Beruflich Dokumente

Kultur Dokumente

Use The Following Information For Nos. 1 and 2: Classroom Exercise For Financial Reporting in Hyperinflationary

Hochgeladen von

alyssaOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Use The Following Information For Nos. 1 and 2: Classroom Exercise For Financial Reporting in Hyperinflationary

Hochgeladen von

alyssaCopyright:

Verfügbare Formate

CLASSROOM EXERCISE FOR FINANCIAL REPORTING IN HYPERINFLATIONARY

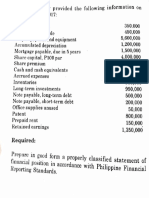

Use the following information for nos. 1 and 2

JACQUES reported the following in its statement of financial position:

Cash in bank 800,000

Accounts receivable 1,600,000

Inventory 600,000

Financial assets at fair value 200,000

Patent 400,000

Advances to employees 80,000

Advances to suppliers 160,000

Prepaid expenses 40,000

Accounts Payable 200,000

Accrued expenses 100,000

Bonds payable 600,000

Finance lease liability 800,000

Unearned revenue 60,000

Advances from customers 240,000

Estimated warranty liability 40,000

Deferred tax liability 80,000

1. If JACQUES is operating in a hyperinflationary economy, how much should be classified

as monetary assets?

2. If JACQUES is operating in a hyperinflationary economy, how much should be classified

as monetary liabilities?

3. JONES was formed on January 1, 2014. Selected balances from historical cost statement

of financial position on December 31, 2020:

Land (purchased on January 1, 2014) 1,200,000

Investment in long-term bonds (purchased on January 1, 2017) 600,000

Long term debt (issued on January 1, 2014) 800,000

The general price index was 120 on January 1, 2014, 150 on January 1, 2017 and 300 on

December 31, 2020.

What amount should be reported in a hyperinflationary statement of financial position?

4. KRABAPPEL operates in a hyperinflationary economy and has provided the following

information on December 31, 2020:

Cash 350,000

Inventory 2,700,000

Property, plant and equipment 900,000

Current liabilities 700,000

Noncurrent liabilities 500,000

Share capital 400,000

Retained earnings 2,350,000

The index number had moved on December 31 of each year: 2016 – 100; 2017 – 130;

2018 – 150; 2019 – 240 and 2020 – 300. The property, plant and equipment were

purchased on December 31, 2018 while the noncurrent liabilities were raised on

December 31, 2019. Share capital was issued on December 31, 2016. How much is the

balance of retained earnings on December 31, 2020?

5. KRUSTY reported the following historical income statement for 2020:

Sales 2,500,000

Inventory – January 1 175,000

Purchases 1,250,000

Inventory – December 31 250,000

Operating expenses 1,000,000

Depreciation 1,000,000

All items were earned and incurred evenly throughout the year except for beginning and

ending inventories which were acquired during the last week of each year. Depreciable

assets with a 5-year life were acquired on January 1, 2017. The general index numbers

were 125 on January 1, 2017; 140 on January 1, 2020 and 360 on December 31, 2020.

How much should be reported as net loss?

6. On January 1, 2017, KWAN purchased machinery for 1,200,000. The machinery was

depreciated over 10 years. On October 1, 2020, the machinery was sold for 800,000. The

general price index numbers were:

January 1, 2017 100

December 31, 2017 120

October 1, 2020 280

December 31, 2020 300

How much should be reported as loss on sale in a hyperinflationary income statement?

7. On January 1, 2020, LARGO had monetary assets of 1,500,000 and monetary liabilities

of 620,000. Sales during the year amounted to 3,900,000. Purchases and expenses

(including income tax of 585,000) amounted to 2,340,000 and 975,000 respectively. Cash

dividends of 200,000 were declared and paid on December 31, 2020. Index numbers for

2020 are 110 on January 1 and 280 on December 31. What is the gain or loss on

purchasing power for 2020?

Das könnte Ihnen auch gefallen

- Chapter 2 - Review On Financial StatementsDokument6 SeitenChapter 2 - Review On Financial StatementsLorraine Millama PurayNoch keine Bewertungen

- Financial Accounting Part 3 PDFDokument6 SeitenFinancial Accounting Part 3 PDFFiona Mirasol P. BeroyNoch keine Bewertungen

- (Cpar2016) Far-6183 (Statement of Financial Position and Comprehensive Income)Dokument2 Seiten(Cpar2016) Far-6183 (Statement of Financial Position and Comprehensive Income)Irene ArantxaNoch keine Bewertungen

- Statement of Financial Position Basic Problems Problem 1-1 (IFRS)Dokument7 SeitenStatement of Financial Position Basic Problems Problem 1-1 (IFRS)Corina Mamaradlo CaragayNoch keine Bewertungen

- 150.curren and Non Current Assets and Liabilities 2Dokument3 Seiten150.curren and Non Current Assets and Liabilities 2Melanie SamsonaNoch keine Bewertungen

- Assignment 1 Statement of Financial Position-Compressed - Compressed - Compressed-Min-CompressedDokument10 SeitenAssignment 1 Statement of Financial Position-Compressed - Compressed - Compressed-Min-CompressedJason MablesNoch keine Bewertungen

- 6727 Statement of Financial PositionDokument3 Seiten6727 Statement of Financial PositionJane ValenciaNoch keine Bewertungen

- P1 Cash FlowDokument2 SeitenP1 Cash FlowBeth Diaz LaurenteNoch keine Bewertungen

- AsdasdDokument3 SeitenAsdasdMark Domingo MendozaNoch keine Bewertungen

- SOFP-mcq ProblemsDokument4 SeitenSOFP-mcq Problemschey dabest100% (1)

- Review - SFP To Interim ReportingDokument3 SeitenReview - SFP To Interim ReportingAna Marie IllutNoch keine Bewertungen

- ACC203 - AssignmentDokument2 SeitenACC203 - AssignmentHailsey WinterNoch keine Bewertungen

- Corporate Finance Practice Problems: Jeter Corporation Income Statement For The Year Ended 31, 2001Dokument9 SeitenCorporate Finance Practice Problems: Jeter Corporation Income Statement For The Year Ended 31, 2001Eunice NanaNoch keine Bewertungen

- Sanchez Activity2.2Dokument5 SeitenSanchez Activity2.2Carmina SanchezNoch keine Bewertungen

- December-12Dokument3 SeitenDecember-12Kathleen MarcialNoch keine Bewertungen

- 2, Questions and Answers 2, Questions and AnswersDokument35 Seiten2, Questions and Answers 2, Questions and AnswersCarlos John Talania 1923Noch keine Bewertungen

- Chapter 05 - AnswerDokument2 SeitenChapter 05 - Answerlouise carino100% (1)

- Practical Accounting 1 ValixDokument277 SeitenPractical Accounting 1 ValixyzaNoch keine Bewertungen

- Afar 107 - Business Combination Part 2Dokument4 SeitenAfar 107 - Business Combination Part 2Maria LopezNoch keine Bewertungen

- Problem Solving Updates in Philippine Accounting and Financial Reporting StandardsDokument5 SeitenProblem Solving Updates in Philippine Accounting and Financial Reporting StandardsgnlynNoch keine Bewertungen

- Ia3 Prelim Exam - Set ADokument11 SeitenIa3 Prelim Exam - Set AClara MacallingNoch keine Bewertungen

- Chapter 2 Hyperinflation LectureDokument4 SeitenChapter 2 Hyperinflation LectureChristine SondonNoch keine Bewertungen

- Business Combination Accounted For Under The Equity MethodDokument4 SeitenBusiness Combination Accounted For Under The Equity MethodMixx MineNoch keine Bewertungen

- Ia3 Prelim Exam - Set ADokument11 SeitenIa3 Prelim Exam - Set AClara MacallingNoch keine Bewertungen

- Comprehensive Quiz No. 007-Hyperinflation Current Cost Acctg - GROUP-3Dokument4 SeitenComprehensive Quiz No. 007-Hyperinflation Current Cost Acctg - GROUP-3Jericho VillalonNoch keine Bewertungen

- FFS - NumericalsDokument5 SeitenFFS - NumericalsFunny ManNoch keine Bewertungen

- Practice Comptency Exam 124Dokument3 SeitenPractice Comptency Exam 124Ivan Pacificar BioreNoch keine Bewertungen

- GPV & SCF (Assignment)Dokument16 SeitenGPV & SCF (Assignment)Mica Moreen GuillermoNoch keine Bewertungen

- Quiz - Consolidated FS Part 2Dokument3 SeitenQuiz - Consolidated FS Part 2skyieNoch keine Bewertungen

- PDF Chapter 2 CompressDokument33 SeitenPDF Chapter 2 CompressRonel GaviolaNoch keine Bewertungen

- Acctg 102 Prelim Exam With SolutionsDokument12 SeitenAcctg 102 Prelim Exam With SolutionsYsabel ApostolNoch keine Bewertungen

- Acc 102Dokument3 SeitenAcc 102Ike UzuNoch keine Bewertungen

- Jan. 1, 20x1 Abc Co. XYZ, Inc.: Total Assets 670,000 160,000Dokument5 SeitenJan. 1, 20x1 Abc Co. XYZ, Inc.: Total Assets 670,000 160,000Nathaniel IgotNoch keine Bewertungen

- P1 QuestionsDokument31 SeitenP1 QuestionsWillen Christia M. MadulidNoch keine Bewertungen

- Cash Accrual Practice SetDokument2 SeitenCash Accrual Practice SetMa. Trixcy De VeraNoch keine Bewertungen

- Case 1.: Additional InformationDokument3 SeitenCase 1.: Additional InformationPearl Jade YecyecNoch keine Bewertungen

- Summative Assessment Test 1-APPLIED AUDITDokument5 SeitenSummative Assessment Test 1-APPLIED AUDITChristine Rey RocoNoch keine Bewertungen

- 162 PresummativeDokument5 Seiten162 PresummativeMeichigo SwadeeNoch keine Bewertungen

- Financial Acctg & Reporting 1 - CASE ANALYSIS SUMMARYDokument23 SeitenFinancial Acctg & Reporting 1 - CASE ANALYSIS SUMMARYJaquelyn ClataNoch keine Bewertungen

- (LAB) Activity - Preparation of Financial Statements Using SpreadsheetDokument3 Seiten(LAB) Activity - Preparation of Financial Statements Using SpreadsheetJUVEN LOGAGAY0% (1)

- DIFFICULTDokument7 SeitenDIFFICULTQueen ValleNoch keine Bewertungen

- Quiz - SFP With AnswersDokument4 SeitenQuiz - SFP With Answersjanus lopezNoch keine Bewertungen

- 2.1.1 Statement of Financial PositionDokument5 Seiten2.1.1 Statement of Financial Positionjoint accountNoch keine Bewertungen

- Service BusinessDokument12 SeitenService BusinessRemalyn AmmakNoch keine Bewertungen

- Buscom DiscussionDokument3 SeitenBuscom DiscussionLorie Grace LagunaNoch keine Bewertungen

- Problem #1: Adjusting EntriesDokument5 SeitenProblem #1: Adjusting EntriesShahzad AsifNoch keine Bewertungen

- A. 1a Problem 4Dokument1 SeiteA. 1a Problem 4shuzoNoch keine Bewertungen

- CSTUDY Jul22 BBAHONS AFM8 Final 20221205090450Dokument8 SeitenCSTUDY Jul22 BBAHONS AFM8 Final 20221205090450Melokuhle MhlongoNoch keine Bewertungen

- Activity Part 1 Prepartion of Financial StatementsDokument4 SeitenActivity Part 1 Prepartion of Financial Statementsjrmsu-3Noch keine Bewertungen

- Cannon Ball Review With Exercises PART 1Dokument11 SeitenCannon Ball Review With Exercises PART 1Genelyn Langote100% (1)

- 5 6294322980864393322Dokument10 Seiten5 6294322980864393322CharlesNoch keine Bewertungen

- Intermediate Accounting 3 Second Grading Quiz: Name: Date: Professor: Section: ScoreDokument2 SeitenIntermediate Accounting 3 Second Grading Quiz: Name: Date: Professor: Section: ScoreGrezel NiceNoch keine Bewertungen

- PT 4&5 PDFDokument3 SeitenPT 4&5 PDFADRIAN ALDRIEZ NICDAONoch keine Bewertungen

- ACC124 ReviewerDokument22 SeitenACC124 Reviewermarites yuNoch keine Bewertungen

- Statement of Financial PositionDokument3 SeitenStatement of Financial Positionlyka0% (1)

- Chapter 1Dokument20 SeitenChapter 1Coursehero PremiumNoch keine Bewertungen

- Business Combination-Intercompany Sale of InventoriesDokument2 SeitenBusiness Combination-Intercompany Sale of InventoriesMixx MineNoch keine Bewertungen

- 162 003Dokument5 Seiten162 003Alvin John San Juan33% (3)

- Accounting for Real Estate Transactions: A Guide For Public Accountants and Corporate Financial ProfessionalsVon EverandAccounting for Real Estate Transactions: A Guide For Public Accountants and Corporate Financial ProfessionalsNoch keine Bewertungen

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionVon EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNoch keine Bewertungen

- Chapter 6 - EntrepreneurshipDokument21 SeitenChapter 6 - EntrepreneurshipalyssaNoch keine Bewertungen

- Republic of The Philippines Court of Tax Appeals Quezon CityDokument27 SeitenRepublic of The Philippines Court of Tax Appeals Quezon CityalyssaNoch keine Bewertungen

- AudTheo Salosagcol 2018ed Ansv1Dokument13 SeitenAudTheo Salosagcol 2018ed Ansv1alyssaNoch keine Bewertungen

- Cta Eb CV 01024 M 2016mar09 AssDokument9 SeitenCta Eb CV 01024 M 2016mar09 AssalyssaNoch keine Bewertungen

- Republic of The Philippines Court of Tax Appeals Quezon CityDokument19 SeitenRepublic of The Philippines Court of Tax Appeals Quezon CityalyssaNoch keine Bewertungen

- Republic of The Philippines Court of Tax Appeals Quezon CityDokument31 SeitenRepublic of The Philippines Court of Tax Appeals Quezon CityalyssaNoch keine Bewertungen

- Republic of Philippines Court of Tax Appeals Quezon City: Archipelago Motor No. 1258Dokument12 SeitenRepublic of Philippines Court of Tax Appeals Quezon City: Archipelago Motor No. 1258alyssaNoch keine Bewertungen

- Court Oft Ax Appeals: en BaneDokument6 SeitenCourt Oft Ax Appeals: en BanealyssaNoch keine Bewertungen

- Enbanc: Republic of The Philippines Court of Tax Appeals QuezonDokument5 SeitenEnbanc: Republic of The Philippines Court of Tax Appeals QuezonalyssaNoch keine Bewertungen

- Enbanc: Republic of The Philippines Court of Tax Appeals Quezon CityDokument10 SeitenEnbanc: Republic of The Philippines Court of Tax Appeals Quezon CityalyssaNoch keine Bewertungen

- Deductions From Gross IncomeDokument10 SeitenDeductions From Gross IncomewezaNoch keine Bewertungen

- As Handwritten Summary CA Avinash SamchetiDokument24 SeitenAs Handwritten Summary CA Avinash Samchetianshuno247Noch keine Bewertungen

- NikecaseDokument13 SeitenNikecaseecoditaNoch keine Bewertungen

- Quiz 1&2 - IiDokument29 SeitenQuiz 1&2 - IiJenz Crisha PazNoch keine Bewertungen

- Q: No: 45 (KAPLAN) Hapsburg Consolidated Statement of Financial Position: - Non - Current AssetsDokument4 SeitenQ: No: 45 (KAPLAN) Hapsburg Consolidated Statement of Financial Position: - Non - Current AssetszarimanufacturingNoch keine Bewertungen

- MWG Annual Report 2020 5Dokument143 SeitenMWG Annual Report 2020 5Ngọc NguyễnNoch keine Bewertungen

- Mle02 Far 1 Answer KeyDokument9 SeitenMle02 Far 1 Answer KeyCarNoch keine Bewertungen

- Quiz Feedback - Coursera Week 4 Intro To FinanceDokument7 SeitenQuiz Feedback - Coursera Week 4 Intro To FinanceVictoriaLukyanova0% (1)

- Practical Accounting 1 With AnswersDokument10 SeitenPractical Accounting 1 With Answerslibraolrack50% (8)

- BU127 Midterm 2 Winter 2017 Final Version Including SolutionsDokument10 SeitenBU127 Midterm 2 Winter 2017 Final Version Including SolutionsAdams BruinsNoch keine Bewertungen

- Trans-Asia Petroleum CorpDokument21 SeitenTrans-Asia Petroleum CorpSherillyn BardoquilloNoch keine Bewertungen

- The Value of Common Stocks: Principles of Corporate FinanceDokument43 SeitenThe Value of Common Stocks: Principles of Corporate FinanceMakar FilchenkoNoch keine Bewertungen

- 2017-12 ICMAB FL 001 PAC Year Question December 2017Dokument3 Seiten2017-12 ICMAB FL 001 PAC Year Question December 2017Mohammad ShahidNoch keine Bewertungen

- Home Office and Branch Accounting Special ProceduresDokument17 SeitenHome Office and Branch Accounting Special ProceduresOrnica BalesNoch keine Bewertungen

- Unit 3 Cost of CapitalDokument41 SeitenUnit 3 Cost of CapitalVïñü MNNoch keine Bewertungen

- ForewordDokument10 SeitenForewordhuihihiNoch keine Bewertungen

- Question 1. Grizzlies Inc. Was Organized On January 2, 2021, With Authorized Capital Stock of 50,000Dokument5 SeitenQuestion 1. Grizzlies Inc. Was Organized On January 2, 2021, With Authorized Capital Stock of 50,000lois martinNoch keine Bewertungen

- IND AS 7 Cash Flow Statement by Rahul MalkanDokument13 SeitenIND AS 7 Cash Flow Statement by Rahul Malkanvishwas jagrawalNoch keine Bewertungen

- Market-Based Valuation: Price MultiplesDokument28 SeitenMarket-Based Valuation: Price MultiplesShaikh Saifullah KhalidNoch keine Bewertungen

- JPM MCPDokument11 SeitenJPM MCPmmmansfiNoch keine Bewertungen

- Screenshot 2023-08-27 at 11.56.55 AMDokument34 SeitenScreenshot 2023-08-27 at 11.56.55 AMShajid HassanNoch keine Bewertungen

- Globo PLC H1 2015 ReportDokument20 SeitenGlobo PLC H1 2015 Reportjenkins-sacadonaNoch keine Bewertungen

- 12 Accountancy CBSE Exam Papers 2018 Comptt All India Set 1Dokument24 Seiten12 Accountancy CBSE Exam Papers 2018 Comptt All India Set 1SundayNoch keine Bewertungen

- Advanced Accounts 1 PDFDokument304 SeitenAdvanced Accounts 1 PDFJohn Louie NunezNoch keine Bewertungen

- CVP LectureDokument9 SeitenCVP Lecturejohanna mapilotNoch keine Bewertungen

- Chapter 12Dokument17 SeitenChapter 12khae123Noch keine Bewertungen

- Sample OTsDokument5 SeitenSample OTsVishnu ArvindNoch keine Bewertungen

- Mrs.V.Madhu Latha: Assistant Professor Department of Business Management VR Siddhartha Engineering CollegeDokument14 SeitenMrs.V.Madhu Latha: Assistant Professor Department of Business Management VR Siddhartha Engineering CollegesushmaNoch keine Bewertungen

- Financial Statement AnalysisDokument34 SeitenFinancial Statement AnalysisanshumanNoch keine Bewertungen

- Introduction To Management AccountingDokument33 SeitenIntroduction To Management Accountinghemanth20032001Noch keine Bewertungen