Beruflich Dokumente

Kultur Dokumente

McCrae Dowless Social Security Fraud Indictment

Hochgeladen von

Brandon WissbaumOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

McCrae Dowless Social Security Fraud Indictment

Hochgeladen von

Brandon WissbaumCopyright:

Verfügbare Formate

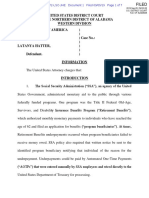

FILED IN OPEN COURT

ON y--,-~ 6(Ut--

Peter A. Moore, Jr., Clerk

US District Court

Eastern District of NC

UNITED STATES DISTRICT COURT

FOR THE EASTERN DISTRICT OF NORTH CAROLINA

SOUTHERN DIVISION

NO. 7·.1,0--(12-5~--I B0(3)

UNITED STATES OF AMERICA )

.)

V. ) INDICTMENT

)

LESLIE MCCRAE DOWLESS JR. )

The Grand Jury charges:

INTRODUCTION

At all times relevant to this Indictment:

1. The Social Security Administration ("SSA''), an agency of the United

States Government, administered monetary aid to the public through various

federally funded programs. One program was the Title XVI Supplemental Security

Income program ("SSI"), which authorized monthly monetary payments to

individuals who were 65 years or older, blind, or disabled, and who met certain

limited income and resource criteria. The a~ount paid to each SSI recipient

depended on how much other income the individual received, among other things.

From 2013 onward, SSI recipients could own up to $2,000.00 in resources, including

cash, bank accounts, life insurance, savings bonds, automobiles, and other property.

SSI recipients who received benefits based upon a disability were required to

periodically complete redetermination forms to review the status of the recipient's

medical condition. SSA required SSI recipients to report any changes in their status,

Case 7:20-cr-00053-BO Document 1 Filed 04/07/20 Page 1 of 8

including any work activity and improvements in their medical condition, within ten

days after the month the change occurred.

2. SSA also managed the Title II Retirement Insurance Benefits program

("RIB"), which authorized monthly monetary payments to eligible retired workers

and their eligible dependents ("program beneficiaries"). RIB was payable to an

individual age 62 or over who met the earnings requirement to be fully insured. Its

purpose was to replace part of the earnings lost due to retirement. Once awarded,

several factors could impact the amount of RIB payments program beneficiaries

received during a given time period. For example, increased earnings, pension

payments, and changes in marital status could trigger a recalculation of the monthly

RIB payment. SSA required program beneficiaries to report any of the listed changes

to the agency as soon as possible. Program beneficiaries were permitted to work while

receiving RIB but any earnings above the annual limit often resulted in a reduction

of RIB payments. In 2018, the annual earnings limit was approximately $17,040.00.

3. On or about February 12, 2013, the Defendant, LESLIE MCCRAE

DOWLESS JR. ("DOWLESS"), applied for SSI citing a disabling condition with a

December 27, 2012 onset date. SSA approved DOWLESS for SSI benefits on or about

April 30, 2013, based upon his alleged disability.

4. On or about April 18, 2014, SSA notified DOWLESS it overpaid him

$5,217.68 in SSI benefits because DOWLESS received $5,258.00 in wages and

unearned income between January and February 2014. The money made DOWLESS

Case 7:20-cr-00053-BO Document 1 Filed 04/07/20 Page 2 of 8

ineligible for the SSI payments he received during that time period.

5. On or about November 16, 2016, DOWLESS completed a SSI

redetermination form claiming he remained disabled and did not receive income

beyond his SSI benefits. SSA continued to pay DOWLESS SSI benefits until in or

around November 2018.

6. On or about July 2, 2018, DOWLESS applied for RIB at the age of 62.

In that application, DOWLESS stated he did not expect to work in 2018 and had not

worked in the two years prior to his application. SSA approved DOWLESS for RIB

on or about July 7, 2018.

7. Unbeknownst to SSA, DOWLESS worked for at least two candidates

and their campaigns during the 2018 Midterm Election. Specifically, between in or

around April 2017, and in or around May 2017, DOWLESS received approximately

$3,300.00 in payments for his work. Between in or around August 2017, and in or

around November 2018, DOWLESS received approximately $132,365.57 in

payments. DOWLESS failed to report his work activ1ty and income to SSA. At the

time DOWLESS applied for RIB, he had received approximately $63,984.57 m

payments between in or around January 2018, and in or around June 2018.

8. Because it was not aware of DOWLESS's ongoing work activity, SSA

issued approximately $8,599.10 in SSI payments to DOWLESS between in or around

March 2017, and in or around June 2018, when those payments were not authorized.

SSA also issued approximately $5,604.00 in RIB payments to DOWLESS between in

Case 7:20-cr-00053-BO Document 1 Filed 04/07/20 Page 3 of 8

or around July 2018, and in or around November 2018. In total, SSA tendered

approximately $14,203.10 in unauthorized payments.

COUNT ONE

9. From in or around March 2017, and continuing until in or around

November 2018, in the Eastern District of North Carolina and elsewhere, the

Defendant, LESLIE MCCRAE DOWLESS JR., did knowingly, intentionally and

willfully embezzle, steal, purloin and convert to his own use and the use of another,

on a recurring basis, money belonging to the United States exceeding the sum of

$1,000, to which he knew he was not entitled, namely, Social Security Title XVI

Supplemental Security Income, and Title II Retirement Insurance Benefits

payments issued to DOWLESS, in violation of Title 18, United States Code, Section

641.

COUNT TWO

10. Paragraphs 1 through 8 are re-alleged and incorporated here as though

fully set forth in this count.

11. From in or around March 2017, and continuing until in or around June

2018, in the Eastern District of North Carolina and elsewhere, the Defendant,

LESLIE MCCRAE DOWLESS JR., in a matter within the jurisdiction of the Social

Security Administration, having knowledge, of the occurrence of an event affecting his

initial and continued right to Supplemental Security Income Benefits; concealed and

failed to disclose such an event with the intent to fraudulently secure payment when

Case 7:20-cr-00053-BO Document 1 Filed 04/07/20 Page 4 of 8

no payment was authorized. Specifically, the defendant, LESLIE MCCRAE

DOWLESS JR., intentionally concealed his work and earnings from the Social

Security Administration knowing that it would affect the Social Security

Administration's ability to properly evaluate his entitlement to benefits, in violation

of Title 42, United States Code, Section 1383a(a)(3).

COUNT THREE

12. Paragraphs 1 through 8 are re-alleged and incorporated here as though

fully set forth in this count.

13. From in or around July 2018, and continuing until in or around

November 2018, in the Eastern District of North Carolina and elsewhere, the

Defendant, LESLIE MCCRAE DOWLESS JR., in a matter within the jurisdiction of

the Social Security Administration, having knowledge of the occurrence of an event

affecting his initial or continued right of payment under Subchapter II of Title 42,

United States Code, did conceal and fail to disclose said event with an intent

fraudulently to secure payment in a greater amount than was due and when no

payment was authorized. Specifically, the Defendant, LESLIE MCCRAE DOWLESS

JR., concealed his work activity and related earnings in order to receive Social

Security Title II Retirement Insurance Benefits payments to which he was not

entitled, in violation of Title 42, United States Code, Section 408(a)(4).

(REMAINDER OF PAGE LEFT BLANK INTENTIONALLY)

Case 7:20-cr-00053-BO Document 1 Filed 04/07/20 Page 5 of 8

COUNT FOUR

14. Paragraphs 1 through 8 are re-alleged and incorporated here as though

fully set forth in this count.

15. On or about July 2, 2018, in the Eastern District of North Carolina and

elsewhere, the Defendant, LESLIE MCCRAE DOWLESS JR., did knowingly and

willfully make materially false, fictitious, and fraudulent statements and

representations in his Retirement Insurance Benefits Application, a matter within

the jurisdiction of the Executive Branch of the Government of the United States, by

falsely representing he was not working at the time of his application, did not expect

to work t~e year of his application, and had not worked in the two years prior to his

application, when in fact he knew that he had been employed since in or around

March 2017, in violation of Title 18, United States Code, Section 1001.

(REMAINDER OF PAGE LEFT BLANK INTENTIONALLY)

Case 7:20-cr-00053-BO Document 1 Filed 04/07/20 Page 6 of 8

FORFEITURE NOTICE

The Defendant is hereby given notice that all of the Defendant's interest in all

property specified herein is subject to forfeiture.

Upon convict1on of the offense set forth in Count One of this Indictment, the

Defendant shall forfeit to the United States, pursuant to Title 18, United States Code,

Section 981(a)(l)(C), as made applicable by 28 United States Code, Section 2461(c),

any. property, real or personal, constituting, or derived from, proceeds traceable to

such violation.

The forfeitable property includes, but is not limited to, the gross proceeds of

the offense described above actually obtained by the Defendant in the amount of at

least fourteen thousand, two hundred and three dollars, and ten cents ($14,203.10)

in U.S. currency.

If any of the above-described forfeitable property, as a result of any act or

omission of the Defendant,

(1) cannot be located upon the exercise of due diligence;

(2) has been transferred or sold to, or deposited with, a third person;

(3) has been placed beyond the jurisdiction of the court;

(4) has been substantially diminished in value; or

Case 7:20-cr-00053-BO Document 1 Filed 04/07/20 Page 7 of 8

(5) has been commingled with other property which cannot be subdivided

without difficulty;

it is the intent of the United States, pursuant t9 Title 21, United States Code, Section

853(p), to seek forfeiture of any other property of said Defendant up to the value of

the above forfeitable property.

A TRUE BILL

I

,c----~d

DATE

ROBERT J. HIGDON, JR.

United States Attorney

Special Assistant United States ttorney

Case 7:20-cr-00053-BO Document 1 Filed 04/07/20 Page 8 of 8

Das könnte Ihnen auch gefallen

- N0 SSN For BAnk AccountDokument6 SeitenN0 SSN For BAnk AccountColton Robert100% (14)

- Seven Crucial Components of a Well Designed I.U.L. (Indexed Universal Life)Von EverandSeven Crucial Components of a Well Designed I.U.L. (Indexed Universal Life)Noch keine Bewertungen

- Federal OffsetDokument6 SeitenFederal OffsetDavid Dienamik100% (2)

- Kelli Prather ComplaintDokument16 SeitenKelli Prather ComplaintSherry Turco CoolidgeNoch keine Bewertungen

- Form Quit Social SecurityDokument2 SeitenForm Quit Social SecurityAkil Bey50% (2)

- Verification Handbook For Investigative ReportingDokument79 SeitenVerification Handbook For Investigative ReportingRBeaudryCCLE100% (2)

- Obtaining A Criminal Pardon: Clear Your Name LegallyVon EverandObtaining A Criminal Pardon: Clear Your Name LegallyNoch keine Bewertungen

- Amended Complaint Against US State Dept For Unconstitutional Passport RevocationDokument12 SeitenAmended Complaint Against US State Dept For Unconstitutional Passport RevocationJeff MaehrNoch keine Bewertungen

- Advacc 2 Chapter 1 ProblemsDokument5 SeitenAdvacc 2 Chapter 1 ProblemsClint-Daniel Abenoja100% (1)

- Face Reading NotesDokument8 SeitenFace Reading NotesNabeel TirmaziNoch keine Bewertungen

- Service Industries LimitedDokument48 SeitenService Industries Limitedmuhammadtaimoorkhan86% (7)

- Winter ParkDokument7 SeitenWinter Parksadafkhan210% (1)

- RavsolovetichikyomhaatzmautDokument61 SeitenRavsolovetichikyomhaatzmautHirshel TzigNoch keine Bewertungen

- Abraham Et Al. COVID Fraud ComplaintDokument16 SeitenAbraham Et Al. COVID Fraud ComplaintMatt TroutmanNoch keine Bewertungen

- 30 Soc - Sec.rep - Ser. 3, Unempl - Ins.rep. CCH 15458a Sam Mazza v. Secretary of Department of Health and Human Services of The United States, 903 F.2d 953, 3rd Cir. (1990)Dokument12 Seiten30 Soc - Sec.rep - Ser. 3, Unempl - Ins.rep. CCH 15458a Sam Mazza v. Secretary of Department of Health and Human Services of The United States, 903 F.2d 953, 3rd Cir. (1990)Scribd Government DocsNoch keine Bewertungen

- Hatter 1Dokument7 SeitenHatter 1jafranklin-1Noch keine Bewertungen

- 22A444Dokument42 Seiten22A444Chris GeidnerNoch keine Bewertungen

- United States Court of Appeals, Tenth CircuitDokument9 SeitenUnited States Court of Appeals, Tenth CircuitScribd Government DocsNoch keine Bewertungen

- Ssa Senate LetterDokument2 SeitenSsa Senate LetterBoston 25 DeskNoch keine Bewertungen

- Fotfb Ak Div: United States Bankruptcy CourtDokument2 SeitenFotfb Ak Div: United States Bankruptcy CourtGreatGreyNoch keine Bewertungen

- David T. Mason v. Francis D. Degeorge, 483 F.2d 521, 4th Cir. (1973)Dokument5 SeitenDavid T. Mason v. Francis D. Degeorge, 483 F.2d 521, 4th Cir. (1973)Scribd Government DocsNoch keine Bewertungen

- UST - WY v. United States Bankruptcy Court For The District of Wyoming - Cheyenne, 10th Cir. BAP (2014)Dokument19 SeitenUST - WY v. United States Bankruptcy Court For The District of Wyoming - Cheyenne, 10th Cir. BAP (2014)Scribd Government DocsNoch keine Bewertungen

- Richard Center v. Richard Schweiker, Secretary of Health and Human Services, 704 F.2d 678, 2d Cir. (1983)Dokument4 SeitenRichard Center v. Richard Schweiker, Secretary of Health and Human Services, 704 F.2d 678, 2d Cir. (1983)Scribd Government DocsNoch keine Bewertungen

- Not PrecedentialDokument5 SeitenNot PrecedentialScribd Government DocsNoch keine Bewertungen

- Accretive Health's Motion To Dismiss Complaint Filed by Minnesota Attorney GeneralDokument6 SeitenAccretive Health's Motion To Dismiss Complaint Filed by Minnesota Attorney GeneralMatthew KeysNoch keine Bewertungen

- Httpslaw - Loyno.edusitesdefaultfilessocial - Security - PDF 22Dokument44 SeitenHttpslaw - Loyno.edusitesdefaultfilessocial - Security - PDF 22Adrienne BrownNoch keine Bewertungen

- UnpublishedDokument11 SeitenUnpublishedScribd Government DocsNoch keine Bewertungen

- Not PrecedentialDokument7 SeitenNot PrecedentialScribd Government DocsNoch keine Bewertungen

- Kriss Mangum, On Behalf of Herself and All Others Similarly Situated v. Anthony Mitchell, Director of The Utah Department of Social Services, 638 F.2d 203, 10th Cir. (1980)Dokument5 SeitenKriss Mangum, On Behalf of Herself and All Others Similarly Situated v. Anthony Mitchell, Director of The Utah Department of Social Services, 638 F.2d 203, 10th Cir. (1980)Scribd Government DocsNoch keine Bewertungen

- Valdez v. Duran, 10th Cir. (2012)Dokument32 SeitenValdez v. Duran, 10th Cir. (2012)Scribd Government DocsNoch keine Bewertungen

- Indictment Against Scott BeardDokument11 SeitenIndictment Against Scott BeardKGW NewsNoch keine Bewertungen

- United States Court of Appeals, Third CircuitDokument11 SeitenUnited States Court of Appeals, Third CircuitScribd Government DocsNoch keine Bewertungen

- United States Bankruptcy Court Southern District of FloridaDokument3 SeitenUnited States Bankruptcy Court Southern District of FloridaMy-Acts Of-SeditionNoch keine Bewertungen

- Scherwitz V Beane ComplaintDokument10 SeitenScherwitz V Beane ComplaintAnonymous 3cOviHTinNoch keine Bewertungen

- United States Court of Appeals, Ninth CircuitDokument16 SeitenUnited States Court of Appeals, Ninth CircuitScribd Government DocsNoch keine Bewertungen

- United States Court of Appeals, Second Circuit.: No. 9, Docket 81-6257Dokument6 SeitenUnited States Court of Appeals, Second Circuit.: No. 9, Docket 81-6257Scribd Government DocsNoch keine Bewertungen

- Ralph Sincavage InformationDokument5 SeitenRalph Sincavage InformationWashington ExaminerNoch keine Bewertungen

- Austin Hsu Complaint On COVID-related FraudDokument15 SeitenAustin Hsu Complaint On COVID-related FraudGeekWireNoch keine Bewertungen

- Federal Indictment of Robbie Rossi For Mail FraudDokument4 SeitenFederal Indictment of Robbie Rossi For Mail FraudPatrick JohnsonNoch keine Bewertungen

- Nicole Smith - Sentencing Memo PDFDokument14 SeitenNicole Smith - Sentencing Memo PDFsarah_larimerNoch keine Bewertungen

- United States Court of Appeals, Tenth CircuitDokument12 SeitenUnited States Court of Appeals, Tenth CircuitScribd Government DocsNoch keine Bewertungen

- United States Court of Appeals, Tenth CircuitDokument12 SeitenUnited States Court of Appeals, Tenth CircuitScribd Government DocsNoch keine Bewertungen

- United States Court of Appeals, Third CircuitDokument40 SeitenUnited States Court of Appeals, Third CircuitScribd Government DocsNoch keine Bewertungen

- Brannon v. McMaster - SC Supreme Court OpinionDokument4 SeitenBrannon v. McMaster - SC Supreme Court OpinionWMBF NewsNoch keine Bewertungen

- Santos, George - GJ ChargesDokument20 SeitenSantos, George - GJ ChargesJessica A. BotelhoNoch keine Bewertungen

- Complaint Against Isaac SoferDokument10 SeitenComplaint Against Isaac SoferDNAinfoNewYorkNoch keine Bewertungen

- Fleyshmakher ComplaintDokument6 SeitenFleyshmakher ComplaintAndrew FordNoch keine Bewertungen

- Star GellDokument15 SeitenStar GellwashlawdailyNoch keine Bewertungen

- (P) Decree (DuMonte) (F)Dokument8 Seiten(P) Decree (DuMonte) (F)HUGO GALVANerdNoch keine Bewertungen

- Rusert Court FilingDokument6 SeitenRusert Court FilingAustin FranklinNoch keine Bewertungen

- United States v. Jersey Shore State Bank, 781 F.2d 974, 3rd Cir. (1986)Dokument16 SeitenUnited States v. Jersey Shore State Bank, 781 F.2d 974, 3rd Cir. (1986)Scribd Government DocsNoch keine Bewertungen

- PrecedentialDokument23 SeitenPrecedentialScribd Government DocsNoch keine Bewertungen

- Texas v. US (N.D. TX)Dokument62 SeitenTexas v. US (N.D. TX)joshblackmanNoch keine Bewertungen

- Muscogee (Creek) Nation v. HUD, 10th Cir. (2012)Dokument14 SeitenMuscogee (Creek) Nation v. HUD, 10th Cir. (2012)Scribd Government DocsNoch keine Bewertungen

- The United State of America vs. James Dadoun Criminal Complaint, Nov. 15, 2023Dokument11 SeitenThe United State of America vs. James Dadoun Criminal Complaint, Nov. 15, 2023David CaplanNoch keine Bewertungen

- Ssa 789Dokument4 SeitenSsa 789lucyNoch keine Bewertungen

- C. v. NM Human Services, 10th Cir. (2006)Dokument5 SeitenC. v. NM Human Services, 10th Cir. (2006)Scribd Government DocsNoch keine Bewertungen

- Guerrero V CDCR, State Personnel BoardDokument19 SeitenGuerrero V CDCR, State Personnel Boardjon_ortiz100% (1)

- Tony W. Strickland v. Richard T. Alexander, 11th Cir. (2014)Dokument28 SeitenTony W. Strickland v. Richard T. Alexander, 11th Cir. (2014)Scribd Government DocsNoch keine Bewertungen

- Description: Tags: FP0606PUBDokument3 SeitenDescription: Tags: FP0606PUBanon-129030Noch keine Bewertungen

- Garcia POC Including Note 1 - No EndorsementDokument31 SeitenGarcia POC Including Note 1 - No EndorsementAC FieldNoch keine Bewertungen

- Federal Prosecutors' Sentencing Memo in Case of Kwame R. Brown, Former D.C. Council ChairmanDokument6 SeitenFederal Prosecutors' Sentencing Memo in Case of Kwame R. Brown, Former D.C. Council ChairmanDel WilberNoch keine Bewertungen

- IN BAD FAITH: The Republican Plan to Destroy Social SecurityVon EverandIN BAD FAITH: The Republican Plan to Destroy Social SecurityNoch keine Bewertungen

- U.S. v. Sun Myung Moon 532 F.Supp. 1360 (1982)Von EverandU.S. v. Sun Myung Moon 532 F.Supp. 1360 (1982)Noch keine Bewertungen

- DA Ben David's Letter To Chief WilliamsDokument4 SeitenDA Ben David's Letter To Chief WilliamsBrandon WissbaumNoch keine Bewertungen

- Signed UNCW, Mike Adams SettlementDokument6 SeitenSigned UNCW, Mike Adams SettlementBrandon WissbaumNoch keine Bewertungen

- Rep. Dixon Email To Sec. CohenDokument2 SeitenRep. Dixon Email To Sec. CohenBrandon WissbaumNoch keine Bewertungen

- Use of Net Transaction Proceeds Related To NHRMC's Potential PartnershipDokument5 SeitenUse of Net Transaction Proceeds Related To NHRMC's Potential PartnershipBrandon WissbaumNoch keine Bewertungen

- UNCW Ethics PolicyDokument6 SeitenUNCW Ethics PolicyBrandon WissbaumNoch keine Bewertungen

- UNCW Student Lawsuit Over COVID-19 Tuition RefundsDokument24 SeitenUNCW Student Lawsuit Over COVID-19 Tuition RefundsBrandon WissbaumNoch keine Bewertungen

- UNCW Policy: Verification of CredentialsDokument4 SeitenUNCW Policy: Verification of CredentialsBrandon WissbaumNoch keine Bewertungen

- Vita Mike S. AdamsDokument6 SeitenVita Mike S. AdamsBrandon WissbaumNoch keine Bewertungen

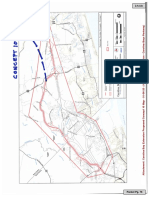

- Carolina Beach Parking LotsDokument1 SeiteCarolina Beach Parking LotsBrandon WissbaumNoch keine Bewertungen

- Internal Documents From WPD's Investigation Into Officers' CommentsDokument17 SeitenInternal Documents From WPD's Investigation Into Officers' CommentsBrandon Wissbaum80% (15)

- EPA Toxic Substances Control Act Consent Orders Need Better CoordinationDokument22 SeitenEPA Toxic Substances Control Act Consent Orders Need Better CoordinationBrandon WissbaumNoch keine Bewertungen

- Cape Fear Museum Feasibility StudyDokument109 SeitenCape Fear Museum Feasibility StudyBrandon WissbaumNoch keine Bewertungen

- Carson Smith ContractDokument2 SeitenCarson Smith ContractBrandon WissbaumNoch keine Bewertungen

- Super Bowl 54 Complaints-Part 2Dokument500 SeitenSuper Bowl 54 Complaints-Part 2Brandon WissbaumNoch keine Bewertungen

- Super Bowl 54 Complaints-Part 1Dokument493 SeitenSuper Bowl 54 Complaints-Part 1Brandon WissbaumNoch keine Bewertungen

- Super Bowl 54 Complaints-Part 3Dokument319 SeitenSuper Bowl 54 Complaints-Part 3Brandon WissbaumNoch keine Bewertungen

- Signed Cairney SettlementDokument6 SeitenSigned Cairney SettlementBrandon WissbaumNoch keine Bewertungen

- Dr. Burns ContractDokument7 SeitenDr. Burns ContractBrandon WissbaumNoch keine Bewertungen

- New Hanover County Schools Athletic Stipend ScheduleDokument1 SeiteNew Hanover County Schools Athletic Stipend ScheduleBrandon WissbaumNoch keine Bewertungen

- Brunswick County Schools Middle School Coaches' Supplement/Stipend ScheduleDokument3 SeitenBrunswick County Schools Middle School Coaches' Supplement/Stipend ScheduleBrandon WissbaumNoch keine Bewertungen

- Markley Contract 2.5.2020Dokument23 SeitenMarkley Contract 2.5.2020Brandon WissbaumNoch keine Bewertungen

- U.S. 421 Water and Wastewater Utilities Expansion ProjectDokument1 SeiteU.S. 421 Water and Wastewater Utilities Expansion ProjectBrandon WissbaumNoch keine Bewertungen

- City of Wilmington NHRMC ResolutionDokument3 SeitenCity of Wilmington NHRMC ResolutionBrandon WissbaumNoch keine Bewertungen

- Pender County Schools Athletic Coaching SupplementsDokument2 SeitenPender County Schools Athletic Coaching SupplementsBrandon WissbaumNoch keine Bewertungen

- James Sprunt Community College Investigative AuditDokument13 SeitenJames Sprunt Community College Investigative AuditBrandon WissbaumNoch keine Bewertungen

- Proposed Carolina Bays Parkway Extension ConceptDokument1 SeiteProposed Carolina Bays Parkway Extension ConceptBrandon WissbaumNoch keine Bewertungen

- 1/15/60 AIRTEL in National Airlines Flight 2511 Crash InvestigationDokument2 Seiten1/15/60 AIRTEL in National Airlines Flight 2511 Crash InvestigationBrandon WissbaumNoch keine Bewertungen

- 03481220191002154910Dokument1 Seite03481220191002154910Brandon WissbaumNoch keine Bewertungen

- Sanitized Consent Order P 08 0508cDokument72 SeitenSanitized Consent Order P 08 0508cBrandon WissbaumNoch keine Bewertungen

- Maguindanao MassacreDokument3 SeitenMaguindanao MassacreMa. Jenelyn DelegenciaNoch keine Bewertungen

- Vak Sept. 16Dokument28 SeitenVak Sept. 16Muralidharan100% (1)

- 2015 Scholarship ApplicationDokument3 Seiten2015 Scholarship Applicationapi-280767644Noch keine Bewertungen

- Tso C139Dokument5 SeitenTso C139Russell GouldenNoch keine Bewertungen

- 3M Case StudyDokument14 Seiten3M Case StudyYasir AlamNoch keine Bewertungen

- Eastern PhilosophyDokument70 SeitenEastern PhilosophyRedimto RoseteNoch keine Bewertungen

- Rising Genset - Generator RentalDokument4 SeitenRising Genset - Generator RentalRising GensetNoch keine Bewertungen

- KEY TO THE SWIMMING POOL TIMETABLE AND PROGRAMMEDokument2 SeitenKEY TO THE SWIMMING POOL TIMETABLE AND PROGRAMMEthomas homerNoch keine Bewertungen

- What's New: Activity 1.2 ModelDokument3 SeitenWhat's New: Activity 1.2 ModelJonrheym RemegiaNoch keine Bewertungen

- Sarva Shiksha Abhiyan, GOI, 2013-14: HighlightsDokument10 SeitenSarva Shiksha Abhiyan, GOI, 2013-14: Highlightsprakash messiNoch keine Bewertungen

- Tourism and Hospitality LawDokument4 SeitenTourism and Hospitality LawSarah Mae AlcazarenNoch keine Bewertungen

- Benyam Private International LawDokument250 SeitenBenyam Private International Lawmuleta100% (2)

- International Business Opportunities and Challenges Vol 2 1St Edition Carpenter Test Bank Full Chapter PDFDokument40 SeitenInternational Business Opportunities and Challenges Vol 2 1St Edition Carpenter Test Bank Full Chapter PDFKathrynBurkexziq100% (7)

- Grade 7 - RatioDokument5 SeitenGrade 7 - RatioHâu NguyenNoch keine Bewertungen

- Boscastle Family Book SeriesDokument4 SeitenBoscastle Family Book SeriesChingirl89100% (1)

- Appendix F - Property ValueDokument11 SeitenAppendix F - Property ValueTown of Colonie LandfillNoch keine Bewertungen

- The Ancient CeltsDokument2 SeitenThe Ancient CeltsArieh Ibn GabaiNoch keine Bewertungen

- HCB 0207 Insurance Ad Risk ManagementDokument2 SeitenHCB 0207 Insurance Ad Risk Managementcollostero6Noch keine Bewertungen

- Rizal Back in MadridDokument3 SeitenRizal Back in MadridElle Dela CruzNoch keine Bewertungen

- Pho 2000 HistoryDokument4 SeitenPho 2000 Historybao phanNoch keine Bewertungen

- 3rd Yr 2nd Sem Business Plan Preparation Quiz 1 MidtermDokument14 Seiten3rd Yr 2nd Sem Business Plan Preparation Quiz 1 MidtermAlfie Jaicten SyNoch keine Bewertungen

- Financial Management Introduction Lecture#1Dokument12 SeitenFinancial Management Introduction Lecture#1Rameez Ramzan AliNoch keine Bewertungen

- Web Design Wordpress - Hosting Services ListDokument1 SeiteWeb Design Wordpress - Hosting Services ListMotivatioNetNoch keine Bewertungen

- People Vs PalmonesDokument8 SeitenPeople Vs PalmonesDan LocsinNoch keine Bewertungen