views expressed in this

report.

Kevin Shaw, P.Eng, (403)781-2715; kshaw@wwcm.com December 15, 2010- 6

Ronald Cheung, CFA (403) 781-2718; rcheung@wwcm.com

TAG Oil Ltd.

Analyst Trading

WWCM permits analysts to own and trade in the securities and/or derivatives of

those companies under their coverage, subject to the following restrictions: no

trades can be executed in anticipation of the initiation of coverage; no trades can

be executed for five days after dissemination of launching coverage or a material

change in recommendation; and no trades can be executed against an analyst’s

recommendation. Exceptions require prior approval of the Head of Research and

can only be executed for a reason unrelated to the outlook of the stock.

Dissemination of Research

WWCM endeavors to make all reasonable efforts to provide research,

simultaneously and electronically to all eligible clients and potential clients.

Company Name Ticker Symbol Applicable Disclosure

TAG Oil Ltd. TAO-V 1,2

Applicable Disclosure Details

1) In the last 12 months, WWCM, or its affiliates, have managed or co-managed

an offering of securities by the subject issuer.

2) In the last 12 months, WWCM, or its affiliates, have received compensation

for investment banking and related services from the subject issuer.

3) The research analyst or a member of the research analyst’s household, or any

associate or individual preparing the report, has a long position in the shares

and/or the options of the subject issuer.

4) The research analyst or a member of the research’s household, or any

associate or individual preparing the report, has a short position in the shares

and/or the options of the subject issuer.

5) WWCM or its affiliates is a market maker, or is associated with the specialist

that makes a market in the securities of the subject issuer.

6) WWCM or its affiliates own more than 1% of any class of common equity of

the subject issuer.

7) WWCM has a conflict of interest with the subject issuer.

8) The research analyst(s) has a conflict of interest with the subject issuer.

9) Over the last 12 months, the research analyst has received compensation based

on a specific investment banking transaction relative to the subject issuer.

10) The research analyst or a member of the research analyst’s household serves as

a Director or Officer or Advisory Board Member of the subject issuer.

11) The research analyst(s) has viewed the material operations of the issuer.

12) A portion of the travel expenses of the analyst were paid or reimbursed by

the issuer.

Analyst Certification

Each analyst of WWCM whose name appears in this research report hereby

certifies that (i) the recommendations and opinions expressed in the research

report accurately reflect the research analyst’s personal views about any and all

of the securities or issuers discussed herein that are within the analyst’s coverage

universe and (ii) no part of the research analyst’s compensation was, is, or will

be, directly or indirectly related to the provision of specific recommendations or

views expressed by the research analyst in the research report.

Kevin Shaw, P.Eng, (403)781-2715; kshaw@wwcm.com December 15, 2010- 7

Ronald Cheung, CFA (403) 781-2718; rcheung@wwcm.com

Das könnte Ihnen auch gefallen

- Mackie Research: TAG Oil Report 12-15-10Dokument4 SeitenMackie Research: TAG Oil Report 12-15-10mpgervetNoch keine Bewertungen

- Falco Announces Positive Preliminary Economic Assessment On Horne 5 Gold ProjectDokument12 SeitenFalco Announces Positive Preliminary Economic Assessment On Horne 5 Gold ProjectrosaliaNoch keine Bewertungen

- Angela CancelledDokument4 SeitenAngela CancelledMike KrugerNoch keine Bewertungen

- FCL1102 NDokument6 SeitenFCL1102 NJeremy SussmanNoch keine Bewertungen

- Wesdome Gold Mines LTD.: Kiena PEADokument8 SeitenWesdome Gold Mines LTD.: Kiena PEAtomNoch keine Bewertungen

- Tag Oil: Speculative BuyDokument22 SeitenTag Oil: Speculative BuyKLMartensenNoch keine Bewertungen

- AC 414 814 - Exam 2 - Practice ProblemsDokument2 SeitenAC 414 814 - Exam 2 - Practice ProblemsCameron McGaffiganNoch keine Bewertungen

- TAG Initiating Coverage - 20111003 CasimirDokument17 SeitenTAG Initiating Coverage - 20111003 CasimirmpgervetNoch keine Bewertungen

- Energold Drilling - Investor PresentationDokument23 SeitenEnergold Drilling - Investor PresentationkaiselkNoch keine Bewertungen

- Bir NaDokument8 SeitenBir NaForexliveNoch keine Bewertungen

- Arrow Explo Report PDFDokument5 SeitenArrow Explo Report PDFRodrigo RodrigoNoch keine Bewertungen

- Properties Liberty 2 3607973589Dokument8 SeitenProperties Liberty 2 3607973589Jhonatan Santa Cruz ChiloNoch keine Bewertungen

- Phase 2 Infill Results Continue To Return High-Grade Over Broad Intervals With 25.3m at 14g/tDokument5 SeitenPhase 2 Infill Results Continue To Return High-Grade Over Broad Intervals With 25.3m at 14g/ttomNoch keine Bewertungen

- Navigating Volatility and Delivering An Income Growth Model: APRIL 2020Dokument35 SeitenNavigating Volatility and Delivering An Income Growth Model: APRIL 2020Libya TripoliNoch keine Bewertungen

- V1.DRAFT - NWGC Research Sales Summary - jrs.11!08!2010Dokument9 SeitenV1.DRAFT - NWGC Research Sales Summary - jrs.11!08!2010jrswitzerNoch keine Bewertungen

- Anderson Energy Announces 2010 Second Quarter Results: HighlightsDokument37 SeitenAnderson Energy Announces 2010 Second Quarter Results: Highlightsikehenderson4879Noch keine Bewertungen

- Total Raw Material CostDokument2 SeitenTotal Raw Material Costpriska jesikaNoch keine Bewertungen

- HLX 2011arDokument158 SeitenHLX 2011arMike MaguireNoch keine Bewertungen

- KEP SC Feb11Dokument6 SeitenKEP SC Feb11waimun88Noch keine Bewertungen

- Topic 5 Tutorial QuestionsDokument4 SeitenTopic 5 Tutorial QuestionshellenijieNoch keine Bewertungen

- Sandstorm Metals & Energy LTD.: SND To Acquire Oil & Gas StreamsDokument8 SeitenSandstorm Metals & Energy LTD.: SND To Acquire Oil & Gas StreamsgjervisNoch keine Bewertungen

- CVE 11jun2013 NBFDokument5 SeitenCVE 11jun2013 NBFprofit_munkeNoch keine Bewertungen

- Implementation of Wave Effects in The Unstructured Delft3D Suite FinalDokument24 SeitenImplementation of Wave Effects in The Unstructured Delft3D Suite FinalSud HaldarNoch keine Bewertungen

- ACACIA-Results For The 3 Months Ended 31 March 2019 - FINAL (1) - 1Dokument22 SeitenACACIA-Results For The 3 Months Ended 31 March 2019 - FINAL (1) - 1Baraka LetaraNoch keine Bewertungen

- Valeura PDFDokument11 SeitenValeura PDFRodrigo RodrigoNoch keine Bewertungen

- Quotes NDDokument12 SeitenQuotes NDdeni_2013Noch keine Bewertungen

- Whitecap Resources IncDokument31 SeitenWhitecap Resources IncJenny QuachNoch keine Bewertungen

- TR CapexDokument1 SeiteTR Capexrahul281081Noch keine Bewertungen

- AEM Q1 2010 ResultsDokument27 SeitenAEM Q1 2010 Resultsgbh_suryoNoch keine Bewertungen

- Ticker: CTM AU Cash 3Q20: US$27m Project: Jaguar Market Cap: A$200m Price: A$0.615/sh Country: BrazilDokument5 SeitenTicker: CTM AU Cash 3Q20: US$27m Project: Jaguar Market Cap: A$200m Price: A$0.615/sh Country: BraziltomNoch keine Bewertungen

- AKL - Kasus Chapter 4 Part 3Dokument15 SeitenAKL - Kasus Chapter 4 Part 3raqhelziuNoch keine Bewertungen

- CPG Annual Report 2011Dokument58 SeitenCPG Annual Report 2011Anonymous 2vtxh4Noch keine Bewertungen

- Mining MontecarloDokument3 SeitenMining Montecarlocajimenezb8872Noch keine Bewertungen

- FKGHDDKDokument2 SeitenFKGHDDKKennedy HarrisNoch keine Bewertungen

- Gulf Oil ExhibitsDokument20 SeitenGulf Oil Exhibitsaskpeeves1Noch keine Bewertungen

- Sales Year 1 Year 2Dokument15 SeitenSales Year 1 Year 2AHMED MOHAMED YUSUFNoch keine Bewertungen

- Initiation - Comment Seadrill Limited: Initiating Coverage of SeadrillDokument25 SeitenInitiation - Comment Seadrill Limited: Initiating Coverage of SeadrillocrandallNoch keine Bewertungen

- UntitledDokument22 SeitenUntitledWild PlatycodonNoch keine Bewertungen

- 12oct10 SembcorpMarineDokument2 Seiten12oct10 SembcorpMarineseantbtNoch keine Bewertungen

- BP Amoco BP Amoco 1997 1997 1997 1998Dokument4 SeitenBP Amoco BP Amoco 1997 1997 1997 1998Raj SharmaNoch keine Bewertungen

- Jawaban Soal Kuis MKDokument13 SeitenJawaban Soal Kuis MKzahrajonevaNoch keine Bewertungen

- K CaseDokument11 SeitenK CaseHenni RahmanNoch keine Bewertungen

- TD Q3 PreviewDokument14 SeitenTD Q3 PreviewForexliveNoch keine Bewertungen

- CH03 PPT BrighamFM1CE Analysis of Financial StatementDokument48 SeitenCH03 PPT BrighamFM1CE Analysis of Financial StatementsujonoNoch keine Bewertungen

- Action Notes: Rating/Target/Estimate ChangesDokument23 SeitenAction Notes: Rating/Target/Estimate ChangesJeff SharpNoch keine Bewertungen

- EZL Barrambie Offtake Term SheetDokument9 SeitenEZL Barrambie Offtake Term SheetjeehwanryooNoch keine Bewertungen

- WKT Lindi Definitive Feasibility Study UpdatedDokument10 SeitenWKT Lindi Definitive Feasibility Study UpdatedRob FletcherNoch keine Bewertungen

- 4334 Ton Year Treatment & Recycling Plant Financial Analysis B-1Dokument1 Seite4334 Ton Year Treatment & Recycling Plant Financial Analysis B-1meteNoch keine Bewertungen

- Questar 2 2010 FinalDokument34 SeitenQuestar 2 2010 FinalhairymoNoch keine Bewertungen

- News Release: Newmont Updates 5-Year Business Plan - 2003 Gold Reserves in Ghana Expected To Reach 10 Million OuncesDokument12 SeitenNews Release: Newmont Updates 5-Year Business Plan - 2003 Gold Reserves in Ghana Expected To Reach 10 Million OuncescobbymarkNoch keine Bewertungen

- Chevron ResultadosDokument10 SeitenChevron Resultadosrborgesdossantos37Noch keine Bewertungen

- OceanaGold Corp Dec 2009Dokument5 SeitenOceanaGold Corp Dec 2009O B Research83% (6)

- Atlantic Bundle - Group3Dokument7 SeitenAtlantic Bundle - Group3Bikasita TalukdarNoch keine Bewertungen

- Action Note: Champion Iron LTDDokument10 SeitenAction Note: Champion Iron LTDForexliveNoch keine Bewertungen

- Scoping Study Results at Cape RayDokument67 SeitenScoping Study Results at Cape RayBabacar Latgrand DioufNoch keine Bewertungen

- Commodity Investing: Maximizing Returns Through Fundamental AnalysisVon EverandCommodity Investing: Maximizing Returns Through Fundamental AnalysisNoch keine Bewertungen

- Modern Glass CharacterizationVon EverandModern Glass CharacterizationMario AffatigatoNoch keine Bewertungen

- Equity Valuation: Models from Leading Investment BanksVon EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNoch keine Bewertungen