Beruflich Dokumente

Kultur Dokumente

EDC

Hochgeladen von

Arvind Harikrishnan0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

21 Ansichten3 SeitenCopyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

21 Ansichten3 SeitenEDC

Hochgeladen von

Arvind HarikrishnanCopyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 3

1.

A narrowing of basis in backwardation market results in –

a. Benefit to the long hedger

b. Benefit to the short hedger

c. Loss to the long hedger and short hedger

d. Loss to long hedger

2. Which of the following is not the duty of the trading member?

a. Assisting the client to arrange for margins

b. Filling of KYC form

c. Execution of client broker agreement

d. Bringing risk factors to the knowledge of clients

3. Futures trading commenced first on

a. Chicago mercantile exchange

b. London international financial futures and options exchange

c. CBO exchange

d. CBOT

4. What is the value of 1 tick, if the tick size of MCX cardamom futures contract is 10 paise and

trading unit and basis unit is 100 kg and 1 kg respectively?

a. 1

b. 10

c. 100

d. 1000

5. Under which of the following conditions, the delivery is considered as complete?

a. Buyer makes full payment of the delivery

b. Buyer lifts delivery of the commodity

c. Seller delivers the commodity at the designated delivery centre

d. Surveyor certifies the quality and quantity of the commodity delivered.

6. Rahul buys 600 units @ 140 and sell 400 @ rate of 130. The settlement price is 130. What is the

mtm profit/loss?

a. 7200

b. 8000

c. -6000

d. 600

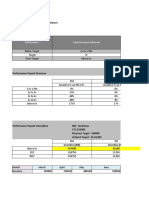

7. The OCT futures contract of RELCAP closed at 1820 yesterday. It closes today at 1780. The spot

closes at 1750. A trader has a short position of 3000 in OCT futures contract. He sells 2000 units

of Oct expiring put options on RELCAP with a strike price of 1800/- for a premium of 73 per unit.

What is the net obligation from/to clearing corporation today?

a. Pay in of Rs.344,200

b. Pay In of Rs. 266,200

c. Pay out 645,000

d. Pay out of 266,000

8. In april 2008, a food processing firm estimates that it will require 25MT of Jeera in may 2008.

Trading unit of May Jeera futures contract at MCX is 2MT. if MCX May jeera future contract is

trading at rs. 7100 per 100 kg and hedge ratio works out to be 1.20, then the firm should _____

for optimum hedge.

a. Buy 15 lots of May Jeera Future

b. Buy 30 lots

c. Sell 15 lots

d. Buy 10 lots

9. Which of the following options can be exercised only on the expiry date?

a. American Options

b. In the money

c. At the money

d. European

10. The reason for future contracts to be more preferred as compared to forward contracts is due

to _____.

a. Less transparency of futures contracts.

b. Higher credit risk in futures contracts.

c. Higher counter party default risk in futures contracts.

d. Low counterparty default risk and greater liquidity in futures contracts.

11. Weekly options traded on NSE follow an ______.

a. European style settlement

b. Weekly options are not traded on NSE

c. Asian style settlement

d. American style settlement.

12. Mr. Arun buys two futures contracts of Gold (1kg per futures contract) at the price of Rs.12,000

per 10 gm. If after 1 month the futures price is Rs.11,800 per 10 gms what is the profit/loss

made by Mr.Arun if he squares off his position?

a. + 20,000

b. – 40,000

c. -20,000

d. +40,000

13. The payoff for a person involved in short hedge when the cash and future prices rise is ____

a. Profit in cash markets and loss in futures.

b. Loss in cash markets and profits in futures.

c. Profit in both cash and futures markets.

d. Loss in both cash and future markets.

14. Statement A – Put call ratio is an indicator to measure the market sentiment. Statement B – Roll

over refers to open positions in future contracts are closed around expiry and similar fresh

positions are taken for the subsequent month

a. Both are false.

b. A true B false

c. Both are true

d. A false B true.

15. A call option at the strike price of Rs.176 is selling at a premium of Rs.8. At what price will it

break even for the buyer of the option?

a. 204

b. 184

c. 196

d. 187

16. Statement A – Long hedge means selling a futures contract to hedge a spot position. Statement

B – short hedge is done with the purpose of protecting against price increase in the spot

market of a commodity that one intends to buy in the future.

a. A is True, B is False

b. A and B are True

c. A is False B is True

d. A and B are False.

17. What will be the MTM profit/loss of Rohan if he buys 1800 @ 140 and sells 1600 @145. The

settlement price of the day was 335.

a. -4000

b. -6000

c. 2000

d. 7000

18. On November 30, 2007 a trader buys one lot of MCX Silver futures contract that is expiring of

December 5, 2007 at Rs.22500 per kg. The initial margin payable is 5% while the tender period

margin is 25%. The tender period of the contract is starting from December 1. If the contract is

not squared off and left open on Dec 1, and the contract is trading at Rs.22800 per kg, what

would be the margin on Dec 1, over and above the initial margin paid at the time of buying the

contract on Nov 30? Note Delivery period margin is inclusive of initial margin.

a. 171000

b. 135000

c. 137250

d. 168750

19. In March 2008, an arbitrager in the commodity market notices riskless profit in Gold June 2008

futures contract. He borrows Rs.12,80,000 @ 12% pa for 2 months and with this loan amount

buys 1 KG Gold in the cash market @ Rs.12,800 per 10 gm and simultaneously shorts 1 contract

( 1 kg each) of Gold June futures @ 13,100 per 10 gms. On expiry of Gold june futures, he

delivers 1 kg of Gold against outstanding short position and earns a profit of ____ after paying

financing cost for 2 months. (ignore all other misc costs on margin, tax, and assume simple

interest on loan amount)

a. 30000

b. 25600

c. 4400

d. 8800

20.

Das könnte Ihnen auch gefallen

- Online Payment ReceiptDokument1 SeiteOnline Payment ReceiptArvind HarikrishnanNoch keine Bewertungen

- Performance Sales Revenue Achieved: Atum Capital Wealth ManagersDokument4 SeitenPerformance Sales Revenue Achieved: Atum Capital Wealth ManagersArvind HarikrishnanNoch keine Bewertungen

- Make A Payment / Transfer: 1. Input Details 2. Verify DetailsDokument2 SeitenMake A Payment / Transfer: 1. Input Details 2. Verify DetailsArvind HarikrishnanNoch keine Bewertungen

- Indusind New Company List Sep MonthDokument2.601 SeitenIndusind New Company List Sep MonthArvind HarikrishnanNoch keine Bewertungen

- Ujjivan Updated Company ListDokument8.941 SeitenUjjivan Updated Company ListArvind HarikrishnanNoch keine Bewertungen

- Ujjivan Updated Company ListDokument8.941 SeitenUjjivan Updated Company ListArvind HarikrishnanNoch keine Bewertungen

- Indusind New Company List Sep MonthDokument2.601 SeitenIndusind New Company List Sep MonthArvind HarikrishnanNoch keine Bewertungen

- Nifty & Bank Nifty Expiry Ohlc Jan 2019 - Jul 2020Dokument4 SeitenNifty & Bank Nifty Expiry Ohlc Jan 2019 - Jul 2020Arvind HarikrishnanNoch keine Bewertungen

- HFC Product Salaried Senp Mortgages ROI PF ROI PF ROI PF PNB Housing Finance HDFC Limited Axis BankDokument2 SeitenHFC Product Salaried Senp Mortgages ROI PF ROI PF ROI PF PNB Housing Finance HDFC Limited Axis BankArvind HarikrishnanNoch keine Bewertungen

- Kotak List and New RateDokument2.021 SeitenKotak List and New RateArvind HarikrishnanNoch keine Bewertungen

- Illustration PDFDokument2 SeitenIllustration PDFArvind HarikrishnanNoch keine Bewertungen

- Currency ManagementDokument7 SeitenCurrency ManagementArvind HarikrishnanNoch keine Bewertungen

- Basics of Investing 80%Dokument13 SeitenBasics of Investing 80%Arvind HarikrishnanNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Titan Financial AnalysisDokument11 SeitenTitan Financial AnalysisAkshay BhardwajNoch keine Bewertungen

- AFA 3e PPT Chap08Dokument80 SeitenAFA 3e PPT Chap08Quỳnh NguyễnNoch keine Bewertungen

- FTSE4 GoodDokument5 SeitenFTSE4 GoodJemayiNoch keine Bewertungen

- Medreich LimitedDokument7 SeitenMedreich LimitedAnishNoch keine Bewertungen

- AGS InfotechDokument349 SeitenAGS InfotechBikashNoch keine Bewertungen

- CIR V CA, CTA & ANSCORDokument3 SeitenCIR V CA, CTA & ANSCORBananaNoch keine Bewertungen

- Buttonwood Life Settlement FundDokument81 SeitenButtonwood Life Settlement Fundclp-jacks8Noch keine Bewertungen

- Vale 20-F FY2016 - IDokument289 SeitenVale 20-F FY2016 - Ibernd81Noch keine Bewertungen

- Technical Analysis1Dokument30 SeitenTechnical Analysis1Ruchika JainNoch keine Bewertungen

- Agriauto Ind LTD Project 2011-13Dokument107 SeitenAgriauto Ind LTD Project 2011-13Malik Nasir AbbasNoch keine Bewertungen

- Hatsun Analysis PDFDokument68 SeitenHatsun Analysis PDFSmart susi0% (1)

- Acctg 14 - Midterm Lesson Part3Dokument21 SeitenAcctg 14 - Midterm Lesson Part3NANNoch keine Bewertungen

- Rule: Electronic Data Gathering, Analysis, and Retrieval System (EDGAR) : Filer Manual UpdatedDokument2 SeitenRule: Electronic Data Gathering, Analysis, and Retrieval System (EDGAR) : Filer Manual UpdatedJustia.comNoch keine Bewertungen

- List of Insurance CompanyDokument3 SeitenList of Insurance Companygalaxy82yngelNoch keine Bewertungen

- Histret SPDokument39 SeitenHistret SPcarrot123456Noch keine Bewertungen

- Analysis & Study of Derivatives MarketDokument76 SeitenAnalysis & Study of Derivatives MarketRikesh Daliya80% (15)

- Organization & Functioning of Securities Markets - STDokument54 SeitenOrganization & Functioning of Securities Markets - STarjunmba119624Noch keine Bewertungen

- Sec V Prosperity - Com, Inc (Pci)Dokument1 SeiteSec V Prosperity - Com, Inc (Pci)Park Chael Reose EonniNoch keine Bewertungen

- Oct 2011 (P (1) .V)Dokument8 SeitenOct 2011 (P (1) .V)Pranathi SangapuNoch keine Bewertungen

- Interim Order in The Matter of Sunshine Hi-Tech Infracon LimitedDokument17 SeitenInterim Order in The Matter of Sunshine Hi-Tech Infracon LimitedShyam Sunder100% (1)

- Dividend Policy and Firm Value Assignment 2Dokument2 SeitenDividend Policy and Firm Value Assignment 2riddhisanghviNoch keine Bewertungen

- Eco Forex-Market and Risk ManagemntDokument90 SeitenEco Forex-Market and Risk ManagemntHitesh MoreNoch keine Bewertungen

- Is Bitcoin GoldenDokument3 SeitenIs Bitcoin GoldenMarcia BellNoch keine Bewertungen

- Industry Specific Sample Questions-2Dokument6 SeitenIndustry Specific Sample Questions-2Talib ZaidiNoch keine Bewertungen

- Interchange FeeDokument3 SeitenInterchange FeeAnkita SrivastavaNoch keine Bewertungen

- CFA L2 Answers PDFDokument404 SeitenCFA L2 Answers PDFIbrahim Jawed100% (6)

- OANDA Currency ConverterDokument2 SeitenOANDA Currency Convertertiger2020Noch keine Bewertungen

- Brokerage CompaniesDokument7 SeitenBrokerage CompaniesnovateelNoch keine Bewertungen

- Indian BankDokument381 SeitenIndian BankganeshNoch keine Bewertungen

- Bloombeg Launchpad English Manual YuErHa PDFDokument32 SeitenBloombeg Launchpad English Manual YuErHa PDFRusheel ChavaNoch keine Bewertungen